Sway Markets was founded in 2022 and is managed by Sway Markets Pty Ltd, which claims a headquarters located in Australia. Despite its Australian naming and registration with ASIC, skepticism arises because Sway Markets also cites Saint Vincent and the Grenadines as a registered location, a region often associated with lax regulations for forex trading. The emergence of this broker signifies a growing trend in the online trading space, focusing on high-leverage options aimed at experienced traders.

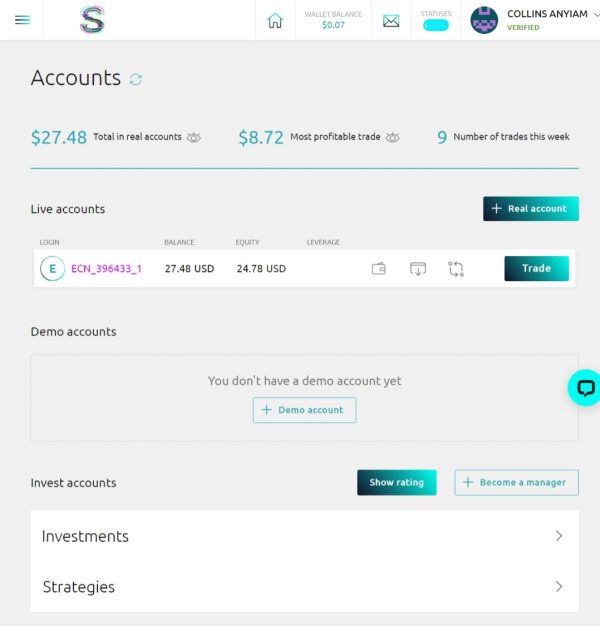

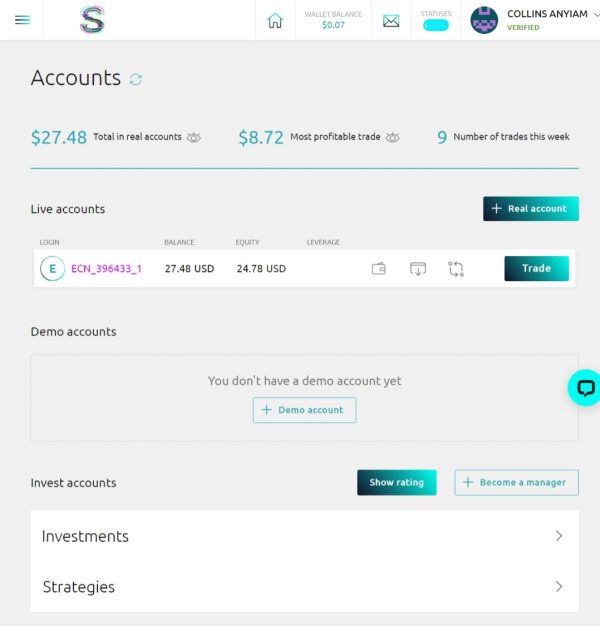

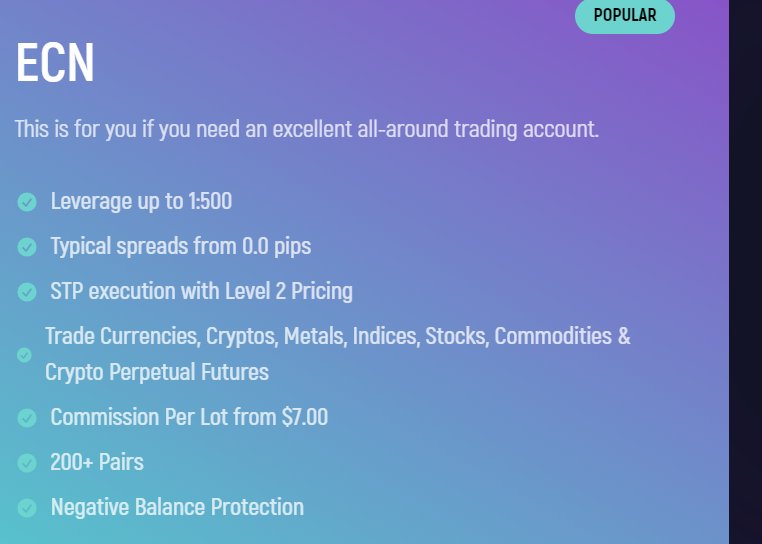

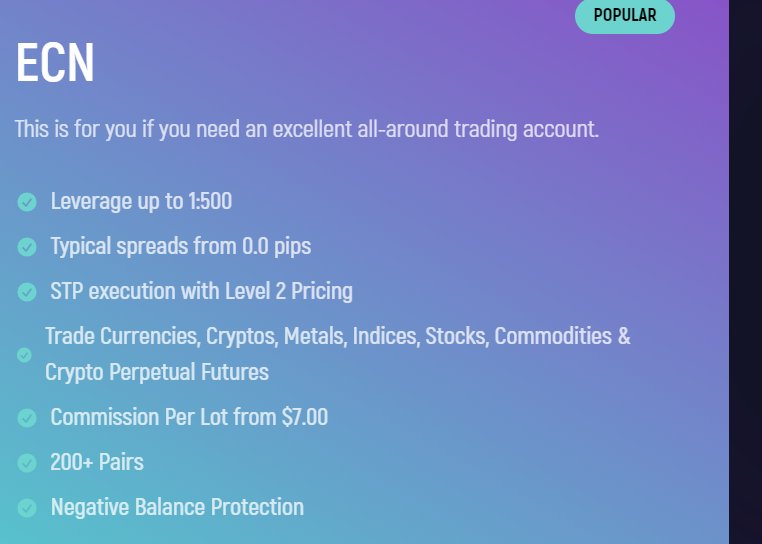

Sway Markets positions itself as a versatile platform for trading various instruments, including Forex, commodities, cryptocurrencies, and stocks. The broker boasts differentiated account types—ECN, No Commission, VIP, and Islamic—tailored to fit distinct trading preferences. The leverage offered can go as high as 1:500, and the trading environment is enhanced by the popular MT5 platform, designed for both novice and seasoned traders. Feasibly structured commissions foster an appealing trade environment, but the reality is complicated by serious compliance and operational concerns.

Sway Markets claims to operate under ASIC regulations; however, their high leverage offerings exceed Australian limits (Max 1:30), raising doubts. User reports suggest the broker's legitimacy remains in question, given insufficient transparency and inconsistent claims regarding regulatory compliance (Sway Markets Review - Forex Judge).

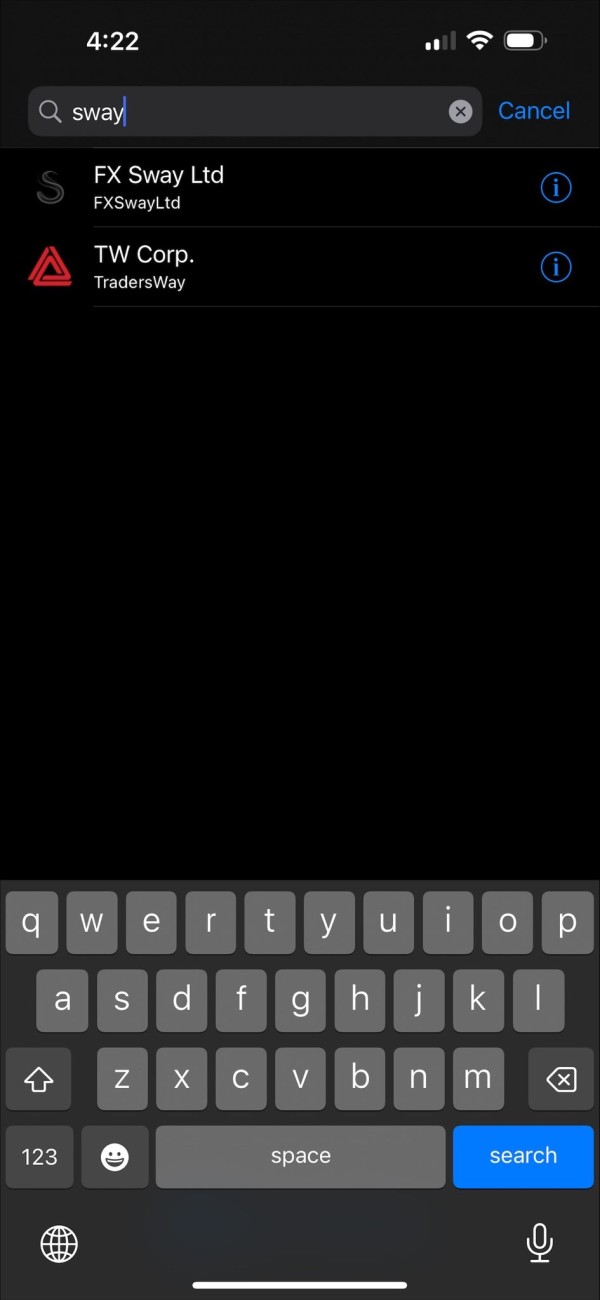

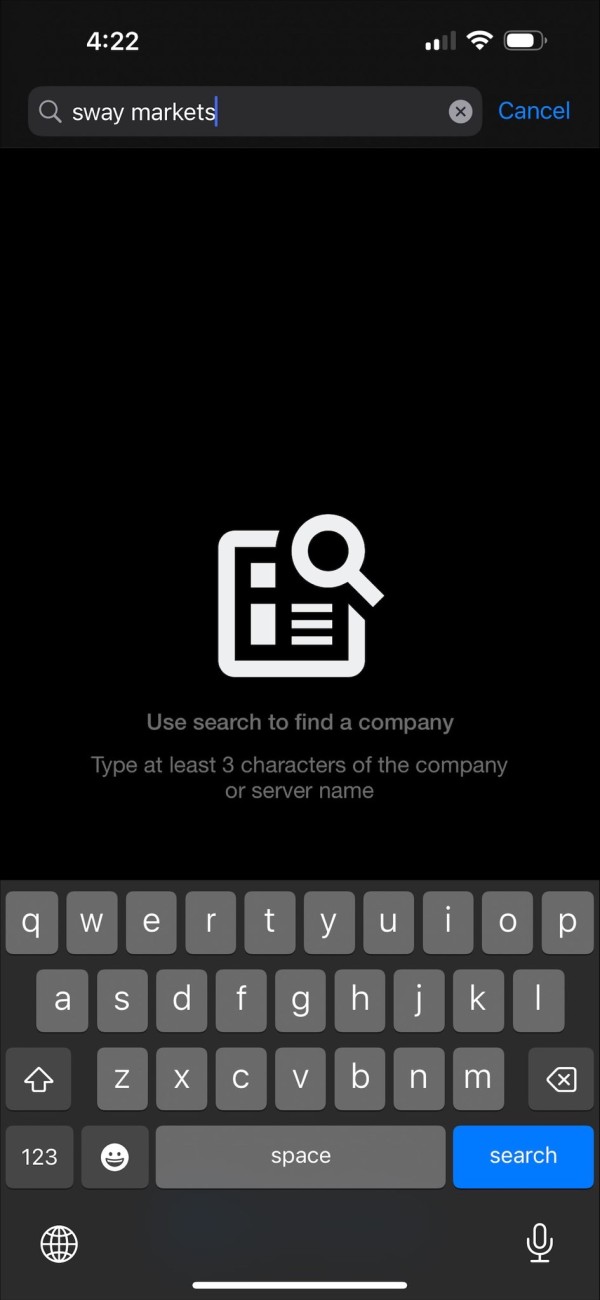

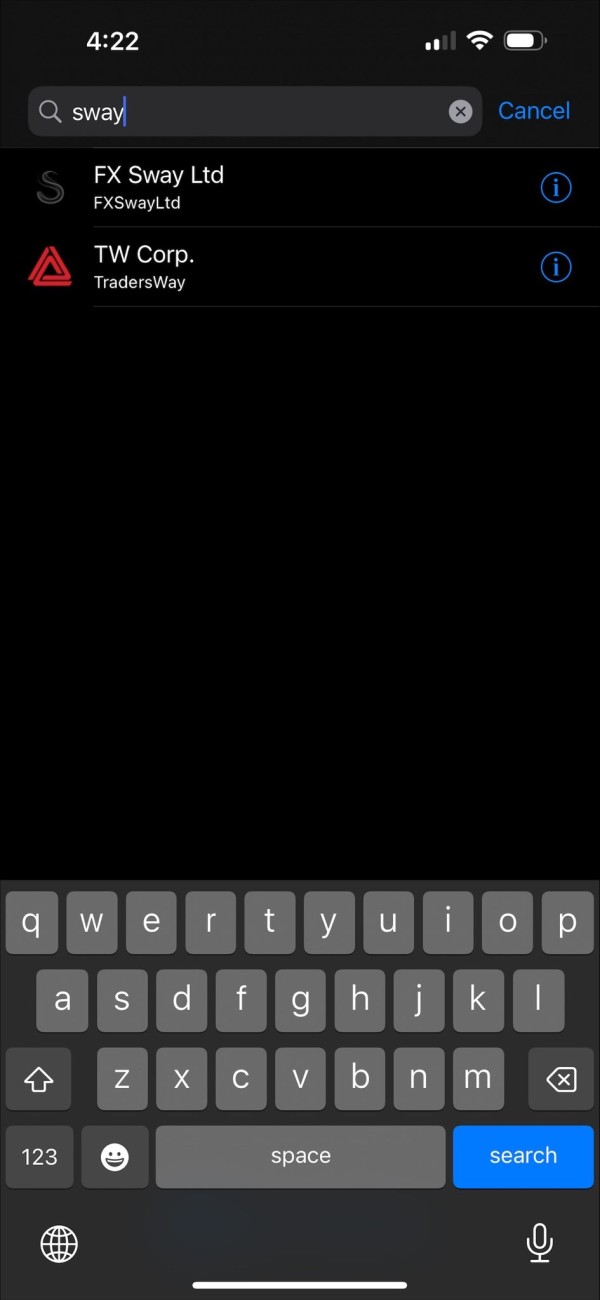

To mitigate the risks associated with investing in Sway Markets, users can independently verify the broker's claims through the following steps:

- Visit the ASIC webpage: Use the ASICs online search tool to look for Sway Markets Pty Ltd or its license number.

- Cross-reference reviews on multiple platforms: Look at user experiences on websites like Trustpilot and ForexPeaceArmy.

- Verify business registration details: Check for inconsistencies regarding their claimed registered locations in Australia and Saint Vincent.

- Engage with support: Attempt to communicate with customer service to ascertain responsiveness and professionalism.

Industry Reputation and Summary

The prevailing sentiment in the trading community is one of caution, with many users advising against engaging with Sway Markets due to unresolved withdrawal issues and insufficient support.

Trading Costs Analysis

Advantages in Commissions

Sway Markets advertises competitive commissions beginning at approximately $3.50 for its VIP accounts, aiming to attract high-frequency traders (Sway Markets Review - BrokersView). Their no-commission accounts with slightly higher spreads can offer enticing prospects.

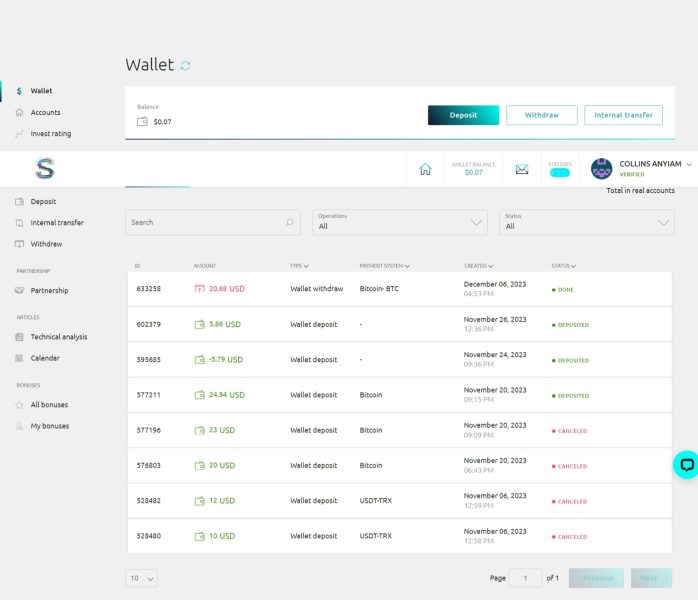

The "Traps" of Non-Trading Fees

Several negative user experiences indicate that hidden fees can emerge during withdrawals, causing frustration for traders who expect straightforward processes. Complaints highlight excessive fees, including allegations of withdrawal fees reaching as high as 30% (Sway Markets Review - The Forex Review).

Customer Feedback: “I paid an unexpected $30 withdrawal fee after expecting a straightforward process.”

Cost Structure Summary

While low commission rates may appeal to various traders, users should remain vigilant about potential hidden costs that could drastically affect their overall profitability.

Platform Diversity

Sway Markets provides the widely popular MetaTrader 5 (MT5) alongside their proprietary trading platform. MT5 is known for its advanced trading tools, user-friendly interface, and access to an extensive collection of technical indicators—an advantageous feature for both novice and experienced traders.

Quality of Tools and Resources

Sway Markets incorporates significant trading analysis tools alongside educational materials that fall short of those provided by more established brokers. The absence of key resources such as live webinars and comprehensive guides can hinder user self-education.

Platform Experience Summary

Many reviews highlight a generally favorable experience with the MT5 platform; however, some traders express concerns over the proprietary platforms limitations and usability.

“The MT5 platform works well but the proprietary tools need improvements.”

User Experience Analysis

Analyzing User Experiences

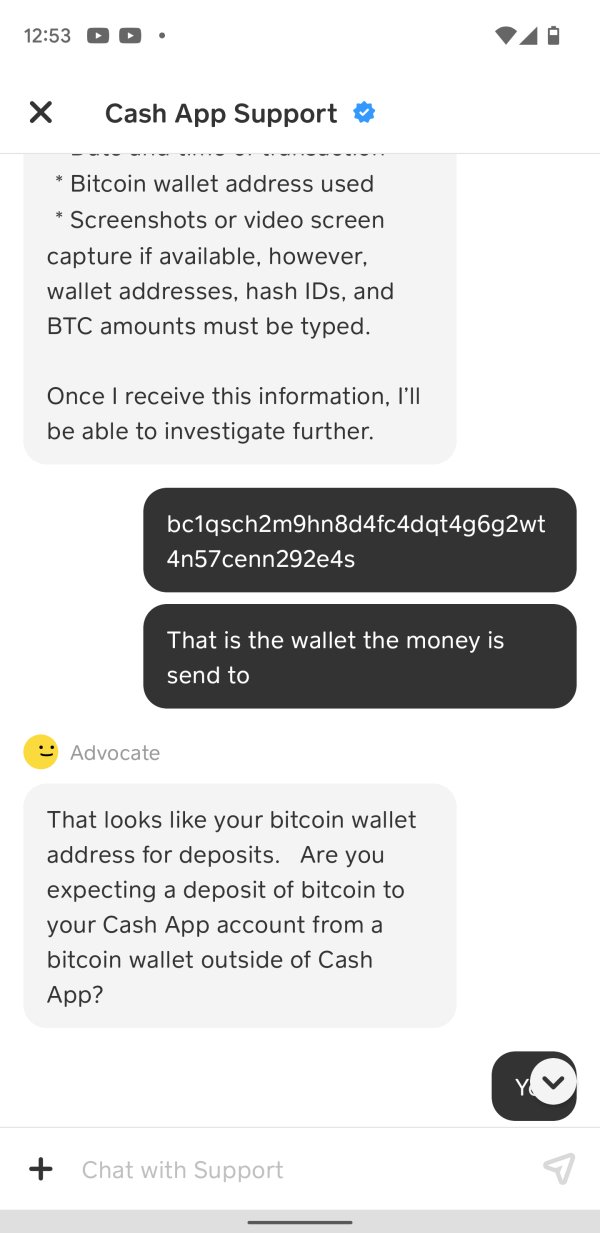

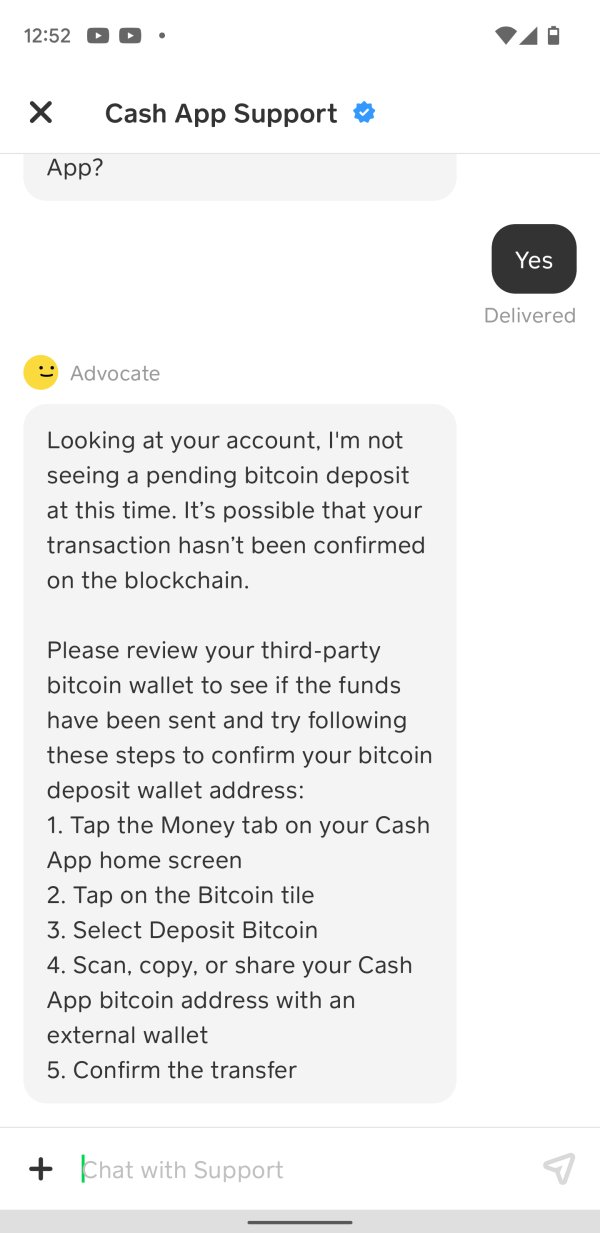

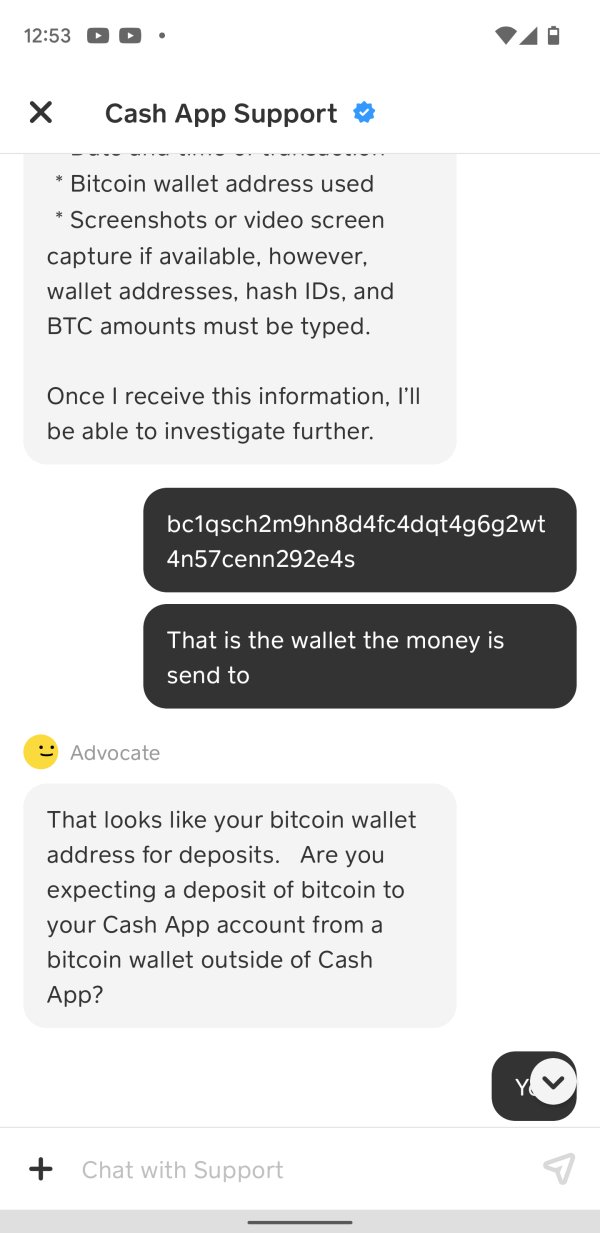

User experiences with Sway Markets indicate overwhelming instances of unresponsive customer service and withdrawal hassles. Many customers noted difficulties in reaching help and stretched wait times for their requests to be addressed.

Gathering General Feedback

Negative feedback dominates the sentiment around Sway Markets, primarily revolving around delayed customer support, withdrawal complexities, and inadequacies in account management assistance.

Summarizing Overall Sentiment

The experiences displayed reveal a disconnect between the broker's promises and the reality faced by users, urging potential clients to tread carefully.

Customer Support Analysis

Assessing Available Support Options

Sway Markets claims to provide various support channels, including email, phone, and 24/7 live chat. However, review assessments indicate that users often find the support lacking when most needed.

General User Feedback

Users report frustrations when trying to engage with the support team, citing delayed responses or inadequate problem resolution.

Rating Customer Support Quality

The high level of unreliability noted in customer service interactions paints a challenging picture for traders requiring timely assistance.

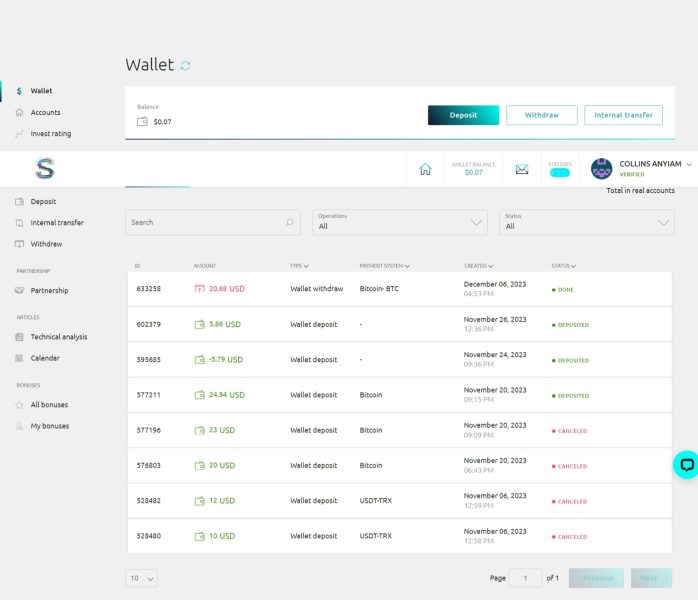

Account Conditions Analysis

Account Types Overview

Sway Markets presents a variety of account types, including ECN, No Commission, VIP, and Islamic accounts. Each account is structured to cater to different trading focuses, from high scalability for experienced traders to zero-commission opportunities.

Investment Depth Comparison

The minimum deposit requirement starts as low as $10, a tempting figure for entry-level traders but potentially misleading considering the subsequent risks associated with engagement.

Conclusion on Conditions

While the broker's flexibility in account offerings may attract a broad audience, cautious evaluation of the associated risks and customer journeys is essential.

Conclusion: A Cautious Path Forward

In summary, Sway Markets emerges as a broker appealing to experienced traders through diverse offerings and high leverage opportunities. However, the serious regulatory ambiguities, reports of troubling customer experiences, and unresolved withdrawal difficulties suggest considerable risks. Potential investors should conduct thorough research and verification before engaging with this broker, seeking guidance on navigating the complexities surrounding operational legitimacy.

Make informed investing decisions and remain vigilant of potential risks while considering Sway Markets for your trading endeavors.