SmartyTrade is registered under the ownership of OM LA Ltd, based in the Marshall Islands. Launched in 2020, the company promises diverse trading options across various assets, including forex, stocks, and cryptocurrencies, combined with features like high leverage and fast order execution. However, its unregulated status raises questions about the safety and reliability of its services, prompting critical energy within the trading community.

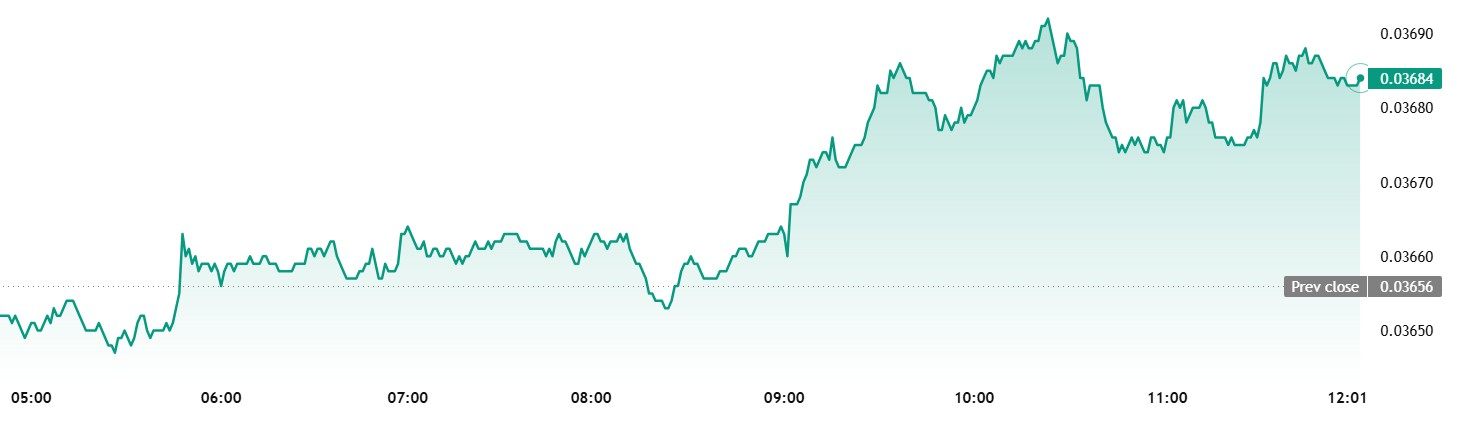

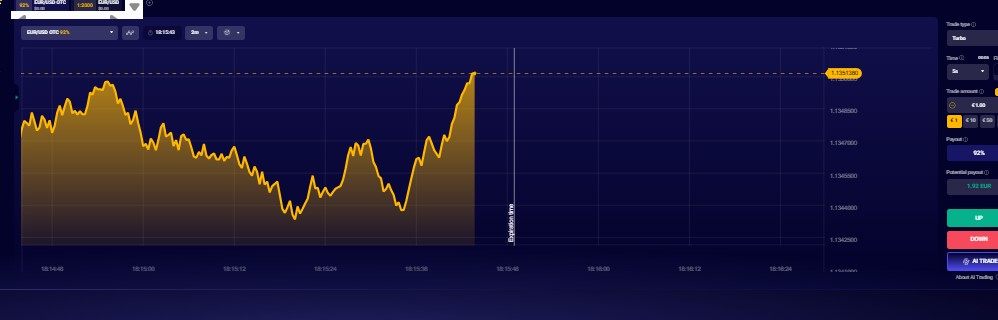

As an unregulated brokerage, SmartyTrade offers a variety of trading instruments through an in-house web-based platform. Users can trade Contracts for Difference (CFDs) across multiple asset classes, including forex pairs, commodities, and indices. The website markets, among other features, high leverage levels up to 1:500, competitive spreads starting from 0 pips for forex, and an enticing binary options trading feature with payouts up to 95%. Despite these appealing factors, the absence of safeguards typical of regulated brokers presents a critical risk for traders.

SmartyTrade operates without any regulatory authority, causing significant concern regarding the safety of user funds. According to reviews, the absence of protection against fraud and mismanagement creates a risky environment for traders.

- Check Registration: Visit the official regulatory body websites to verify if SmartyTrade holds any licenses.

- Research User Feedback: Search for user reviews on platforms like Trustpilot and Reddit.

- Monitor Withdrawal Procedures: Be cautious of indications that withdrawals may be complicating, which is common in unregulated brokers.

Industry Reputation and Summary:

Reviews vary, with some praising fast withdrawal methods while others report significant issues during the withdrawal process.

"After you manage to grow your balance and decide to withdraw your money, these so-called legitimate platforms refuse to answer." — User Feedback

Trading Costs Analysis

Advantages in Commissions:

SmartyTrade advertises low commissions, especially on forex trades; spreads starting at 0 pips and no commission for crypto exchanges stand out.

The "Traps" of Non-Trading Fees:

Users have reported hidden fees and high withdrawal charges as common complaints. Some traders have experienced delays or issues when trying to access their funds, hinting at an unclear fee structure.

"I requested a withdrawal of $500... It took too long to reflect in my bank account, despite the fast agreement." — User Experience

Cost Structure Summary:

While trading costs may appear attractive, the lack of transparency around other fees can quickly lead to unexpected expenses for users unfamiliar with what to look for.

Platform Diversity:

SmartyTrade provides a proprietary platform accessible via web and mobile. Though it offers multiple financial instruments, the platform does not support common trading software like MT4 or MT5, which limits some advanced trading strategies.

Quality of Tools and Resources:

The platform includes various analytical tools, yet lacks in-depth educational resources to aid less experienced traders, potentially leading to costly missteps.

Platform Experience Summary:

Though some users find the platform functional, feedback regarding its intuitiveness is mixed, complicating the trading experience for both newcomers and experienced traders.

"The desktop and mobile platforms feel clunky and unintuitive." — User Review

User Experience Analysis

Trading Environment:

Traders report that SmartyTrade maintains a 24/7 trading environment, appealing to those who prefer flexibility and access.

Real-Time Support:

The effectiveness of customer support is a bright spot, with agents available to assist promptly. This can create a positive trading experience in times of uncertainty.

User Sentiment:

Feedback on the platform varies with mentions of rapid responses to inquiries but raises constant alarms about the handling of funds during withdrawal requests.

Customer Support Analysis

SmartyTrade offers 24/7 multilingual support, which users commend for being responsive and helpful. However, the lack of effective follow-through during withdrawal issues is concerning.

Account Conditions Analysis

SmartyTrade provides various account types—Gold, Silver, and Bronze—tailored to accommodate different trading needs. However, the associated risks remain high, as the terms for accessing bonuses and other features can be unclear and complex.

Conclusion

Throughout this comprehensive review of SmartyTrade, it is evident that while the brokerage offers attractive features such as high leverage and rapid withdrawal times, the overarching absence of regulatory oversight presents significant risks for traders. Experienced individuals might find the opportunities appealing, but newcomers should approach with caution, carefully considering the implications of trading in an unregulated environment. Given user feedback and a lack of transparent practices, aspiring traders should weigh their options against trusted, regulated brokers to safeguard their investments.