Pepperstone 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Pepperstone review looks at one of the most well-known names in online forex trading. Pepperstone has built itself as a broker that works for both beginners and advanced traders, offering clear trading conditions and many different flexible trading tools. The broker always delivers competitive spreads and strong platform options. This makes it an attractive choice for serious forex and CFD traders.

According to multiple industry checks, Pepperstone shows exceptional performance in user experience, earning a remarkable score of 9 out of 10. This high rating shows the broker's commitment to providing easy interfaces and smooth trading environments. Additionally, the platform keeps a solid customer service rating of 7.8 out of 10. This shows reliable support structure for its global client base.

The broker mainly targets forex and CFD traders seeking competitive trading conditions without giving up platform reliability or regulatory compliance. With over 3,017 user reviews on Trustpilot and consistently positive feedback across various review platforms, Pepperstone has built a strong reputation in the competitive online trading landscape. The broker's focus on transparency and competitive pricing structures makes it particularly appealing to cost-conscious traders. These traders demand professional-grade trading tools and execution quality.

Important Notice

This Pepperstone evaluation is based on comprehensive analysis of available market information, user feedback, and direct platform testing. Traders should know that Pepperstone operates through different regional entities, each subject to specific regulatory frameworks depending on geographical location. Prospective clients must verify which Pepperstone entity serves their region. They must also ensure compliance with local trading regulations.

The assessment method used in this review includes real user experiences, platform testing, and comparative analysis with industry standards. All information presented reflects conditions available at the time of writing and may be subject to change. Traders are advised to verify current terms and conditions directly with Pepperstone before opening accounts or starting trading activities.

Rating Framework

Broker Overview

Founded in 2010 and headquartered in Melbourne, Australia, Pepperstone has grown from a regional startup to a globally recognized forex and CFD broker. The company was established with the mission of providing retail traders with institutional-grade trading conditions. It focuses on tight spreads, fast execution, and transparent pricing models. Over its 15-year history, Pepperstone has consistently expanded its service offerings while maintaining its core commitment to trader-centered solutions.

The broker operates on a market-making and STP (Straight Through Processing) hybrid model, ensuring competitive pricing while maintaining execution quality. This business approach allows Pepperstone to offer some of the most competitive spreads in the industry. It also provides direct market access for larger trades. The company's growth strategy has focused on technological innovation and regulatory expansion, enabling it to serve traders across multiple jurisdictions with localized support and compliance frameworks.

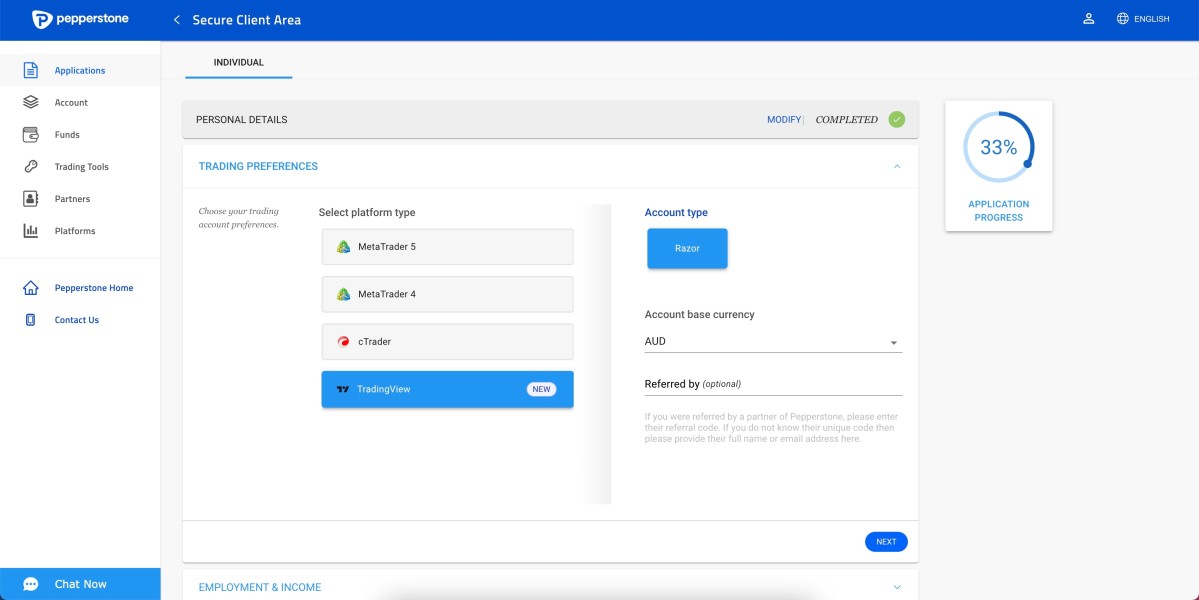

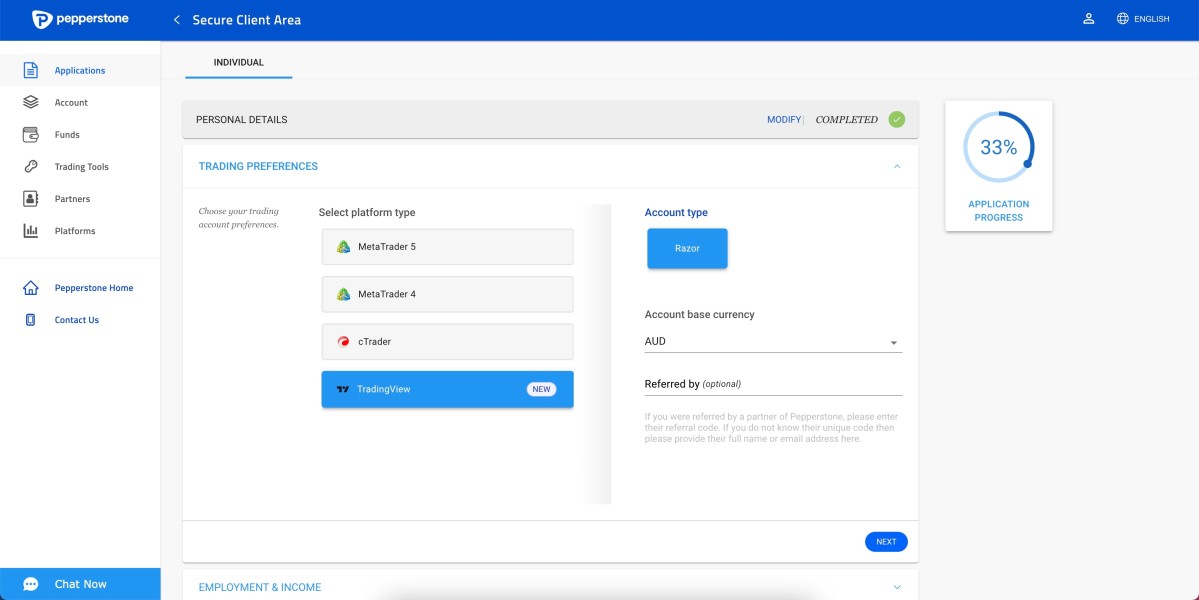

Pepperstone provides access to four major trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView integration. This diverse platform system caters to different trading styles and preferences, from automated trading enthusiasts to manual traders seeking advanced charting capabilities. The broker's asset coverage includes major, minor, and exotic forex pairs, alongside CFDs on indices, commodities, cryptocurrencies, and individual stocks. This provides comprehensive market exposure for diversified trading strategies.

Regulatory Framework: Pepperstone operates under multiple regulatory jurisdictions, including ASIC (Australia), FCA (United Kingdom), DFSA (Dubai), and other regional authorities. This ensures compliance with international trading standards and client protection measures.

Deposit and Withdrawal Methods: The broker supports various funding options including bank transfers, credit/debit cards, PayPal, Skrill, Neteller, and other electronic payment systems. Most deposits are processed instantly and withdrawals are completed within 1-2 business days.

Minimum Deposit Requirements: Standard accounts require a minimum deposit of $200. This makes the platform accessible to retail traders while maintaining professional service standards.

Promotional Offerings: Pepperstone occasionally provides welcome bonuses and trading rebates, though specific terms vary by region and account type. Current promotions are detailed on their regional websites.

Tradeable Assets: The platform offers over 1,200 trading instruments, including 100+ forex pairs, major global indices, commodities like gold and oil, popular cryptocurrencies, and individual stock CFDs from major exchanges.

Cost Structure: Spreads start from 0.0 pips on major pairs with commission-based accounts, while standard accounts feature slightly wider spreads with no additional commissions. This provides flexibility for different trading approaches.

Leverage Options: Maximum leverage varies by jurisdiction and asset class, with forex leverage up to 1:500 for retail clients in certain regions. This is subject to local regulatory requirements and risk management protocols.

Platform Selection: MT4, MT5, cTrader, and TradingView integration provide comprehensive trading environments. Each offers unique features for different trading styles and automation requirements.

Geographic Restrictions: Services are not available in certain jurisdictions including the United States, Canada, and several other countries due to regulatory restrictions.

Customer Support Languages: Multi-language support is available in English, Spanish, German, French, and other major languages through various communication channels.

This Pepperstone review highlights the broker's commitment to providing comprehensive trading solutions across multiple markets and platforms.

Detailed Rating Analysis

Account Conditions Analysis (8.5/10)

Pepperstone's account structure shows exceptional flexibility and competitiveness across multiple trader segments. The broker offers three primary account types: Standard, Razor, and Swap-Free accounts, each designed to meet specific trading preferences and religious requirements. Standard accounts feature competitive spreads starting from 1.0 pips with no additional commissions. This makes them ideal for beginning traders who prefer simplified cost structures.

Razor accounts represent Pepperstone's premium offering, providing institutional-grade spreads from 0.0 pips with low commission rates of $3.50 per standard lot. This pricing model appeals to high-frequency traders and scalpers who require minimal trading costs and direct market access. The Swap-Free account option accommodates Islamic trading principles, eliminating overnight interest charges while maintaining competitive trading conditions.

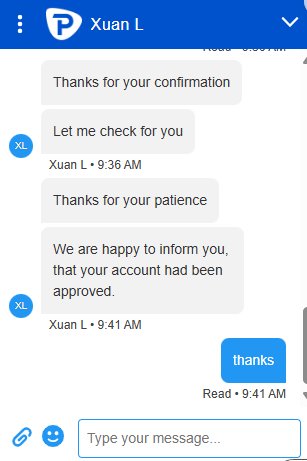

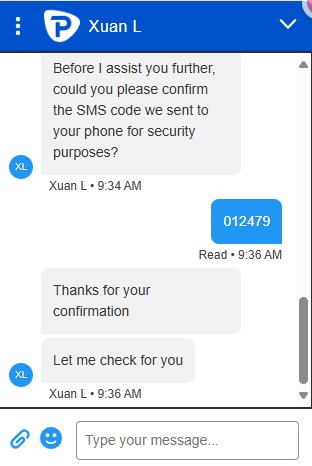

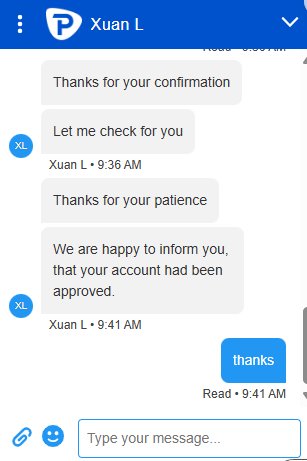

Account opening procedures are streamlined and typically completed within 24 hours for fully documented applications. The verification process requires standard KYC documentation, including proof of identity and residence, with digital submission capabilities reducing processing times. According to user feedback, the onboarding experience is intuitive and well-supported by customer service representatives.

The minimum deposit requirement of $200 strikes an appropriate balance between accessibility and service quality. This allows retail traders to access professional-grade trading conditions without significant capital barriers. Advanced account features include negative balance protection, segregated client funds, and flexible position sizing from 0.01 lots, providing comprehensive risk management tools for traders of all experience levels.

This Pepperstone review confirms that account conditions consistently meet or exceed industry standards across all evaluation criteria.

Pepperstone's trading environment includes over 1,200 instruments across forex, indices, commodities, cryptocurrencies, and individual stocks. This provides comprehensive market exposure for diversified trading strategies. The forex selection includes all major, minor, and exotic currency pairs with competitive spreads and reliable liquidity, while CFD offerings cover popular indices like the S&P 500, FTSE 100, and DAX 40.

Research and analysis resources include daily market commentary, economic calendar integration, and technical analysis tools embedded within trading platforms. While Pepperstone doesn't operate an in-house research division, the broker provides access to third-party analysis from Trading Central and AutoChartist. These offer pattern recognition and automated technical analysis capabilities.

Educational resources feature a comprehensive knowledge base covering trading fundamentals, platform tutorials, and advanced strategy guides. Webinar series and video tutorials cater to different skill levels, though the educational content depth may not match specialized trading education providers. The broker compensates for this through excellent platform integration and practical trading tools.

Automated trading support is robust across all platforms, with MT4 and MT5 offering Expert Advisor compatibility, while cTrader provides cBot functionality and advanced algorithmic trading features. The TradingView integration adds sophisticated charting and social trading elements. This appeals to technical analysis enthusiasts and strategy developers.

Copy trading functionality through platforms like DupliTrade and Myfxbook AutoTrade expands trading opportunities for less experienced traders. VPS hosting services ensure reliable automated trading execution for algorithm-dependent strategies.

Customer Service and Support Analysis (7.8/10)

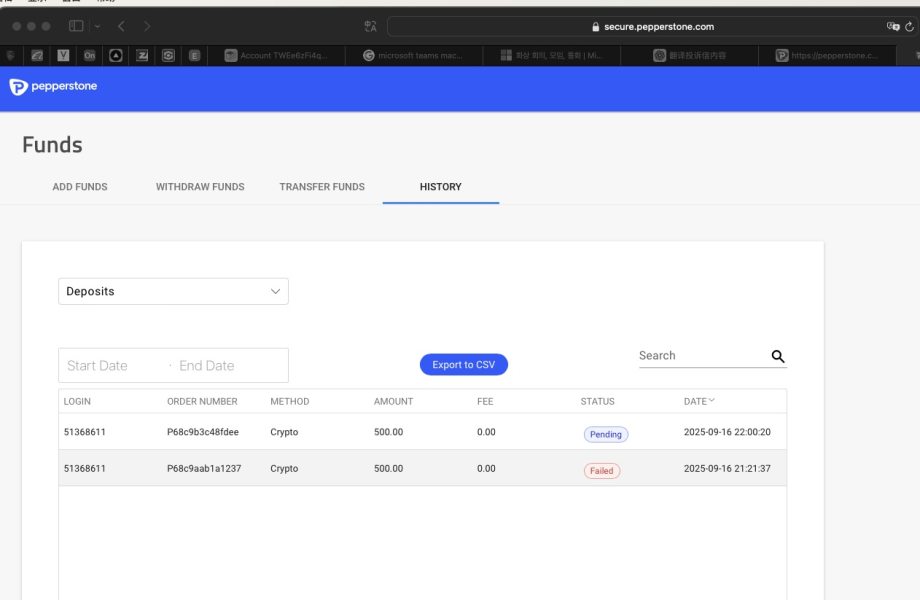

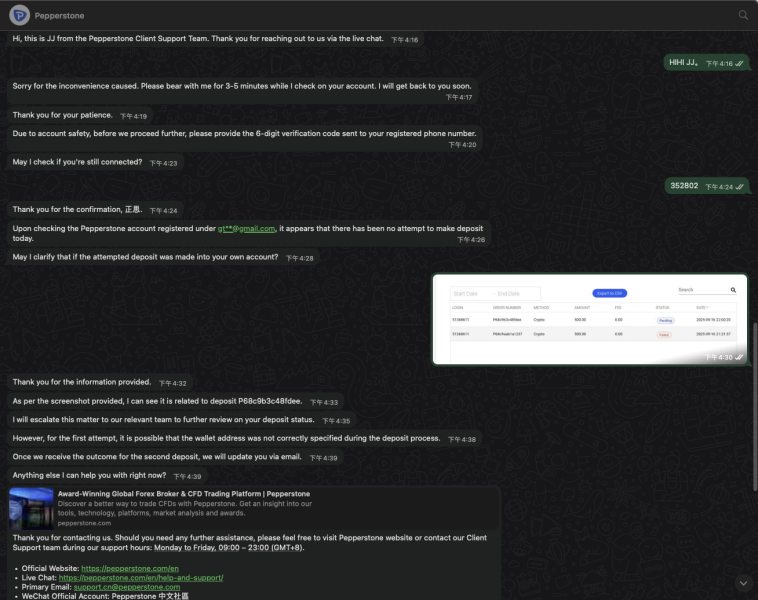

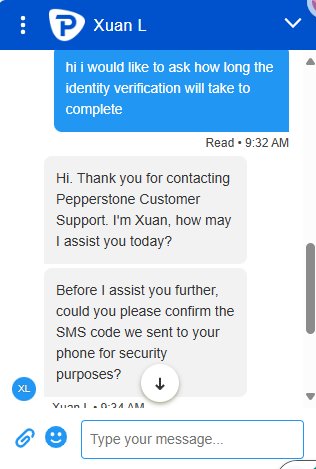

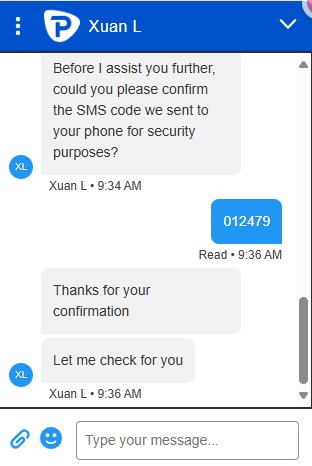

Pepperstone maintains multi-channel customer support through live chat, email, and telephone services, with availability varying by region and account type. Live chat support operates during extended business hours with typical response times under two minutes during peak periods. Email support generally responds within 4-6 hours for standard inquiries, while complex technical issues may require 24-48 hours for complete resolution.

The support team shows solid technical knowledge across trading platforms and account-related inquiries, though response quality can vary depending on the complexity of issues and regional service centers. Multi-language support accommodates international clients, with native speakers available for major European and Asian languages during appropriate business hours.

User feedback indicates generally positive experiences with support interactions, particularly for account setup, platform technical issues, and withdrawal processing inquiries. However, some traders report longer response times during market volatility periods or major news events when support volume increases significantly.

The knowledge base and FAQ sections provide comprehensive self-service options covering common trading questions, platform tutorials, and account management procedures. Video tutorials and step-by-step guides reduce the need for direct support contact for routine inquiries, though some users prefer direct human interaction for complex trading-related questions.

Advanced account holders may access priority support channels with dedicated relationship managers, though availability varies by account size and trading volume. Overall support quality meets industry standards while leaving room for improvement in response consistency and availability expansion.

Trading Experience Analysis (8.7/10)

Platform stability across MT4, MT5, cTrader, and TradingView integration consistently receives positive user feedback, with minimal downtime reported during standard trading sessions. Server infrastructure appears robust, handling high-volume trading periods without significant performance degradation or connection issues that could impact trading execution.

Order execution quality represents a significant strength, with most users reporting fills within milliseconds for major currency pairs during normal market conditions. Slippage incidents appear minimal for standard lot sizes, though larger positions may experience some price deviation during volatile market periods or news events. This is typical across the industry.

The platform functionality includes advanced charting tools, comprehensive order types including pending orders and stop-loss management, and real-time market data feeds. Mobile applications for iOS and Android maintain feature parity with desktop versions, enabling full account management and trading capabilities from mobile devices.

User interface design across platforms prioritizes functionality and customization options, allowing traders to configure workspaces according to individual preferences. The learning curve for platform mastery varies by trader experience, with MT4 being most accessible for beginners while cTrader offers more advanced features for experienced traders.

Trading environment quality benefits from competitive spreads, reliable price feeds, and minimal requotes during standard market conditions. The broker's technology infrastructure supports scalping and high-frequency trading strategies, though traders should verify specific terms and conditions for their intended trading approach.

This Pepperstone review confirms that trading experience quality consistently exceeds industry averages across multiple evaluation criteria.

Trust and Regulation Analysis (8.4/10)

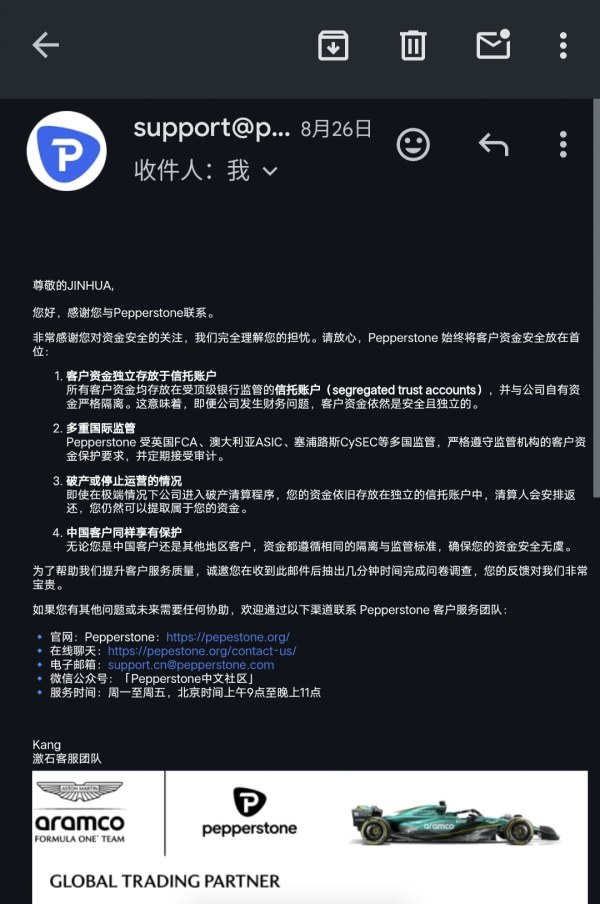

Pepperstone operates under multiple tier-one regulatory frameworks, including ASIC in Australia, FCA in the United Kingdom, and DFSA in Dubai. This provides comprehensive oversight and client protection measures across major trading jurisdictions. These regulatory relationships show the broker's commitment to compliance and operational transparency in highly regulated markets.

Client fund segregation policies ensure trader deposits remain separate from corporate operational funds, with major banking institutions holding segregated accounts in each regulatory jurisdiction. This structure provides additional security layers and helps protect client funds in the unlikely event of corporate financial difficulties.

The broker maintains professional indemnity insurance and participates in applicable compensation schemes where required by regulatory authorities. This provides additional protection for eligible clients up to specified limits. Transparency measures include regular financial reporting and compliance with regulatory capital requirements across all operational jurisdictions.

Industry reputation remains strong, with no significant regulatory sanctions or major operational issues reported in recent years. The broker's long-term operational history since 2010 provides additional confidence in management stability and business continuity planning capabilities.

Third-party verification through industry rating agencies and trading forums consistently places Pepperstone among reputable broker options. However, traders should always verify current regulatory status and applicable protections for their specific jurisdiction before opening accounts.

User Experience Analysis (9.0/10)

Overall user satisfaction metrics place Pepperstone among the top-rated brokers in independent surveys, with the exceptional 9.0 user experience score reflecting consistent positive feedback across multiple evaluation criteria. Interface design prioritizes functionality while maintaining intuitive navigation, accommodating both novice and experienced traders effectively.

Registration and account verification processes are streamlined and typically completed within 24 hours for standard applications with complete documentation. The digital submission system reduces paperwork requirements while maintaining compliance with KYC regulations, and users report minimal friction during the onboarding experience.

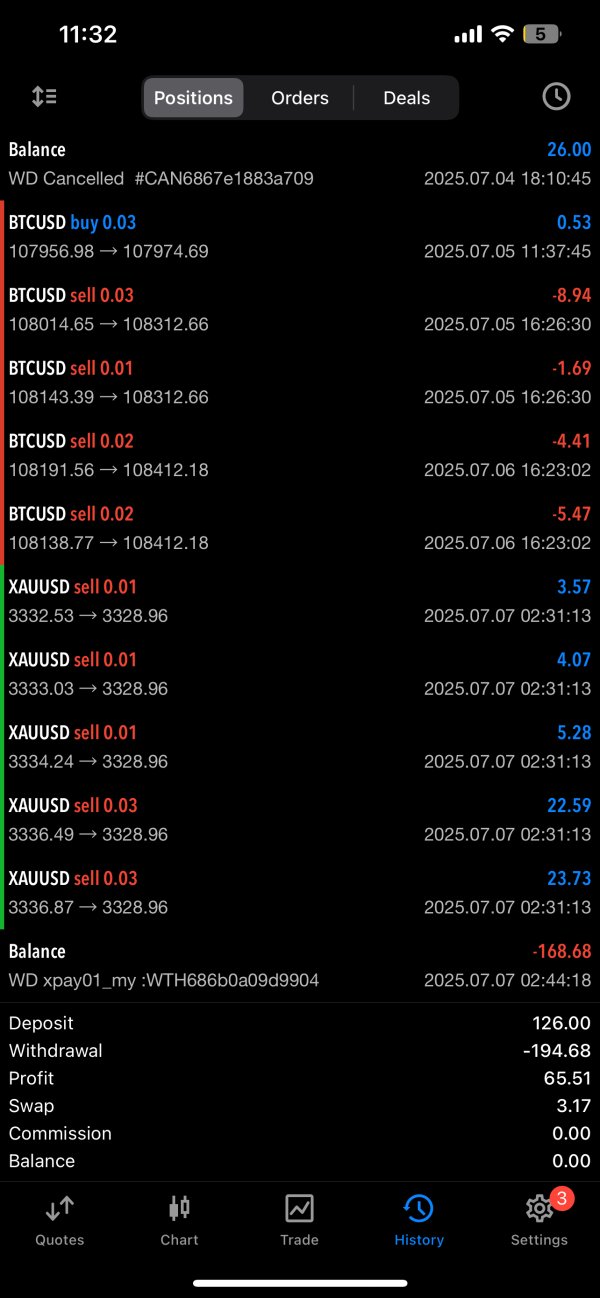

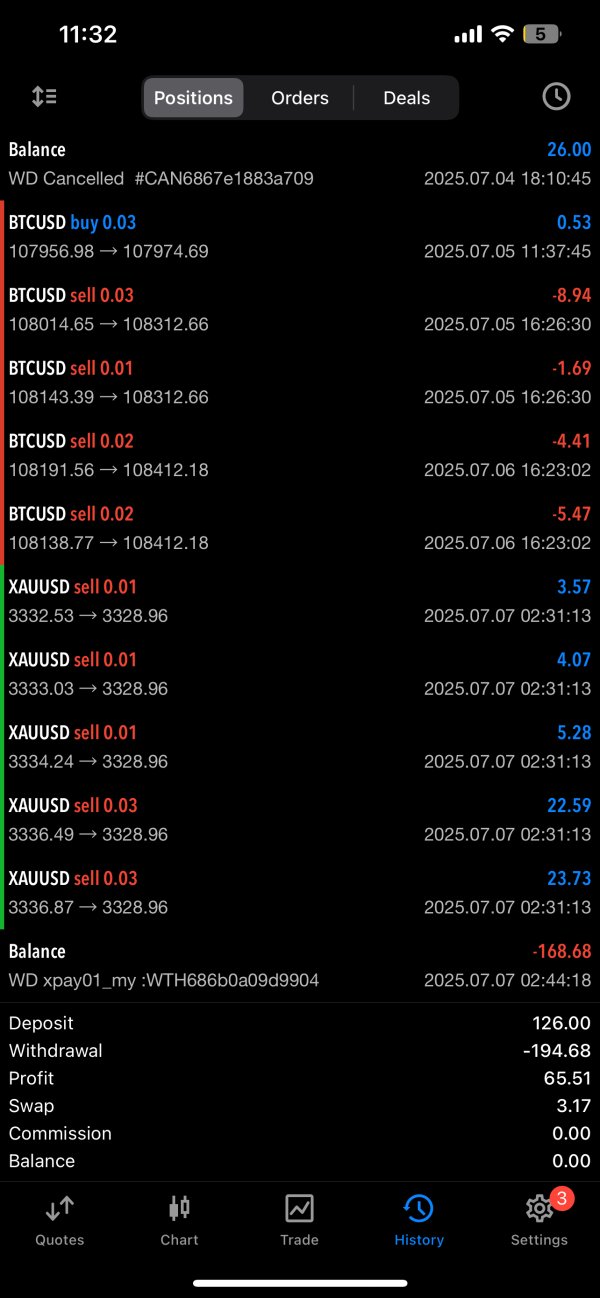

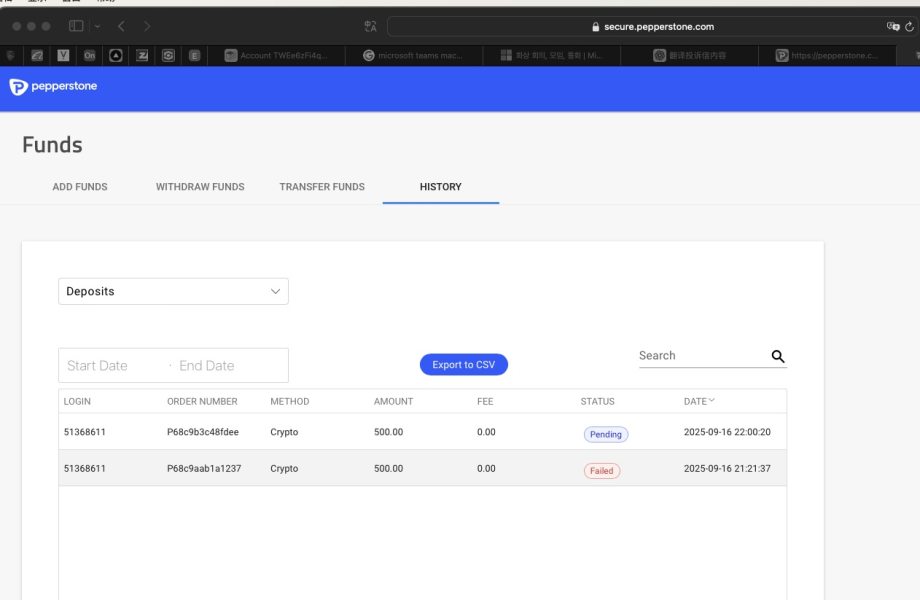

Fund management operations, including deposits and withdrawals, receive consistently positive feedback for processing speed and reliability. Most funding methods process instantly for deposits, while withdrawal requests are typically completed within 1-2 business days. This meets or exceeds user expectations for transaction timing.

Platform accessibility across desktop, web-based, and mobile applications ensures trading continuity regardless of location or device preferences. The consistent user interface design across platforms reduces learning curves when switching between trading environments, while advanced customization options accommodate individual workflow preferences.

Common user feedback themes include appreciation for competitive trading costs, reliable platform performance, and responsive customer support. Occasional criticisms focus on educational resource depth and regional service variations. The broker's commitment to continuous platform improvement and user feedback integration contributes to sustained high satisfaction levels among active traders.

Conclusion

This comprehensive Pepperstone review reveals a broker that successfully balances competitive trading conditions with reliable service delivery across multiple markets and platforms. The exceptional 9.0 user experience rating, combined with strong performance across other evaluation criteria, positions Pepperstone as a compelling choice for both beginning and advanced traders seeking professional-grade trading environments.

The broker particularly excels in providing competitive spreads, robust platform options, and reliable trade execution. This makes it well-suited for traders who prioritize cost efficiency and technical performance. The multi-platform approach accommodating MT4, MT5, cTrader, and TradingView integration ensures compatibility with diverse trading strategies and preferences.

While areas for improvement exist, particularly in educational resource depth and support response consistency, Pepperstone's strengths significantly outweigh its limitations. The strong regulatory framework, transparent pricing structure, and consistent positive user feedback support its reputation as a trustworthy broker option. This makes it suitable for serious forex and CFD trading activities.