1. Executive Summary: A Controversial High-Risk Specialist

IQ Option is one of the most recognized yet controversial names in the online trading sphere. This 2025 review reveals a platform that is fundamentally different from traditional forex and CFD brokers. Its primary identity is rooted in binary and digital options, high-risk, fixed-outcome speculative instruments, although it has expanded to offer CFDs. The platforms slick, proprietary interface and extremely low $10 minimum deposit have made it immensely popular, attracting millions of users, particularly beginners.

However, this accessibility masks a high-risk environment and a complex regulatory structure that is the source of its divisive reputation. For European clients, IQ Option is operated by a CySEC-regulated entity, offering a legitimate and protected trading environment (though binary options are banned for retail clients in the EU). For the vast majority of its global user base, however, it operates through an unregulated entity registered in St. Vincent and the Grenadines. This critical distinction means most traders use the platform without any regulatory protection or recourse.

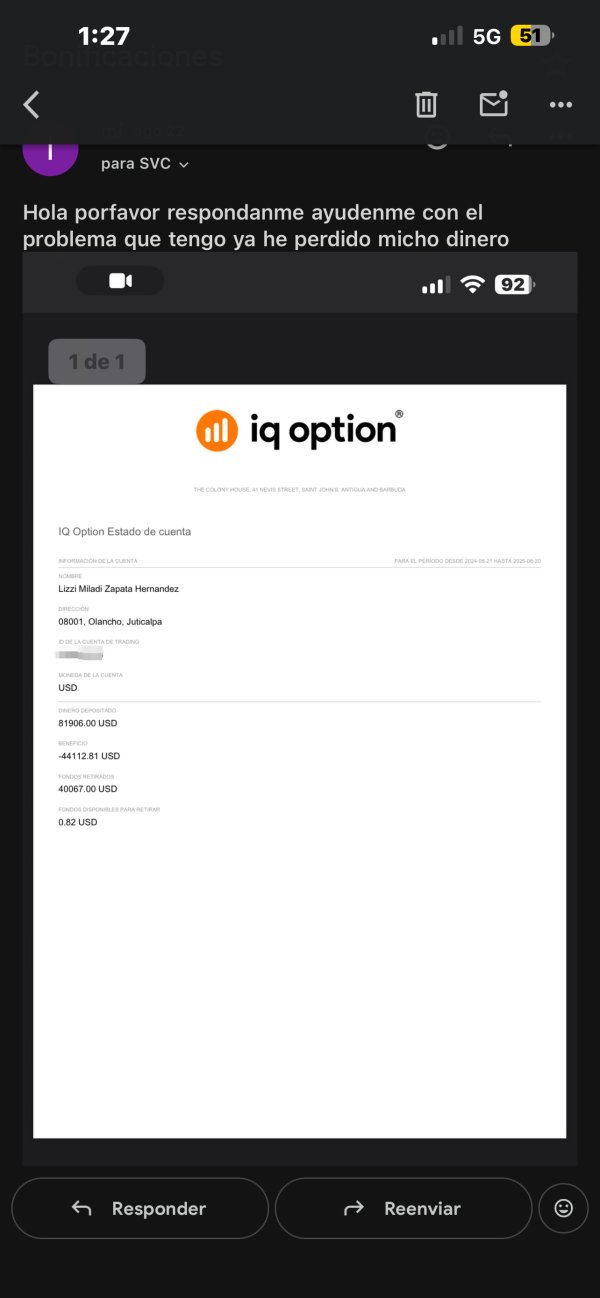

User reviews are deeply polarized. Many praise the platforms usability and fast-paced nature, while a significant number lodge serious complaints regarding withdrawal difficulties, account blocking, and the inherent risks of options trading, often leading to accusations of being a scam. While the CySEC-regulated arm proves IQ Option is not an outright fraudulent operation, its unregulated international arm and its focus on a product akin to gambling place it in a category of its own.

Verdict: IQ Option is a legitimate but extremely high-risk platform. It is not a traditional investment broker. It is a specialist in short-term speculation. It is absolutely not recommended for beginners, despite its marketing. It is suitable only for experienced traders who fully understand the nature of binary options and are comfortable operating in an unregulated environment with the full acceptance of the potential for total capital loss.

Overall Rating Framework: 2025

2. What is IQ Option? Understanding Binary Options vs. CFDs

To evaluate IQ Option fairly, one must first understand that it is not a standard forex broker. Its foundation and primary product are Binary Options.

Binary Options Explained

A binary option is a simple “”yes or no“” proposition. You speculate on whether the price of an asset will be above or below a certain point at a specific, very short time in the future (often 60 seconds to a few minutes).

- If you are correct, you receive a fixed payout (e.g., 85% of your stake).

- If you are wrong, you lose your entire stake.

There is no concept of stop-loss or take-profit. The outcome is “”binary“”—you either win a fixed amount or lose everything. This all-or-nothing structure is why it is often compared to gambling and is considered extremely high-risk. Due to these risks, binary options have been banned for retail traders by top-tier regulators, including CySEC in the EU and the FCA in the UK.

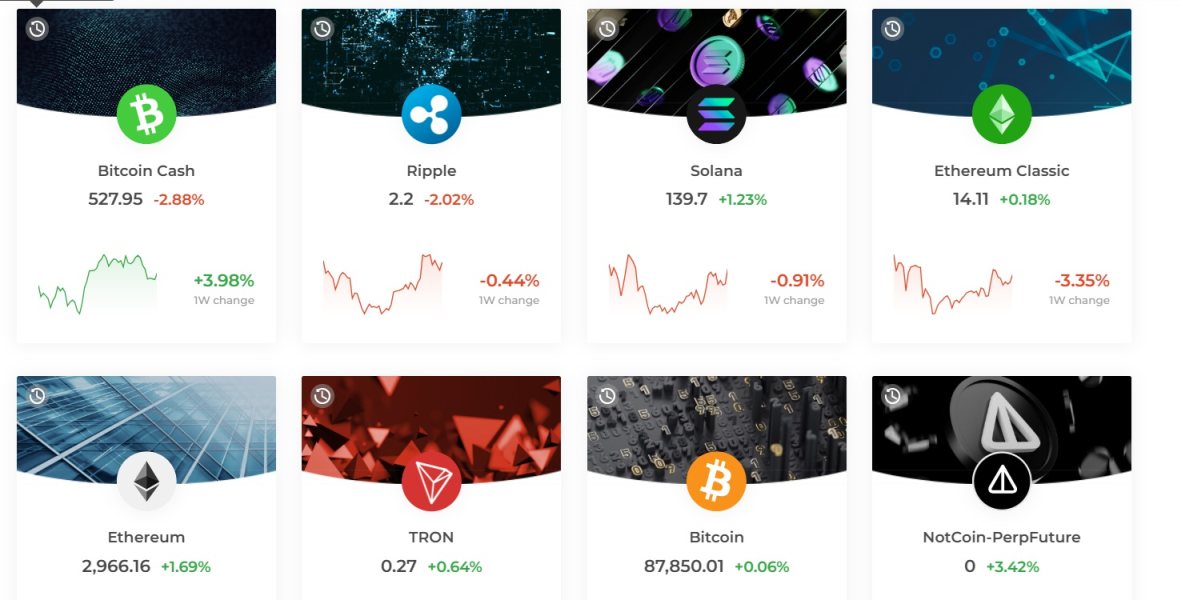

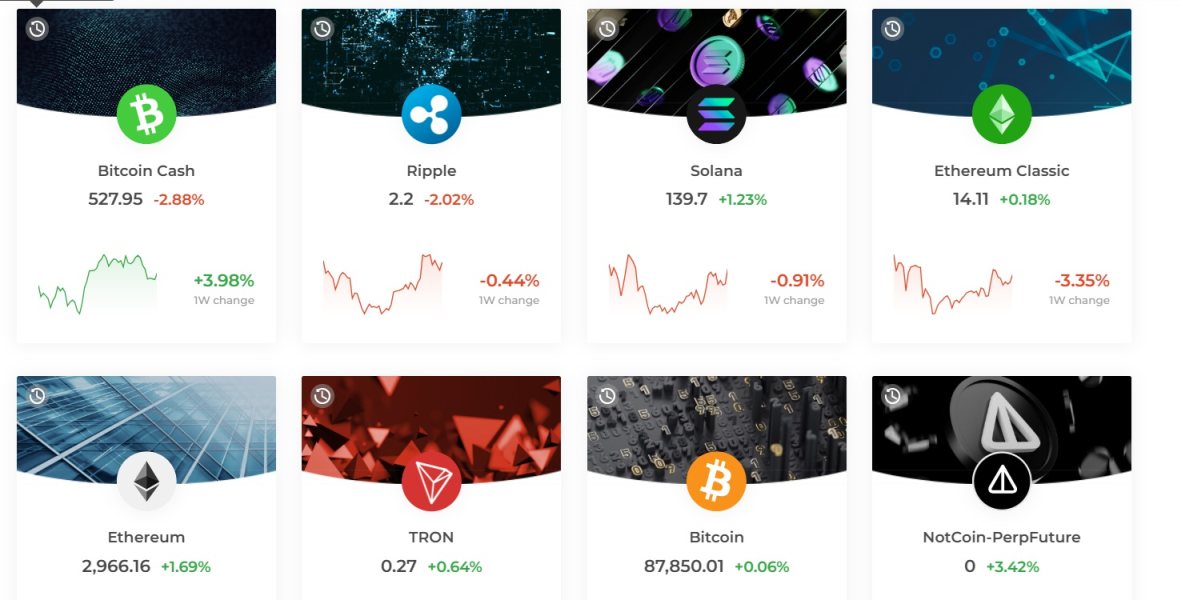

CFD Trading at IQ Option

IQ Option has also added traditional CFD trading to its platform. This allows users to trade Forex, stocks, and cryptocurrencies with leverage, spreads, and stop-losses, similar to a standard broker. However, the platforms core identity and user base remain heavily influenced by its options trading roots.

3. The Critical Issue of Regulation: CySEC vs. Unregulated

This is the most important section of this review. IQ Options regulatory status is split into two completely different worlds, and which one you fall into determines your safety.

1. The Regulated Entity: IQ Option Europe Ltd (for EEA Clients)

For clients residing within the European Economic Area (EEA), the platform is operated by IQ Option Europe Ltd.

- Regulator: Cyprus Securities and Exchange Commission (CySEC)

- License Number: 247/14

- Protections:

- Membership in the Investor Compensation Fund (ICF), protecting funds up to €20,000.

- Negative Balance Protection.

- Strict adherence to MiFID II rules on transparency and fund segregation.

- Key Restriction: Under CySEC rules, this entity cannot offer binary options to retail clients. European users can only trade CFDs and professional-level options.

The existence of this entity proves that IQ Option is a legitimate company capable of meeting the standards of a major regulator.

2. The Unregulated Entity: IQ Option LLC (for Global Clients)

For almost everyone outside of the EEA (including clients from Asia, South America, Africa, etc.), the platform is operated by IQ Option LLC.

- Registration: St. Vincent and the Grenadines (SVG)

- Regulatory Status:Completely Unregulated. SVG is a popular location for offshore brokers because its Financial Services Authority (FSA) does not regulate forex or binary options activities.

- Protections:

- None. There is no compensation fund.

- There is no legal requirement for negative balance protection (though the platform may offer it).

- There is no regulatory body to appeal to in case of a dispute. Your funds are not protected by any oversight.

Conclusion on Regulation: The vast majority of IQ Options clients are trading with an unregulated entity. This means they are operating with a very high level of counterparty risk. If the broker refuses a withdrawal or a dispute arises, the trader has virtually no legal recourse. This is the single biggest risk of using the platform.

4. The Proprietary Trading Platform

IQ Option does not offer MetaTrader 4 or 5. Instead, it has developed its own proprietary platform, which is central to its appeal.

Key Features:

- Slick and Intuitive UI: The platform is renowned for its beautiful design, smooth animations, and user-friendly layout. It is visually engaging and feels more like a modern tech application than a traditional trading terminal.

- Excellent Charting: The charts are powerful and highly functional, with a wide range of technical indicators, drawing tools, and widgets (like trader sentiment and high/low values).

- Multi-Chart Layout: Users can display multiple charts simultaneously, which is great for monitoring several assets at once.

- Integrated Experience: Everything from trading, account management, and support is handled within one seamless interface, available on Web, Desktop (Windows/macOS), and Mobile (iOS/Android).

- Gamification: The fast-paced nature of options trading, combined with the slick interface and features like trading competitions, creates a “”gamified“” experience. This is highly effective at engaging users but can also encourage reckless, gambling-like behavior.

Platform Verdict: The platform itself is technically excellent and a major achievement. However, its closed ecosystem means traders cannot use third-party tools or Expert Advisors (EAs) from the MetaTrader world.

5. Account Types & The True Cost of Trading

IQ Option keeps its account structure incredibly simple and accessible.

- Standard/Real Account: The standard account is available to everyone with a minimum deposit of just $10. This ultra-low entry barrier is a key part of their business model.

- VIP Account: This is available for clients who deposit a significant amount (typically over $1,900). It offers benefits like a personal account manager, monthly trading analysis, and slightly higher payout rates on options.

The Cost of Trading

- Binary/Digital Options: The cost is built into the payout rate. For example, if the payout for a successful trade is 87%, it means the broker retains the remaining 13% as its edge. For a losing trade, the broker keeps 100% of the stake. This ensures a consistent statistical advantage for the house over time.

- CFD Trading: For CFDs, IQ Option uses a variable spread model. Spreads on major pairs like EUR/USD are typically higher than on dedicated CFD brokers, often starting around 1.0 - 1.4 pips.

- Non-Trading Fees:

- Inactivity Fee: A fee of €10 per month is charged after 90 days of inactivity.

- Withdrawal Fees: IQ Option generally offers one free withdrawal per month. Subsequent withdrawals, especially via bank transfer, can incur fees (e.g., ~$31 for a wire transfer). Fees for e-wallets are lower.

6. Analyzing the “”Scam“” Allegations & User Complaints

A search for “”IQ Option“” will reveal thousands of reviews, many of which are extremely negative and use the word “”scam.“” Its important to understand the context behind these complaints.

- The Nature of the Product: The primary driver of complaints is the high-risk nature of binary options. Inexperienced traders, attracted by the low deposit and simple interface, can lose their entire deposit very quickly. Feeling wronged, and not fully understanding the risk they took, they often label the broker a scam.

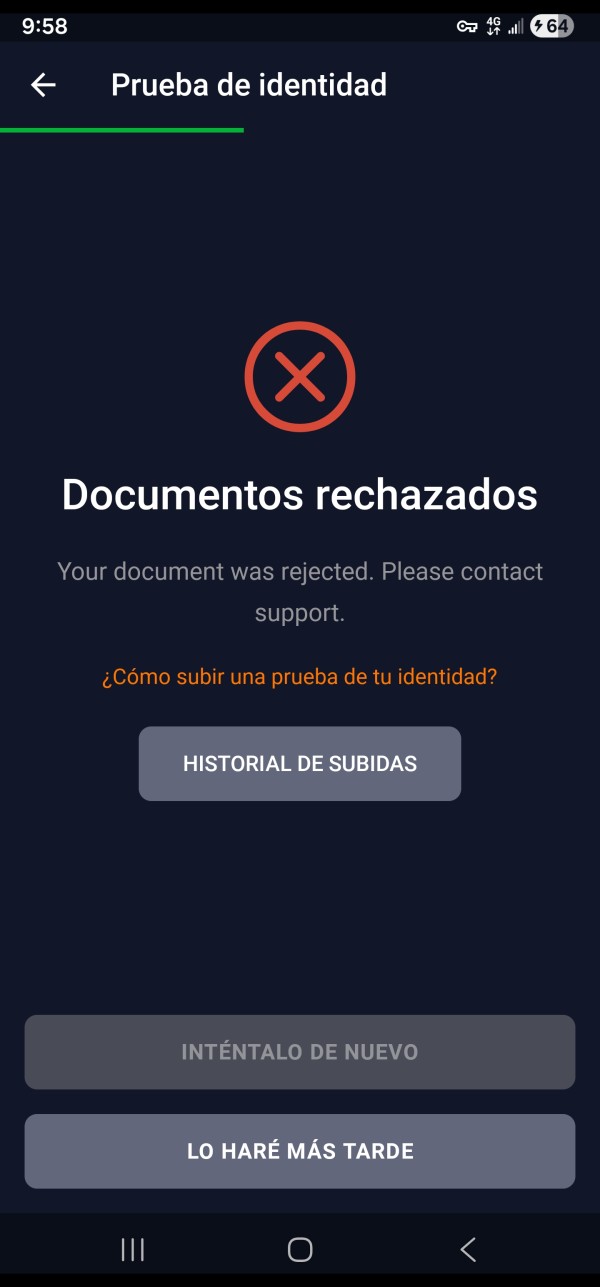

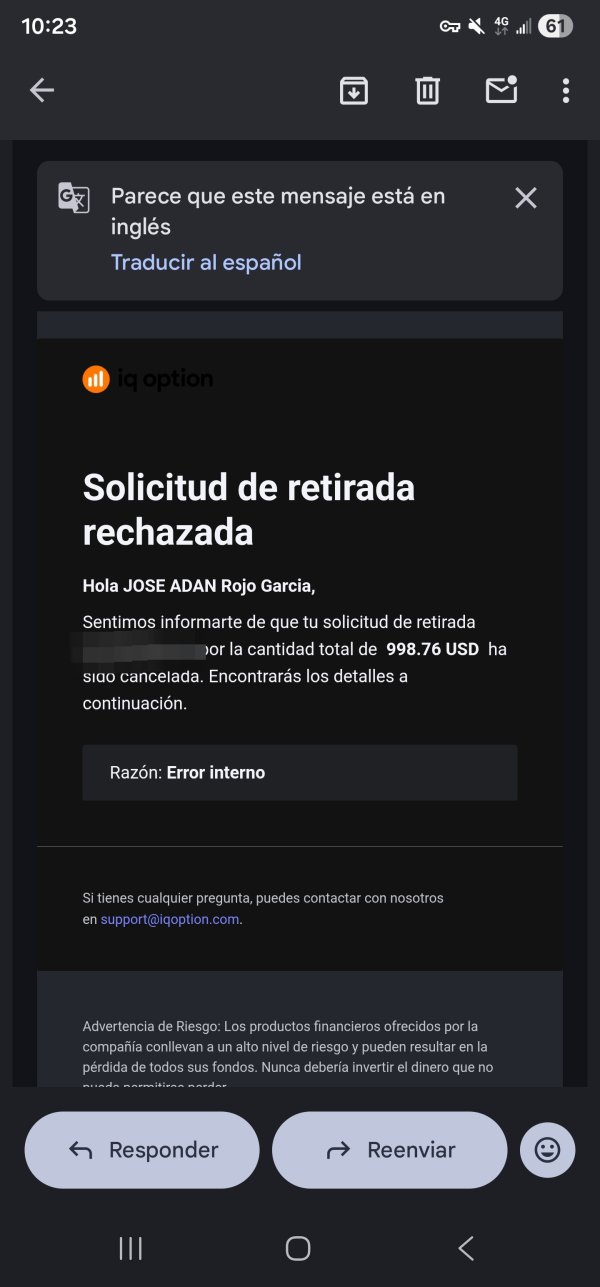

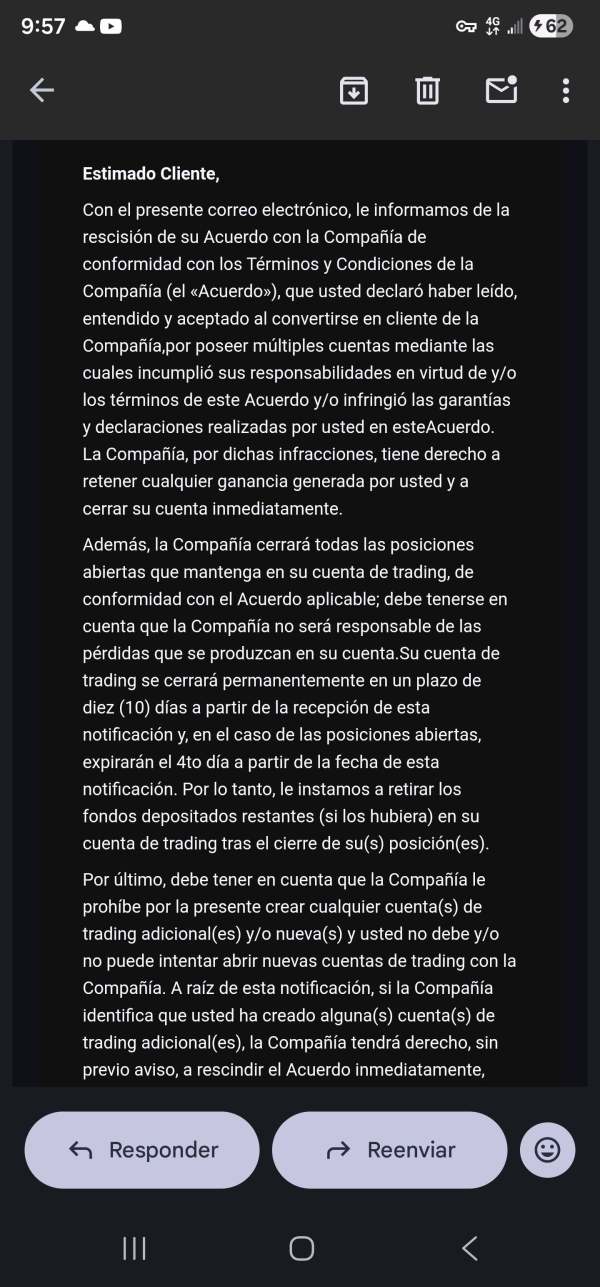

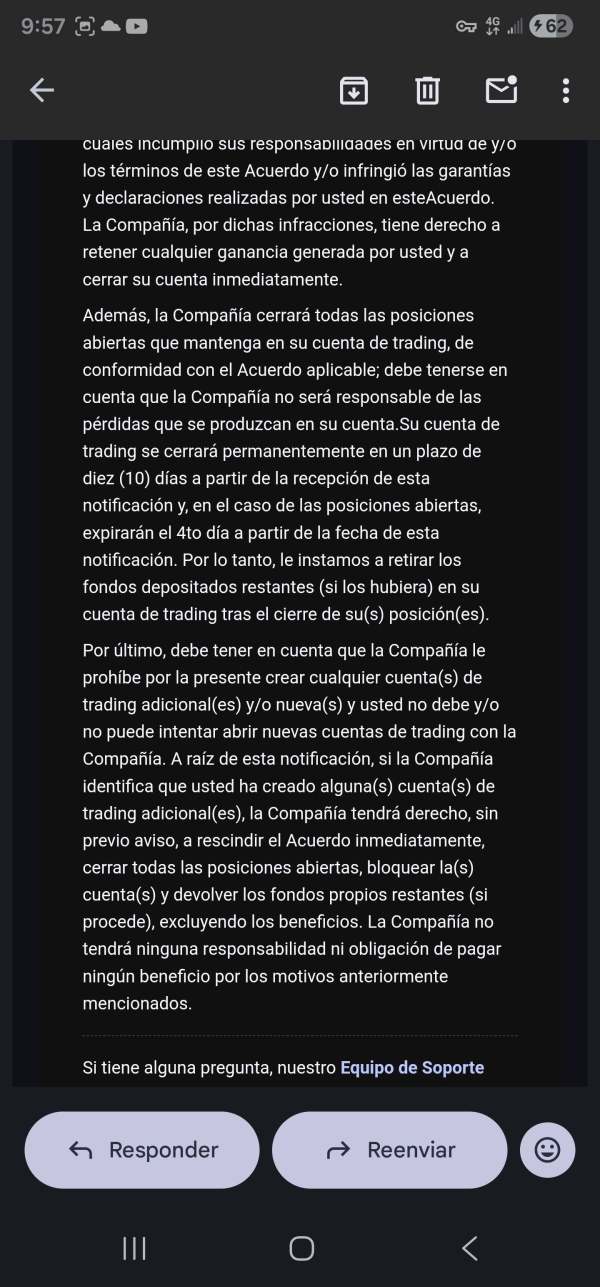

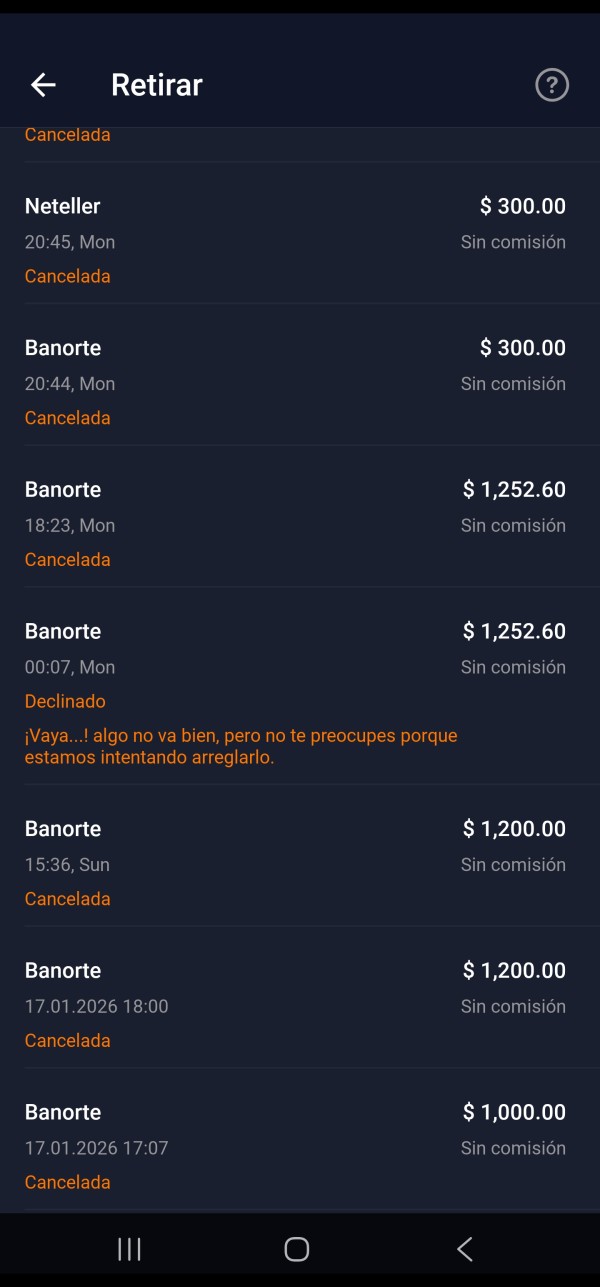

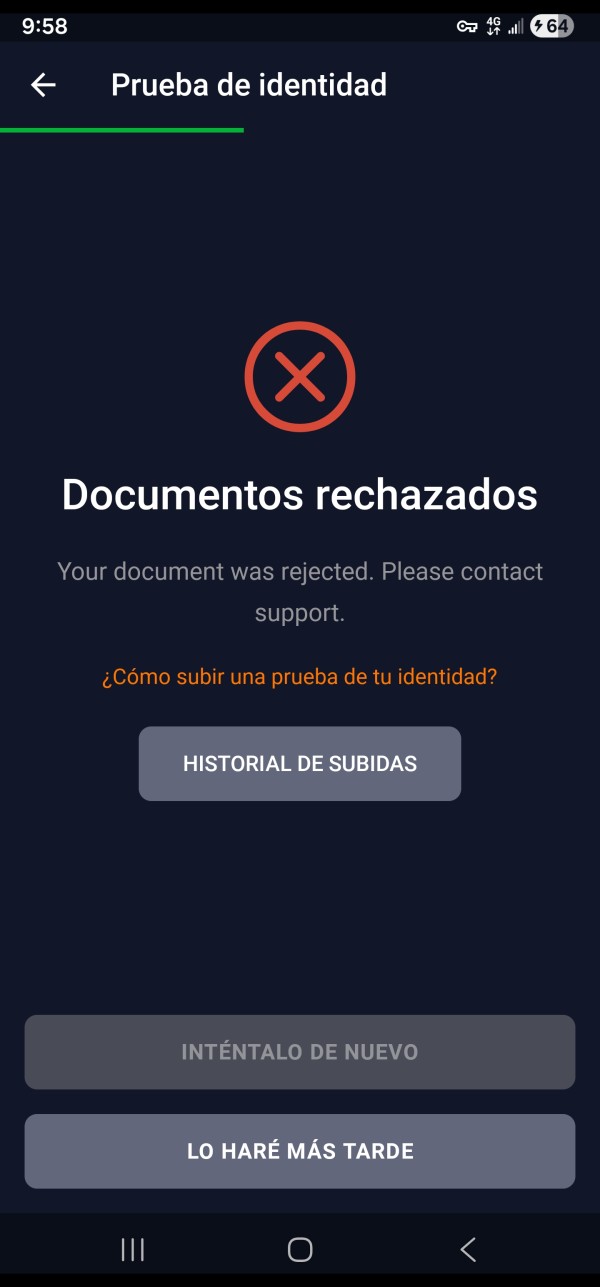

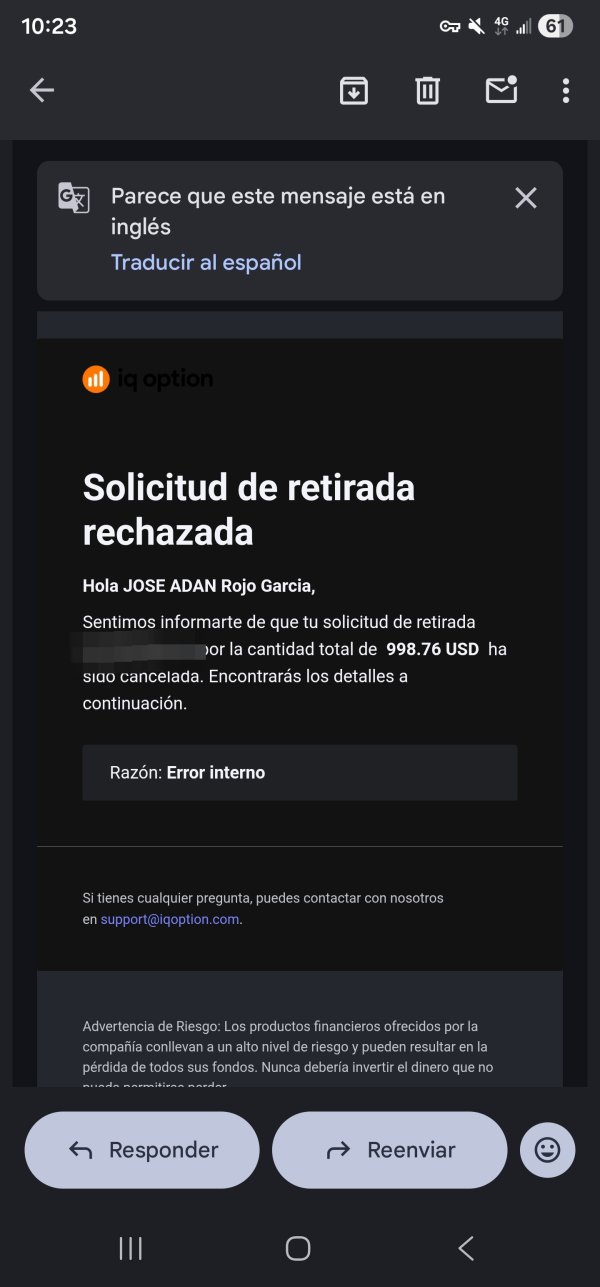

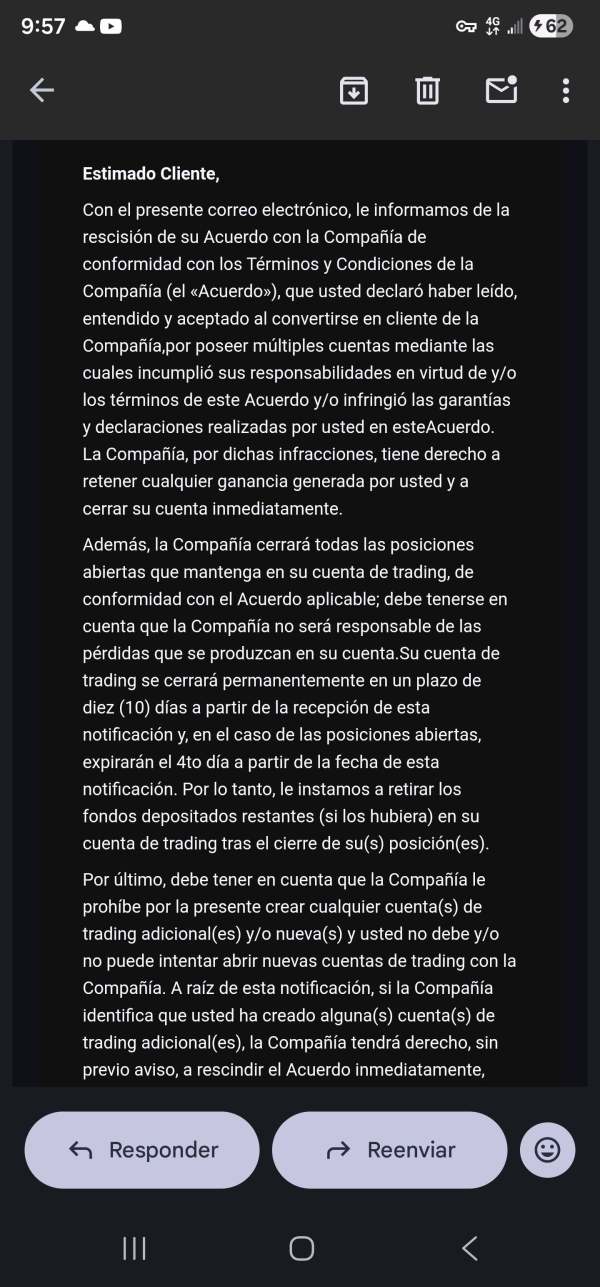

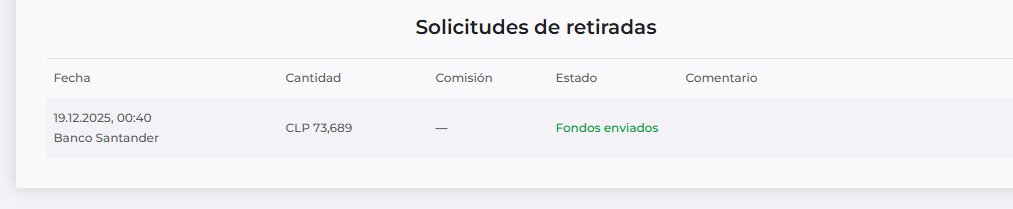

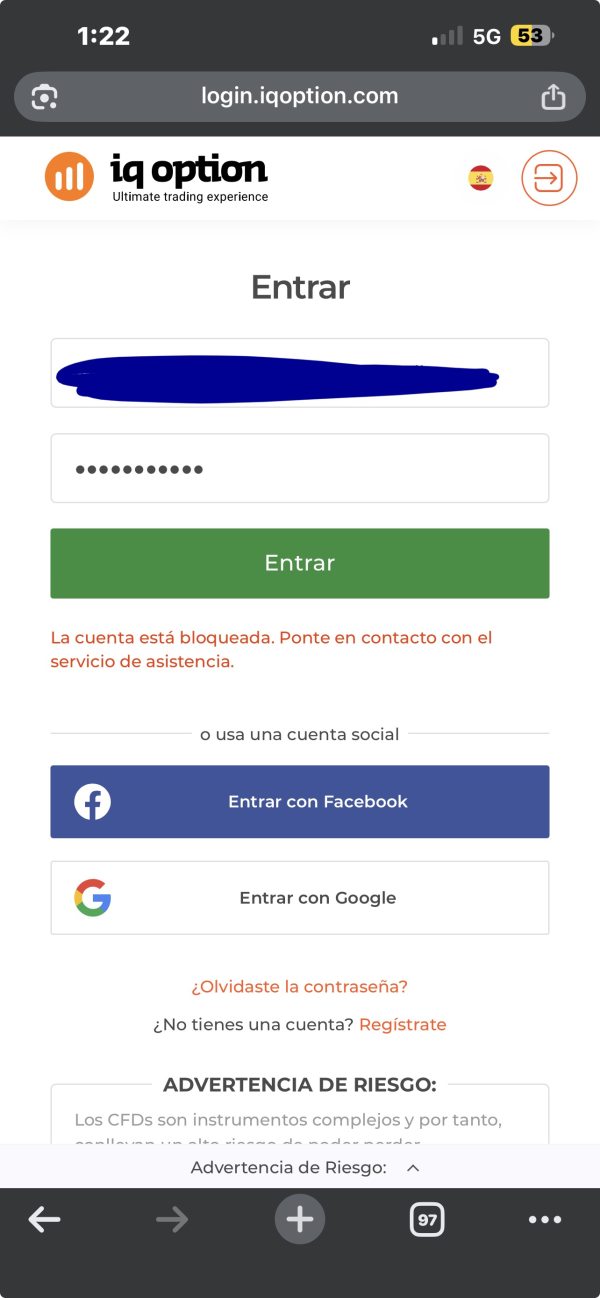

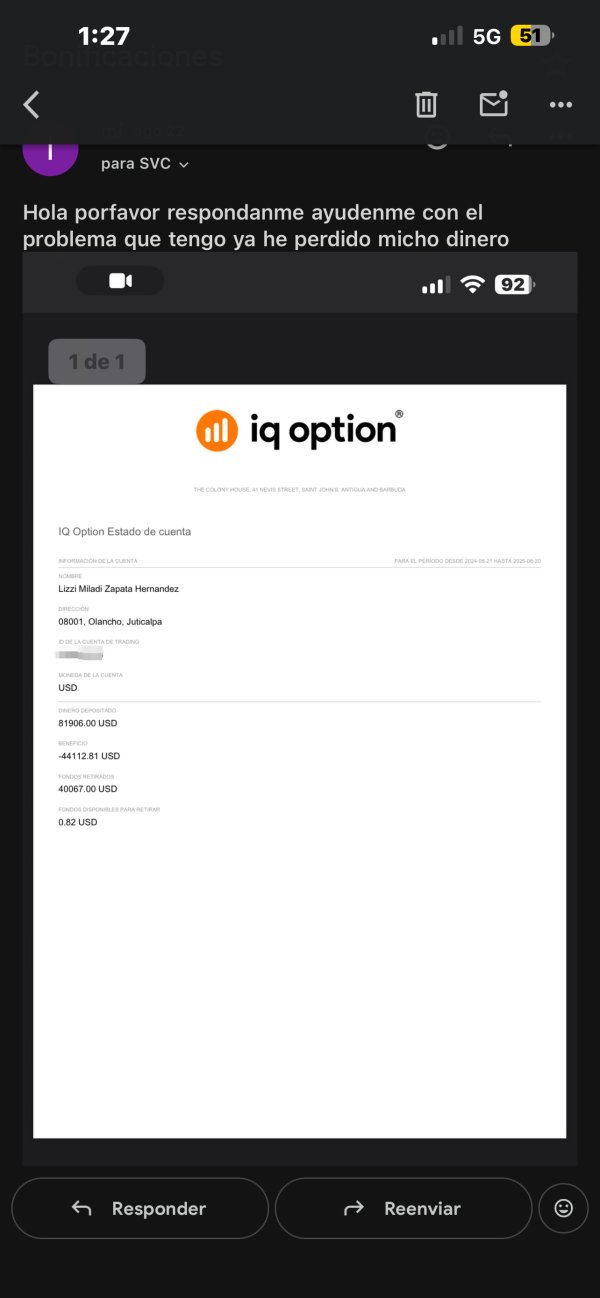

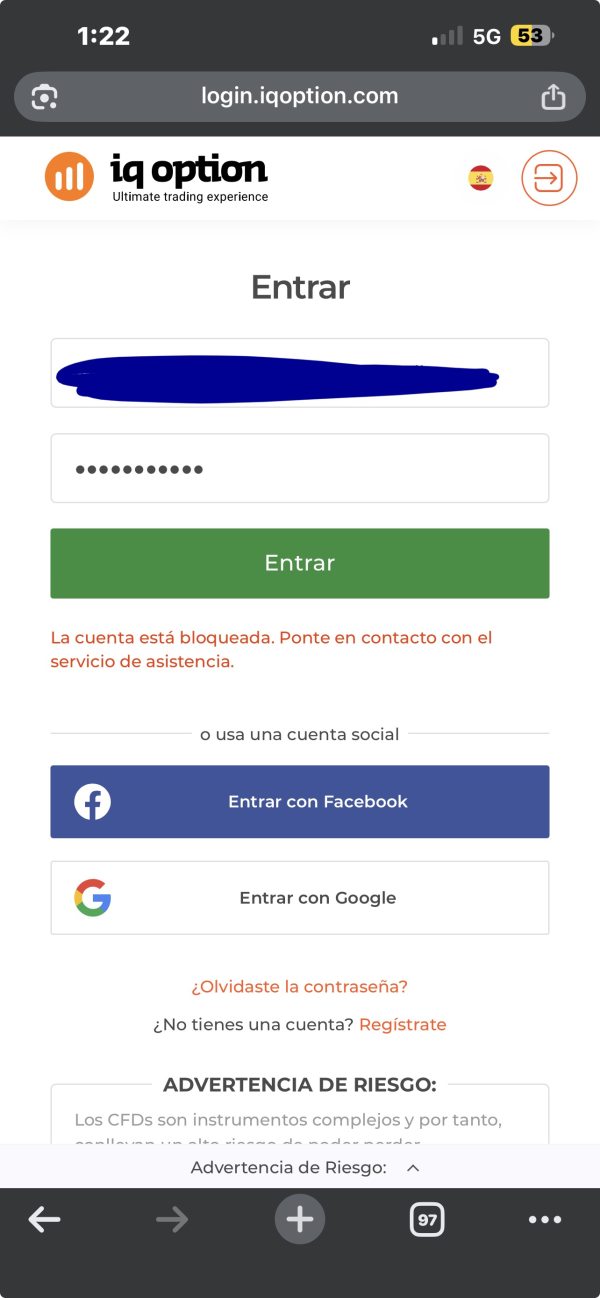

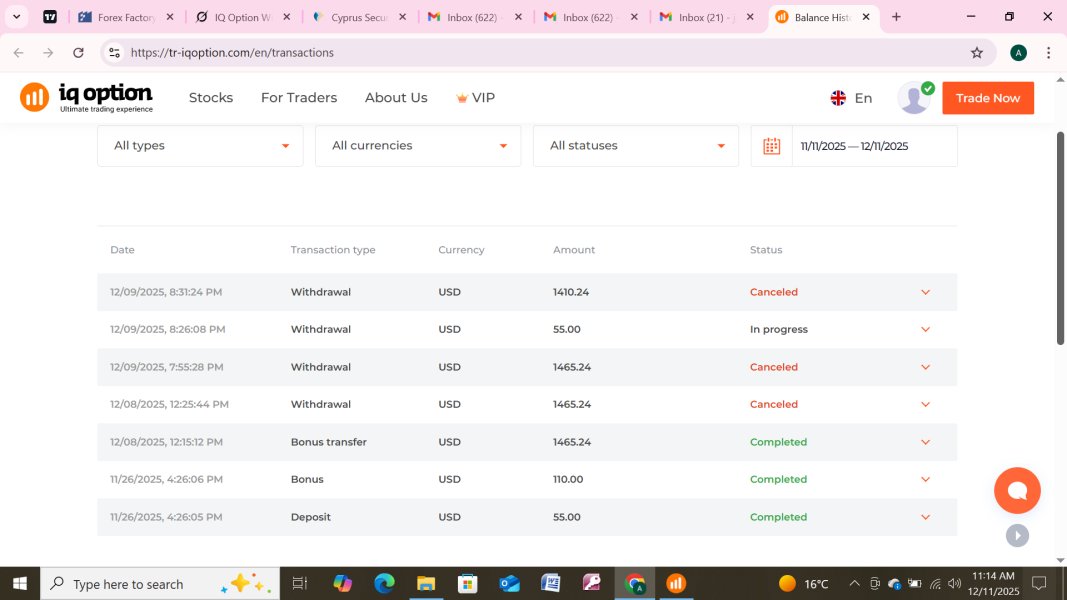

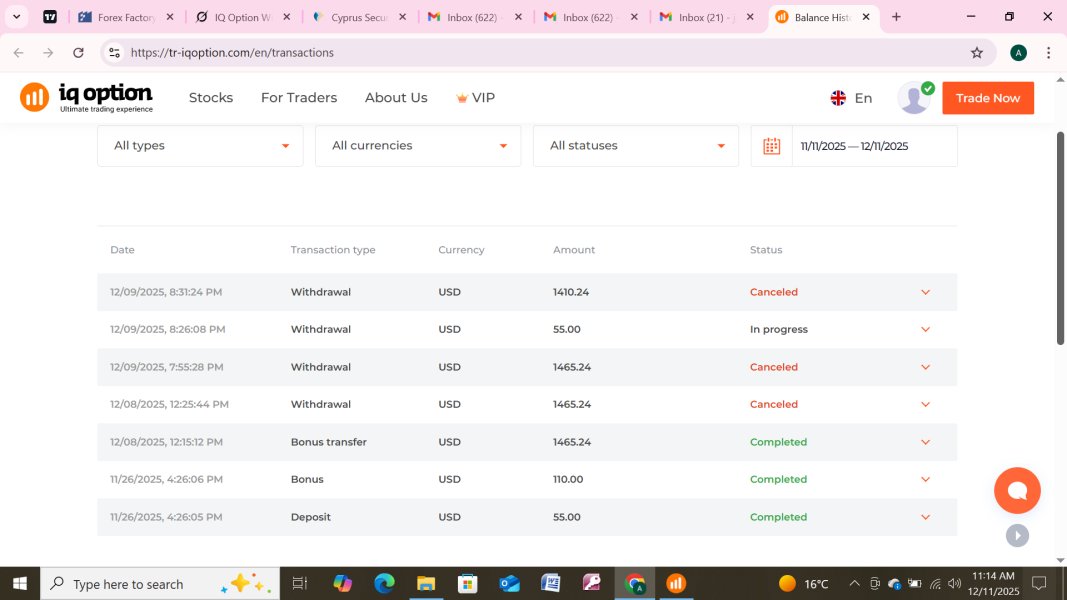

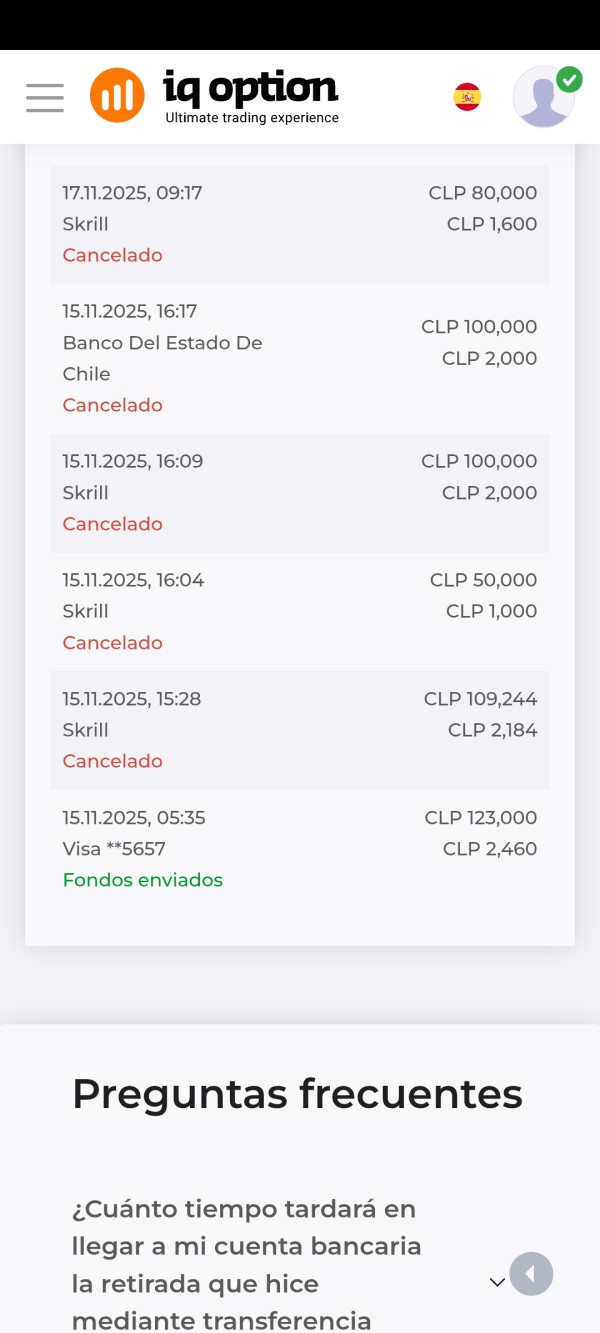

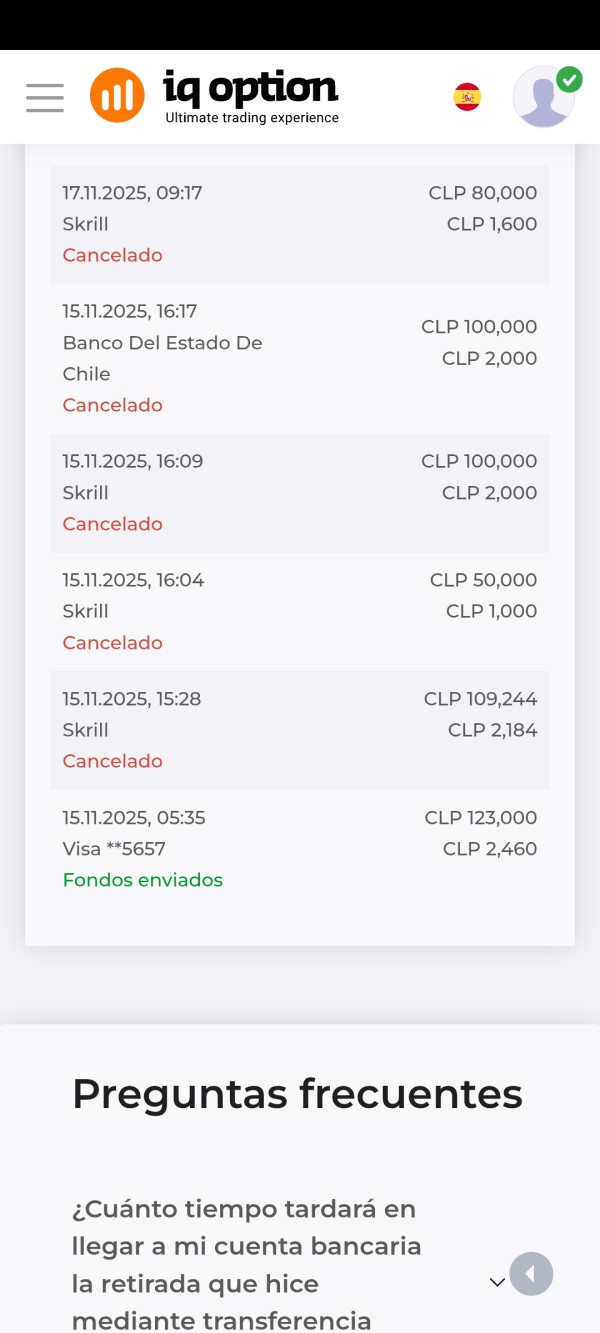

- Withdrawal and Verification Issues: This is the most common legitimate complaint. IQ Option has a very strict KYC/AML verification process. Users who sign up with inconsistent details or from unsupported regions often have their accounts blocked when they try to withdraw. While necessary for compliance (in their regulated entity), the process can be slow and frustrating, leading users to believe the broker is intentionally withholding funds.

- Unregulated Environment: For the millions of international clients, the lack of regulation is a real problem. If they have a legitimate dispute, there is no authority to turn to for help, which can leave them feeling powerless and scammed.

- Accusations of Price Manipulation: In the world of short-term options, a tiny price movement can determine a win or a loss. Many users have accused the platform of manipulating the price feed at the moment of expiry. While impossible to prove without a full audit, this is a common accusation against all binary options brokers.

7. Final Conclusion: Who Should (and Absolutely Should Not) Use IQ Option?

After a detailed analysis, our verdict is clear.

IQ Option is NOT a scam in the sense of being a fraudulent entity designed solely to steal deposits. Its CySEC-regulated operation proves it is a real company.

However, it operates in a high-risk, controversial segment of the market and uses an unregulated entity for the majority of its clients.

Who should AVOID IQ Option at all costs?

- Beginners: Despite its marketing, this platform is one of the most dangerous places for a new trader. The combination of a gamified interface and a high-risk product is a recipe for quick and total financial loss.

- Investors: IQ Option is not for investing. It is for short-term speculation. If you are looking to build long-term wealth, look elsewhere.

- Anyone Prioritizing Safety: If you are not in the EEA, you will be trading with an unregulated entity. If safety and regulatory protection are important to you, do not use IQ Option.

Who MIGHT consider IQ Option?

- Experienced Speculators: A very small niche of experienced traders who are already experts in binary options, fully understand the statistical disadvantages, and are willing to accept the immense risks of an unregulated environment might use the platform for its liquidity and excellent interface.

In conclusion, for the vast majority of people reading this review, the answer is simple: stay away. The risks associated with the product and the lack of regulatory protection for most clients far outweigh the benefits of a slick platform and a low entry deposit. There are hundreds of well-regulated, reputable brokers available that offer a much safer environment to trade the financial markets.