Is TECHNOLOGY safe?

Pros

Cons

Is Technology Safe or a Scam?

Introduction

In the ever-evolving landscape of the forex market, traders are continually seeking reliable platforms to facilitate their trading activities. Technology, a broker that claims to offer a comprehensive trading experience, has emerged as a notable contender. However, the question remains: Is Technology safe or a scam? Given the prevalence of fraudulent activities in the financial sector, it is crucial for traders to conduct thorough evaluations of any broker before committing their funds. This article aims to provide an objective analysis of Technology, examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. Our investigation is based on data from regulatory sources, user reviews, and expert evaluations, ensuring a comprehensive understanding of the broker's legitimacy.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety and legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to stringent standards and practices. In the case of Technology, it is essential to assess whether the broker is regulated and by which authorities.

| Regulator | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

Unfortunately, Technology lacks regulation from any recognized financial authority. This absence of oversight raises significant concerns about the broker's operational practices and the safety of client funds. Regulatory bodies such as the FCA (Financial Conduct Authority) in the UK and ASIC (Australian Securities and Investments Commission) in Australia enforce strict guidelines to protect traders. Brokers not regulated by these or similar entities may operate with minimal scrutiny, increasing the risk of fraudulent activities.

The quality of regulation is paramount; brokers under top-tier regulators are generally expected to maintain higher operational standards, including transparent pricing, fair execution, and adequate client protection measures. Without such oversight, traders may find themselves vulnerable to unscrupulous practices.

Company Background Investigation

Understanding the history and ownership structure of a broker provides valuable insights into its credibility. Technology was established with the intent to offer a seamless trading experience, but the details surrounding its ownership and management remain obscure.

The lack of information about the company's history and the identities of its management team raises red flags. A reputable broker typically provides clear information about its founders, management, and operational history. This transparency fosters trust among potential clients. However, in the case of Technology, the absence of such disclosures may indicate a lack of accountability and could be a warning sign for prospective traders.

Furthermore, the management team's background and professional experience are critical in assessing the broker's reliability. A team with a robust track record in finance and trading can significantly enhance a broker's credibility. Unfortunately, Technology does not provide adequate information regarding its management, leaving potential clients in the dark about the expertise guiding their trading platform.

Trading Conditions Analysis

The trading conditions offered by a broker, including fees and spreads, play a vital role in a trader's overall experience. Technology claims to provide competitive trading conditions, but it is essential to analyze the fee structure in detail.

| Fee Type | Technology | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | N/A | Varies |

Upon investigation, it appears that Technology does not disclose specific details regarding its fees and spreads, which is concerning. A broker that lacks transparency in its fee structure may impose hidden charges, leading to unexpected costs for traders. This lack of clarity can be detrimental, especially for new traders who may not fully understand the implications of hidden fees on their trading profitability.

Moreover, the absence of a clear commission model can lead to confusion among traders regarding their overall trading costs. Industry standards suggest that brokers should provide detailed information about spreads, commissions, and overnight interest rates to ensure traders can make informed decisions.

Customer Funds Safety

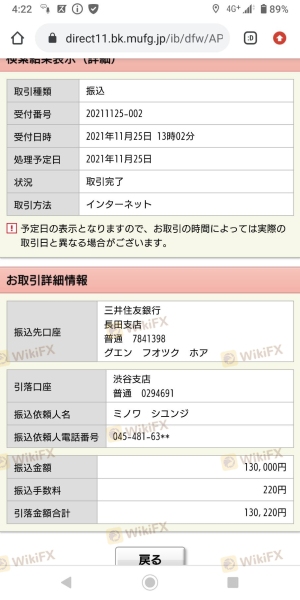

The safety of customer funds is a paramount concern for any trader. Brokers must implement robust security measures to protect client deposits from potential risks. In the case of Technology, an analysis of its fund safety protocols reveals several shortcomings.

Technology reportedly does not provide adequate information regarding its fund segregation practices, investor protection schemes, or negative balance protection policies. These measures are essential for ensuring that client funds are kept separate from the broker's operational funds, reducing the risk of loss in the event of financial instability.

Additionally, the absence of information regarding past incidents or disputes related to fund safety further raises concerns. A broker with a history of financial issues or client complaints regarding fund access may not be a reliable choice for traders seeking a secure trading environment.

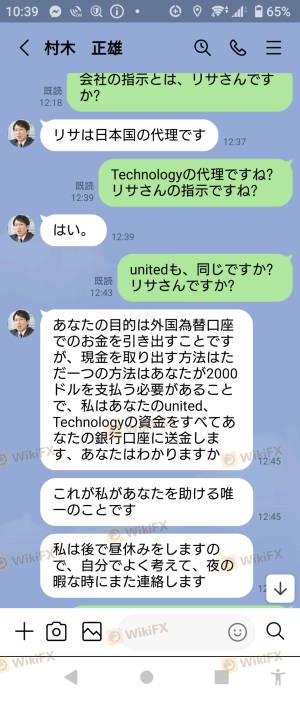

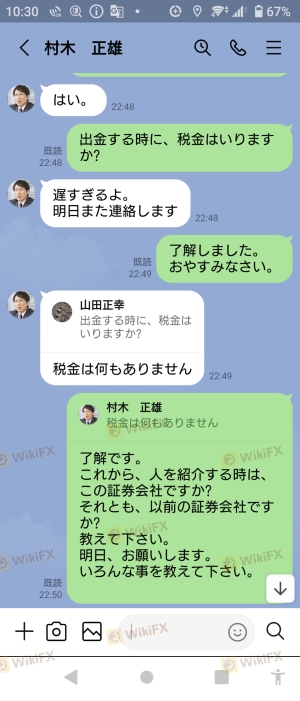

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. An analysis of user experiences with Technology reveals a mixed bag of reviews, with some users expressing dissatisfaction with the broker's services.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

| Lack of Transparency | High | No Response |

Common complaints among users include difficulties with withdrawals, poor customer support, and a general lack of transparency regarding trading conditions. These issues can severely impact a trader's experience and lead to distrust in the broker's operations.

For instance, one user reported experiencing significant delays in processing withdrawal requests, which can be alarming for traders who need timely access to their funds. Another common complaint is the lack of responsive customer support, leaving traders feeling unsupported when they encounter issues.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for successful trading. Traders rely on their platforms for executing trades quickly and effectively. In the case of Technology, a detailed evaluation of the platform's performance is necessary.

While specific details about the platform's stability and user experience are limited, any signs of poor execution quality, such as high slippage rates or frequent rejections of orders, can indicate deeper issues within the broker's trading infrastructure. Traders should be wary of platforms that exhibit signs of manipulation or inconsistencies in trade execution.

Risk Assessment

Using Technology as a forex broker presents several risks that traders should consider before proceeding.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker poses significant risks. |

| Financial Stability | Medium | Lack of transparency raises concerns. |

| Customer Service | High | Poor support can lead to unresolved issues. |

The overall risk associated with using Technology is high due to its lack of regulation and transparency. Traders are encouraged to exercise caution and consider alternative options with better safety profiles.

Conclusion and Recommendations

In conclusion, the analysis of Technology raises significant concerns regarding its legitimacy and safety. The absence of regulation, coupled with a lack of transparency in its operations and trading conditions, suggests that Technology is not safe for traders.

While some users may have had positive experiences, the potential risks outweigh the benefits. Traders are advised to seek out regulated brokers with proven track records and transparent practices to ensure their funds are secure and their trading experience is positive.

For those considering trading with Technology, it may be prudent to explore alternative options that offer better regulatory oversight and customer support. Reliable brokers such as [Broker A], [Broker B], and [Broker C] provide safer environments for forex trading, ensuring that traders can engage in their activities with confidence.

Is TECHNOLOGY a scam, or is it legit?

The latest exposure and evaluation content of TECHNOLOGY brokers.

TECHNOLOGY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TECHNOLOGY latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.