InstaForex 2025 Review: Everything You Need to Know

Executive Summary

InstaForex is a forex broker that started in 2007. The company has built a strong presence in the global trading market over its 18-year history, serving millions of clients worldwide with comprehensive trading services. Based in Russia and regulated by ACPR, this instaforex review reveals a platform that offers extensive trading opportunities with over 2,600 trading instruments, including forex pairs, CFDs, and cryptocurrency assets. The broker stands out with very high leverage ratios reaching up to 1:1000. It also has an ultra-low minimum deposit requirement of just $1 USD, making it easy for newcomers to enter the forex market.

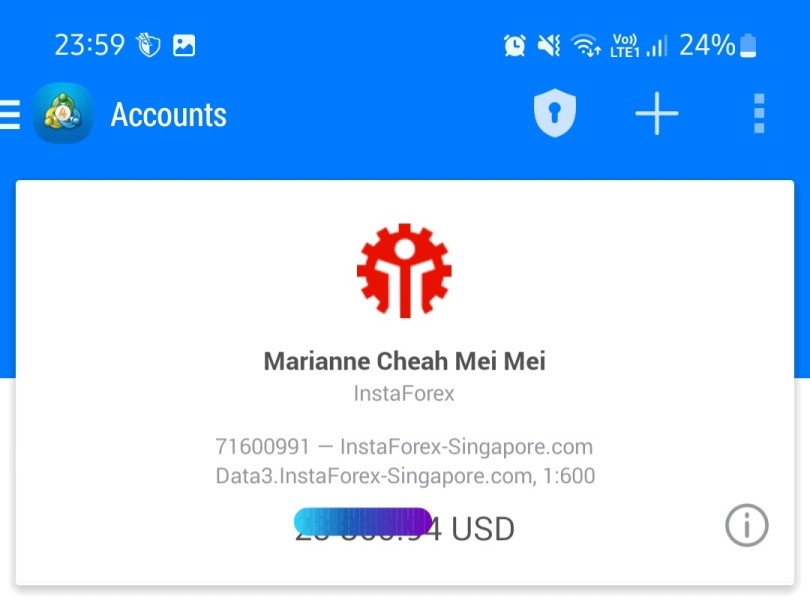

The platform serves two main user groups: beginner traders seeking low-barrier entry into forex trading, and experienced investors looking for high-leverage trading opportunities. InstaForex supports the widely-used MetaTrader 4 platform alongside its own trading interface. This setup helps traders who are familiar with industry-standard tools. According to broker listings, the company claims to serve over seven million clients worldwide. However, user feedback presents a mixed picture, with experiences varying significantly based on individual trading approaches and expectations. This complete evaluation examines all aspects of InstaForex's services to provide potential clients with essential insights for informed decision-making.

Important Disclaimers

Regional Entity Differences: InstaForex operates under ACPR regulation. However, specific license numbers are not clearly shown in available public documentation. Traders should be aware that regulatory frameworks and available services may differ based on their geographical location and local financial regulations. The broker does not accept clients from the United States. Certain features or trading conditions may vary for clients in different jurisdictions.

Review Methodology: This instaforex review is based on comprehensive analysis of publicly available information, user feedback from multiple sources, and official broker documentation. Our evaluation method includes real user experiences, regulatory information, and technical platform assessments. All information presented reflects data available as of 2025 and should be verified independently by potential clients before making trading decisions.

Overall Rating Framework

Broker Overview

InstaForex entered the forex trading industry in 2007. The company established itself as a global trading platform headquartered in Russia, building substantial market presence over nearly two decades of operation. Over nearly two decades of operation, the company has positioned itself as a comprehensive trading solution serving both novice and experienced traders across international markets. The broker's business model focuses on providing broad market access through multiple asset classes. It emphasizes accessibility through low entry barriers and high leverage options that appeal to diverse trading strategies.

According to official company information, InstaForex has built a substantial client base exceeding seven million registered users worldwide. The broker's approach centers on offering extensive trading opportunities across forex, CFDs, and cryptocurrency markets. These opportunities are supported by established trading platforms and competitive trading conditions. The company has maintained consistent operations since its founding, adapting to evolving market conditions while expanding its service offerings to meet changing trader demands.

The broker operates primarily through MetaTrader 4 and its proprietary trading platform. These platforms provide clients with familiar and reliable trading environments that most traders recognize from other brokers. InstaForex offers access to major forex currency pairs, commodities, indices, and an expanding selection of cryptocurrency CFDs, totaling over 2,600 trading instruments. This diverse asset selection positions the broker as a one-stop solution for traders seeking exposure to multiple markets through a single platform. The company's regulatory status under ACPR supervision provides a framework for operational oversight. However, specific regulatory details require further verification by prospective clients.

Regulatory Jurisdiction: InstaForex operates under the supervision of ACPR (Autorité de Contrôle Prudentiel et de Résolution). This provides regulatory oversight for the broker's operations, though the level of protection may vary compared to other regulatory bodies. However, specific license numbers and detailed regulatory compliance information are not prominently featured in available documentation, which may concern traders prioritizing regulatory transparency.

Minimum Deposit Requirements: The broker sets an exceptionally low minimum deposit of $1 USD. This makes it one of the most accessible platforms for new traders who want to start with minimal capital. This minimal entry requirement allows beginners to start trading with very limited capital, though traders should consider whether such small amounts provide sufficient margin for meaningful trading activities.

Available Trading Assets: InstaForex provides access to an extensive range of over 2,600 trading instruments. The selection includes major and minor forex pairs, commodity CFDs, stock indices, and cryptocurrency assets, covering most popular trading categories. This comprehensive selection covers most popular trading categories and provides opportunities for portfolio diversification within a single platform.

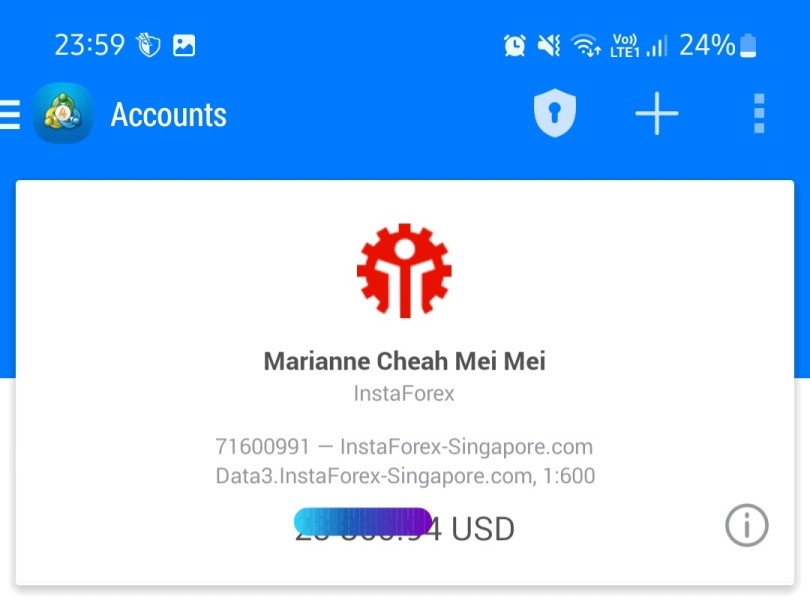

Leverage Ratios: The platform offers maximum leverage of up to 1:1000. This ranks among the highest in the industry and can significantly amplify both profits and losses. While this high leverage can amplify potential profits, it also significantly increases risk exposure and requires careful risk management from traders, particularly those with limited experience.

Trading Platform Options: InstaForex supports the industry-standard MetaTrader 4 platform alongside its proprietary trading interface. MT4 provides familiar functionality for experienced traders who have used this platform with other brokers. MT4 provides familiar functionality for experienced traders, while the broker's custom platform may offer additional features specific to InstaForex's service model.

Base Currency Support: The platform accommodates multiple base currencies including USD, EUR, and RUB. This provides flexibility for international clients and reduces currency conversion requirements for users in different regions, making it easier to manage accounts in preferred currencies.

Demo Account Availability: InstaForex offers demo accounts. These allow potential clients to test platform functionality and trading conditions before committing real funds without any financial risk. This feature is particularly valuable for new traders learning platform navigation and testing strategies.

This instaforex review notes that specific information regarding deposit and withdrawal methods, promotional offers, commission structures, geographical restrictions, and customer service language support requires additional verification through direct broker contact.

Account Conditions Analysis (Score: 6/10)

InstaForex's account conditions present a mixed picture that appeals primarily to traders prioritizing accessibility over premium features. The broker's standout feature is its remarkably low minimum deposit requirement of just $1 USD. This removes virtually all financial barriers for new traders entering the forex market, making it one of the most accessible brokers available. This ultra-low threshold is particularly attractive for beginners who want to experience live trading without significant capital commitment, though practical trading with such minimal funds may prove challenging due to margin requirements.

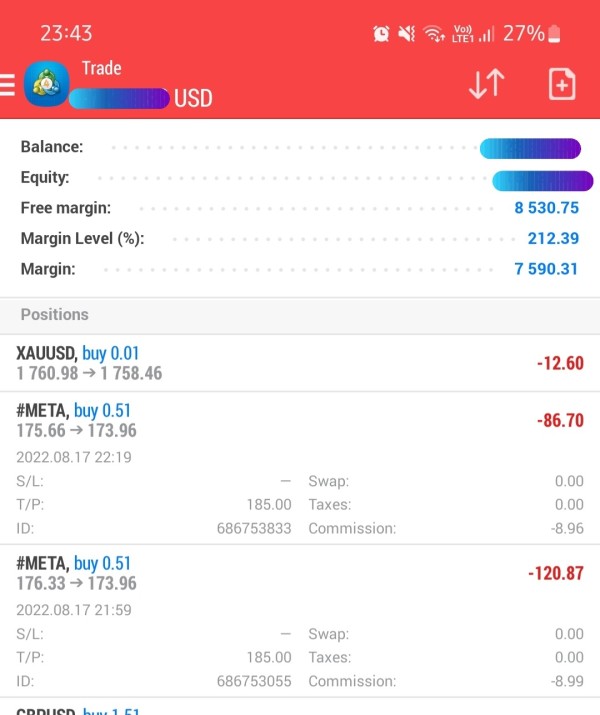

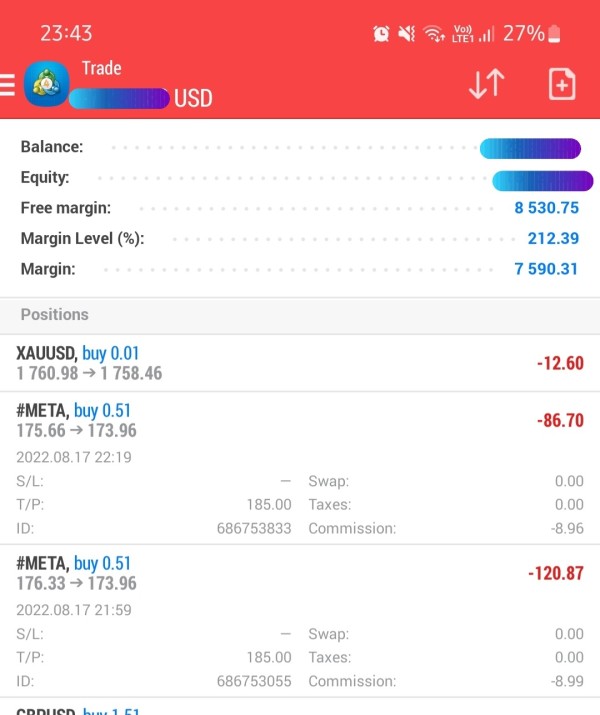

The platform's leverage offering of up to 1:1000 represents one of the highest ratios available in the retail forex market. This extreme leverage can amplify trading opportunities significantly, allowing traders to control large positions with small amounts of capital. While this extreme leverage can amplify trading opportunities, it also creates substantial risk exposure that requires sophisticated risk management skills. Experienced traders may appreciate this flexibility for specific strategies. However, novice traders should approach such high leverage with considerable caution.

However, available information suggests limited diversity in account types. Specific details about different account tiers, their respective features, and associated benefits are not clearly outlined in public documentation, which limits options for traders with varying needs. This lack of account variety may limit options for traders with specific needs or those seeking premium services typically associated with higher-tier accounts.

User feedback regarding account opening processes and ongoing account management appears mixed. Some clients report straightforward registration while others mention complications during verification procedures that can delay account activation. The absence of detailed information about Islamic accounts, professional trading accounts, or other specialized account types may limit appeal for certain trader segments.

Compared to industry competitors, InstaForex's account conditions favor accessibility over sophistication. While the low minimum deposit and high leverage attract attention, they may not provide the comprehensive features that experienced traders expect. The apparent lack of account customization options and unclear fee structures place it at a disadvantage compared to brokers offering more comprehensive account packages. This instaforex review finds that account conditions serve basic trading needs but may not satisfy traders seeking advanced account features or premium service levels.

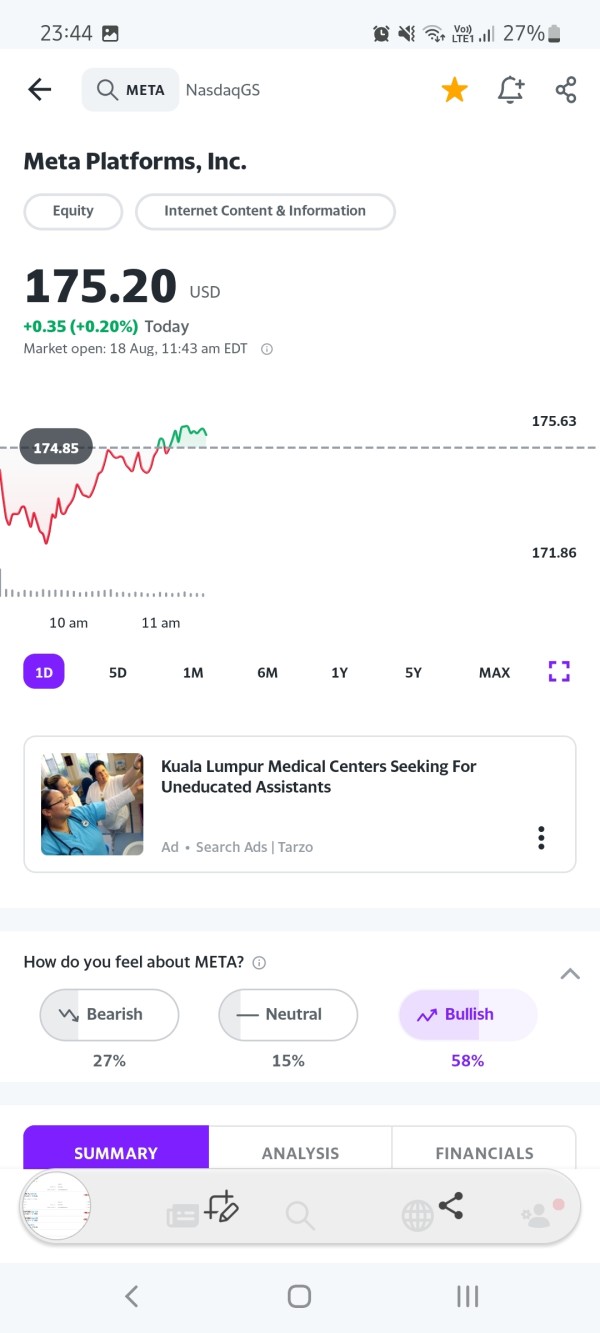

InstaForex demonstrates significant strength in its trading tools and instrument selection, offering over 2,600 trading instruments that span multiple asset classes. This extensive range includes major and minor forex currency pairs, commodity CFDs covering precious metals and energy products, stock indices from global markets, and an expanding selection of cryptocurrency CFDs that reflects current market trends. The breadth of available instruments positions InstaForex favorably against many competitors. It also provides traders with substantial diversification opportunities within a single platform, eliminating the need for multiple broker accounts.

The broker's instrument offering covers all major trading categories that active forex and CFD traders typically require. Currency pairs include all major combinations like EUR/USD, GBP/USD, and USD/JPY. The platform also offers numerous minor and exotic pairs that appeal to experienced traders seeking unique opportunities. Commodity access encompasses popular trading assets like gold, silver, crude oil, and natural gas, while index CFDs provide exposure to major global markets including US, European, and Asian indices.

Cryptocurrency trading capabilities have become increasingly important for modern brokers. InstaForex addresses this demand with CFD access to major digital assets, allowing traders to participate in crypto markets without technical complications. This crypto offering allows traders to speculate on price movements without directly holding cryptocurrency, which simplifies the trading process and regulatory compliance for many clients.

However, specific information about research and analysis resources, educational materials, and automated trading support is not prominently featured in available documentation. Many competitors provide comprehensive market analysis, economic calendars, trading signals, and educational content that enhance the overall trading experience. The apparent absence or limited promotion of such resources represents a potential weakness in InstaForex's value proposition.

User feedback generally supports satisfaction with the variety of available trading instruments. Clients appreciate the platform's comprehensive asset selection, which allows them to diversify their trading strategies. The ability to trade multiple markets through a single account simplifies portfolio management and reduces the need for multiple broker relationships.

Customer Service and Support Analysis (Score: 5/10)

Customer service represents one of the more concerning aspects revealed in this instaforex review. User feedback indicates inconsistent support quality and response times that fall short of industry standards, creating frustration for clients who need assistance. Multiple user reports suggest that customer service responsiveness can be problematic, with clients experiencing delays in receiving assistance for both technical issues and account-related inquiries.

Available documentation does not clearly specify the full range of customer support channels, contact hours, or guaranteed response times. This creates uncertainty for traders who may require timely assistance during market hours, particularly during volatile trading periods. This lack of transparency regarding support availability is particularly concerning for active traders who depend on reliable customer service for issue resolution.

User feedback reveals mixed experiences with support quality. Some clients report helpful interactions while others describe frustrating encounters with representatives who appeared to lack sufficient knowledge or authority to resolve complex issues. This inconsistency in service quality suggests potential training gaps or resource limitations within the customer support department.

The absence of clearly promoted multilingual support information may also limit accessibility for international clients. This is particularly concerning given InstaForex's global client base spanning multiple regions and languages. Effective customer support typically requires native-language assistance for complex trading or technical issues.

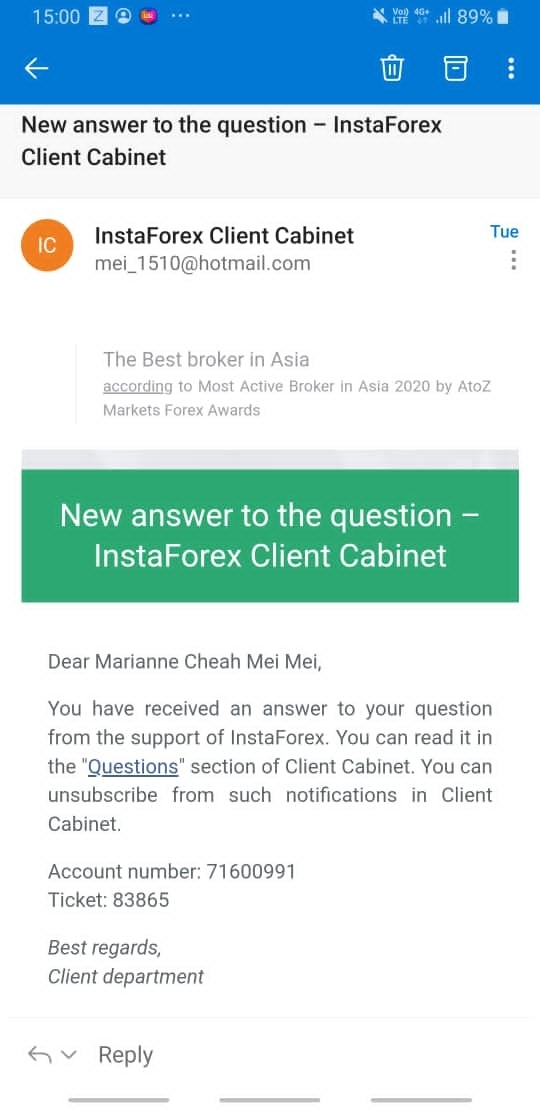

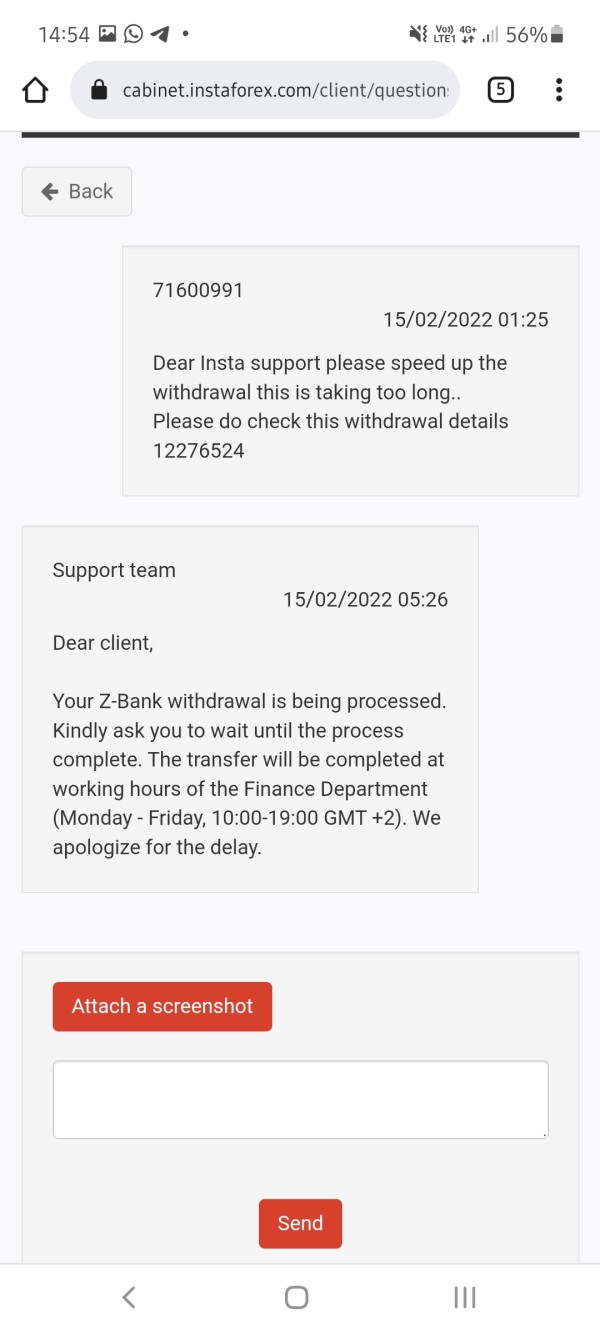

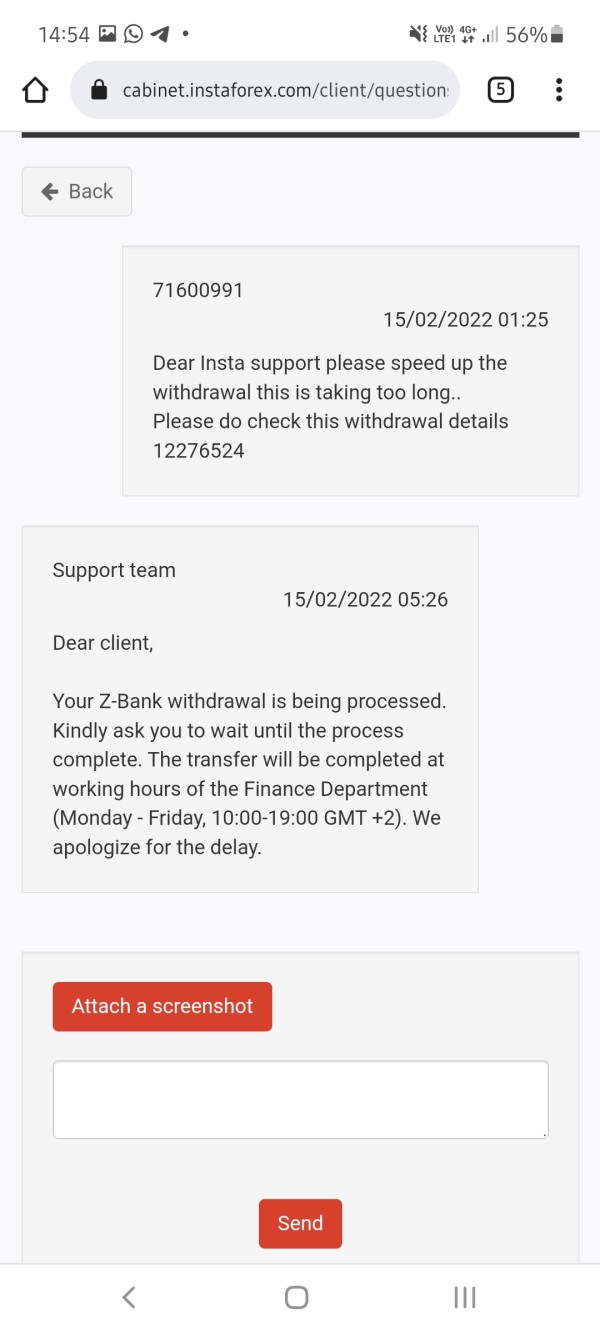

Response time complaints appear frequently in user reviews. Some clients report extended delays for email inquiries and difficulties reaching support during peak trading periods. For active traders who may encounter urgent issues during volatile market conditions, such delays can result in missed opportunities or unresolved problems that impact trading performance.

Problem resolution effectiveness also receives mixed reviews. Some users report satisfactory outcomes while others describe prolonged resolution processes for relatively straightforward issues. The lack of clear escalation procedures or service level commitments further complicates the support experience for clients requiring assistance.

Trading Experience Analysis (Score: 7/10)

The trading experience with InstaForex shows generally positive feedback regarding platform stability and execution speed. However, specific performance metrics like average slippage rates and order rejection frequencies are not readily available in public documentation. Users frequently praise the platform's reliability during regular market conditions, suggesting that the underlying technology infrastructure supports consistent trading operations.

MetaTrader 4 integration provides a familiar and robust trading environment for experienced forex traders. MT4's proven functionality includes advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors. MT4's proven functionality, including advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors, enhances the overall trading experience. The platform's widespread industry adoption means that most traders can quickly adapt to InstaForex's MT4 implementation without extensive learning curves.

Platform execution speed receives generally favorable user reviews. Clients report satisfactory order processing during normal market conditions, which is essential for effective trading. However, performance during high-volatility periods or major news events is less clearly documented, and specific data about execution quality metrics would strengthen confidence in the platform's capabilities.

The proprietary trading platform offered alongside MT4 provides additional options for traders who prefer alternative interfaces. However, detailed information about the features, functionality, and advantages of this custom platform is limited in available documentation. However, detailed information about the features, functionality, and advantages of this custom platform is limited in available documentation, making it difficult to assess its value compared to the standard MT4 offering.

Mobile trading capabilities are essential for modern forex trading. However, comprehensive reviews of InstaForex's mobile platform performance and feature completeness are not prominently available. Given the importance of mobile trading for active traders, this information gap represents a limitation in evaluating the complete trading experience.

User feedback regarding spreads and overall trading costs presents mixed perspectives. Some traders express satisfaction while others note concerns about cost competitiveness compared to other brokers. The absence of detailed spread information and commission structures in readily available documentation makes it challenging for potential clients to accurately assess total trading costs. This instaforex review finds that while basic trading functionality appears solid, more transparency regarding execution quality and costs would improve trader confidence.

Trust and Regulation Analysis (Score: 6/10)

InstaForex's regulatory status under ACPR supervision provides a foundation for operational oversight. However, several transparency concerns affect overall trust assessment. While ACPR regulation offers some level of regulatory framework, the absence of prominently displayed specific license numbers or detailed compliance information creates uncertainty about the extent and nature of regulatory oversight.

The broker's 18-year operational history since 2007 demonstrates business continuity and market survival through various economic cycles. This includes the 2008 financial crisis and subsequent market volatility, showing the company's ability to maintain operations during challenging periods. This longevity suggests operational stability, though it does not necessarily guarantee future performance or regulatory compliance standards.

Financial transparency represents a significant concern. Detailed company financial reports, segregated account information, and client fund protection measures are not readily available in public documentation. Modern forex brokers typically provide clear information about client fund segregation, deposit insurance coverage, and financial reporting to build client confidence, but such details are notably absent from easily accessible InstaForex materials.

The company's Russian headquarters may present additional considerations for some traders. This is particularly relevant given evolving international regulatory environments and potential restrictions that could affect operations or client access. Traders should consider how geopolitical factors might impact their relationship with a Russian-based broker.

Industry recognition through awards or third-party certifications is not prominently featured in available documentation. This contrasts with many established brokers who actively promote regulatory achievements and industry recognition. Such external validation typically helps build trust and credibility within the trading community.

User trust feedback reveals mixed sentiments. Some long-term clients express satisfaction while others report concerns about fund security and withdrawal processes. The lack of clear information about negative balance protection, compensation schemes, or dispute resolution procedures further complicates trust assessment. Regulatory verification through ACPR records would provide additional confidence, but the absence of easily accessible license details makes such verification challenging for potential clients.

User Experience Analysis (Score: 6/10)

Overall user satisfaction with InstaForex varies significantly based on individual trading approaches, experience levels, and specific service interactions. This instaforex review finds that user experiences tend to polarize between satisfied long-term clients and disappointed users who encountered specific issues with platform services or support. The broker appears to serve its intended target market of entry-level traders relatively well, with the low minimum deposit and high leverage attracting beginners seeking accessible forex trading opportunities.

However, user feedback suggests that some novice traders may struggle with the platform's complexity or lack sufficient educational resources to trade effectively. This can lead to negative experiences that reflect inexperience rather than platform deficiencies. The absence of comprehensive educational materials may contribute to poor trading outcomes for new users.

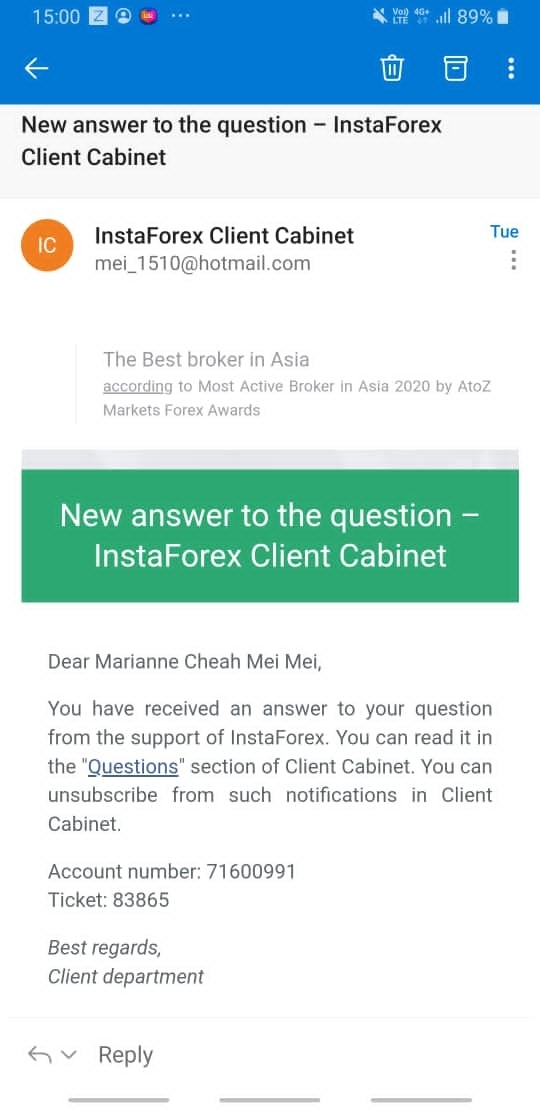

Registration and account verification processes receive mixed reviews. Some users report straightforward onboarding while others describe complications or delays during document verification. The absence of clear information about typical verification timeframes and requirements creates uncertainty for new clients planning their account setup.

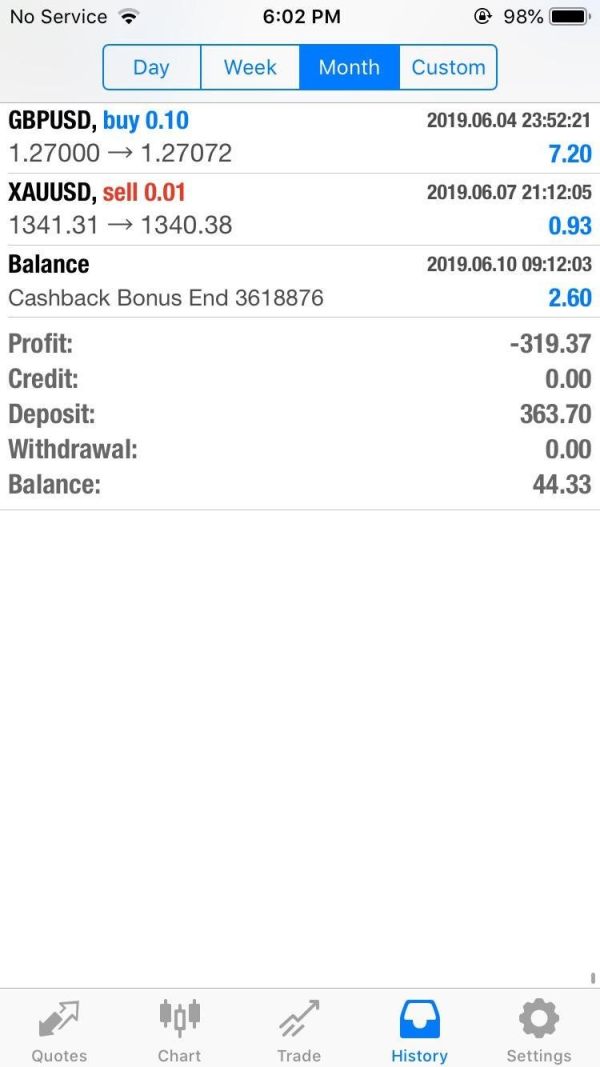

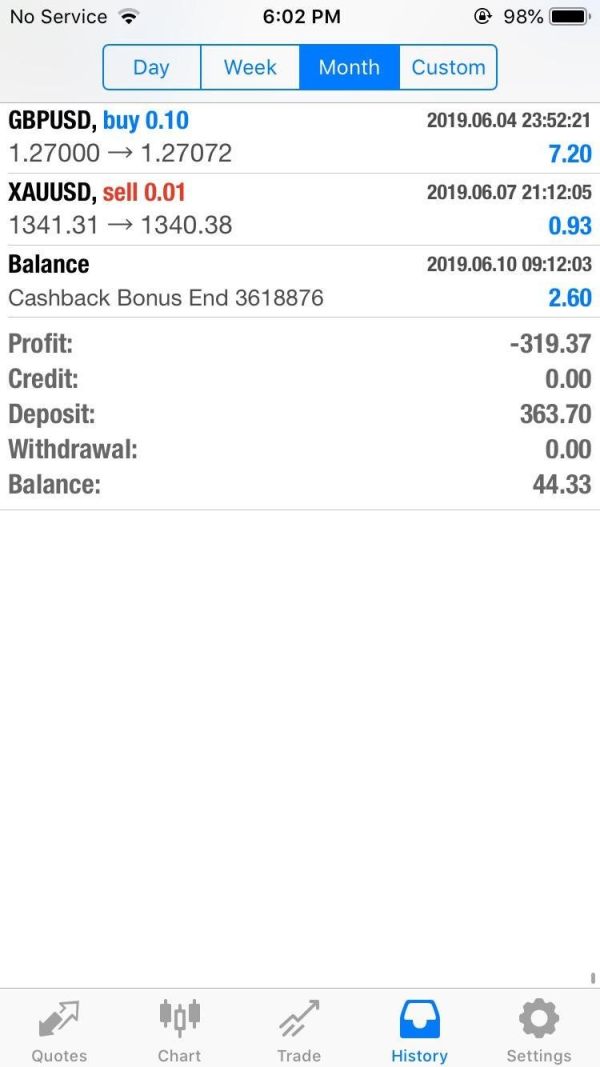

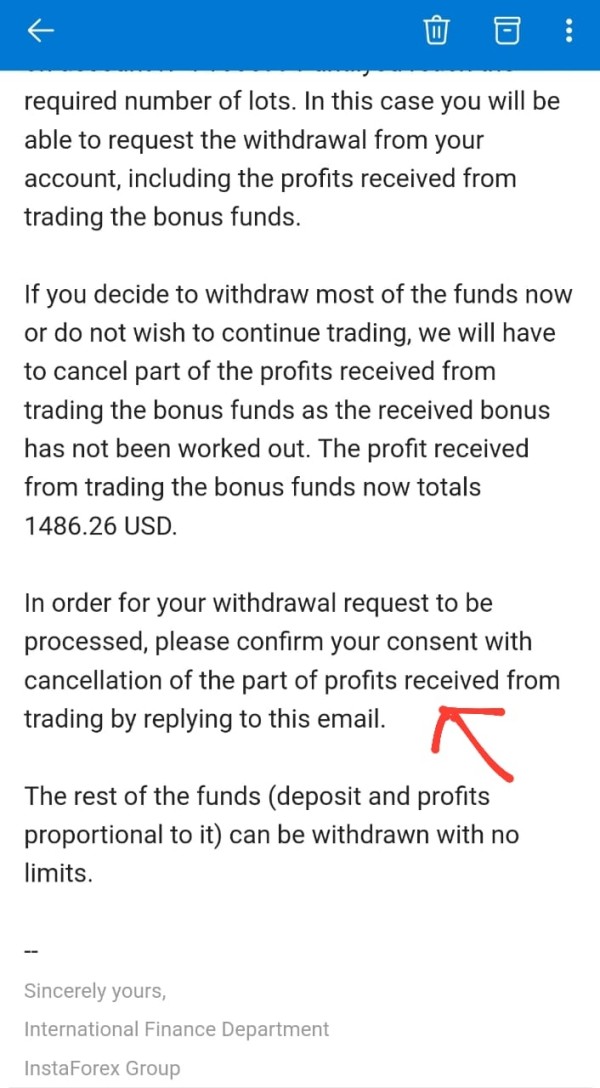

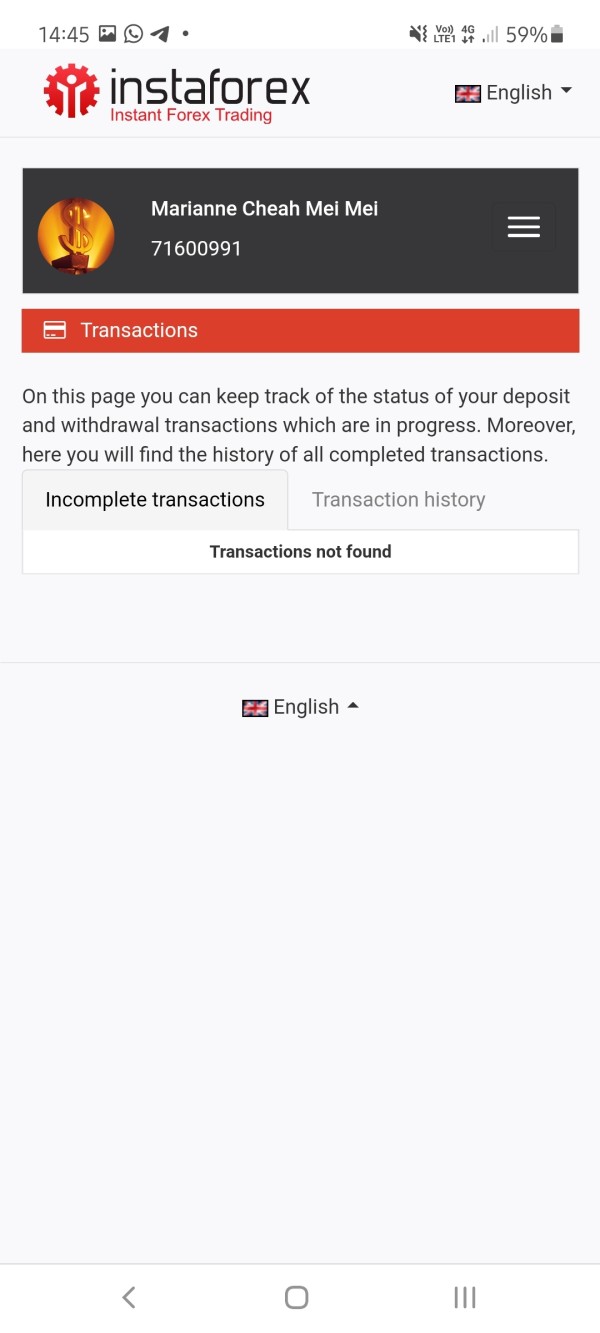

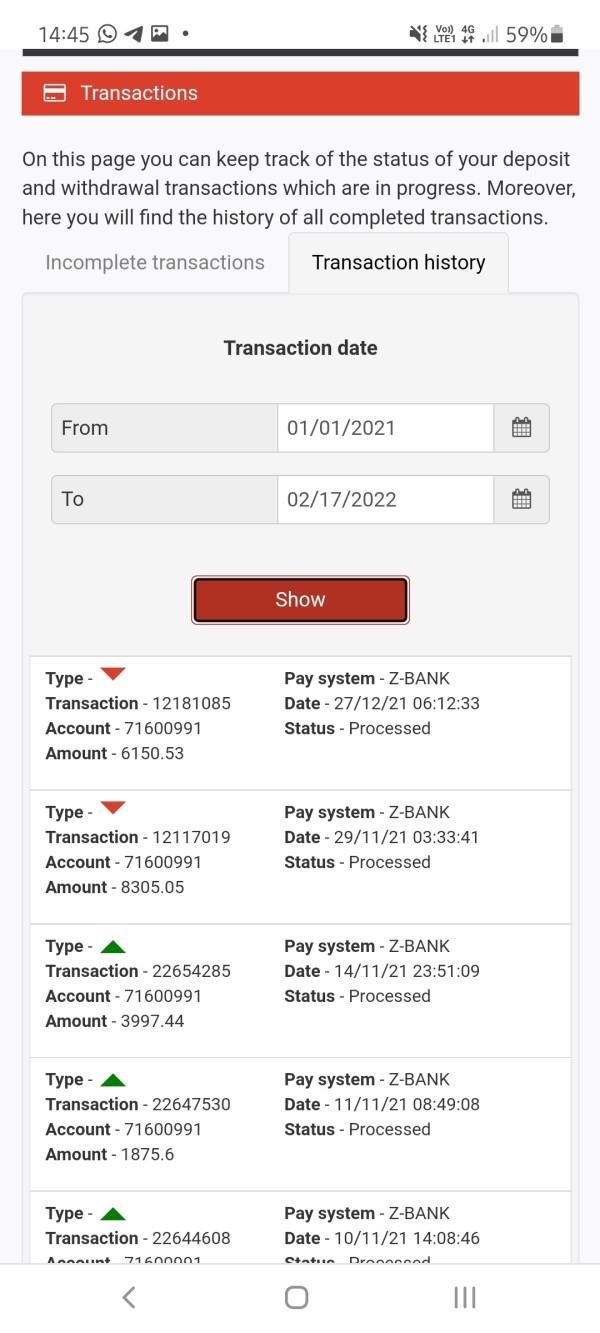

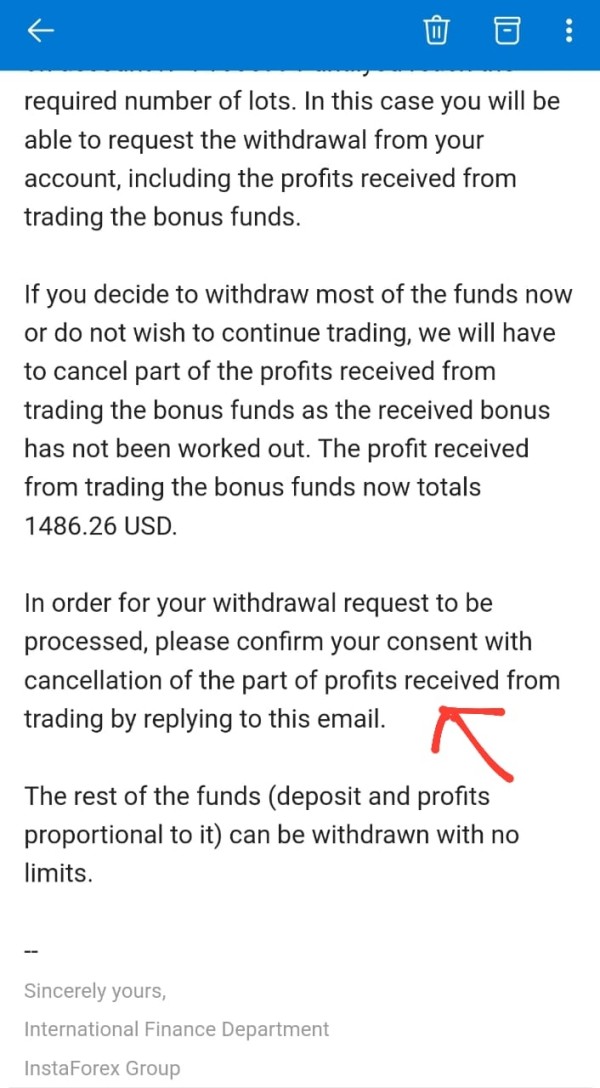

Deposit and withdrawal experiences show varied user feedback. However, specific information about available payment methods, processing times, and associated fees is not comprehensively detailed in readily available documentation. Some users report satisfactory fund management experiences while others mention delays or complications during withdrawal processes.

Interface design and platform usability generally receive positive feedback. This is particularly true regarding MT4 implementation which benefits from the platform's established user interface and functionality. However, detailed reviews of InstaForex's proprietary platform usability are less common, making it difficult to assess the complete user experience across all available trading interfaces.

Common user complaints center around customer service responsiveness and transparency regarding trading conditions and fees. These issues appear to affect user satisfaction significantly, particularly for clients who require support assistance or encounter unexpected costs during trading. The inconsistency in service quality creates frustration among users who expect reliable support.

The user demographic appears well-suited to InstaForex's positioning. The platform attracts both newcomers seeking low-barrier entry and experienced traders interested in high-leverage opportunities. However, the mixed feedback suggests that service consistency and support quality improvements could significantly enhance overall user satisfaction. Users who prioritize regulatory transparency and comprehensive support services may find better alternatives, while those focused primarily on accessible trading conditions and instrument variety may find InstaForex adequate for their needs.

Conclusion

This comprehensive instaforex review reveals a forex broker that offers significant accessibility advantages through its ultra-low $1 minimum deposit and extensive selection of over 2,600 trading instruments. These features make it particularly attractive for newcomers to forex trading and experienced traders seeking high-leverage opportunities up to 1:1000. The platform's 18-year operational history and broad asset selection spanning forex, CFDs, and cryptocurrency markets demonstrate substantial market experience and comprehensive trading capabilities.

However, several areas require improvement, particularly customer service responsiveness and regulatory transparency. User feedback consistently highlights concerns about support quality and response times, which can significantly impact the trading experience. The lack of detailed regulatory information and fee structures creates uncertainty for potential clients. These limitations primarily affect traders who prioritize premium service levels and comprehensive regulatory disclosure.

InstaForex is best suited for budget-conscious beginners seeking affordable market entry and experienced traders comfortable with high-leverage trading who can navigate potential service limitations independently. The platform may not satisfy traders requiring premium support services, detailed regulatory transparency, or sophisticated account features typically offered by higher-tier brokers. Potential clients should carefully evaluate their priorities regarding cost versus service quality when considering InstaForex for their trading needs.