Regarding the legitimacy of Exness forex brokers, it provides FCA, CYSEC, FSCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is Exness safe?

Pros

Cons

Is Exness markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Exness (UK) Ltd

Effective Date:

2016-09-01Email Address of Licensed Institution:

ukcompliance@exness.comSharing Status:

No SharingWebsite of Licensed Institution:

www.exness.ukExpiration Time:

--Address of Licensed Institution:

107 Cheapside London EC2V 6DN UNITED KINGDOMPhone Number of Licensed Institution:

+442033754207Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Exness (Cy) Ltd

Effective Date:

2012-09-05Email Address of Licensed Institution:

csd@exness.comSharing Status:

No SharingWebsite of Licensed Institution:

www.exness.euExpiration Time:

--Address of Licensed Institution:

1, Siafi Street, Porto Bello, Office 401, CY-3042 LimassolPhone Number of Licensed Institution:

+357 25 245 730, +357 25 030 959Licensed Institution Certified Documents:

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

EXNESS ZA (PTY) LTD

Effective Date:

2020-12-11Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

MERCHANT HOUSE OFFICE 104 AND 204,1ST AND 2ND FLOOR,19 DOCK ROAD V AND A WATERFRONT8001Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Exness (SC) Ltd

Effective Date:

--Email Address of Licensed Institution:

exness_sc@exness.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.exness.comExpiration Time:

--Address of Licensed Institution:

Office 107, 1st Floor, Waterside Property Ltd, Eden Island, Mahe, SeychellesPhone Number of Licensed Institution:

(+248) 4346767Licensed Institution Certified Documents:

Is Exness A Scam?

Introduction

Exness is a prominent online trading platform that has gained significant traction in the forex market since its inception in 2008. With a focus on providing a wide range of trading instruments, including forex, cryptocurrencies, commodities, and stocks, Exness positions itself as a versatile broker catering to both novice and experienced traders. Given the proliferation of online trading platforms, it becomes crucial for traders to evaluate the legitimacy and reliability of brokers before committing their funds. This article aims to provide a comprehensive analysis of Exness, examining its regulatory status, company background, trading conditions, client fund security, customer experience, platform performance, and associated risks. The evaluation is based on a thorough review of available data, user feedback, and expert opinions.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing the safety and legitimacy of a forex broker. Exness operates under multiple regulatory authorities, which underscores its commitment to compliance and client protection. Below is a summary of Exness's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 730729 | United Kingdom | Verified |

| CySEC | 178/12 | Cyprus | Verified |

| FSA | SD025 | Seychelles | Verified |

| FSCA | 51024 | South Africa | Verified |

| FSC | SIBA/L/20/1133 | British Virgin Islands | Verified |

| CBSC | 003 LSI | Curacao | Verified |

Exness is regulated by several reputable authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This multi-jurisdictional regulation is crucial, as it ensures that Exness adheres to stringent financial standards and operational guidelines aimed at protecting clients. The broker's history of compliance is reflected in its transparent operations and regular audits conducted by independent firms such as Deloitte. Such oversight helps mitigate the risks of fraud and malpractice, positioning Exness as a legitimate player in the forex market.

Company Background Investigation

Founded in 2008, Exness has evolved from a small startup into one of the leading forex brokers globally, serving hundreds of thousands of clients across various regions. The company is headquartered in Limassol, Cyprus, and operates under different entities to cater to diverse regulatory environments. The ownership structure of Exness is centered around Nymstar Limited, which oversees its operations in regions outside the European Economic Area (EEA).

The management team at Exness comprises experienced professionals with backgrounds in finance, technology, and customer service. This diverse expertise contributes to the broker's innovative approach to trading and client support. Exness emphasizes transparency, providing clients with detailed information about its operations, trading conditions, and fees. Regular updates and disclosures further enhance the trustworthiness of the broker, allowing clients to make informed decisions.

Trading Conditions Analysis

Exness offers competitive trading conditions, characterized by low spreads, flexible leverage options, and a variety of account types. The overall fee structure is designed to accommodate different trading styles and preferences. Below is a summary of the core trading costs associated with Exness:

| Fee Type | Exness | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 1.0 pips |

| Commission Model | Up to $3.50 per lot (for raw spread accounts) | $5.0 per lot |

| Overnight Interest Range | Varies by instrument | Varies widely |

Exness provides several account types, including Standard, Pro, Raw Spread, and Zero accounts, each with distinct features. The Standard and Standard Cent accounts are particularly appealing to beginners due to their low minimum deposit requirements and absence of commissions. However, the Pro, Raw Spread, and Zero accounts cater to more experienced traders, offering tighter spreads and commission-based trading.

While Exness promotes a transparent fee structure, some users have reported unexpected charges related to specific payment methods. It is essential for traders to familiarize themselves with all applicable fees before opening an account.

Client Fund Security

The security of client funds is paramount in the forex trading industry. Exness employs several robust measures to ensure the safety of traders' deposits. Funds are kept in segregated accounts, which means that clients' money is separated from the broker's operational funds. This segregation is a critical safeguard against potential financial mishaps or insolvency.

Additionally, Exness offers negative balance protection, ensuring that clients cannot lose more than their deposited amount. This feature is particularly beneficial for novice traders who may be more susceptible to market volatility. Furthermore, Exness participates in an investor compensation scheme, providing additional coverage for clients in case of unforeseen circumstances.

Historically, Exness has maintained a clean record regarding fund security, with no significant incidents of financial misconduct or client fund mismanagement reported. This track record enhances its reputation as a trustworthy broker.

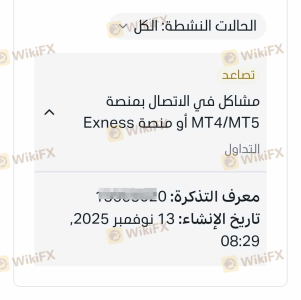

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating any trading platform. Overall, Exness has received positive reviews from users, particularly praising its trading conditions, ease of use, and customer support. However, some common complaints have emerged, which warrant attention.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Delays in Withdrawals | Medium | Generally responsive, but some delays reported |

| Customer Support Availability | Medium | Mixed reviews on response times |

| Limited Educational Resources | Low | Acknowledged, with ongoing improvements |

Notably, clients have reported occasional delays in withdrawal processing, particularly during high-volume periods. While Exness typically processes withdrawals promptly, users have expressed a desire for more consistent communication regarding their requests. Additionally, while the broker provides educational resources, some users feel that the offerings could be expanded to include more advanced content.

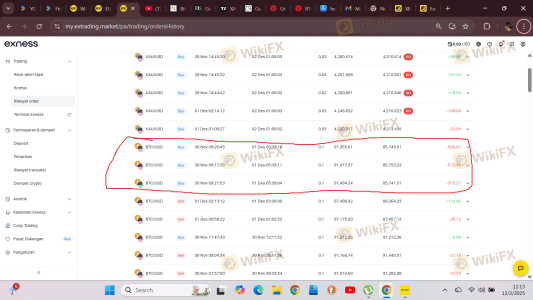

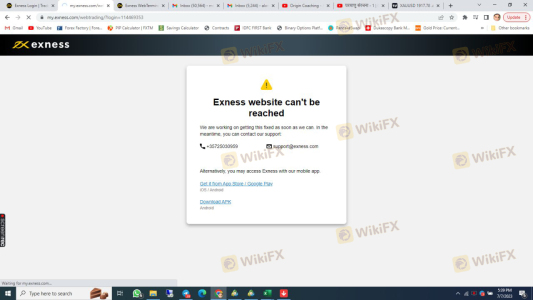

Platform and Execution

Exness provides access to popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their reliability and advanced analytical tools. The broker's proprietary platform, Exness Terminal, also offers a user-friendly interface and a comprehensive suite of features.

The execution quality on Exness is generally regarded as high, with minimal slippage and fast order execution times. However, some traders have reported instances of rejected orders during periods of high volatility, which may be a concern for those employing aggressive trading strategies.

Risk Assessment

Using Exness as a trading platform comes with inherent risks, as is the case with any forex broker. Below is a summary of the key risk areas associated with trading through Exness:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Changes in regulations may affect trading conditions |

| Market Risk | High | Forex trading is inherently volatile |

| Operational Risk | Medium | Potential for technical issues or order rejections |

| Fraud Risk | Low | Strong regulatory oversight reduces this risk |

To mitigate these risks, traders should engage in thorough research, utilize risk management strategies, and remain informed about market conditions and regulatory changes.

Conclusion and Recommendations

Based on the comprehensive analysis presented, Exness appears to be a legitimate and reliable forex broker with a solid regulatory framework, competitive trading conditions, and a commitment to client fund security. While there are areas for improvement, particularly regarding customer support and educational resources, the overall feedback from users is largely positive.

For traders seeking a trustworthy platform, Exness is a commendable choice, especially for those looking to engage in forex trading or explore a variety of other financial instruments. However, potential clients should remain aware of the inherent risks associated with trading and carefully consider their individual trading goals and risk tolerance.

For those seeking alternatives, brokers such as IG, Pepperstone, and OANDA offer similar services and may be worth exploring based on specific trading needs and preferences.

Is Exness a scam, or is it legit?

The latest exposure and evaluation content of Exness brokers.

Exness Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Exness latest industry rating score is 8.99, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.99 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.