1. Executive Summary: A Tale of Two Reputations

MultiBank Group, founded in 2005, stands as one of the largest and most globally-regulated financial derivatives brokers in the world. This 2025 review reveals a broker of immense scale and significant contradictions. On one hand, it presents an impeccable regulatory portfolio, with licenses from over 11 authorities including top-tier bodies like ASIC, BaFin, and MAS. It boasts an astonishing range of over 20,000 tradable instruments, high leverage up to 1:500, and a history spanning two decades, serving over a million clients.

On the other hand, this impressive institutional facade is starkly contrasted by a troubling pattern of negative user feedback across platforms like Trustpilot. The core of this review investigates this paradox: how can a broker with such a strong regulatory foundation and numerous industry awards generate such a high volume of client complaints regarding customer service, withdrawals, and bonus conditions?

The broker offers three distinct account types—Standard, Pro, and ECN—with its ECN account providing competitive raw spreads from 0.0 pips plus a reasonable $6 commission per lot. Access to MetaTrader 4 and 5 ensures a familiar trading environment. However, its aggressive marketing, particularly the promotion of large deposit bonuses, often becomes a source of conflict and misunderstanding for retail clients.

Verdict: MultiBank Group is undeniably a legitimate, well-established, and powerfully regulated entity, not a scam. It is best suited for experienced, well-capitalized traders who can navigate a complex corporate structure, prioritize regulatory diversity and a vast instrument selection above all else, and are savvy enough to decline potentially problematic bonus offers. It is not recommended for beginners or any trader who requires attentive, high-quality customer support and a seamless user experience, as the documented user feedback indicates a significant risk of frustration in these areas.

Overall Rating Framework: 2025

2. The Regulatory Maze: Unpacking 11+ Global Licenses

MultiBank Group‘s greatest asset is its vast and complex regulatory framework. This is not just a marketing point; it’s a testament to their global operational scale and commitment to compliance. However, a traders safety is determined by the specific entity and regulator they are registered with.

Heres a breakdown of their key licenses by tier:

What This Means for You:

If you are a resident of Australia or Germany, you will be onboarded by a Tier-1 regulated entity, offering you the highest level of protection but with lower leverage (e.g., 1:30). If you are a client from many other parts of the world, you will likely be registered under the CIMA (Cayman Islands) entity. While CIMA is a reputable offshore regulator, it does not provide the same level of investor protection or compensation schemes as a Tier-1 body. This is the critical trade-off for accessing higher leverage (up to 1:500).

3. The User Experience Paradox: Why Is a Regulated Giant Rated So Poorly?

This is the central question of this review. Despite its powerful regulatory standing and industry awards, MultiBank Groups Trustpilot score hovers in a very poor range, with a high percentage of 1-star reviews. The complaints are not random; they follow distinct patterns.

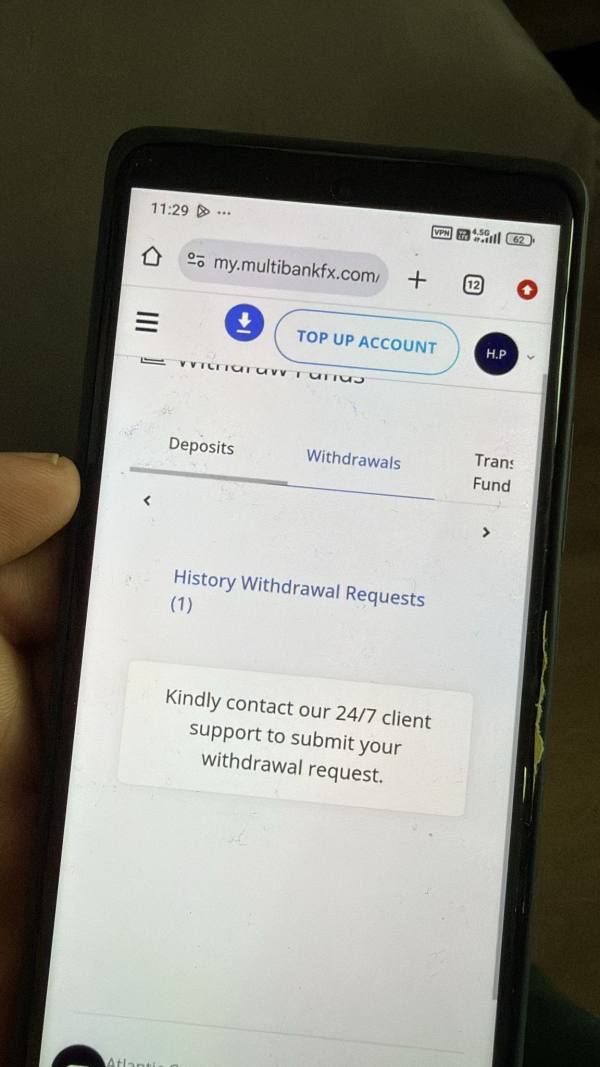

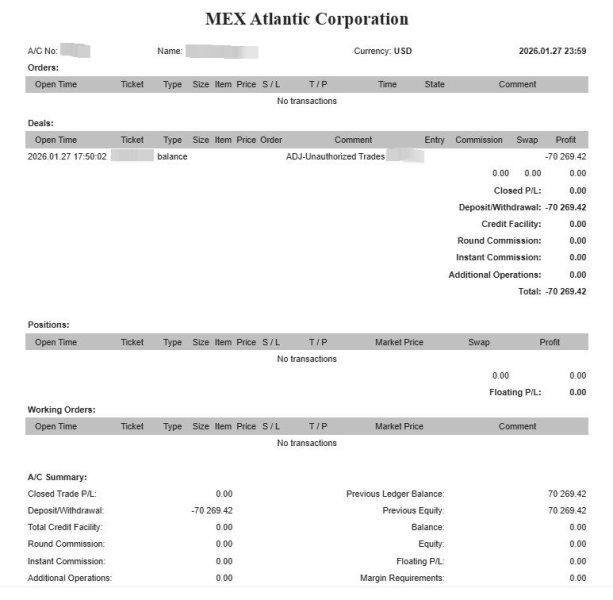

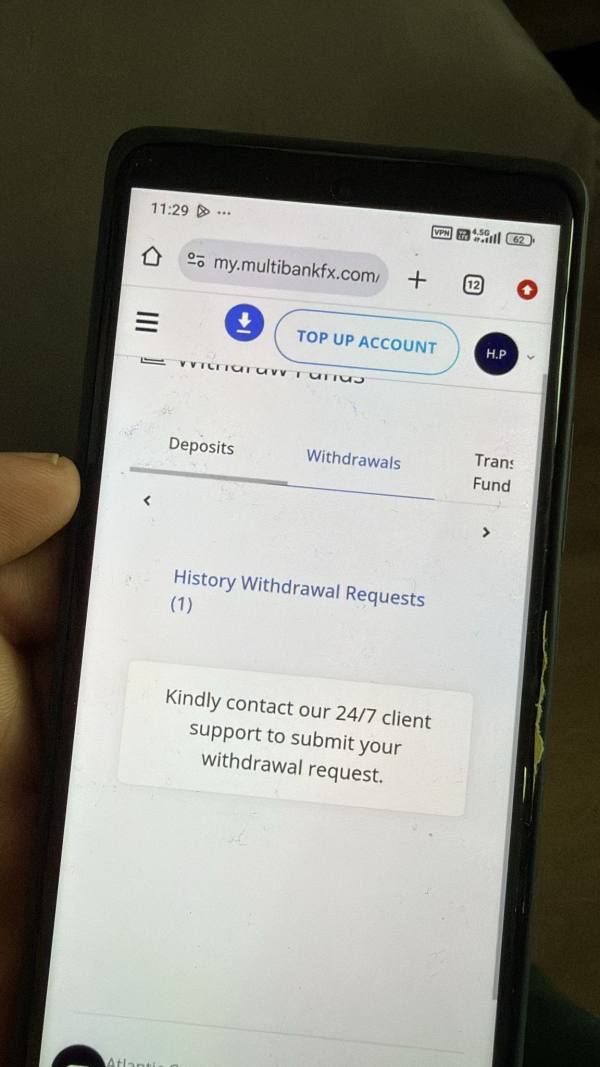

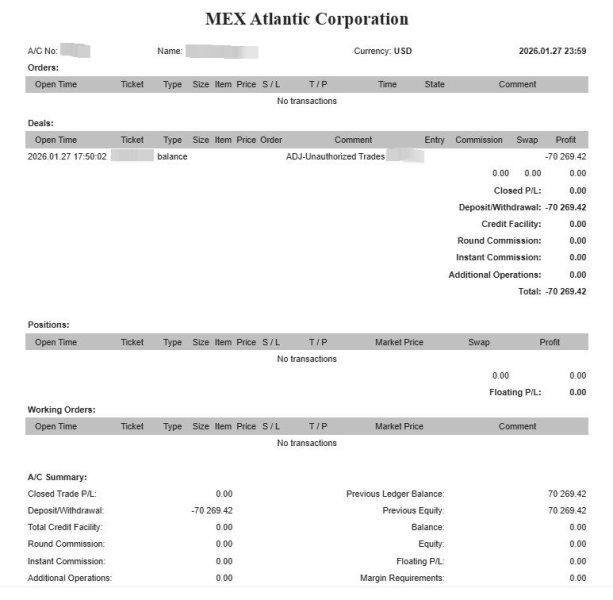

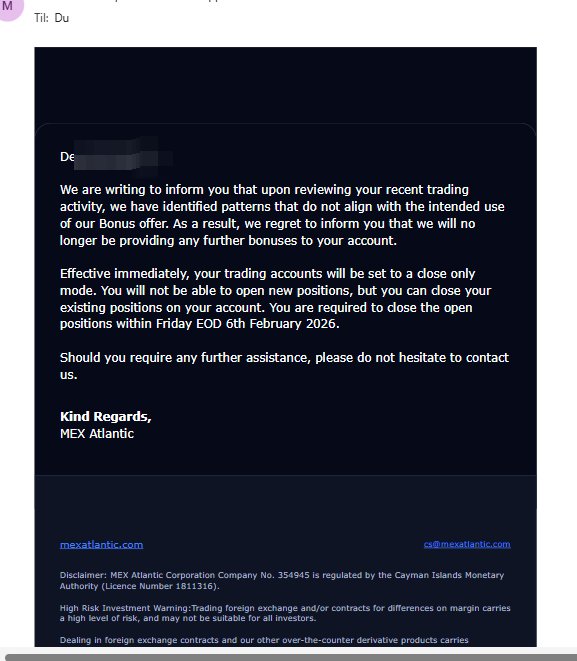

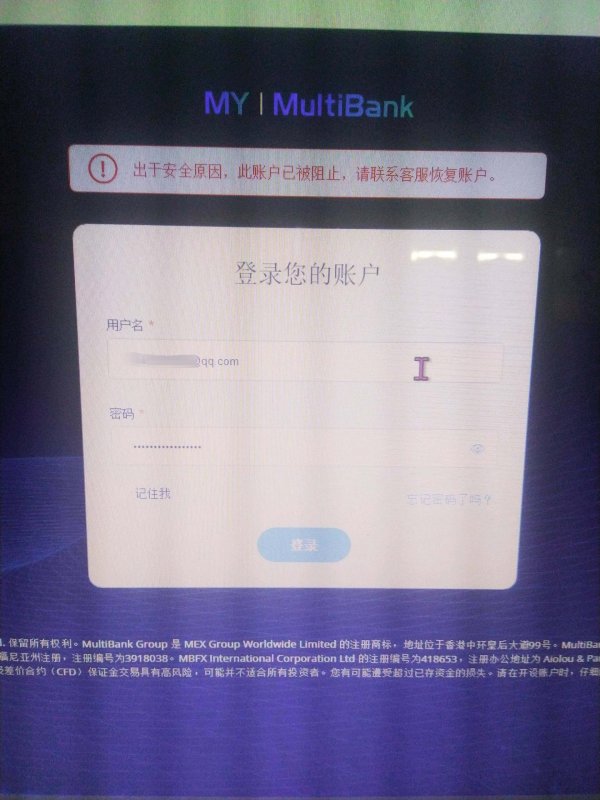

- Withdrawal Problems: This is the most common and serious complaint. Users report lengthy delays, unresponsive support when inquiring about their withdrawal status, and sometimes requests for excessive additional documentation. While a regulated broker will not steal your money, frustrating and opaque withdrawal processes can make it feel that way.

- Customer Support Issues: Many users describe the support as slow, unhelpful, or difficult to reach. For a global 24/7 operation, this suggests potential understaffing or inconsistent service quality across different regional offices.

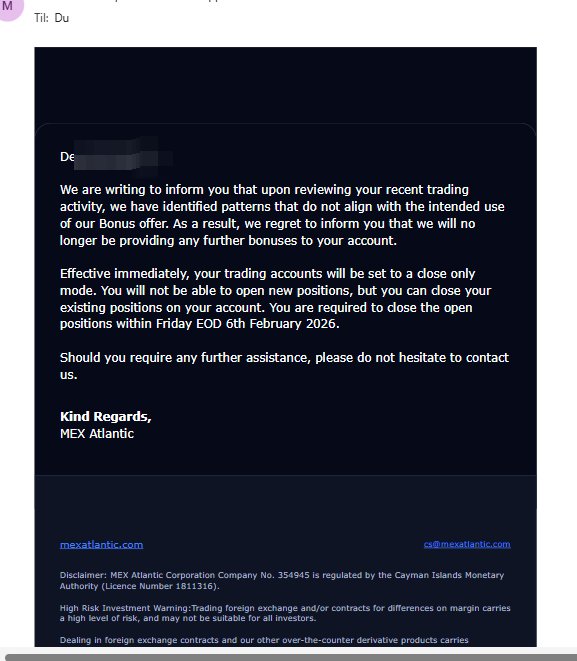

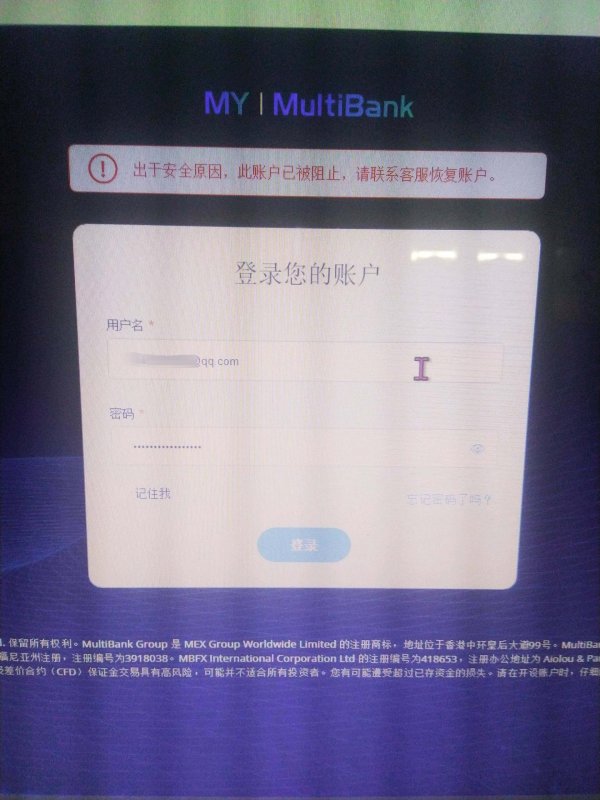

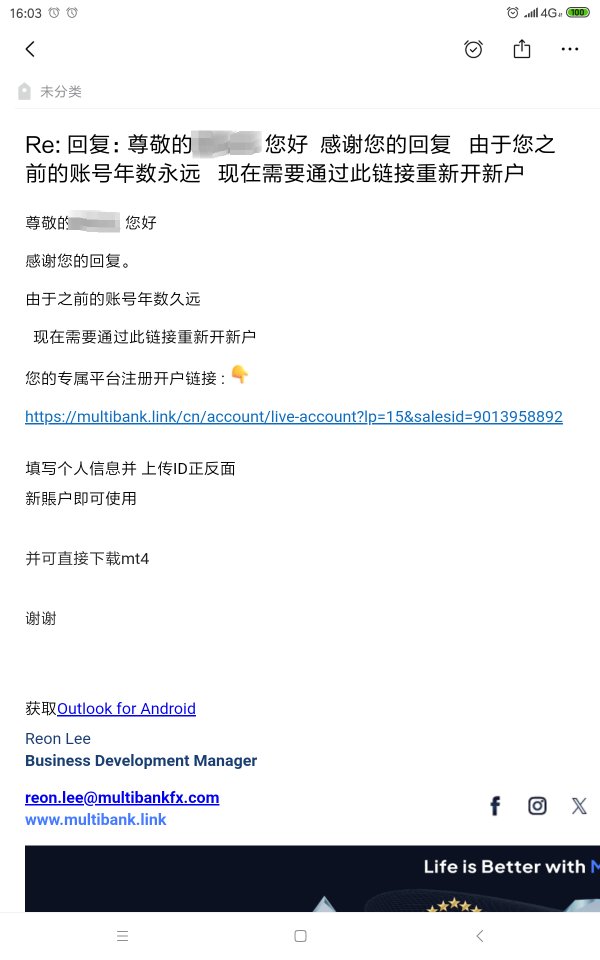

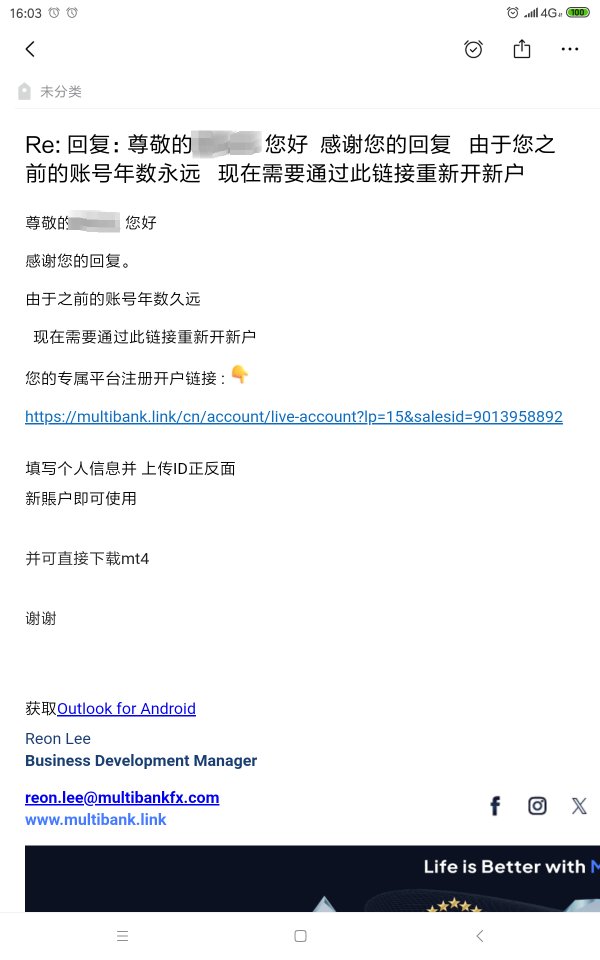

- Bonus and Promotion Conflicts: MultiBank is known for offering large deposit bonuses. These bonuses almost always come with complex terms and conditions, such as requiring an enormous trading volume before the bonus (and sometimes the initial deposit) can be withdrawn. Many negative reviews stem from users who accepted a bonus without understanding these terms and then felt their funds were being held hostage.

- Aggressive Sales/Account Managers: Some users report persistent and unwanted pressure from account managers to deposit more funds or take on riskier trades.

Conclusion on the Paradox: The disconnect likely stems from a large, decentralized corporate structure where marketing and sales targets may conflict with a positive user experience. While the top-level regulatory compliance ensures the broker is legitimate, the day-to-day operational execution in areas like customer support and payment processing appears to be a significant and persistent failure point.

4. Account Types and Trading Costs

MultiBank Group offers a clear three-tiered account structure to cater to different types of traders.

Cost Analysis: Where is the Best Value?

Lets compare the all-in cost for a standard lot of EUR/USD across the accounts:

- Standard Account:

- Typical Spread: ~1.5 pips

- Commission: $0

- Total Cost per Trade: 1.5 pips * $10/pip = ~$15.00

- Verdict: This is an average, acceptable cost for an entry-level account.

- Pro Account:

- Typical Spread: ~0.8 pips

- Commission: $0

- Total Cost per Trade: 0.8 pips * $10/pip = ~$8.00

- Verdict: This is excellent value for a commission-free account. The $1,000 minimum deposit makes it accessible to serious retail traders.

- ECN Account:

- Typical Spread: ~0.1 pips

- Commission: $6.00

- Total Cost per Trade: (0.1 pips * $10/pip) + $6.00 = $1.00 + $6.00 = ~$7.00

- Verdict: A total cost of ~$7.00 is highly competitive and meets the standard for professional-grade ECN trading. The $5,000 minimum deposit targets serious, well-capitalized traders.

5. The 20,000+ Instrument Universe & Trading Platforms

A World-Class Asset Library

MultiBank Groups claim of over 20,000 instruments is not an exaggeration. This makes it one of the most comprehensive multi-asset brokers available.

- Forex: A full range of major, minor, and exotic currency pairs.

- Metals: Gold, Silver, and other precious metals.

- Indices: CFDs on all major global stock indices.

- Commodities: A wide selection of energies (Oil, Gas) and soft commodities.

- Cryptocurrencies: CFDs on major cryptocurrencies like Bitcoin and Ethereum.

- Share CFDs: This is the core of their offering. Traders can access thousands of stock CFDs from exchanges across the US, Europe, and Asia, making it a paradise for equity traders.

Trading Platforms

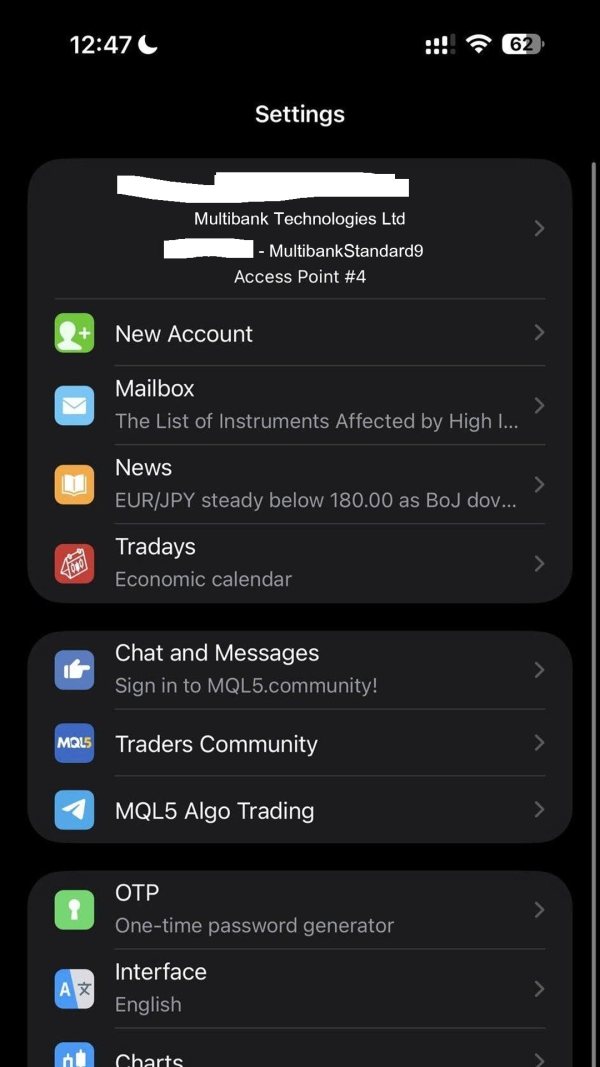

The broker relies on the industry-standard MetaTrader suite, ensuring reliability and familiarity.

- MetaTrader 4 (MT4): The worlds most popular trading platform, famous for its stability and extensive support for automated trading via Expert Advisors (EAs).

- MetaTrader 5 (MT5): The modern successor to MT4, offering more timeframes, more built-in indicators, and superior tools for trading non-forex assets like stocks.

- Proprietary Platform: MultiBank also offers its own social trading and mobile applications, though the MetaTrader platforms remain the primary choice for most desktop traders.

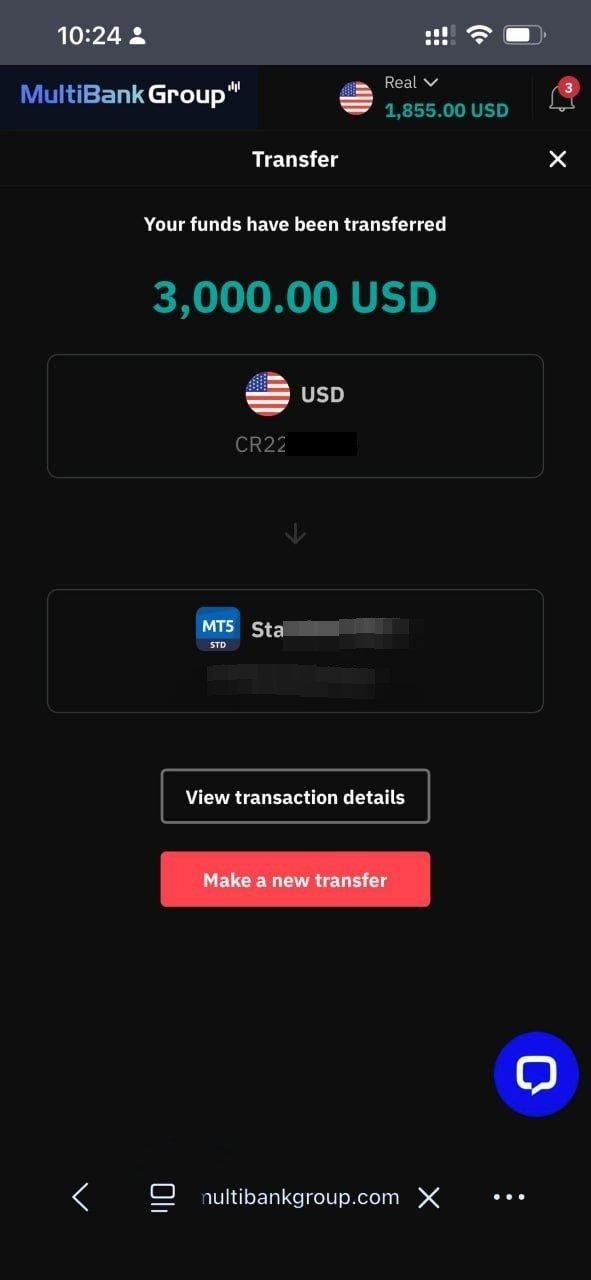

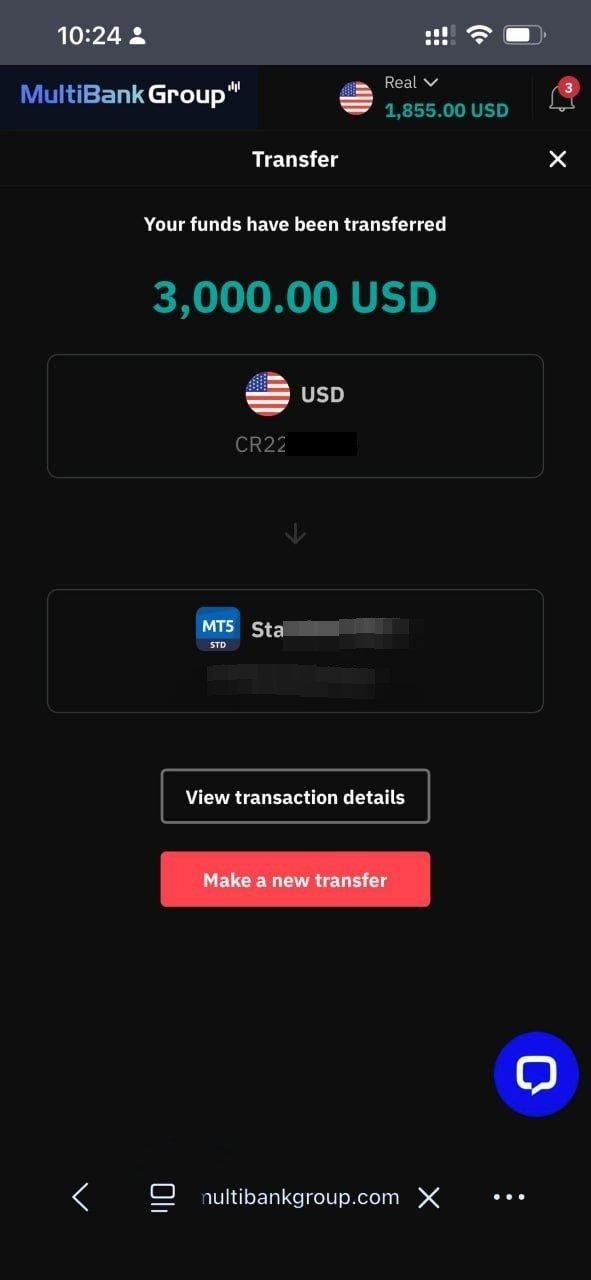

6. The Lure of High Bonuses: A Word of Warning

MultiBank actively promotes large deposit bonuses, sometimes offering up to 100% bonuses or premium packages worth tens of thousands of dollars. While enticing, traders must approach these with extreme caution.

- Restrictive Terms: These bonuses are not free money. They are trading credits that are locked until a very high trading volume is met.

- Source of Conflict: The most common source of withdrawal complaints is related to bonus terms. A user might try to withdraw their initial deposit, only to be told they have not met the volume requirements of the bonus they accepted, leading to disputes.

- Professional Advice: Most professional traders do not accept bonuses for this very reason. It complicates the relationship with the broker and can restrict access to your own capital. It is strongly recommended to read the terms and conditions meticulously or, better yet, opt out of any bonus promotions.

7. Final Conclusion: Who is MultiBank Group Best For?

MultiBank Group is a paradox. It is, by all objective measures, one of the most heavily regulated and largest brokers in the world. Its product offering is immense, and its ECN pricing is competitive. Yet, the documented trail of negative user experiences presents a significant red flag.

MultiBank Group is a potentially suitable choice for:

- Experienced, Well-Capitalized Traders: Traders with significant capital who can meet the minimums for the Pro or ECN accounts and who prioritize regulatory diversity and asset selection above all else.

- Self-Sufficient Traders: Individuals who are confident in their ability to trade without needing hand-holding from customer support and who are savvy enough to navigate a large corporate structure.

- Traders Seeking Specific Global Stocks: Its vast share CFD offering may be a compelling reason to choose them if you need access to a particular market.

MultiBank Group should be approached with extreme caution by:

- Beginners: New traders are most in need of reliable customer support and a smooth, frustration-free experience. The risk of encountering withdrawal or service issues is too high.

- Traders Susceptible to Aggressive Marketing: The lure of high bonuses can be a trap for the unwary.

- Anyone Who Values a Positive Customer Service Experience: If you expect prompt, helpful, and empathetic support, the balance of user feedback suggests you may be disappointed.

In conclusion, before opening an account with MultiBank Group, a trader must ask themselves: Do I prioritize the safety of a top-tier regulatory license and a massive product list, and am I willing to potentially endure a frustrating customer service experience to get it? If the answer is yes, they may be a fit. If not, there are other brokers who offer a more balanced and positive overall experience.