Auro Markets 2025 Review: Everything You Need to Know

Summary

This Auro Markets review shows major concerns about this forex broker based on user feedback and available information. Auro Markets presents itself as a trading platform offering automated trading tools for forex and CFD markets, targeting traders interested in algorithmic trading solutions. However, our analysis finds troubling patterns that potential investors should carefully consider.

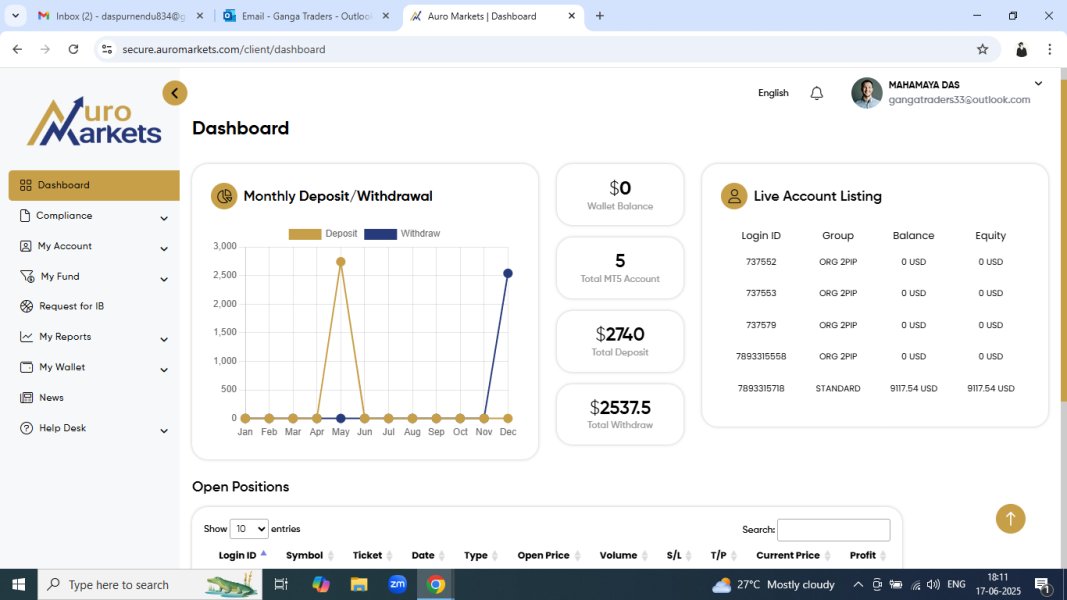

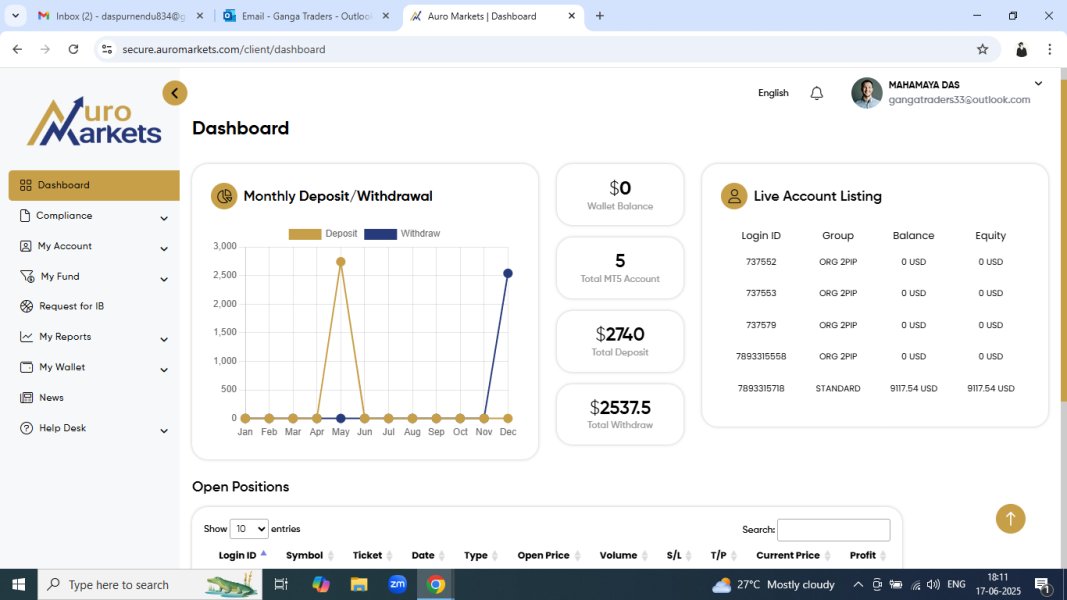

The broker has received mixed user reviews, with some traders reporting smooth deposit and withdrawal processes alongside responsive customer service. These positive experiences are overshadowed by serious allegations from multiple sources warning that Auro Markets may be a fraudulent operation created by anonymous scam groups. The platform's TrustScore stands at a concerning 35/100, indicating substantial trust issues within the trading community.

Key features include automated trading tools and claims of dynamic market opportunity identification. The lack of clear regulatory information, combined with widespread scam allegations and inconsistent user experiences, raises significant red flags. While some users report satisfactory interactions with customer support and successful fund operations, the overwhelming evidence suggests extreme caution is warranted when considering this broker.

Important Notice

This review is based on available user feedback, industry reports, and publicly accessible information about Auro Markets. Our evaluation methodology prioritizes objective analysis of user experiences, regulatory compliance, and platform performance to ensure fair and comprehensive assessment. We maintain strict editorial independence and present both positive and negative findings to help traders make informed decisions.

The information presented reflects the current state of available data and may be subject to change as new information becomes available. Traders should conduct their own due diligence and consider multiple sources before making investment decisions.

Rating Framework

Broker Overview

Auro Markets operates as a forex and CFD trading platform, though critical information about its establishment date and corporate background remains unclear. According to multiple industry sources, the platform has been identified as potentially being created by anonymous scam groups, raising immediate concerns about its legitimacy and operational integrity. The broker claims to offer dynamic market analysis and profitable opportunity identification through its team of professionals.

The platform positions itself as a comprehensive trading solution with emphasis on automated trading capabilities. Auro Markets promotes its ability to help traders "embrace financial markets with confidence" and offers what it describes as sophisticated trading tools designed for the evolving market landscape. However, the lack of transparent corporate information and the presence of scam allegations significantly undermine these promotional claims.

Regarding trading infrastructure, Auro Markets provides automated trading tools, though specific details about platform types such as MetaTrader 4 or MetaTrader 5 integration are not clearly specified. The broker appears to focus on forex trading while potentially offering CFD products, though the exact range of tradeable assets remains unclear. The absence of clear regulatory oversight information further complicates the assessment of this Auro Markets review.

Regulatory Status: Available information does not specify any recognized regulatory authorities overseeing Auro Markets operations. This represents a significant concern for potential traders seeking regulated trading environments.

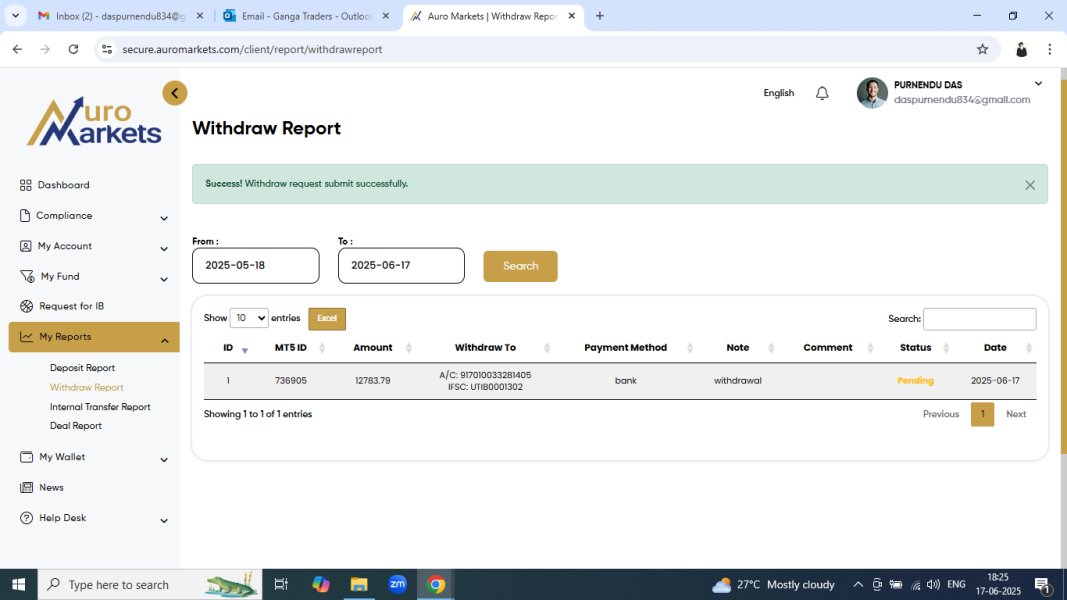

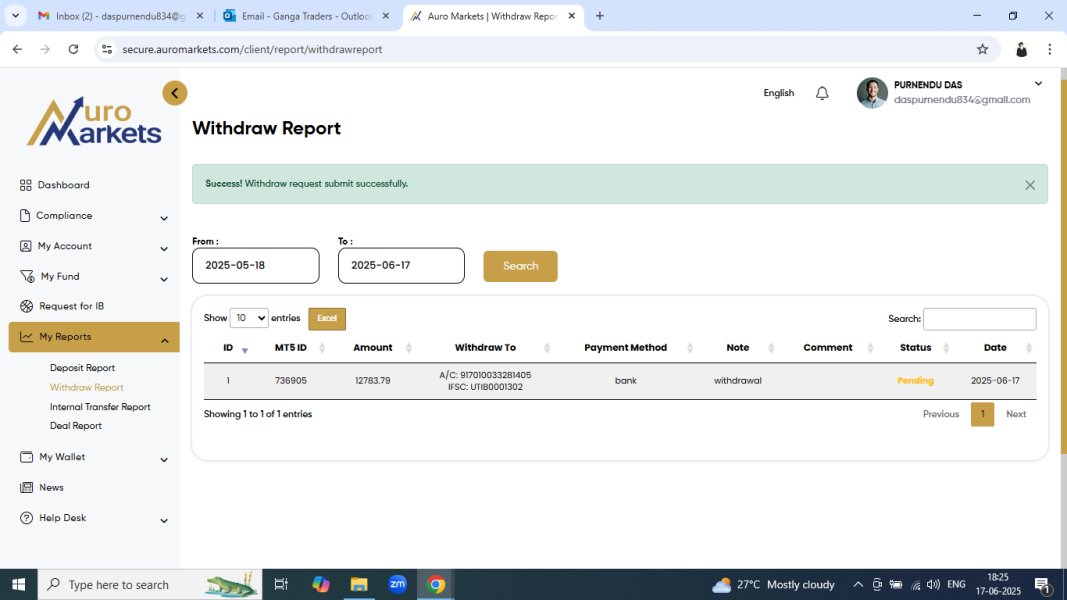

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available sources. Some users report successful fund operations.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with Auro Markets is not specified. Available documentation lacks this critical information.

Bonuses and Promotions: Information regarding welcome bonuses, promotional offers, or trading incentives is not mentioned in current available sources.

Tradeable Assets: While the platform appears to focus on forex trading with potential CFD offerings, the complete range of available instruments is not comprehensively detailed. This includes currency pairs, commodities, indices, and stocks.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not provided in available sources. This makes cost comparison with other brokers challenging.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in current available information.

Platform Options: Beyond automated trading tools, specific trading platform software and mobile application details are not clearly outlined.

Geographic Restrictions: Information about restricted countries or regional limitations is not specified. Available sources lack this important operational detail.

Customer Support Languages: Available languages for customer service communication are not detailed in current documentation.

This Auro Markets review highlights the significant lack of transparent operational information. This itself serves as a warning sign for potential investors.

Detailed Rating Analysis

Account Conditions Analysis (1/10)

The account conditions evaluation for Auro Markets reveals substantial concerns due to the complete absence of detailed information. Available sources do not specify the variety of account options, minimum deposit requirements, or special account features that traders typically expect from legitimate brokers. This lack of transparency represents a fundamental operational deficiency that significantly impacts trader confidence.

The account opening process details are not clearly outlined in available documentation. This leaves potential clients uncertain about verification requirements, documentation needs, and approval timelines. Professional brokers typically provide comprehensive account information including demo account availability, Islamic account options for Muslim traders, and tiered account structures with varying benefits.

User feedback regarding account conditions is limited, with available reviews focusing more on general platform concerns rather than specific account-related experiences. The absence of clear account terms and conditions, combined with the overall trust concerns surrounding the platform, contributes to the poor rating in this category. The lack of regulatory oversight further complicates account safety, as traders cannot rely on standard investor protection schemes typically available with regulated brokers.

This Auro Markets review emphasizes that the unclear account structure represents a significant risk factor for potential investors.

Auro Markets promotes automated trading tools as a key feature, which represents the primary strength in this evaluation category. The platform claims to offer sophisticated algorithmic trading capabilities designed to identify profitable market opportunities automatically. However, detailed specifications about these tools, their performance metrics, and customization options are not comprehensively provided in available sources.

The absence of information about additional trading tools such as economic calendars, market analysis resources, technical indicators, and charting capabilities limits the overall assessment. Professional trading platforms typically offer comprehensive research resources, daily market analysis, and educational materials to support trader development and decision-making. Educational resources and training materials are not mentioned in available documentation, which represents a significant gap for traders seeking to improve their skills and market understanding.

Quality brokers typically provide webinars, tutorials, trading guides, and market commentary to support their clients' trading journey. Third-party tool integration, such as social trading platforms, copy trading services, or advanced analytical software, is not detailed in current available information. The moderate rating reflects the presence of automated trading capabilities while acknowledging the substantial gaps in comprehensive tool and resource offerings.

Customer Service and Support Analysis (6/10)

Customer service evaluation reveals mixed experiences among users, with some reporting responsive and helpful support interactions. According to available user feedback, customer service representatives demonstrate timely response capabilities, which represents a positive aspect of the platform's operations. However, these positive experiences must be weighed against the broader context of scam allegations and trust concerns.

The specific customer support channels, such as live chat, email, phone support, or support ticket systems, are not clearly detailed in available documentation. Professional brokers typically provide multiple communication channels with specified operating hours and response time commitments. The lack of transparent support structure information limits the comprehensive evaluation of service quality.

Multilingual support capabilities are not specified, which may limit accessibility for international traders. Quality customer service typically includes support in multiple languages with culturally appropriate assistance for diverse client bases. The absence of this information represents a gap in service transparency.

While some users report satisfactory customer service experiences, the overall context of platform reliability concerns and scam allegations significantly impacts the credibility of support services. Even responsive customer service cannot compensate for fundamental platform integrity issues that may affect user security and financial safety.

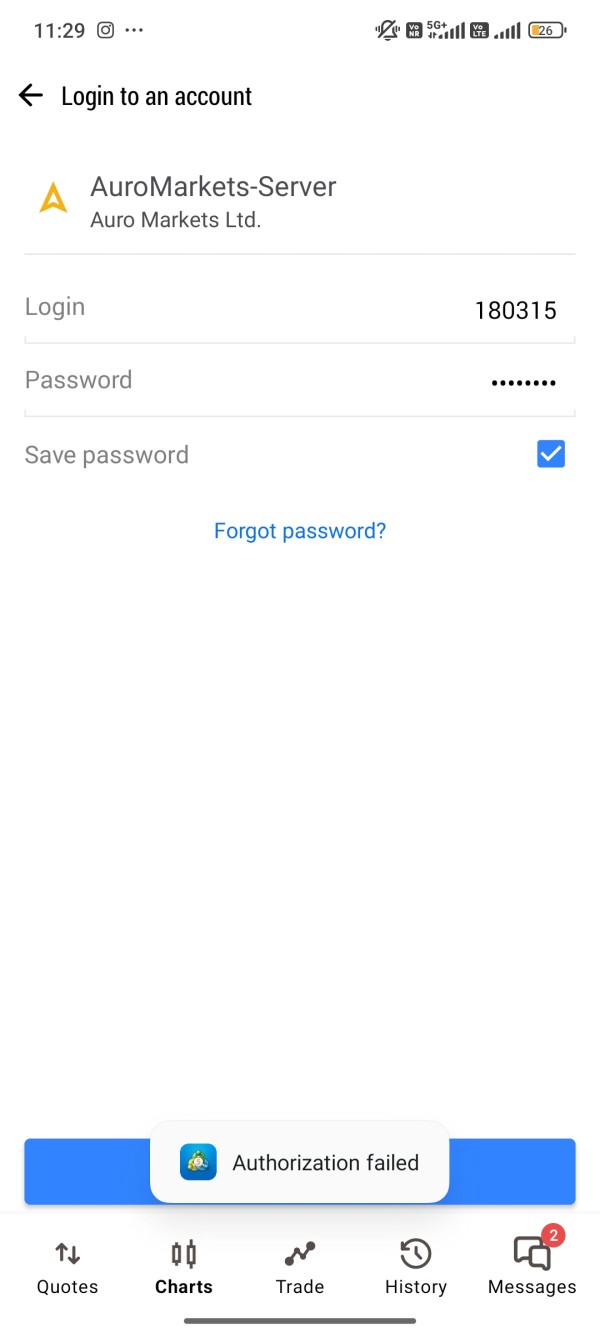

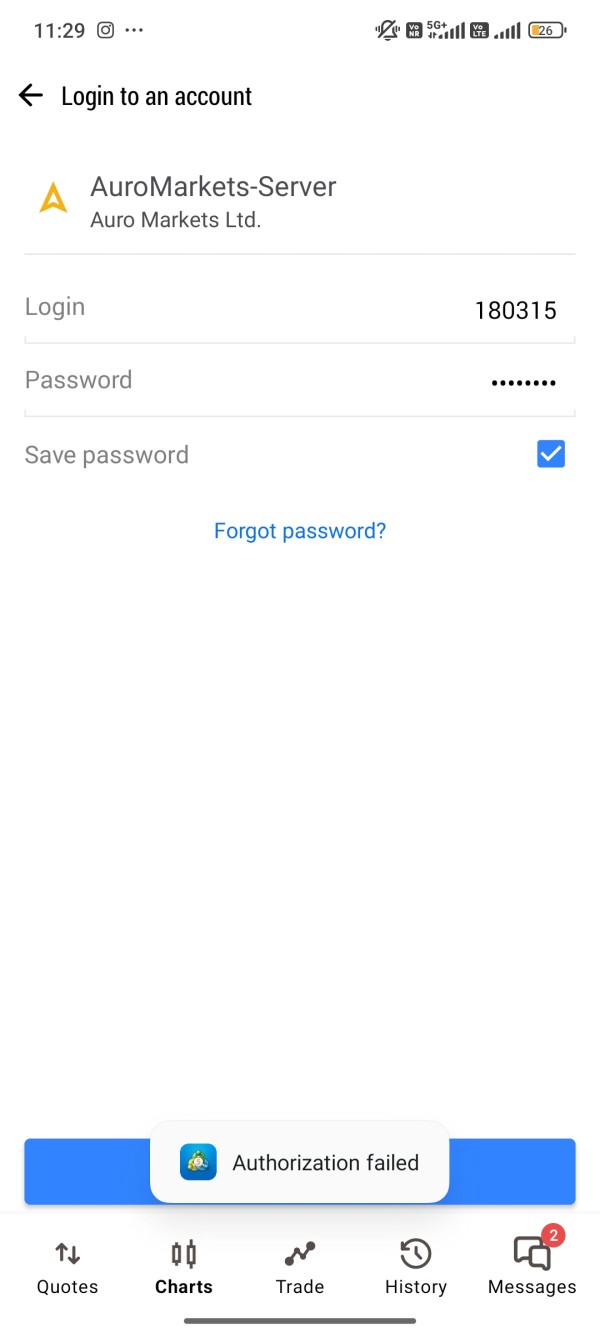

Trading Experience Analysis (4/10)

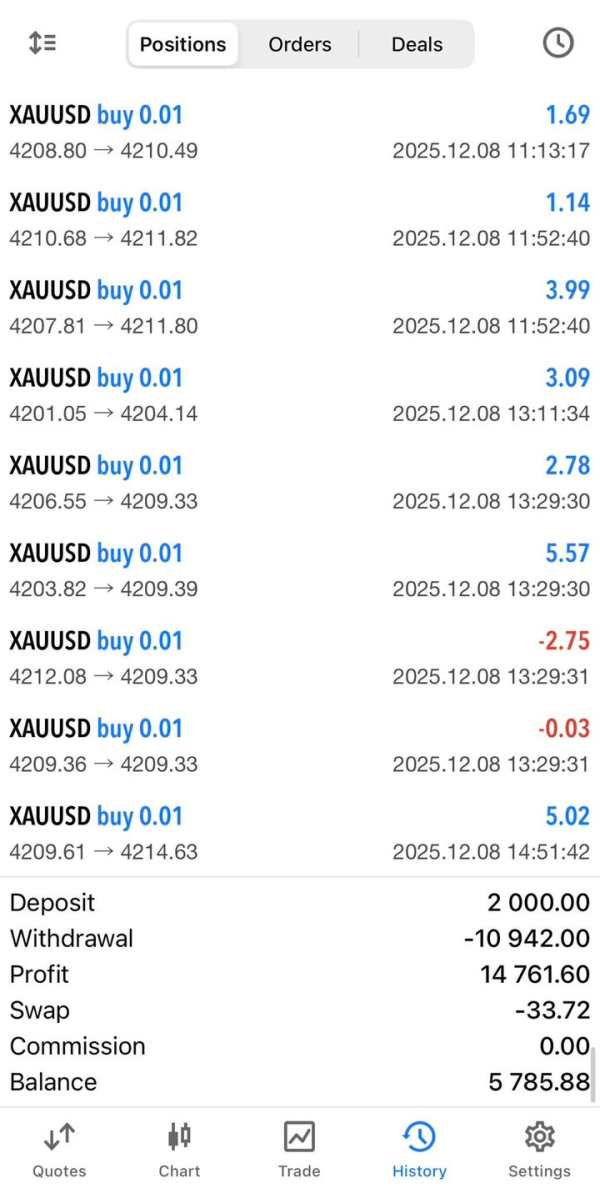

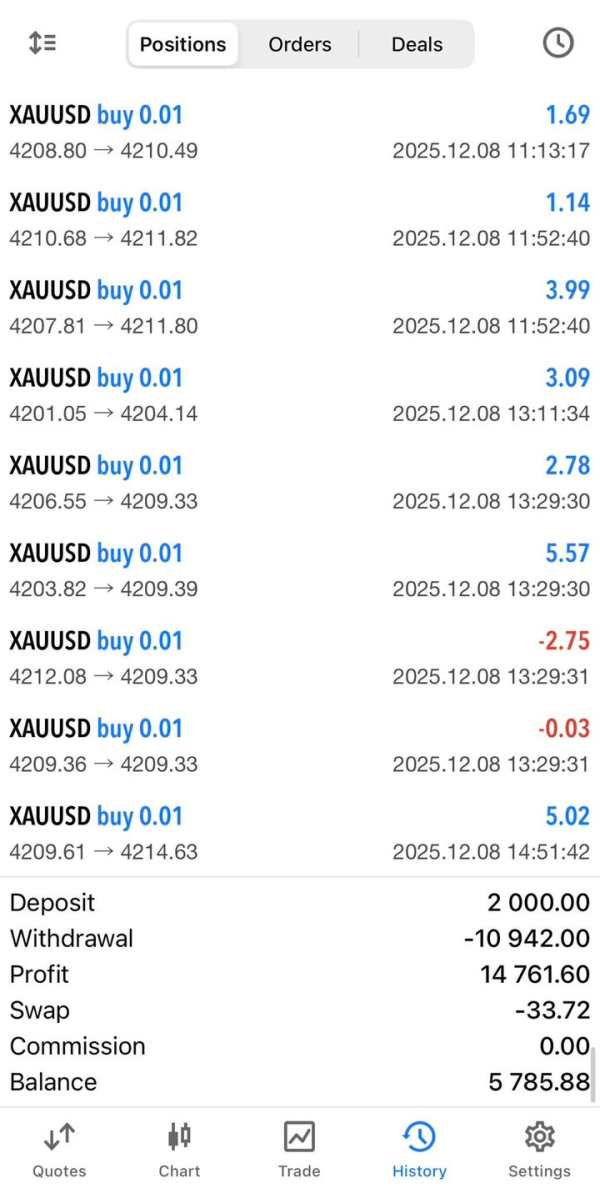

The trading experience evaluation is significantly hampered by inconsistent user feedback and limited detailed information about platform performance. Some users report successful deposit and withdrawal operations, suggesting that basic platform functionality may work for certain traders. However, these positive experiences are contradicted by numerous warnings about potential fraudulent activities.

Platform stability and execution quality information is not comprehensively available, making it difficult to assess critical factors such as order execution speed, slippage rates, and system uptime. Professional trading platforms typically provide detailed performance statistics and uptime guarantees to demonstrate reliability to potential clients. Mobile trading capabilities and cross-device synchronization features are not clearly outlined in available sources.

Modern traders expect seamless mobile trading experiences with full functionality across smartphones, tablets, and desktop computers. The absence of detailed mobile platform information represents a significant evaluation gap. The inconsistent user experiences, ranging from smooth operations to scam allegations, create an unreliable trading environment that undermines confidence.

This Auro Markets review emphasizes that trading experience quality requires consistent platform performance and user satisfaction. This appears lacking based on available evidence.

Trust and Reliability Analysis (1/10)

Trust and reliability represent the most concerning aspects of Auro Markets operations. The platform's TrustScore of 35/100 indicates significant trust issues within the trading community, reflecting widespread concerns about platform legitimacy and operational integrity. Multiple sources have identified Auro Markets as potentially being created by anonymous scam groups, representing a fundamental threat to user security.

The absence of clear regulatory oversight from recognized financial authorities eliminates standard investor protection mechanisms that traders rely on for security. Legitimate brokers typically hold licenses from respected regulators such as the FCA, ASIC, or CySEC, providing legal recourse and compensation schemes for clients. Fund security measures, segregated account policies, and client money protection protocols are not detailed in available information.

Professional brokers implement strict fund segregation, insurance coverage, and transparent financial reporting to ensure client asset safety. The lack of such information raises serious concerns about fund security. Industry reputation analysis reveals predominantly negative assessments, with multiple warnings about potential fraudulent activities.

The handling of negative events and user complaints appears inadequate, with scam allegations remaining unaddressed through transparent communication or corrective actions. These factors combine to create an extremely concerning trust profile that warrants serious caution.

User Experience Analysis (4/10)

Overall user satisfaction with Auro Markets demonstrates significant inconsistency, with experiences ranging from satisfactory to highly negative. This polarization in user feedback creates uncertainty about platform reliability and service quality. Some traders report smooth deposit and withdrawal processes, while others warn about potential fraudulent activities, creating a confusing landscape for potential users.

Interface design and platform usability information is not comprehensively available, limiting assessment of user-friendly features and navigation efficiency. Modern trading platforms emphasize intuitive design, customizable interfaces, and streamlined workflows to enhance user productivity and satisfaction. Registration and account verification processes are not clearly detailed, though this represents a standard operational requirement for legitimate brokers.

The absence of transparent onboarding information may indicate operational deficiencies or deliberate opacity that concerns potential users. Fund operation experiences show mixed results, with some users successfully completing transactions while others express concerns about platform reliability. This inconsistency undermines user confidence and creates uncertainty about financial security.

Common user complaints focus on scam allegations and trust concerns rather than specific platform functionality issues. This indicates fundamental operational problems rather than minor technical difficulties.

Conclusion

This comprehensive Auro Markets review reveals significant concerns that strongly advise against investment with this platform. The combination of a low TrustScore, widespread scam allegations, and lack of regulatory oversight creates an environment of substantial risk for potential traders. While the platform offers automated trading tools and some users report satisfactory experiences with deposits and customer service, these limited positives are overwhelmed by fundamental trust and safety concerns.

The absence of transparent operational information, including regulatory status, comprehensive fee structures, and clear account conditions, represents unacceptable operational standards for professional forex trading. The identification of Auro Markets as potentially being created by anonymous scam groups constitutes a critical warning that cannot be overlooked regardless of any reported positive experiences. No trader profile can be safely recommended for this platform given the substantial risk factors identified.

The inconsistent user experiences and serious allegations about fraudulent activities create an environment where financial loss appears highly probable. Traders seeking reliable forex trading services should prioritize regulated brokers with transparent operations, clear regulatory oversight, and consistent positive user feedback to ensure the safety of their investments and trading capital.