Is RoboForex safe?

Pros

Cons

Is RoboForex A Scam?

Introduction

RoboForex, founded in 2009, is a well-known player in the forex market, offering a diverse range of trading options and platforms. With its headquarters in Belize, RoboForex has positioned itself as a global broker catering to traders from various backgrounds, including beginners and experienced investors. Given the rapid growth of online trading and the increasing number of brokers, it is imperative for traders to exercise caution when selecting a forex broker. A thorough assessment of a broker's legitimacy, regulatory compliance, and customer experiences is essential to safeguard one's investments.

In this article, we will critically evaluate RoboForex by examining its regulatory status, company background, trading conditions, customer fund safety measures, client experiences, platform performance, and associated risks. Our investigation combines narrative analysis with structured data to provide a comprehensive overview of RoboForex, enabling traders to make informed decisions.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for ensuring the safety of traders' funds and maintaining fair trading practices. RoboForex is regulated by the International Financial Services Commission (IFSC) of Belize, which oversees its operations under license number 000138/437. While the IFSC is a recognized regulatory body, it is often considered a tier-4 regulator, which raises questions about the level of investor protection compared to top-tier regulators like the FCA (UK) or ASIC (Australia).

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| IFSC | 000138/437 | Belize | Verified |

The importance of regulation cannot be understated, as it provides a framework for accountability and recourse in case of disputes. RoboForex's adherence to IFSC regulations indicates a commitment to operational standards; however, it lacks oversight from more stringent regulators. This aspect may pose risks for traders who prioritize regulatory security.

Historically, RoboForex has maintained a clean compliance record, with no major regulatory infractions reported. Nevertheless, the offshore nature of its regulation could lead to concerns among traders about the effectiveness of oversight and the potential for issues related to fund security.

Company Background Investigation

RoboForex has a history of over a decade in the forex industry, establishing itself as a reputable broker. The company's ownership structure is transparent, with its parent company, RoboForex Ltd., operating under the laws of Belize. The management team consists of experienced professionals with backgrounds in finance and trading, which enhances the company's credibility.

The firm's transparency is reflected in its willingness to disclose operational practices and regulatory compliance details. RoboForex provides comprehensive information regarding its services, trading conditions, and risk factors on its website. This level of disclosure is essential for building trust with clients and ensuring that they are well-informed before engaging in trading activities.

Furthermore, RoboForex has received numerous awards for its services, including recognition for its trading platforms and customer support. These accolades suggest a commitment to quality and customer satisfaction, reinforcing its position as a reliable broker in the competitive forex market.

Trading Conditions Analysis

RoboForex offers a variety of trading accounts, catering to different trader preferences and experience levels. The broker's fee structure is designed to be competitive, with spreads starting from 0 pips on certain account types. However, it is important to analyze the overall cost structure to ensure that traders are aware of potential hidden fees.

| Fee Type | RoboForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0 pips | 1.0 pips |

| Commission Model | $10-$20 per million traded | $5-$15 per million traded |

| Overnight Interest Range | Varies | Varies |

The trading costs at RoboForex are competitive compared to industry standards, particularly for its ECN and Prime accounts. However, some accounts may incur higher spreads and commissions, which could impact profitability for active traders. It is crucial for traders to carefully review the specific fees associated with their chosen account type and trading instruments.

Additionally, RoboForex's promotional offers, such as deposit bonuses and cashback programs, can provide further incentives for traders. However, these promotions often come with specific terms and conditions that traders should thoroughly understand before participation.

Client Fund Safety

The safety of client funds is a paramount concern for any broker. RoboForex employs several measures to protect its clients' investments, including segregated accounts that separate client funds from the company's operational funds. This practice is essential for safeguarding clients' assets in the event of financial difficulties faced by the broker.

Moreover, RoboForex offers negative balance protection, ensuring that clients cannot lose more than their deposited amount. This feature is particularly beneficial in volatile market conditions, where rapid price movements can lead to significant losses. Additionally, RoboForex participates in the Financial Commission's compensation fund, which provides coverage of up to €20,000 per claim in the event of disputes.

Despite these measures, traders should remain vigilant and conduct their own due diligence regarding the broker's financial stability and historical performance. Any past incidents related to fund safety should be thoroughly investigated to ensure that RoboForex is a reliable partner for trading.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with a broker. RoboForex has garnered a mix of reviews, with many users praising its trading conditions, platform performance, and prompt customer support. However, some common complaints have also emerged.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

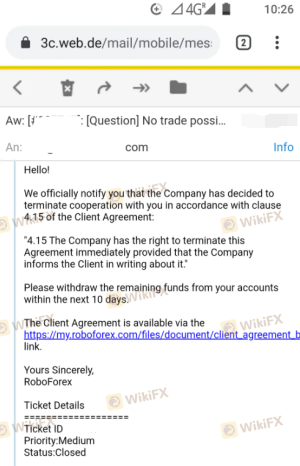

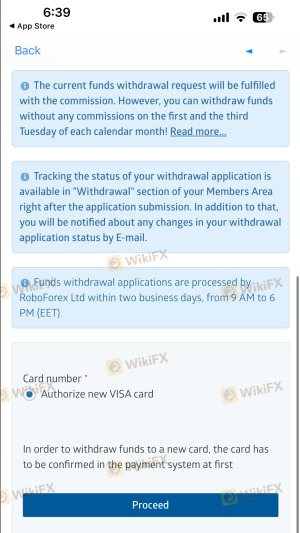

| Withdrawal Delays | Moderate | Addressed promptly |

| Platform Stability Issues | High | Ongoing improvements |

| Customer Support Responsiveness | Moderate | Generally positive |

Typical complaints include delays in withdrawals, which can be a significant concern for traders needing timely access to their funds. However, RoboForex has demonstrated a commitment to resolving these issues, with many users reporting satisfactory experiences with the support team. The company's responsiveness to feedback indicates a willingness to improve its services continuously.

One notable case involved a trader who faced delays in processing a withdrawal request. After reaching out to customer support, the issue was resolved within 24 hours, showcasing the broker's commitment to customer satisfaction. Such instances highlight the importance of effective communication and responsiveness in building client trust.

Platform and Trade Execution

RoboForex provides a range of trading platforms, including the popular MetaTrader 4 and 5, as well as its proprietary platforms. The performance and stability of these platforms are critical for traders, as any disruptions can adversely affect trading outcomes.

Traders have reported generally positive experiences with platform performance, citing fast order execution and minimal slippage. However, some users have noted instances of platform instability during high-volatility periods, which could lead to execution delays or rejected orders. It is essential for traders to be aware of these potential issues and implement risk management strategies accordingly.

Risk Assessment

Engaging with RoboForex, like any trading platform, entails certain risks. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited regulatory oversight |

| Fund Security Risk | Low | Segregated accounts and protections |

| Platform Risk | Medium | Potential stability issues during volatility |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts for practice, and implement robust risk management strategies. It is advisable to start with smaller investments until one becomes familiar with the platform and its trading conditions.

Conclusion and Recommendations

In conclusion, RoboForex presents itself as a legitimate broker with a solid reputation in the forex market. While it is regulated by the IFSC in Belize, the lack of oversight from top-tier regulators may raise concerns for some traders. Nevertheless, the broker's commitment to fund safety, negative balance protection, and transparent operations suggests a reliable trading environment.

Traders should approach RoboForex with a balanced perspective, weighing its advantages against potential risks. For novice traders, RoboForex offers a low minimum deposit and a variety of account types, making it accessible for those starting in forex trading. However, experienced traders may want to consider alternatives with stronger regulatory oversight.

Overall, RoboForex can be a viable option for traders seeking a diverse range of products and competitive trading conditions, but it is essential to remain vigilant and informed about the associated risks. For those prioritizing regulatory security, exploring brokers with tier-1 licenses may be advisable.

Is RoboForex a scam, or is it legit?

The latest exposure and evaluation content of RoboForex brokers.

RoboForex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RoboForex latest industry rating score is 2.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.