iqcent Review 41

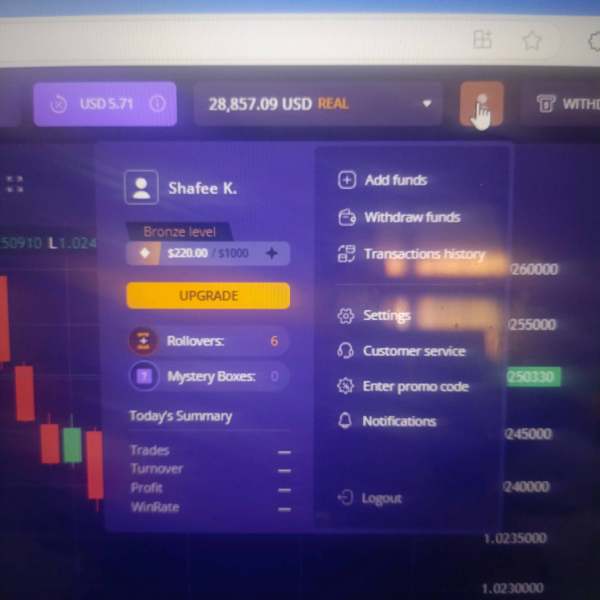

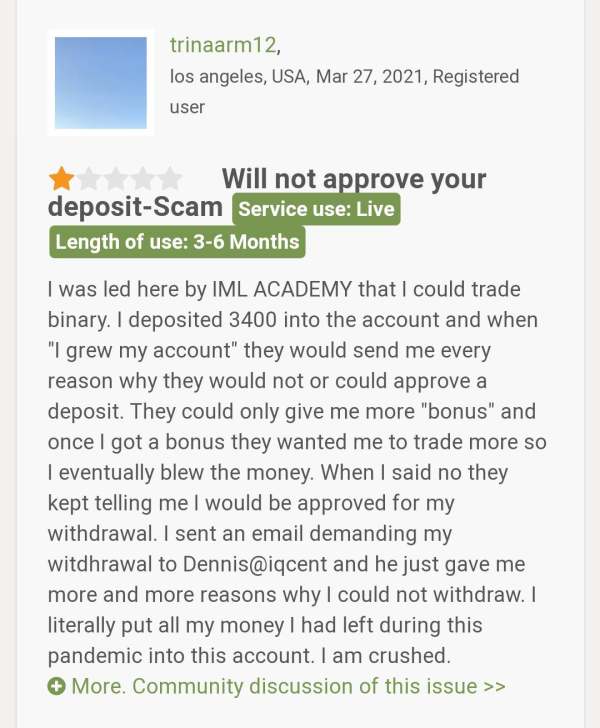

I was brought to IQcent by one of IQcent man who deals in signals and attracting people across the web. _trader and started earning, when the profit reached 28,000$ then I requested a withdrawal but it was rejected and was alleged that my account is involved in some suspicious activity. I asked them to clarify or share any evidence but was left unattended till date. Stay away from this fraudulent platform.

Scam!!!!. I wanted to work with them and to test it out, I deposited $100. In demo mode, you win every minute and it's very fast to go from $100 to $500. They pay you 95%, but when you switch to the real account, it's not the same. Only a couple of currency pairs pay you 90% and it's not as easy to win anymore. Could it be that they manipulate the charts in demo mode? Then, when you want to withdraw the funds, they ask for 1000 requirements. And when you fulfill all of them, they say they did it, but they don't provide any valid document, certificate, or code. They made me open a bitcoin wallet and they told me they deposited the money there, but it didn't arrive. Then they tell me they sent it to the bank (and I didn't give them any bank account), and they sent me a code that doesn't exist when I verify it at the bank. Then they tell me they returned it to the credit card, but they couldn't tell me which credit card, at least the last 4 digits. The support only says that I have to wait, and it's been 3 months already! And now they're closing the account.

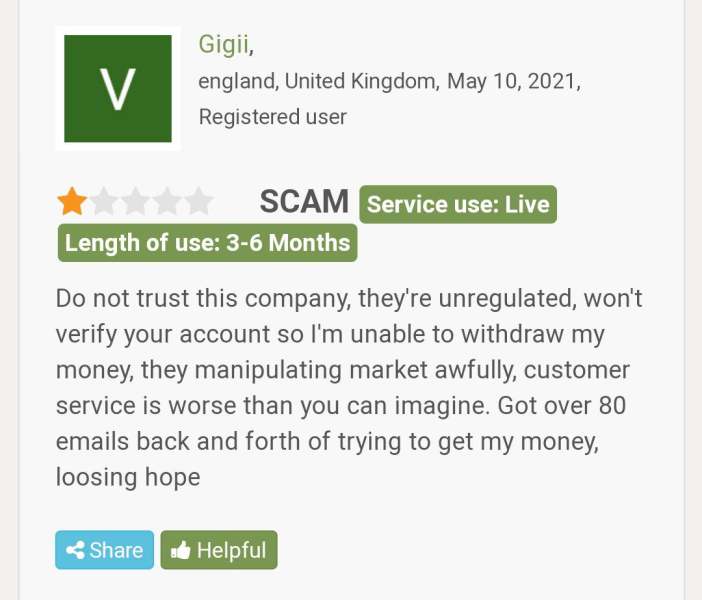

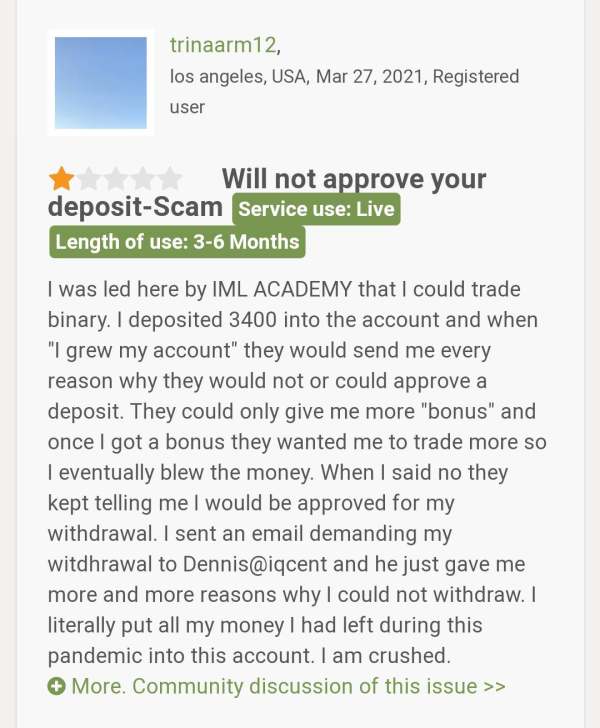

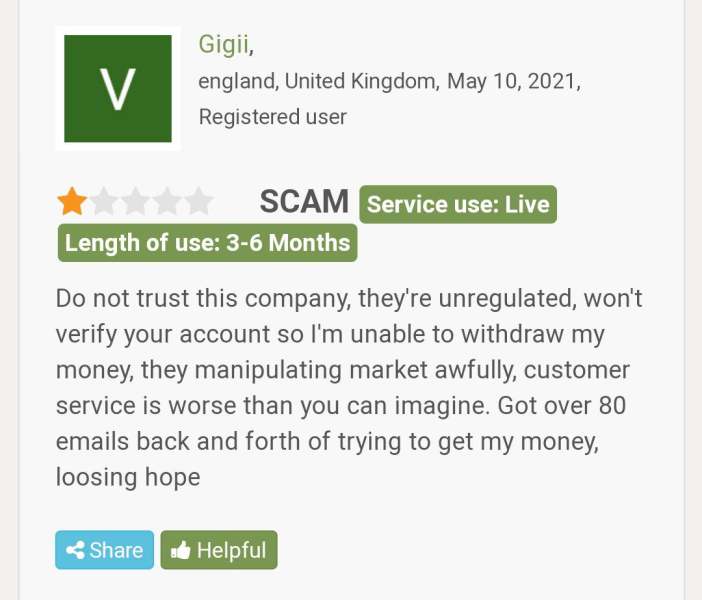

IQCent had scammed many clients by not allowing them withdrawals and their customer service is very poor and unresponsive.

After trying a few platforms I settled on this one because of its simplicity and low starting amount. I trade occasionally and use crypto to deposit and withdraw. So far everything has been processed within a few hours and I have had no problems accessing my funds.

As someone who trades part-time, I need something that fits into my schedule. This does. I can log in, make a few trades, and log out with no fuss. Tried copy trading one night just for fun, and it worked out way better than expected. And yes—withdrawals are quick, which always boosts confidence.

I’ve only been at it for a few months, but already feel way more confident. Copy trading has taught me tricks I’d never figure out alone, and the tournaments make everything more fun. Plus, getting withdrawals processed quickly is a big bonus. I’ve had my ups and downs, but overall, this has been a super rewarding experience.

I was drawn to this platform because of its high leverage, which goes up to 1:500. That’s not something you see on every broker, especially one this simple to use. Withdrawals also impressed me—they happen much faster than I expected. If there’s one area that could be improved, it’s the range of technical analysis tools. I prefer more advanced indicators, but for standard trading, the available features are enough.

I joined this platform on a whim, and it’s been one of the best decisions I’ve made. Trading has turned into a hobby that I genuinely enjoy, and the platform’s features make it easy to stay engaged. The tournaments add an exciting layer to the experience, and I’ve even managed to win a small prize. Copy trading has been the main advantage of this platform for me. I’ve been trying out strategies from professional traders, which helps me understand the market faster. This feature is ideal for beginners. I also noticed that account deposits are processed without delays. However, I found that the selection of stocks here is too small. If you want to work with stocks, it might be better to look for alternatives. But for forex and cryptocurrency, the platform works well.