Regarding the legitimacy of equiti forex brokers, it provides CYSEC, FSA, FCA and WikiBit, (also has a graphic survey regarding security).

Is equiti safe?

Pros

Cons

Is equiti markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 8

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Equiti Global Markets Ltd

Effective Date:

2022-09-12Email Address of Licensed Institution:

compliance@equitiglobalmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.equiti-capital.com/cy-en/Expiration Time:

--Address of Licensed Institution:

Spyrou Kyprianou 82, EUROHOUSE Building, Office 11,Potamos Germasogeias, 4042, Limassol, CyprusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Equiti Brokerage (Seychelles) Ltd

Effective Date: Change Record

--Email Address of Licensed Institution:

localsupport@equiti.comSharing Status:

No SharingWebsite of Licensed Institution:

www.equiti.comExpiration Time:

--Address of Licensed Institution:

First Floor, Marina House, Eden Island SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Equiti Capital UK Limited

Effective Date:

2011-04-27Email Address of Licensed Institution:

compliance@equiti.comSharing Status:

No SharingWebsite of Licensed Institution:

www.equiticapital.co.ukExpiration Time:

--Address of Licensed Institution:

11 Ironmonger Lane London EC2V 8EY UNITED KINGDOMPhone Number of Licensed Institution:

+4402070970402Licensed Institution Certified Documents:

Is Equiti A Scam?

Introduction

Equiti is a prominent player in the forex and CFD trading markets, known for its global reach and diverse range of financial instruments. Established in 2008, Equiti operates under multiple regulatory frameworks and offers trading services across various regions, including Europe, the Middle East, and North Africa (MENA). As the trading landscape becomes increasingly saturated, it is essential for traders to exercise caution and thoroughly evaluate their chosen brokers. The integrity and reliability of a broker can significantly impact a trader's financial well-being. This article aims to provide a comprehensive analysis of Equiti, assessing its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The evaluation will rely on data from multiple trustworthy sources, including regulatory disclosures, user reviews, and industry comparisons.

Regulation and Legitimacy

Equiti's regulatory status is a critical factor in determining its legitimacy as a broker. The company is regulated by several reputable authorities, which adds a layer of security for traders. The following table summarizes the core regulatory information for Equiti:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| FCA | 528328 | United Kingdom | Verified |

| JSC | 50248 | Jordan | Verified |

| SCA | 20200000026 | UAE | Verified |

| CMA | 107 | Kenya | Verified |

| CBA | 0011 | Armenia | Verified |

| FSA | SD 064 | Seychelles | Verified |

The Financial Conduct Authority (FCA) in the UK is known for its stringent regulatory standards, requiring brokers to maintain significant capital reserves and adhere to strict operational guidelines. Equiti's compliance with the FCA signifies a commitment to safeguarding client interests. Additionally, the company is subject to the regulations of the Jordan Securities Commission (JSC) and the Securities and Commodities Authority (SCA) in the UAE, further enhancing its credibility.

Equiti has maintained a positive regulatory track record, with no significant historical compliance issues reported. This robust regulatory framework not only assures traders of the broker's legitimacy but also provides a safety net through compensation schemes in case of broker insolvency. Overall, the regulatory environment surrounding Equiti suggests that it operates within a legitimate framework, minimizing the likelihood of fraudulent activities.

Company Background Investigation

Equiti Group Ltd. was initially established as Divisa Capital in 2008 and has since undergone significant growth and restructuring. The company rebranded to Equiti in 2018 and has expanded its operations to include various subsidiaries worldwide. Equiti's headquarters are located in London, UK, with regional offices in Dubai, Amman, and other key financial hubs. This global presence allows Equiti to cater to a diverse clientele, offering localized services in multiple languages.

The management team at Equiti comprises experienced professionals from the finance and technology sectors, contributing to the company's operational efficiency and strategic direction. The leadership's expertise enhances the firm's ability to navigate the complexities of the financial markets and maintain compliance with various regulatory requirements.

Equiti is transparent about its operations, providing detailed information about its services, regulatory status, and trading conditions on its website. This level of transparency is crucial for building trust with clients and differentiating itself from less reputable brokers that may obscure important information.

Trading Conditions Analysis

Equiti offers competitive trading conditions, which are essential for attracting and retaining clients. The broker provides two primary account types: the Standard account and the Premier account. The fee structure is designed to cater to different trading styles and preferences.

The following table outlines the core trading costs associated with Equiti:

| Fee Type | Equiti | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.4 pips | 1.2 pips |

| Commission Model | $7 per lot (Premier) | $5 per lot |

| Overnight Interest Range | Varies | Varies |

The Standard account offers an average spread of 1.4 pips with no commissions, making it suitable for beginner and casual traders. In contrast, the Premier account, aimed at more experienced traders, features tighter spreads starting from 0 pips but incurs a commission of $7 per million traded. While the spreads offered by Equiti are competitive, they are slightly higher than the industry average for major currency pairs, which could impact high-frequency traders.

Equiti does not impose deposit or withdrawal fees, which is a significant advantage. However, traders should be aware of potential fees from payment providers, particularly for e-wallet transactions. Additionally, the broker does not charge inactivity fees, which is beneficial for traders who may not trade frequently.

Overall, Equiti's trading conditions are designed to be transparent and competitive, although the slightly higher spreads may deter some traders, particularly those seeking the lowest possible trading costs.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry, and Equiti has implemented several measures to protect its clients' investments. The broker adheres to strict regulatory requirements, ensuring that client funds are held in segregated accounts. This means that traders' funds are kept separate from the broker's operational funds, reducing the risk of loss in the event of the broker's insolvency.

Equiti also participates in compensation schemes, such as the Financial Services Compensation Scheme (FSCS) in the UK, which protects clients' deposits up to £85,000. This adds an additional layer of security for traders operating under the FCA's jurisdiction. Furthermore, Equiti employs advanced cybersecurity measures to safeguard client data and transactions, ensuring that sensitive information remains confidential and secure.

Despite these protective measures, it is essential for traders to remain vigilant and conduct due diligence when selecting a broker. Equiti has not faced significant historical issues related to client fund safety, reinforcing its reputation as a trustworthy broker.

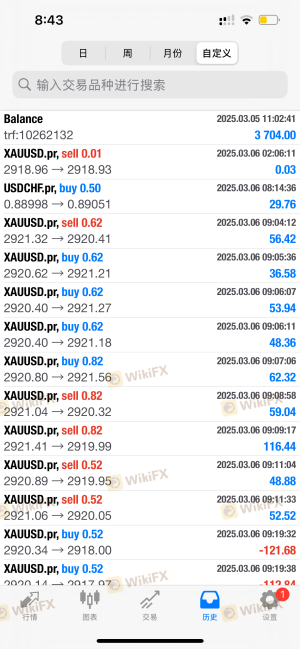

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Equiti has received a mix of positive and negative reviews from users, reflecting a range of experiences. The broker's customer support is available 24/6, and traders can reach out via email, phone, or live chat. However, some users have reported delays in response times, particularly during peak trading hours.

The following table summarizes common complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Slow customer support | Medium | Mixed feedback |

| High spreads | Low | Addressed |

| Withdrawal delays | High | Under investigation |

Several traders have expressed dissatisfaction with the slow response times from customer support, particularly when seeking assistance with account issues or technical difficulties. However, many users have also praised the support team's professionalism and knowledge when they could connect with them.

A notable case involved a trader experiencing significant delays in withdrawing funds. While the broker ultimately resolved the issue, it highlighted potential areas for improvement in Equiti's withdrawal processing times. Overall, while there are areas for enhancement, the general sentiment towards Equiti's customer service is relatively positive.

Platform and Trade Execution

Equiti offers its clients access to two primary trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are well-regarded in the trading community for their user-friendly interfaces, advanced charting tools, and comprehensive analytical capabilities. The performance of these platforms is generally stable, with traders reporting fast execution speeds and minimal slippage.

However, some users have noted occasional instances of slippage during high volatility periods, which is not uncommon in the forex market. Equiti's execution model is based on no dealing desk (NDD) technology, which means that orders are sent directly to liquidity providers without interference. This model is designed to enhance transparency and ensure that traders receive the best available prices.

While there have been no significant reports of platform manipulation or unethical practices, traders should remain aware of the inherent risks associated with trading, particularly during volatile market conditions.

Risk Assessment

Engaging with any broker carries inherent risks, and Equiti is no exception. The following table summarizes the key risk areas associated with trading through Equiti:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by multiple authorities. |

| Execution Risk | Medium | Occasional slippage during volatility. |

| Fund Safety Risk | Low | Segregated accounts and compensation schemes in place. |

| Customer Support Risk | Medium | Mixed feedback on response times. |

To mitigate risks, traders should carefully consider their trading strategies and maintain a diversified portfolio. Additionally, ensuring that they have a clear understanding of the trading conditions and fees associated with their accounts can help minimize potential losses.

Conclusion and Recommendations

In conclusion, Equiti is a well-regulated broker with a solid reputation in the forex and CFD trading markets. The company's adherence to strict regulatory standards, combined with its commitment to client fund safety, positions it as a trustworthy option for traders. While there are areas for improvement, particularly in customer support response times and withdrawal processing, the overall sentiment towards Equiti remains positive.

For traders considering Equiti, it is essential to weigh the benefits of competitive trading conditions and regulatory protection against the potential drawbacks of higher spreads and occasional execution issues. New traders may find Equiti's educational resources and demo accounts particularly beneficial for developing their trading skills.

For those seeking alternatives, reputable brokers such as IG, OANDA, and Forex.com offer similar services with competitive pricing and robust support, providing additional options for traders looking to navigate the forex market safely.

Is equiti a scam, or is it legit?

The latest exposure and evaluation content of equiti brokers.

equiti Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

equiti latest industry rating score is 5.05, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.05 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.