User experiences reported in various forums reflect the necessity of conducting thorough research; as one user stated, “I cannot understand why the company has not yet taken care of its own support center.”

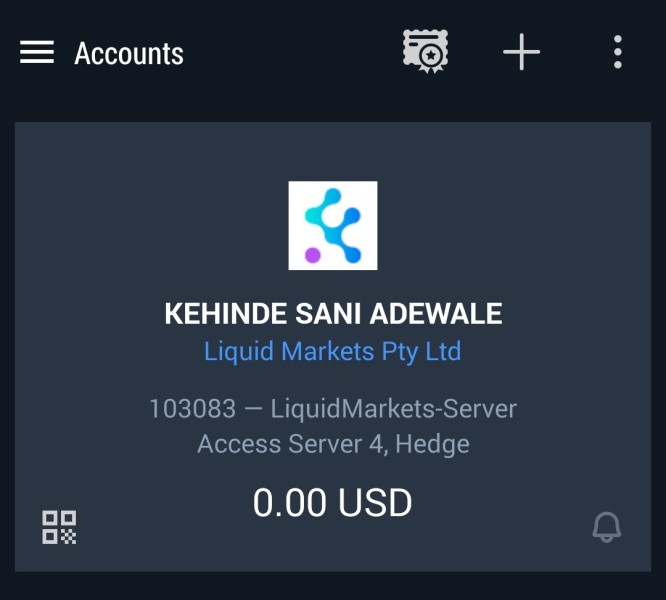

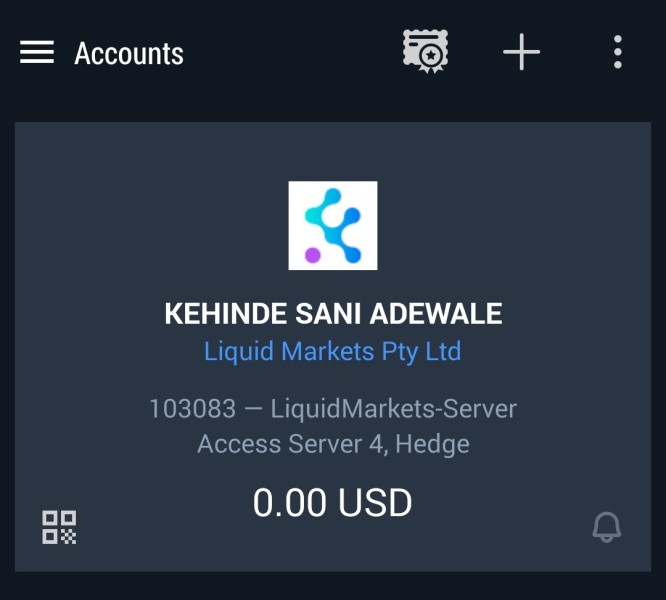

Liquid Brokers' claims of FCA regulation contrast starkly with the conflicting reports regarding the clarity of its operational licensure. While some users report trading success, others caution that navigating this environment comes with significant risks. The absence of licensed regulatory oversight in several regions raises alarm bells, and prospective users should approach this broker with an informed stance.

- Check the FCA website for company listings.

- Look for user reviews on independent trading platforms.

- Verify the operational status of Liquid Brokers with local regulatory bodies.

- Use online forums to compare personal experiences from multiple sources.

Industry Reputation and Summary

User feedback is split, with some citing solid trading experiences while others question the integrity of financial dealings and customer service. As one disheartened user lamented,

"Liquid will definitely deceive! They don't send deals anywhere. Trading takes place within the company."

Trading Costs Analysis

Advantages in Commissions

Liquid Brokers offers a competitive commission structure, with fees ranging from 0.0% to 0.3% depending on account levels and trading volume. The broker is particularly appealing to volume traders who can benefit from reduced fees tied to higher trading activity.

The "Traps" of Non-Trading Fees

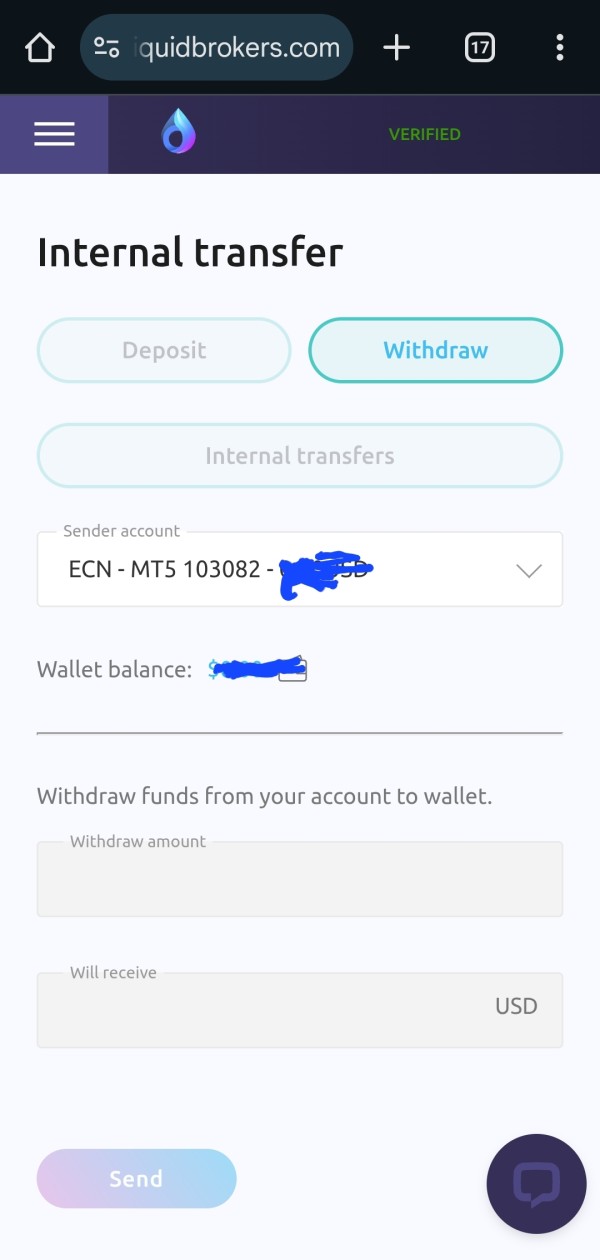

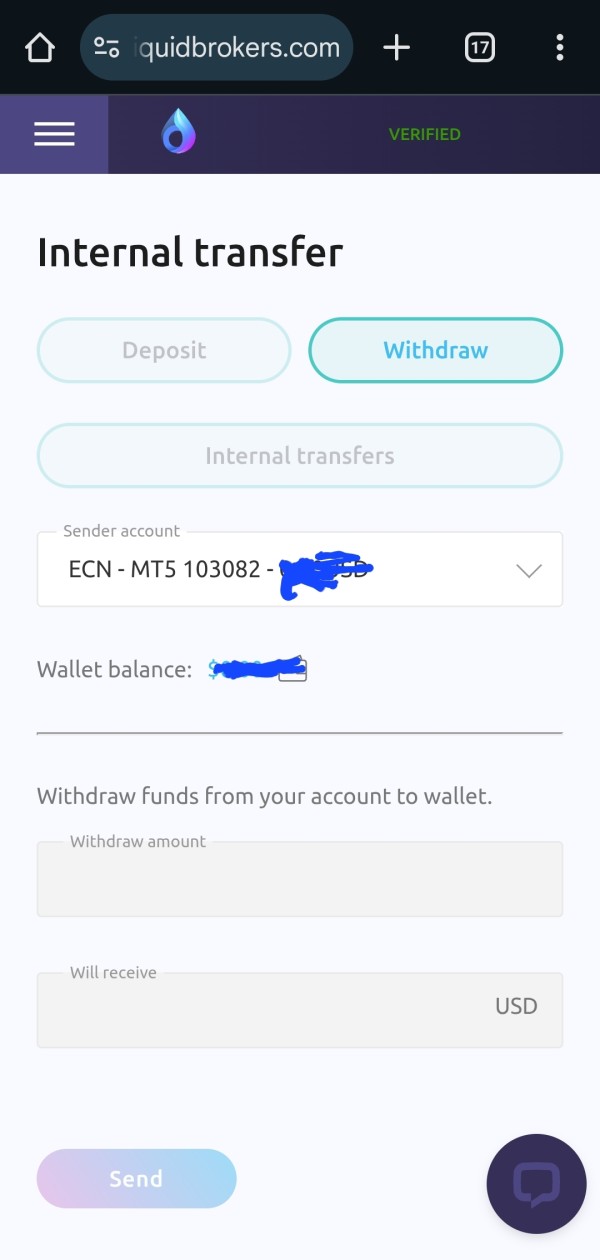

Despite low trading commissions, high withdrawal fees can significantly lessen the benefits. Users report fees as high as $30, coupled with delays that may mislead traders about available funds and their public perception of Liquid Brokers.

Cost Structure Summary

The overall cost structure presents a dual-edged sword. While trading may be economical for frequent traders, others may find themselves burdened by withdrawal costs that diminish expected profits, making it less suitable for traders looking for flexibility in accessing their funds.

Liquid Brokers supports a range of platforms, including its proprietary solution geared towards both beginners and advanced traders. However, it falls short compared to leading competitors that offer a wider array of advanced tools such as customizable alerts and robust analytics.

Users have noted that educational resources and analytical tools meet basic standards but lack the comprehensive nature expected in todays competitive environment. Charting tools are functional but could benefit from enhancements.

User experiences illustrate a generally positive reception of the user interface; however, there are notable concerns regarding its functionality under heavy trading conditions. Reports of sluggish performance during peak periods have been documented, and this could deter potential users.

User Experience Analysis

Overview of Traders' Feedback

Traders generally report a user-friendly interface, but their experiences are marred by prolonged response times from customer service and inconsistent withdrawal processes. Notably, "I traded on this platform for a while, but then found a crypto exchange with more loyal conditions," reflecting the sentiments of users seeking better-suited alternatives.

User Accessibility

While the platform's access is heralded as beneficial due to its low deposit threshold, it also invites a broader demographic that may lead to heightened user support challenges.

Customer Support Analysis

Responsiveness and Availability

Liquid Brokers' customer support is primarily handled via email and live chat; however, this has not consistently translated into efficient service, particularly during higher traffic periods. Users have cited frustrations associated with lengthy response times and inadequate assistance.

User Satisfaction

A blend of feedback reveals dissatisfaction over customer service reliability, suggesting that user support may require further improvement to effectively address incoming trader inquiries.

Account Conditions Analysis

Flexibility and User-Friendly Features

Liquid Brokers promotes flexible account conditions that cater to prospective traders of various experience levels. The platform allows for multiple funding options, yet severe limitations are imposed on withdrawal methods.

Summary of Account Policies

While the minimum deposit is appealing, potential users are left grappling with withdrawal restrictions and possible fees that diminish trading efficacy on the platform.

Conclusion

In summation, Liquid Brokers stands at a crossroads of opportunity and risk. While users can potentially exploit favorable trading fees and a myriad of cryptocurrency options, tales of withdrawal issues and inadequate support remind traders to tread with care. As always, it is paramount for prospective users to conduct thorough research and consider their individual risk tolerance before entering the marketplace, especially in light of mixed reviews and regulatory uncertainties.