Is Funding Pips safe?

Pros

Cons

Is Funding Pips A Scam?

Introduction

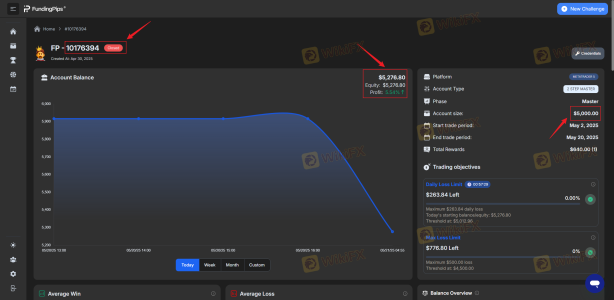

Funding Pips is a proprietary trading firm that has emerged in the forex market, offering traders the opportunity to manage accounts with substantial capital without risking their own funds. Established in 2022 and headquartered in Dubai, UAE, Funding Pips aims to support traders by providing a structured evaluation process that leads to funded accounts. Given the rise of proprietary trading firms, it is essential for traders to exercise caution when selecting a firm, as the potential for scams and unreliable operations exists in this competitive landscape. In this article, we will conduct a thorough investigation into Funding Pips, utilizing various sources and reviews to assess its legitimacy and safety. Our evaluation framework includes an analysis of regulatory status, company background, trading conditions, customer experience, and overall risk assessment.

Regulatory and Legitimacy

The regulatory environment is crucial for any trading firm, as it ensures that the company adheres to established financial standards and provides a level of protection for traders. Funding Pips operates under minimal regulation, which is common for proprietary trading firms. While it is registered in the UAE, it does not hold a license from major financial regulatory bodies such as the FCA or ASIC. This lack of oversight can raise concerns regarding the safety and security of traders' funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | UAE | Unverified |

The absence of stringent regulation means that Funding Pips is not subject to the same level of scrutiny as regulated brokers. However, the firm claims to implement strict internal policies and security measures to protect its clients. It is essential to consider that while the lack of regulation does not inherently indicate that Funding Pips is a scam, it does necessitate a more cautious approach from potential clients.

Company Background Investigation

Funding Pips was founded by Khaled Ayesh, who has positioned the firm as a trader-centric platform. The company has a relatively short history, having been established in 2022, which may raise questions about its stability and long-term viability. The management team is reported to have experience in trading and finance, but detailed profiles of key executives are not readily available, which could affect transparency.

The firm operates with a focus on providing an accessible entry point for traders looking to access capital. However, the lack of publicly available information about the company's ownership structure and management team may lead to concerns regarding its transparency. For a trading firm to gain trust, it must be open about its operations and provide clear information about its leadership.

Trading Conditions Analysis

When evaluating a trading firm, understanding the trading conditions it offers is critical. Funding Pips has structured its trading conditions to attract traders, with a focus on low fees and high profit splits. However, it is important to delve into the specifics of its fee structure to identify any potential red flags.

| Fee Type | Funding Pips | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies (close to 0 pips) | 1-2 pips |

| Commission Model | $2 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

Funding Pips charges a commission of $2 per lot on forex trades, which is competitive compared to the industry average. However, traders should be aware of any additional fees that may apply, such as withdrawal fees or hidden charges that are not immediately apparent. The firm also implements a profit-sharing model where traders can retain between 80% to 100% of their profits, depending on their performance and the evaluation type.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trading firm. Funding Pips claims to prioritize the security of client funds through various measures, including segregated accounts and a robust KYC process. However, it is important to assess whether these measures are effectively implemented.

Funding Pips does not hold client funds directly, which minimizes the risk associated with fund security. Instead, it operates on a model where traders pay evaluation fees to gain access to company funds. While this approach reduces the risk of mismanagement of client funds, it also means that traders must be vigilant about the firm's operational integrity.

Throughout its short history, there have been no major reported incidents of fund mismanagement or security breaches at Funding Pips. However, the lack of regulatory oversight may lead to concerns about the firm's long-term stability and reliability in safeguarding client assets.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating any trading firm. Funding Pips has received a mix of reviews, with many users praising its fast payouts and supportive customer service. However, there are also complaints regarding the strictness of its evaluation process and the challenges faced during the onboarding phase.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Slow KYC Process | Medium | Addressed promptly |

| Strict Evaluation Rules | High | No adjustments made |

| Platform Issues | Medium | Ongoing improvements |

Typical complaints revolve around the strict rules imposed during the evaluation phases, which some traders find challenging to navigate. While the firm has responded to some complaints, it is crucial for potential clients to weigh these issues against the overall customer satisfaction ratings.

Platform and Trade Execution

The trading platform's performance is critical for a seamless trading experience. Funding Pips offers several platforms, including Match Trader, cTrader, and Trade Locker, catering to different trading styles and preferences. While the platforms are generally well-received, there have been reports of slippage and execution delays during high volatility periods.

Traders should consider the platform's reliability and user experience, as these factors can significantly impact trading outcomes. Any signs of platform manipulation or consistent issues with trade execution should raise red flags for potential clients.

Risk Assessment

Engaging with Funding Pips involves certain risks, which should be carefully considered. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Oversight | High | Minimal regulation in place |

| Evaluation Rigidity | Medium | Strict rules may lead to disqualification |

| Fund Security | Medium | No direct fund management |

To mitigate these risks, traders should conduct thorough research, understand the firm's evaluation process, and maintain strict adherence to risk management rules.

Conclusion and Recommendations

In conclusion, while Funding Pips does not exhibit clear signs of being a scam, potential clients should exercise caution due to its minimal regulatory oversight and the challenges associated with its evaluation process. The firm offers competitive profit splits and a variety of trading platforms, making it an appealing option for many traders. However, the lack of transparency regarding its management and the strict evaluation rules may deter some individuals.

For traders seeking a reputable proprietary trading firm, it is advisable to consider alternatives that offer a more established regulatory framework and clearer management structures. Firms like FTMO or The Funded Trader may provide safer options for those looking to engage in proprietary trading without the risks associated with less regulated entities like Funding Pips. Ultimately, traders should weigh their options carefully and choose a firm that aligns with their trading goals and risk tolerance.

Is Funding Pips a scam, or is it legit?

The latest exposure and evaluation content of Funding Pips brokers.

Funding Pips Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Funding Pips latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.