FBS 2025 Review: Everything You Need to Know

Executive Summary

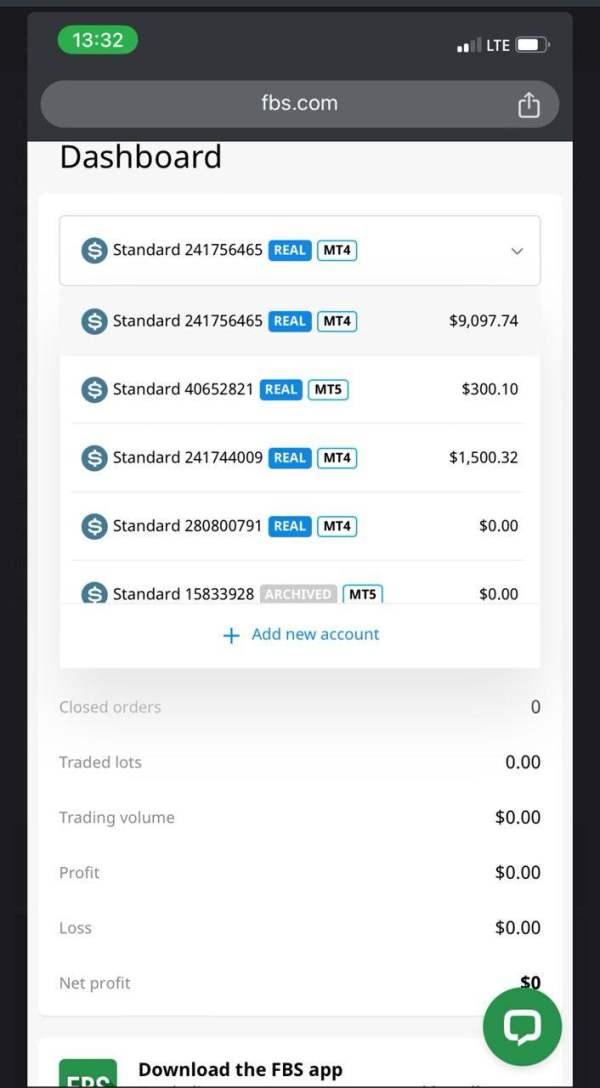

FBS is one of the most trusted forex and CFD brokers in the world. This broker stands out for its beginner-friendly approach and easy trading conditions that new traders can understand. Founded in 2009 and based in Belize City, Belize, this fbs review shows a broker that has built a huge client base of over 27 million traders across more than 100 countries.

The broker offers great trading conditions with spreads starting from 0 pips and a very low minimum deposit of just $5. This makes it easy for newcomers to start forex trading without spending much money. FBS works under multiple rules including ASIC, CySEC, and IFSC, giving clients negative balance protection and better security.

This detailed analysis shows that FBS mainly targets beginner traders and small investors who want reliable, cheap trading solutions. The broker removes the barrier of high starting costs that many other companies require. With over 90 industry awards and recognition from various financial authorities, FBS has proven itself as a credible player in the competitive forex brokerage space.

The company offers over 72 forex pairs along with metals, indices, and stock CFDs for diverse trading opportunities.

Important Disclaimers

Traders should know that FBS operates through different regional companies under various regulatory rules. These include the Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), and International Financial Services Commission (IFSC). These different regulatory frameworks may result in varying trading conditions, client protections, and available services depending on where the trader lives and which specific FBS entity they deal with.

This evaluation is based on detailed analysis of available regulatory information, user feedback from multiple sources, and public data about FBS's operations and services. The information presented reflects the most current data available at the time of writing, though specific terms and conditions may vary by region and can change. Prospective clients should verify current regulations and terms directly with FBS before opening an account.

Rating Framework

Broker Overview

FBS Markets started in the forex brokerage world in 2009. The company set up its headquarters in Belize City, Belize, as a private company dedicated to providing easy forex and CFD trading services that regular people could use. Over the past 15 years, the company has shown remarkable growth, expanding its operations to serve clients across more than 100 countries around the world.

The broker has successfully built a huge client base with more than 27 million traders. FBS has also developed a network of over 700,000 partners worldwide, which shows strong market reach and business development skills that few other brokers can match. The company's business model centers on providing complete forex and CFD trading services with a particular focus on serving beginner traders and those with limited starting money.

FBS operates as a market maker and STP (Straight Through Processing) broker, offering multiple account types designed to fit different trading styles and experience levels. The broker's smart focus on emerging markets and developing economies has helped significantly with its rapid expansion and client growth success. According to multiple industry sources, this fbs review confirms that FBS operates under a multi-jurisdictional regulatory framework, maintaining compliance with the Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), and International Financial Services Commission (IFSC).

This regulatory diversity allows the broker to serve clients across different geographical regions while maintaining appropriate oversight and client protection standards. The company's asset offerings include traditional forex pairs, precious metals, stock indices, individual stock CFDs, and commodities, providing traders with a complete range of instruments for portfolio diversification that meets most trading needs.

Regulatory Jurisdictions: FBS maintains regulatory compliance across multiple jurisdictions, with ASIC regulation covering Australian clients, CySEC oversight for European Union traders, and IFSC supervision for international markets. This multi-regulatory approach ensures that the broker meets different regional requirements while providing appropriate client protections based on local financial regulations that vary from country to country.

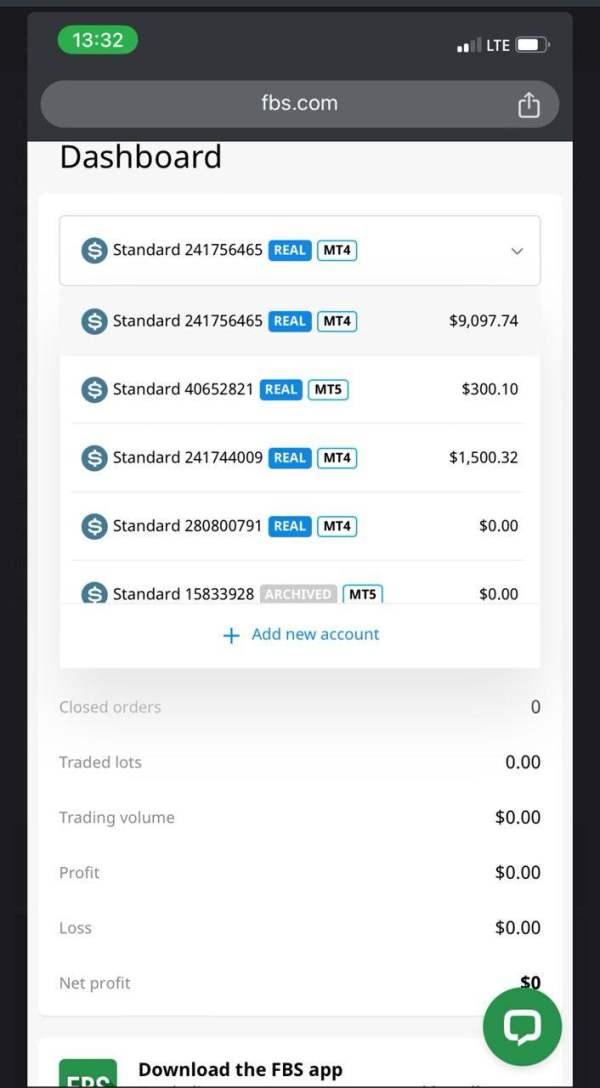

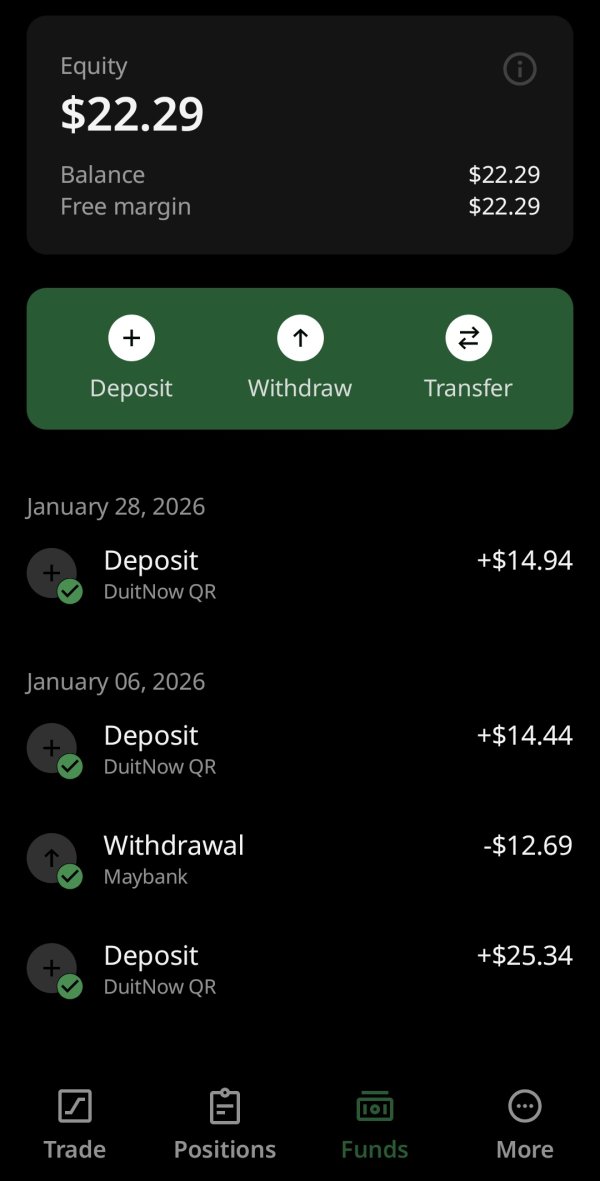

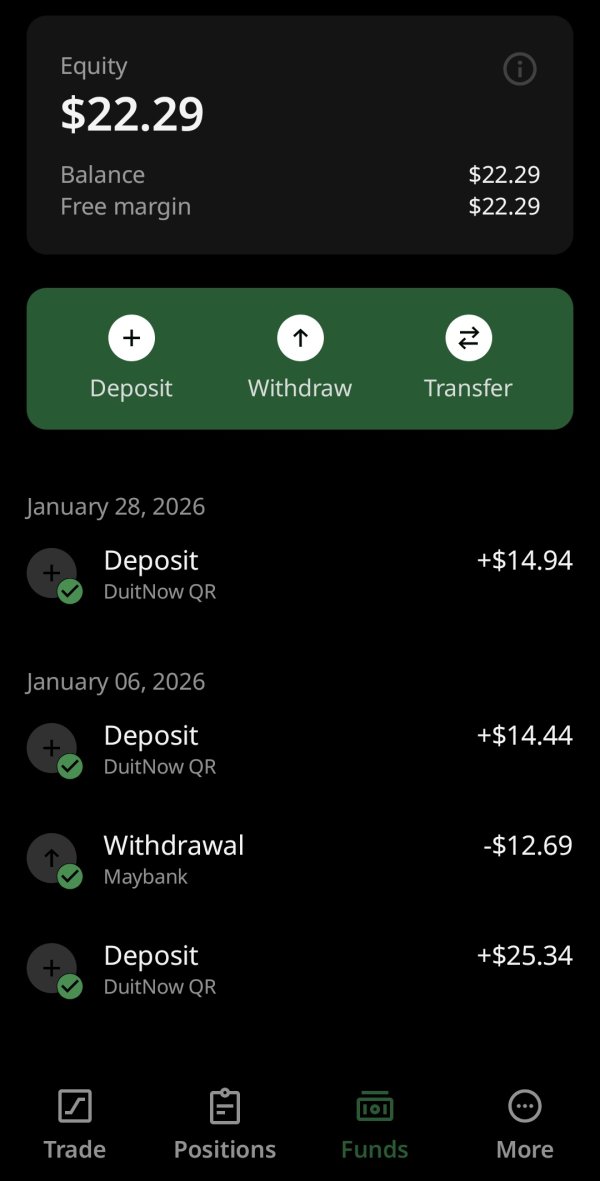

Deposit and Withdrawal Methods: While specific payment methods are not extensively detailed in available sources, FBS supports various funding options typical of international brokers. The standout feature remains the exceptionally low minimum deposit requirement of just $5, making it one of the most accessible brokers for new traders entering the forex market without much starting capital.

Minimum Deposit Requirements: The $5 minimum deposit represents one of FBS's most competitive features, particularly appealing to beginner traders who want to start with minimal financial risk. This low barrier to entry significantly differentiates FBS from many competitors who typically require minimum deposits ranging from $100 to $500, which can be too much for many new traders to afford.

Promotional Offerings: Available information indicates that FBS provides various promotional programs and bonuses, though specific details about current promotional terms, conditions, and availability require direct verification with the broker as these programs frequently change and may vary by region. Traders should always check current offers directly with FBS to get accurate information about what bonuses might be available to them.

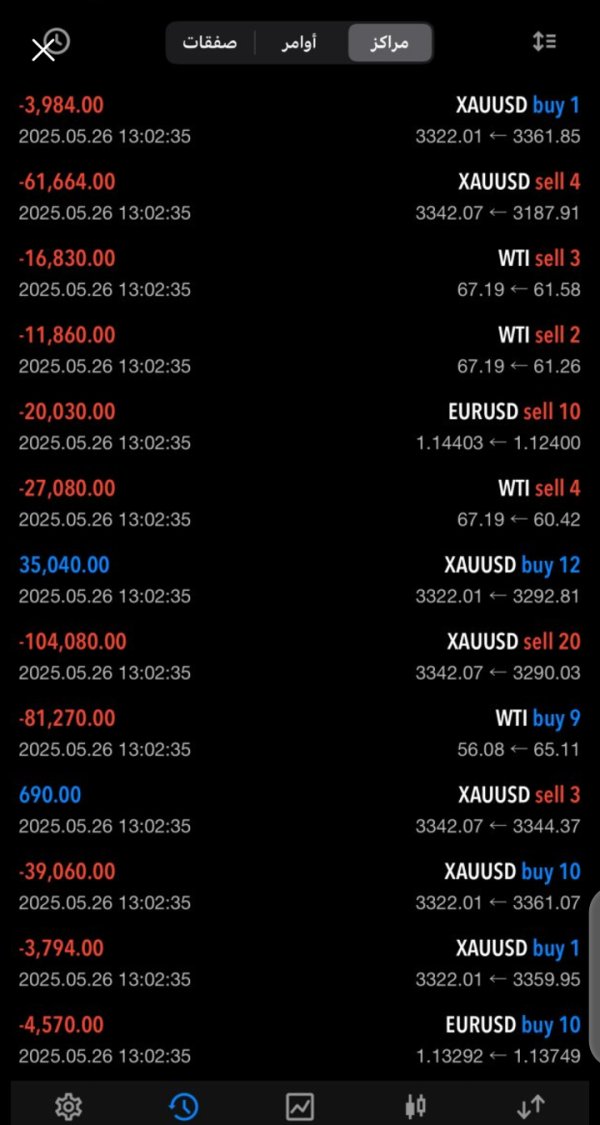

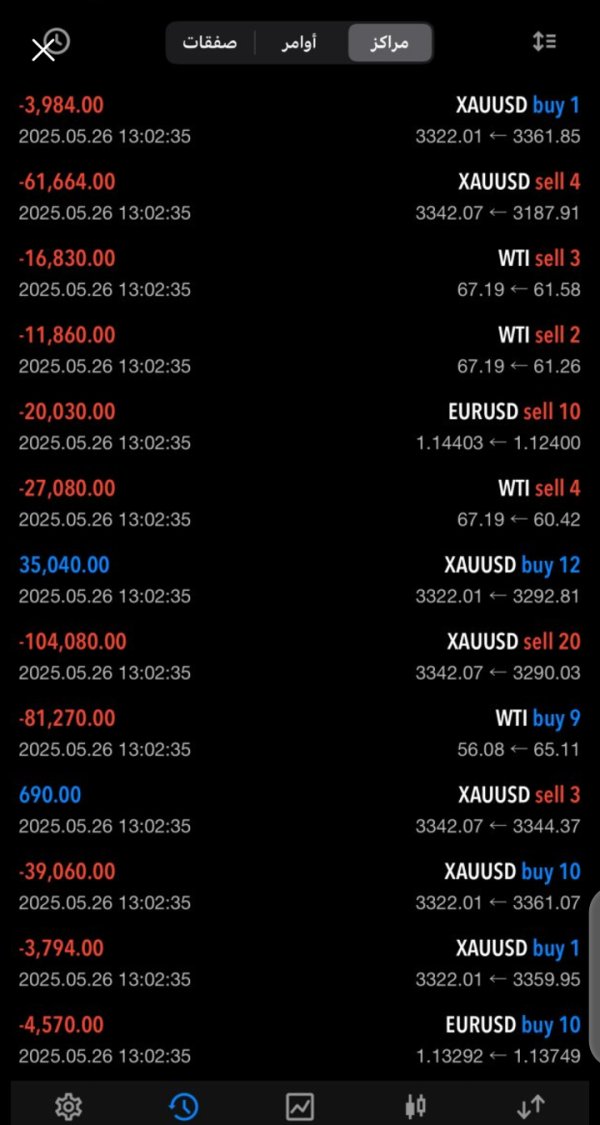

Tradeable Assets: FBS offers an extensive range of trading instruments including over 72 forex currency pairs covering major, minor, and exotic combinations. Additionally, traders can access precious metals like gold and silver, major stock indices from global markets, individual stock CFDs, and commodity futures, providing complete market exposure opportunities that allow for diverse trading strategies.

Cost Structure Analysis: This fbs review highlights that FBS offers highly competitive spreads starting from 0 pips on major currency pairs, though specific commission structures and account-type variations in pricing are not fully detailed in available sources. The zero-spread offering particularly benefits scalping strategies and high-frequency trading approaches where every pip counts toward profitability.

Leverage Ratios: Specific leverage ratios are not extensively documented in available materials, though international regulatory standards typically limit retail client leverage to 1:30 for major currency pairs in regulated jurisdictions, with higher leverage potentially available for professional clients. Traders should verify current leverage offerings directly with FBS based on their location and account type.

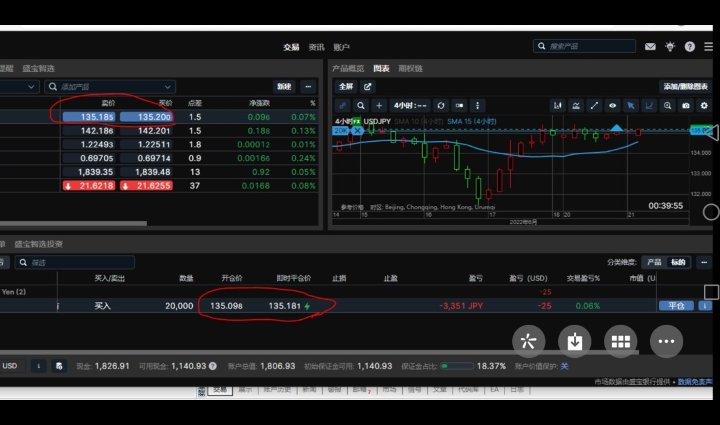

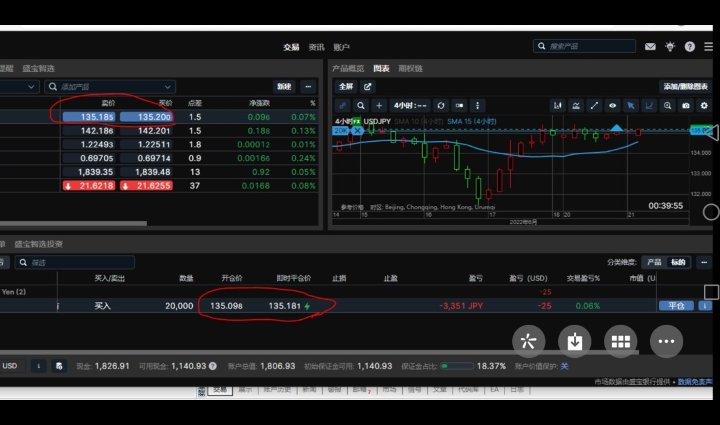

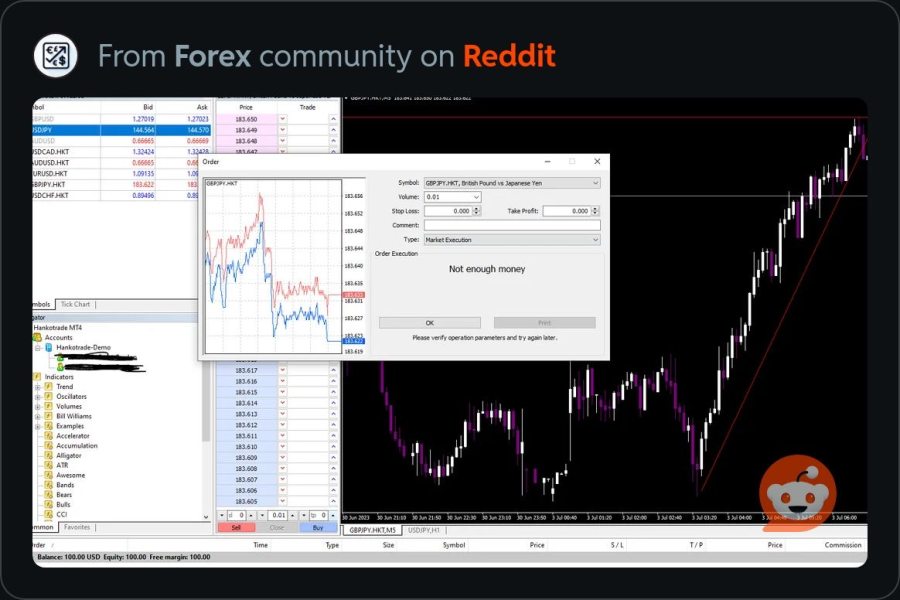

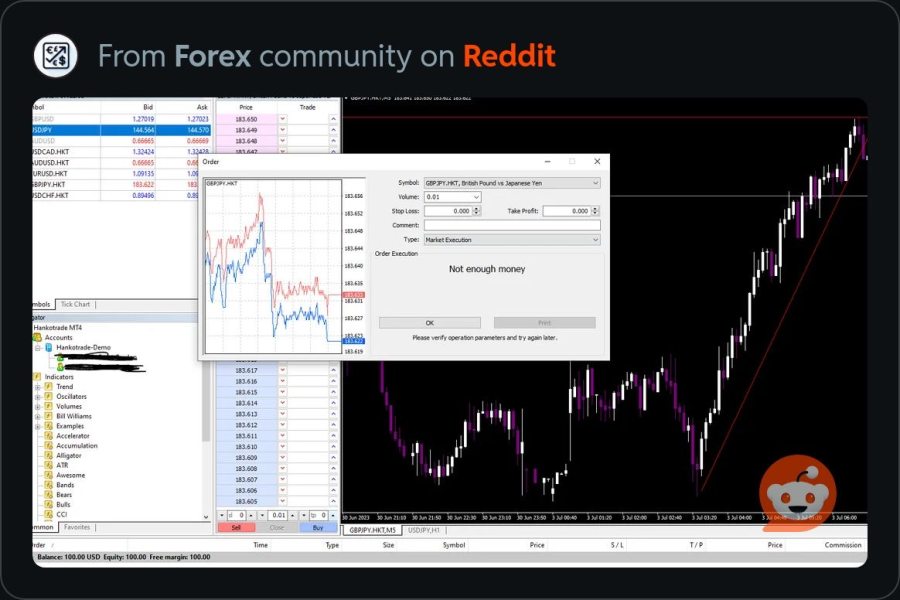

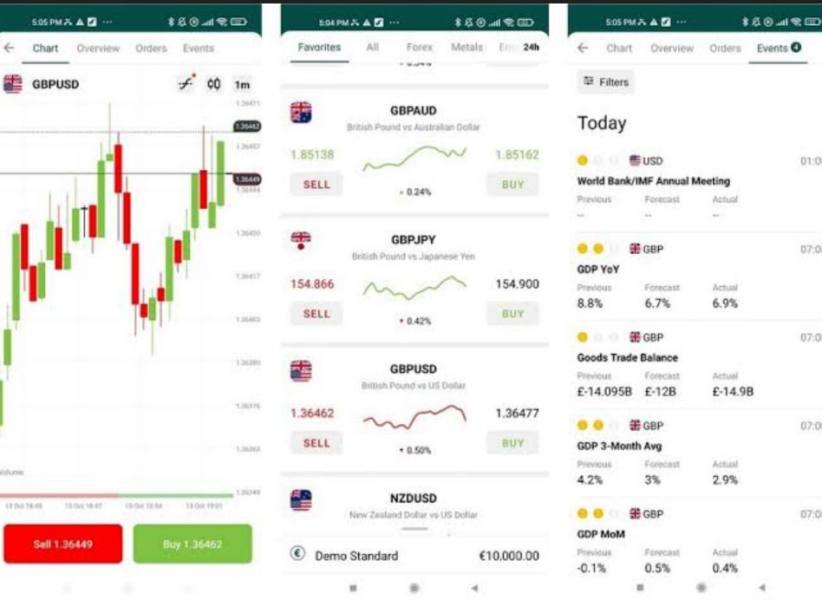

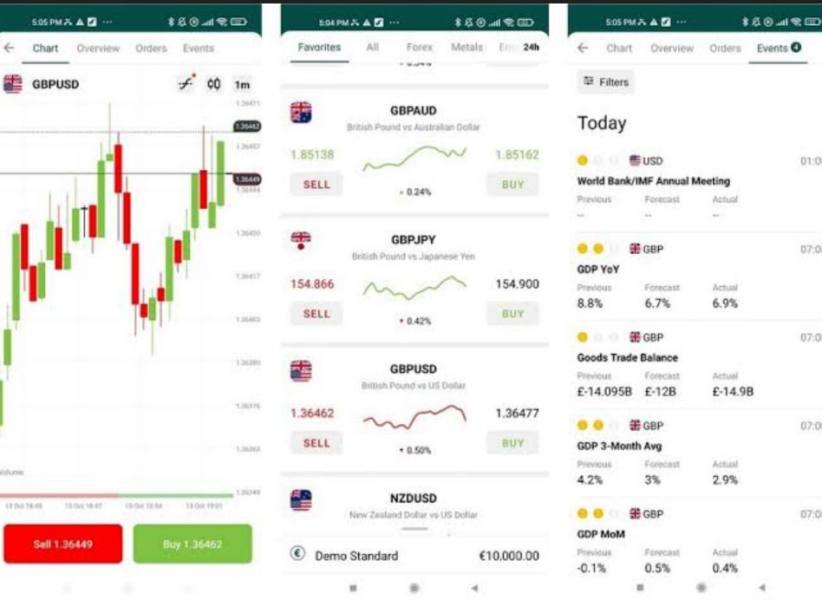

Platform Options: While specific trading platform details require further verification, FBS likely offers industry-standard platforms including MetaTrader 4 and MetaTrader 5, which are common among international forex brokers. These platforms provide the tools and features that most traders need for successful trading activities.

Geographic Restrictions: Available information suggests that FBS serves clients globally across 100+ countries, though specific restrictions may apply based on local regulations and licensing requirements in certain jurisdictions. Potential clients should check if their country is accepted before starting the account opening process.

Customer Support Languages: Given the broker's global reach and diverse client base, multilingual support is likely available, though specific language options and availability hours are not detailed in current sources. Traders who need support in specific languages should verify availability before opening an account.

Account Conditions Analysis

FBS demonstrates exceptional accessibility in its account conditions, particularly through its industry-leading minimum deposit requirement of just $5. This fbs review reveals that this low entry barrier represents one of the most competitive offerings in the forex brokerage industry, making it particularly attractive for beginner traders who want to start their trading journey without significant financial commitment that could cause stress or financial hardship.

The broker's approach to account accessibility extends beyond just low deposits, encompassing a structure designed to accommodate traders at various experience levels. While specific details about the variety of account types are not extensively documented in available sources, the broker's focus on beginner traders suggests multiple account tiers with varying features and benefits that grow with trader experience. The account opening process appears streamlined, though specific verification requirements and timeframes for account approval are not detailed in current materials.

The $5 minimum deposit requirement stands in stark contrast to many established brokers who typically require $100-$500 minimum deposits, positioning FBS as exceptionally accessible for new traders. This low barrier to entry, combined with negative balance protection, creates a risk-managed environment where beginners can gain real trading experience without substantial financial exposure that could lead to significant losses. However, specific information about Islamic account availability, account management features, and premium account benefits requires direct verification with the broker.

User feedback regarding account conditions generally reflects satisfaction with the accessibility and straightforward account structure, though comprehensive user experience data is limited in available sources. The broker's focus on emerging markets and developing economies aligns well with its low minimum deposit strategy, making forex trading accessible to demographics that might otherwise be excluded from the market due to high entry costs.

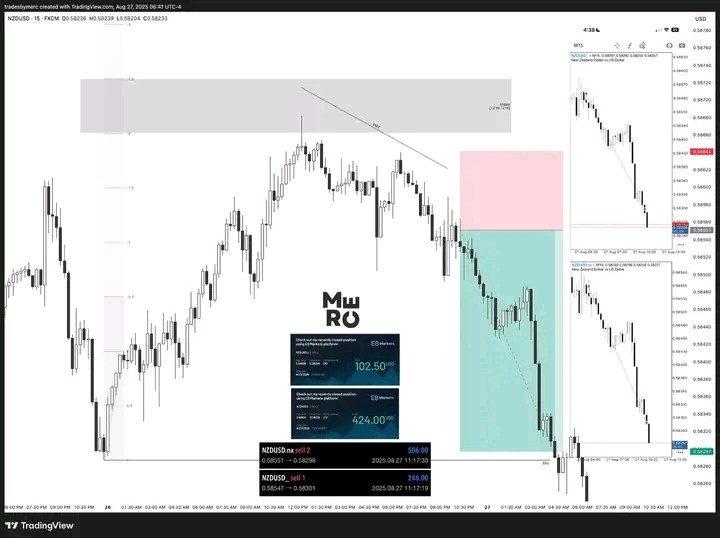

FBS provides a comprehensive suite of trading instruments that caters to diverse trading strategies and market preferences. This fbs review confirms that the broker offers over 72 forex pairs, covering major currency combinations like EUR/USD, GBP/USD, and USD/JPY, alongside minor and exotic pairs that provide opportunities for experienced traders seeking higher volatility and unique market dynamics that can lead to profitable trading opportunities.

The extensive forex offering ensures that traders can access virtually any currency combination they wish to trade. Beyond forex, FBS expands its instrument offering to include precious metals trading, particularly gold and silver, which serve as important hedging instruments and alternative investments during market uncertainty when traditional currencies might be unstable. The broker also provides access to major global stock indices, allowing traders to capitalize on broader market movements without trading individual stocks.

Additionally, individual stock CFDs enable traders to take positions on specific companies across various global markets. While specific details about research and analysis resources are not extensively documented in available sources, the broker's focus on beginner traders suggests that educational materials and market analysis tools are likely available to support trading decisions and help new traders learn the market. However, the quality and comprehensiveness of these resources require direct evaluation through the broker's platform.

The availability of automated trading support, expert advisors, and algorithmic trading tools is not clearly detailed in current materials, though the likely inclusion of MetaTrader platforms would suggest standard automated trading capabilities. Educational resources, webinars, and training materials are presumably available given the broker's beginner-focused positioning, but specific details about the scope and quality of these offerings need verification directly from FBS.

Customer Service and Support Analysis

Customer service and support capabilities represent a crucial aspect of any brokerage operation, yet specific details about FBS's customer support infrastructure are not extensively documented in available sources. The broker's global reach across 100+ countries suggests that multilingual support capabilities are likely in place to serve its diverse international client base, though specific language options and availability hours require direct verification with the company.

Given FBS's focus on serving beginner traders, responsive and helpful customer support would be essential for addressing the numerous questions and concerns that new traders typically have. However, specific information about support channels (live chat, email, phone), response times, and service quality metrics is not detailed in current materials, making it difficult to assess the actual quality of support services. The broker's substantial client base of over 27 million traders suggests that robust customer support systems must be in place to handle the volume of inquiries and requests.

Additionally, the company's network of over 700,000 partners indicates extensive relationship management capabilities, though this doesn't necessarily translate directly to retail customer support quality. User feedback regarding customer service quality is not extensively documented in available sources, making it difficult to assess actual service delivery performance based on real customer experiences. Prospective clients should consider testing the broker's customer support responsiveness during the account opening process to evaluate service quality firsthand.

The availability of 24/7 support, particularly important in forex trading due to global market hours, is not specifically confirmed in current materials. Traders who need round-the-clock support should verify availability before committing to the broker.

Trading Experience Analysis

The trading experience at FBS appears to be structured around competitive cost conditions and beginner-friendly execution, with spreads starting from 0 pips representing a significant advantage for cost-conscious traders. This fbs review indicates that these tight spreads can substantially reduce trading costs, particularly for scalping strategies and high-frequency trading approaches where spread costs can quickly accumulate and eat into profits.

Platform stability and execution speed are critical factors in trading experience, yet specific performance metrics regarding order execution times, slippage rates, and platform uptime are not detailed in available sources. The broker's substantial client base suggests that robust technical infrastructure must be in place to handle significant trading volumes, though specific performance benchmarks require direct evaluation through actual trading experience. Order execution quality, including fill rates and requote frequency, represents another crucial aspect of trading experience that is not extensively documented in current materials.

The broker's regulatory oversight from ASIC, CySEC, and IFSC suggests adherence to execution quality standards, though specific performance data is not available for analysis. Mobile trading capabilities and platform functionality across different devices are increasingly important for modern traders, yet specific details about FBS's mobile offerings and cross-platform synchronization are not detailed in available sources that we could review. The overall trading environment benefits from negative balance protection, which prevents traders from losing more than their account balance, providing important risk management for beginners who might otherwise face substantial losses due to inexperience.

Trust and Reliability Analysis

FBS demonstrates strong credentials in terms of regulatory oversight and industry recognition, operating under the supervision of three major regulatory bodies: the Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), and International Financial Services Commission (IFSC). This multi-jurisdictional regulatory framework provides clients with enhanced protection and ensures that the broker adheres to strict operational and financial standards across different markets where it operates.

The broker's commitment to client fund safety is evidenced by its provision of negative balance protection, which prevents traders from losing more than their account balance even in extreme market conditions. This protection mechanism is particularly valuable for beginner traders who may not fully understand the risks associated with leveraged trading and could otherwise face devastating losses. The regulatory oversight ensures that client funds are segregated from company operational funds, providing additional security for trader deposits.

FBS's industry recognition is substantial, with over 90 awards received from various financial industry organizations and publications. These accolades reflect peer recognition of the broker's services, innovation, and client satisfaction levels that demonstrate consistent quality over time. The company's 15-year operational history since 2009 demonstrates longevity and stability in the competitive forex brokerage market, where many brokers fail to achieve long-term success.

The broker's transparency regarding its regulatory status and operational framework contributes to its credibility, though specific details about financial reporting, audit processes, and compliance procedures are not extensively documented in available sources. The substantial client base of 27 million traders and 700,000+ partners indicates strong market confidence and successful business operations, though specific information about negative event handling and dispute resolution processes requires further verification directly with the company.

User Experience Analysis

The overall user experience at FBS appears to be designed with beginner traders in mind, emphasizing accessibility and ease of use rather than advanced features that might overwhelm new traders. The exceptionally low $5 minimum deposit requirement represents a user-centric approach that removes traditional barriers to entry and allows newcomers to gain real trading experience without substantial financial risk that could cause stress.

Interface design and platform usability details are not extensively documented in available sources, though the broker's focus on beginner traders suggests that user-friendly design principles are likely prioritized. The registration and account verification processes are presumably streamlined to facilitate quick account opening, though specific timeframes and documentation requirements are not detailed in current materials that we reviewed. The user demographic appears to be primarily composed of beginner traders and small-scale investors, particularly in emerging markets where the low minimum deposit and accessible trading conditions are most appealing.

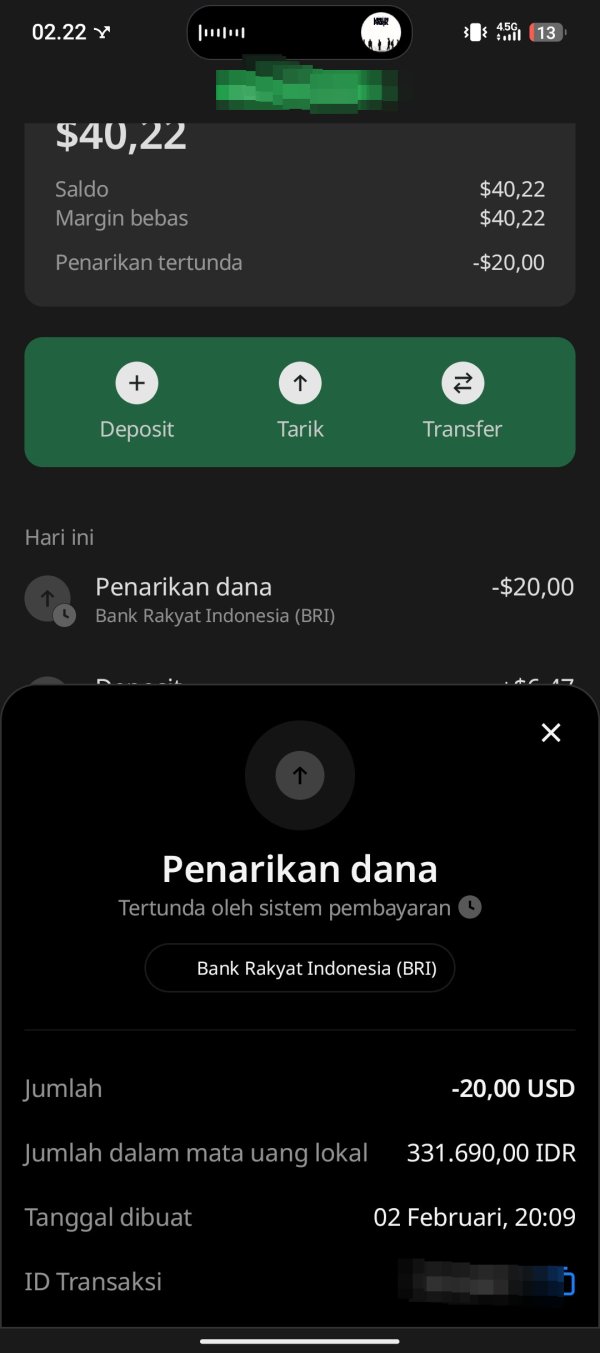

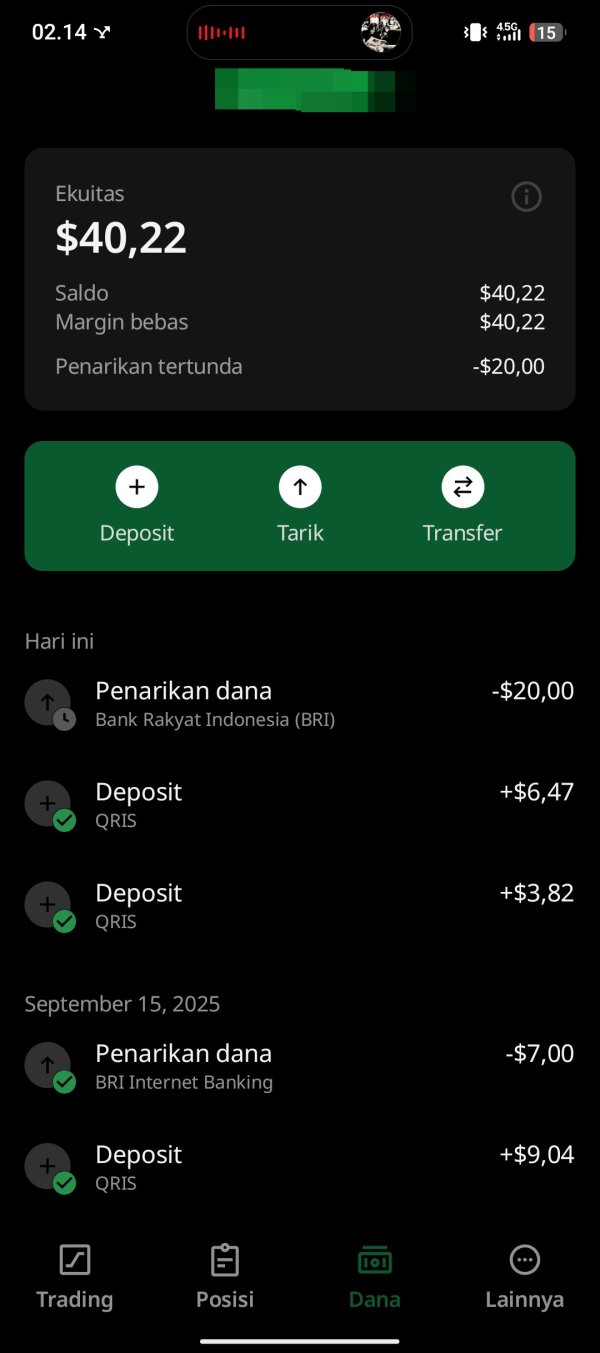

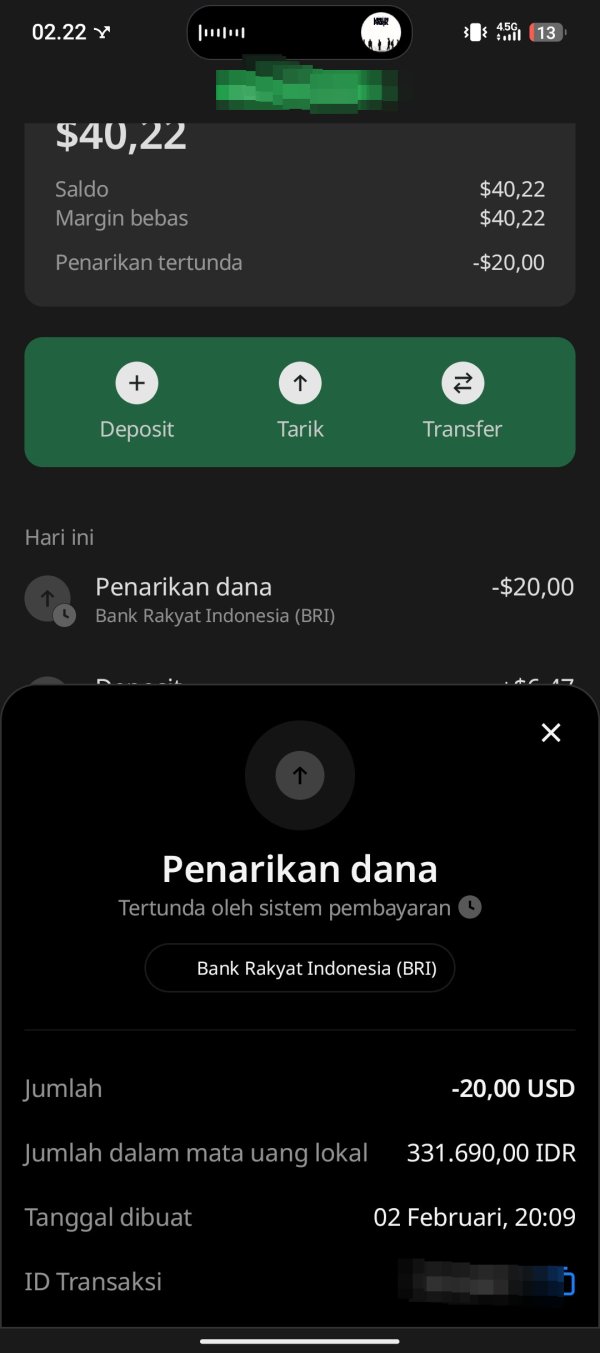

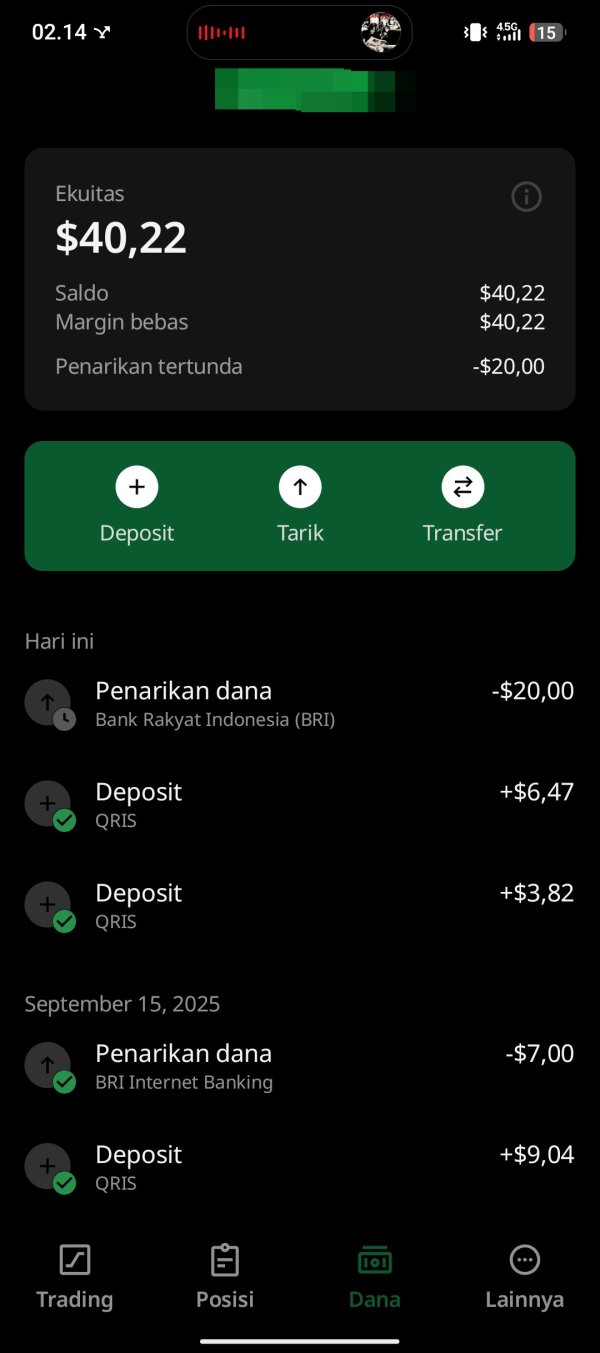

This positioning aligns well with the broker's service structure and regulatory approach, creating a coherent user experience targeted at specific market segments. Funding and withdrawal experiences, including processing times and fee structures, are not extensively detailed in available sources, though the broker's regulatory oversight suggests adherence to standard industry practices for client fund handling that protect customer money. Common user complaints and satisfaction metrics are not comprehensively documented, making it difficult to assess actual user experience quality beyond the structural advantages of low costs and regulatory protection.

The broker's substantial growth to 27 million clients suggests generally positive user experiences and effective retention strategies, though specific user satisfaction data and testimonials are not extensively available for detailed analysis.

Conclusion

This fbs review concludes that FBS represents a solid choice for beginner traders and small-scale investors seeking accessible, regulated forex and CFD trading services. The broker's primary strengths include its exceptionally low $5 minimum deposit requirement, competitive spreads starting from 0 pips, comprehensive regulatory oversight from ASIC, CySEC, and IFSC, and strong industry recognition with over 90 awards that demonstrate consistent quality.

The broker is particularly well-suited for new traders who want to gain real market experience without significant financial commitment, traders in emerging markets seeking accessible international brokerage services, and cost-conscious investors who prioritize low spreads and minimal account requirements. The negative balance protection and regulatory oversight provide important safety features for inexperienced traders who might otherwise face significant losses. However, potential limitations include limited detailed information about platform performance, customer service quality metrics, and advanced trading tools that experienced traders might require.

While FBS excels in accessibility and basic trading conditions, traders seeking sophisticated analysis tools, premium research resources, or advanced platform features may need to evaluate whether the broker meets their specific requirements. Overall, FBS offers a compelling package for its target market of beginner and cost-conscious traders.