Regarding the legitimacy of BDSWISS forex brokers, it provides FSA, CYSEC and WikiBit, (also has a graphic survey regarding security).

Is BDSWISS safe?

Pros

Cons

Is BDSWISS markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

BDSwiss (Seychelles) Ltd

Effective Date:

--Email Address of Licensed Institution:

info@bdswissglobal.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.global.bdswiss.comExpiration Time:

--Address of Licensed Institution:

Block B, Room 6, No. 1, Global Village, Jivan’s Complex, Mont Fleuri, Mahe, SeychellesPhone Number of Licensed Institution:

4325840Licensed Institution Certified Documents:

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Viverno Markets Ltd

Effective Date: Change Record

2013-05-31Email Address of Licensed Institution:

info@viverno.comSharing Status:

No SharingWebsite of Licensed Institution:

www.viverno.comExpiration Time:

--Address of Licensed Institution:

Apostolou Andrea Street 11 Hyper Tower 5th Floor 4007 Mesa Yeitonia Limassol CyprusPhone Number of Licensed Institution:

+357 25 053 940Licensed Institution Certified Documents:

Is BDSwiss A Scam?

Introduction

BDSwiss, established in 2012, has rapidly positioned itself as a notable player in the forex and CFD trading market, catering to over 1.6 million registered clients across more than 180 countries. As a multi-asset broker, it offers a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. However, the forex trading landscape is fraught with risks, and traders must exercise caution when selecting a broker. With numerous options available, it is crucial to assess the reliability and legitimacy of a broker like BDSwiss. This article aims to provide an objective evaluation of BDSwiss by exploring its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework within which a broker operates is paramount for ensuring the safety and security of client funds. BDSwiss is regulated by several authorities, including the Financial Services Commission (FSC) in Mauritius, the Financial Services Authority (FSA) in Seychelles, the Financial Sector Conduct Authority (FSCA) in South Africa, and the Mwali International Services Authority (MISA). The presence of multiple regulatory licenses can enhance trust among traders.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| FSC | C116016172 | Mauritius | Active |

| FSA | SD047 | Seychelles | Active |

| FSCA | 49479 | South Africa | Active |

| MISA | T2023244 | Mwali | Active |

While BDSwiss holds several licenses, it is essential to note that these regulators are not considered top-tier compared to authorities like the FCA in the UK or ASIC in Australia. The FSC and FSA are classified as tier-3 regulators, which may have less stringent compliance requirements. However, BDSwiss has maintained a relatively clean regulatory history, with no significant violations reported, which contributes positively to its legitimacy.

Company Background Investigation

BDSwiss was founded in 2012 and has since expanded its operations globally, establishing a strong presence in Europe and other regions. The company operates under various entities, including BDS Markets and BDS Ltd, which are regulated in their respective jurisdictions. The ownership structure appears to be transparent, with no hidden affiliations that could raise concerns about potential conflicts of interest.

The management team at BDSwiss comprises experienced professionals with backgrounds in finance and trading, enhancing the company's credibility. Their commitment to transparency is evident through the comprehensive information available on their website, including detailed descriptions of the services offered, regulatory status, and trading conditions. This level of openness is essential for fostering trust among clients.

Trading Conditions Analysis

BDSwiss offers a competitive trading environment with a variety of account types tailored to different trader needs. The broker employs a spread-based fee model, with spreads varying depending on the account type. However, it is crucial to scrutinize the fee structure for any hidden costs.

| Fee Type | BDSwiss | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips (Classic) | 1.0 pips |

| Commission Model | $6 per lot (Raw) | $5 per lot |

| Overnight Interest Range | Variable | Variable |

BDSwiss charges a monthly inactivity fee of $30 if there is no trading activity for over 90 days, which can be considered steep compared to other brokers. Additionally, while the broker does not charge for deposits or withdrawals in most cases, a $10 fee applies to bank wire withdrawals under $100. These fees could impact overall profitability, especially for less active traders.

Client Fund Safety

Ensuring the safety of client funds is a primary concern for any trader. BDSwiss implements several measures to protect client capital, including segregated accounts, which keep client funds separate from the company's operational funds. This practice is crucial in the event of insolvency, as it ensures that client funds are not used for operational expenses.

Moreover, BDSwiss offers negative balance protection, which guarantees that clients cannot lose more than their deposited amount. This feature is particularly beneficial for traders using high leverage, as it mitigates the risk of substantial losses. However, it is essential to remain cautious, as there have been reports of fund withdrawal issues and client complaints regarding the speed and efficiency of the withdrawal process.

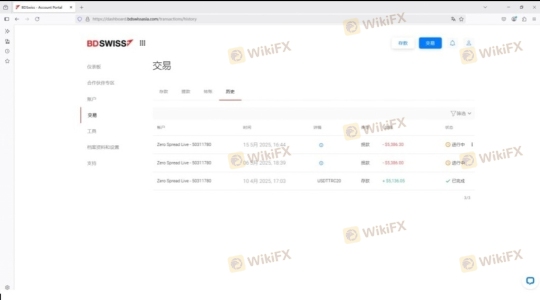

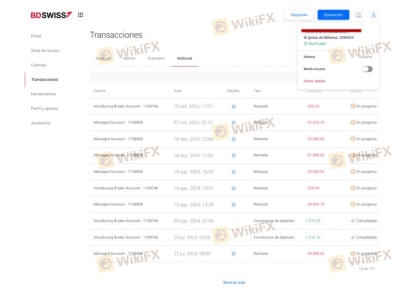

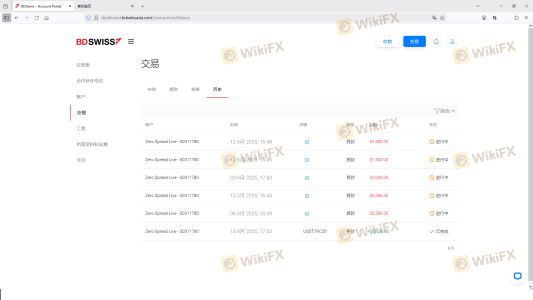

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. BDSwiss has received mixed reviews from clients, with some praising its user-friendly platform and educational resources, while others have expressed concerns about withdrawal delays and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Account Verification | Medium | Generally responsive |

| Inactivity Fees | Medium | Addressed in FAQs |

For instance, some users have reported issues with the withdrawal process taking longer than expected, leading to frustration. Others have noted that while the customer support team is generally helpful, response times can vary significantly during peak hours. These complaints highlight the importance of assessing a broker's customer service quality before committing funds.

Platform and Trade Execution

BDSwiss provides access to several trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as its proprietary web-based platform. The performance of these platforms is generally well-regarded, with users reporting stable connections and efficient trade execution.

The broker claims a high execution quality, with a significant percentage of orders executed without requotes or slippage. However, traders should remain vigilant for any signs of platform manipulation or execution issues, especially during high volatility periods.

Risk Assessment

Trading with BDSwiss carries various risks that traders should consider. The following risk assessment summarizes key risk categories associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Multiple tier-3 regulators |

| Fund Safety | Low | Segregated accounts, negative balance protection |

| Trading Costs | Medium | Inactivity fees and withdrawal charges |

| Customer Support | Medium | Mixed feedback on responsiveness |

To mitigate these risks, traders should conduct thorough research, maintain realistic expectations regarding trading outcomes, and consider starting with a demo account to familiarize themselves with the platform.

Conclusion and Recommendations

In conclusion, BDSwiss presents itself as a legitimate broker with a solid operational history and a variety of trading options. While it is regulated by several authorities, the lack of top-tier licenses may raise concerns for some traders. However, the broker's commitment to fund safety, negative balance protection, and a user-friendly trading environment are significant positives.

Traders should exercise caution, especially regarding the inactivity fees and withdrawal processes. For those seeking a broker with robust regulatory oversight, it may be worthwhile to consider alternatives such as brokers regulated by the FCA or ASIC.

Ultimately, BDSwiss could be a suitable choice for beginners and active traders looking for a competitive trading environment, but it is essential to weigh the potential risks and fees before proceeding.

Is BDSWISS a scam, or is it legit?

The latest exposure and evaluation content of BDSWISS brokers.

BDSWISS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BDSWISS latest industry rating score is 3.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.