Regarding the legitimacy of Just2Trade forex brokers, it provides CYSEC, NFA, CBR and WikiBit, (also has a graphic survey regarding security).

Is Just2Trade safe?

Software Index

Risk Control

Is Just2Trade markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Lime Trading (CY) Ltd

Effective Date:

2015-09-25Email Address of Licensed Institution:

supervision@just2trade.onlineSharing Status:

Website of Licensed Institution:

https://just2trade.online, www.J2T.comExpiration Time:

--Address of Licensed Institution:

Magnum Business Center, 4B, Spyrou Kyprianou Avenue 78, Limassol 3076, CyprusPhone Number of Licensed Institution:

+357 25 344 563Licensed Institution Certified Documents:

NFA Derivatives Trading License (AGN)

National Futures Association

National Futures Association

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

LIME TRADING CORP

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

450 7th Avenue 31st Floor New York, NY 10123 United StatesPhone Number of Licensed Institution:

646-558-3232Licensed Institution Certified Documents:

CBR Forex Trading License (EP)

Central Bank of Russia

Central Bank of Russia

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Общество с ограниченной ответственностью "ФИНАМ ФОРЕКС"

Effective Date:

2015-12-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

127006, г. Москва, пер. Настасьинский, д.7, стр. 2, комн. 17Phone Number of Licensed Institution:

8 (495) 796-90-24Licensed Institution Certified Documents:

Is Just2Trade A Scam?

Introduction

Just2Trade is a multi-asset brokerage firm that has been operating since 2007, providing access to a diverse range of financial instruments, including forex, stocks, commodities, and indices. With a client base of over 155,000 across 130 countries, Just2Trade positions itself as a competitive player in the online trading landscape. However, with the rise of online trading comes the necessity for traders to exercise caution when selecting a broker. The potential for scams and fraudulent activities in the forex market is significant, making it essential for traders to thoroughly evaluate brokers before committing their funds. This article investigates the legitimacy of Just2Trade by analyzing its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and associated risks.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining a broker's reliability. Just2Trade operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC), which is known for enforcing strict compliance with financial regulations. The regulatory framework aims to protect investors and ensure fair trading practices. Below is a summary of Just2Trade's regulatory information:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CySEC | 281/15 | Cyprus | Verified |

CySEC's oversight mandates that Just2Trade segregates client funds from operational funds, providing an additional layer of security for traders. Furthermore, the broker is a member of the Investor Compensation Fund, which offers compensation to clients in the event of the broker's insolvency. While CySEC is a reputable regulator, some traders express concerns regarding the level of enforcement compared to other top-tier regulators like the FCA or ASIC. Historically, Just2Trade has maintained a compliant standing, but the absence of regulation from more stringent authorities could be a potential red flag for some investors.

Company Background Investigation

Just2Trade is owned by Lime Trading (Cy) Ltd., which has established a significant presence in the online brokerage industry. The company was founded in 2007 and has since expanded its services to cater to a global audience. The management team comprises experienced professionals with backgrounds in finance and trading, contributing to the broker's operational integrity. The company's transparency is reflected in its comprehensive disclosures regarding trading conditions, fees, and available instruments. However, some users have noted that the website design appears outdated, which may impact user trust. Overall, Just2Trade's history and ownership structure suggest a commitment to providing a reliable trading environment, but potential clients should remain vigilant and conduct their own due diligence.

Trading Conditions Analysis

Just2Trade offers a variety of trading accounts, each with distinct features and fee structures. The overall cost of trading with Just2Trade is competitive, particularly for high-volume traders. However, some aspects of the fee structure may raise concerns among new traders. Below is a comparison of core trading costs:

| Fee Type | Just2Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 0.6 pips |

| Commission Model | $2-$3 per lot | $3-$5 per lot |

| Overnight Interest Range | 0.5% - 2.5% | 1% - 3% |

The spreads offered by Just2Trade are generally lower than the industry average, making it an attractive option for cost-conscious traders. However, the commission structure, particularly for the ECN account, may deter some traders due to the associated costs. Moreover, the broker's overnight interest fees can vary significantly, impacting long-term trading strategies. Transparency regarding these fees is crucial, and potential clients should carefully review the fee schedule before opening an account.

Client Funds Safety

The safety of client funds is paramount in the trading environment. Just2Trade implements several measures to safeguard client deposits, including fund segregation and negative balance protection. Client funds are held in separate accounts, ensuring they are not used for the broker's operational expenses. Additionally, Just2Trade's membership in the Investor Compensation Fund provides a safety net for clients in the event of financial difficulties. However, it is essential for traders to remain aware of the broker's historical performance regarding fund safety. While there have been no major incidents reported, the lack of regulation from more stringent authorities may cause some traders to question the overall security of their investments.

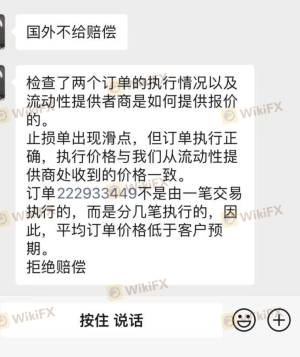

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reputation. Just2Trade has received mixed reviews from users, with some praising its competitive pricing and customer support, while others express dissatisfaction with withdrawal processes and platform stability. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Platform Downtime | Medium | Acknowledged |

| Poor Customer Support | High | Limited availability |

Two notable cases illustrate the concerns raised by clients. One trader reported being unable to withdraw funds for an extended period, leading to frustration and distrust. Another user experienced significant platform downtime during critical trading hours, resulting in missed opportunities. These complaints highlight the importance of reliable customer support and operational stability in maintaining client trust.

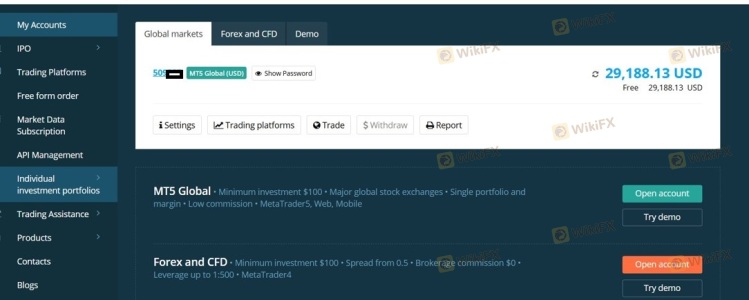

Platform and Execution

Just2Trade offers several trading platforms, including MetaTrader 4 and MetaTrader 5, known for their robust features and user-friendly interfaces. The performance of these platforms is generally stable, but some users have reported issues with order execution, including slippage and rejections. The broker's commitment to providing a seamless trading experience is evident, but any signs of platform manipulation or execution issues could raise concerns among traders.

Risk Assessment

Using Just2Trade carries inherent risks, as with any online broker. An assessment of key risk areas reveals the following:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited regulation by CySEC only. |

| Financial Risk | High | Potential for fund withholding based on user complaints. |

| Platform Risk | Medium | Occasional platform downtime and execution issues. |

To mitigate these risks, traders should perform thorough research, start with smaller investments, and utilize demo accounts to familiarize themselves with the platform before committing significant capital.

Conclusion and Recommendations

In conclusion, Just2Trade presents itself as a legitimate brokerage with regulatory oversight from CySEC. However, the mixed reviews and certain operational concerns warrant caution. While the broker offers competitive trading conditions and a wide range of instruments, potential clients should be wary of withdrawal issues and platform stability. For traders seeking a reliable broker, it may be advisable to explore alternatives with stronger regulatory frameworks and better user feedback. Recommended alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide a higher level of investor protection.

Is Just2Trade a scam, or is it legit?

The latest exposure and evaluation content of Just2Trade brokers.

Just2Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Just2Trade latest industry rating score is 6.96, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.96 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.