Executive Summary

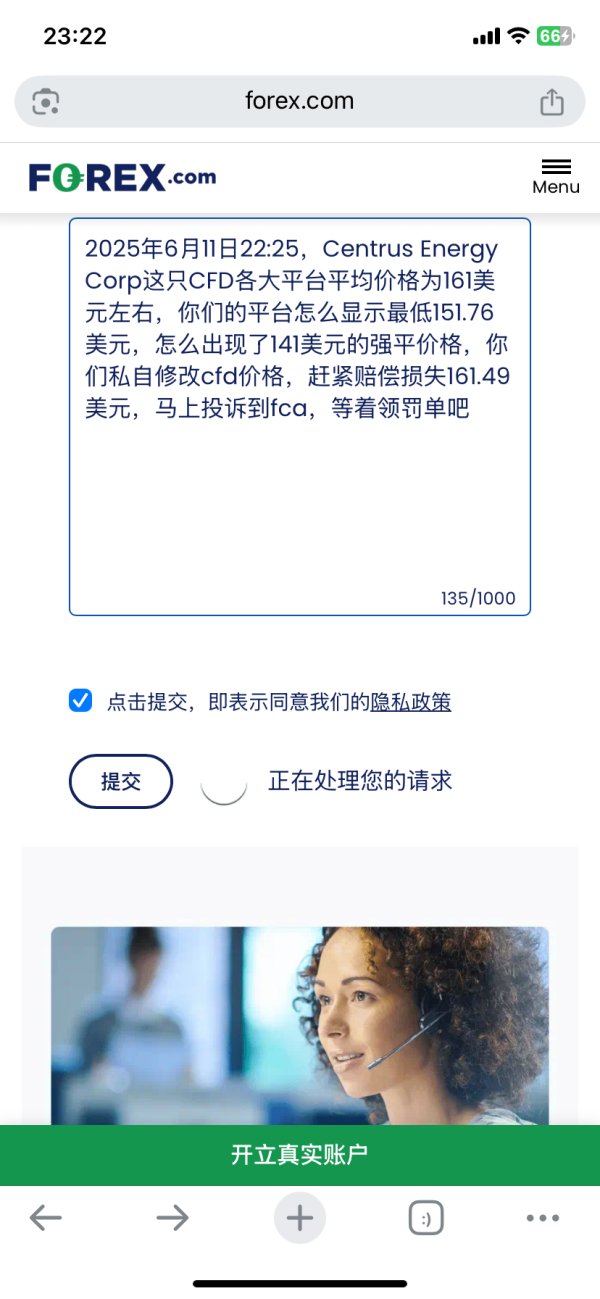

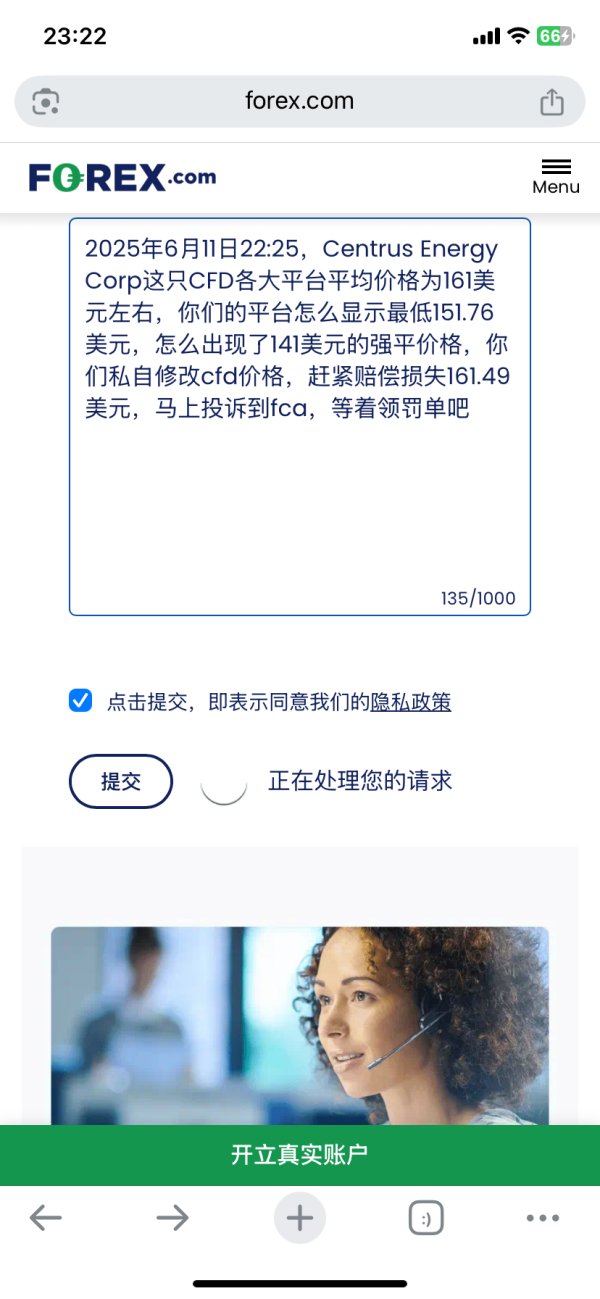

This comprehensive Forex.com review looks at one of the top players in online forex trading. Forex.com works as a regulated online forex broker with oversight from multiple financial regulatory authorities, including the Financial Conduct Authority (FCA), which makes it a reliable choice for traders who want regulatory protection. The platform has received mostly positive user feedback. Traders like its commitment to safety and regulatory compliance.

Two key highlights make Forex.com stand out in the competitive forex landscape. First, the broker provides multiple trading platforms and tools designed to help traders across different experience levels, from beginners to advanced professionals. Second, it has built a reputation as a secure and dependable trading environment backed by strong regulatory oversight. The platform's multi-faceted approach to trading technology ensures that users can access markets through their preferred interface while benefiting from comprehensive trading resources.

Forex.com targets a diverse user base. This includes novice traders seeking educational resources and platform reliability, as well as experienced traders requiring advanced tools and competitive trading conditions. The broker's regulatory standing and positive user testimonials make it particularly attractive to traders who prioritize security and trustworthiness over aggressive promotional offers.

Important Disclaimers

Potential traders should know that Forex.com operates through different regional entities to comply with varying international regulatory requirements. This structure means that trading conditions, available instruments, leverage ratios, and promotional offerings may differ significantly depending on your geographic location and the specific Forex.com entity serving your region. Always verify the exact terms and conditions applicable to your jurisdiction before opening an account.

This review is based on publicly available information, user feedback, and regulatory filings current as of 2025. While we try for accuracy, trading conditions, fees, and platform features may change. The evaluation may not cover all aspects of the trading experience, and individual results may vary based on trading style, experience level, and market conditions.

Rating Framework

Broker Overview

Forex.com has established itself as a prominent name in the online forex trading industry. The company operates as a specialized broker focused on providing foreign exchange and multi-asset trading services to retail and institutional clients. The company has built its reputation on regulatory compliance and platform reliability, positioning itself as a conservative choice for traders who prioritize safety over aggressive marketing tactics. While specific founding details vary across different sources, Forex.com has maintained a consistent presence in major financial markets for over two decades.

The broker's business model centers on providing comprehensive online trading services across multiple asset classes. Foreign exchange remains its core offering. Forex.com generates revenue through spreads and commissions while maintaining a commitment to transparent pricing structures. The company has strategically positioned itself to serve both beginners seeking educational resources and experienced traders requiring sophisticated analytical tools and competitive execution.

Forex.com offers multiple trading platforms to accommodate different trading preferences and technical requirements. The platform selection includes proprietary solutions alongside industry-standard options, ensuring traders can access markets through their preferred interface. The broker covers foreign exchange pairs, commodities, indices, and other financial instruments, though the exact selection varies by regulatory jurisdiction. Most significantly, Forex.com operates under the supervision of the Financial Conduct Authority (FCA) and other respected regulatory bodies, providing clients with investor protection and operational oversight that meets international standards.

Regulatory Coverage: Forex.com maintains regulatory oversight from multiple authorities including the Financial Conduct Authority (FCA). This ensures compliance with strict operational and financial standards across different jurisdictions.

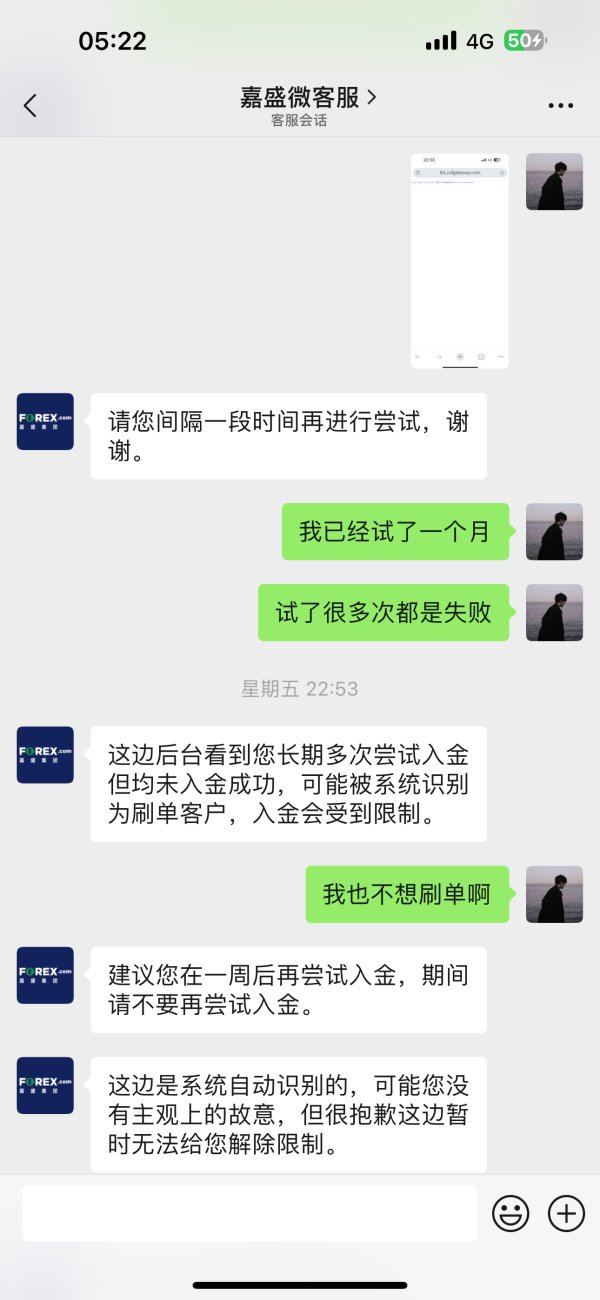

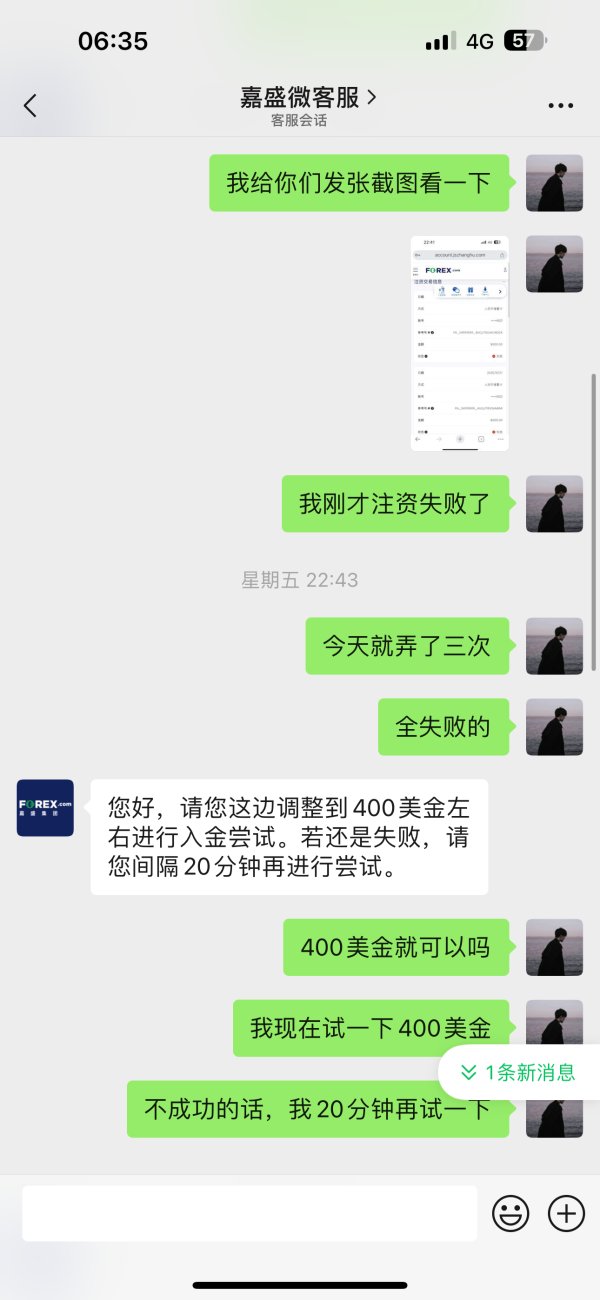

Deposit and Withdrawal Methods: The platform supports various funding options including bank transfers, credit cards, and electronic payment systems. Specific methods may vary by region and regulatory requirements.

Minimum Deposit Requirements: Account opening thresholds are competitive with industry standards. Exact amounts depend on account type and regulatory entity serving your jurisdiction.

Promotional Offers: The broker occasionally provides welcome bonuses and trading incentives. These are generally conservative compared to more aggressive competitors, reflecting the company's focus on regulatory compliance.

Tradeable Assets: Beyond forex pairs, the platform offers access to commodities, stock indices, and other financial instruments. Availability is subject to regional regulatory restrictions and licensing agreements.

Cost Structure: Pricing operates through spread-based and commission models depending on account type. Costs are generally competitive within industry ranges though not necessarily the lowest available.

Leverage Options: Maximum leverage varies significantly by region due to regulatory requirements. Ratios typically range from conservative levels in highly regulated jurisdictions to more flexible options where permitted.

Platform Selection: Multiple trading interfaces are available including proprietary platforms and industry-standard options. This ensures compatibility with different trading styles and technical requirements.

Geographic Restrictions: Service availability depends on local regulations. Some regions are excluded due to licensing limitations or regulatory compliance requirements.

Customer Support Languages: Multi-language support is provided though coverage varies by region and service level.

This Forex.com review reveals a broker that prioritizes regulatory compliance and operational stability over aggressive market positioning.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Forex.com provides a range of account types designed to accommodate different trading styles and experience levels. The specific offerings vary by regulatory jurisdiction. The broker typically offers standard retail accounts alongside more sophisticated options for experienced traders, with each account type featuring distinct characteristics in terms of minimum deposits, spread structures, and available features. While not groundbreaking, these account options provide reasonable flexibility for most traders.

Minimum deposit requirements are generally competitive with industry standards. This makes the platform accessible to beginner traders while not being so low as to attract purely speculative activity. The account opening process follows standard industry practices with identity verification and regulatory compliance checks, though some users report that the verification timeline can extend longer than with some competitors.

Special account features such as Islamic-compliant accounts are available in relevant jurisdictions. This demonstrates the broker's attention to diverse client needs. However, the account structure lacks some of the innovative features offered by newer market entrants, reflecting Forex.com's conservative approach to product development.

User feedback regarding account conditions is generally positive. Traders appreciate the straightforward terms and conditions. However, some experienced traders note that the account benefits could be more competitive compared to specialized platforms targeting professional users. This Forex.com review finds the account conditions solid but not exceptional in the current competitive landscape.

Forex.com demonstrates strong performance in providing trading tools and resources suitable for traders across different experience levels. The platform offers multiple analytical tools including technical indicators, charting packages, and market research resources that enable both basic and advanced market analysis. The diversity of available tools reflects the broker's understanding that different traders require different analytical approaches to succeed in the markets.

Research and analysis resources include market commentary, economic calendars, and periodic market insights. The depth and frequency of these resources may not match specialized research providers. The educational component shows particular strength, with structured learning materials that help beginning traders understand market fundamentals and trading concepts. These educational resources demonstrate genuine effort to improve trader knowledge rather than simply encouraging more trading activity.

The platform supports various levels of automation and algorithmic trading. The specific capabilities depend on the chosen trading platform. Advanced traders can typically access API connections and automated trading tools, while beginners benefit from simpler automated features and risk management tools.

User feedback consistently highlights the quality and accessibility of the trading tools. Many traders note that the platform provides sufficient functionality for their trading strategies. Professional traders occasionally seek more advanced features, but the overall tool selection satisfies most user requirements effectively.

Customer Service and Support Analysis (7/10)

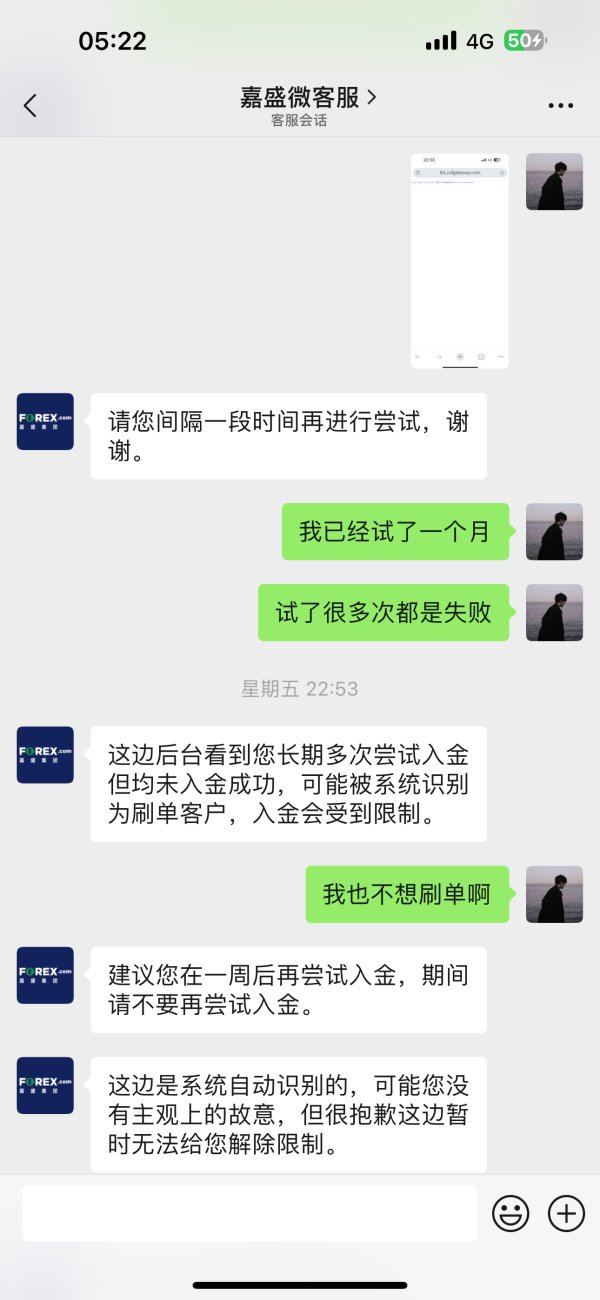

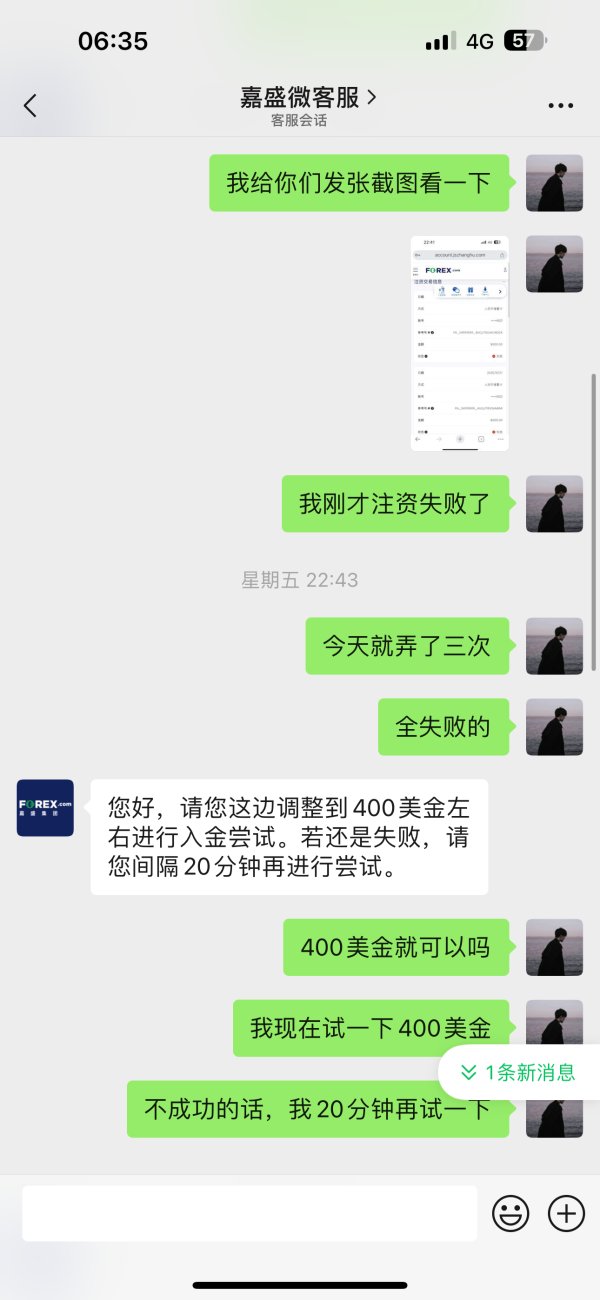

Customer service at Forex.com operates through multiple channels including phone support, email assistance, and live chat functionality. Availability varies by region and account type. The broker maintains professional support standards with trained representatives capable of addressing both technical and account-related inquiries. However, response times can vary significantly depending on market hours and inquiry complexity.

Service quality generally meets industry standards. Representatives demonstrate adequate knowledge of platform features and trading conditions. However, some users report inconsistencies in support quality, particularly during high-volume periods or when dealing with complex technical issues. The multi-language support reflects the broker's international presence, though the quality and availability of non-English support may vary.

Customer service hours provide reasonable coverage for international markets. However, 24/7 availability is not guaranteed across all support channels. The broker has implemented various self-service options including FAQ sections and video tutorials, which help address common inquiries without requiring direct contact.

User feedback regarding customer service shows mixed results. Many traders are satisfied with routine support interactions while others express frustration with resolution times for complex issues. The overall service level is professional and competent, though not exceptional compared to brokers that have made customer service a primary competitive differentiator.

Trading Experience Analysis (7/10)

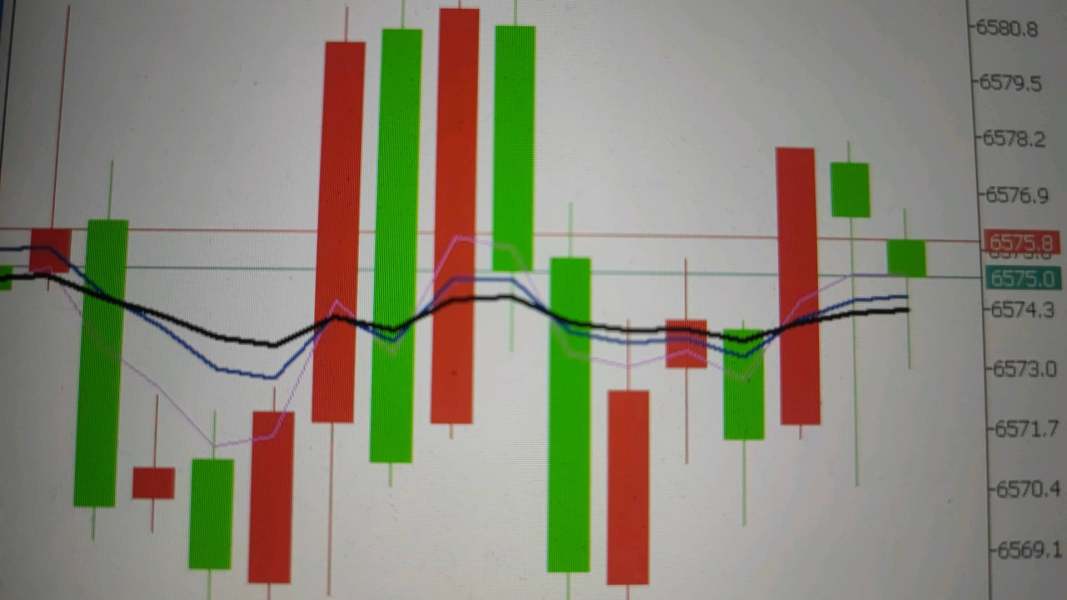

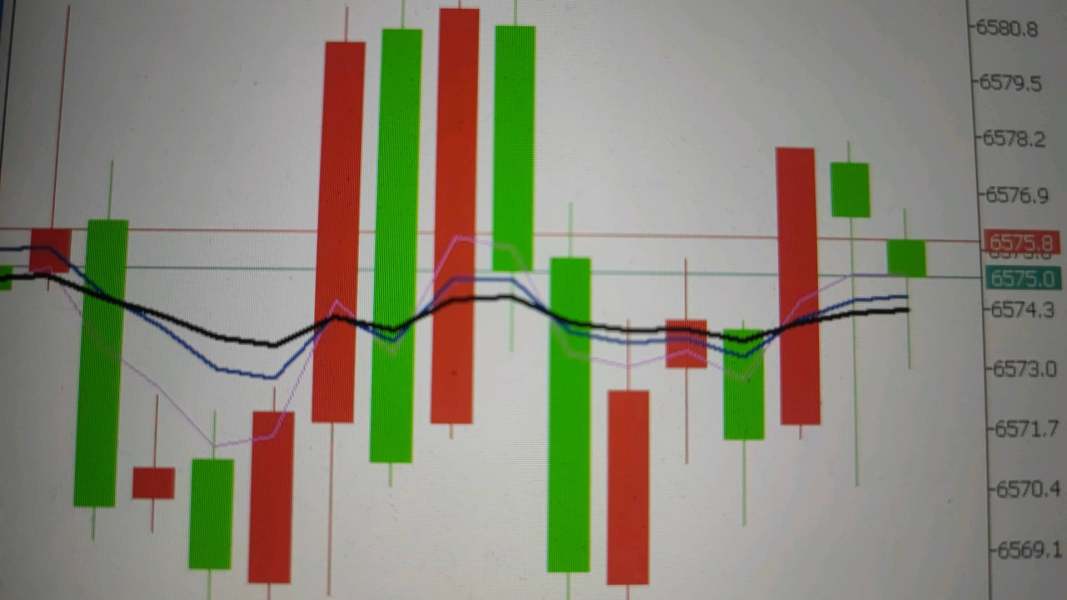

The trading experience at Forex.com centers on platform stability and reliable order execution. Most users report consistent performance during normal market conditions. Platform uptime is generally strong, though some traders note occasional connectivity issues during high-volatility periods or major news events. The execution quality meets industry standards with reasonable slippage rates and minimal requotes under typical trading conditions.

Platform functionality provides comprehensive trading capabilities including advanced order types, risk management tools, and real-time market data. The interface design balances functionality with usability, though some traders find the layout less intuitive than newer platform designs. Technical indicators and analytical tools are well-integrated, supporting various trading strategies from scalping to long-term position trading.

Mobile trading experience offers reasonable functionality through dedicated applications. This allows traders to monitor positions and execute trades while away from desktop platforms. However, the mobile interface may lack some advanced features available on desktop versions, which can limit its utility for sophisticated trading strategies.

The trading environment provides competitive spreads and reasonable liquidity across major currency pairs. Costs may be higher for exotic pairs or during low-liquidity periods. This Forex.com review finds the overall trading experience reliable and professional, meeting most trader expectations without being exceptional in any particular area.

Trustworthiness Analysis (9/10)

Forex.com excels in trustworthiness through its comprehensive regulatory oversight from respected authorities including the Financial Conduct Authority (FCA). This regulatory framework provides clients with significant investor protection including segregated client funds, compensation scheme coverage, and operational transparency requirements. The broker's long-standing regulatory relationships demonstrate consistent compliance with evolving international standards.

The company maintains robust financial safeguards including segregated client accounts and professional indemnity insurance. This provides multiple layers of protection for client funds. Regular regulatory reporting and auditing requirements ensure ongoing operational oversight and financial stability monitoring. The broker's transparent approach to regulatory compliance contrasts favorably with less regulated competitors.

Corporate transparency includes regular publication of execution quality reports and clear disclosure of trading conditions, fees, and potential conflicts of interest. The company's ownership structure and management information are readily available, providing additional confidence in the organization's stability and accountability.

Industry reputation remains strong with recognition from regulatory bodies and professional organizations. The broker has not aggressively pursued industry awards or marketing recognition. User trust indicators show consistently positive feedback regarding fund safety and withdrawal processing, with minimal complaints about operational integrity or financial disputes.

User Experience Analysis (7/10)

Overall user satisfaction with Forex.com shows positive trends. Most traders express confidence in the platform's reliability and regulatory standing. User reviews consistently highlight the broker's trustworthiness and platform stability as primary strengths, while noting areas for improvement in competitive positioning and feature innovation.

Interface design and usability receive generally positive feedback. Some users find the platform less modern or intuitive compared to newer market entrants. The registration and verification process follows industry standards with reasonable completion times, though some traders report longer verification periods compared to less regulated competitors.

Funding operations generally proceed smoothly with reasonable processing times for deposits and withdrawals. International transfers may experience delays due to banking intermediaries. Users appreciate the transparency of funding processes and fee structures, with minimal complaints about unexpected charges or processing issues.

Common user concerns include desires for more competitive pricing, enhanced mobile functionality, and expanded educational resources. However, these concerns are typically balanced against appreciation for the broker's regulatory standing and operational reliability. The user base appears to value security and compliance over aggressive promotional offers or cutting-edge features.

Conclusion

This comprehensive Forex.com review reveals a broker that prioritizes regulatory compliance, operational stability, and user safety over aggressive market positioning or promotional tactics. Forex.com has established itself as a reliable choice for traders who value regulatory oversight and platform dependability, backed by supervision from respected authorities including the Financial Conduct Authority.

The platform is particularly well-suited for conservative traders, beginners seeking educational resources, and experienced traders who prioritize regulatory protection over cutting-edge features or ultra-competitive pricing. The broker's multi-platform approach and comprehensive tool selection accommodate various trading styles while maintaining professional operational standards.

The primary strengths include strong regulatory standing, positive user trust indicators, reliable platform performance, and comprehensive trading resources. Areas for improvement include enhancing competitive positioning in pricing, expanding advanced features for professional traders, and improving customer service responsiveness during peak periods. Overall, Forex.com represents a solid, trustworthy choice in the forex broker landscape, particularly for traders who prioritize safety and regulatory protection in their broker selection criteria.