Regarding the legitimacy of OANDA forex brokers, it provides ASIC, FCA, FSA, NFA, CIRO, MAS, FSC and WikiBit, (also has a graphic survey regarding security).

Is OANDA safe?

Pros

Cons

Is OANDA markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

OANDA AUSTRALIA PTY LTD

Effective Date: Change Record

2012-03-26Email Address of Licensed Institution:

ntoh@oanda.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

GRAHAM MORRIS L 1 60 MARTIN PL SYDNEY NSW 2000Phone Number of Licensed Institution:

82437100Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

OANDA Europe Limited

Effective Date:

2011-05-17Email Address of Licensed Institution:

handerson@oanda.comSharing Status:

No SharingWebsite of Licensed Institution:

www.oanda.comExpiration Time:

--Address of Licensed Institution:

Dashwood House 69 Old Broad Street London EC2M 1QS UNITED KINGDOMPhone Number of Licensed Institution:

+4402071011600Licensed Institution Certified Documents:

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

OANDA証券株式会社

Effective Date:

2009-03-02Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都千代田区平河町1-3-13Phone Number of Licensed Institution:

03-3262-5431Licensed Institution Certified Documents:

NFA Forex Trading License (EP)

National Futures Association

National Futures Association

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

OANDA CORPORATION

Effective Date:

2003-03-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

17 State Street Suite 300 New York, NY 10004 United StatesPhone Number of Licensed Institution:

1212 858 7690Licensed Institution Certified Documents:

CIRO Derivatives Trading License (EP)

Canadian Investment Regulatory Organization

Canadian Investment Regulatory Organization

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

OANDA (Canada) Corporation ULC

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www1.oanda.comExpiration Time:

--Address of Licensed Institution:

370 King Street West 2nd Floor, P.O. Box 60 Toronto ON M5V 1J9Phone Number of Licensed Institution:

416-593-6767Licensed Institution Certified Documents:

MAS Derivatives Trading License (EP)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

OANDA ASIA PACIFIC PTE. LTD.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

http://www.oanda.sgExpiration Time:

--Address of Licensed Institution:

1 RAFFLES PLACE #26-02 ONE RAFFLES PLACE TOWER 1 048616Phone Number of Licensed Institution:

+65 65798288Licensed Institution Certified Documents:

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

OANDA GLOBAL MARKETS LIMITED

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is OANDA A Scam?

Introduction

OANDA is a well-established player in the forex market, founded in 1996 and headquartered in New York, USA. With over 25 years of experience, it has developed a reputation for providing reliable trading services to clients globally. OANDA offers a wide range of trading instruments, including forex, indices, commodities, and cryptocurrencies, making it a versatile choice for traders of all levels. However, as with any financial service, traders need to exercise caution and conduct thorough evaluations before engaging with a broker. This is particularly important given the prevalence of scams in the forex industry, where unregulated or poorly regulated brokers can expose traders to significant risks.

In this article, we will investigate OANDA's regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. Our assessment is based on a comprehensive review of multiple reputable sources, including regulatory bodies, user reviews, and industry analyses. By synthesizing this information, we aim to provide a clear and balanced view of whether OANDA is a safe and trustworthy broker or if there are potential red flags that traders should consider.

Regulation and Legitimacy

OANDA operates under the oversight of multiple regulatory bodies, which is a critical factor in determining its reliability as a forex broker. Regulation ensures that brokers adhere to strict operational standards, providing a level of protection for traders. OANDA is regulated by several tier-1 jurisdictions, including the CFTC and NFA in the United States, the FCA in the UK, and ASIC in Australia. These regulatory bodies enforce rigorous compliance measures, ensuring that brokers maintain transparency and fairness in their dealings.

Regulatory Information Table

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFTC | 0325821 | USA | Verified |

| NFA | 0325821 | USA | Verified |

| FCA | 542574 | UK | Verified |

| ASIC | 412981 | Australia | Verified |

| IIROC | 09-0280 | Canada | Verified |

| MAS | 200704926K | Singapore | Verified |

| FSA | 1571 | Japan | Verified |

| BVI FSC | SIBA/L/20/1130 | British Virgin Islands | Verified |

The presence of multiple regulatory licenses indicates that OANDA is committed to maintaining a high standard of compliance and investor protection. For instance, the FCA requires brokers to provide negative balance protection, ensuring that clients cannot lose more than their initial deposit. This is a significant advantage for traders seeking a secure trading environment. Furthermore, OANDA's history of compliance with these regulations adds to its credibility as a trustworthy broker.

Company Background Investigation

OANDA was founded by Dr. Richard Olsen and Dr. Michael Stumm, who envisioned a platform that democratized access to forex trading through technology. Over the years, the company has expanded its operations globally, establishing offices in key financial markets, including Canada, Japan, Singapore, and the UK. This international presence allows OANDA to cater to a diverse client base while adhering to various regulatory frameworks.

The management team at OANDA comprises experienced professionals with extensive backgrounds in finance and technology. This expertise is reflected in the broker's innovative trading platforms and commitment to customer education. OANDA's transparency is another strong point; the company regularly publishes its financial reports and regulatory compliance updates, allowing clients to stay informed about its operations.

Trading Conditions Analysis

OANDA offers competitive trading conditions, which are crucial for attracting and retaining clients. The broker operates under a market maker model, meaning it acts as the counterparty to client trades. This model can lead to tighter spreads and faster execution times, but it also raises questions about potential conflicts of interest.

Core Trading Cost Comparison Table

| Fee Type | OANDA | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.0 pips | From 1.2 pips |

| Commission Model | $50 per million (Core account) | Varies widely |

| Overnight Interest Range | Standard rates apply | Varies by broker |

OANDA's spreads are competitive, particularly for major currency pairs, which can be as low as 1.0 pips. However, the broker does charge a commission on its Core account, which may not be as favorable compared to brokers that offer commission-free trading. Additionally, OANDA levies an inactivity fee after 12 months of account dormancy, which is a common practice among brokers but may be a concern for infrequent traders.

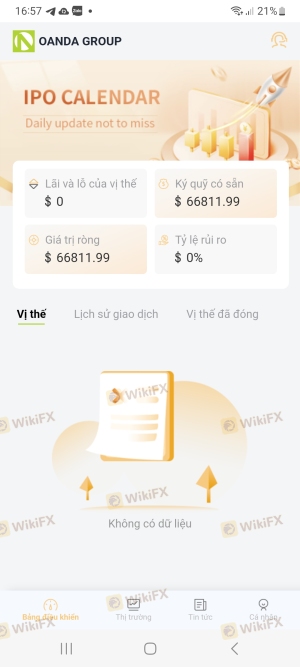

Client Fund Security

OANDA prioritizes the security of client funds through various measures, including segregated accounts and negative balance protection. Client funds are held in top-tier bank accounts, separate from OANDA's operational funds, ensuring that traders' money remains safe even if the broker encounters financial difficulties.

Furthermore, OANDA is a participant in investor compensation schemes in several jurisdictions, providing an additional layer of protection for clients. For instance, UK clients are protected by the Financial Services Compensation Scheme (FSCS), which covers investments up to £85,000. However, it's important to note that US clients do not benefit from the same level of investor protection, as the NFA does not provide coverage for forex transactions.

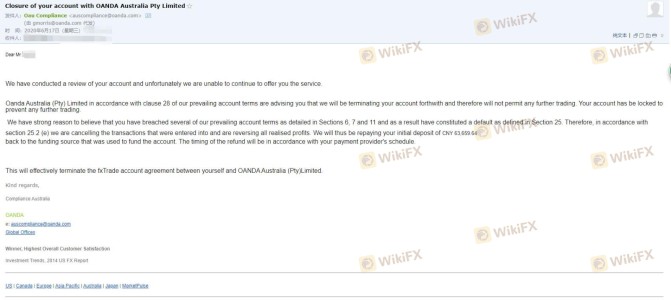

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. OANDA generally receives positive reviews for its user-friendly platform and customer support. However, some clients have reported issues with response times and the quality of support during peak trading periods.

Complaints Type and Severity Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Slow Customer Support | Moderate | Generally responsive, but can be slow during peak times |

| Withdrawal Delays | High | Usually resolved, but some clients report delays |

| Account Verification Issues | Moderate | Addressed promptly, but can take several days |

One common complaint involves withdrawal delays, which can cause frustration for traders needing quick access to their funds. Although OANDA generally resolves these issues, the response time can vary based on demand.

Platform and Trade Execution

OANDA's trading platforms are known for their performance and reliability. The broker offers a proprietary platform, OANDA Trade, along with popular third-party options like MetaTrader 4 and TradingView. Users typically find the platforms intuitive and feature-rich, with advanced charting tools and technical analysis capabilities.

In terms of order execution, OANDA boasts competitive speeds, with most trades executed in milliseconds. However, some users have reported instances of slippage during high volatility periods, which can affect trading outcomes.

Risk Assessment

Trading with OANDA, like any broker, involves inherent risks. While the broker is regulated and offers various protective measures, traders should still be aware of the potential for losses, especially when using leverage.

Risk Rating Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Low | Strong regulatory oversight from multiple tier-1 bodies |

| Fund Security | Low | Segregated accounts and investor protection schemes |

| Customer Support | Medium | Generally responsive but can be slow during peak times |

| Trading Platform Reliability | Low | High performance and reliability, though slippage can occur |

To mitigate risks, traders should employ prudent risk management strategies, such as using stop-loss orders and limiting leverage to manageable levels.

Conclusion and Recommendations

In conclusion, OANDA is a well-regulated broker with a long history in the forex market. The evidence suggests that it is not a scam, but rather a reliable option for traders seeking a secure trading environment. The broker's multiple regulatory licenses, commitment to transparency, and robust client fund security measures contribute to its credibility.

However, potential clients should be aware of the lack of investor protection for US clients and the possibility of withdrawal delays. For novice traders, OANDA's educational resources and user-friendly platform make it an attractive choice. More experienced traders may appreciate the competitive spreads and advanced trading tools offered.

For those seeking alternatives, brokers like FXCM and IG may offer similar services with different fee structures and regulatory protections. Ultimately, traders should assess their individual needs and preferences when choosing a broker.

Is OANDA a scam, or is it legit?

The latest exposure and evaluation content of OANDA brokers.

OANDA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OANDA latest industry rating score is 8.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.