Regarding the legitimacy of octa forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is octa safe?

Software Index

Risk Control

Is octa markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Octa Markets Cyprus Ltd

Effective Date:

2018-12-10Email Address of Licensed Institution:

info@octaeu.comSharing Status:

No SharingWebsite of Licensed Institution:

www.octabroker.eu, www.octatrade.eu, www.octa.broker, www.octatrading.eu, www.octamarket.eu, www.octamarkets.eu, www.octa.trading, www.octa.trade, www.octa.market, www.octa.markets, www.octaeu.net, www.octaeu.org, www.octaeu.com, www.octaeurope.comExpiration Time:

--Address of Licensed Institution:

1, Agias Zonis and Thessalonikis Corner, Nicolaou Pentadromos Center, Block: B', Office: 201, 3026, LimassolPhone Number of Licensed Institution:

+357 25 251 973Licensed Institution Certified Documents:

Is OctaFX A Scam?

Introduction

OctaFX, a well-known name in the forex trading market, has been operational since 2011, offering a range of trading services to clients across numerous countries. Positioned as a broker that provides competitive trading conditions, OctaFX has attracted a diverse clientele, particularly from Asia-Pacific regions. However, the forex industry is fraught with risks, including potential scams and unreliable brokers. Therefore, traders must exercise caution and conduct thorough evaluations before committing their funds to any brokerage. This article aims to provide an objective analysis of OctaFX, examining its regulatory status, company background, trading conditions, fund security measures, customer experiences, and overall risk profile. The assessment will be based on a comprehensive review of available data, user feedback, and regulatory information.

Regulation and Legitimacy

Understanding a broker's regulatory status is crucial for assessing its legitimacy and the level of protection it offers to traders. OctaFX operates under multiple regulatory frameworks, which is a positive indicator of its credibility. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) of Saint Vincent and the Grenadines, among others. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| CySEC | 372/18 | Cyprus | Verified |

| FSA | 19776 | Saint Vincent | Verified |

| MISA | T2023320 | Comoros | Verified |

The presence of a CySEC license indicates that OctaFX is subject to stringent regulatory standards, which include capital requirements and investor protection measures. Clients with accounts under CySEC regulations are eligible for compensation of up to €20,000 in case of broker insolvency. However, it is essential to note that while CySEC is regarded as a tier-1 regulator, the FSA of Saint Vincent is considered a lower-tier regulator, which may not provide the same level of protection. Overall, OctaFX's regulatory status suggests an average risk profile, with the potential for both protection and exposure depending on the specific entity under which a trader operates.

Company Background Investigation

Founded in 2011, OctaFX has established itself as a significant player in the global forex market. The company operates under the ownership of Octa Markets Inc., registered in Saint Vincent and the Grenadines, and has expanded its reach through various subsidiaries, including Octa Markets Cyprus Ltd. The management team behind OctaFX comprises professionals with extensive experience in finance and trading, contributing to the broker's operational integrity.

The company's transparency is reflected in its commitment to providing clear information about its services, trading conditions, and regulatory compliance. Moreover, OctaFX has won numerous industry awards, which further bolster its reputation as a trustworthy broker. However, the reliance on offshore regulation, particularly from Saint Vincent, may raise concerns for some traders regarding the level of oversight and protection available.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and commissions, is vital. OctaFX offers a competitive trading environment, but it is essential to scrutinize the associated costs. The broker's fee structure is primarily based on spreads, with no additional commissions for most account types. Below is a comparison of core trading costs:

| Fee Type | OctaFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 - 1.1 pips | 0.8 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | None (swap-free) | Varies |

OctaFX's spreads are competitive, particularly for major currency pairs, which can be as low as 0.6 pips. The absence of commissions and overnight fees (for swap-free accounts) makes it appealing for cost-conscious traders. However, potential traders should be aware that spreads may widen during periods of high volatility, which could impact trading costs. Overall, while OctaFX offers attractive trading conditions, it is crucial for traders to understand the potential for varying costs based on market conditions.

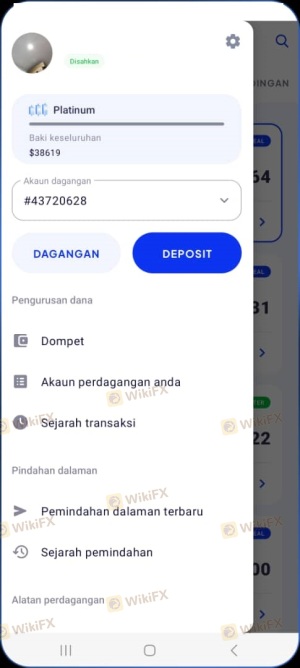

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. OctaFX implements several measures to protect client deposits, including segregated accounts, which ensure that client funds are kept separate from the company's operational funds. This practice is crucial for safeguarding clients in the event of financial difficulties faced by the broker. Additionally, OctaFX offers negative balance protection, meaning that clients cannot lose more than their deposited amount, providing an extra layer of security.

The broker's commitment to fund security is further demonstrated through its use of SSL encryption technology, which protects personal data and financial transactions from unauthorized access. However, while these measures contribute to a secure trading environment, it is essential for traders to remain vigilant and informed about any historical issues or disputes related to fund security that may arise.

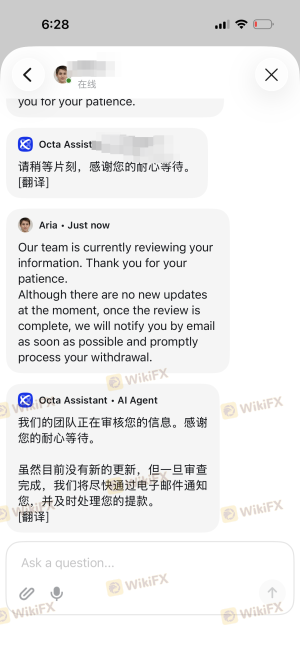

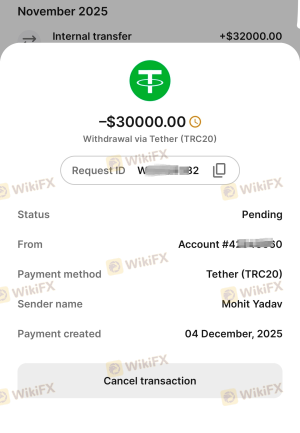

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall experience with a broker. OctaFX generally receives positive reviews regarding its trading platform, customer support, and competitive fees. However, common complaints include issues related to withdrawal times and the availability of payment methods. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Responsive |

| Limited Payment Options | Moderate | Improving |

For instance, some users have reported delays in fund withdrawals, which can be a concern for traders needing quick access to their capital. However, OctaFX's customer support has been noted for its responsiveness, often addressing issues within a short time frame. Overall, while there are some areas for improvement, the majority of customer experiences with OctaFX are positive.

Platform and Trade Execution

The performance and reliability of a trading platform are critical factors for traders. OctaFX provides access to popular trading platforms, including MetaTrader 4, MetaTrader 5, and its proprietary Octa Trader platform. User reviews indicate that the platforms are generally stable, with quick execution speeds and minimal slippage. However, some users have reported occasional lag during periods of high market activity.

In terms of order execution quality, OctaFX claims to execute over 97% of orders without slippage, which is a noteworthy statistic that enhances trader confidence. Nonetheless, traders should be aware of potential issues related to market volatility, which can impact execution quality.

Risk Assessment

Engaging with any forex broker entails certain risks. Evaluating the overall risk profile of OctaFX involves considering its regulatory status, trading conditions, and customer feedback. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Mixed regulatory oversight with tier-1 and tier-3 regulators. |

| Fund Security Risk | Low | Strong measures in place for fund security and negative balance protection. |

| Customer Service Risk | Medium | Generally positive feedback, but some complaints about withdrawal delays. |

To mitigate risks, traders are advised to conduct thorough research, start with a demo account, and carefully consider their risk tolerance when trading with leverage.

Conclusion and Recommendations

In conclusion, OctaFX is a legitimate broker with a solid reputation in the forex market. Its regulatory status, particularly under CySEC, provides a level of assurance for traders. While there are areas for improvement, such as withdrawal times and payment options, the overall trading conditions, competitive fees, and customer support make it a viable option for many traders.

However, potential users should remain cautious and conduct their own research to ensure that OctaFX aligns with their trading needs and risk tolerance. For those seeking alternatives, brokers with stronger regulatory oversight and a wider range of trading instruments may be worth considering.

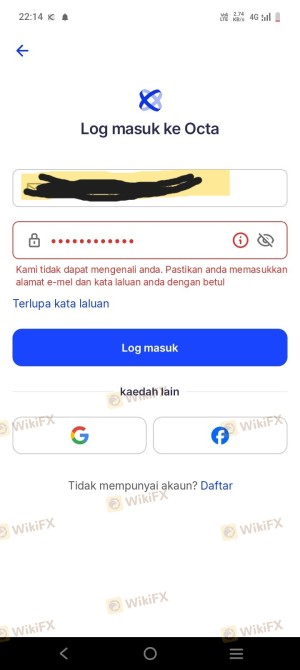

Is octa a scam, or is it legit?

The latest exposure and evaluation content of octa brokers.

octa Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

octa latest industry rating score is 6.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.