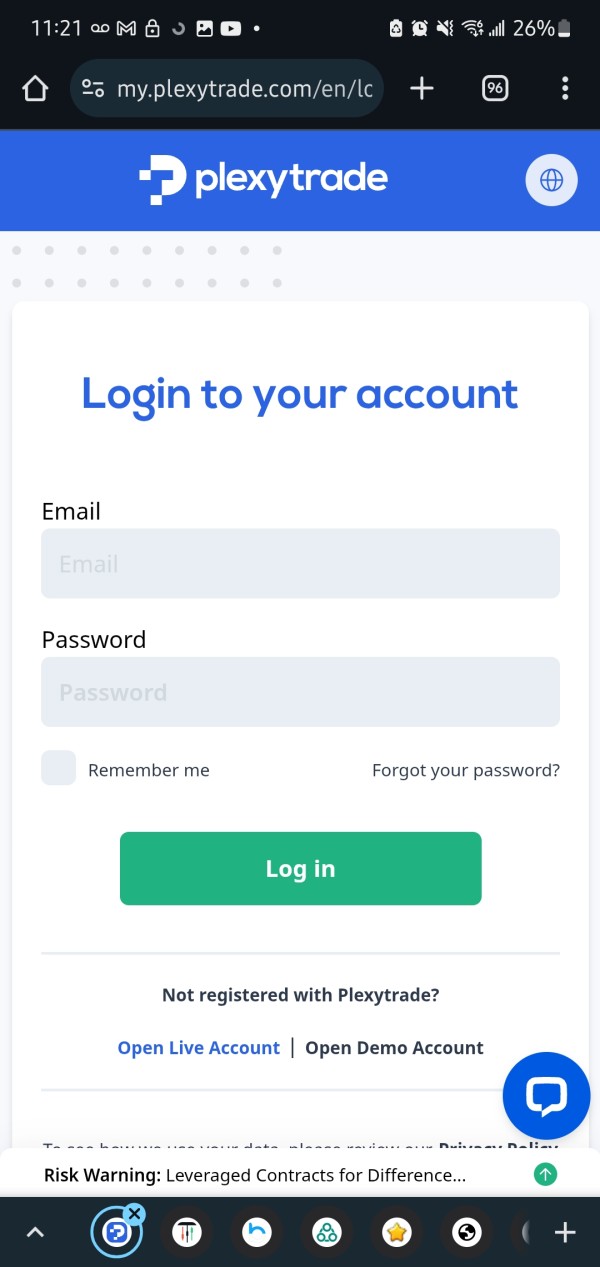

Plexytrade is a relatively new broker, founded in 2024 following a merger with the established firm LQDFX. Headquartered in Saint Lucia, the broker markets itself as a platform designed for high-leverage trading and boasts a user-friendly interface tailored for both retail and more active traders. However, Plexytrade's claim to operational integrity faces scrutiny due to its lack of regulatory oversight, making comprehensive user research essential for prospective clients.

Plexytrade specializes in trading contracts for difference (CFDs), providing access to over 100 financial instruments including more than 40 forex pairs, indices, commodities, and select cryptocurrencies. The broker's trading environment is characterized by low costs, with leveraged trading options that appeal to high-frequency traders. Despite these features, it is imperative to note their claims of segregated accounts and negative balance protection do not equate to regulatory safeguards.

Plexytrade's lack of regulation raises fundamental questions about its reliability. Operating out of Saint Lucia, where foreign exchange is not closely overseen, Plexytrade's claims of fund security through segregated accounts do little to instill confidence. The following steps can help users verify the safety of their investments:

- Check if Plexytrade is regulated by visiting NFA and FCA or other relevant financial control agencies.

- Search for user feedback across review websites, focusing on those that provide detailed trading experiences and insights.

- Assess Plexytrades adherence to recommended trading practices and its reputation among investors for fund safety.

Overall, while Plexytrade presents a platform with attractive offerings, the overwhelming consensus is that its unregulated status poses significant risks that potential traders should not overlook.

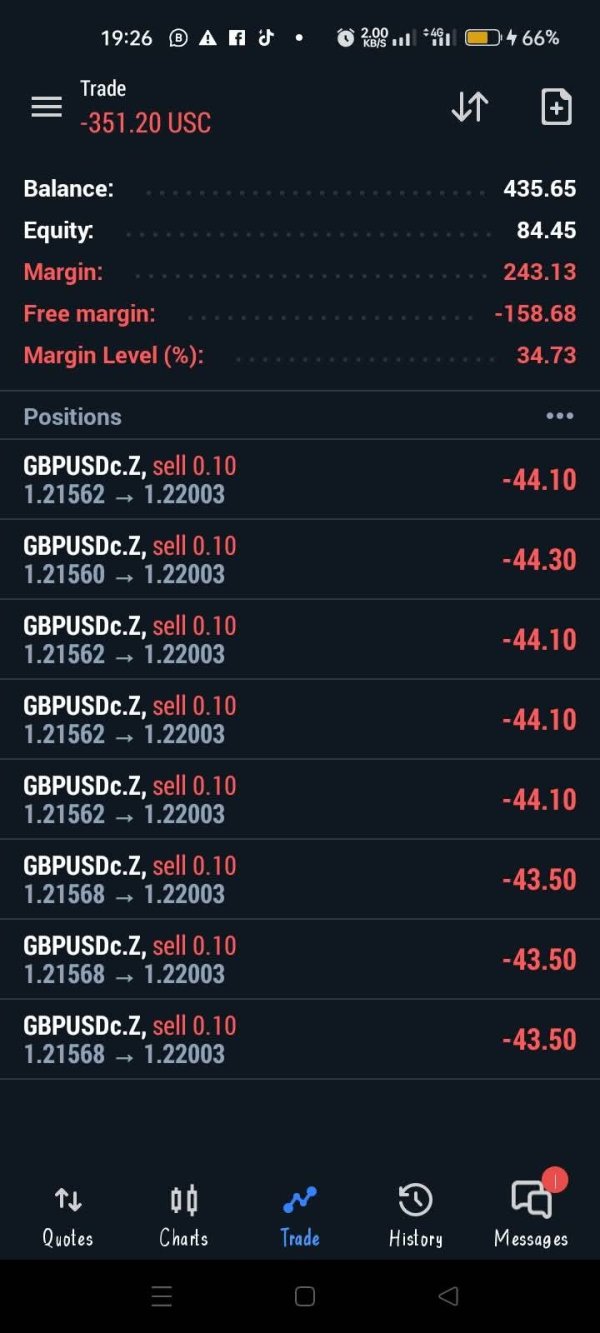

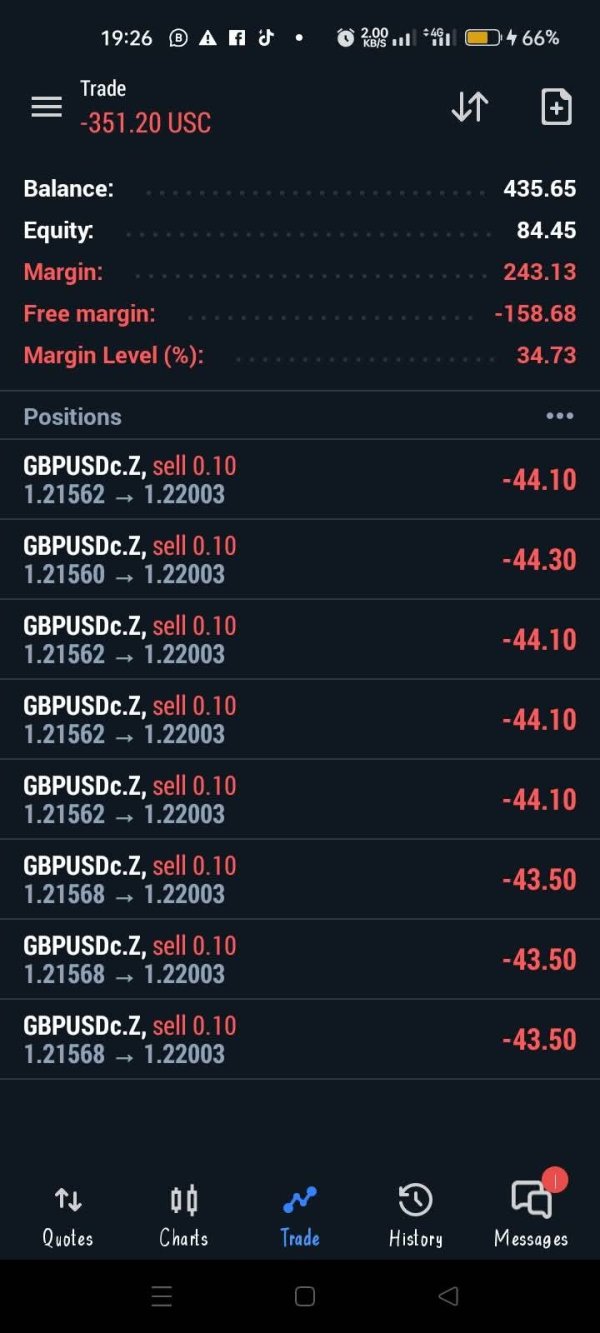

Trading Costs Analysis

Plexytrade offers a competitive trading environment that promotes low-cost trading strategies. The broker provides variable spreads, starting from 0.7 pips on major forex pairs; however, it's crucial to decipher the complete cost structure, including non-trading fees.

Advantages in Commissions: Plexytrade is noted for its low commissions, with specifics detailing that the minimum spread on the EUR/USD pair is 0.7 pips.

The "Traps" of Non-Trading Fees: Some users have raised concerns regarding withdrawal fees and processing difficulties. As one user noted:

"There are withdrawal fees and complications with accessing funds after requesting them."

- Cost Structure Summary: While the low trading costs may be appealing to experienced traders, the potential for hidden fees, especially related to withdrawals, necessitates a careful review of all conditions before engaging with the platform.

Plexytrade implements established trading platforms—the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5)—to facilitate user trading experiences.

Platform Diversity: The broker does not offer proprietary software but supports well-recognized platforms known for their usability and reliability among traders.

Quality of Tools and Resources: The availability of advanced tools, while beneficial, will require more in-depth educational resources, which are currently lacking.

Platform Experience Summary: User experiences vary widely, with some noting:

“The interface is clean and simple, but support was slow in resolving my issues.”

This statement highlights a key deficiency in user experience due to customer service challenges.

User Experience Analysis

User experiences with Plexytrade's platform have yielded mixed results. Positive feedback typically centers on the easy navigation of the trading platform and competitive pricing. However, there is considerable criticism regarding the responsiveness of customer support and withdrawal processes.

- Feedback from Users: Many users have echoed sentiments regarding the trading experience.

"Great platform but customer support needs improvement."

Despite an overall satisfactory trading interface, this inconsistency in customer service presents a barrier for full user confidence.

Customer Support Analysis

Customer support appears to be a significant area for improvement at Plexytrade. Assistance is available 24/5 via email, yet response times can be slow, reflecting users' frustrations.

Support System Evaluation: Clients have expressed difficulty receiving timely responses during operational issues, with support often taking up to two days for email queries.

Challenges in User Resolution: The inability of user support to handle onboarding problems promptly remains a concern. One user stated:

"I had email authentication issues, and resolution took too long."

That being said, efficient customer service is critical for retaining trader confidence.

Account Conditions Analysis

Plexytrade's account offerings cater to a diverse range of trading preferences:

Account Types Available: The broker provides four account types, optimizing the experience for both low-budget and high-investment traders with leverage options significantly impacting trading dynamics.

Account Accessibility: The low minimum deposit of $50 for the micro account stands out, offering traders the chance to start without substantial financial commitment.

Potential Drawbacks: However, the lack of regulatory backing does complicate the scenario at Plexytrade, marking it a potential risk zone for many investors.

Quality Control

Strategy for Handling Information Conflicts: Discrepancies regarding Plexytrades operational standards and user experiences should be clearly outlined. Users are urged to verify all information through reliable financial scopes, hence balancing worrisome user complaints with appreciating some positive feedback on trading performance.

Potential Information Gaps:

- Specific details regarding withdrawal processing times.

- Comprehensive listing of available cryptocurrencies for deposits.

- User testimonials focusing on different customer support experiences.

In conclusion, while Plexytrade presents numerous appealing trading conditions centered around high leverage and diverse instruments, its unregulated status alongside significant user complaints should lead prospective traders to tread carefully, ensuring thorough research and verification of claims before investing.