Fidelity 2025 Review: Everything You Need to Know

Fidelity Investments has established itself as a leading brokerage, offering a comprehensive suite of services that cater to both novice and experienced investors. With zero commissions on stock and ETF trades, along with a robust selection of no-expense-ratio mutual funds, Fidelity continues to receive high praise for its user-friendly platforms and extensive research tools. However, areas such as customer service and specific trading features may leave room for improvement.

Note: It's important to consider that different entities operate in various regions, which may affect the services and features available to users. This review aims to provide a fair and accurate comparison based on the latest information available.

Rating Summary

We rate brokers based on comprehensive research and user feedback to ensure a balanced perspective.

Broker Overview

Founded in 1946, Fidelity Investments has grown into one of the largest asset managers globally, overseeing over $11.5 trillion in assets. The firm offers a variety of trading platforms, including its flagship Active Trader Pro, which is designed for active investors, and a user-friendly web platform. Fidelity allows trading in various asset classes, including stocks, ETFs, options, mutual funds, bonds, and cryptocurrencies like Bitcoin and Ethereum. The brokerage is regulated by the SEC and FINRA, ensuring a secure trading environment for its clients.

Detailed Section

Regulated Geographic Areas/Regions:

Fidelity operates primarily in the United States and is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). It also has regulatory oversight from other entities, ensuring compliance with stringent financial standards.

Deposit/Withdrawal Currencies/Cryptocurrencies:

Fidelity allows clients to deposit and withdraw in USD. Additionally, it offers cryptocurrency trading through a separate account, focusing on Bitcoin and Ethereum, with a built-in markup on trades.

Minimum Deposit:

Fidelity has a minimum deposit requirement of $0, making it accessible for new investors. However, some investment products may have their own minimums.

Bonuses/Promotions:

Fidelity currently offers promotional bonuses for new account holders who deposit a minimum amount. For instance, new customers can receive a $100 bonus for opening an account with a deposit of $50 or more.

Tradable Asset Classes:

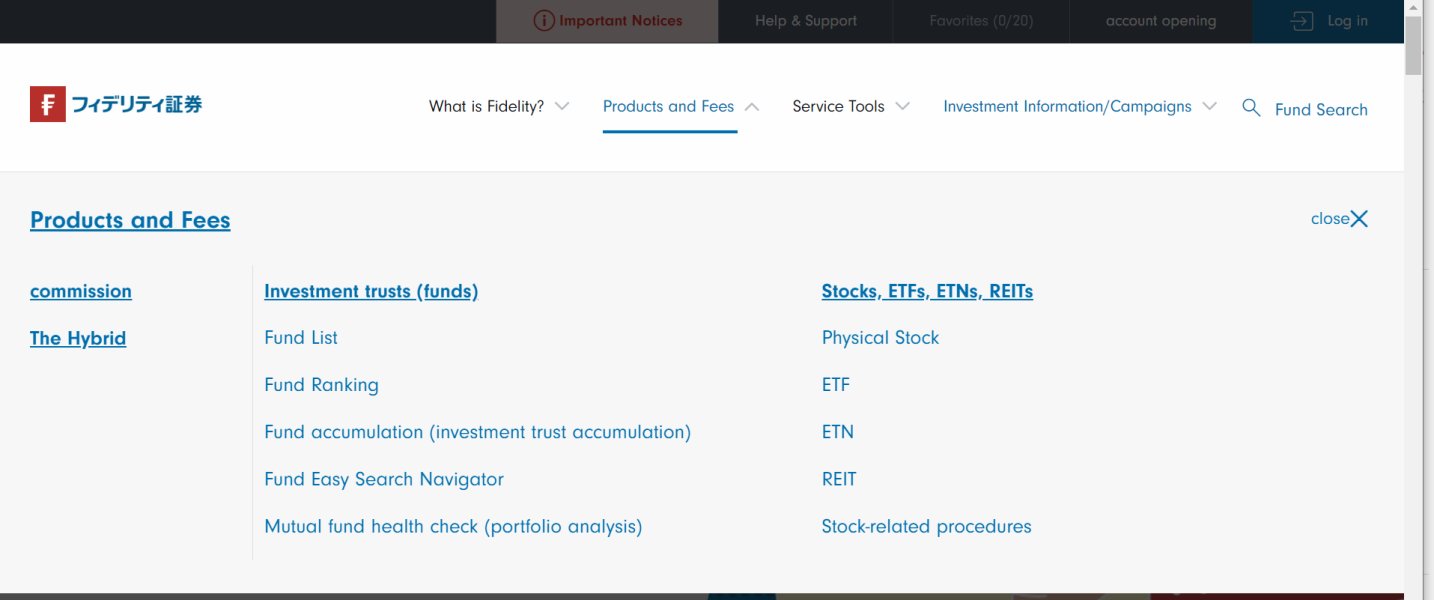

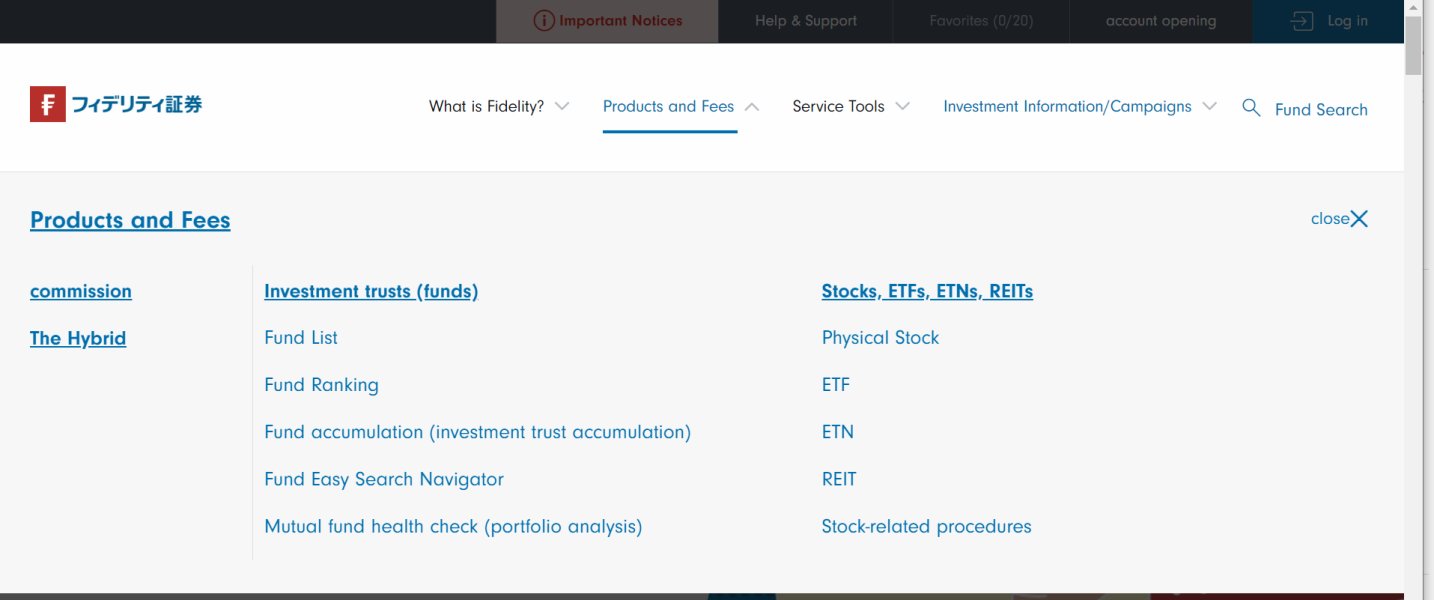

Fidelity provides a wide range of tradable assets, including stocks, ETFs, mutual funds, options, bonds, and cryptocurrencies. While it excels in traditional asset classes, it does not offer futures or forex trading.

Costs (Spreads, Fees, Commissions):

Fidelity does not charge commissions for stock and ETF trades, which is a significant advantage for cost-conscious investors. However, options trades incur a fee of $0.65 per contract. The brokerage also charges a $49.95 fee for purchasing non-Fidelity mutual funds within 60 days.

Leverage:

Fidelity's margin rates are relatively high compared to some competitors, ranging from approximately 9.25% to 13.575% depending on the account balance. This may be a consideration for active traders looking to leverage their investments.

Allowed Trading Platforms:

Fidelity offers multiple trading platforms, including its web-based platform, a mobile app, and the advanced Active Trader Pro for desktop users. Each platform provides various tools and resources tailored to different types of investors.

Restricted Regions:

Fidelity primarily serves U.S. residents, with limited services available for Canadian clients. International investors may find restrictions on certain trading products.

Available Customer Support Languages:

Fidelity provides customer support primarily in English, with additional resources available in other languages through their online platform.

Repeated Rating Summary

Detailed Breakdown

Account Conditions (10/10):

Fidelity stands out with a $0 minimum deposit requirement and no account maintenance fees, making it highly accessible for new investors. It offers a variety of account types, including individual and retirement accounts.

Tools and Resources (9/10):

The brokerage excels in providing extensive research tools, including reports from over 20 independent research firms. Its stock and mutual fund screeners are user-friendly and highly detailed, allowing for effective investment analysis.

Customer Service and Support (8/10):

Fidelity provides 24/7 customer service through phone and online chat. While the support is generally well-rated, some users have reported longer wait times during peak hours.

Trading Setup (8/10):

The trading experience on Fidelity's platforms is generally smooth, but some users find the Active Trader Pro desktop platform slightly outdated compared to competitors. The mobile app is well-designed but lacks certain advanced trading features.

Trustworthiness (9/10):

Fidelity is a highly trusted brokerage, regulated by the SEC and FINRA. It offers SIPC insurance coverage up to $500,000, providing additional peace of mind for investors.

User Experience (8/10):

Overall, Fidelity's platforms are user-friendly, but new users may initially find the extensive features overwhelming. The educational resources provided are beneficial for both beginners and experienced investors.

Additional Features (7/10):

While Fidelity offers many features, it lacks a paper trading option, which could be beneficial for beginners looking to practice before investing real money.

In conclusion, the Fidelity Review for 2025 underscores its position as a leading brokerage with a comprehensive offering suitable for various investor types. While it excels in many areas, potential users should consider their specific needs, particularly regarding advanced trading features and customer service responsiveness.