Regarding the legitimacy of fpmarkets forex brokers, it provides ASIC, CYSEC and WikiBit, (also has a graphic survey regarding security).

Is fpmarkets safe?

Pros

Cons

Is fpmarkets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

First Prudential Markets Pty Ltd

Effective Date: Change Record

2005-05-31Email Address of Licensed Institution:

compliance@fpmarkets.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.fpmarkets.com.auExpiration Time:

--Address of Licensed Institution:

MATHEW MURPHIE L 5 10 BRIDGE ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0282526800Licensed Institution Certified Documents:

CYSEC Derivatives Trading License (STP) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

First Prudential Markets Ltd

Effective Date:

2018-11-19Email Address of Licensed Institution:

supportdesk@fpmarkets.euSharing Status:

No SharingWebsite of Licensed Institution:

www.fpmarkets.eu, www.fpmarkets.com/euExpiration Time:

--Address of Licensed Institution:

25 Serifou, Office 101/2, 3046, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 589 200Licensed Institution Certified Documents:

Is FP Markets A Scam?

Introduction

FP Markets, established in 2005 and headquartered in Sydney, Australia, has positioned itself as a significant player in the forex and CFD trading markets. The broker offers a diverse range of trading instruments, including over 10,000 assets across various asset classes, including forex, commodities, indices, and cryptocurrencies. As the online trading landscape continues to evolve, it is crucial for traders to exercise caution when selecting a broker. With numerous options available, the potential for scams and unreliable brokers looms large. This article aims to provide an objective assessment of FP Markets, evaluating its regulatory status, company background, trading conditions, customer safety measures, and overall reputation based on user feedback. The investigation is based on a thorough analysis of multiple credible sources, including regulatory filings, customer reviews, and industry reports.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its legitimacy and reliability. FP Markets is regulated by several reputable authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies impose stringent requirements on brokers, ensuring they adhere to high standards of conduct and financial security.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 286354 | Australia | Verified |

| CySEC | 371/18 | Cyprus | Verified |

| FSA | 126 LLC 2019 | St. Vincent & the Grenadines | Verified |

| FSC | GB 21026264 | Mauritius | Verified |

| FSCA | 50926 | South Africa | Verified |

| CMA | 103 | Kenya | Verified |

The presence of ASIC as a tier-1 regulator indicates that FP Markets is subject to rigorous oversight, which includes maintaining adequate capital reserves and ensuring client funds are held in segregated accounts. Furthermore, FP Markets has not faced significant regulatory infractions or penalties, which enhances its credibility. However, it is important to note that while the ASIC and CySEC entities provide robust protections, the offshore entities, such as those in St. Vincent and the Grenadines, may not offer the same level of security, as they are subject to less stringent regulations.

Company Background Investigation

FP Markets was founded in 2005 and has grown to become one of the leading forex and CFD brokers globally. The company operates under the umbrella of First Prudential Markets Pty Ltd, which is owned by a group of financial professionals with extensive experience in the trading industry. The management team comprises individuals with backgrounds in finance, trading, and technology, contributing to the broker's reputation for transparency and reliability.

FP Markets has consistently demonstrated a commitment to providing a secure trading environment and has received numerous awards for its services, including recognition for customer satisfaction and execution quality. The company maintains a high level of transparency, with clear disclosures regarding its operations, fees, and trading conditions. This transparency is crucial for building trust with clients, as it allows traders to make informed decisions based on accurate information.

Trading Conditions Analysis

FP Markets offers a competitive trading environment with a variety of account types, including standard and raw accounts. The fee structure is designed to cater to different trading styles, with the standard account featuring wider spreads but no commissions, while the raw account offers tighter spreads with a commission fee.

| Fee Type | FP Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.0 pips (Standard) / 0.0 pips (Raw) | 1.2 pips |

| Commission Model | $3 per side (Raw) | $5 per side |

| Overnight Interest Range | Varies by instrument | Varies by instrument |

The overall trading costs at FP Markets are considered competitive, particularly for high-frequency traders who benefit from the raw account's low spreads. However, some users have reported high fees associated with stock CFDs, which may deter certain traders. The absence of deposit and withdrawal fees further enhances the broker's appeal, although some payment methods may incur third-party charges.

Customer Funds Safety

FP Markets implements several measures to ensure the safety of client funds. Client deposits are held in segregated accounts at top-tier banks, which means that client funds are kept separate from the broker's operating capital. This segregation protects traders' funds in the event of the broker facing financial difficulties. Furthermore, FP Markets offers negative balance protection, ensuring that clients cannot lose more than their account balance.

Despite these safety measures, it is essential for traders to be aware of the potential risks associated with trading with an offshore entity. While the ASIC and CySEC-regulated entities provide a high level of security, the offshore entities may not offer the same protections. As such, traders should carefully consider which entity they are trading with and the associated risks.

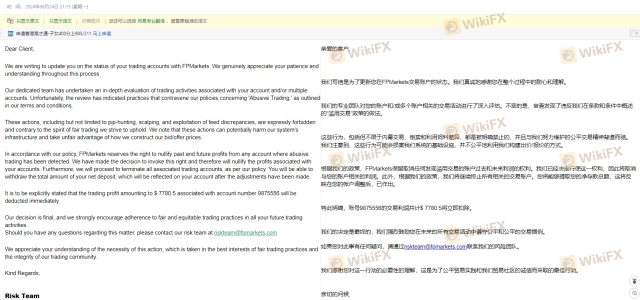

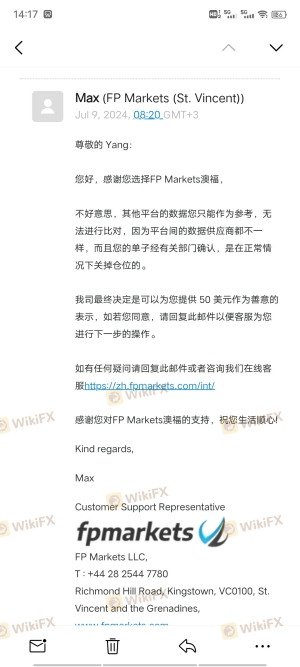

Customer Experience and Complaints

Customer feedback provides valuable insights into the overall experience of trading with FP Markets. Many users report positive experiences, highlighting the broker's competitive spreads, fast execution times, and responsive customer service. However, there are also common complaints regarding withdrawal delays and account management issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Account Management Issues | High | Mixed responses |

One notable case involved a trader who experienced difficulties withdrawing funds after a series of profitable trades. While the broker eventually resolved the issue, the initial delay caused frustration. Such instances highlight the importance of effective communication and timely responses from the broker.

Platform and Execution

FP Markets provides access to several trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, which are known for their reliability and advanced features. The broker emphasizes low-latency execution, and many users report positive experiences regarding order execution quality and minimal slippage. However, there have been occasional reports of rejected orders during periods of high volatility, which can be a concern for traders relying on precise execution.

Risk Assessment

Using FP Markets involves certain risks that traders should consider. The broker's regulatory status provides a level of reassurance, but the presence of offshore entities introduces potential vulnerabilities.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Varies by entity |

| Execution Risk | Medium | Occasional slippage/rejections |

| Fund Safety Risk | Low | Segregated accounts |

To mitigate these risks, traders are advised to conduct thorough research and consider trading only with the ASIC and CySEC-regulated entities.

Conclusion and Recommendations

In conclusion, FP Markets is a well-regulated broker that offers a competitive trading environment with a diverse range of instruments. The broker's strong regulatory oversight from ASIC and CySEC enhances its credibility, while its commitment to client safety through fund segregation and negative balance protection further solidifies its reputation.

However, potential traders should be cautious of the risks associated with offshore entities and should ensure they are trading with the regulated branches of the broker. Overall, FP Markets appears to be a legitimate and trustworthy option for both novice and experienced traders. For those seeking alternatives, brokers like IC Markets and Pepperstone may also provide competitive trading conditions and regulatory oversight.

Is fpmarkets a scam, or is it legit?

The latest exposure and evaluation content of fpmarkets brokers.

fpmarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

fpmarkets latest industry rating score is 8.88, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.88 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.