Plus500 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Plus500 review looks at one of the market's most user-friendly CFD trading platforms. It works especially well for beginners who want cost-effective trading solutions. Plus500 has become a reliable choice for retail traders, offering competitive spreads and low commission structures across commonly traded markets. The platform's clear fee structure and simple approach make it easy for newcomers to use, while its FCA regulation provides important credibility.

However, traders who want advanced analytical tools or access to emerging markets may find Plus500's offerings too limited. The platform focuses on basic trading functions rather than advanced features, which fits its target audience of cost-conscious beginners. According to ForexBrokers.com, Plus500 has a solid reputation for reliability and transparency, though it lacks the comprehensive research tools found on more advanced platforms.

The broker's strength lies in its simplicity and cost-effectiveness. This makes it particularly attractive to retail futures traders who value straightforward access to major markets without complex fee structures or overwhelming interface designs.

Important Notice

Regional Service Variations: Plus500 does not provide CFD services to residents of the United States, as confirmed by their official website statement. This review focuses on services available to international clients outside restricted jurisdictions.

Review Methodology: This evaluation is based on publicly available information from official sources, independent broker review platforms, and documented user feedback from established financial websites. All data has been cross-referenced for accuracy and reflects information available as of 2025.

Rating Framework

Broker Overview

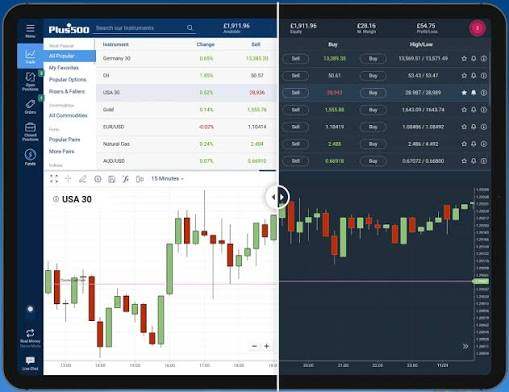

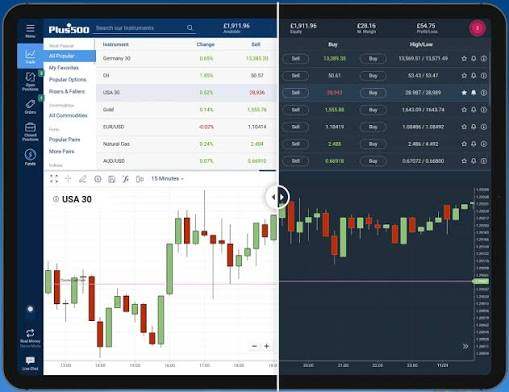

Plus500 operates as a specialized online trading platform focusing primarily on Contracts for Difference (CFDs) across multiple asset classes. The company has built its reputation on providing accessible trading solutions for retail investors, particularly those new to financial markets. According to BrokerNotes, Plus500's business model centers on offering straightforward access to popular trading instruments without the complexity often associated with traditional brokers.

The platform's approach emphasizes simplicity and cost-effectiveness. This makes it a popular choice among traders who prioritize low fees over advanced analytical capabilities. Plus500's proprietary trading platform serves as the primary interface for all trading activities, providing essential functionality without overwhelming users with excessive features.

Plus500 offers trading across multiple asset categories including forex pairs, commodities, stock indices, and individual stock CFDs. The broker operates under FCA (Financial Conduct Authority) regulation, providing clients with regulatory protection and operational transparency. This regulatory framework ensures adherence to strict financial standards and client fund protection protocols, as noted in multiple independent reviews.

Regulatory Status: Plus500 operates under FCA regulation in the United Kingdom, providing comprehensive oversight and client protection measures. This regulatory framework ensures compliance with stringent financial standards and operational transparency requirements.

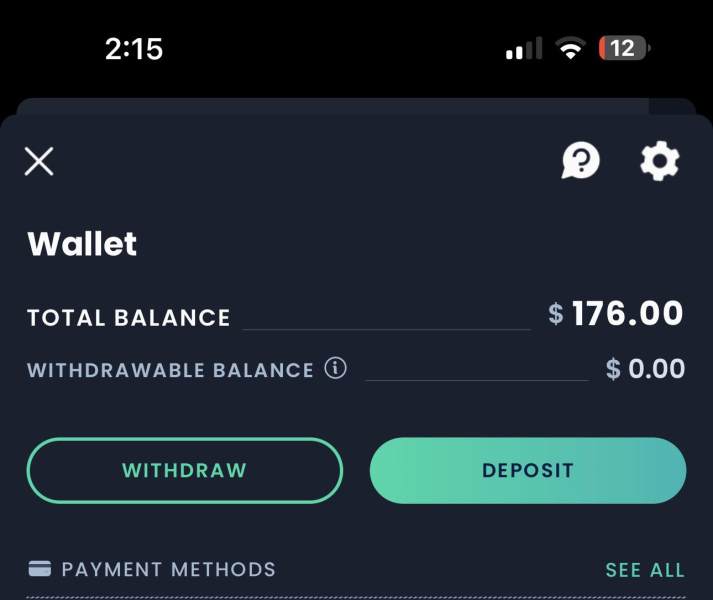

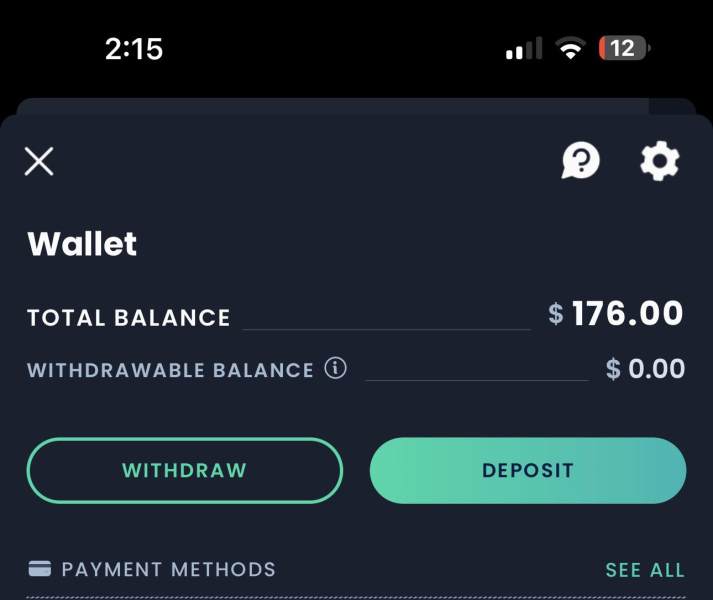

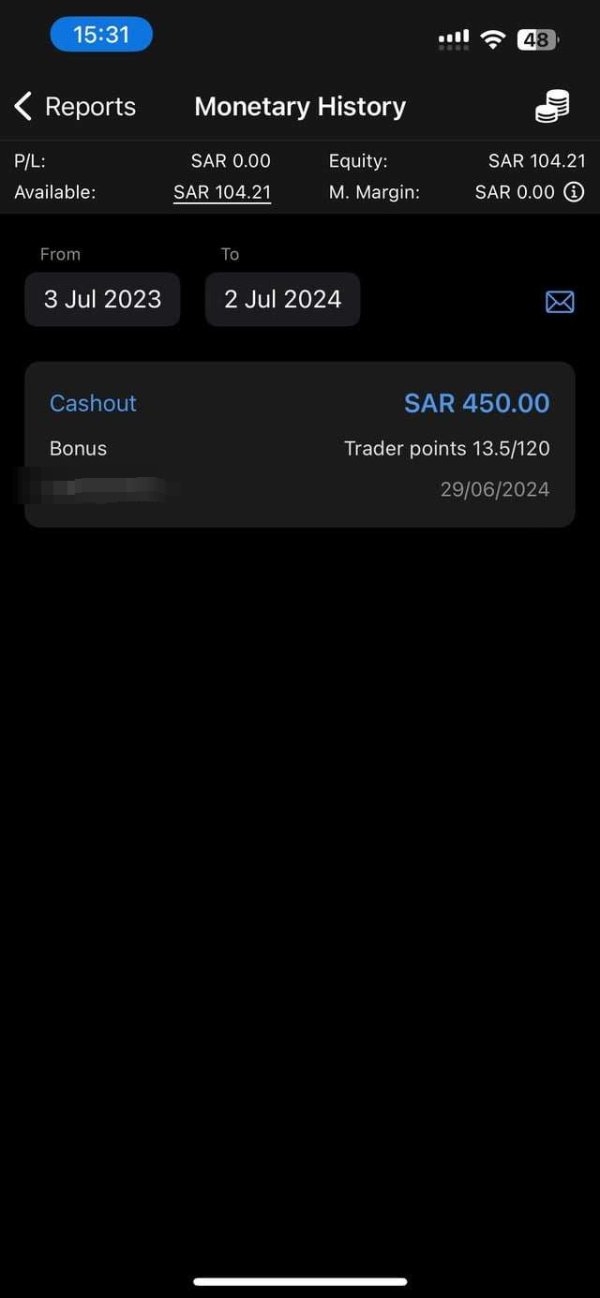

Deposit and Withdrawal Methods: While specific payment methods are not detailed in available documentation, the platform typically supports standard banking and electronic payment options common to FCA-regulated brokers.

Minimum Deposit Requirements: Specific minimum deposit information was not detailed in available sources. However, the platform's focus on accessibility suggests reasonable entry requirements for retail traders.

Promotional Offers: Current bonus or promotional structures are not specified in available documentation. This indicates a focus on transparent pricing rather than incentive-based marketing.

Tradeable Assets: Plus500 provides access to CFDs across forex, commodities, stock indices, and individual stocks. The platform focuses on commonly traded instruments rather than exotic or emerging market products.

Cost Structure: The broker emphasizes competitive spreads and low commission rates as primary advantages. According to multiple sources, Plus500's transparent fee structure eliminates hidden costs while maintaining affordability for frequent traders.

Leverage Options: Specific leverage ratios are not detailed in available documentation but operate within FCA regulatory limits for retail clients.

Platform Technology: Plus500 utilizes its proprietary trading platform, designed specifically for user-friendly operation and efficient order execution across supported asset classes.

Geographic Restrictions: The platform explicitly excludes US residents from CFD services. It focuses primarily on international markets where CFD trading is permitted.

Customer Support Languages: Specific language support details are not comprehensively outlined in available sources. However, international operations suggest multi-language capabilities.

This comprehensive Plus500 review indicates a broker focused on essential trading services rather than comprehensive market research or educational resources.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Plus500's account structure reflects its commitment to simplicity and cost-effectiveness, earning strong marks for accessibility and transparent pricing. According to ForexBrokers.com, the platform's competitive spread structure provides excellent value for frequent traders, particularly those focusing on major currency pairs and popular indices. The broker's low commission approach eliminates many hidden fees common among competitors.

While specific account tier information is not comprehensively detailed in available sources, the platform's design suggests a streamlined approach to account management. The emphasis on user-friendly access indicates minimal complexity in account opening procedures, though specific verification requirements follow standard FCA compliance protocols.

The absence of complex account hierarchies appeals to beginners who may find traditional broker account structures overwhelming. However, this simplicity may limit options for traders seeking specialized account features or premium services. The platform's focus on essential functionality over premium features aligns with its target demographic of cost-conscious retail traders.

Account funding appears straightforward, though specific minimum deposit requirements and funding methods require direct verification with the broker. The transparent fee structure mentioned across multiple reviews suggests no hidden account maintenance costs, a significant advantage for smaller account holders.

This Plus500 review finds the account conditions particularly suitable for traders prioritizing low costs and straightforward access over premium account features or specialized services.

Plus500's analytical capabilities represent perhaps its most significant limitation, particularly for traders seeking sophisticated market analysis tools. According to BrokerNotes, the platform "can't provide you with sophisticated analytical tools to develop complex strategies," which directly impacts its appeal to advanced traders.

The platform focuses on essential trading functionality rather than comprehensive market research or educational resources. While this approach maintains interface simplicity, it limits opportunities for traders seeking to develop advanced trading strategies or conduct detailed technical analysis. Independent reviews consistently note the absence of advanced charting tools and market research capabilities found on more comprehensive platforms.

Educational resources appear limited compared to competitors offering extensive learning materials and market analysis. This gap particularly affects beginners who might benefit from structured educational content, though the platform's simplicity may compensate by reducing the learning curve for basic trading operations.

The platform's proprietary technology emphasizes execution efficiency over analytical depth. While this approach serves traders with existing market knowledge, it may disappoint those seeking integrated research and analysis capabilities. Real-time data availability and basic charting functionality support essential trading decisions without overwhelming users with complex analytical options.

Third-party tool integration appears limited, requiring traders to seek external resources for comprehensive market analysis. This limitation reinforces the platform's positioning as a execution-focused service rather than a comprehensive trading solution.

Customer Service and Support Analysis (7/10)

Plus500's customer support infrastructure maintains industry-standard accessibility while focusing on essential service delivery. Available information suggests multiple contact channels, though specific response time guarantees and service level commitments are not detailed in accessible documentation.

The FCA regulatory framework requires minimum customer service standards, ensuring basic protection and complaint resolution procedures. However, specific service quality metrics and user satisfaction data are not comprehensively available in current reviews, limiting detailed assessment of actual service delivery.

Support availability appears aligned with international trading hours, accommodating the global nature of CFD trading. Multi-language support capabilities are implied by the platform's international operations, though specific language offerings require direct verification.

User feedback regarding support quality is not extensively documented in available sources, suggesting either satisfactory service levels that generate minimal complaints or limited user engagement in public feedback channels. The platform's straightforward design may reduce support ticket volume by minimizing user confusion.

Response efficiency for account-related issues and technical problems appears adequate based on the absence of significant negative feedback in major review platforms. However, the lack of detailed user testimonials limits comprehensive assessment of support quality during high-stress trading situations or complex technical issues.

Trading Experience Analysis (8/10)

Plus500's trading environment excels in user accessibility and execution efficiency, particularly for its target demographic of beginning and intermediate traders. Multiple sources highlight the platform's user-friendly design as a primary strength, creating an intuitive trading environment that minimizes complexity without sacrificing essential functionality.

The proprietary platform architecture emphasizes execution speed and order reliability over advanced features. According to independent reviews, this approach successfully delivers consistent performance across commonly traded instruments, though it may feel limiting to traders accustomed to more sophisticated platforms.

Competitive spreads enhance the overall trading experience by reducing transaction costs, particularly beneficial for frequent traders or those operating with smaller account sizes. The transparent pricing structure eliminates confusion about trading costs, allowing traders to focus on market opportunities rather than fee calculations.

Mobile trading capabilities appear integrated into the overall platform design, though specific mobile app features and performance metrics are not detailed in available documentation. The emphasis on simplicity suggests mobile functionality prioritizes essential trading operations over comprehensive analysis tools.

Order execution quality receives positive mentions in available reviews, indicating reliable performance during normal market conditions. However, specific execution statistics or performance during high-volatility periods are not detailed in accessible sources.

This Plus500 review finds the trading experience particularly well-suited to traders who value efficiency and simplicity over advanced platform features or comprehensive market analysis capabilities.

Trust Factor Analysis (8/10)

Plus500's regulatory standing provides a solid foundation for trader confidence, with FCA regulation offering comprehensive oversight and client protection measures. The Financial Conduct Authority's stringent requirements ensure adherence to capital adequacy standards, client fund segregation, and operational transparency protocols.

The broker's regulatory compliance history appears clean based on available public records, with no significant regulatory actions or sanctions noted in accessible documentation. This clean regulatory record supports the platform's credibility among retail traders seeking reliable service providers.

Client fund protection follows FCA standards, including segregated account requirements and compensation scheme participation. These protections provide essential safeguards for client deposits, though specific insurance coverage details and compensation limits require direct verification with the broker.

Financial transparency appears adequate based on regulatory requirements, though detailed financial statements and company performance metrics are not extensively available in public documentation. The FCA's ongoing oversight provides ongoing monitoring of financial stability and operational compliance.

Industry reputation among peer brokers and financial publications appears positive, with consistent recognition for reliability and transparent operations. The absence of significant negative publicity or regulatory concerns supports the platform's trustworthiness for retail trading operations.

User Experience Analysis (7/10)

Plus500's user experience design prioritizes accessibility and simplicity, creating an environment particularly welcoming to beginning traders seeking straightforward market access. The platform's intuitive interface reduces barriers to entry while maintaining professional functionality for essential trading operations.

Registration and account verification processes appear streamlined based on user feedback patterns, though specific procedural details and timeframes are not comprehensively documented in available sources. The emphasis on user-friendly design suggests minimal complexity in onboarding procedures.

Interface design successfully balances simplicity with functionality, providing essential trading tools without overwhelming users with complex features. This approach particularly benefits traders who prefer focused trading environments over feature-rich platforms that may create decision paralysis.

Navigation efficiency appears optimized for quick access to commonly used functions, supporting active trading styles while remaining accessible to occasional traders. The platform's design philosophy emphasizes intuitive operation over extensive customization options.

User satisfaction indicators from available reviews suggest positive reception among the target demographic of cost-conscious beginners, though detailed user surveys or satisfaction metrics are not extensively available. The consistent positive mentions of user-friendliness across multiple review sources support the platform's success in meeting user experience objectives.

Common user complaints are not extensively documented in available sources, suggesting either effective design that minimizes user frustration or limited public feedback channels for user concerns.

Conclusion

This comprehensive Plus500 review reveals a broker that successfully delivers on its core promise of providing accessible, cost-effective CFD trading for retail investors. The platform's strengths in competitive pricing, user-friendly design, and regulatory compliance make it particularly suitable for beginning traders and cost-conscious investors seeking straightforward market access.

Ideal User Profile: Plus500 best serves beginning to intermediate traders who prioritize low costs and simplicity over advanced analytical tools. The platform appeals to investors seeking reliable access to major markets without complex fee structures or overwhelming interface designs.

Key Advantages: Competitive spreads, transparent pricing, user-friendly platform design, and solid FCA regulation provide essential benefits for retail traders. Primary Limitations: Limited analytical tools, restricted educational resources, and lack of sophisticated trading features may disappoint advanced traders or those seeking comprehensive market research capabilities.

Plus500 represents a solid choice for traders who understand their market analysis needs and seek efficient execution at competitive prices. However, it may not satisfy users requiring integrated research tools or advanced platform features.