Inefex 2025 Review: Everything You Need to Know

Executive Summary

This inefex review shows major concerns about this unregulated CFD broker. Traders should think carefully before investing their money here. Inefex works from Mauritius, which has loose forex rules, and many sources say it might be a fake platform.

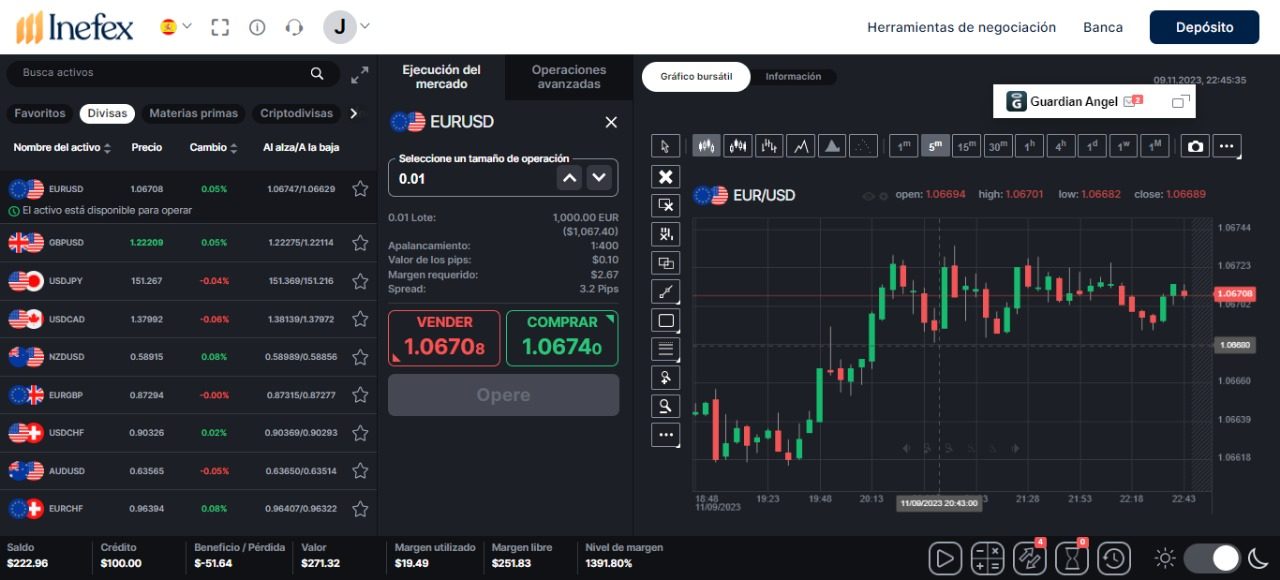

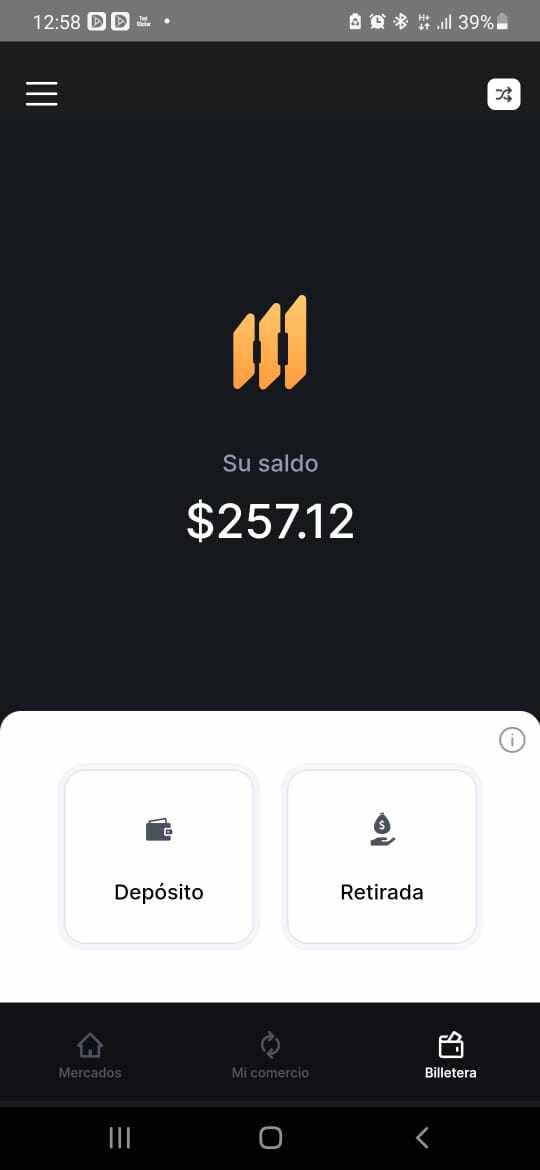

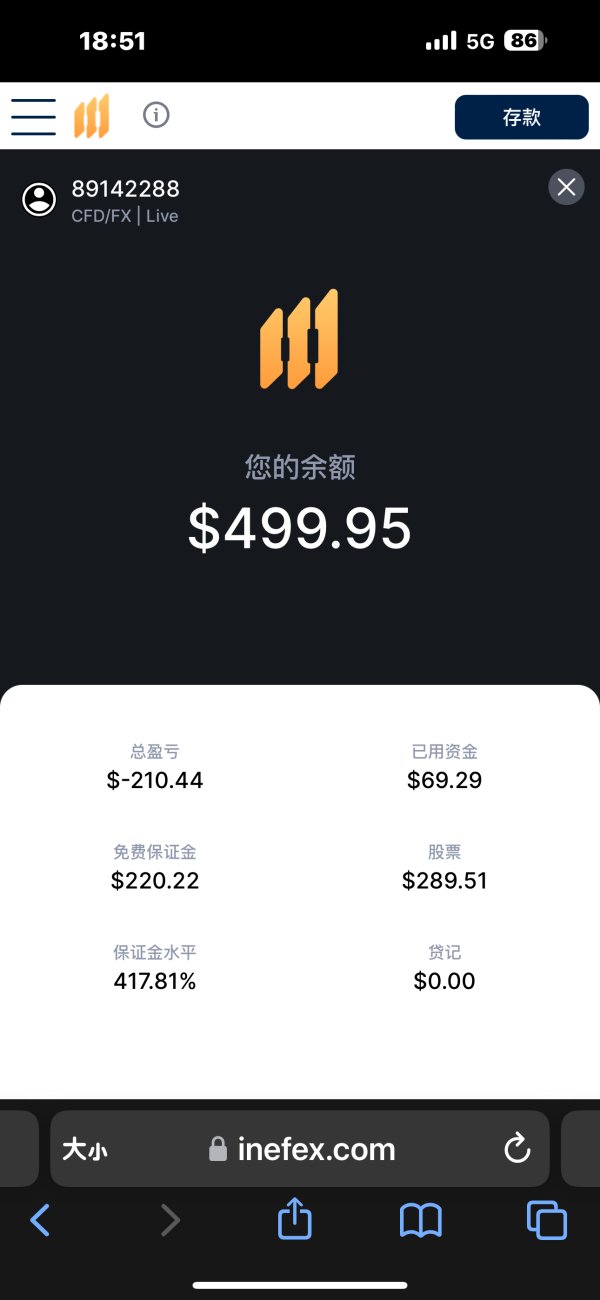

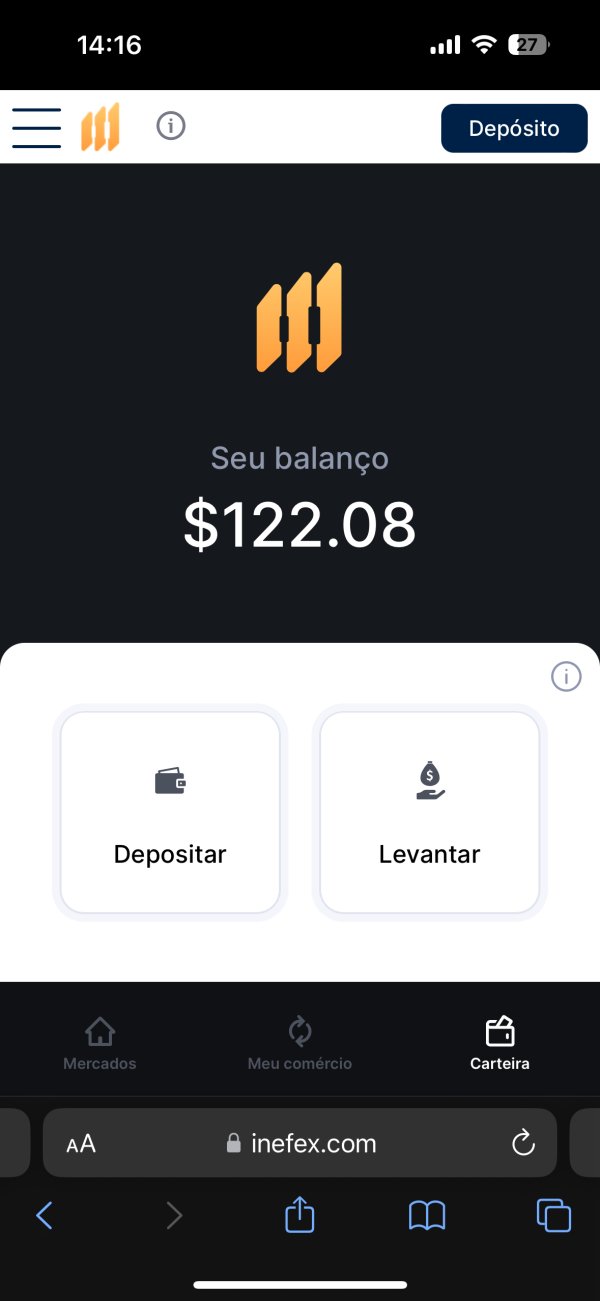

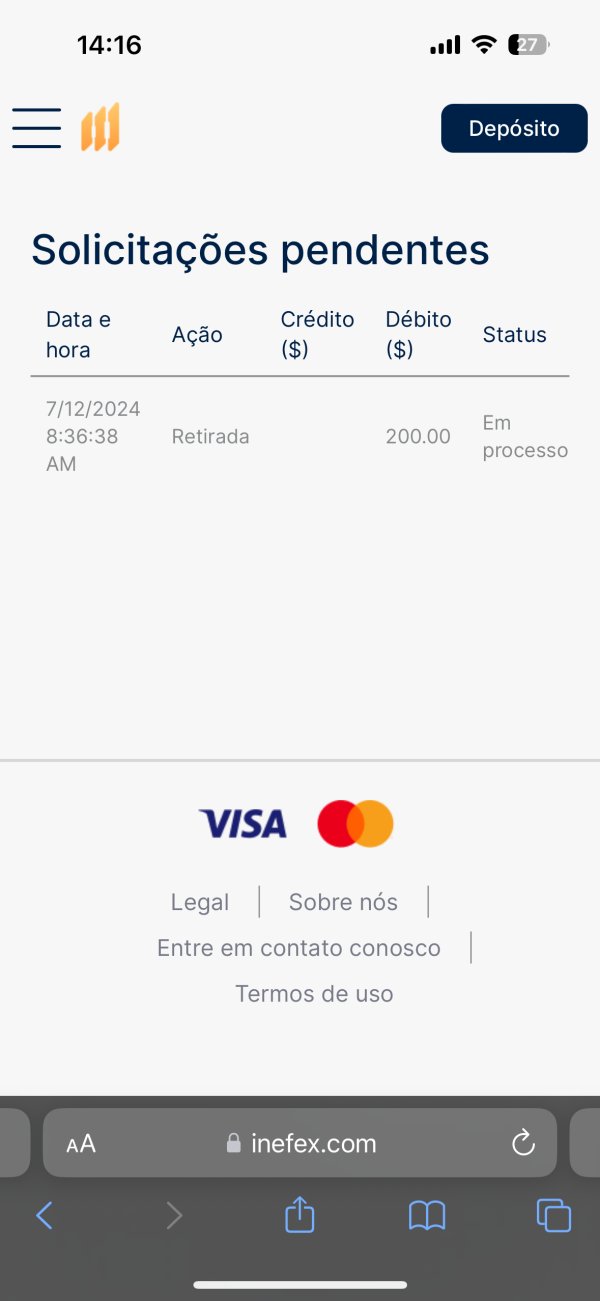

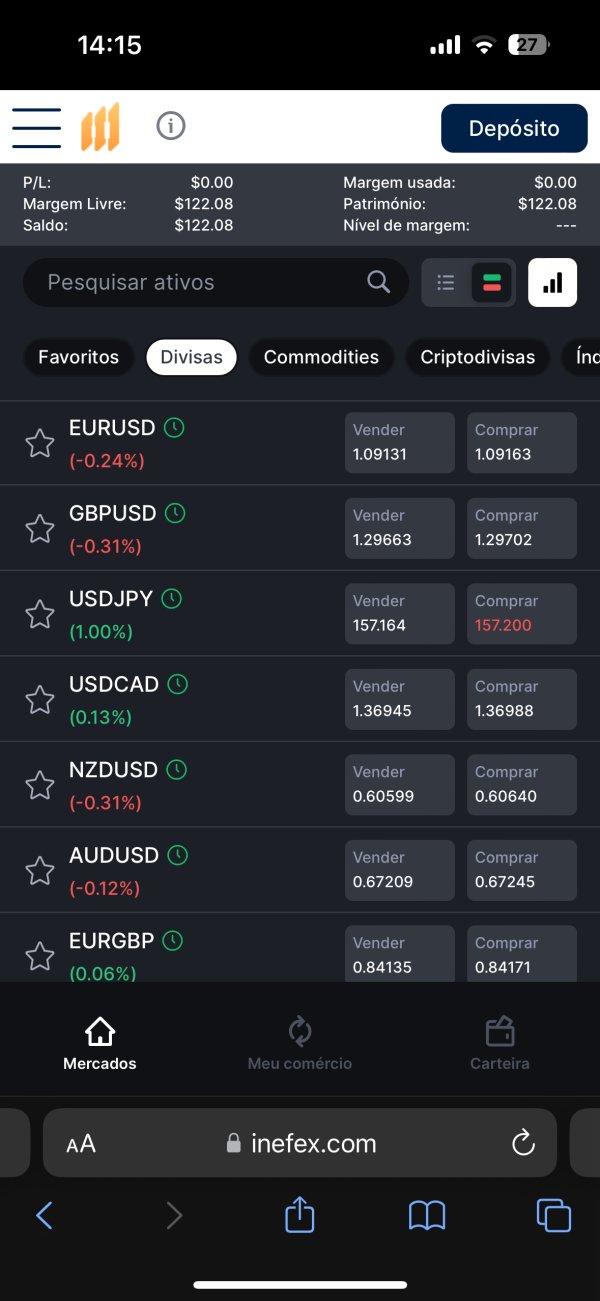

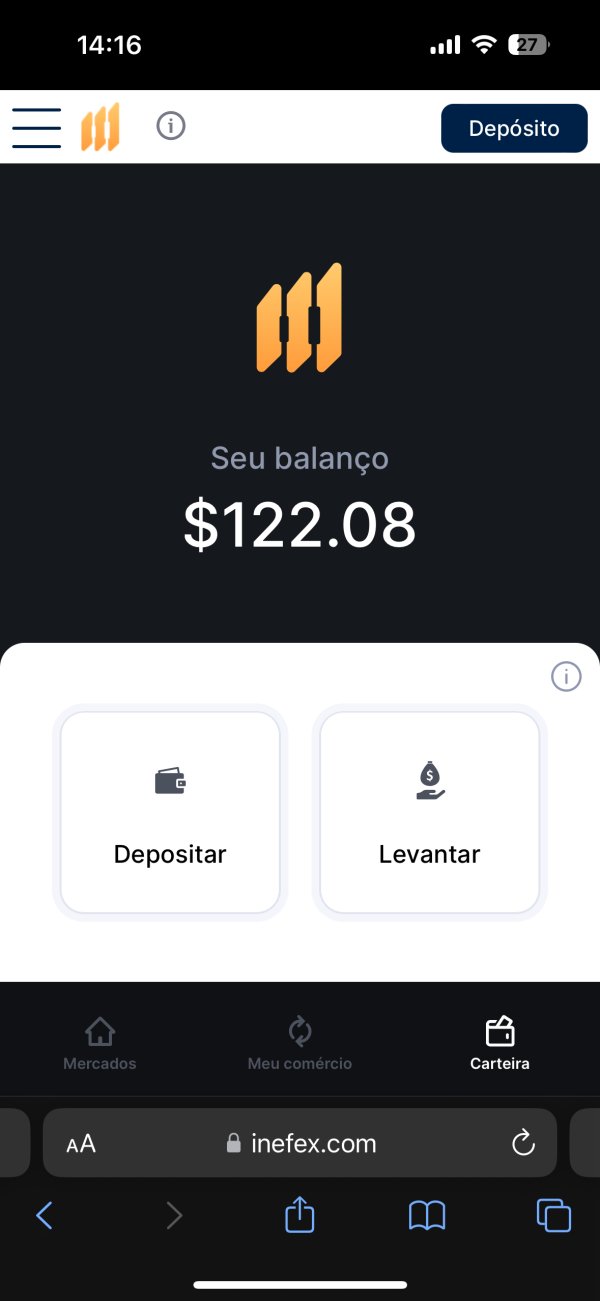

The broker offers high leverage up to 1:400 and lets you trade currencies, cryptocurrencies, commodities, stocks, and indices CFDs. But these features don't make up for serious trust and operation problems. The platform targets active traders who want high-leverage chances, but users always complain about withdrawal problems and bad customer service.

Reviews.io gives Inefex a worrying 2.3 rating. Trustpilot ratings aren't available because the company broke their rules. The broker has no regulatory oversight, reports of scam activities, and charges up to 1,000 euros for inactive accounts, making it wrong for most traders, especially beginners and careful investors who want reliable trading.

Important Notice

Regional Entity Differences: Inefex operates from Mauritius, where forex regulations are much more lenient than major financial centers like the UK, EU, or Australia. This regulatory environment may greatly impact the level of oversight and consumer protection available to traders. You should think about the company's base in this area when checking if trading services are safe and reliable.

Review Methodology: This evaluation uses available user feedback, online reviews from platforms like Reviews.io, regulatory databases, and market intelligence. Because there's limited official documentation and the broker has no regulation, some information may be incomplete or hard to verify.

Rating Framework

Broker Overview

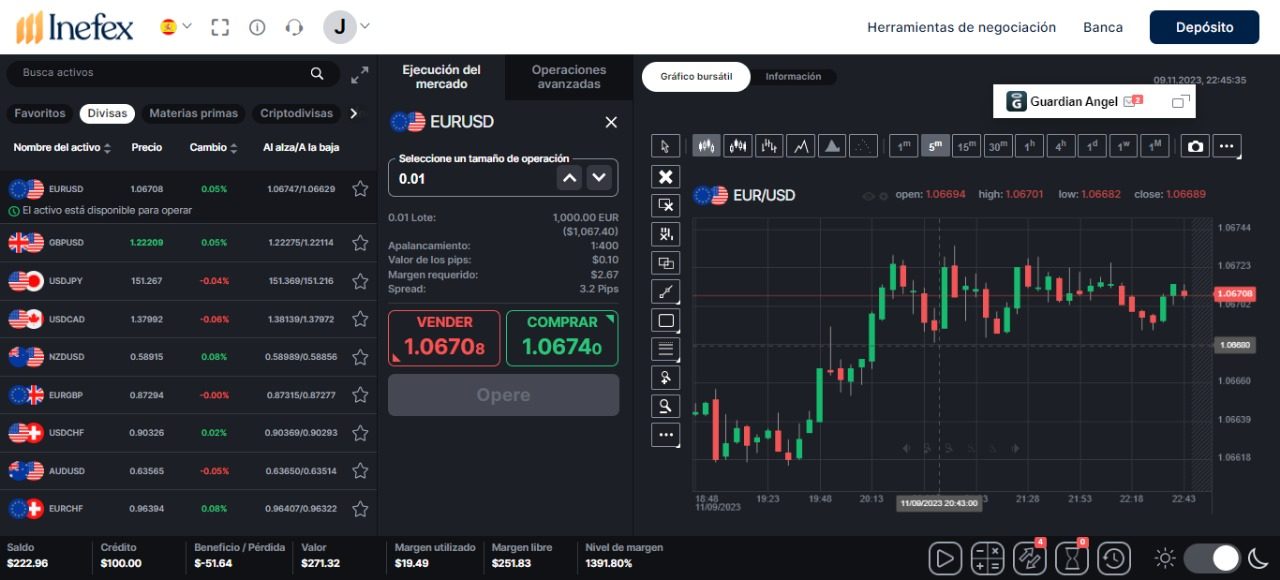

Inefex calls itself a CFD trading platform based in Mauritius. It operates in a place known for relaxed oversight of financial services. The company focuses on providing Contract for Difference (CFD) trading across multiple asset classes, trying to appeal to traders who want high-leverage opportunities.

But the broker's history and user feedback show concerning problems with reliability and trustworthiness. The platform mainly tries to attract traders with competitive leverage ratios and diverse market access. Inefex offers trading in currencies, cryptocurrencies, commodities, stocks, and indices CFDs, trying to serve various trading strategies and preferences.

Despite these offerings, the broker operates without regulatory supervision from recognized financial authorities. This greatly impacts trader protection and options for getting help. According to multiple online sources, including planetofreviews.com, Inefex has been identified as a potential broker scam, with users reporting big difficulties in fund recovery and poor overall service quality.

Regulatory Status: Inefex operates as an unregulated CFD broker based in Mauritius, where forex laws are relatively permissive. This lack of regulatory oversight means traders have limited protection and options for getting help compared to regulated alternatives.

Minimum Deposit: The platform requires a minimum deposit of 30 currency units. This seems competitive but must be weighed against the risks and fee structure.

Trading Assets: Inefex provides access to multiple market instruments including forex pairs, cryptocurrency CFDs, commodity contracts, stock CFDs, and index derivatives. This offers reasonable diversification options for traders.

Cost Structure: One of the most concerning aspects is the inactivity fee, which can reach up to 1,000 euros for dormant accounts. Specific information about spreads and commission structures remains unclear in available documentation.

Leverage Options: The broker offers leverage up to 1:400. While this attracts experienced traders, it presents significant risk exposure, especially given the unregulated environment.

Trading Platform: Specific details about the trading platform technology and features are not clearly outlined in available sources. This raises questions about the quality and reliability of trading infrastructure.

Geographic Restrictions: Information about specific geographic limitations or restricted territories is not detailed in current inefex review materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

Inefex's account conditions show a mixed picture with major red flags that hurt the overall value. The broker offers four different account types, though specific details about the features and benefits of each level remain unclear in available documentation. The minimum deposit requirement of 30 currency units appears competitive on the surface.

This makes the platform accessible to traders with limited starting capital. However, the most concerning aspect of Inefex's account structure is the excessive inactivity fee, which can reach up to 1,000 euros for dormant accounts. This fee structure is extremely high compared to industry standards and represents a major financial risk for traders who may need to temporarily pause their trading activities.

Such punitive fees are often linked with predatory broker practices and serve as a major warning sign for potential clients. The account opening process details are not clearly outlined in available sources, which adds to the overall lack of transparency. Additionally, there is no mention of Islamic account options for traders requiring Sharia-compliant trading conditions.

When compared to regulated brokers with transparent fee structures and reasonable account maintenance costs, Inefex's conditions appear unfavorable and potentially exploitative. This justifies the low rating in this inefex review category.

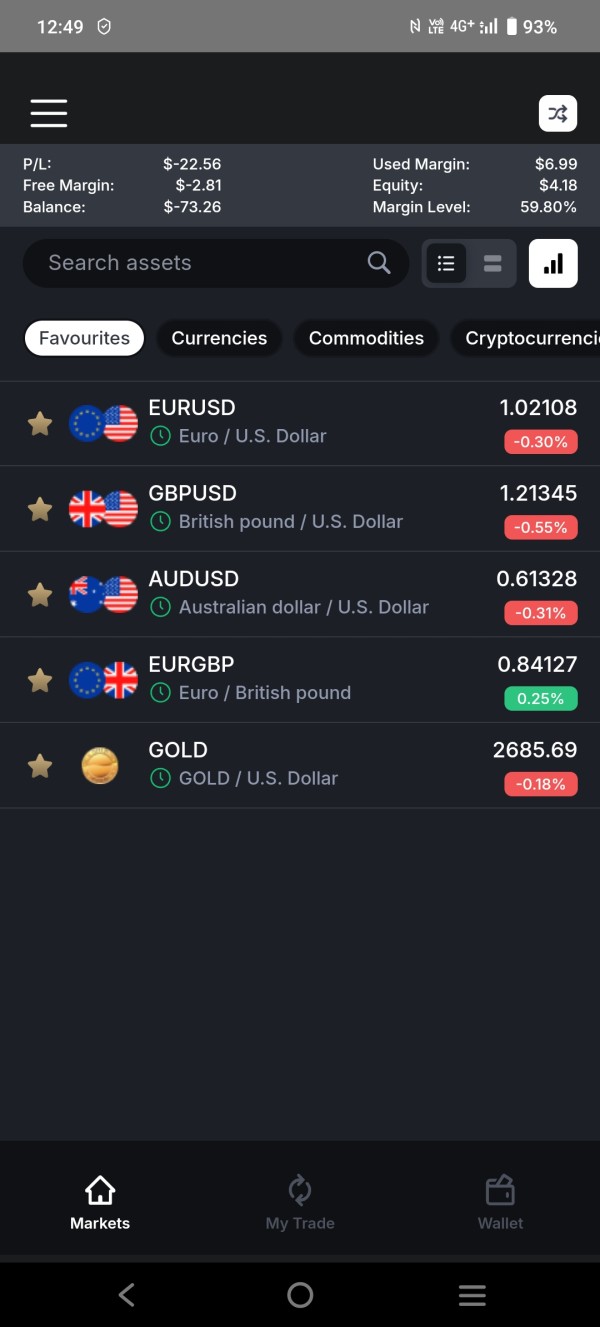

Inefex provides access to various market instruments across multiple asset classes, including currencies, cryptocurrencies, commodities, stocks, and indices CFDs. This diversification offers traders reasonable opportunities to build varied portfolios and use different trading strategies. The range of available instruments suggests the broker tries to serve different trader preferences and market approaches.

However, the quality and depth of trading tools remain unclear based on available information. There is no specific mention of advanced charting capabilities, technical analysis tools, or market research resources that experienced traders typically expect. The absence of detailed information about research and analysis resources raises questions about the platform's ability to support informed trading decisions.

Educational resources, which are crucial for trader development and success, are not mentioned in available documentation. Similarly, there is no information about automated trading support, expert advisors, or algorithmic trading capabilities. The lack of transparency about platform features and tools suggests either limited offerings or poor communication of available resources.

Both of these negatively impact the overall trading experience and justify the mediocre rating in this evaluation category.

Customer Service and Support Analysis (Score: 2/10)

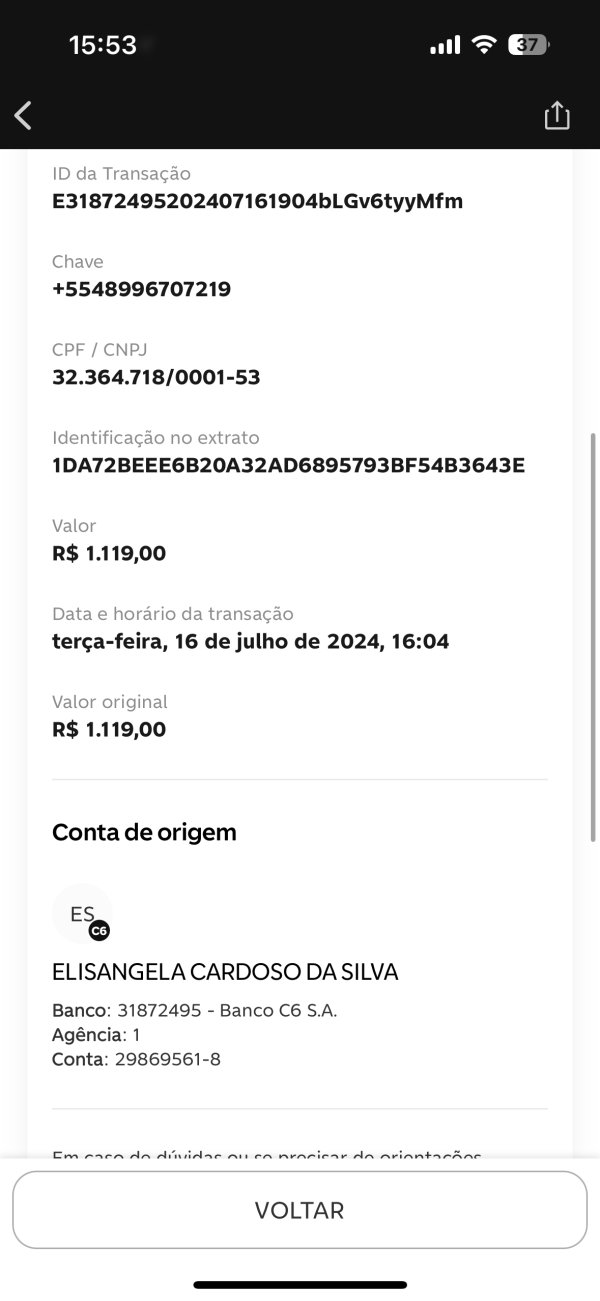

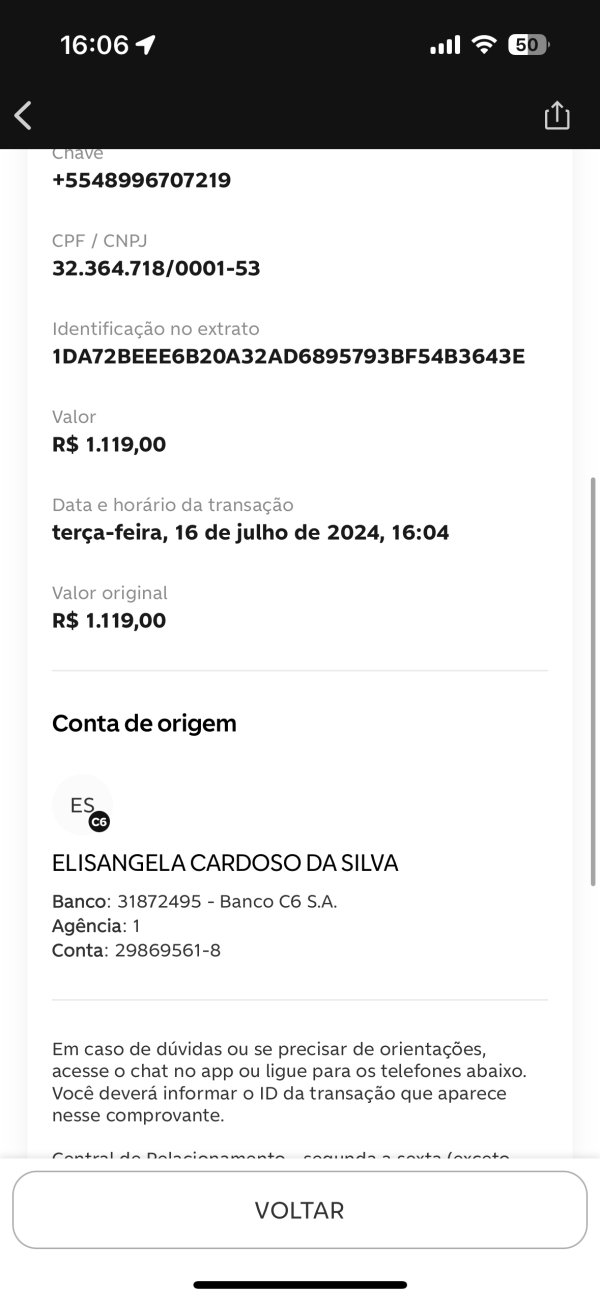

Customer service represents one of Inefex's most critical weaknesses. User feedback consistently highlights poor support quality and responsiveness. Multiple sources indicate that traders have experienced significant difficulties when attempting to resolve issues, particularly regarding withdrawal requests and account management problems.

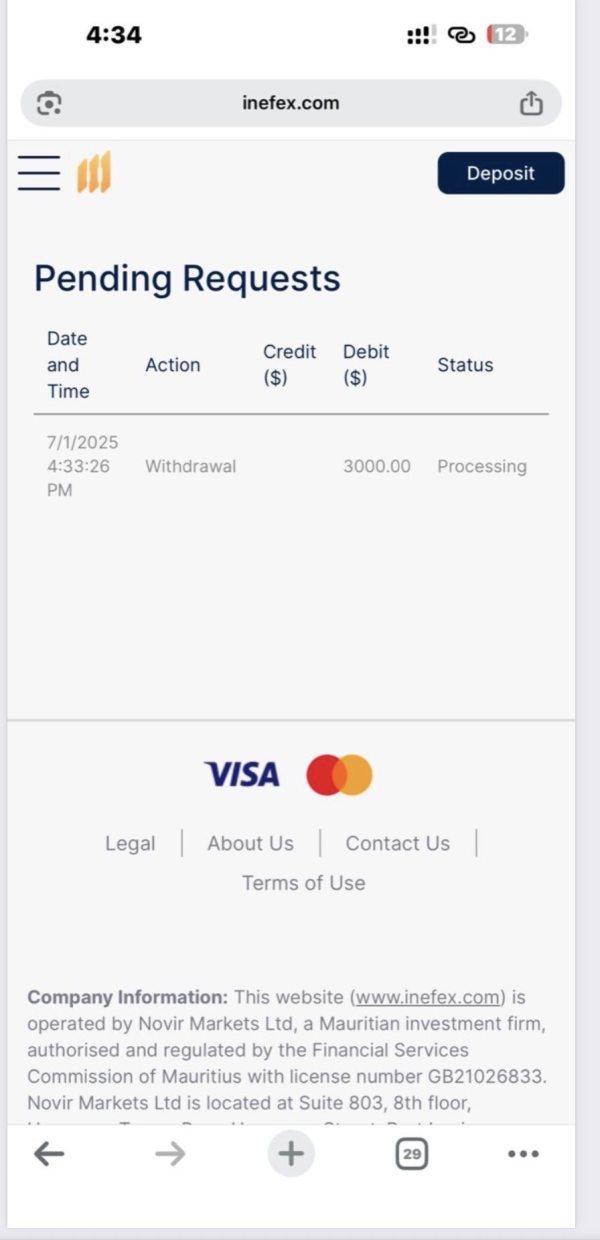

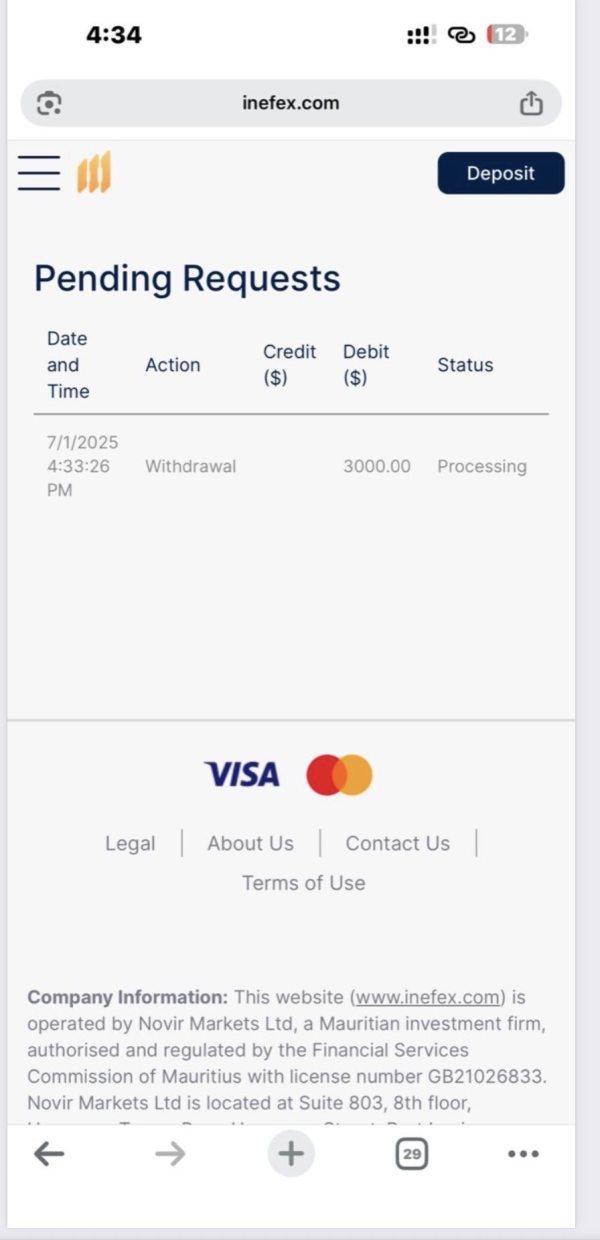

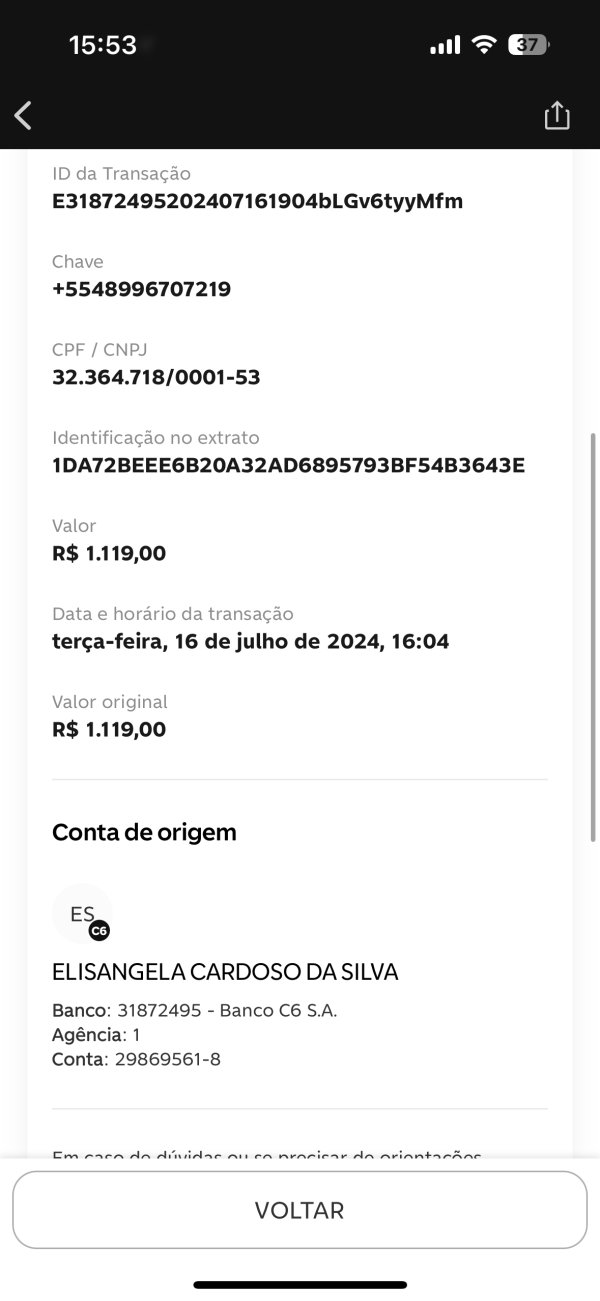

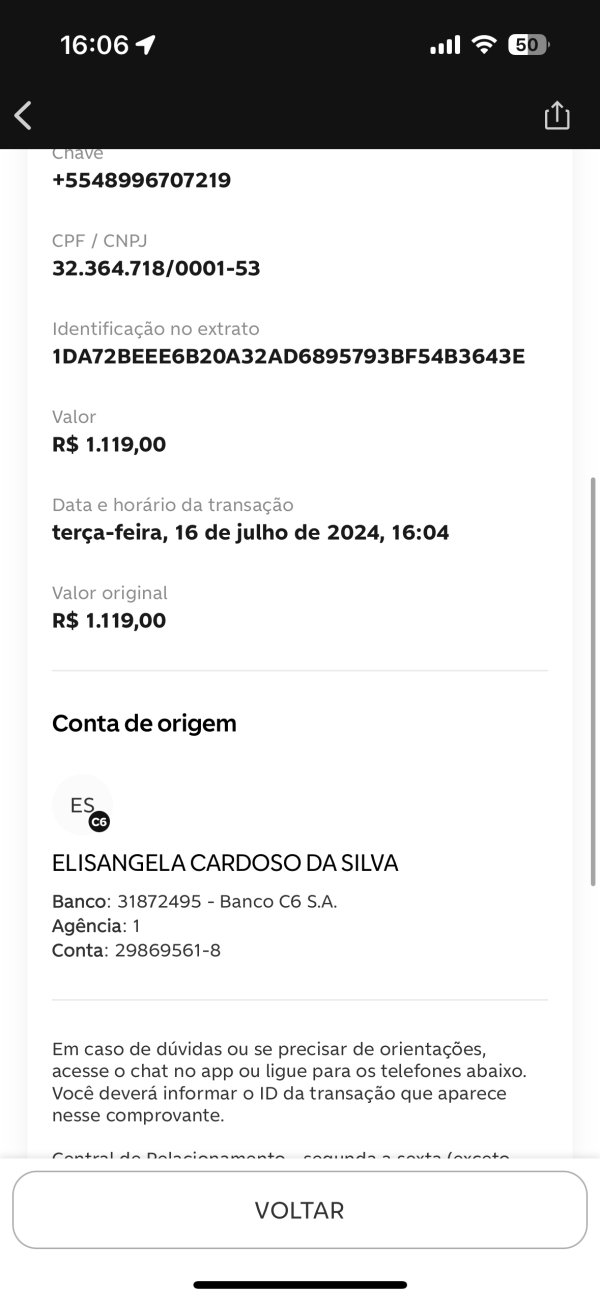

The lack of readily available information about customer service channels, response times, and support availability suggests inadequate infrastructure for client assistance. User reports consistently mention withdrawal problems, which are among the most serious issues any broker can face. When traders cannot access their funds reliably, it indicates fundamental operational problems and potential fraudulent behavior.

The absence of effective problem resolution mechanisms has led to numerous negative reviews and complaints across various platforms. According to available feedback, response times are slow, and the quality of assistance provided is substandard. There is no mention of multilingual support options or 24/7 availability, which are standard expectations in the modern forex industry.

The combination of withdrawal issues, poor responsiveness, and lack of transparent communication channels creates a customer service environment that fails to meet basic industry standards. This warrants the very low rating assigned to this crucial aspect of broker operations.

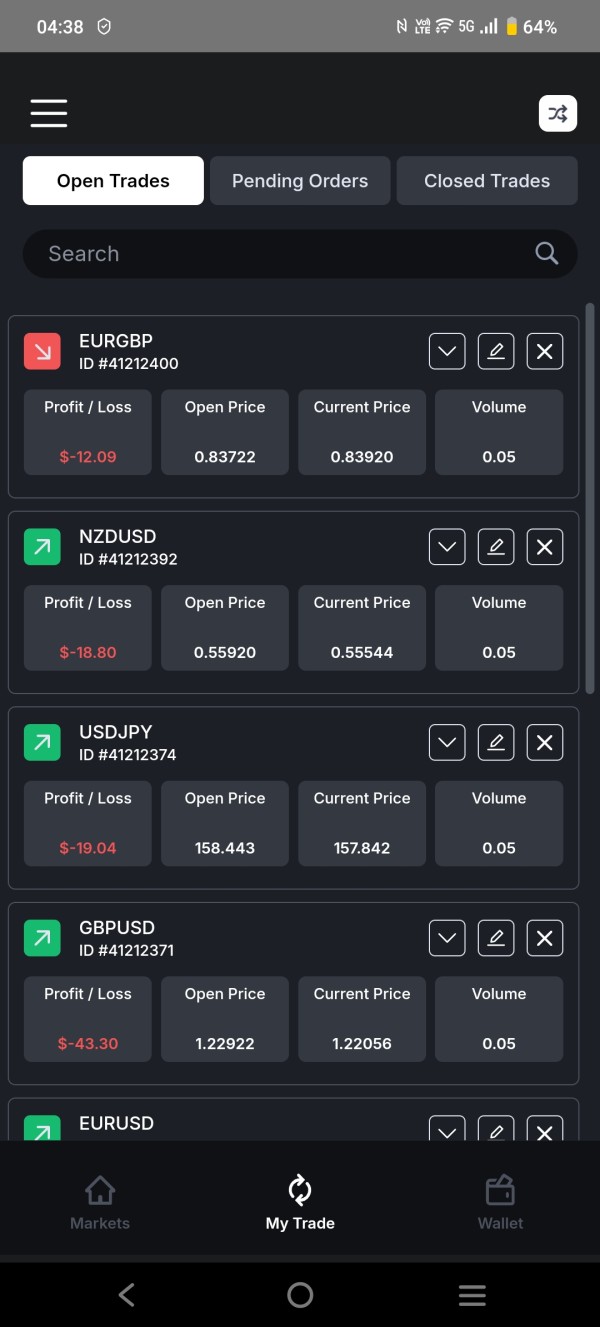

Trading Experience Analysis (Score: 4/10)

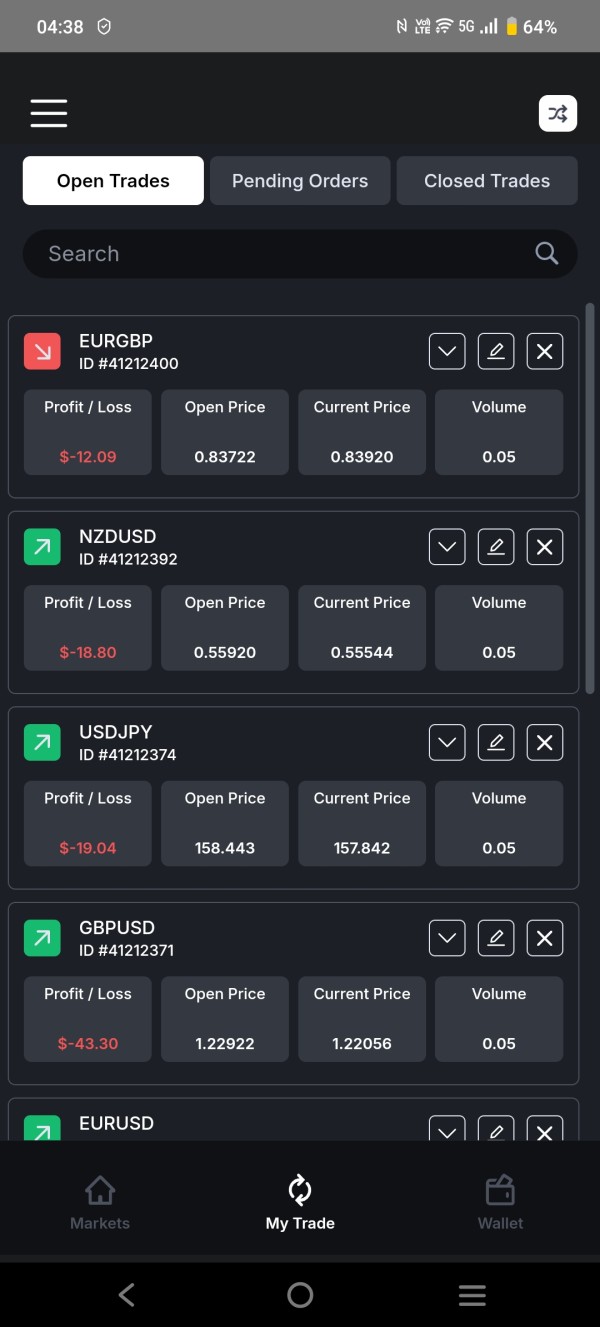

The trading experience with Inefex appears compromised by several factors that negatively impact overall platform usability and reliability. While the broker offers high leverage up to 1:400 and access to multiple asset classes, these features are undermined by concerns about platform stability, execution quality, and overall operational reliability. User feedback suggests that the trading environment falls short of professional standards expected in the industry.

Specific information about platform performance, including execution speeds, slippage rates, and system stability, is not readily available in current documentation. This lack of transparency about crucial technical aspects raises concerns about the quality of trading infrastructure. Professional traders require reliable platforms with consistent execution and minimal technical disruptions, but available evidence suggests Inefex may not meet these requirements.

The absence of detailed information about mobile trading capabilities, advanced order types, and platform customization options further limits the appeal for serious traders. Additionally, user feedback indicates general dissatisfaction with the overall trading environment, though specific technical complaints are not detailed in available sources. The combination of limited platform information, user dissatisfaction, and concerns about operational reliability contributes to the below-average rating for trading experience in this inefex review.

Trust and Safety Analysis (Score: 1/10)

Trust and safety represent the most critical concerns with Inefex, earning the lowest possible rating due to multiple red flags that indicate serious reliability issues. The broker operates without regulatory supervision from recognized financial authorities, which eliminates crucial investor protections and oversight mechanisms that regulated brokers must maintain. This unregulated status means traders have limited options for getting help if problems arise.

Multiple sources, including planetofreviews.com, have specifically identified Inefex as a potential broker scam, warning traders to avoid the platform. Such designations from review sites and industry watchdogs represent serious credibility concerns that cannot be ignored. The broker's reputation in the industry appears severely compromised, with various platforms flagging potential fraudulent activities.

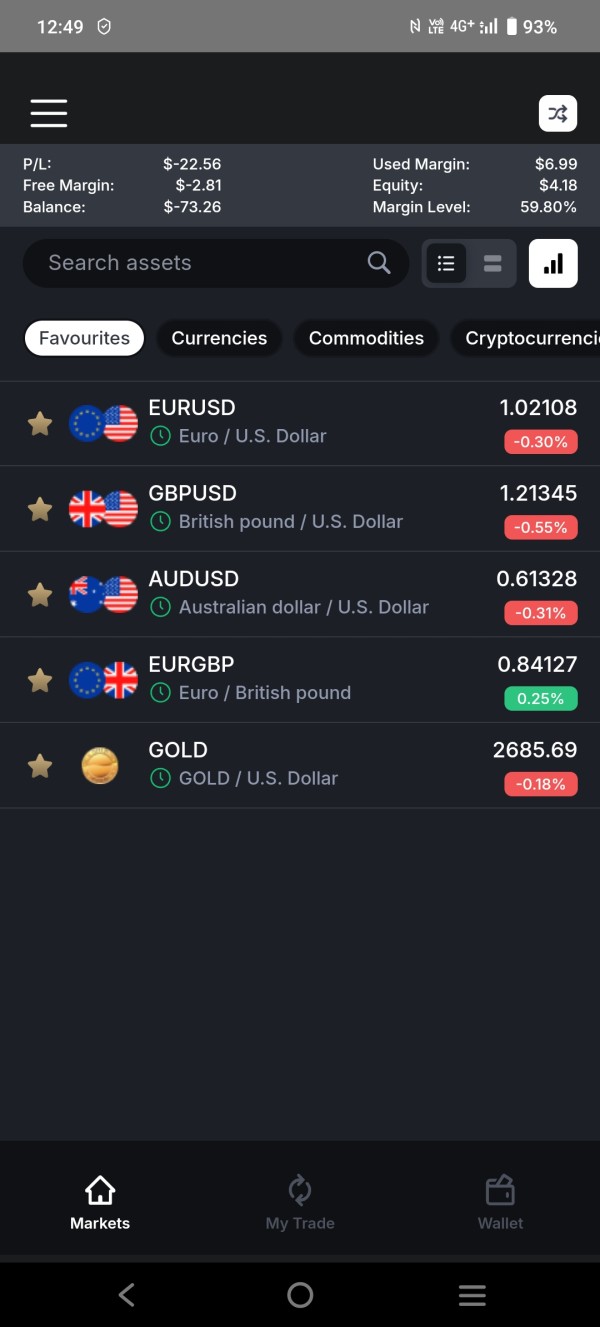

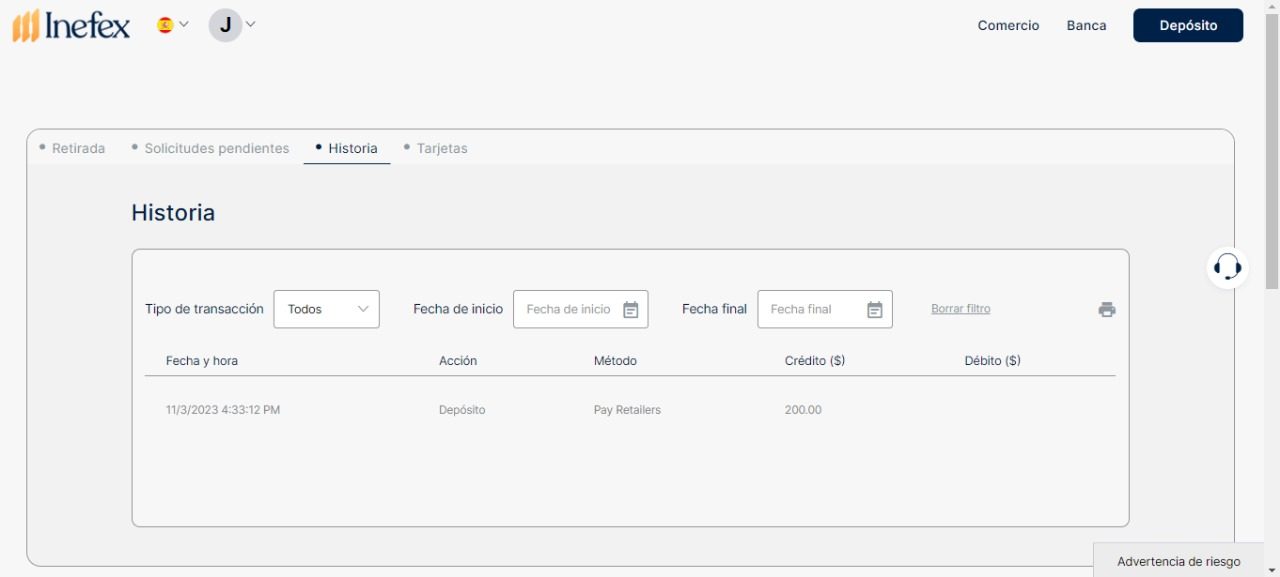

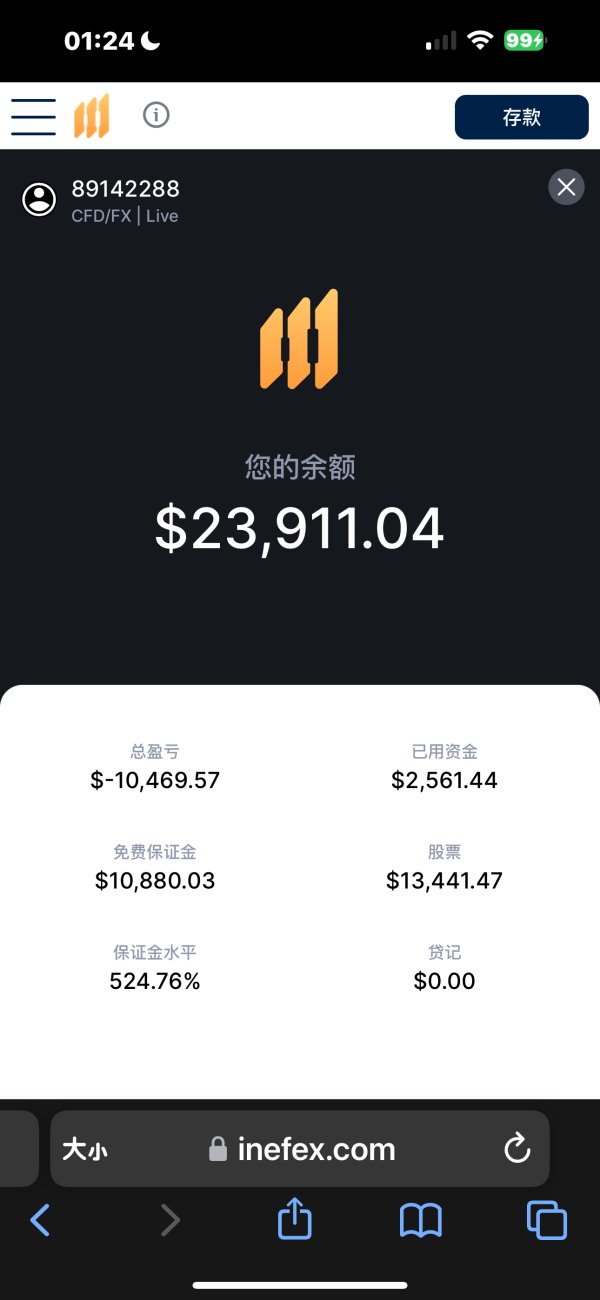

Fund security measures are not clearly outlined in available documentation, raising questions about client money protection and segregation practices. The lack of regulatory oversight means there are no mandatory requirements for client fund segregation or compensation schemes that provide safety nets for traders. Trustpilot ratings are unavailable due to guideline breaches, while Reviews.io shows a concerning 2.3 rating, indicating widespread user dissatisfaction.

The combination of regulatory absence, scam allegations, poor user ratings, and lack of transparency about fund protection creates an environment where trader safety cannot be assured. This justifies the critical rating in this essential category.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Inefex appears significantly compromised based on available feedback and rating data. Reviews.io shows a 2.3 rating with only 34% of reviewers recommending the broker, indicating widespread dissatisfaction among actual users. These metrics suggest that the majority of traders who have experience with the platform would not endorse it to others, which is a strong indicator of poor user experience.

The most frequently reported user complaints center around withdrawal difficulties and poor customer service quality. These fundamental operational issues create frustration and financial stress for traders attempting to access their funds or resolve account problems. The severity and frequency of withdrawal complaints suggest systemic problems rather than isolated incidents, indicating deep-rooted operational issues.

While specific details about interface design, registration processes, and platform usability are not extensively documented, the overall pattern of negative feedback suggests that multiple aspects of the user journey are problematic. The target user profile appears to be traders seeking high-leverage opportunities, but the associated risks and operational problems make the platform unsuitable for most trader categories. Based on available feedback patterns, improvements in transparency, customer service, and operational reliability would be necessary to enhance user experience, though the fundamental trust issues may be difficult to overcome given the current regulatory status and industry reputation.

Conclusion

Based on this comprehensive inefex review, the broker presents significant risks that outweigh any potential benefits for most traders. While Inefex offers high leverage up to 1:400 and access to diverse market instruments, these features cannot compensate for the fundamental issues of regulatory absence, withdrawal problems, and poor customer service quality. The platform's unregulated status, combined with multiple scam allegations and consistently negative user feedback, creates an environment unsuitable for safe trading.

The broker is particularly inappropriate for beginner traders and risk-averse investors who require reliable, regulated platforms with strong consumer protections. Even experienced traders seeking high-leverage opportunities would be better served by regulated alternatives that offer similar features without the associated trust and safety concerns. The exceptionally high inactivity fees and reported withdrawal difficulties further diminish any appeal the platform might have for active traders.

In summary, this evaluation strongly advises traders to consider regulated alternatives with transparent operations, reliable customer service, and positive user feedback rather than risking capital with Inefex's problematic platform.