Regarding the legitimacy of Plus500 forex brokers, it provides ASIC, FSA, CYSEC, FCA, CIRO, FMA, CMA, MAS, FSA, SCB and WikiBit, (also has a graphic survey regarding security).

Is Plus500 safe?

Pros

Cons

Is Plus500 markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

PLUS500AU PTY. LTD.

Effective Date:

2012-10-09Email Address of Licensed Institution:

complaints@plus500.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

PLUS500AU PTY LTD L 39 264-278 GEORGE ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0292621554Licensed Institution Certified Documents:

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Plus500JP証券株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都港区東新橋1-5-2 汐留シティセンター33階Phone Number of Licensed Institution:

03-6263-8170Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 18

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Plus500CY Ltd

Effective Date:

2014-10-10Email Address of Licensed Institution:

compliance@plus500.com.cySharing Status:

No SharingWebsite of Licensed Institution:

www.plus500.com.cy, www.plus500.com, www.plus500.nl, www.plus500.pl, www.plus500.at, www.plus500.be, www.plus500.ch, www.plus500.ee, www.plus500.li, www.plus500.ro, www.plus500.lv, www.plus500.lt, www.plus500.dk, www.plus500.ru, www.plus500.it, www.plus500.ae, www.plus500.cz, www.plus500.gr, www.plus500.fr, www.plus500.se, www.plus500.hu, www.plus500.no, www.plus500.es, www.plus500.pt, www.plus500.si, www.plus500.ie, www.plus500.fi, www.plus500.bg, www.plus500.lu, www.plus500.com.hr, www.plus500.com.mt, www.plus500.com.uy, www.plus500.is, www.plus500.eu, www.plus500.rs, www.plus500.de, www.plus500.sk, www.plus500.com.my, www.plus500.hr, www.plus500.com.mx, www.plus500.coExpiration Time:

--Address of Licensed Institution:

169-171 Avenue Arch. Makarios III, Cedars Oasis Tower, Floor 1, 3027, LimassolPhone Number of Licensed Institution:

+357 25 344 544Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Plus500UK Ltd

Effective Date:

2010-06-29Email Address of Licensed Institution:

compliance@plus500.co.uk, disputes@plus500.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.plus500.com/en/Expiration Time:

--Address of Licensed Institution:

8 Angel Court Copthall Avenue London EC2R 7HJ UNITED KINGDOMPhone Number of Licensed Institution:

+442038761640Licensed Institution Certified Documents:

CIRO Derivatives Trading License (EP)

Canadian Investment Regulatory Organization

Canadian Investment Regulatory Organization

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Plus500CA Ltd

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

5200 Yonge Street Suite 200 North York, ON M2N 5P6Phone Number of Licensed Institution:

+1 437-375-9346Licensed Institution Certified Documents:

FMA Derivatives Trading License (MM)

Financial Markets Authority

Financial Markets Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

PLUS500AU PTY. LTD

Effective Date:

2016-09-30Email Address of Licensed Institution:

complaints@plus500.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Suite 39-06 Australia Square Tower, 264 George St, Sydney, Nsw, 2000, AustraliaPhone Number of Licensed Institution:

+61292621554Licensed Institution Certified Documents:

CMA Forex Trading License (EP)

Capital Market Authority

Capital Market Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Plus500Gulf Securities L.L.C

Effective Date:

2024-08-22Email Address of Licensed Institution:

rizwan.rizvi@plus500.aeSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Office 405, The Offices 4, One Central, Dubai, UAEPhone Number of Licensed Institution:

971-45703891Licensed Institution Certified Documents:

MAS Derivatives Trading License (EP)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

PLUS500SG PTE. LTD.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

http://www.plus500.com.sgExpiration Time:

--Address of Licensed Institution:

1 TEMASEK AVENUE #18-07 MILLENIA TOWER 039192Phone Number of Licensed Institution:

+65 63201111Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Plus500SEY Ltd

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.plus500.com.scExpiration Time:

--Address of Licensed Institution:

Second Floor, The Quadrant, Victoria, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4303355Licensed Institution Certified Documents:

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Plus500BHS Ltd

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Bayside Executive Park, No. 3, West Bay Street & Blake Road, Nassau, BahamasPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Plus500 A Scam?

Introduction

Plus500 is a well-known online trading platform that specializes in Contracts for Difference (CFDs) across various asset classes, including forex, stocks, commodities, and cryptocurrencies. Founded in 2008 and headquartered in Israel, Plus500 has gained a significant foothold in the financial markets, attracting millions of users globally. However, the rise of online trading has led to a proliferation of brokers, making it essential for traders to carefully evaluate the credibility and safety of their chosen platforms. This article aims to provide an objective analysis of Plus500, addressing concerns about its legitimacy and safety for traders.

To conduct this investigation, we have utilized data from multiple reputable sources, including regulatory information, user reviews, and expert analyses. Our evaluation framework encompasses regulatory compliance, company background, trading conditions, customer fund safety, user experiences, platform performance, and risk assessment.

Regulation and Legitimacy

The regulatory status of a trading platform is crucial in determining its legitimacy and safety. Plus500 operates under several tier-1 regulatory authorities, which indicates a commitment to maintaining high standards of transparency and accountability. The following table summarizes the core regulatory information for Plus500:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| FCA (UK) | 509909 | United Kingdom | Verified |

| CySEC | 250/14 | Cyprus | Verified |

| ASIC | 417727 | Australia | Verified |

| MAS | CMS 100648-1 | Singapore | Verified |

| FMA | 486026 | New Zealand | Verified |

| FSCA | 47546 | South Africa | Verified |

Plus500 is regulated by some of the most respected financial authorities globally, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC). These regulators enforce strict compliance standards, including maintaining sufficient capital reserves and ensuring that client funds are held in segregated accounts.

Historically, Plus500 has faced some regulatory scrutiny, notably in 2015 when it experienced account freezes due to anti-money laundering reviews by the FCA. However, the company has since rectified these issues and resumed normal operations, demonstrating its ability to comply with regulatory requirements. The presence of multiple regulatory licenses across various jurisdictions further strengthens Plus500's credibility as a trading platform.

Company Background Investigation

Plus500 was founded in 2008 by a group of alumni from the Technion Israel Institute of Technology. The company quickly established itself in the CFD market and has since expanded its operations globally. In 2013, Plus500 went public on the London Stock Exchange, further enhancing its transparency and accountability as a publicly traded entity.

The management team at Plus500 is composed of experienced professionals with extensive backgrounds in finance and technology. This expertise is crucial in navigating the complex regulatory landscape and ensuring the platform's operational integrity. The company has consistently demonstrated a commitment to innovation, launching various features and updates to enhance user experience.

Moreover, Plus500 has maintained a high level of transparency regarding its operations, regularly publishing financial reports and updates on its website. This level of disclosure is essential for building trust with clients and investors alike.

Trading Conditions Analysis

When evaluating a trading platform, understanding its fee structure and trading conditions is paramount. Plus500 operates on a commission-free model, generating revenue primarily through spreads. Below is a comparison of core trading costs:

| Fee Type | Plus500 | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips (EUR/USD) | 0.5 - 1.0 pips |

| Commission Model | None | Varies by broker |

| Overnight Interest Range | Varies | Varies |

Plus500's spreads are competitive, particularly for major currency pairs like EUR/USD, where the average spread is 0.6 pips. However, some users have reported that spreads can widen during periods of high volatility. Additionally, while there are no commissions on trades, Plus500 does impose an inactivity fee of $10 after three months of no trading activity, which is somewhat standard in the industry.

The absence of hidden fees and the clear presentation of costs contribute to a transparent trading environment. However, traders should be aware of the potential for overnight financing charges when holding positions beyond the trading day, which can accumulate over time.

Customer Fund Safety

The safety of customer funds is a critical consideration for any trader. Plus500 implements several measures to protect client funds, including segregated accounts, which ensure that user funds are kept separate from the company's operational funds. This segregation is a requirement of the FCA and other regulatory bodies, providing an additional layer of security in the event of company insolvency.

Moreover, Plus500 offers negative balance protection, which means that clients cannot lose more than the amount they have deposited in their accounts. This policy is particularly important in the volatile CFD market, where leverage can amplify losses. Additionally, while Plus500 does not provide specific deposit insurance, clients in the UK are covered by the Financial Services Compensation Scheme (FSCS), which protects eligible clients up to £85,000 in the event of broker failure.

Historically, Plus500 has maintained a strong track record regarding fund safety, with no significant incidents of fund misappropriation or security breaches reported.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a trading platform. Overall, Plus500 has received a mix of positive and negative reviews from users. Many traders praise the platform's user-friendly interface and the availability of a demo account, which allows new users to practice trading without financial risk. However, some common complaints have emerged, particularly regarding customer support and the lack of educational resources.

The following table summarizes the main types of complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account verification delays | Medium | Generally responsive |

| Limited educational resources | Low | Acknowledged |

| Customer support availability | High | Improvement needed |

For instance, some users have reported delays in account verification, which can hinder the trading process for new clients. Additionally, the absence of phone support has been a point of contention among users who prefer direct communication. However, Plus500 has demonstrated a commitment to improving its customer service, with 24/7 live chat support available in multiple languages.

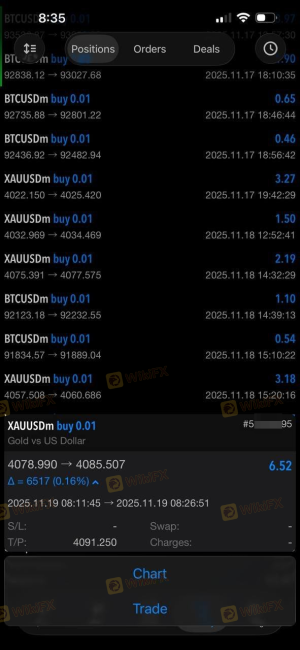

Platform and Trade Execution

Plus500's trading platform, known as WebTrader, is designed for ease of use and functionality. The platform provides a range of features, including advanced charting tools, real-time market data, and various order types. However, it does not support automated trading or integration with third-party platforms like MetaTrader.

Users have generally reported high levels of satisfaction with order execution speeds, with minimal slippage and a low rate of rejected orders. The platform's performance is stable, and it is accessible via both desktop and mobile devices, allowing traders to manage their accounts on the go.

Risk Assessment

While Plus500 offers a robust trading environment, it is essential to consider the inherent risks associated with trading CFDs. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight |

| Market Risk | High | Volatility in asset prices |

| Platform Risk | Medium | Limited integration options |

| Customer Support Risk | Medium | Need for improved response times |

Traders should be aware of the high level of market risk associated with CFD trading, particularly given the leverage offered. To mitigate these risks, it is advisable for traders to employ sound risk management strategies, such as setting stop-loss orders and limiting leverage usage.

Conclusion and Recommendations

In conclusion, Plus500 is not a scam; it is a legitimate trading platform regulated by multiple reputable authorities. The company's strong regulatory framework, combined with its commitment to client fund safety and transparent trading conditions, positions it as a trustworthy option for traders. However, potential users should remain cautious of the inherent risks associated with CFD trading and the limitations in customer support and educational resources.

For beginners, Plus500 offers a user-friendly platform and a demo account to practice trading strategies. Experienced traders may appreciate the competitive spreads and advanced trading tools. However, those seeking a more comprehensive educational experience or advanced trading features may want to consider alternatives such as IG or CMC Markets.

Overall, Plus500 presents a solid choice for traders looking to engage in CFD trading, but it is essential to conduct thorough research and consider individual trading needs before opening an account.

Is Plus500 a scam, or is it legit?

The latest exposure and evaluation content of Plus500 brokers.

Plus500 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Plus500 latest industry rating score is 7.99, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.99 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.