Regarding the legitimacy of iq option forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is iq option safe?

Pros

Cons

Is iq option markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

IQOption Europe Ltd

Effective Date:

2014-07-30Email Address of Licensed Institution:

compliance@iqoption.comSharing Status:

Website of Licensed Institution:

www.eu.iqoption.com, quadcodemarkets.comExpiration Time:

--Address of Licensed Institution:

82nd road, 4 Kato Polemidia, 4153, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 281 641Licensed Institution Certified Documents:

Is IQ Option A Scam?

Introduction

IQ Option is a well-known online trading platform that has gained significant popularity since its inception in 2013. Initially recognized for its binary options trading, the platform has since expanded to offer a variety of financial instruments, including Forex, CFDs, ETFs, and cryptocurrencies. With millions of registered users worldwide, IQ Option has positioned itself as a key player in the online trading market. However, the rise of online trading has also led to an increase in fraudulent schemes, making it imperative for traders to carefully evaluate the legitimacy of their chosen brokers. This article aims to provide a comprehensive analysis of IQ Option, exploring its regulatory status, company background, trading conditions, customer experience, and overall risk assessment to determine whether it is a trustworthy platform or a potential scam.

To gather information for this analysis, we conducted extensive research, drawing on credible sources, including regulatory bodies, user reviews, and expert opinions. Our evaluation framework focuses on key aspects such as regulatory compliance, company history, trading conditions, customer fund security, and user experiences.

Regulation and Legitimacy

The regulatory status of a trading platform is crucial in determining its legitimacy and trustworthiness. IQ Option operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC), which provides oversight to ensure that the broker adheres to established financial standards and practices. Regulatory compliance not only protects traders but also enhances the broker's credibility.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CySEC | 247/14 | European Economic Area | Active |

CySEC is considered a mid-tier regulator, which means it has certain standards for brokers operating within its jurisdiction. While IQ Option is regulated by CySEC, it is important to note that its international operations are managed by an entity registered in St. Vincent and the Grenadines, which is not regulated. This dual structure raises concerns about the level of protection offered to traders outside the European Economic Area (EEA).

Historically, IQ Option has faced regulatory scrutiny, with reports of fines imposed for non-compliance with certain regulations. However, the broker has made efforts to address these issues, and its current status indicates a commitment to maintaining regulatory compliance. Overall, the presence of regulation by CySEC lends credibility to IQ Option, but potential traders should be cautious, especially if they reside outside the EEA.

Company Background Investigation

Founded in 2013, IQ Option has rapidly grown to become one of the leading online trading platforms globally. The company is headquartered in St. Vincent and the Grenadines, with additional offices in Cyprus. The ownership structure of IQ Option is not publicly disclosed, which can be a red flag for potential investors seeking transparency.

The management team at IQ Option comprises experienced professionals with backgrounds in finance and technology. This expertise is reflected in the platform's user-friendly interface and innovative trading tools. However, the lack of detailed information about the company's leadership may raise concerns about transparency and accountability.

In terms of information disclosure, IQ Option provides a wealth of resources for traders, including educational materials, market analysis, and customer support. The availability of a demo account allows potential users to familiarize themselves with the platform before committing real funds, which is a positive aspect of the company's approach to user engagement.

Trading Conditions Analysis

An essential aspect of evaluating any trading platform is its trading conditions, including fees and spreads. IQ Option offers a competitive fee structure, with a low minimum deposit requirement of just $10, making it accessible to a wide range of traders. The platform does not charge commissions on trades, which can be attractive for frequent traders.

| Fee Type | IQ Option | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 - 1.5 pips | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.01% - 0.5% | 0.02% - 0.5% |

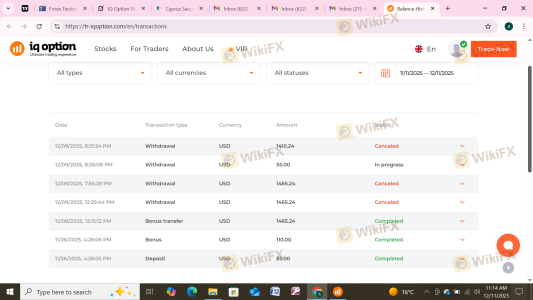

While IQ Option's spreads are generally competitive, some users have reported higher spreads during volatile market conditions. Additionally, the platform imposes a withdrawal fee of 2% after the first free withdrawal each month, which could be a concern for traders who frequently withdraw funds. An inactivity fee of €10 is charged after 90 days of account inactivity, which may deter some users from keeping their accounts open during periods of reduced trading activity.

Overall, while IQ Option's trading conditions are generally favorable, potential traders should be aware of the fee structure and consider how it may impact their trading strategy.

Customer Fund Security

The safety of customer funds is a critical consideration when evaluating any trading platform. IQ Option employs several measures to ensure the security of client funds. Client deposits are held in segregated accounts, separate from the company's operational funds, which helps protect traders in the event of financial difficulties faced by the broker.

Additionally, IQ Option offers negative balance protection, ensuring that traders cannot lose more than their invested capital. This is particularly important for leveraged trading, where the potential for losses can exceed the initial investment.

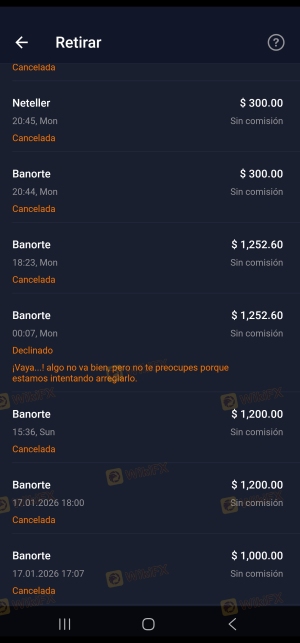

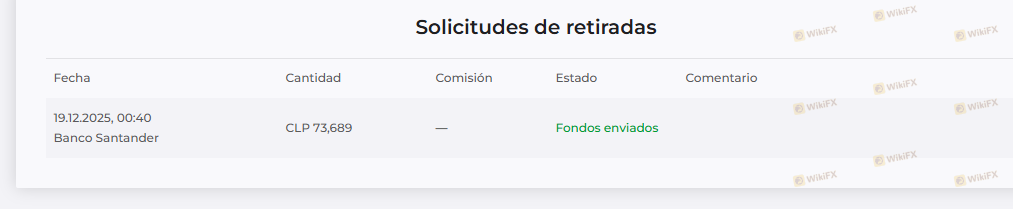

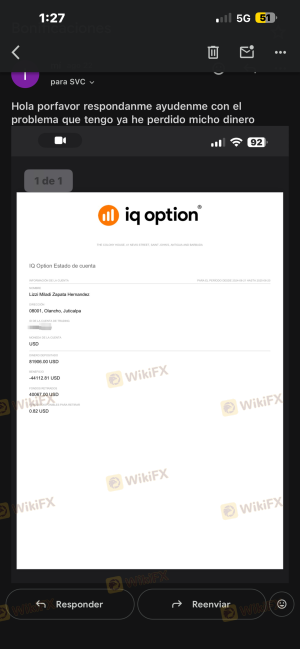

Despite these measures, there have been historical concerns regarding the security of funds at IQ Option. Some users have reported difficulties in withdrawing their funds, particularly after profitable trades. While these issues may not be widespread, they highlight the importance of being cautious when trading on any platform, especially for those new to online trading.

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. Overall, IQ Option has received mixed reviews from users. Many traders appreciate the platform's user-friendly interface, educational resources, and responsive customer support. However, common complaints include issues related to fund withdrawals and account verification processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Varies |

| Account Verification Issues | Medium | Generally Prompt |

| Platform Performance | Low | Addressed in Updates |

Typical case studies highlight instances where traders experienced delays in withdrawing funds after successful trades, leading to frustration and claims of poor service. While IQ Option has made efforts to improve its withdrawal process, the presence of these complaints raises concerns about the overall user experience.

Platform and Trade Execution

The performance of a trading platform significantly impacts the trading experience. IQ Option offers a proprietary trading platform that is generally well-regarded for its speed and functionality. The platform includes various tools for technical analysis, multiple chart types, and a customizable interface.

However, some users have reported issues with order execution quality, particularly during periods of high market volatility. Instances of slippage and rejected orders have been noted, which can be detrimental to traders looking to execute timely trades. The overall stability of the platform is generally considered good, but potential users should be aware of these concerns.

Risk Assessment

Trading with IQ Option carries inherent risks, as with any trading platform. The use of leverage can amplify both potential gains and losses, making it essential for traders to implement effective risk management strategies.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited regulation for international clients. |

| Fund Security Risk | Medium | Historical issues with withdrawals. |

| Market Risk | High | Trading involves significant market volatility. |

To mitigate these risks, traders should consider using the demo account to practice their strategies before trading with real money. Additionally, setting strict limits on leverage and utilizing stop-loss orders can help manage potential losses.

Conclusion and Recommendations

In conclusion, IQ Option is a legitimate trading platform that has garnered a substantial user base since its inception. While it is regulated by CySEC, potential traders should be cautious, particularly those outside the EEA, due to the lack of regulation for its international operations. The platform offers competitive trading conditions, but users should remain vigilant regarding withdrawal processes and account verification requirements.

For traders seeking a reliable broker, IQ Option presents a viable option, especially for those interested in trading derivatives. However, it may not be suitable for all, particularly those looking for direct asset ownership or a wider variety of trading instruments.

For those who may have reservations about IQ Option, alternative brokers such as eToro, XTB, or Plus500 offer robust regulatory frameworks and a broader range of assets for trading. As always, it is crucial for traders to conduct thorough research and consider their individual trading needs before choosing a broker.

Is iq option a scam, or is it legit?

The latest exposure and evaluation content of iq option brokers.

iq option Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

iq option latest industry rating score is 5.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.