ForexMart emerged on the trading scene in 2015 and has since positioned itself as a low-cost broker for forex and crypto traders. With a minimum deposit of just $1 and the backing of a regulatory framework from the Cyprus Securities and Exchange Commission (CySEC), ForexMart markets itself as an accessible platform aimed primarily at beginners and casual traders. It boasts a diverse range of instruments, including over 100 forex pairs, CFDs, and cryptocurrencies.

However, alongside its compelling offerings are significant red flags. Regulatory scrutiny and numerous negative user reviews—primarily concerning withdrawal issues and high non-trading fees—pose substantial risks. This duality begs the question for potential users: Is ForexMart a valuable entry point into forex trading, or is it a potential pitfall fraught with difficulties? The trade-off between low initial investment and subsequent user experiences may dictate the brokers viability for different trader profiles.

- Check ForexMart's regulatory status on official financial regulation sites like the CySEC.

- Read user testimonials on reputable financial forums for firsthand accounts of the broker's service.

- Verify the general and financial information of ForexMarts parent company to understand its credibility.

Rating Framework

Broker Overview

Company Background and Positioning

ForexMart is operated by Instant Trading EU Ltd and is primarily located in Cyprus. Founded in 2015, the broker has positioned itself as a low-cost provider targeting mainly novice traders. It operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC), which, while providing some level of credibility, is not without flaws as many users question its oversight efficacy.

Core Business Overview

ForexMart provides various trading services, including forex trading, CFDs on stocks, commodities, and cryptocurrencies. Available instruments and trading conditions are listed below:

- Trading Platforms: Primarily operates on MetaTrader 4 (MT4) and a web-based trading option.

- Asset Classes: Beyond forex and cryptocurrencies, ForexMart offers futures contracts for commodities and shares.

- Regulation Affiliations: Operating under CySEC regulations, ForexMart is also part of the Investor Compensation Fund (ICF), providing limited protection to clients up to €20,000.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching Users to Manage Uncertainty

1. Analysis of Regulatory Information Conflicts

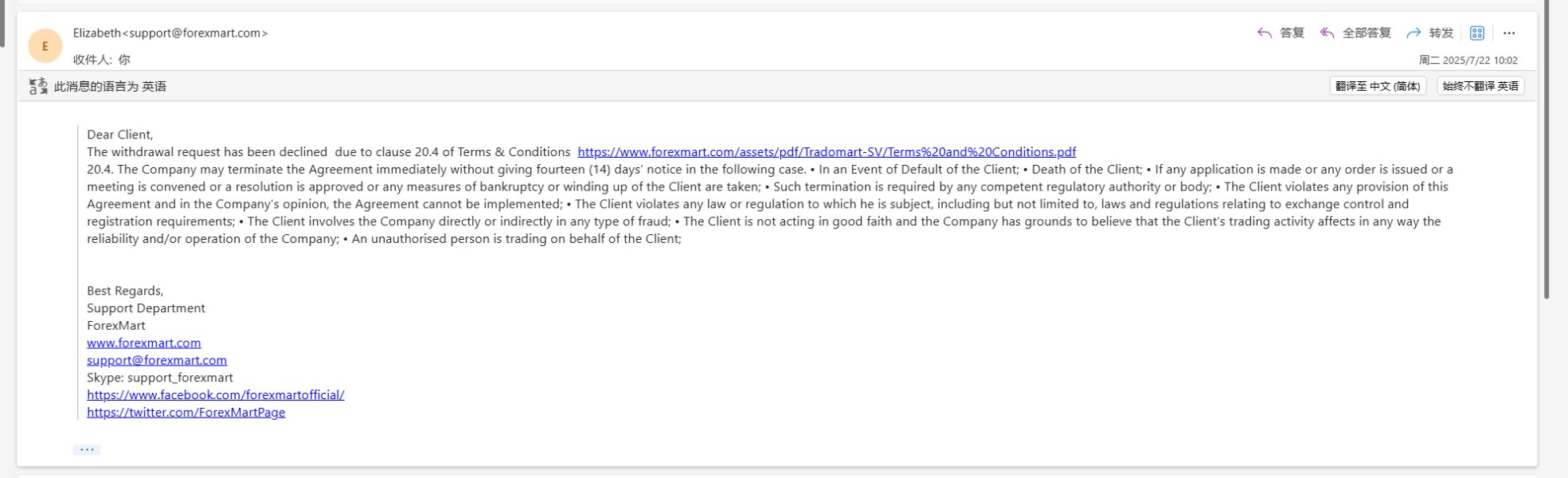

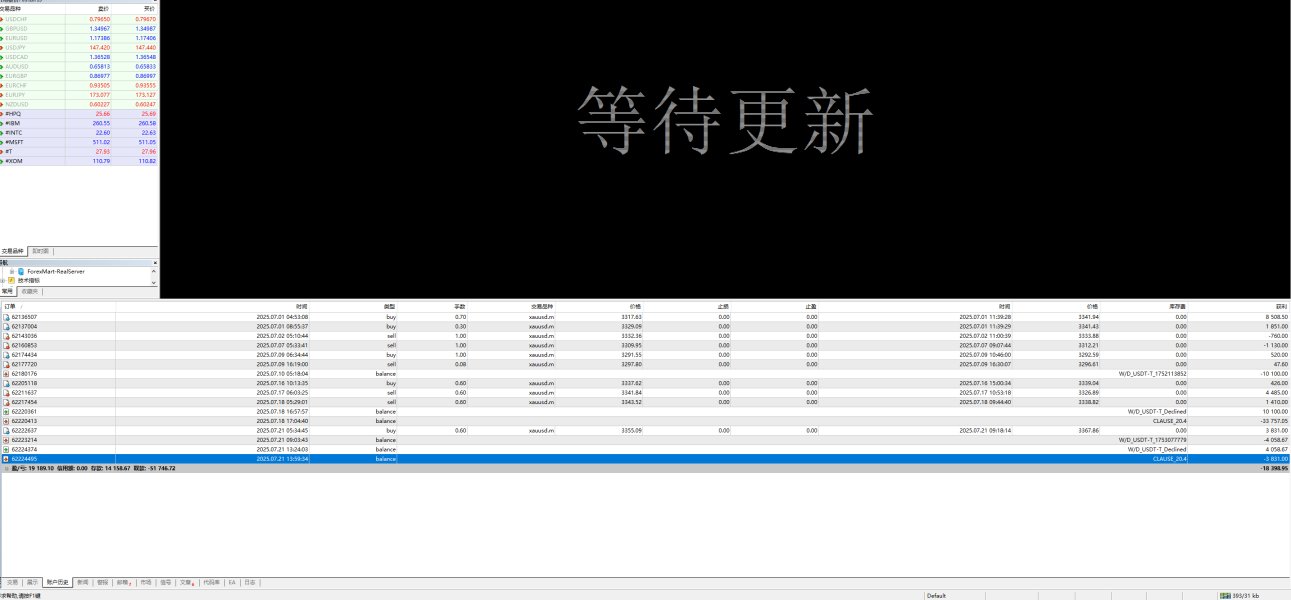

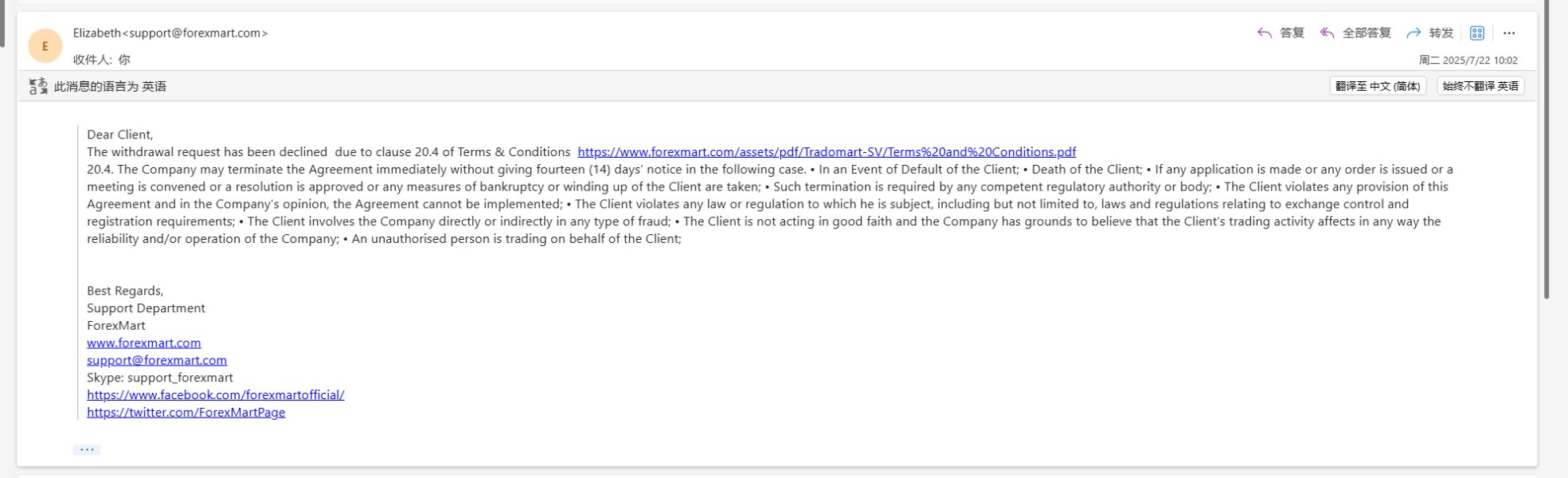

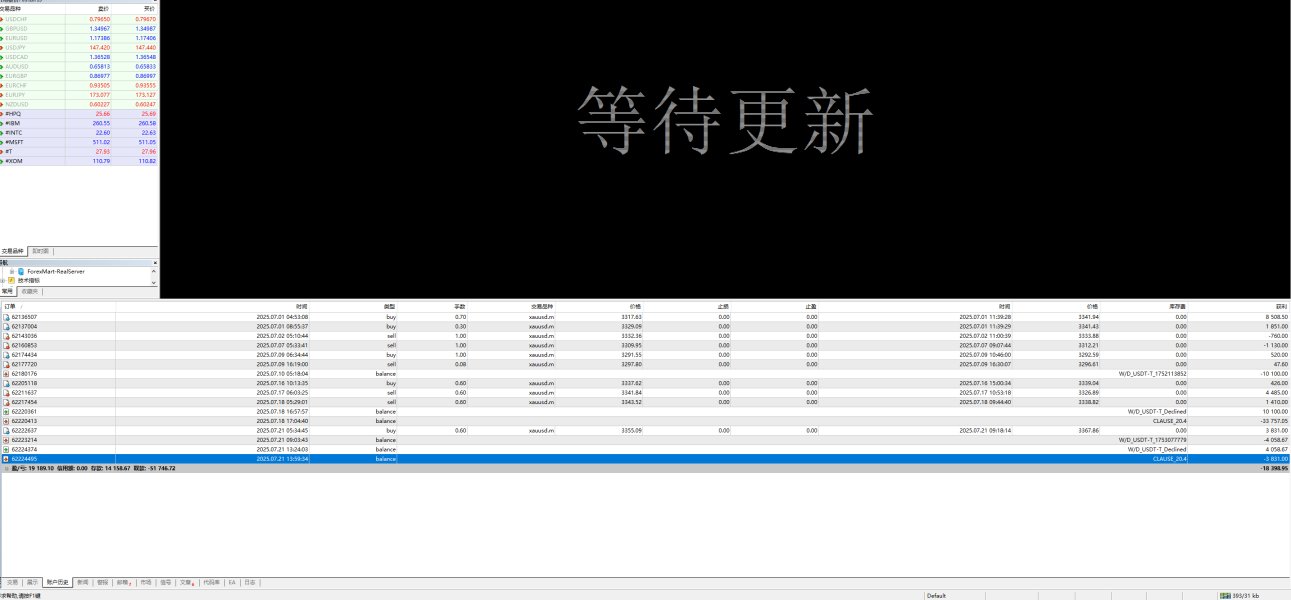

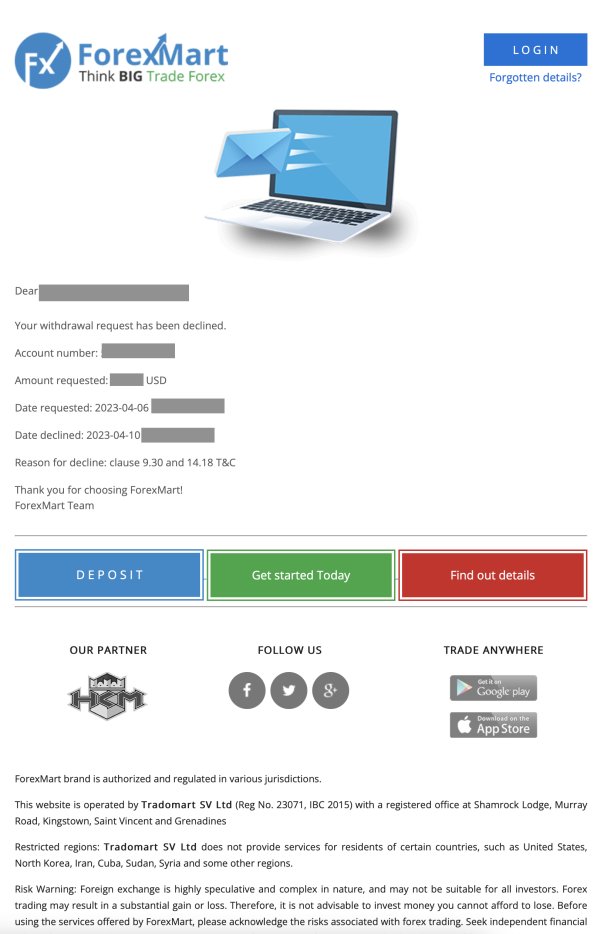

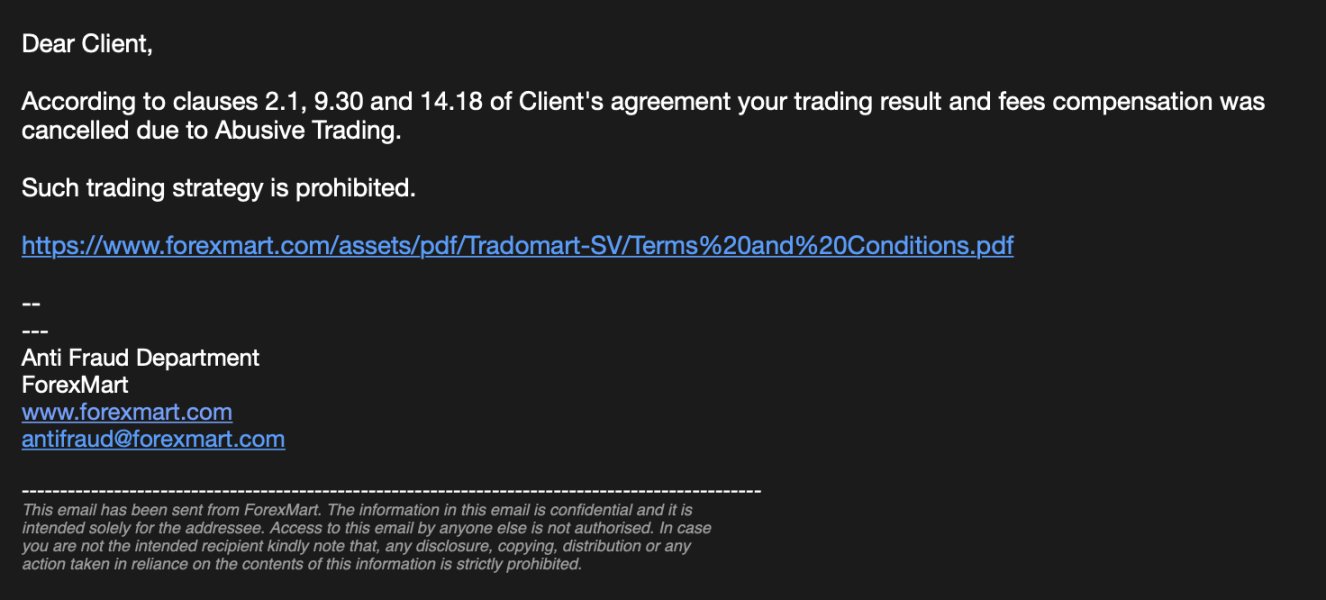

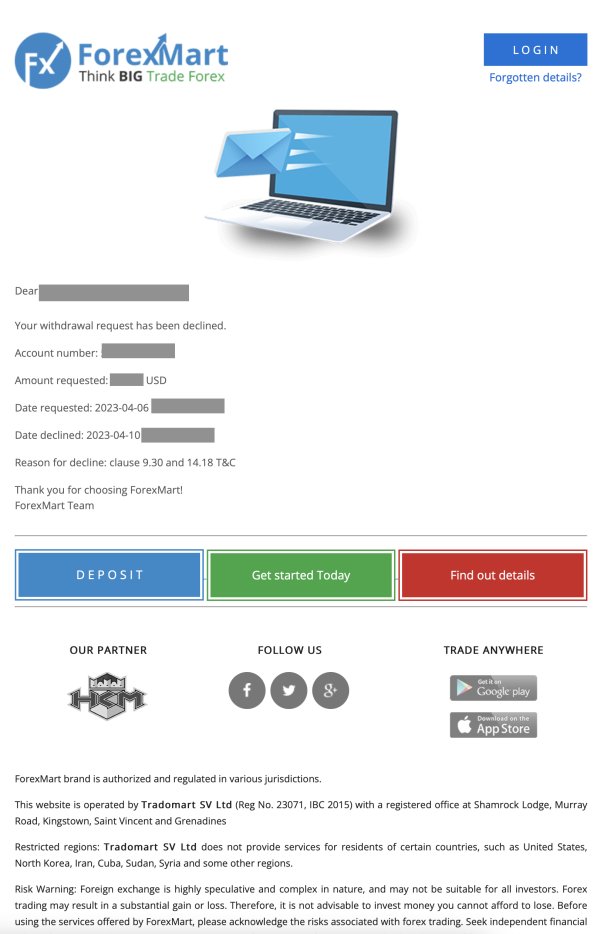

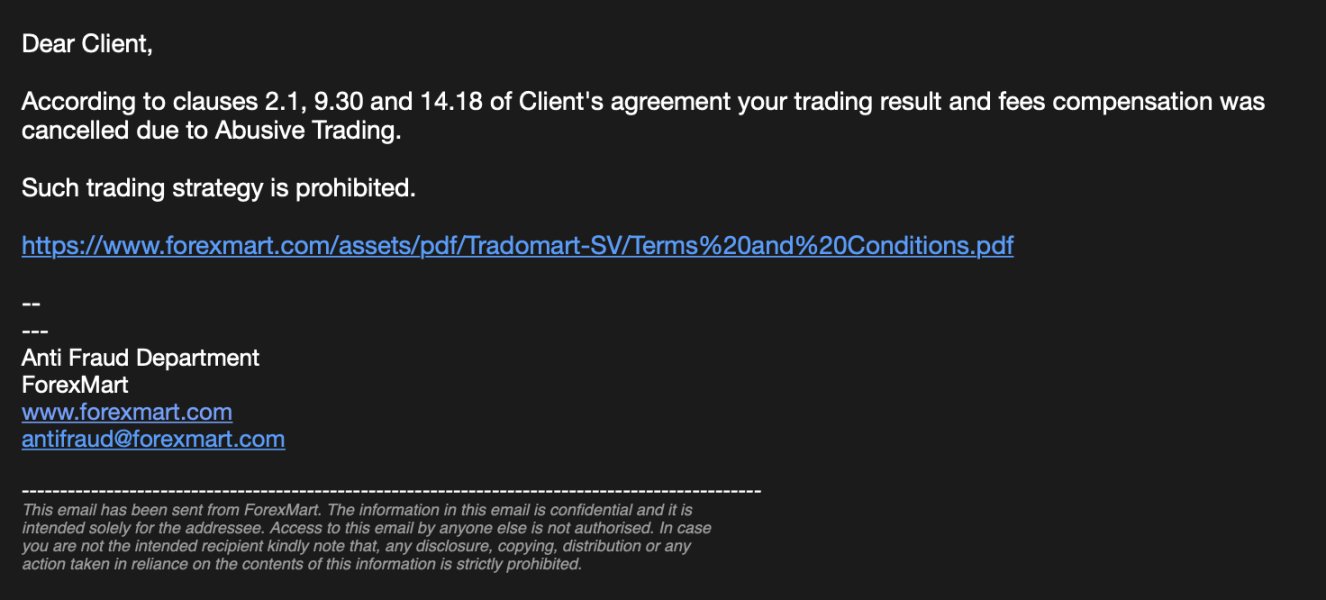

ForexMart presents a mixed bag in regulatory standing, primarily regulated by CySEC and, to a lesser extent, by Belize's FSC. Yet, user reviews expose a troubling pattern of withdrawal complaints that paint a bleak portrait of the broker's operations.

"ForexMart manipulates in various ways so as not to withdraw clients money." - User Feedback

2. User Self-Verification Guide

- Check License: Start by searching for ForexMart's licensing details on the CySEC website.

- Look Up Reviews: Utilize platforms like Trustpilot and Forex Peace Army to read trader experiences.

- Investigate Reputations: Check with financial regulatory bodies for any standing complaints or red flags against ForexMart.

3. Industry Reputation and Summary

User feedback suggests a mix of positive initial impressions regarding trading conditions, but the recurring theme of withdrawal issues undermines its reputation.

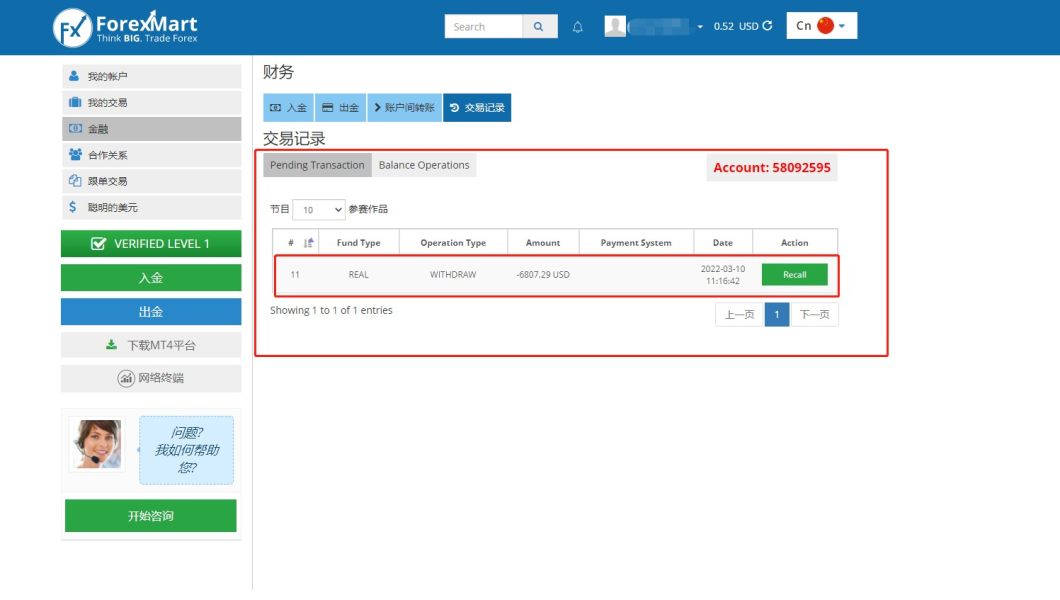

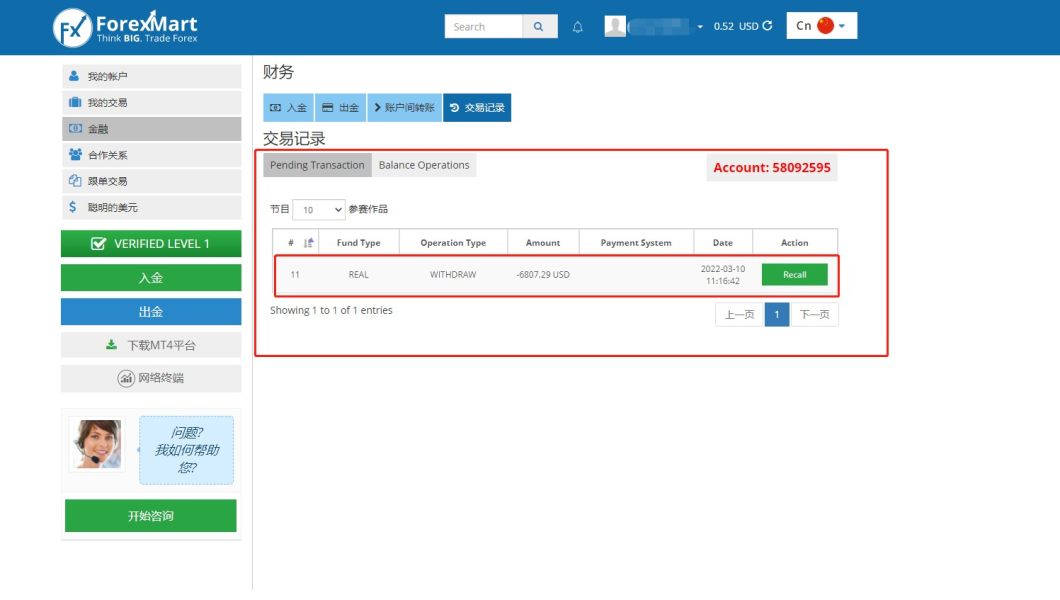

"ForexMart has been called a scam by several users, particularly over withdrawal processes." - User Complaints

Trading Costs Analysis

The Double-edged Sword Effect

1. Advantages in Commissions

ForexMart boasts competitive trading commissions, particularly for forex trading, with spreads starting as low as 0.0 pips on selected accounts. This positions the broker as potentially attractive for cost-sensitive traders.

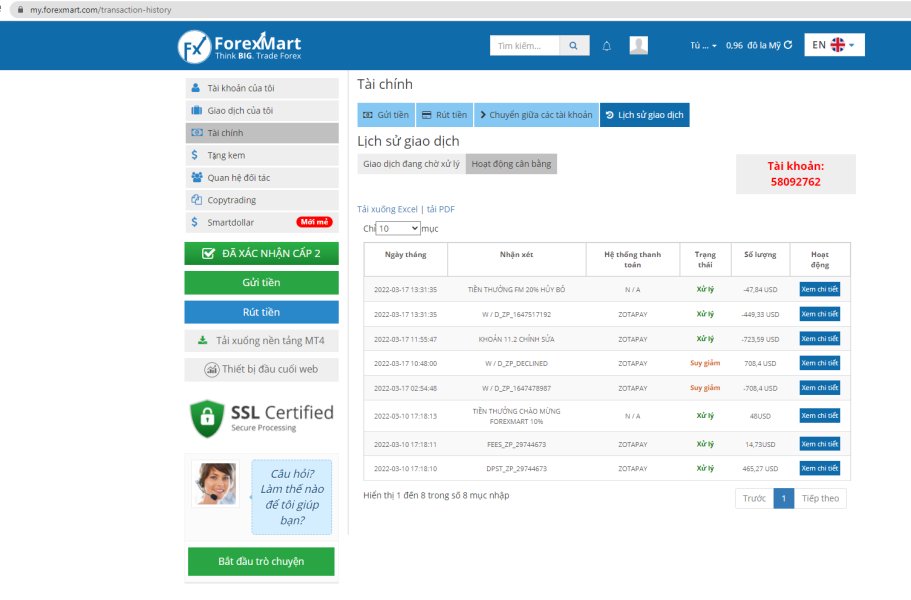

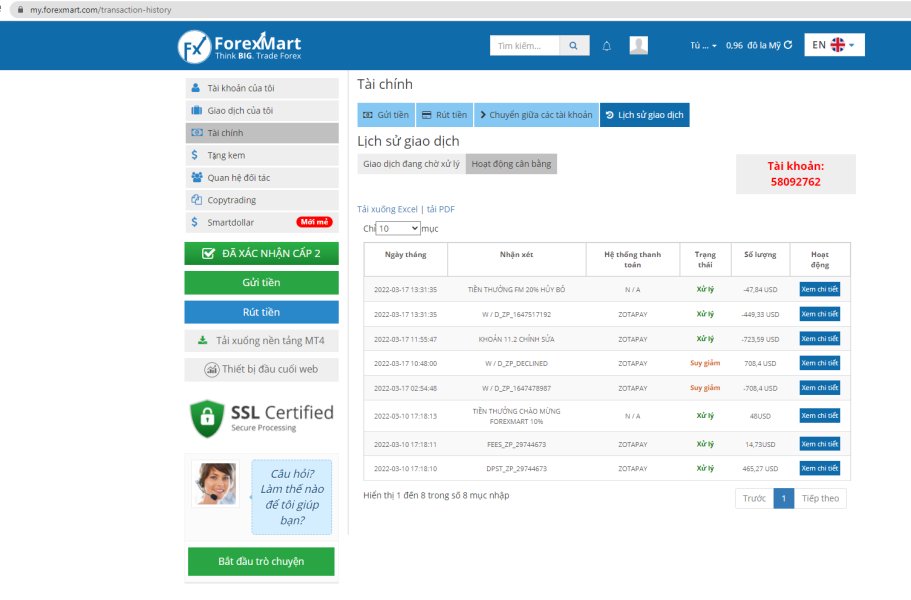

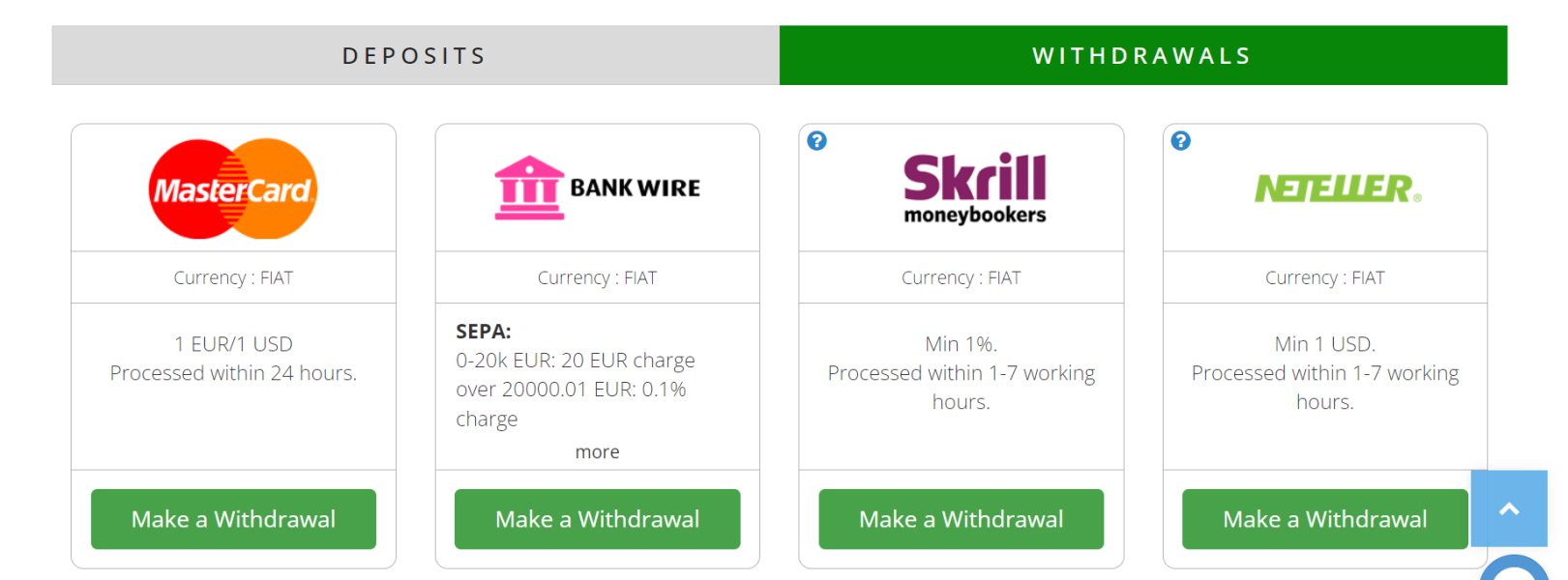

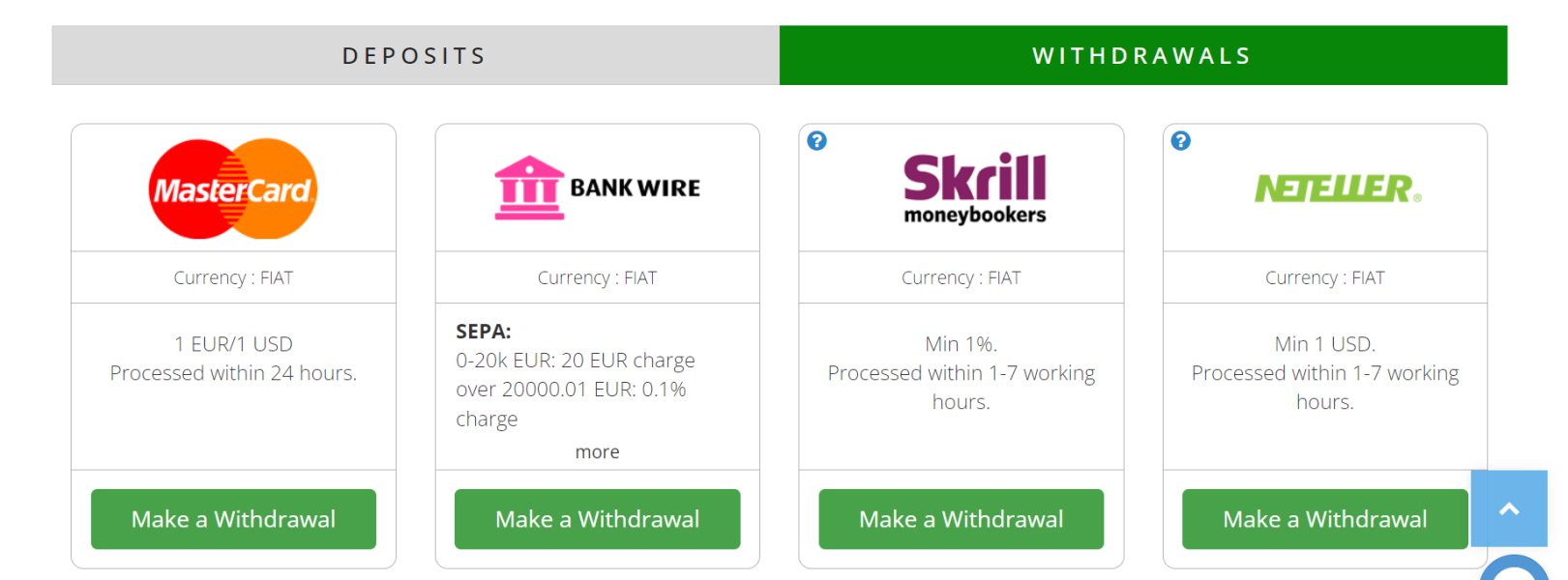

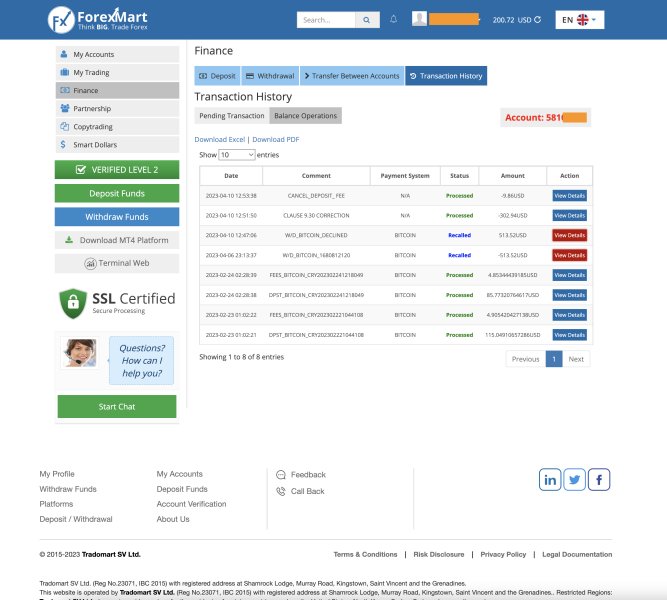

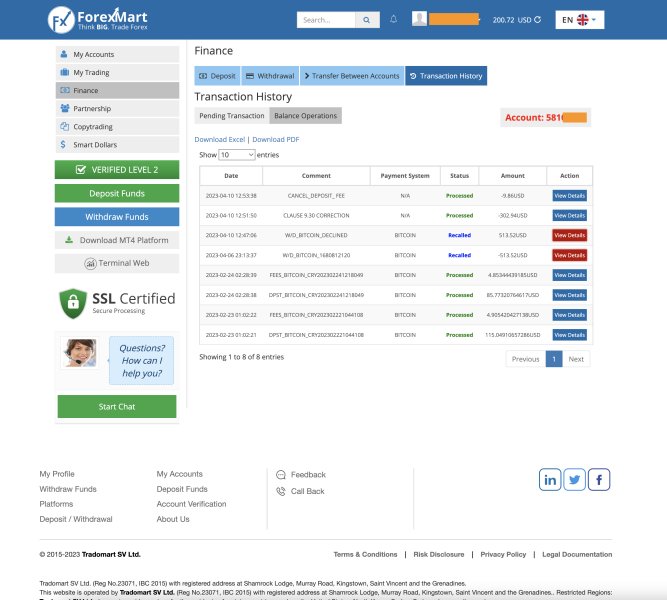

2. The "Traps" of Non-Trading Fees

However, user reports reveal hidden costs associated with withdrawals. Fees can be as high as 2% plus a possible flat fee of $30, negatively impacting overall profitability when attempting to access funds.

"The money was withdrawn to me only in 18 days, and they withheld a large fee." - User Feedback

3. Cost Structure Summary

While traders may benefit from low trading costs initially, the layering of withdrawal fees can lead to unforeseen expenses that detract from overall earnings.

Professional Depth vs. Beginner-friendliness

1. Platform Diversity

ForexMart's main platform, MT4, is recognized for its robustness and versatility. The introduction of a web trader also facilitates accessibility. However, ForexMart does not support MT5 or cTrader, limiting options for advanced traders.

2. Quality of Tools and Resources

The platform's features meet basic trading needs, such as enhanced charting tools, but lack advanced analytical tools that some competitors offer.

3. Platform Experience Summary

User experiences with the platform are generally positive, emphasizing ease of use but marred by complaints of slow performance and downtime during periods of high volatility.

"The platform freezes, large spreads, and slippage were my last straw." - User Feedback

Customer Support Analysis

Navigating Traders' Concerns

1. Availability of Support

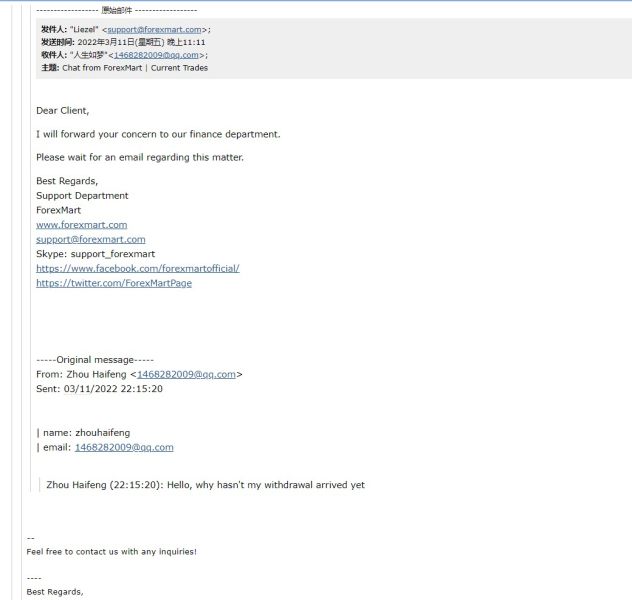

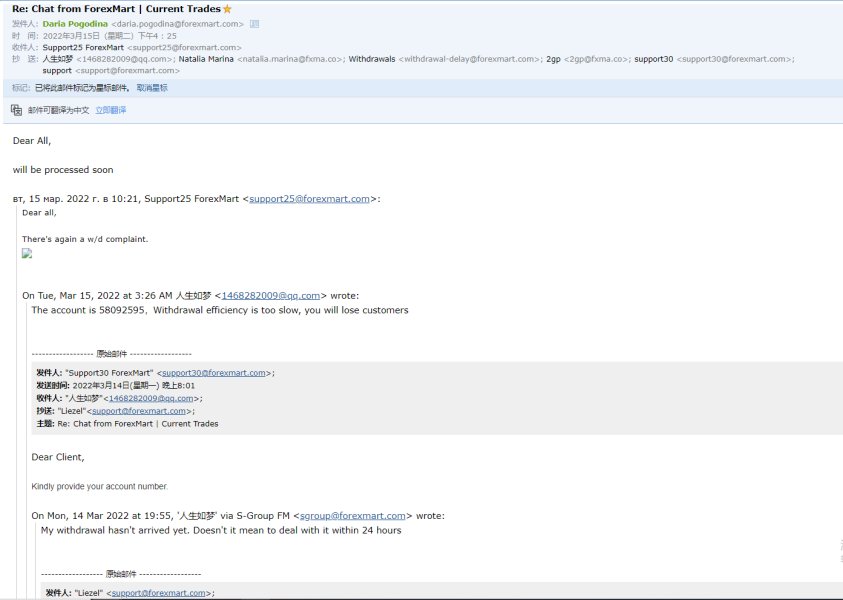

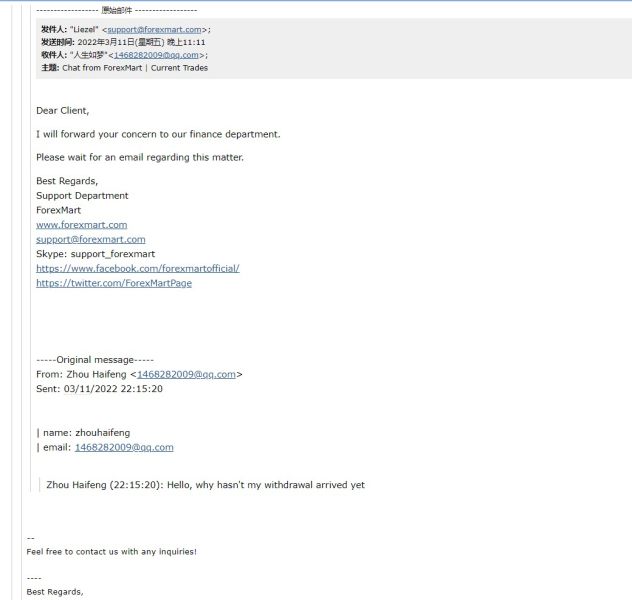

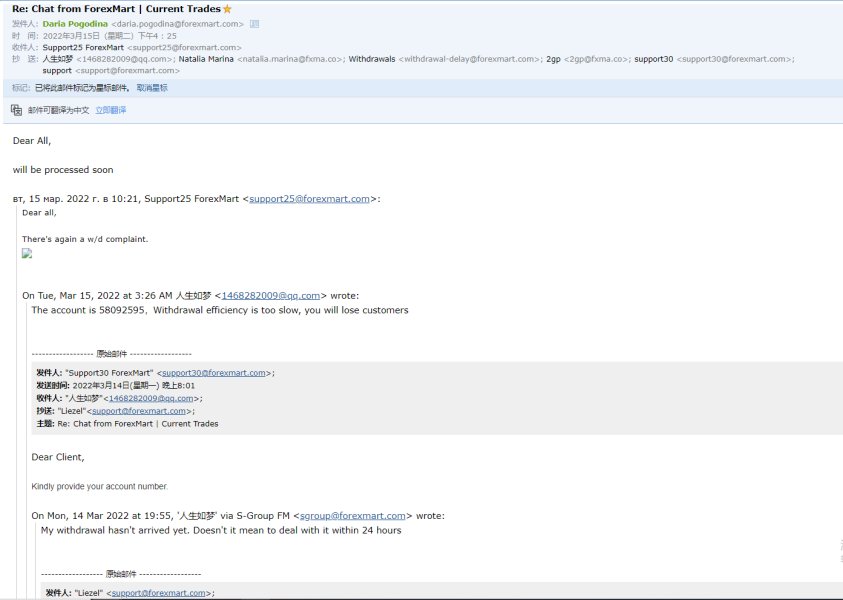

Customer support is available 24/5 but has received criticism for slow response times, especially during peak trading periods.

2. Quality of Customer Support Services

Feedback reveals deficiencies in resolving withdrawal-related issues swiftly, a crucial aspect of any brokerage service.

3. User Experience Summary

While some appreciate the multiple contact options available (live chat, email, phone), the inconsistency in service quality has led many to question ForexMart's customer support efficacy.

"Support is very slow and responds unprofessionally." - User Feedback

Account Conditions Analysis

Evaluating Offerings and Limitations

1. Available Account Types

ForexMart offers various account types, including Classic, Pro, Cents, and Zero Spread, catering to different trading strategies and capital commitments.

2. Minimum Deposit Requirements

With a minimum deposit starting from just $1 for certain account types, ForexMart appeals to beginners and those testing the waters in trading.

3. Pros and Cons Summary

While diverse options are presented, high fees on specific withdrawals pose challenges, compelling traders to navigate carefully through the varied account conditions for optimal profitability.

Final Thoughts

ForexMart presents itself as an intriguing option for beginner traders and those interested in low-cost forex trading, yet it bears serious scrutiny. Regulatory concerns, significant user complaints about withdrawal processes, and layers of fees provide an ample caveat for potential clients. While the allure of a low minimum deposit and attractive trading costs are present, the overarching narrative of trustworthiness, user experiences, and customer support paints a more complex portrait that every trader should consider before proceeding.

Conclusion

In conclusion, ForexMart may serve as a gateway for novice traders looking to dip their feet into the world of trading, but the pitfalls outlined—from regulatory hesitations to user experience issues—warrant a thorough understanding and caution. As always, aspiring traders are advised to conduct diligent research and weigh the potential risks against the rewards offered by ForexMart.