Regarding the legitimacy of IG forex brokers, it provides ASIC, FCA, FSA, FCA, BaFin, FMA, DFSA, FSCA, MAS and WikiBit, (also has a graphic survey regarding security).

Is IG safe?

Pros

Cons

Is IG markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

IG AUSTRALIA PTY LTD

Effective Date: Change Record

2020-06-02Email Address of Licensed Institution:

compliance.au@ig.comSharing Status:

No SharingWebsite of Licensed Institution:

www.ig.comExpiration Time:

--Address of Licensed Institution:

'L32' 376 COLLINS ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

0398601711Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

IG MARKETS LIMITED

Effective Date:

2001-12-01Email Address of Licensed Institution:

compliance@ig.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.ig.com/Expiration Time:

--Address of Licensed Institution:

Cannon Bridge House 25 Dowgate Hill London EC4R 2YA UNITED KINGDOMPhone Number of Licensed Institution:

+442078960011Licensed Institution Certified Documents:

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

IG証券株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都港区六本木1-6-1 泉ガーデンタワー26階Phone Number of Licensed Institution:

0120-965-915Licensed Institution Certified Documents:

FCA Derivatives Trading License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

IG Index Limited

Effective Date:

2001-12-01Email Address of Licensed Institution:

compliance@ig.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.ig.com/Expiration Time:

--Address of Licensed Institution:

Cannon Bridge House 25 Dowgate Hill London EC4R 2YA UNITED KINGDOMPhone Number of Licensed Institution:

+442078960011Licensed Institution Certified Documents:

BaFin Forex Trading License (EP) 2

Federal Financial Supervisory Authority

Federal Financial Supervisory Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

IG Europe GmbH

Effective Date: Change Record

2018-09-28Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Westhafenplatz 1 60327 Frankfurt DeutschlandPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FMA Derivatives Trading License (MM)

Financial Markets Authority

Financial Markets Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

IG AUSTRALIA PTY LTD

Effective Date:

2021-07-09Email Address of Licensed Institution:

kylie.paton@ig.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 32, Queen & Collins, 376-390 Collins Street, Vic, 3000, Australia, Bell Gully, 171 Featherston Street, Wellington Central, Wellington, 6011, New ZealandPhone Number of Licensed Institution:

+61 3 9860 1736Licensed Institution Certified Documents:

DFSA Derivatives Trading License (MM)

Dubai Financial Services Authority

Dubai Financial Services Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

IG Limited

Effective Date:

2015-06-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Units 2 & 3, Level 27, Al Fattan Currency House, Tower 2, DIFC, PO Box 506968, Dubai, UAEPhone Number of Licensed Institution:

971 4 559 2000Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

IG MARKETS SOUTH AFRICA LIMITED

Effective Date:

2010-04-13Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

THE MARC, TOWER 2 FLOOR 9 SANDTON 2196Phone Number of Licensed Institution:

27010 344 0053Licensed Institution Certified Documents:

MAS Derivatives Trading License (EP)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

IG ASIA PTE LTD

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

http://www.ig.com/sgExpiration Time:

--Address of Licensed Institution:

50 RAFFLES PLACE, #27-01 SINGAPORE LAND TOWER 048623Phone Number of Licensed Institution:

+65 63905118Licensed Institution Certified Documents:

Is IG A Scam?

Introduction

IG Group, founded in 1974, is one of the leading online trading platforms known for its extensive range of financial instruments, including forex, CFDs, and spread betting. As a pioneer in the industry, IG has built a strong reputation over the decades, serving over 300,000 clients worldwide. However, as the online trading landscape grows, it becomes increasingly important for traders to carefully evaluate the legitimacy and reliability of their chosen brokers. This is particularly crucial in the forex market, where the risk of fraud and mismanagement can lead to significant financial losses. In this article, we will investigate whether IG is a safe and trustworthy broker or if there are red flags that traders should be aware of. Our evaluation will be based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer safety measures, and user experiences.

Regulation and Legitimacy

The regulatory framework surrounding a trading broker is a critical factor in determining its legitimacy. IG operates under the supervision of several top-tier regulatory authorities, which adds a layer of security for its clients. The following table summarizes IG's key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 195355 | UK | Verified |

| Australian Securities and Investments Commission (ASIC) | 220440 | Australia | Verified |

| Monetary Authority of Singapore (MAS) | 200510021K | Singapore | Verified |

| Swiss Financial Market Supervisory Authority (FINMA) | 182246 | Switzerland | Verified |

| Commodity Futures Trading Commission (CFTC) | 0509630 | USA | Verified |

| Japanese Financial Services Authority (JFSA) | 3010001141001 | Japan | Verified |

| Financial Markets Authority (FMA) | 41393 | New Zealand | Verified |

| Dubai Financial Services Authority (DFSA) | F001780 | UAE | Verified |

IG is regulated by eight tier-1 authorities, which indicates a high level of trustworthiness. Regulatory bodies like the FCA and ASIC are known for their stringent oversight and require brokers to adhere to strict financial standards, including capital adequacy and client fund protection. Historically, IG has maintained compliance with these regulations, ensuring that client funds are kept in segregated accounts and are not used for the broker's operational expenses. This regulatory structure not only protects clients but also enhances IG's credibility in the forex market.

Company Background Investigation

IG Group has a rich history that spans nearly five decades. Founded by Stuart Wheeler, the company initially specialized in spread betting before expanding its offerings to include CFDs and forex trading. Today, IG is a publicly traded company listed on the London Stock Exchange, which further enhances its transparency and accountability. The company operates under a well-defined ownership structure, with its shares owned by a diverse group of institutional and retail investors.

The management team at IG comprises experienced professionals with extensive backgrounds in finance and trading. This expertise is crucial in navigating the complexities of the financial markets and ensuring that the company adheres to regulatory requirements. IG's commitment to transparency is evident in its regular financial disclosures and market reports, which provide insights into its performance and operational strategies.

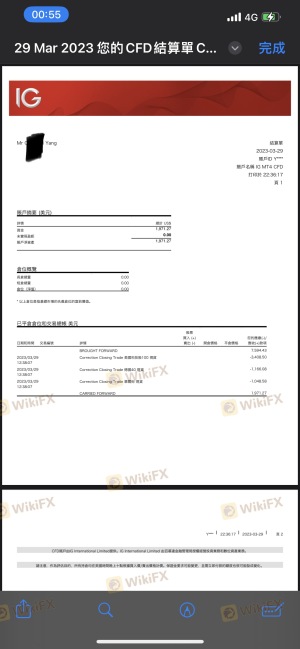

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fee structures is essential. IG offers a competitive fee structure, which is appealing to both retail and professional traders. The following table outlines IG's core trading costs:

| Fee Type | IG | Industry Average |

|---|---|---|

| Average Spread (EUR/USD) | 0.9 pips | 1.0 pips |

| Commission Structure | Commission-free for CFDs | Varies by broker |

| Overnight Financing Range | Varies by asset | Varies by broker |

IG's average spread for major currency pairs is competitive, making it an attractive option for active traders. However, it is important to note that IG charges commissions on certain assets, particularly when trading shares, which can be higher than average. Additionally, the broker applies overnight financing fees for leveraged positions, which can accumulate over time and impact overall trading costs. Traders should carefully review the fee structure to understand the potential costs associated with their trading strategies.

Customer Funds Safety

The safety of customer funds is paramount when choosing a broker. IG employs several measures to ensure the security of client assets. Client funds are kept in segregated accounts at reputable banks, which means that they are separate from the company's operational funds. This segregation protects clients' money in the event of insolvency.

Moreover, IG offers negative balance protection, ensuring that clients cannot lose more money than they have deposited, even in volatile market conditions. This feature is particularly important for traders using leverage, as it mitigates the risk of incurring significant losses. IG's commitment to client fund protection is further reinforced by its adherence to regulatory standards set by the FCA and other governing bodies.

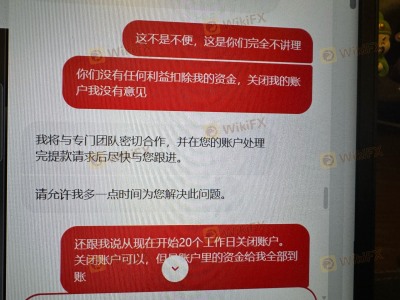

Customer Experience and Complaints

Customer feedback plays a significant role in assessing a broker's reliability. IG has received a mix of reviews from users, with many praising its user-friendly platform and extensive educational resources. However, some common complaints have also emerged. The table below summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive, but some delays reported |

| Platform Outages | High | Acknowledged and addressed during high volatility |

| High Fees for Occasional Traders | Moderate | Clarified fee structures offered |

Typical cases involve users experiencing delays in withdrawals, especially during high trading volumes or market volatility. While IG generally responds to complaints and provides assistance, the occasional platform outage during critical trading times has raised concerns among users, highlighting the importance of a stable trading environment.

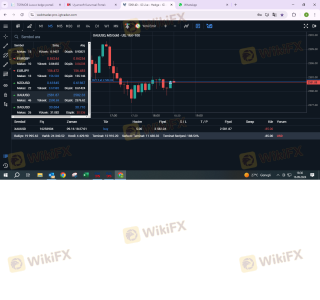

Platform and Trade Execution

IG's trading platform is known for its robust performance and user-friendly interface. The platform offers a range of features, including advanced charting tools, real-time market data, and customizable layouts. Users have reported high levels of satisfaction with the platform's stability and execution speed. However, some traders have experienced slippage and order rejections during periods of high volatility, which can impact trading outcomes.

The platform's execution quality is generally considered reliable, with low latency and fast order processing times. Nevertheless, traders should remain vigilant and monitor their trades closely, especially during significant market events that may lead to increased volatility.

Risk Assessment

Using IG as a trading platform involves certain risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by multiple authorities |

| Market Risk | High | High volatility can lead to significant losses |

| Platform Risk | Medium | Occasional outages during peak times |

| Fee Structure Risk | Medium | Higher fees for occasional traders |

To mitigate these risks, traders are advised to conduct thorough research, utilize risk management tools, and engage in continuous education to enhance their trading skills.

Conclusion and Recommendations

In conclusion, IG is a reputable and well-regulated broker with a long-standing history in the trading industry. The evidence suggests that IG is not a scam and operates within a robust regulatory framework. However, traders should be cautious of the potential risks associated with trading, including market volatility and the fee structure, which may not be favorable for occasional traders.

For those considering IG, it is recommended to take advantage of its extensive educational resources and demo accounts to familiarize themselves with the platform before committing real funds. Additionally, traders who prioritize low-cost trading might explore alternative brokers that offer more competitive pricing for smaller accounts. Overall, IG remains a strong choice for traders seeking a reliable and secure trading environment.

Is IG a scam, or is it legit?

The latest exposure and evaluation content of IG brokers.

IG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IG latest industry rating score is 8.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.