Regarding the legitimacy of AVATRADE forex brokers, it provides ASIC, FSA, CBI, ADGM, FSCA and WikiBit, (also has a graphic survey regarding security).

Is AVATRADE safe?

Pros

Cons

Is AVATRADE markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

AVA CAPITAL MARKETS AUSTRALIA PTY LTD

Effective Date: Change Record

2011-11-09Email Address of Licensed Institution:

D.Ferguson@avatrade.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

AVA CAPITAL MARKETS AUSTRALIA C/- WEWORK G 320 PITT ST SYDNEY NSW 2000Phone Number of Licensed Institution:

1800206496Licensed Institution Certified Documents:

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

アヴァトレード・ジャパン株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都港区赤坂2-18-1 赤坂ヒルサイドビル4階Phone Number of Licensed Institution:

03-4577-8900Licensed Institution Certified Documents:

CBI Market Making License (MM) 20

Central Bank of Ireland

Central Bank of Ireland

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

AVA Trade EU Limited

Effective Date:

2009-07-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

DocklineMayor StreetDublin 1Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

ADGM Forex Execution License (STP)

Abu Dhabi Global Market

Abu Dhabi Global Market

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Ava Trade Middle East Limited

Effective Date:

2020-02-06Email Address of Licensed Institution:

f.abouras@avatrade.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

United Arab Emirates, Abu Dhabi, Maryah Island, Cloud Suite 306-307, 11th Floor, Al Sarab Tower, Abu Dhabi Global Market SquarePhone Number of Licensed Institution:

+971544313777Licensed Institution Certified Documents:

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

AVA CAPITAL MARKETS (PTY) LTD

Effective Date:

2015-11-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

NESLON MANDELA SQUARE, OFFICE TOWERS WES SANDTON JOHANNESBURG 2196Phone Number of Licensed Institution:

+27 0118815875Licensed Institution Certified Documents:

Is AvaTrade A Scam?

Introduction

AvaTrade, founded in 2006 and headquartered in Dublin, Ireland, is a prominent player in the forex and CFD trading markets. With a global presence and a diverse range of trading instruments, including forex, commodities, cryptocurrencies, and indices, AvaTrade has attracted a significant number of traders worldwide. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with AvaTrade. This article aims to provide a comprehensive analysis of AvaTrade, focusing on its regulatory status, company background, trading conditions, client fund security, customer feedback, platform performance, and associated risks. The evaluation is based on extensive research, including reviews from reputable financial websites, regulatory information, and user testimonials.

Regulation and Legitimacy

AvaTrade operates under the supervision of multiple regulatory authorities across different jurisdictions, which is a significant factor in determining its legitimacy and trustworthiness. The presence of regulation ensures that the broker adheres to strict financial standards and practices designed to protect clients. Below is a summary of AvaTrade's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Central Bank of Ireland (CBI) | C53877 | Ireland | Verified |

| Australian Securities and Investments Commission (ASIC) | 406684 | Australia | Verified |

| Financial Services Authority (FSA) | 1662 | Japan | Verified |

| Financial Sector Conduct Authority (FSCA) | 45984 | South Africa | Verified |

| British Virgin Islands Financial Services Commission (BVIFSC) | SIBA/L/13/1049 | British Virgin Islands | Verified |

| Abu Dhabi Global Market (ADGM) | 190018 | UAE | Verified |

AvaTrade's regulation by tier-1 authorities such as the CBI and ASIC is particularly noteworthy, as these regulators impose stringent compliance requirements on brokers. Furthermore, AvaTrade has maintained a clean regulatory history, with no significant penalties or sanctions reported against it. This robust regulatory framework enhances the broker's credibility and provides clients with a level of confidence in their operations.

Company Background Investigation

AvaTrade has a rich history spanning over 15 years in the online trading industry. Initially established to provide retail traders access to the forex market, the company has since expanded its offerings to include a wide array of financial instruments. AvaTrade is owned by Ava Capital Markets Ltd., which operates through various subsidiaries across the globe, each regulated by local authorities.

The management team at AvaTrade comprises experienced professionals with backgrounds in finance and technology, contributing to the broker's innovative approach and commitment to customer service. The company emphasizes transparency and information disclosure, regularly updating its clients on market conditions and trading opportunities. AvaTrades website is comprehensive, providing detailed information on trading conditions, fees, and educational resources, which further supports its reputation for transparency.

Trading Conditions Analysis

AvaTrade's trading conditions are competitive, characterized by a transparent fee structure and a variety of trading instruments. The broker operates on a spread-only model, meaning that it does not charge commissions on trades. Below is a comparison of AvaTrade's core trading costs against industry averages:

| Fee Type | AvaTrade | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.9 pips | 1.2 pips |

| Commission Model | None | Varies by broker |

| Overnight Financing Costs | Varies | Varies |

AvaTrade's spreads are generally competitive, particularly for major currency pairs. However, the broker does impose inactivity fees, charging $50 after three months of inactivity and an additional $100 after one year. This fee structure may be considered high compared to some competitors, which do not charge inactivity fees.

Client Fund Security

The safety of client funds is a paramount concern for any trader. AvaTrade implements several measures to ensure the security of its clients' funds. Client funds are held in segregated accounts, separate from the broker's operational funds, which protects clients in the event of financial difficulties faced by the broker. Additionally, AvaTrade offers negative balance protection, ensuring that clients cannot lose more than their deposited amount.

AvaTrade also participates in investor compensation schemes in certain jurisdictions, providing additional financial protection for clients in case of insolvency. The broker employs advanced encryption technology to secure online transactions and personal data, further enhancing the safety of client funds.

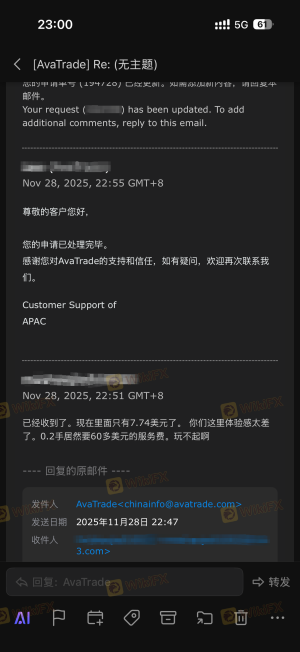

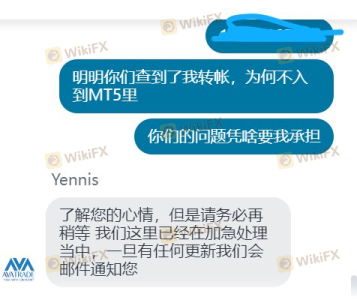

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. AvaTrade generally receives positive reviews for its user-friendly platforms and comprehensive educational resources. However, some common complaints have been noted, particularly regarding withdrawal processing times and customer support responsiveness.

Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Mixed responses |

| Customer Support Quality | High | Improvement needed |

| Inactivity Fees | Medium | Clearly stated in policies |

For instance, some users have reported delays in processing withdrawals, which can take up to five business days. While AvaTrade has a responsive customer support team, there have been instances where clients experienced long wait times for assistance. Overall, while the majority of feedback is positive, the broker could enhance its customer service to address these concerns more effectively.

Platform and Trade Execution

AvaTrade offers a variety of trading platforms, including its proprietary web-based platform, AvaTrade Go, and the widely-used MetaTrader 4 and 5. The platforms are designed to provide a seamless trading experience, featuring advanced charting tools and technical indicators.

In terms of order execution, AvaTrade generally maintains a good reputation, with most trades executed promptly. However, there have been occasional reports of slippage, particularly during periods of high market volatility. The broker's commitment to transparency is evident in its execution policies, which are clearly outlined on its website.

Risk Assessment

Engaging with AvaTrade, like any trading activity, comes with inherent risks. Below is a summary of the key risk areas associated with trading with AvaTrade:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight |

| Market Risk | High | Exposure to market volatility |

| Operational Risk | Medium | Occasional withdrawal delays |

| Customer Service Risk | Medium | Mixed feedback on support responsiveness |

To mitigate these risks, traders are advised to stay informed about market conditions, utilize risk management tools offered by AvaTrade, and maintain open communication with customer support for any issues that may arise.

Conclusion and Recommendations

Based on the comprehensive evaluation, AvaTrade is a legitimate and well-regulated broker with a solid reputation in the forex and CFD trading industry. There are no substantial indications of fraudulent activity, and the broker's commitment to regulatory compliance and client fund security is commendable.

For traders, especially beginners, AvaTrade offers a user-friendly platform, extensive educational resources, and a variety of trading instruments. However, potential clients should be aware of the inactivity fees and the occasional delays in withdrawal processing.

In summary, AvaTrade is a suitable choice for traders looking for a reliable trading environment. However, for those seeking a broker with a wider array of trading instruments or lower inactivity fees, it may be beneficial to explore alternative options such as eToro or IG.

Is AVATRADE a scam, or is it legit?

The latest exposure and evaluation content of AVATRADE brokers.

AVATRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AVATRADE latest industry rating score is 9.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 9.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.