Regarding the legitimacy of NCE forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is NCE safe?

Pros

Cons

Is NCE markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

NCE SC Limited

Effective Date:

--Email Address of Licensed Institution:

info@nce.scSharing Status:

No SharingWebsite of Licensed Institution:

https://www.nce.sc, https://www.xnce.comExpiration Time:

--Address of Licensed Institution:

House of Francis, Office 301(D), Ile Du Port, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4 325 033Licensed Institution Certified Documents:

Is NCE A Scam?

Introduction

NCE, known as the National Coin Exchange, positions itself as a multi-asset broker in the forex market, offering a range of trading instruments including forex, commodities, cryptocurrencies, and indices. With the growing number of online trading platforms, traders are often faced with the challenge of distinguishing between legitimate brokers and potential scams. It is crucial for traders to conduct thorough evaluations of any broker before committing their funds, as the financial industry can be rife with risks and fraudulent activities.

This article aims to provide an objective analysis of NCE by examining its regulatory status, company background, trading conditions, customer fund safety, customer experiences, platform performance, and associated risks. The investigation is based on a review of various online sources, including user testimonials, regulatory filings, and expert analyses.

Regulation and Legitimacy

NCE operates under the regulatory framework provided by the Seychelles Financial Services Authority (FSA). While the Seychelles is known for its offshore regulatory environment, this status can raise concerns about the level of oversight and protection offered to traders. Below is a summary of the core regulatory information pertaining to NCE:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD112 | Seychelles | Offshore Regulated |

The importance of regulatory oversight cannot be overstated; it serves as a safeguard for traders, ensuring that brokers adhere to certain standards of conduct. The FSA, although a recognized authority, does not provide the same level of investor protection as more stringent regulators like the FCA or ASIC. Historical compliance issues have been noted with brokers operating under less stringent regulations, raising red flags for potential investors.

Company Background Investigation

NCE was founded in 2017 and is registered in Australia, although it operates under the auspices of an offshore entity. The company claims to have a solid foundation in trading and investment services, but the lack of transparency regarding its ownership structure and management team is concerning. There is little publicly available information about the individuals behind NCE, which can hinder the ability of potential clients to assess the credibility and expertise of the management team.

The transparency of a brokerage is critical; it allows traders to understand who is managing their investments and the qualifications of those individuals. NCE's limited disclosure on these matters may indicate a potential risk for investors seeking a trustworthy trading environment.

Trading Conditions Analysis

NCE offers a variety of trading conditions, including competitive spreads and leverage options that can attract traders. However, it is essential to scrutinize the overall fee structure and any hidden costs that may affect profitability. Below is a comparison of core trading costs associated with NCE:

| Cost Type | NCE | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.6 pips | From 1.0 pips |

| Commission Model | $3.8 per lot | Varies |

| Overnight Interest Range | Not specified | Varies |

While NCE promotes low trading costs, the spreads on major currency pairs are higher than some industry averages. Additionally, the commission structure may not be as competitive as advertised, which could affect overall trading performance. Traders should be wary of any unusual fees that may not be clearly outlined in the broker's terms and conditions.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. NCE claims to maintain strict measures for fund security, including the segregation of client funds from company assets. This practice is essential for protecting traders in the event of financial difficulties faced by the broker. However, the effectiveness of these measures is contingent upon the regulatory framework under which the broker operates.

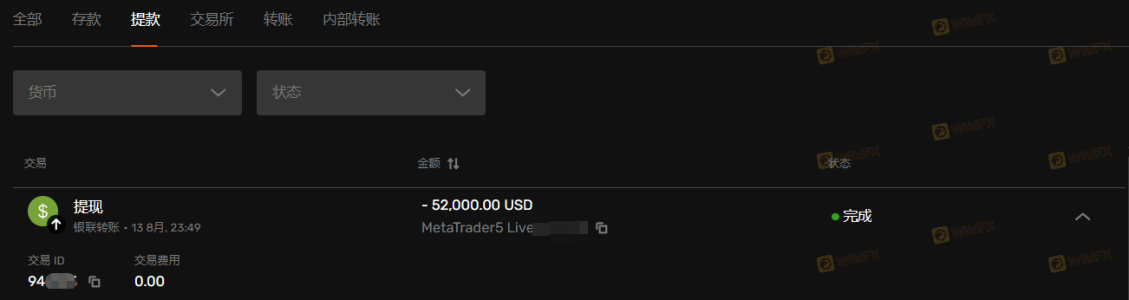

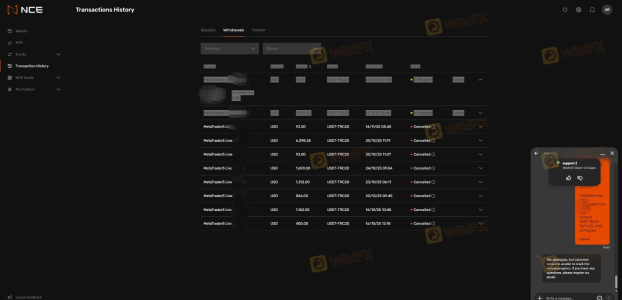

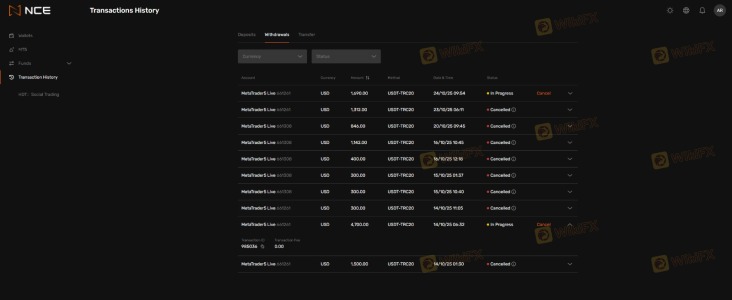

NCE's offshore regulatory status raises questions about the robustness of its investor protection policies. Additionally, there have been reports of withdrawal issues, which can be indicative of deeper financial problems within the brokerage. Historical controversies regarding fund safety or security breaches can significantly impact a trader's decision to engage with a broker.

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reliability. NCE has received mixed reviews from users, with some praising the platform's ease of use and others expressing frustration over withdrawal difficulties. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

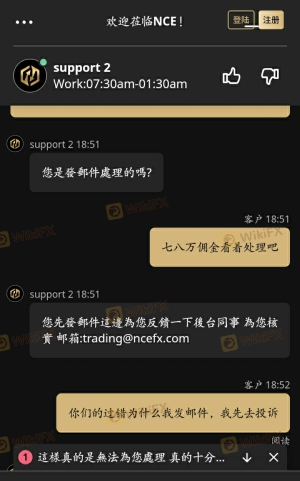

| Withdrawal Issues | High | Slow or unresponsive |

| Platform Stability | Medium | Generally positive |

| Customer Support Quality | Low | Mixed feedback |

Real user experiences highlight significant concerns regarding withdrawal processes, with numerous reports indicating that clients have faced challenges in accessing their funds. Such complaints can serve as a warning sign for potential traders, suggesting that they may encounter similar issues if they choose to trade with NCE.

Platform and Execution

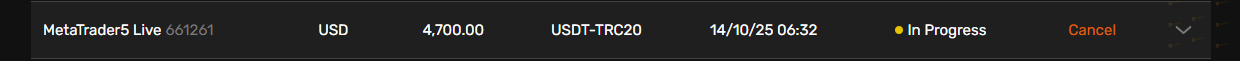

NCE offers the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, known for their robust features and user-friendly interfaces. However, the quality of order execution, including slippage and rejection rates, is critical for successful trading. Traders have reported varying experiences with execution quality on NCE's platforms, with some noting instances of slippage during volatile market conditions.

The potential for platform manipulation or poor execution can significantly impact trading outcomes. Traders should remain vigilant and consider these factors when evaluating the overall performance of NCE's trading environment.

Risk Assessment

Engaging with NCE involves several risks that traders should carefully consider. The following risk assessment summarizes key risk areas associated with trading with NCE:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight. |

| Withdrawal Risk | High | Reports of significant withdrawal issues. |

| Transparency Risk | Medium | Limited information on company management and operations. |

| Execution Risk | Medium | Variability in order execution quality. |

To mitigate these risks, potential traders should conduct thorough due diligence, consider starting with a demo account, and only invest funds they can afford to lose.

Conclusion and Recommendations

Based on the evidence presented, NCE raises several red flags that warrant caution. While it operates under some regulatory oversight, the offshore nature of its licensing, coupled with numerous complaints regarding withdrawal issues, suggests that it may not be a trustworthy choice for traders.

For those considering trading with NCE, it is advisable to proceed with caution and consider alternative brokers with stronger regulatory frameworks and better reputations. Some reliable alternatives include brokers regulated by the FCA or ASIC, which typically offer a higher level of investor protection and transparency. Ultimately, the decision to engage with NCE should be made after careful consideration of the associated risks and potential challenges.

Is NCE a scam, or is it legit?

The latest exposure and evaluation content of NCE brokers.

NCE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NCE latest industry rating score is 4.73, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.73 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.