trading.com Review 7

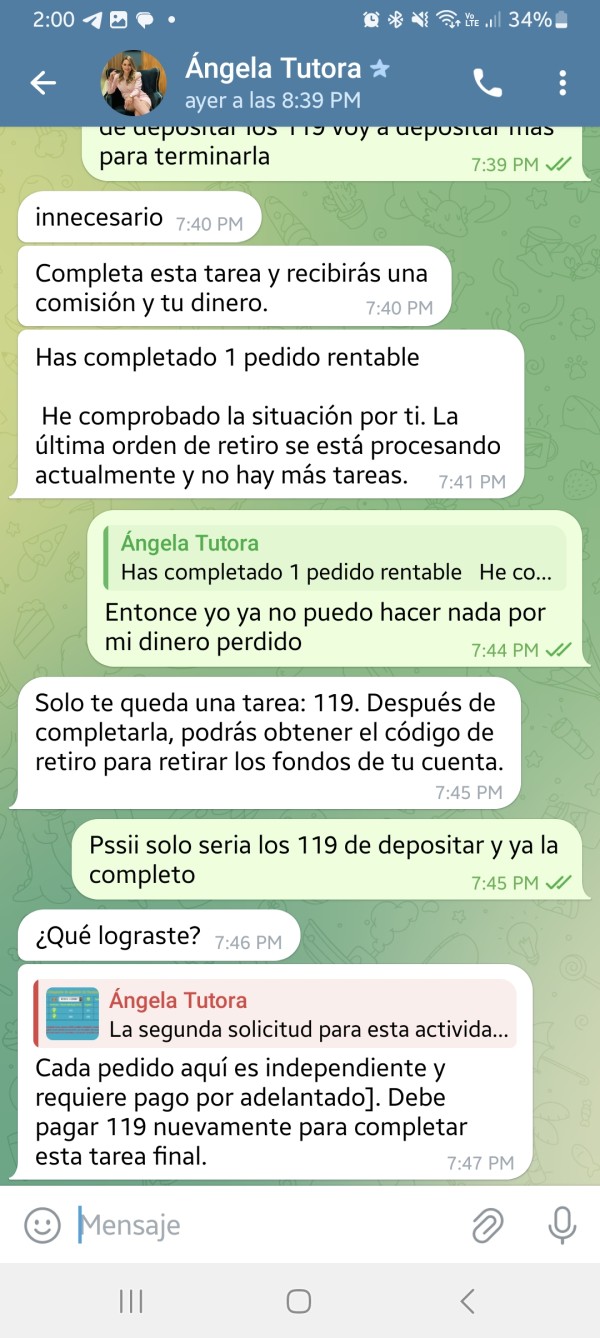

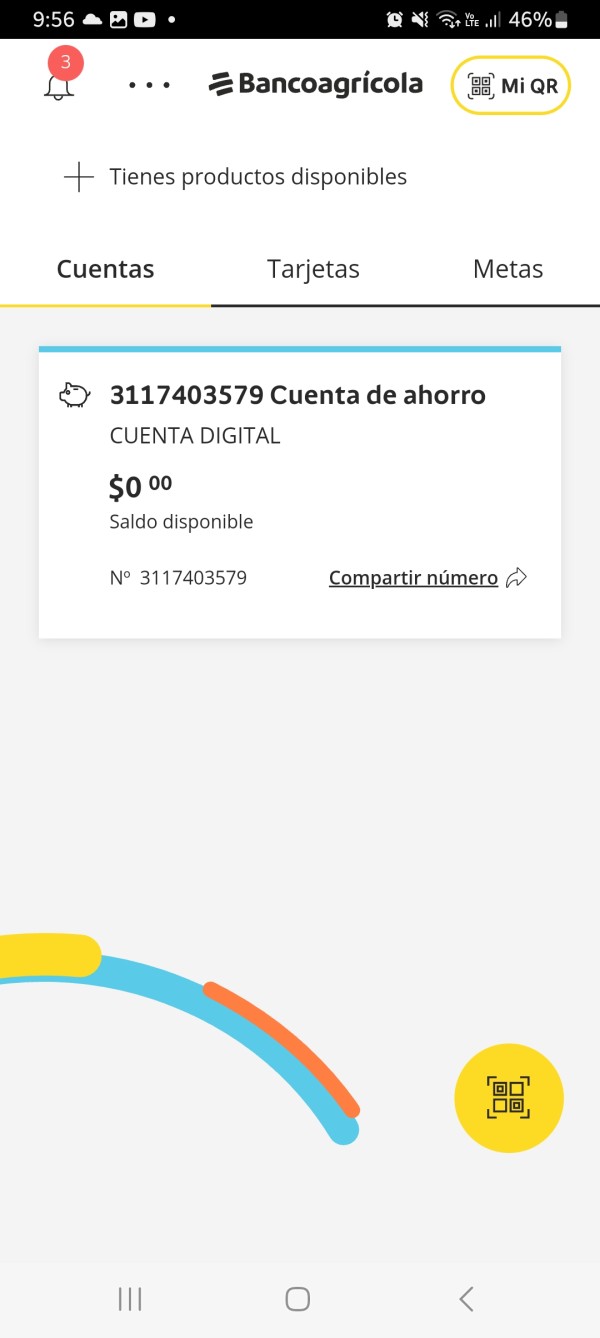

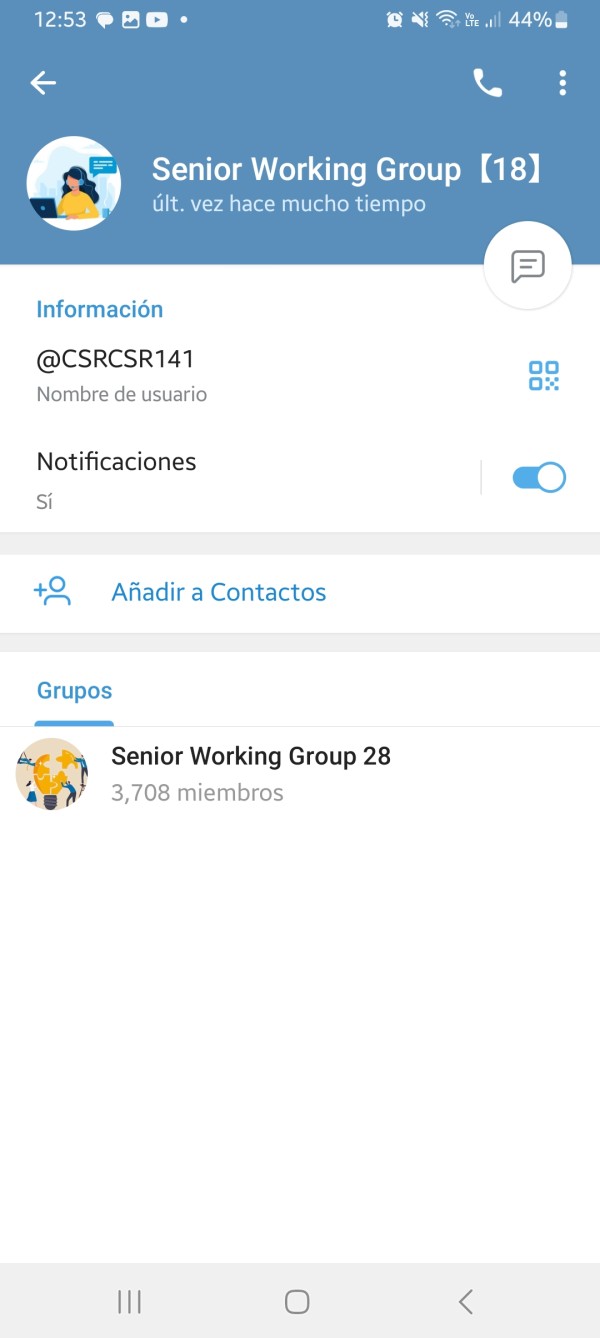

I received a call but didn't answer. Then I received a message saying that they are Tommie Mccray, the director of Indeed, but that company doesn't even exist. They told me to install Telegram to contact @DecimaBadrinath. She said she would send tasks to rate restaurants, etc. I did them and then moved on to other tasks where she told me to contact @AngelaTutora. She asked me to deposit $17, so I did. The task was to visit a website that is like a wallet to buy coins, but it doesn't even exist. It only showed coinbytex.op. I received the payment and then she asked me to send $45. I only had $44, so she said she would authorize me to deposit that amount. I did it, but she didn't send anything. Then she sent me another task to deposit $119. I told her I didn't have money in my account, but she told me to get it as soon as possible to receive the payment. However, I didn't. I told her I want a refund, but she said they won't make any refunds. THEY ARE SCAMMERS and I fell for it. 😔 I need help to recover my $44 USD. Their Telegram group is called Senior working Group 28, that's how it appears.

The withdrawal website cannot be accessed and it has no Chinese character version, and there is no staff to deal with the problem.

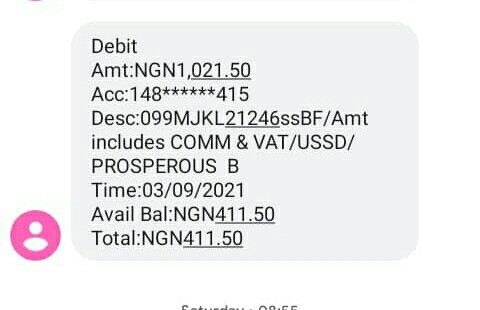

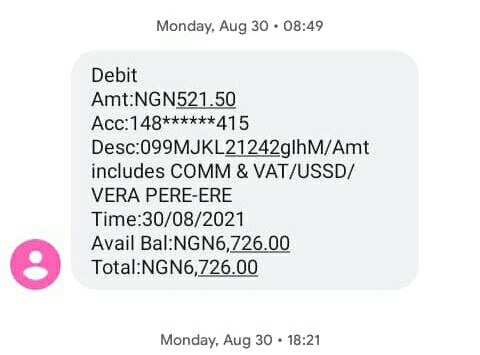

actually someone introduced me to this very site, he told me everything about it, but what shocked me was when he said I can invest as low as 1,000 to trade with and still be earning high profit, it was seducing, I didn't hesitate to join, I deposit and started trading, he was guiding me through it then wen it was time for me to withdraw, I was asked to pay a little more amount to enable me withdraw, which. I did, but after I did that I was still asked to pay again, then I realise it was a scam

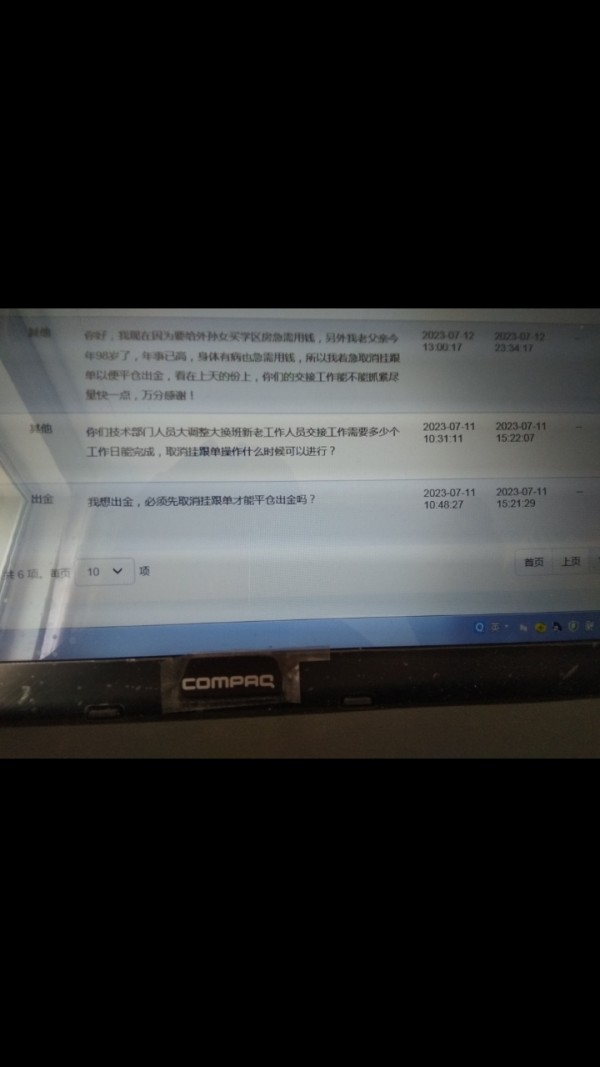

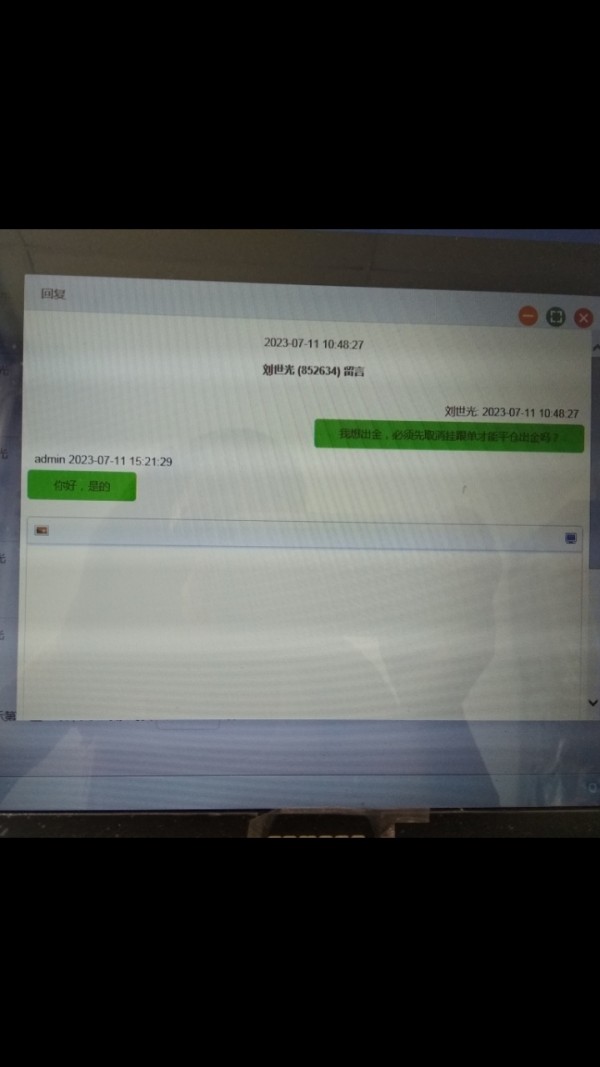

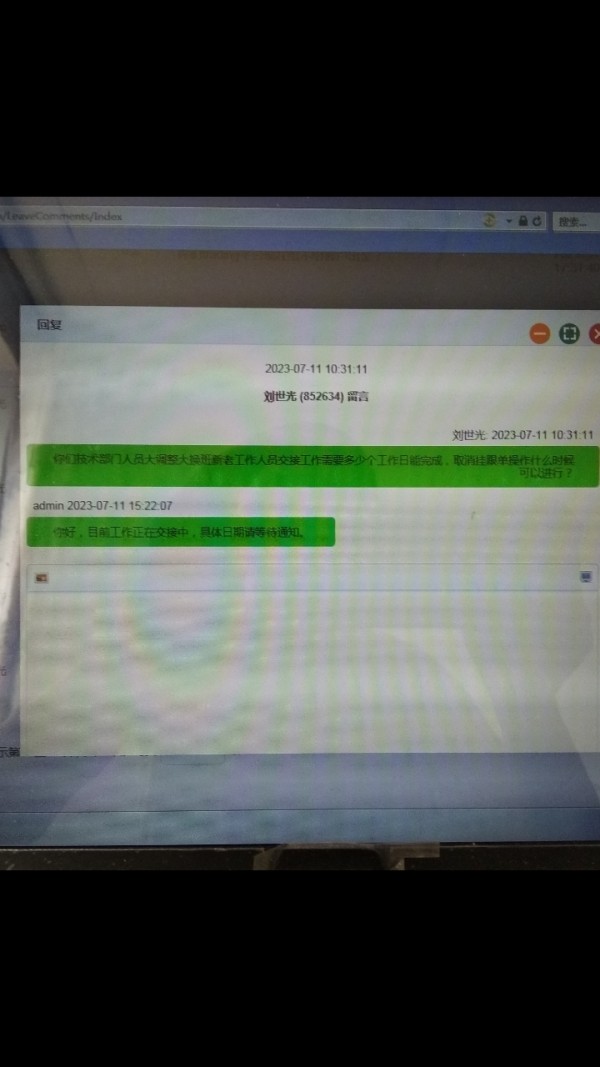

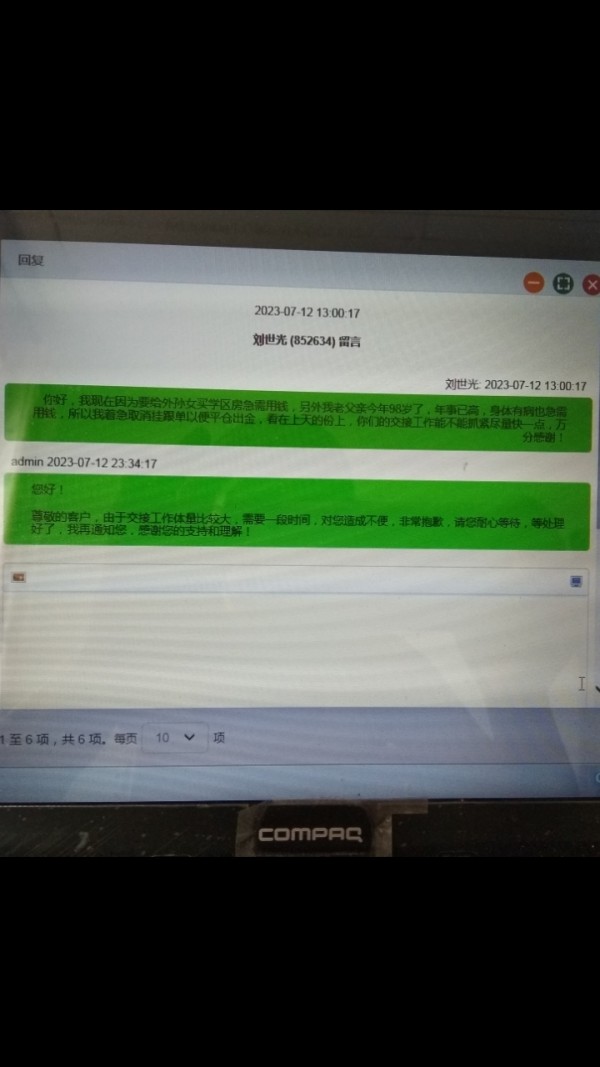

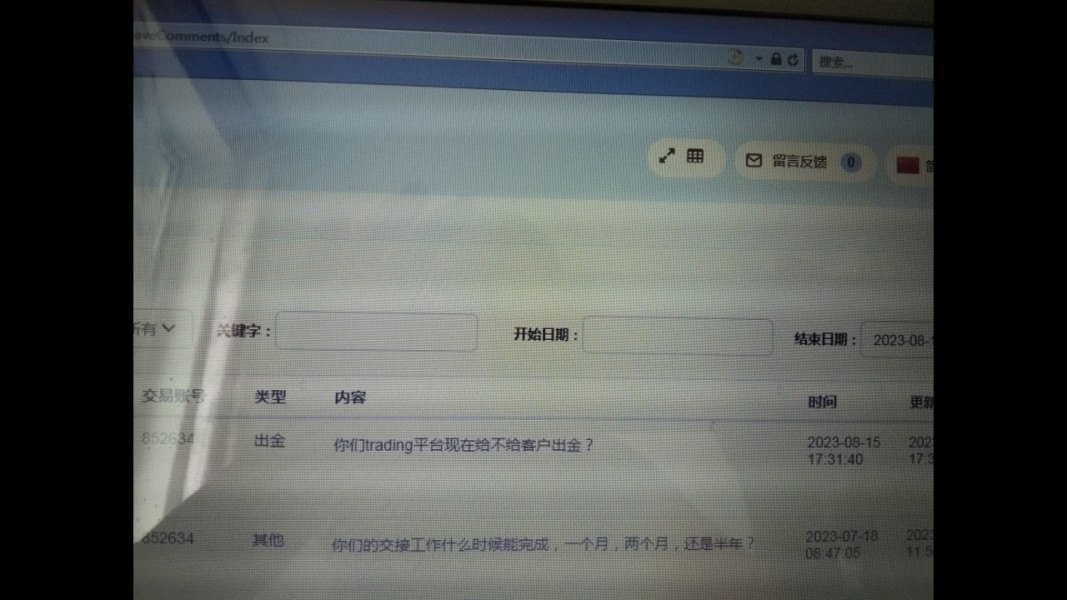

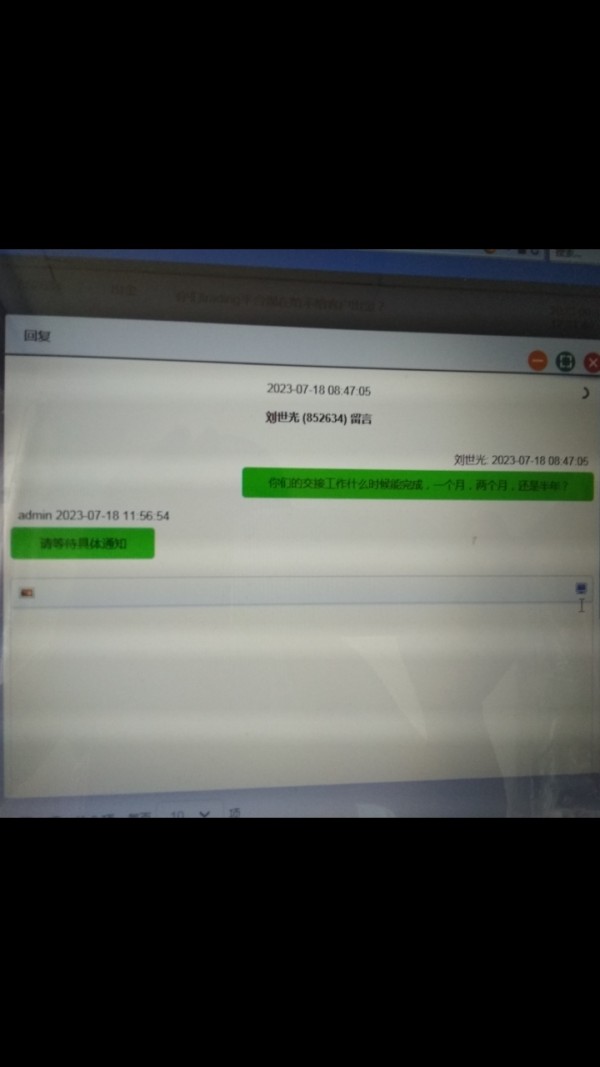

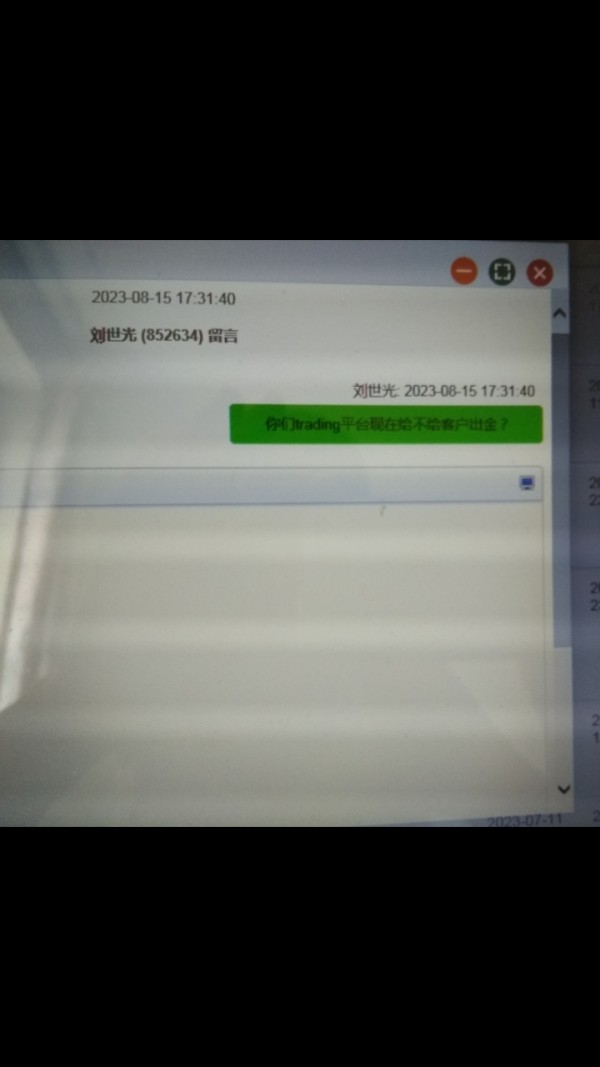

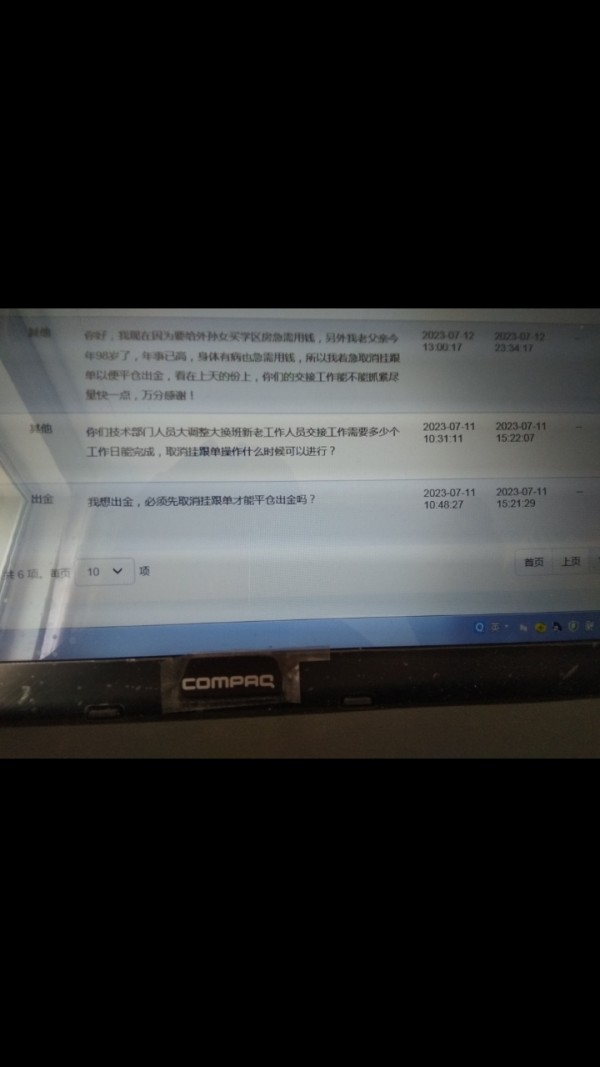

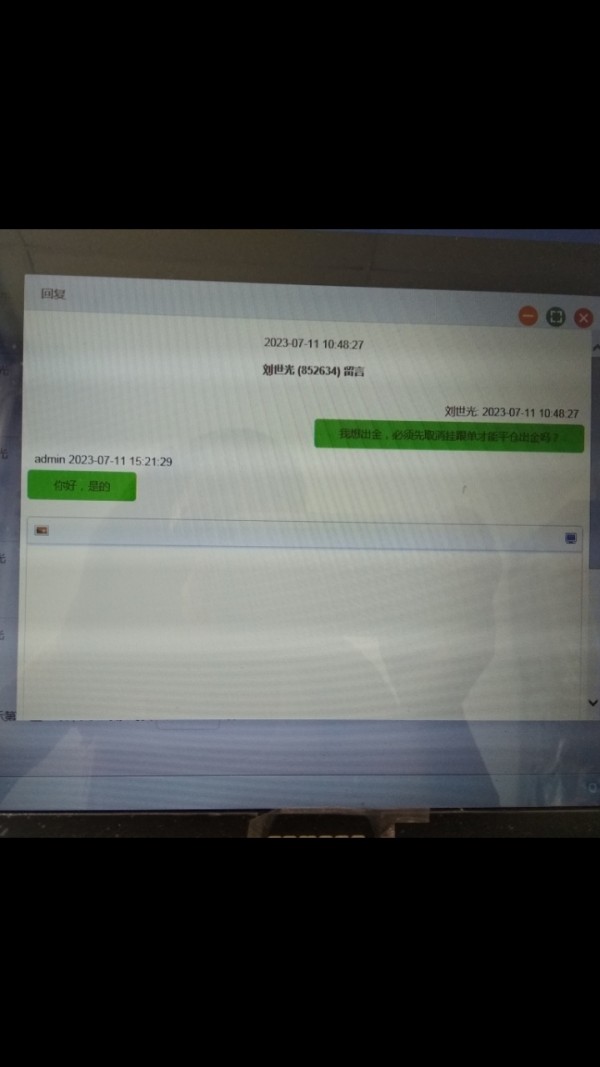

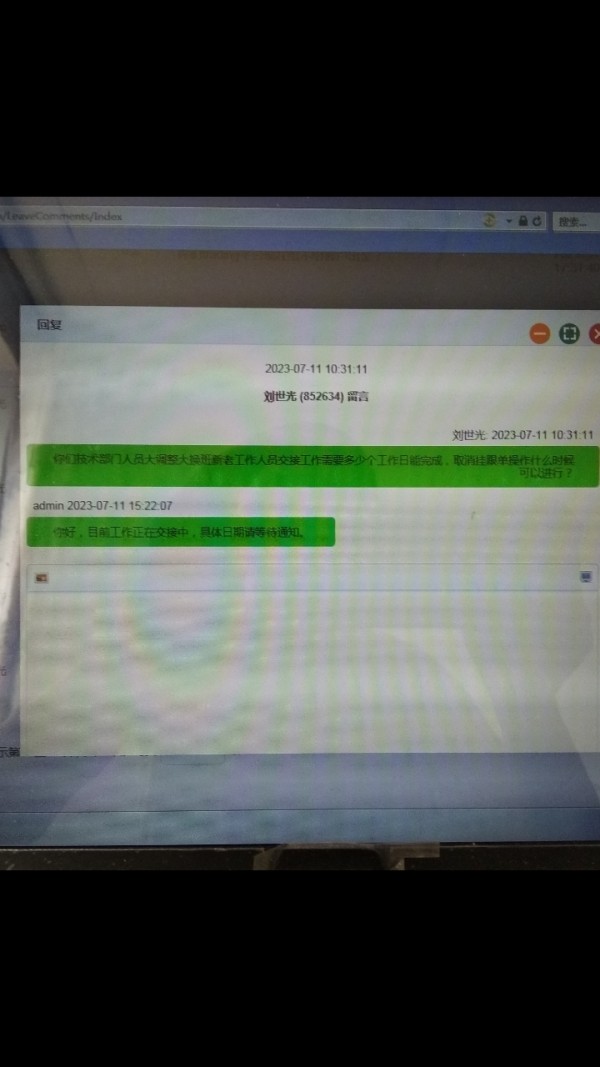

Withdrawals and deposits are still available on June 15 this year. However, since July 9th, the withdrawal cannot be done normally. The excuse given is that the technical staff of the company’s technical department has undergone major adjustments, and a large amount of handover work is required, and the normal withdrawal of funds can only be performed after the handover work is completed. I asked them how long it would take for the handover to be completed, and they only replied that please wait for the notification. It has been delayed until today, forty days. Ask them one last time if they can withdraw money to clients now. They have not replied until now. I strongly urge the platform to end the personnel adjustment work immediately, resume the normal operation of the platform and deposit and withdrawal work, and give our customers a fair answer! ! !

I will relate the facts of the cyber scam that i was subjected to. On April 12 of this year, I saw an ad on facebook for a program called Shark Tank Mexico where two young entrepreneurs appeared showing a technological application that, through an algorithm, carried out operations to buy and sell assets (in this case cryptocurrencies). So it seemed like a good idea to invest part of my savings. Entering the page and filling out the form with my data. After a while, "My name is Erika (# 744 362 0795) with a colombian accent. She said she represented the sales company Trading club and she told me that to access to her platform and be able to invest. He required a deposit of 250 usd. He sent a link to my email where the payment request for the company "sayan limited" and a tada payments logo appeared in the amount of $4749.29 (or the equivalent of 250 USD). I paid and from that moment I was "registered" in the platform Trading club. I was assigned an advisor: alejandro.sanchez@ Trading -club.com. This gentleman with a spanish accent was calling from spain (+34 930 46 46 75) and asked me to download an app called AnyDesk on my mobile device so that he could access to my technological application. He showed me how to make my supposed first asset purchase (ADAUST and COSMO) from the platform. As the days passed, this adviser first undertook with a cordial attitude to invest more capital (10,000 usd), to buy the cryptocurrencies that were booming such as bitcoin and etherum. On April 19, he sent me a list of 10 different leagues or receipts via WhatsApp so that I could deposit in mexican pesos the amount corresponding to 1,000 USD for each deposit. These were intended to be paid at HSBC as payment for services to a mexican company named SAFTPAY MEXICO (also called SafetyPay). In total, 10 deposits were made for the total amount of $181,078.00 national currency (or the equivalent of 10,000USD). I saw that these deposits were reflected in the technological application of Trading-club.com on my mobile device which made me think that the investment was made, the company even gave me a bonus of 3,500 USD for this investment. From here I asked this adviser Alejandro Sánchez to be able to withdraw my earnings and he always gave me a long time. On April 20, he told me that he had the portfolio of a great investor and that there was an opportunity for me to grow my capital. according to him, i was going to triple my investment but i had to deposit 6,000 more USD. With great insistence, and above all with deceit and lies he convinced me. In the same way as the previous deposits, on April 20, I made 6 deposits of 1,000 USD each in the HSBC bank for the company SaftPay México, the amount of $18,116.00 for each of the 6 deposits, giving a total of $108,696.00 mn. Ireceived the 6 tickets (attached) from HSBC bank with seal and signature. With these more than 16,000 USD, cryptocurrencies such as: Bitcoin, Litecoin, Etherum, etc. were purchased. I checked in my technological application about these deposits and the amount of 19,751 USD appeared in my name. I told him again that I had already deposited all my savings and that I needed to withdraw as soon as possible, but this spanish scoundrel, having control of my account, no longer allowed me to withdraw. Then on friday, april 21, another alleged risk area advisor of this company was communicated Trading -club.com or sayan limited to tell me that my investment had very strong losses due to the fall of Bitcoin and Etherum and that I had to deposit at least 7,500 USD otherwise I would lose all my investment. I argued that I had no more to deposit and he commented that the company was going to lend me that amount but I had to deposit it in the following monday. I did not agree but this gentleman hung up on me. I wanted to communicate with my supposed adviser but he never answered. On monday, April 24, this spaniard, like a real extortionist, forced me to have to pay that loan to Trading club otherwise they would keep all my investment. I had the need to request savings from my family to carry out and pay that supposed loan of 7,500 USD. This time, 8 more deposits were made for the total amount of $134,709.50 mn, they were made in the same way as the previous ones, for the company SaftPay Mexico or SafetyPay. Resulting in 7 deposits that correspond to 1,000 USD in Mexican pesos and another deposit of 500 usd. After making these deposits, I observed in the technological application that it was available to withdraw (12,000 USD) but i could not do it because i had not sent to the company Trading -club.con or Sayan Ltd an identification, proof of address, and the debit card where they were going to deposit me, the advisor ended up informing me. They were also going to mail me a deposit statement with my deposits that added up to 24 and I had to sign, scan and return it. I did so and even with that I was not allowed to withdraw my investment. In total, the sum that I deposited in this fraudulent company was 23,750 USD or the equivalent in Mexican pesos $429,232.79. from here the technological application installed on my mobile device of this fraudulent company called Trading -club.com indicated that it had an accumulated investment of 27,251 USD but the losses never abated despite the fact that Bitcoin was supposedly recovering. This caused this person to keep bothering me to ask me to deposit more money for the supposed losses, which I refused to do. and from here this scam company named Sayan Limited or also called Trading -club.com has its address at beachmont busines centre, suite 344 kingtown, st vincent and the grenadines with telephone number +44 7984 751777. Sayan Ltd, reg. no, 11263 marshall islands. Email: support@ Trading -club.com. I ask you to help me to get my savings back from this scam company.

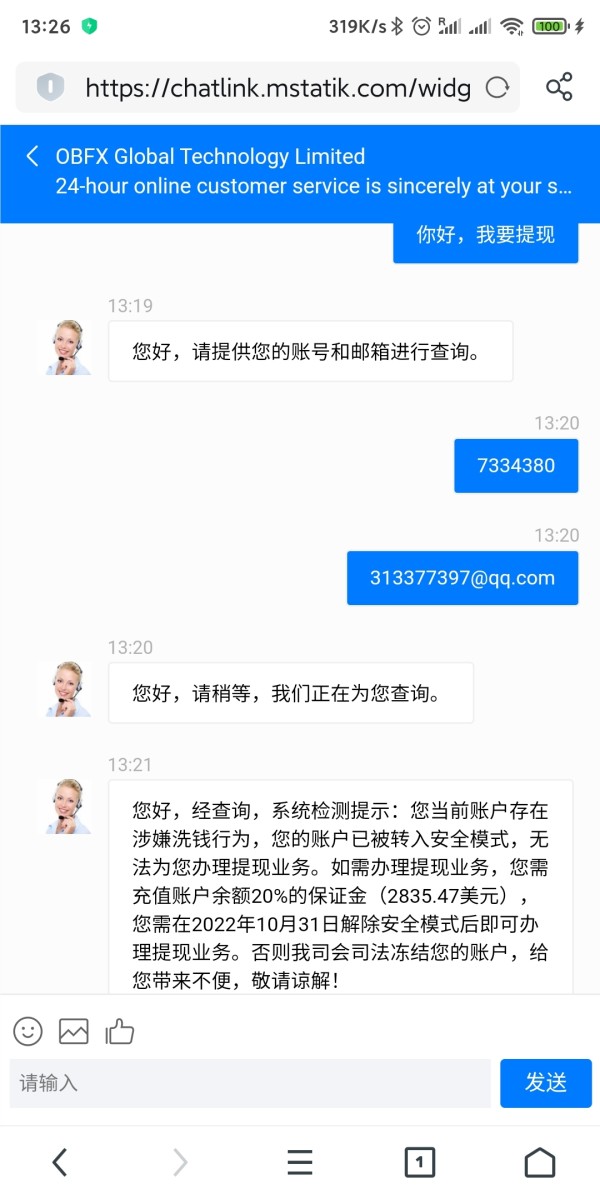

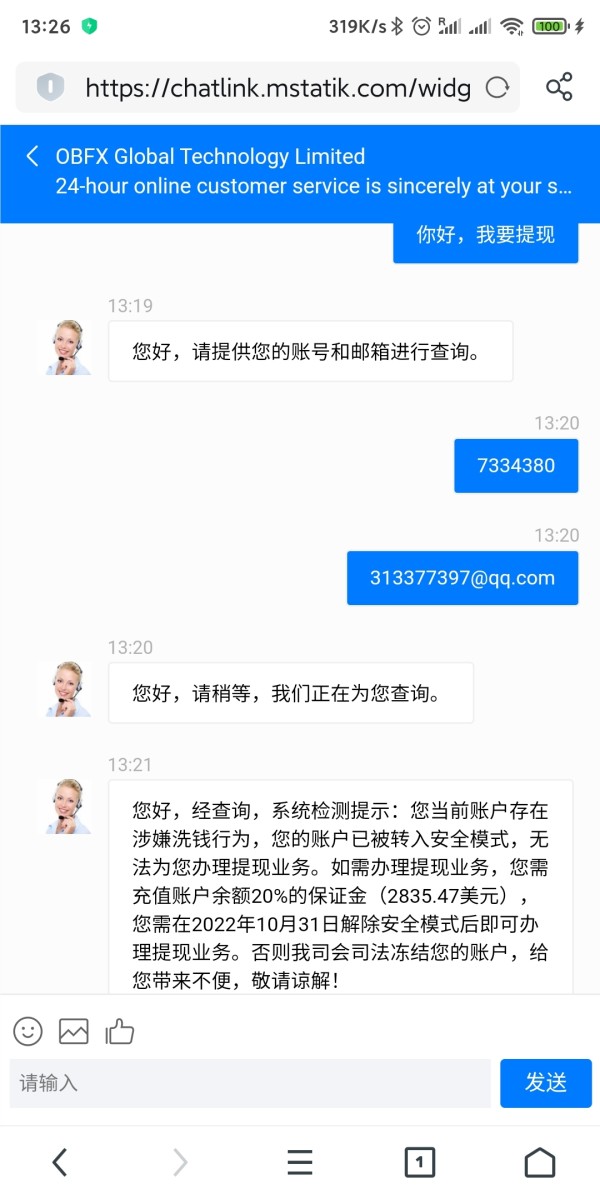

Refused to withdraw funds for various reasons. The first time, I had to pay tax. After paying the tax, they said that the withdrawal address provided was risky. It was frozen for one month and automatically unfrozen. After one month, I had to withdraw cash. , anyway, there are various reasons for you to pay, liar liar liar liar

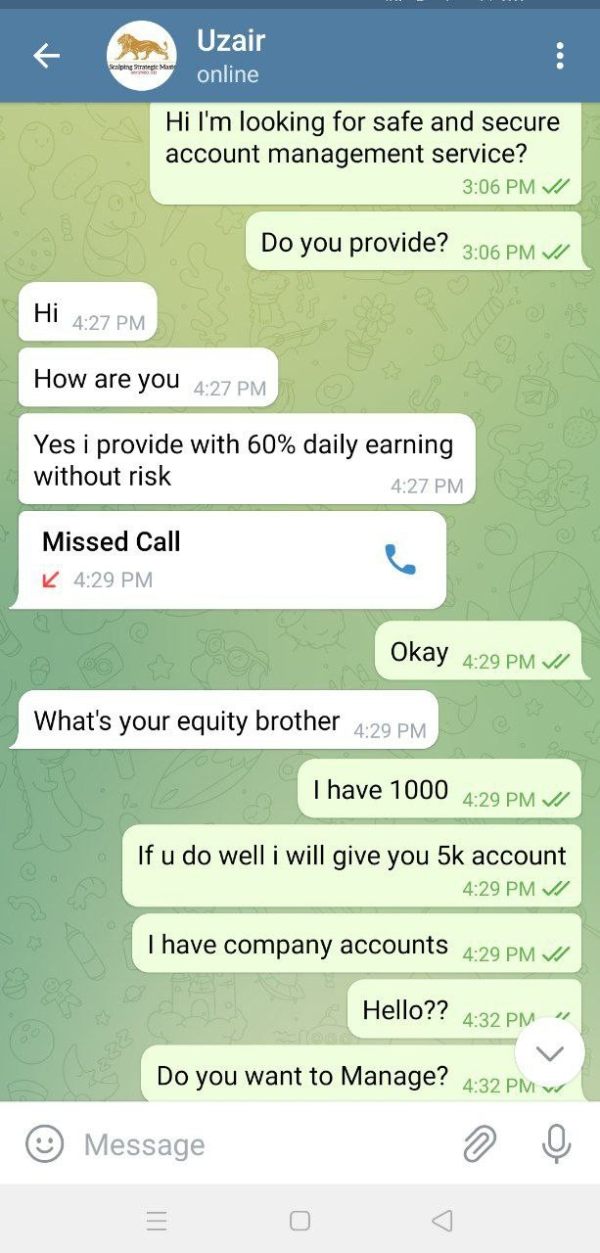

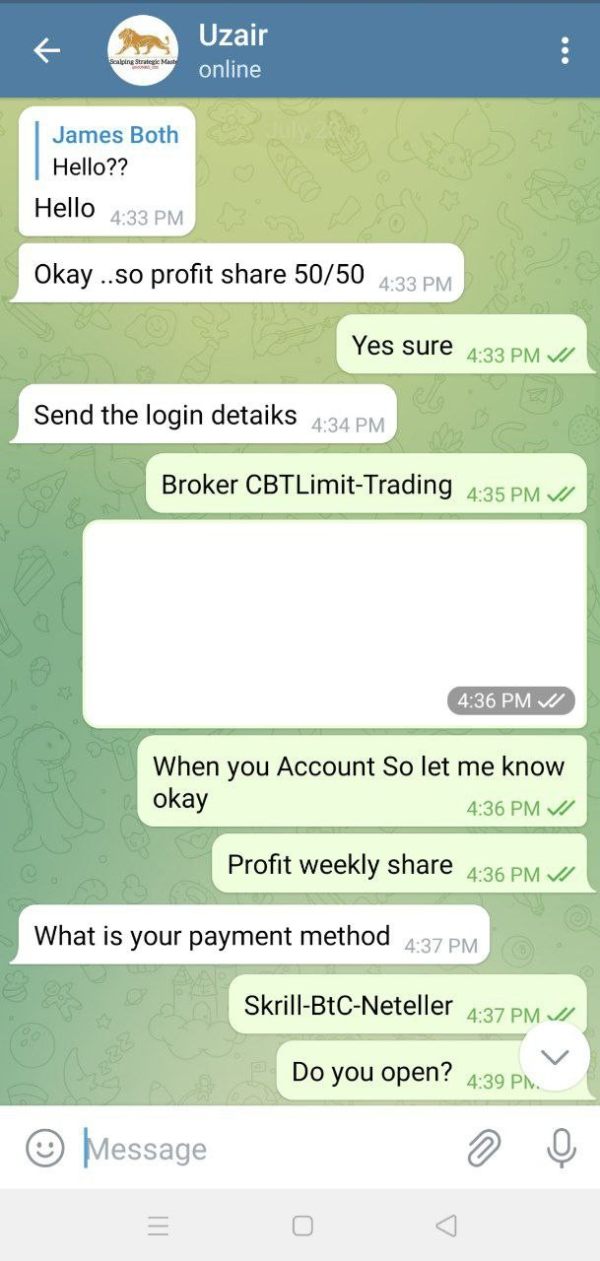

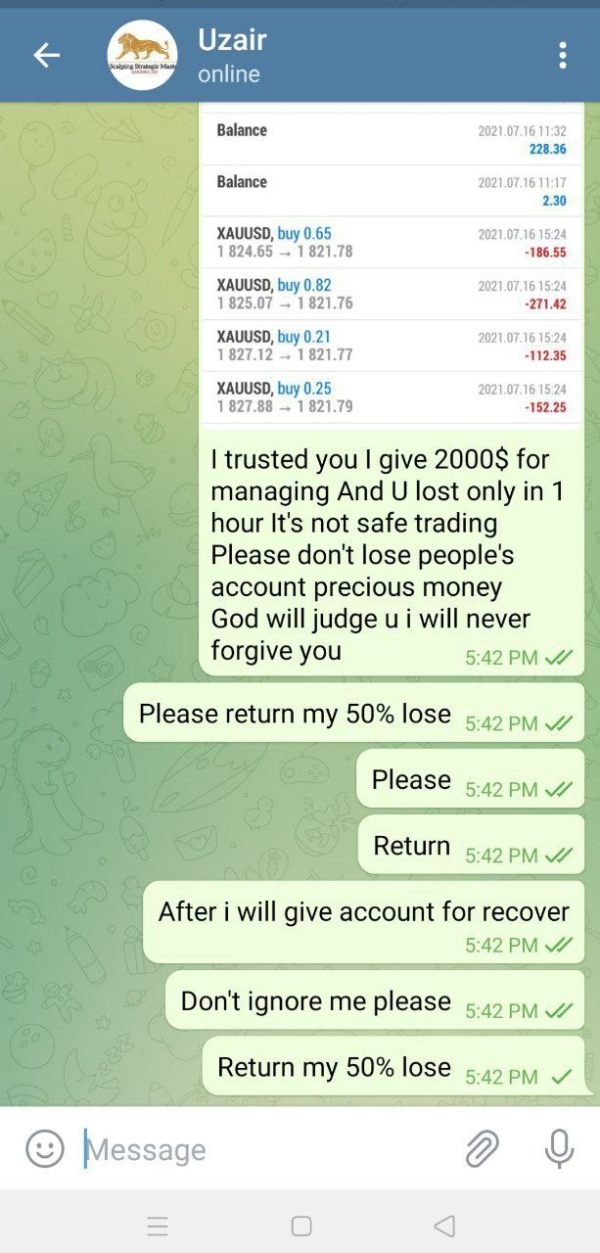

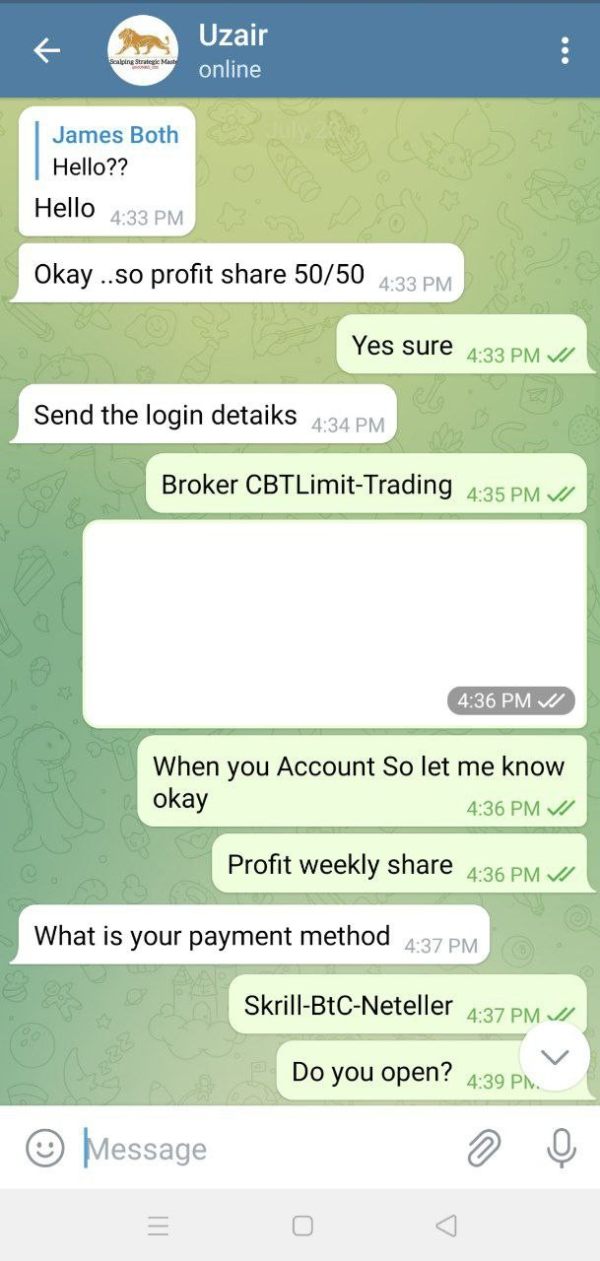

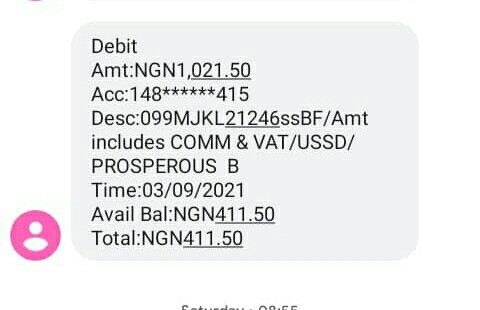

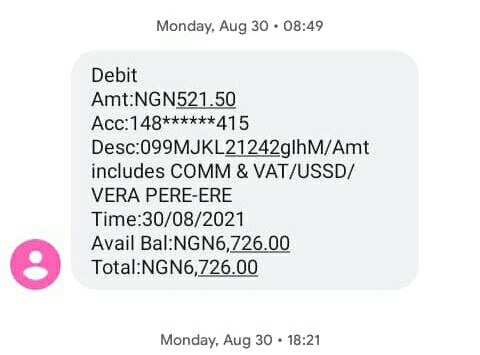

I contacted this guy who provides account management service. I found his service inside broker's telegram channel. So i decided to approach him. He told me he can give me a return of 60% daily. Originally i deposit 1k USD, but then i added more money because he guarantees 60% return daily. Only in 1 hour, 50% of my fund was gone! Ridiculous strategy and bad money management! I think he purposely lose the money so the broker can earn! He wont return or even answer my calls!