OANDA Review 2025: All You Need to Know

Executive Summary

This OANDA review gives you a complete look at one of the oldest forex brokers around. OANDA is a well-regulated forex broker that has been working for over 25 years under top financial authorities like the CFTC and NFA. The broker has earned a "Great" rating on Trustpilot with over 1,085 reviews, which shows that users are happy and trust the company.

OANDA's main strengths include different trading platforms like OANDA Trade (web and mobile), MetaTrader 4, and TradingView. The broker offers fast deposits and withdrawals, good spreads, and lets you trade forex and cryptocurrencies. With several account types and strong rules watching over it, OANDA gives traders a safe and flexible place to trade whether they're new or experienced.

The broker focuses on being honest and following regulations, plus it has been around since 1996, which makes it a good choice for traders who want a trusted partner. However, some users have said the customer service isn't always professional, especially in some regional offices.

Important Notice

OANDA works in many different countries with different rules in each place. This review looks at the different rules and services across different areas, including operations under CFTC and NFA watch. The review here is based on careful study of user feedback, regulatory information, and market data to give you a fair look.

For fairness and accuracy, our scoring uses the best-performing regional offerings for each factor we check. Traders should verify specific terms and conditions for their region before opening an account, as different regulations may affect available services and protections.

Scoring Framework

Broker Overview

OANDA Corporation started in 1996 and has become one of the most well-known names in online forex trading. The company is based in the United States and has built a solid reputation over its 25+ years of operation, serving traders worldwide with new technology and reliable services. The broker's main business focuses on online forex and CFD trading, giving retail and institutional clients access to global currency markets.

The company started as a currency data provider and became a full-service forex broker, which shows it really understands foreign exchange markets. OANDA's focus on being honest and fair with pricing has been a key part of its business, helping build trust with traders at all experience levels.

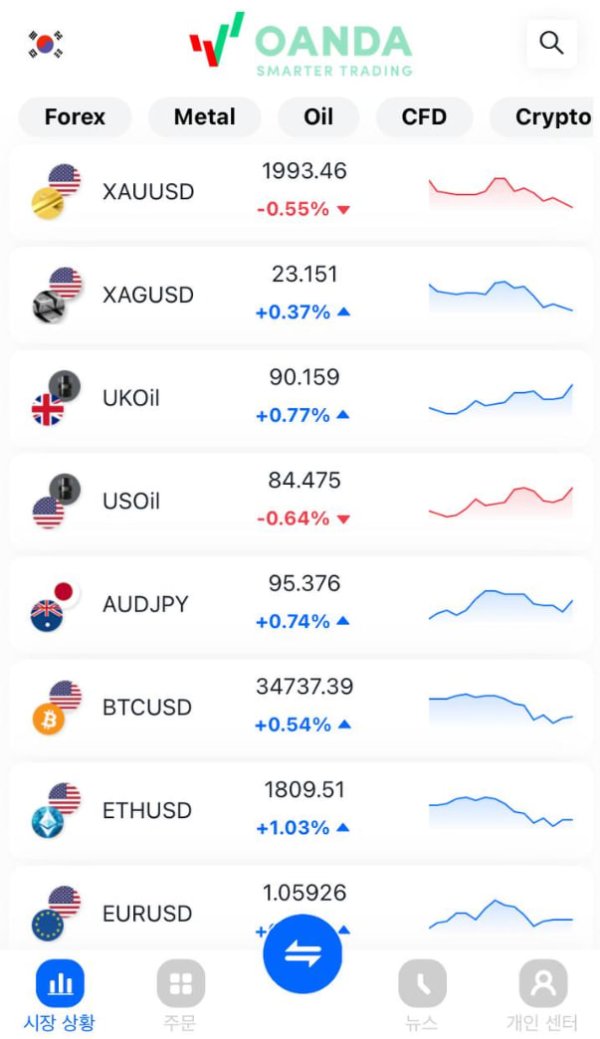

OANDA offers multiple trading platforms to fit different trading preferences and strategies. The OANDA Trade platform is their own creation and works on both web and mobile apps, giving smooth trading experiences across devices. The broker also supports MetaTrader 4, one of the most popular platforms in the industry, and works with TradingView for advanced charts and analysis. The main things you can trade include major, minor, and exotic forex pairs, plus cryptocurrency options. All operations follow strict rules from the U.S. Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), making sure they follow tough financial regulations and client protection standards.

Regulatory Coverage: OANDA operates under strong supervision from the CFTC and NFA in the United States, making sure they follow strict financial regulations and protect client funds. This regulatory framework gives traders confidence in the broker's honesty and compliance standards.

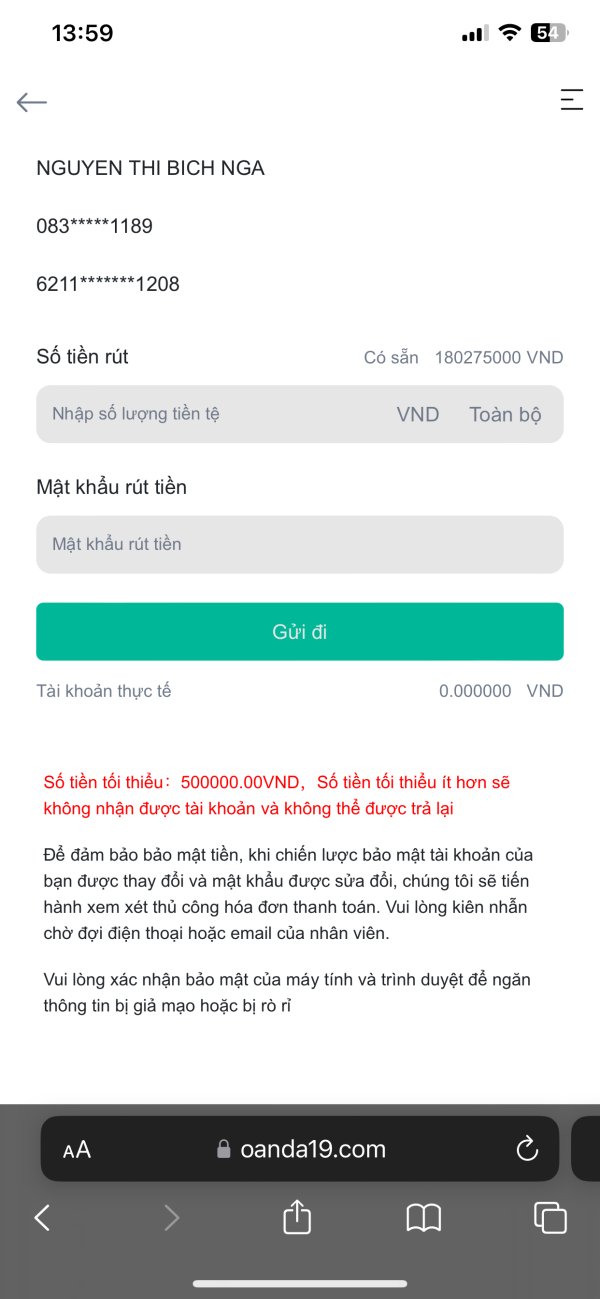

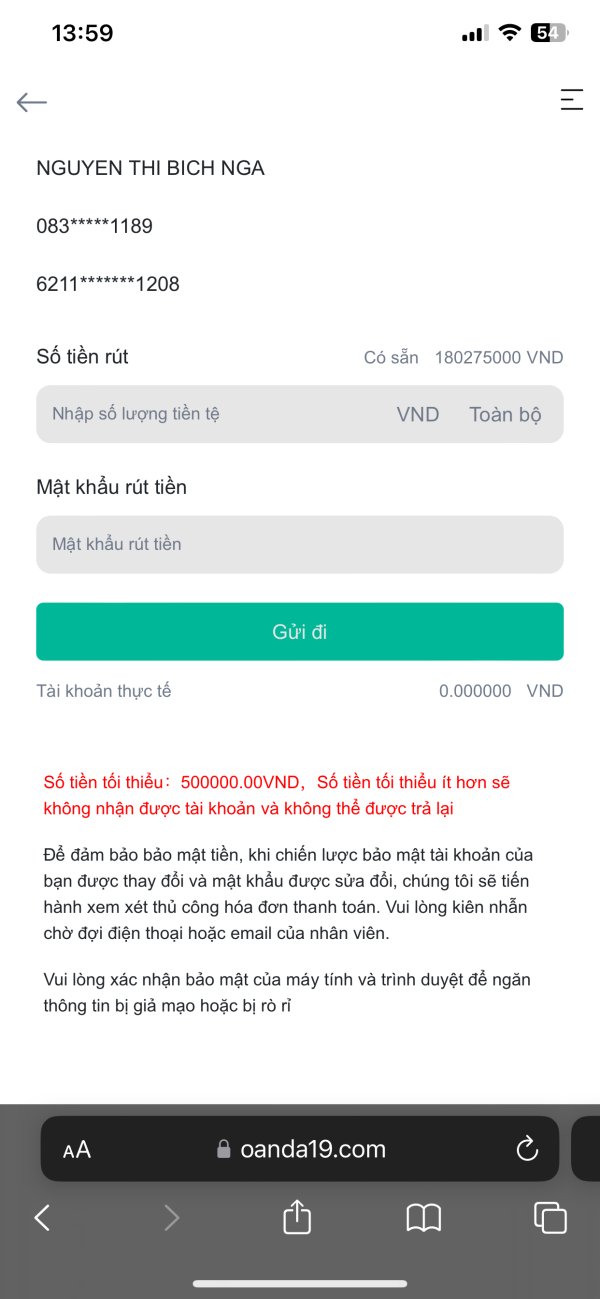

Deposit and Withdrawal Methods: According to available information, OANDA provides fast deposit and withdrawal services, though specific payment methods and processing times need to be checked with the broker directly based on regional availability.

Minimum Deposit Requirements: Specific minimum deposit amounts are not detailed in available materials and may vary by account type and region. People who want to trade should confirm current requirements during the account opening process.

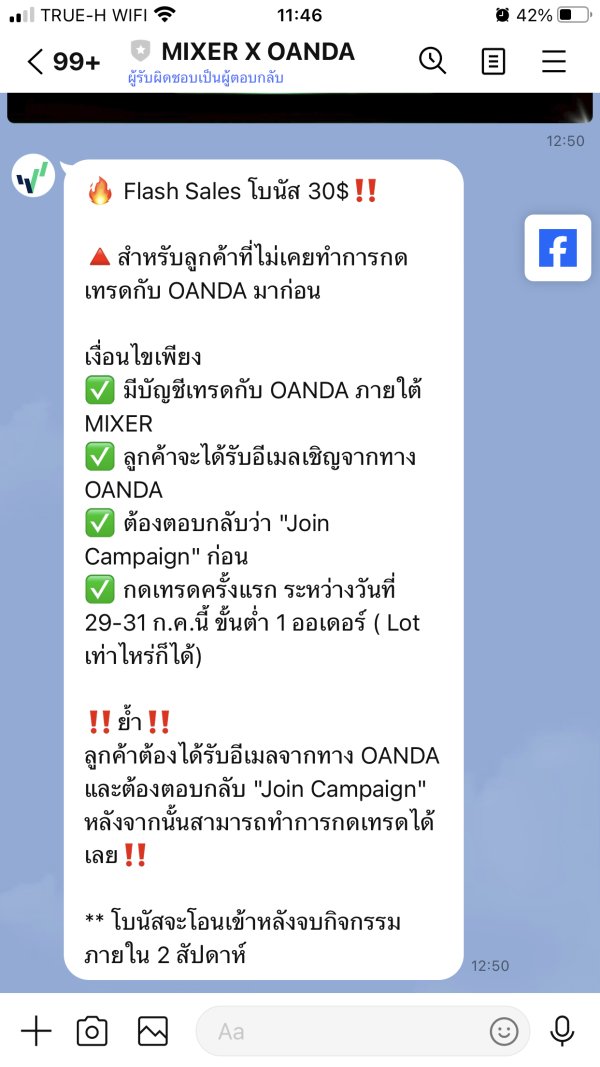

Bonus and Promotions: Information about current bonus programs and promotional offerings is not specified in available resources and would need to be checked directly with OANDA.

Tradeable Assets: OANDA's asset list mainly focuses on forex trading with major, minor, and exotic currency pairs. The broker also offers cryptocurrency trading options, expanding beyond traditional forex markets to meet changing trader demands.

Cost Structure: OANDA operates with competitive spreads across its forex offerings. The broker's pricing model focuses on being transparent, though specific commission structures and fee schedules need direct verification for current rates.

Leverage Options: Leverage ratios follow regulatory requirements in different areas and are not specifically detailed in available documentation. Traders should confirm applicable leverage limits based on their regional regulations.

Platform Selection: The broker provides three main trading platforms: OANDA Trade (their own web and mobile platform), MetaTrader 4 for advanced trading functionality, and TradingView integration for comprehensive market analysis and charting capabilities.

Geographic Restrictions: Specific geographic limitations are not detailed in available information and may vary based on regulatory requirements in different areas.

Customer Support Languages: Available customer service language options are not specified in current materials and should be confirmed based on regional operations.

This comprehensive OANDA review continues with detailed analysis of each evaluation criterion to provide traders with thorough insights into the broker's offerings and suitability for different trading needs.

Detailed Analysis by Category

Account Conditions Analysis (Score: 7/10)

OANDA's account structure shows its focus on providing flexible trading solutions, though specific details about account tiers and minimum requirements are not fully detailed in available materials. The broker's approach focuses on being accessible for traders across different experience levels, from beginners to advanced professionals.

The account opening process benefits from OANDA's established infrastructure and regulatory compliance systems, though specific steps and requirements may vary by region. The broker's long-standing market presence suggests smooth onboarding processes, but checking current procedures is recommended for potential clients.

While multiple account types are said to be available, the specific features, benefits, and requirements for each tier are not detailed in current documentation. This includes information about special account types such as Islamic accounts for traders requiring Sharia-compliant trading conditions.

The scoring reflects OANDA's solid foundation and regulatory standing, but the lack of specific details about minimum deposits, account features, and tier structures impacts the overall evaluation. This OANDA review recommends direct verification of account conditions that align with individual trading requirements and regional availability.

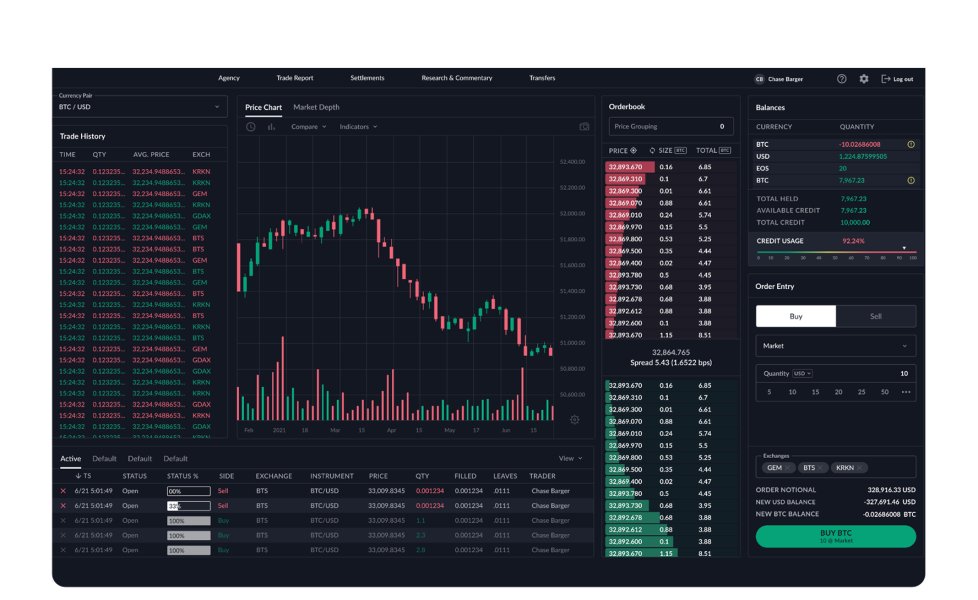

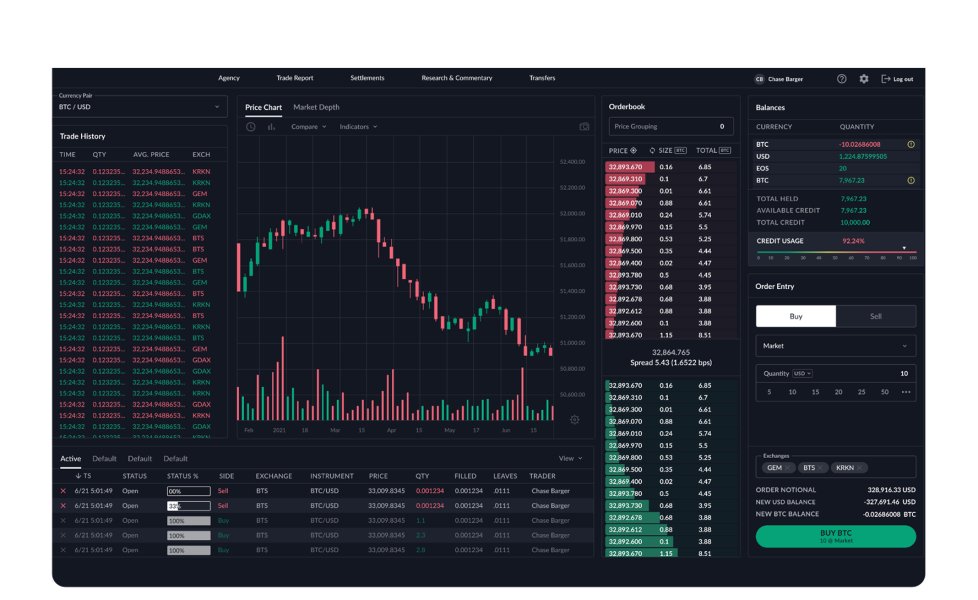

OANDA shows strong abilities in providing diverse trading tools and platform options to meet varied trader needs. The broker's multi-platform approach, featuring OANDA Trade, MetaTrader 4, and TradingView integration, offers comprehensive trading environments suitable for different strategies and preferences.

The OANDA Trade platform represents the broker's commitment to innovation and user experience, providing both web-based and mobile trading solutions. The inclusion of MetaTrader 4 addresses the needs of traders preferring this industry-standard platform with its extensive customization options and automated trading capabilities.

TradingView integration enhances the analytical capabilities available to OANDA clients, providing access to advanced charting tools, technical indicators, and market analysis features. This combination of platforms ensures traders have access to comprehensive market analysis and execution tools.

However, specific details about research resources, educational materials, and analytical tools beyond platform offerings are not fully covered in available documentation. The evaluation recognizes OANDA's strong platform diversity while noting the need for more detailed information about additional trading resources and educational support materials.

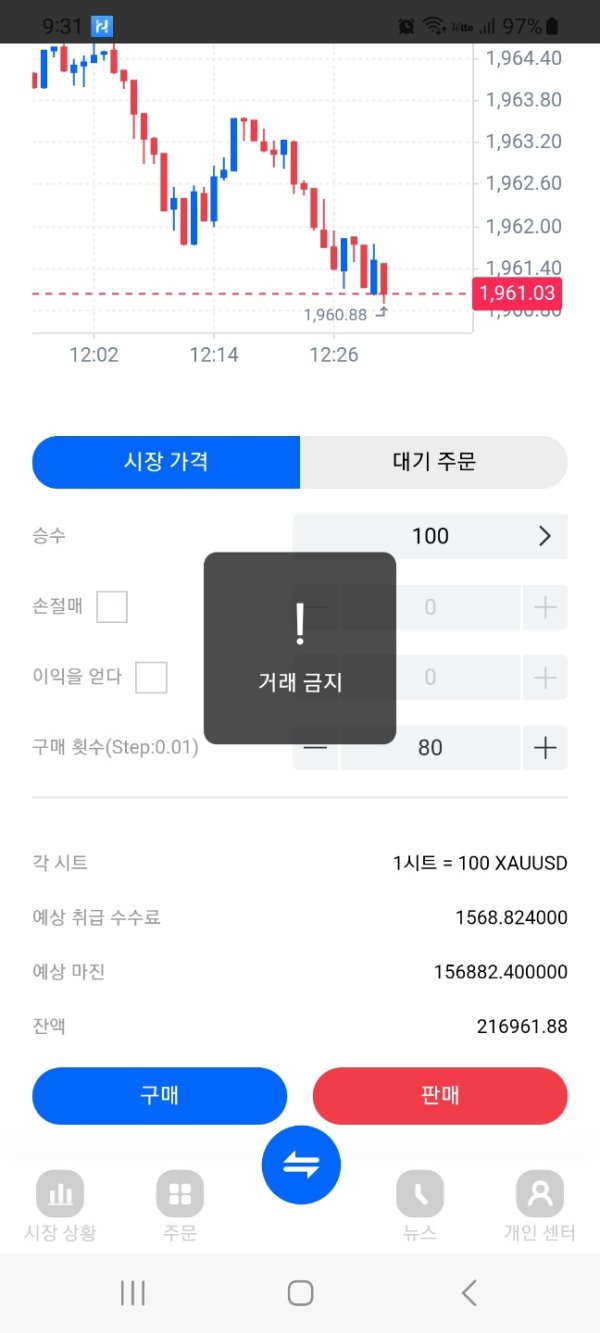

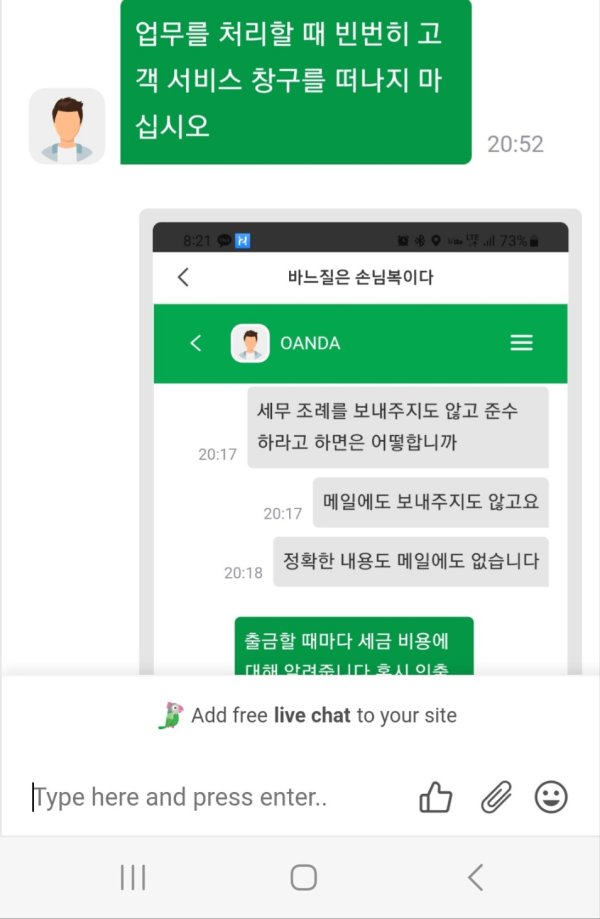

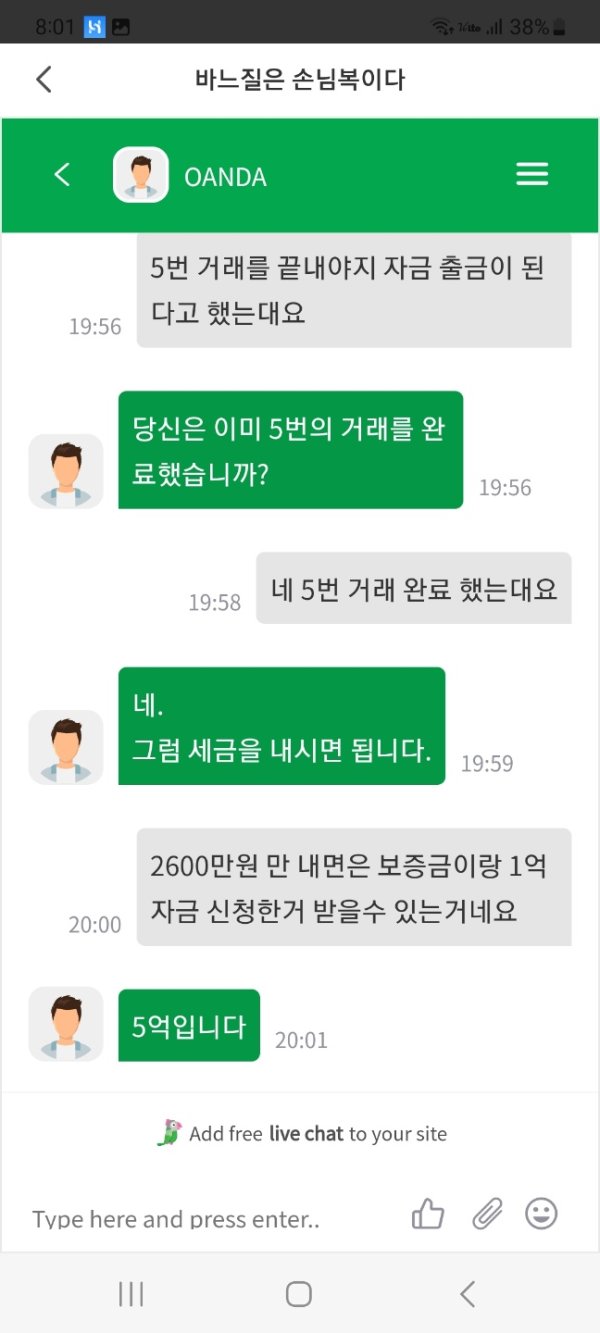

Customer Service and Support Analysis (Score: 6/10)

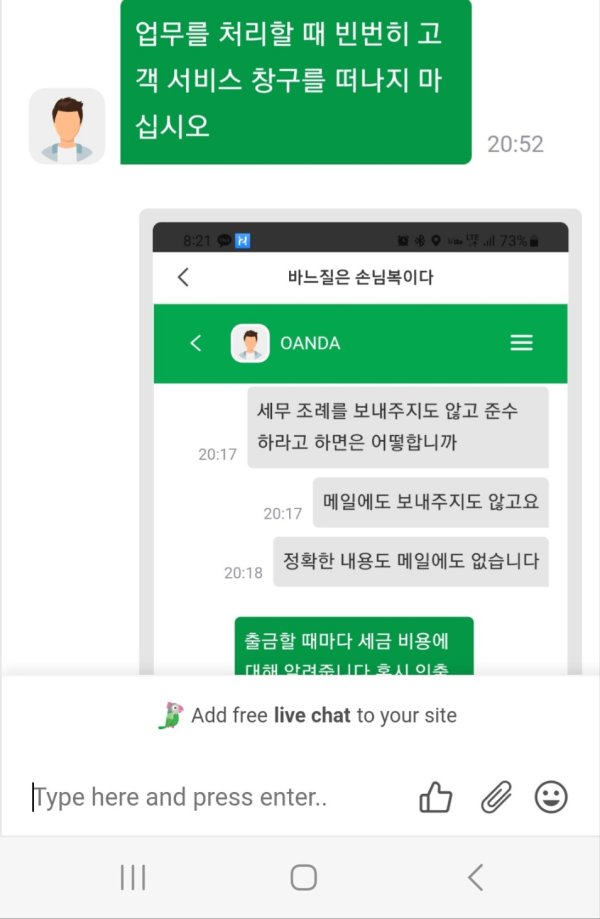

Customer service represents an area where OANDA receives mixed feedback from users. According to Trustpilot reviews, some users have expressed concerns about customer service quality, particularly noting issues with support team professionalism in certain regional offices. One review specifically mentioned that "support in Canada is ridiculous unprofessional," suggesting inconsistencies in service quality across different locations.

The broker provides multiple support channels including phone, email, and online chat options, ensuring various methods for client communication. However, the effectiveness and responsiveness of these channels appear to vary based on user experiences and regional operations.

The availability of multilingual support and specific customer service hours are not detailed in available information, which may impact the overall support experience for international clients. Response times and resolution efficiency also require verification based on current operational standards.

The scoring reflects the mixed user feedback regarding customer service quality, with particular attention to reported professionalism concerns. While OANDA provides standard support channels, the user feedback suggests room for improvement in service consistency and staff training across different regional operations.

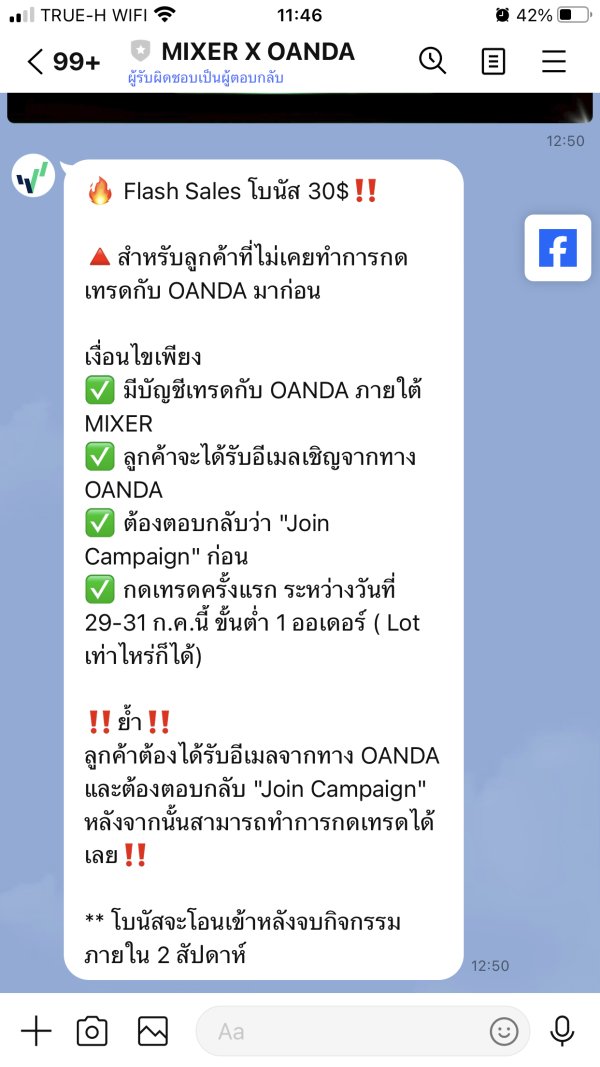

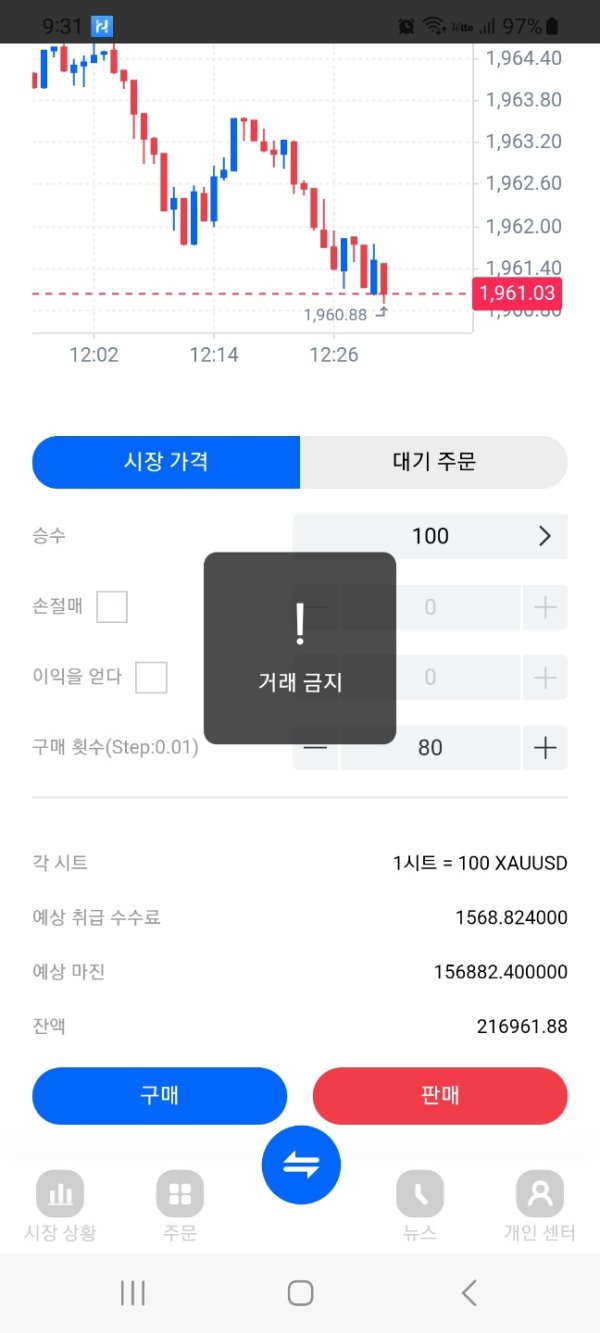

Trading Experience Analysis (Score: 8/10)

OANDA provides a generally positive trading experience supported by its diverse platform offerings and technological infrastructure. User feedback indicates good overall satisfaction with the trading environment, though specific performance metrics such as execution speeds and slippage data are not detailed in available materials.

The broker's platform stability and functionality receive positive recognition, with the variety of available platforms allowing traders to choose environments that best suit their strategies and preferences. The combination of their own technology through OANDA Trade and industry-standard options like MetaTrader 4 provides flexibility for different trading approaches.

The mobile trading experience through OANDA Trade applications appears to meet user expectations, though specific feature sets and performance characteristics require direct evaluation. The broker's focus on providing rich charting tools and technical indicators supports comprehensive market analysis capabilities.

Order execution quality and trade management features benefit from OANDA's established infrastructure and regulatory compliance requirements. However, specific data regarding execution speeds, spread stability during volatile market conditions, and liquidity provision are not fully documented in available materials.

This OANDA review recognizes the positive user feedback regarding trading experience while noting the need for more detailed performance metrics to provide complete evaluation of execution quality and trading conditions.

Trust and Regulation Analysis (Score: 9/10)

OANDA excels in regulatory compliance and trustworthiness, operating under the supervision of premier financial authorities including the U.S. Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). This regulatory framework provides substantial client protections and ensures adherence to strict operational standards.

The broker's 25+ year operational history demonstrates sustained compliance and market credibility. OANDA's long-standing presence in the forex industry, combined with its regulatory oversight, establishes a strong foundation for trader confidence and fund security.

The company's commitment to transparency and fair trading practices aligns with regulatory requirements and industry best practices. OANDA's reputation within the financial services industry reflects its consistent approach to client protection and regulatory compliance.

While specific details about fund segregation, insurance coverage, and additional security measures are not fully detailed in available materials, the regulatory framework under CFTC and NFA supervision provides substantial safeguards for client interests.

The high scoring in this category reflects OANDA's excellent regulatory standing and established market credibility, positioning it among the most trustworthy brokers in the industry based on regulatory oversight and operational history.

User Experience Analysis (Score: 7/10)

Overall user satisfaction with OANDA reflects positively in its "Great" rating on Trustpilot, based on over 1,085 user reviews. This substantial review base provides meaningful insights into the broker's performance across different aspects of service delivery and client satisfaction.

User testimonials indicate strong confidence in the platform, with one trader noting, "I've been trading with OANDA for about one year and completely trust the platform." This type of feedback demonstrates the broker's ability to build long-term client relationships and maintain trading confidence.

The fast deposit and withdrawal services receive positive recognition from users, contributing to overall satisfaction with the broker's operational efficiency. However, the previously mentioned customer service concerns impact the overall user experience evaluation.

The broker's suitability for both beginners and advanced traders suggests effective user interface design and feature accessibility across different experience levels. The multiple platform options allow users to select trading environments that match their skill levels and requirements.

Areas for improvement include addressing customer service consistency issues and ensuring professional support standards across all regional operations. The balance between positive trading experiences and service delivery concerns results in a good but not excellent user experience rating.

Conclusion

This comprehensive OANDA review reveals a well-established forex broker with strong regulatory credentials and diverse trading solutions suitable for traders across different experience levels. OANDA's 25+ year market presence, combined with CFTC and NFA regulatory oversight, positions it as a trustworthy choice for forex and cryptocurrency trading.

The broker's key strengths include its multi-platform approach featuring OANDA Trade, MetaTrader 4, and TradingView integration, providing flexibility for various trading strategies and preferences. Fast deposit and withdrawal services, competitive spreads, and strong regulatory compliance further enhance its appeal to both novice and experienced traders.

However, customer service consistency emerges as an area requiring attention, with some users reporting professionalism concerns in certain regional offices. Despite this limitation, OANDA's overall offering represents solid value for traders seeking a regulated, established broker with comprehensive platform options and reliable market access.

OANDA is particularly well-suited for traders prioritizing regulatory security, platform diversity, and long-term broker stability, making it a viable choice for both beginners entering forex markets and experienced traders requiring robust trading infrastructure.