Assexmarkets 2025 Review: Everything You Need to Know

Executive Summary

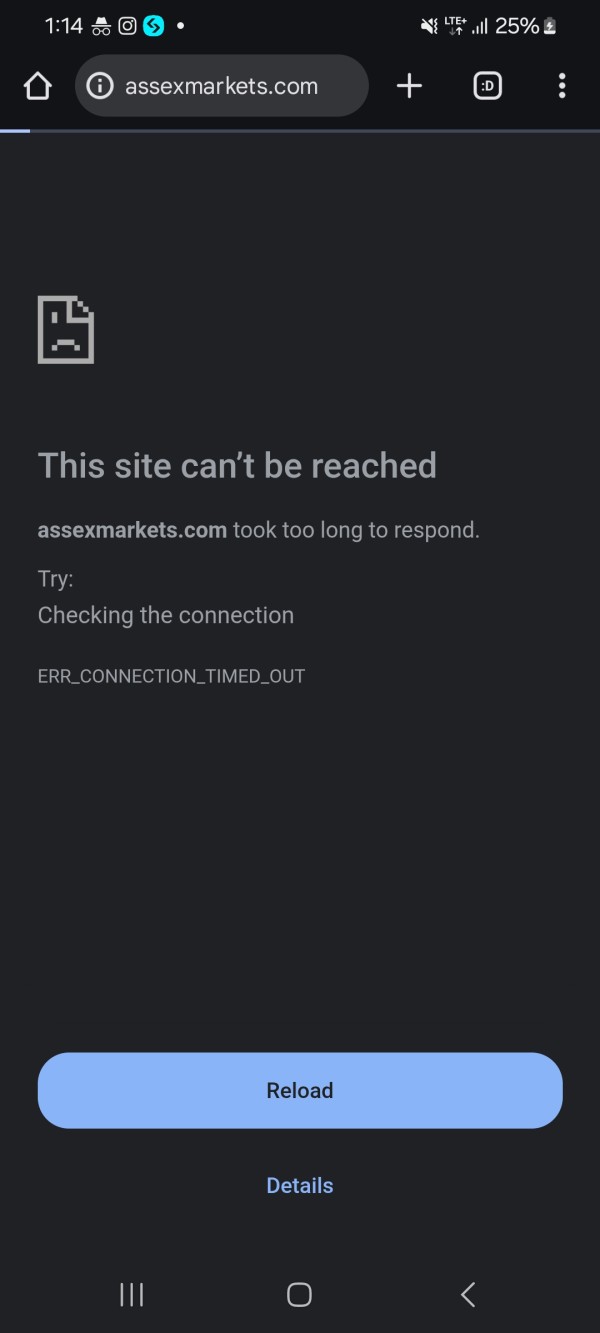

This comprehensive Assexmarkets review examines an unregulated forex broker. The broker has raised serious concerns within the trading community. Assexmarkets presents itself as a modern trading platform offering AI-powered automated trading solutions, but its lack of regulatory oversight has led many users to question its legitimacy and safety.

The platform offers leverage up to 1:500. It also claims ultra-fast execution speeds with low latency trading conditions. According to available information, Assexmarkets offers trading in forex CFDs, commodities, indices, and cryptocurrency CFDs with spreads starting from zero. However, the absence of regulatory supervision and user reports labeling it as a potential "scam" raise serious red flags for potential investors.

This broker targets traders seeking high leverage ratios and rapid trade execution. The broker particularly appeals to those interested in automated trading systems. However, given the serious concerns about its regulatory status and legitimacy, traders should exercise extreme caution when considering this platform. The overall assessment reveals a broker with limited transparency, questionable credibility, and substantial risks that outweigh any potential benefits.

Important Disclaimers

Due to Assexmarkets' unregulated status, traders must be aware that different jurisdictions may have varying legal implications when dealing with such entities. The absence of regulatory oversight means that standard investor protections typically available through licensed brokers are not applicable. This creates additional risks for traders in all regions, regardless of their local financial regulations.

This evaluation is based on currently available information from various sources and user feedback collected through multiple platforms. The analysis does not constitute investment advice, and readers should conduct their own thorough research and consider consulting with qualified financial advisors before making any trading decisions involving Assexmarkets or similar unregulated entities.

Rating Framework

Broker Overview

Assexmarkets positions itself as a modern forex broker offering AI-driven automated trading solutions. According to available information, the platform promises high profitability through its automated systems, simple onboarding processes, and streamlined withdrawal procedures. The broker claims to provide superior market conditions with tight spreads and low latency execution, targeting traders who prioritize speed and efficiency in their trading operations.

The company's business model centers around automated trading technology. This suggests that it appeals to traders who prefer algorithmic strategies over manual trading approaches. However, critical information about the company's founding date, corporate background, and operational history remains notably absent from publicly available sources, which raises concerns about transparency and corporate accountability.

The broker offers trading access to multiple asset classes including forex CFDs, commodities, indices, and cryptocurrency CFDs. Despite these offerings, the most significant concern surrounding Assexmarkets review discussions is the complete absence of regulatory oversight. The platform operates without supervision from any recognized financial regulatory authority, which places it outside the standard framework of investor protection that legitimate brokers typically provide.

Regulatory Status: Assexmarkets operates without regulation from any recognized financial authority. This unregulated status means the broker is not subject to the oversight, compliance requirements, or investor protection measures that regulated brokers must maintain.

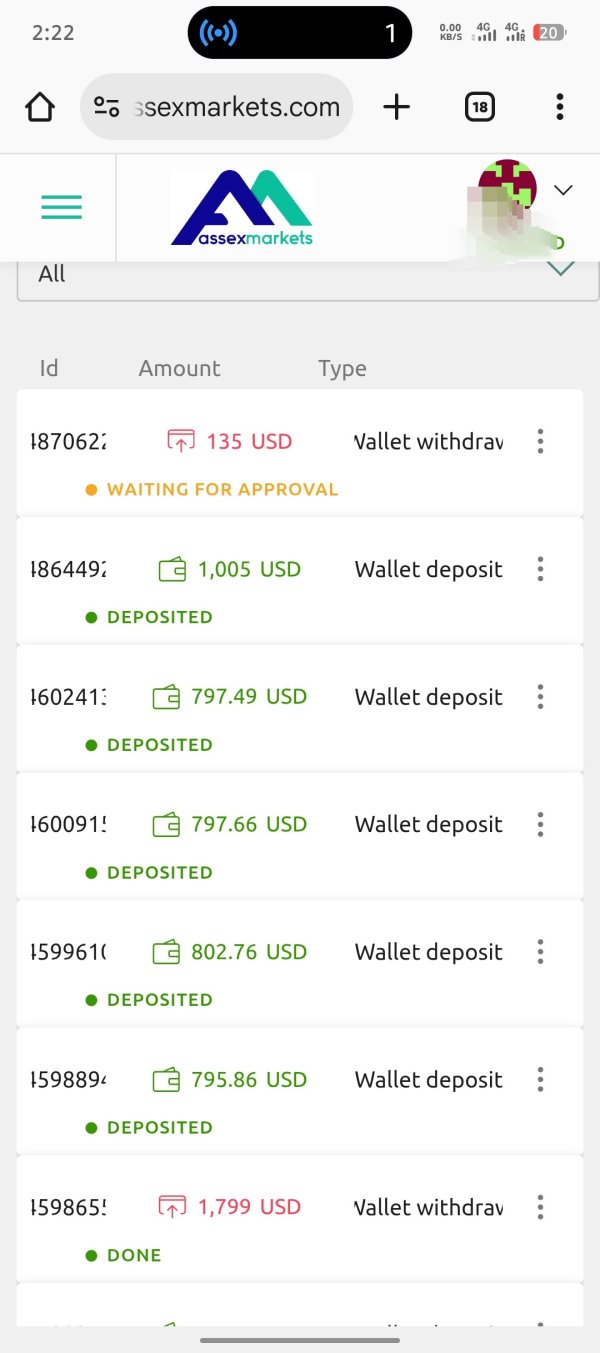

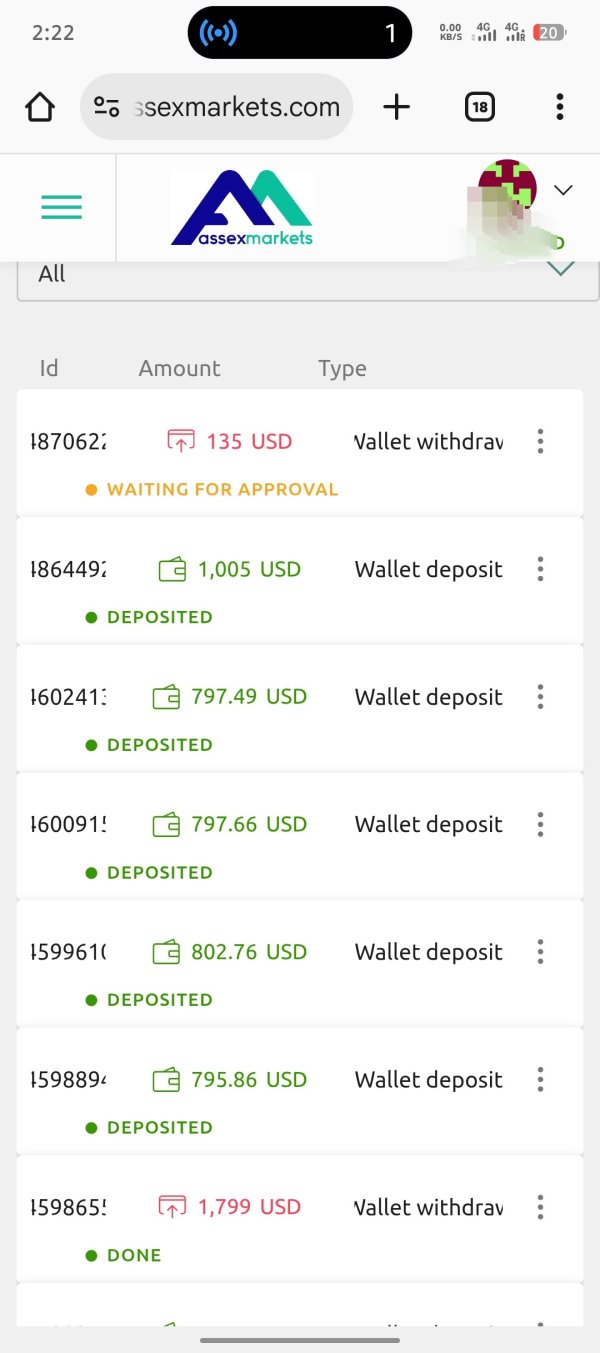

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available sources. This represents a significant transparency concern for potential clients seeking to understand fund management procedures.

Minimum Deposit Requirements: The platform does not clearly specify minimum deposit requirements in available documentation. This makes it difficult for traders to plan their initial investment approach.

Bonuses and Promotions: No specific information about promotional offers or bonus structures is available in current sources. This suggests either minimal promotional activity or lack of transparency in marketing practices.

Tradeable Assets: The platform provides access to forex CFDs, commodities, indices, and cryptocurrency CFDs. It offers a reasonably diverse range of trading instruments across major asset classes.

Cost Structure: According to available information, spreads begin from zero. However, specific commission structures and additional fees are not clearly detailed. This lack of comprehensive fee disclosure raises concerns about hidden costs.

Leverage Ratios: The broker offers maximum leverage up to 1:500. This represents high-risk trading conditions that can amplify both profits and losses significantly.

Platform Options: Specific trading platform names and features are not detailed in available sources. This represents another area where transparency is lacking in this Assexmarkets review.

Regional Restrictions: Information about geographical limitations or restricted territories is not available in current documentation.

Customer Service Languages: Available customer support languages are not specified in accessible sources.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions offered by Assexmarkets receive a poor rating due to significant transparency issues and lack of detailed information. Available sources do not provide specific details about different account types, their respective features, or the requirements for accessing various service levels. This absence of clear account structure information makes it extremely difficult for potential traders to make informed decisions about which account might suit their trading needs.

The minimum deposit requirements remain unspecified. This is highly unusual for legitimate forex brokers who typically provide clear information about initial funding requirements. Without this basic information, traders cannot properly plan their investment approach or understand the financial commitment required to begin trading.

The account opening process is not detailed in available documentation. This raises questions about verification procedures, documentation requirements, and the time required to activate trading accounts. Legitimate brokers typically provide comprehensive information about their onboarding process to help clients understand what to expect.

No information is available regarding special account features such as Islamic accounts for Muslim traders, VIP accounts for high-volume traders, or other specialized services that established brokers commonly offer. This Assexmarkets review finds the lack of account condition transparency concerning and indicative of poor customer service standards.

Assexmarkets receives a below-average rating for tools and resources, primarily based on its emphasis on AI-driven automated trading systems. While the platform promotes advanced automated trading capabilities, specific details about the technology, its performance metrics, or user control features are not comprehensively documented in available sources.

The broker's focus on automated trading suggests some technological sophistication. However, without detailed information about the underlying algorithms, risk management features, or customization options, traders cannot properly evaluate the quality or suitability of these tools. Professional traders typically require detailed specifications about trading tools before committing to a platform.

Educational resources, which are crucial for trader development, are not mentioned in available documentation. Legitimate brokers typically provide extensive educational materials including webinars, tutorials, market analysis, and trading guides. The absence of such resources suggests limited commitment to client education and development.

Research and analysis tools, including market commentary, economic calendars, and technical analysis resources, are not detailed in current sources. These tools are essential for informed trading decisions, and their absence or lack of documentation represents a significant limitation for serious traders seeking comprehensive market insights.

Customer Service and Support Analysis (4/10)

Customer service receives a poor rating due to the complete absence of detailed information about support channels, availability, and service quality. Available sources do not specify whether the broker offers phone support, live chat, email assistance, or other communication methods that traders typically expect from professional brokers.

Response times, which are crucial for traders who may need urgent assistance with time-sensitive issues, are not documented anywhere in available information. Professional trading environments require reliable, fast customer support, especially during volatile market conditions when technical issues or account problems can result in significant financial losses.

Service quality assessments from actual users are notably absent from available sources. This is unusual given that customer feedback typically provides valuable insights into broker performance. The lack of user testimonials about customer service experiences raises questions about the broker's commitment to client satisfaction.

Multi-language support capabilities are not specified. This could limit accessibility for international traders. Professional brokers typically provide support in multiple languages to serve their global client base effectively, and the absence of such information suggests potential limitations in international service delivery.

Trading Experience Analysis (6/10)

The trading experience receives an average rating based on claims of ultra-fast execution speeds and low latency conditions. According to available information, Assexmarkets emphasizes superior market conditions with tight spreads starting from zero and rapid order execution, which could benefit active traders who prioritize speed and cost efficiency.

Platform stability and reliability information is not comprehensively documented. However, the broker's emphasis on "ultra-fast and precise execution" suggests some focus on technical performance. However, without specific uptime statistics, server location details, or performance benchmarks, traders cannot properly evaluate the platform's reliability under various market conditions.

Order execution quality, including information about slippage rates, requotes, or execution delays, is not detailed in available sources. These factors are crucial for traders, particularly those using scalping strategies or trading during high-volatility periods where execution quality directly impacts profitability.

Mobile trading capabilities and platform functionality are not specifically addressed in current documentation. Modern traders increasingly rely on mobile platforms for flexibility and convenience, making this information gap particularly relevant for this Assexmarkets review assessment.

Trust and Safety Analysis (2/10)

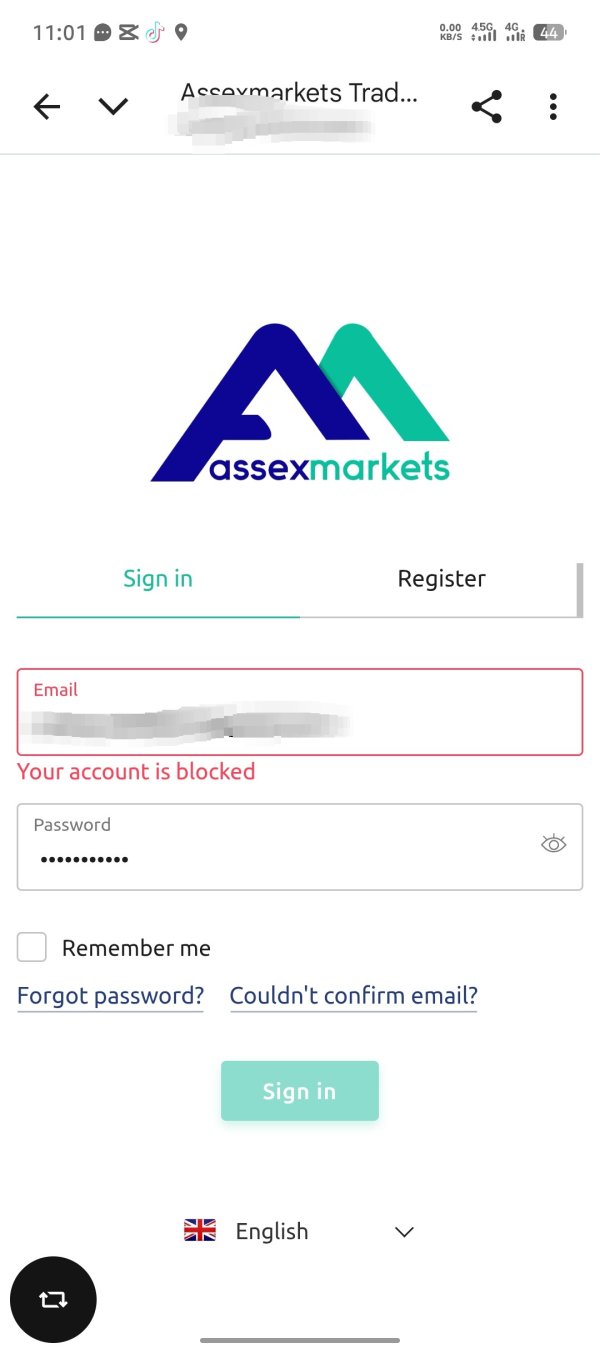

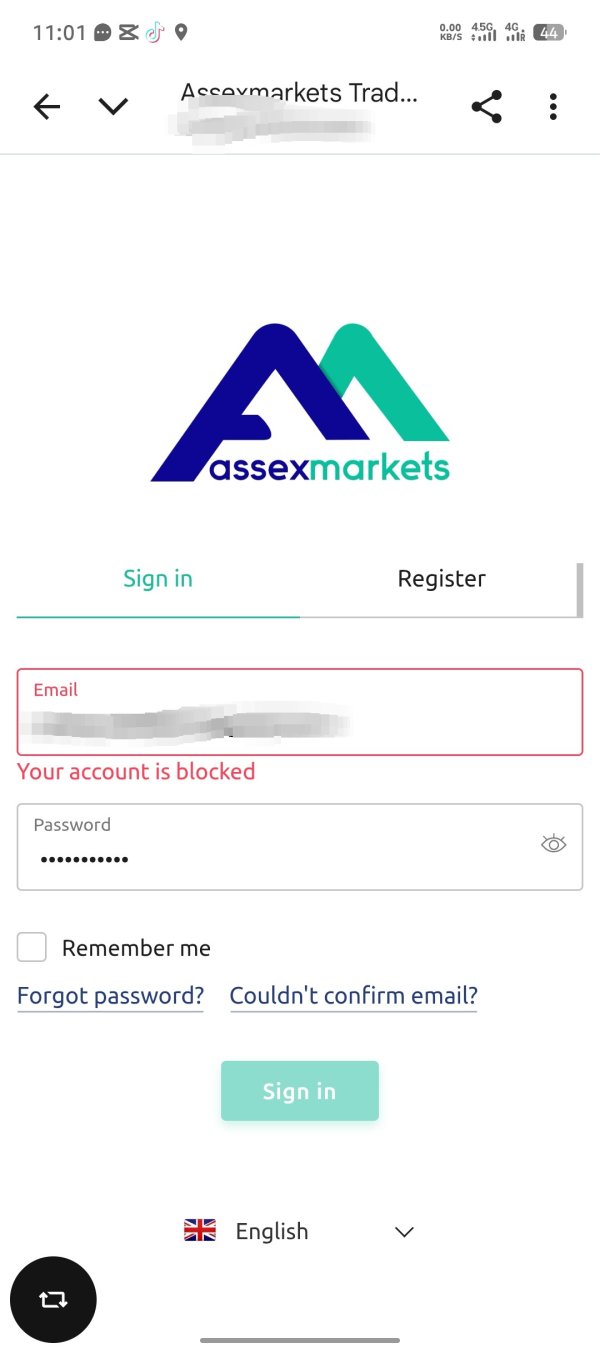

Trust and safety receive a very poor rating due to fundamental concerns about regulatory oversight and legitimacy. The most significant issue is Assexmarkets' complete lack of regulation from any recognized financial authority, which means the broker operates without the oversight and compliance requirements that protect traders' interests and funds.

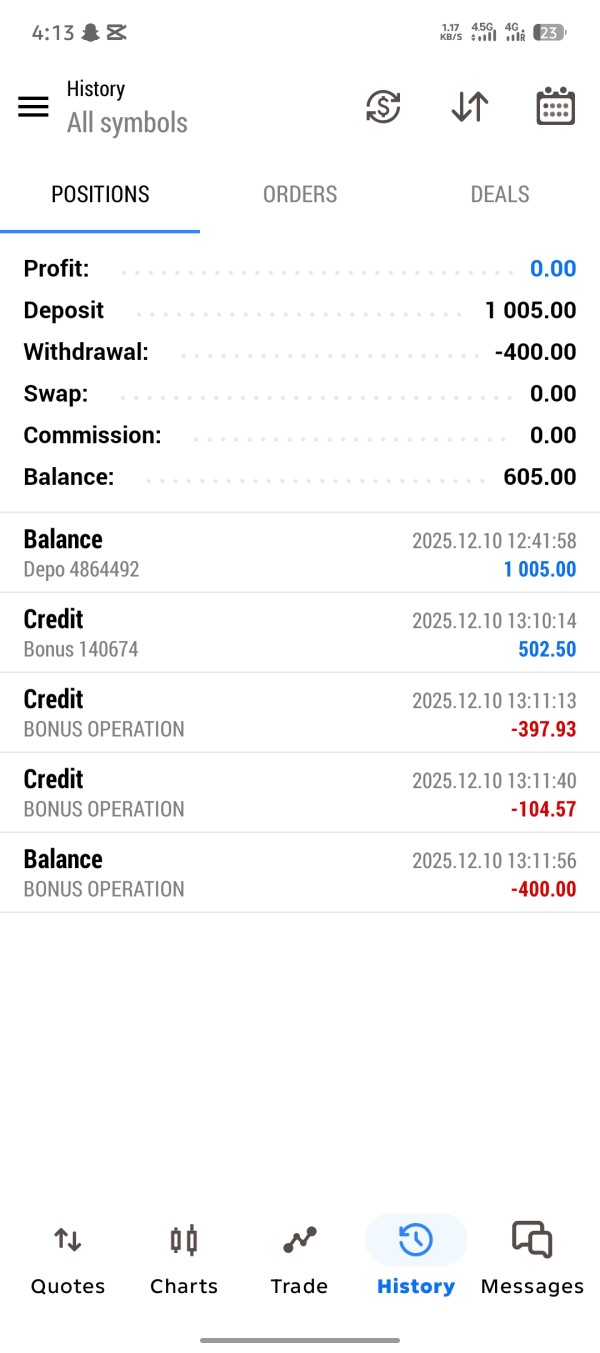

The absence of regulatory supervision means that standard investor protection measures, such as segregated client funds, compensation schemes, or regulatory dispute resolution processes, are not available to Assexmarkets clients. This creates substantial risks for traders who have no recourse through official channels if problems arise.

According to available information, some sources have labeled Assexmarkets as a potential "scam." This represents serious reputational concerns within the trading community. While these allegations require careful verification, their existence indicates significant trust issues that potential clients should carefully consider.

Fund safety measures, including client money protection procedures, bank segregation practices, and insurance coverage, are not detailed in available documentation. Legitimate brokers typically provide comprehensive information about how they protect client funds, and the absence of such details raises serious concerns about financial security.

User Experience Analysis (5/10)

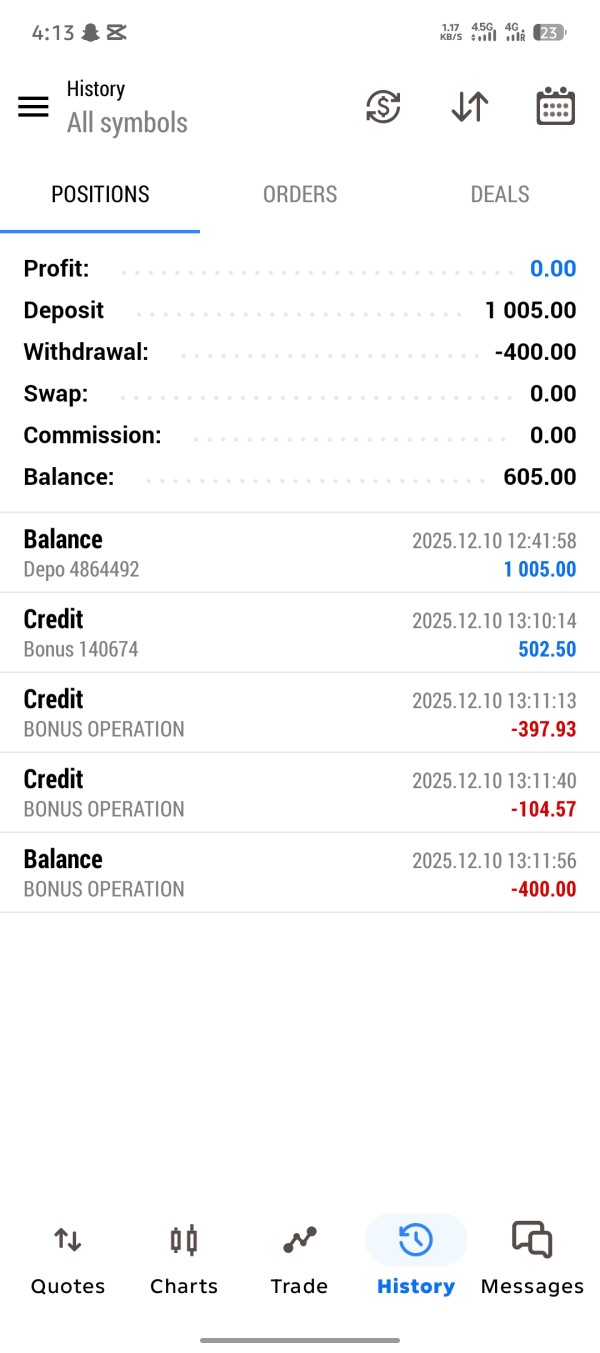

User experience receives a below-average rating due to limited available information about actual user satisfaction and platform usability. While Assexmarkets claims to offer simple onboarding and effortless withdrawal processes, specific user feedback and satisfaction metrics are not comprehensively documented in available sources.

Interface design and usability information is not detailed. This makes it difficult to assess whether the platform provides an intuitive and efficient trading environment. Modern traders expect sophisticated yet user-friendly interfaces that facilitate quick decision-making and efficient trade management.

The registration and verification process details are not clearly outlined. However, the broker claims simple onboarding procedures. Without specific information about required documentation, verification timeframes, and approval processes, potential clients cannot properly prepare for account opening.

Common user complaints and concerns are not systematically documented. However, the existence of legitimacy questions suggests that user experiences may include significant concerns about platform reliability and trustworthiness. The absence of detailed user feedback represents a significant information gap for potential clients evaluating the platform.

Conclusion

This comprehensive Assexmarkets review reveals significant concerns about an unregulated forex broker that lacks the transparency and regulatory oversight essential for safe trading. While the platform offers high leverage up to 1:500 and claims ultra-fast execution speeds, these potential benefits are overshadowed by fundamental trust and safety issues.

The broker may appeal to experienced traders seeking high-leverage opportunities and automated trading solutions. However, the lack of regulatory protection makes it unsuitable for most retail investors. The absence of detailed information about account conditions, customer service, and fee structures further compounds concerns about transparency and professionalism.

The primary advantages include high leverage ratios and claimed fast execution speeds. The significant disadvantages encompass lack of regulation, limited transparency, questionable legitimacy, and absence of investor protection measures. Given these substantial risks, traders should exercise extreme caution and consider regulated alternatives that provide appropriate investor protections and transparent operating conditions.