Axi 2025 Review: Everything You Need to Know

Executive Summary

Axi is a trusted forex and CFD broker. The company has served traders around the world since 2007. This detailed axi review shows a broker that offers competitive trading with strong rules and oversight. Axi started in Australia and now serves traders in over 100 countries, giving access to more than 220 trading tools across many types of investments like forex, commodities, indices, stocks, and digital currencies.

The broker offers great spreads starting from 0 pips and flexible leverage up to 500:1. This makes it very appealing for traders who want cost-effective trading. Axi works under strict rules from three major financial authorities: the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, and the Dubai Financial Services Authority (DFSA).

User feedback from multiple review sites shows Axi has a solid reputation with a trust score of 92 out of 100. However, user ratings show a moderate 3-star average across over 1,250 reviews. The broker mainly serves forex and CFD traders worldwide, from beginners who need educational resources to experienced traders who require advanced trading tools and fast execution speeds.

Important Notice

Axi operates through different regional companies under different rules depending on where the trader lives. Users must understand which regulatory company governs their trading relationship because this affects available products, leverage limits, and investor protection measures. Traders in Australia fall under ASIC regulation, UK residents are covered by FCA oversight, while those in the Middle East region are supervised by DFSA.

This review is based on detailed analysis of user feedback, regulatory filings, and market data collected from multiple independent sources. The evaluation method includes both number-based metrics such as spreads and fees, alongside quality assessments of customer service and trading experience. All information presented reflects the broker's offerings as of 2025 and may be subject to change based on regulatory requirements or business decisions.

Rating Framework

Account Conditions (7/10): Based on competitive spreads from 0 pips and leverage up to 500:1, though minimum deposit requirements vary by region and account type.

Tools and Resources (8/10): Strong offering with 220+ trading instruments and comprehensive educational materials, supported by robust trading platforms.

Customer Service and Support (9/10): Highly rated 24/5 multilingual support with multiple contact channels and consistently positive user feedback.

Trading Experience (8/10): Reliable MetaTrader 4 platform with stable execution and good liquidity across major markets.

Trust and Regulation (9/10): Triple regulation from tier-1 authorities (ASIC, FCA, DFSA) with high transparency and strong industry reputation.

User Experience (7/10): Generally positive user feedback with room for improvement in certain platform features and account opening processes.

Broker Overview

Company Background and History

Axi was started in 2007. The company has grown from an Australian startup to become a globally recognized forex and CFD broker. The company is based in Sydney, Australia, and has built its reputation on providing reliable trading conditions and maintaining strict regulatory compliance across multiple jurisdictions. Over its 18-year history, Axi has consistently focused on serving retail traders while expanding its institutional offerings.

The broker's business model centers on providing direct market access through its MetaTrader 4 platform. This lets traders access global financial markets with competitive pricing and execution speeds. According to industry reports, Axi has been recognized as one of the top 10 global brokers, reflecting its commitment to maintaining high service standards and technological innovation in the competitive forex brokerage landscape.

Trading Platform and Asset Coverage

Axi mainly operates through the MetaTrader 4 (MT4) platform. This gives traders advanced charting capabilities, automated trading support, and comprehensive technical analysis tools. The platform supports both desktop and mobile trading, ensuring traders can manage their positions across different devices seamlessly.

The broker's asset coverage spans multiple markets, offering over 220 trading instruments including major and minor forex pairs, precious metals, energy commodities, global stock indices, individual equities, and popular cryptocurrencies. This diverse selection caters to various trading strategies and risk preferences. Axi operates under regulation from three major financial authorities: ASIC in Australia, FCA in the United Kingdom, and DFSA in Dubai, ensuring compliance with international standards and providing traders with multiple layers of investor protection.

Regulatory Coverage: Axi maintains licenses from three tier-1 regulatory bodies. The Australian entity is regulated by ASIC (license number 318232), the UK operations fall under FCA supervision (license number 509909), and Middle Eastern services are overseen by DFSA (license number F003484). This multi-jurisdictional approach ensures compliance with local regulations while providing comprehensive investor protection.

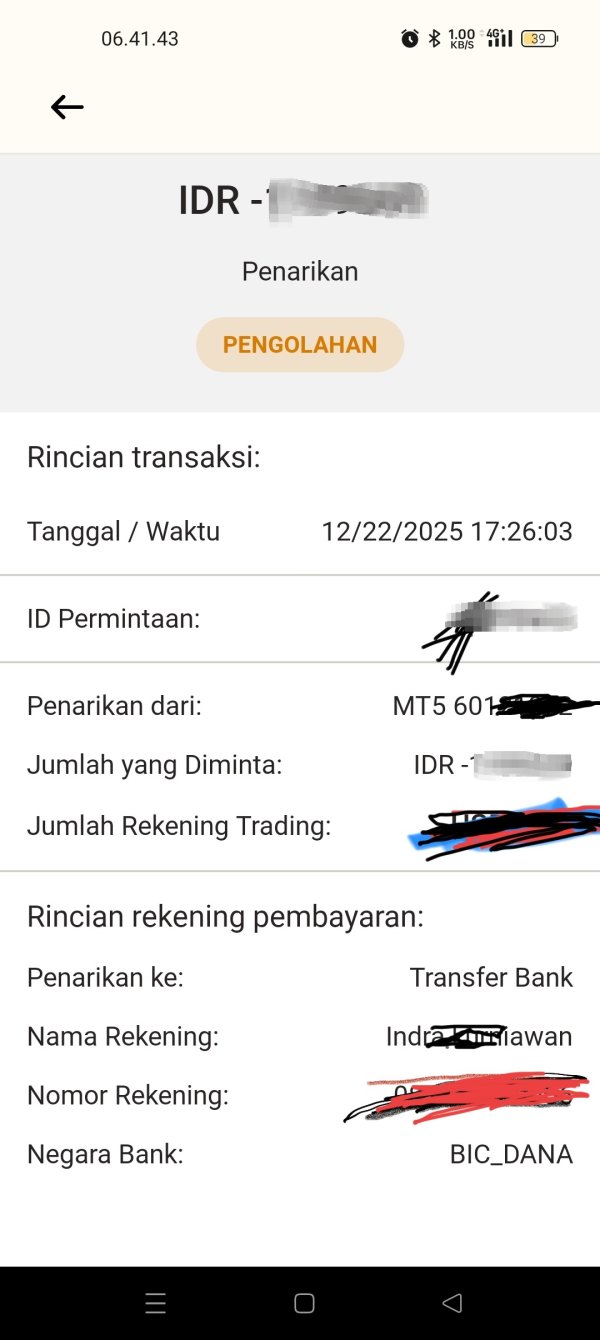

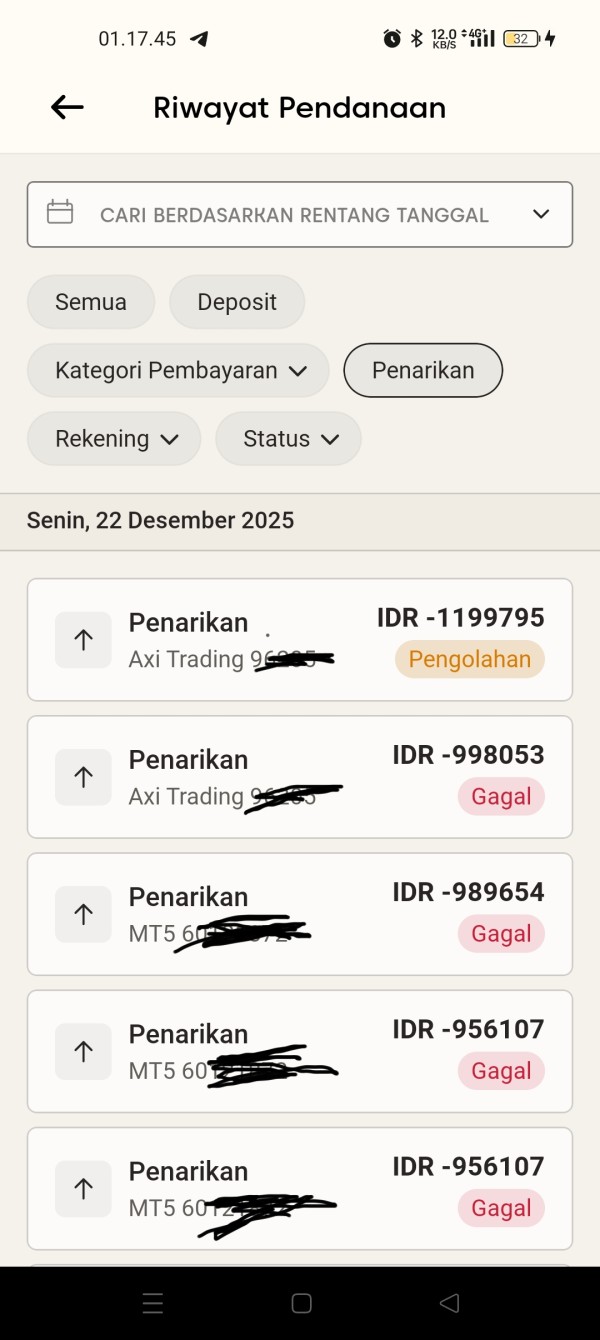

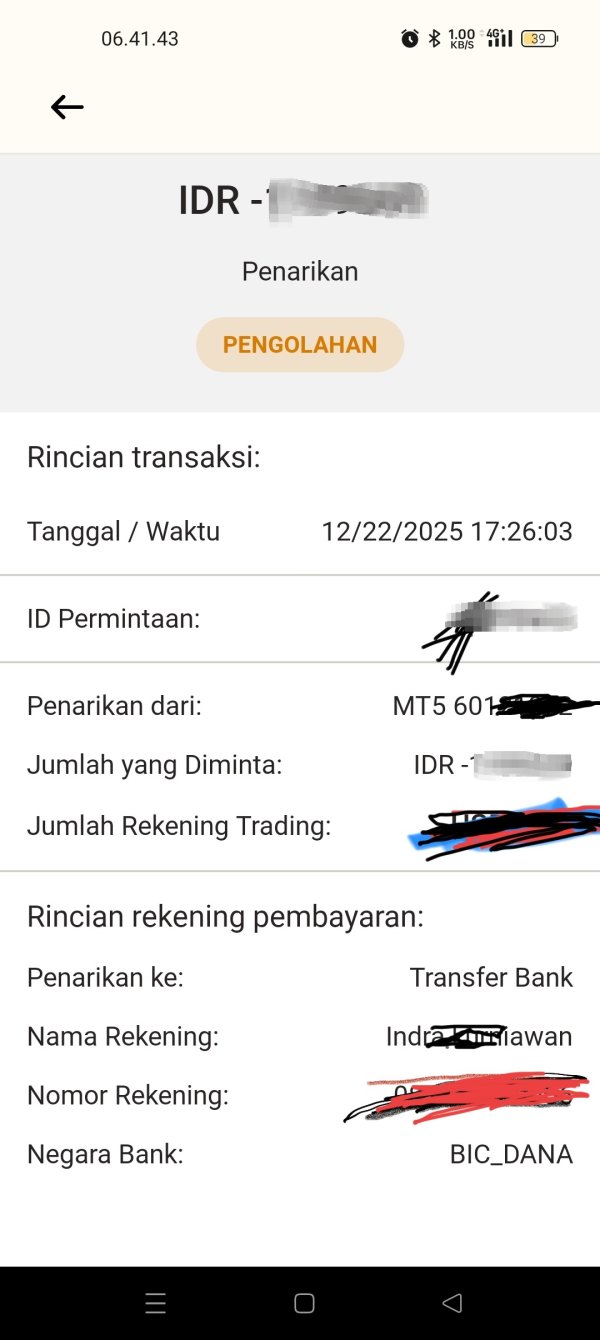

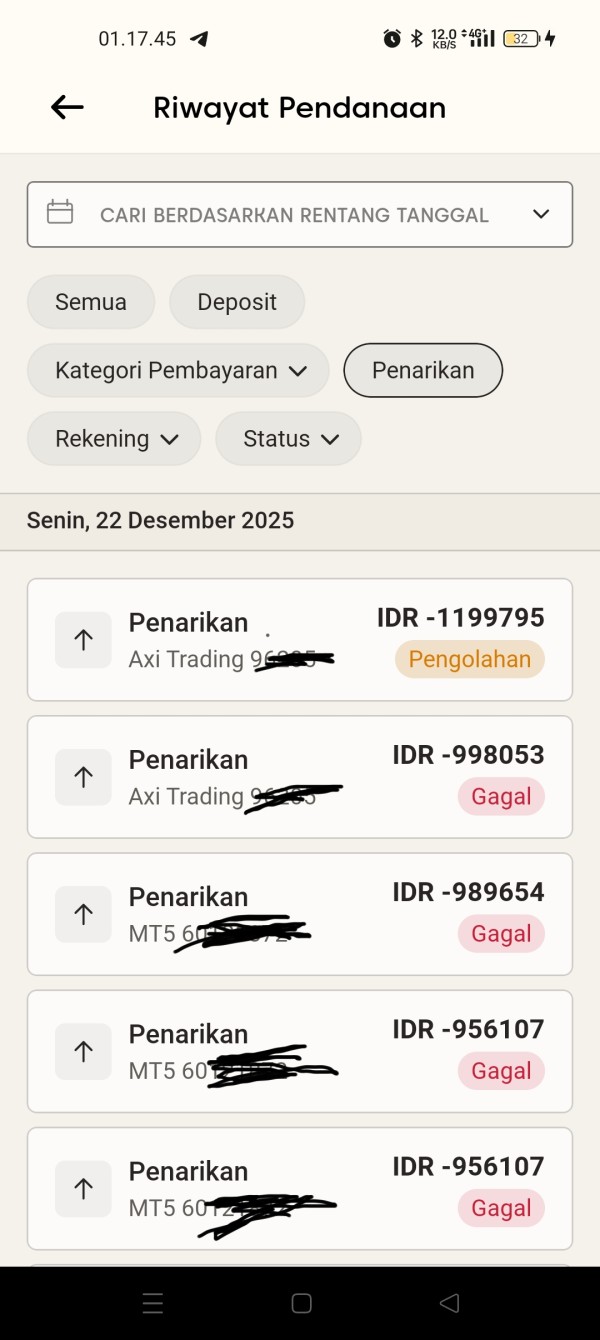

Deposit and Withdrawal Methods: The broker supports multiple funding options including bank wire transfers, credit/debit cards, and various electronic payment systems. Processing times vary by method, with electronic transfers typically completing within 24 hours while bank wires may take 3-5 business days. Specific payment methods available depend on the trader's jurisdiction and account type.

Minimum Deposit Requirements: Minimum deposit amounts vary by account type and regulatory jurisdiction. Standard accounts typically require lower initial funding compared to professional trading accounts. Exact amounts are determined during the account opening process based on the trader's location and selected account features.

Bonus and Promotional Offers: Current promotional offerings include educational webinars, trading competitions, and cashback programs for active traders. Specific terms and availability of promotional offers depend on local regulations and account classification, with detailed terms provided during account registration.

Available Trading Assets: The comprehensive asset selection includes over 80 forex pairs covering majors, minors, and exotic currencies. It also includes precious metals (gold, silver, platinum, palladium), energy commodities (crude oil, natural gas), global stock indices from major markets, individual company shares, and popular cryptocurrencies including Bitcoin, Ethereum, and other digital assets.

Cost Structure: Spreads start from 0 pips on major forex pairs for certain account types. Commission structures vary by account classification. The broker operates both spread-only and commission-based pricing models, allowing traders to choose the cost structure that best fits their trading style and volume requirements.

Leverage Options: Maximum leverage reaches 500:1 for retail clients in certain jurisdictions. Actual leverage limits depend on regulatory requirements in the trader's location, asset class, and account type. Professional traders may access higher leverage subject to qualification criteria and regulatory approval.

Platform Selection: MetaTrader 4 serves as the primary trading platform. It offers comprehensive charting tools, automated trading capabilities through Expert Advisors, and mobile compatibility. The platform supports multiple order types, advanced technical indicators, and customizable interface options to accommodate different trading preferences.

Geographic Restrictions: Services are available in over 100 countries. However, certain jurisdictions are restricted due to local regulations. Specific availability depends on regulatory requirements and compliance considerations in each region.

Customer Support Languages: Multilingual support is available with customer service representatives fluent in major languages including English, Spanish, French, German, and Arabic. This ensures effective communication across diverse client bases.

This detailed axi review information demonstrates the broker's commitment to providing comprehensive trading services while maintaining regulatory compliance across multiple jurisdictions.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Axi's account conditions show a strong commitment to competitive trading terms. However, some areas show room for improvement. The broker offers multiple account types designed to accommodate different trader profiles, from beginners to institutional clients. Standard accounts provide access to competitive spreads starting from 0 pips on major forex pairs, while professional accounts may offer enhanced conditions for qualified traders meeting specific criteria.

The account opening process receives generally positive feedback from users. Most report a straightforward online application that can be completed within 15-30 minutes. However, verification procedures may extend the timeline, particularly for clients from certain jurisdictions requiring additional documentation. According to user reviews, the know-your-customer (KYC) process is thorough but can occasionally cause delays for complex applications.

Leverage options up to 500:1 provide flexibility for traders seeking to optimize their capital efficiency. Actual limits depend on regulatory requirements in each jurisdiction. ESMA regulations restrict EU clients to lower leverage ratios, while other regions may offer higher limits subject to local compliance requirements. The broker's risk management tools include negative balance protection and margin call systems to help protect trader accounts.

Compared to industry competitors, Axi's spreads and leverage offerings rank among the more competitive options available. This is particularly true for active traders processing higher volumes. User feedback consistently highlights the cost-effectiveness of trading conditions, though some note that certain exotic currency pairs carry wider spreads than major competitors. This axi review component reflects solid but not exceptional account conditions that meet most trader requirements effectively.

Axi provides a comprehensive suite of trading tools and educational resources. These significantly enhance the trading experience for clients across all experience levels. The broker's offering includes over 220 trading instruments spanning multiple asset classes, providing traders with diverse opportunities to build balanced portfolios and implement various trading strategies.

The educational component features regular webinars, market analysis reports, and comprehensive trading guides covering both fundamental and technical analysis approaches. According to user feedback, the educational content quality receives high marks for clarity and practical applicability. Professional traders particularly appreciate the advanced market research and analysis tools, including economic calendars, sentiment indicators, and real-time news feeds integrated into the trading platform.

Technical analysis capabilities through the MetaTrader 4 platform include over 50 built-in technical indicators, multiple timeframe analysis, and support for automated trading through Expert Advisors. The platform's customization options allow traders to create personalized workspace configurations optimized for their specific trading approaches and preferences.

Research resources include daily market commentary, weekly outlook reports, and specialized analysis for major economic events. Users consistently rate the quality and timeliness of market insights as above average compared to industry standards. The broker also provides risk management tools including position sizing calculators, correlation matrices, and volatility indicators to help traders make informed decisions. Industry experts recognize Axi's commitment to providing professional-grade tools accessible to retail traders, contributing to the strong rating in this axi review category.

Customer Service and Support Analysis (9/10)

Axi's customer service consistently receives exceptional ratings from users across multiple review platforms. This establishes it as one of the broker's strongest competitive advantages. The support team operates 24 hours a day, five days a week, providing coverage during all major trading sessions and ensuring assistance availability when markets are active.

Multiple contact channels include live chat, email support, and telephone assistance with dedicated phone lines for different regions. User feedback consistently highlights rapid response times, with live chat inquiries typically answered within 2-3 minutes during business hours. Email responses generally arrive within 4-6 hours, though complex technical questions may require additional time for comprehensive resolution.

The quality of support interactions receives particularly high praise. Users note that representatives demonstrate strong technical knowledge of trading platforms, market conditions, and account management procedures. Multilingual support capabilities ensure effective communication for the broker's diverse international client base, with native speakers available for major languages during appropriate regional hours.

Problem resolution effectiveness stands out as a key strength. Users report that most issues receive satisfactory solutions on first contact. More complex problems involving technical analysis, platform functionality, or account-specific questions are typically escalated to specialized teams with relevant expertise. The support team's proactive communication during market volatility or platform maintenance periods helps maintain client confidence and satisfaction levels. User testimonials frequently mention the professional and helpful attitude of support staff, contributing significantly to overall client retention and satisfaction levels.

Trading Experience Analysis (8/10)

The trading experience on Axi's platform demonstrates strong performance across key metrics that matter most to active traders. Platform stability receives consistently positive feedback, with users reporting minimal downtime and reliable connectivity during both normal and volatile market conditions. The MetaTrader 4 infrastructure appears well-maintained with regular updates and optimizations that enhance performance without disrupting user workflows.

Order execution quality represents a particular strength. Users report competitive fill rates and minimal slippage on standard market orders. During high-impact news events, execution speeds may slow slightly, but generally remain within acceptable ranges compared to industry benchmarks. The broker's liquidity provision ensures that most orders receive fills at or near requested prices, particularly for major currency pairs and popular CFD instruments.

Platform functionality through MT4 provides comprehensive trading capabilities including multiple order types, advanced charting tools, and automated trading support through Expert Advisors. Users appreciate the platform's stability and the extensive customization options available for creating personalized trading environments. Technical indicators, drawing tools, and analytical capabilities meet professional standards while remaining accessible to newer traders.

Mobile trading experience receives generally positive reviews. The MT4 mobile application provides essential functionality for position management and market monitoring while away from desktop computers. Some users note that certain advanced features work better on desktop versions, but core trading functions operate smoothly across devices. The overall trading environment supports both scalping and longer-term strategies effectively, with infrastructure capable of handling various trading approaches and volumes.

Trust and Regulation Analysis (9/10)

Axi's regulatory framework represents one of its strongest attributes. Licenses from three tier-1 financial authorities provide comprehensive oversight and investor protection. The Australian Securities and Investments Commission (ASIC) regulation ensures compliance with strict capital adequacy requirements, client money segregation, and operational standards that rank among the world's most stringent regulatory frameworks.

Financial Conduct Authority (FCA) oversight in the United Kingdom adds another layer of protection for European clients. This includes additional safeguards including participation in the Financial Services Compensation Scheme (FSCS) providing up to 拢85,000 in deposit protection. The Dubai Financial Services Authority (DFSA) regulation facilitates services in the Middle East region while maintaining international compliance standards.

Corporate transparency receives high marks. This includes regular financial reporting, clear disclosure of business practices, and accessible information about company ownership and management structure. The broker maintains segregated client accounts with tier-1 banking institutions, ensuring customer funds remain separate from operational capital and protected in the unlikely event of corporate financial difficulties.

Industry reputation reflects consistent recognition from financial publications and trading communities. Awards and certifications from reputable organizations validate the broker's commitment to excellence. Independent verification of regulatory licenses and ongoing compliance monitoring provide additional confidence in the broker's operational integrity. The absence of significant regulatory actions or client fund issues throughout the company's 18-year history demonstrates consistent adherence to professional standards and regulatory requirements.

User Experience Analysis (7/10)

Overall user satisfaction with Axi demonstrates solid performance with room for improvement in certain areas. The 3-star average rating across over 1,250 reviews indicates generally acceptable service levels, though this suggests some users experience issues that prevent higher satisfaction scores. Analysis of user feedback reveals a mixed but generally positive sentiment toward the broker's services.

Interface design and usability receive moderate praise. Most users find the account management portal and trading platform navigation intuitive and functional. The MetaTrader 4 platform's familiarity helps new users adapt quickly, while experienced traders appreciate the comprehensive feature set and customization options available for optimizing their trading workflow.

Registration and account verification processes generally proceed smoothly. However, some users report delays during peak application periods or when additional documentation requirements arise. The onboarding experience includes educational materials and platform tutorials that help new traders understand available features and begin trading with confidence.

Funding and withdrawal experiences vary by payment method and geographic location. Electronic transfers typically process efficiently while traditional banking methods may involve longer processing times. Users in certain regions report smoother experiences than others, likely reflecting differences in local banking infrastructure and regulatory requirements.

Common user complaints include occasional platform connectivity issues during extreme market volatility, limited advanced trading tools compared to institutional platforms, and varying customer service quality depending on inquiry complexity. However, positive feedback consistently mentions competitive trading costs, reliable execution, and helpful educational resources. The user base appears to consist primarily of retail traders and smaller institutional clients who value cost-effective trading conditions and reliable service delivery.

Conclusion

This comprehensive axi review reveals a well-established broker that successfully balances competitive trading conditions with regulatory compliance and customer service excellence. Axi's 18-year track record, combined with triple-tier regulation from ASIC, FCA, and DFSA, positions it as a trustworthy option for traders seeking reliable access to global financial markets.

The broker particularly suits traders who prioritize cost-effective trading conditions. Spreads from 0 pips and leverage up to 500:1 provide competitive advantages for active trading strategies. The strong customer service rating and comprehensive educational resources make it especially appropriate for intermediate traders looking to develop their skills while accessing professional-grade trading tools.

Key strengths include exceptional customer support, robust regulatory oversight, competitive pricing, and a comprehensive selection of trading instruments across multiple asset classes. Areas for improvement include enhancing platform features to match more advanced competitors and streamlining certain operational processes to improve overall user experience ratings. Overall, Axi represents a solid choice for forex and CFD traders seeking a balance between competitive conditions and regulatory security.