Regarding the legitimacy of Pepperstone forex brokers, it provides ASIC, CYSEC, FCA, SCB and WikiBit, (also has a graphic survey regarding security).

Is Pepperstone safe?

Pros

Cons

Is Pepperstone markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

PEPPERSTONE GROUP LIMITED

Effective Date: Change Record

2013-02-04Email Address of Licensed Institution:

compliance.au@pepperstone.comSharing Status:

No SharingWebsite of Licensed Institution:

https://pepperstone.comExpiration Time:

--Address of Licensed Institution:

'TOWER ONE' L 16 727 COLLINS ST DOCKLANDS VIC 3008Phone Number of Licensed Institution:

1300 033 375Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 16

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Pepperstone EU Limited

Effective Date:

2020-08-03Email Address of Licensed Institution:

info.eu@pepperstone.comSharing Status:

No SharingWebsite of Licensed Institution:

https://pepperstone.com/Expiration Time:

--Address of Licensed Institution:

3, Myronos Str, 3035, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 030 573Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Pepperstone Limited

Effective Date:

2015-08-05Email Address of Licensed Institution:

londonoffice@pepperstone.com, compliance.uk@pepperstone.comSharing Status:

No SharingWebsite of Licensed Institution:

www.pepperstone.comExpiration Time:

--Address of Licensed Institution:

70 Gracechurch Street London EC3V 0HR UNITED KINGDOMPhone Number of Licensed Institution:

+448000465473Licensed Institution Certified Documents:

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Pepperstone Markets Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Pineapple House, Old Fort Bay, Western Road, Nassau, BahamasPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Pepperstone A Scam?

Introduction

Pepperstone is a prominent online forex and CFD broker founded in 2010 in Melbourne, Australia. It has quickly gained a reputation for offering competitive trading conditions, low spreads, and a wide range of trading platforms, making it a popular choice among both novice and experienced traders. Given the vast number of brokers in the market, it is crucial for traders to carefully evaluate the legitimacy and reliability of any trading platform before committing their funds. This article aims to provide a comprehensive analysis of Pepperstone, exploring its regulatory status, company background, trading conditions, client fund safety, customer experience, platform performance, and associated risks. The findings are based on a thorough review of various reputable sources, including industry reports, user reviews, and regulatory information.

Regulation and Legitimacy

One of the most important factors in assessing the safety and legitimacy of a forex broker is its regulatory status. Pepperstone is regulated by several top-tier authorities, which adds a layer of security for its clients. Below is a summary of its key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Australian Securities and Investments Commission (ASIC) | AFSL 414530 | Australia | Verified |

| Financial Conduct Authority (FCA) | FRN 684312 | United Kingdom | Verified |

| Cyprus Securities and Exchange Commission (CySEC) | 388/20 | Cyprus | Verified |

| Dubai Financial Services Authority (DFSA) | F004356 | UAE | Verified |

| Federal Financial Supervisory Authority (BaFin) | 151148 | Germany | Verified |

| Capital Markets Authority (CMA) | 128 | Kenya | Verified |

| Securities Commission of the Bahamas (SCB) | SIA-F-217 | Bahamas | Verified |

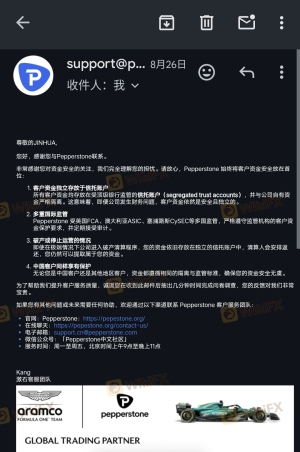

The presence of multiple regulatory licenses indicates that Pepperstone adheres to strict financial standards and operational guidelines. ASIC and FCA, in particular, are known for their rigorous regulatory frameworks, which require brokers to maintain adequate capital reserves, implement effective risk management practices, and ensure the segregation of client funds from corporate assets. This regulatory oversight enhances the trustworthiness of Pepperstone as a trading platform.

Historically, Pepperstone has maintained a good compliance record, with no significant regulatory breaches reported. This track record further solidifies its reputation as a reliable broker. However, it is essential for traders to remain vigilant and conduct their own due diligence, as the forex market is inherently risky, and even regulated brokers can face challenges.

Company Background Investigation

Pepperstone was established in 2010 by Owen Kerr and Joe Davenport, both of whom had extensive experience in the trading industry. The company was founded with the goal of providing a better trading experience for retail and institutional clients by addressing common frustrations such as delayed executions and high trading costs. Over the years, Pepperstone has grown significantly, expanding its services and regulatory reach to cater to a global audience.

The company's ownership structure has evolved, with a majority stake sold to Champ Private Equity in 2016. However, the original founders regained control of the company in 2018. This transition reflects a commitment to maintaining the company's core values while also adapting to the dynamic nature of the financial markets.

Pepperstone operates with a high degree of transparency, providing detailed information about its services, fees, and regulatory status on its website. This level of openness is crucial for building trust with clients, as it allows traders to make informed decisions about where to allocate their funds. Furthermore, the company's commitment to customer service is evident through its 24/5 support availability in multiple languages, ensuring that clients can receive assistance whenever needed.

Trading Conditions Analysis

Pepperstone is known for its competitive trading conditions, which are essential for attracting and retaining clients. The broker offers two primary account types: the Standard Account and the Razor Account. The Standard Account is commission-free and features slightly wider spreads, while the Razor Account is designed for more experienced traders and offers lower spreads with a commission structure.

Heres a breakdown of the core trading costs associated with Pepperstone:

| Cost Type | Pepperstone | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.1 pips | 1.2 pips |

| Commission Structure | $3.50 per lot (Razor Account) | $5.00 per lot |

| Overnight Interest Range | Varies by instrument | Varies by broker |

The average spread for major currency pairs on Pepperstone's Standard Account is approximately 1.1 pips, which is competitive compared to the industry average of 1.2 pips. For the Razor Account, spreads can start from as low as 0.0 pips, making it an attractive option for traders who prioritize low costs.

In addition to spreads and commissions, traders should be aware of any potential overnight fees or other charges that may apply, particularly for positions held overnight. While Pepperstone aims to maintain a transparent fee structure, it is essential for traders to fully understand these costs to manage their trading expenses effectively.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Pepperstone takes several measures to ensure the security of its clients' capital. Client funds are held in segregated accounts with top-tier banks, which means that they are kept separate from the broker's operational funds. This segregation provides an additional layer of protection, ensuring that client funds are not used for any other purposes, including hedging activities.

Furthermore, Pepperstone offers negative balance protection, which prevents clients from losing more than their account balance during periods of high volatility. This feature is particularly important in the forex market, where sudden price movements can lead to significant losses.

Despite these safeguards, it is worth noting that no broker is entirely risk-free. Traders should remain aware of the inherent risks associated with trading, including market risk and counterparty risk. However, Pepperstone's commitment to fund security and regulatory compliance positions it as a trustworthy option for traders looking to enter the forex market.

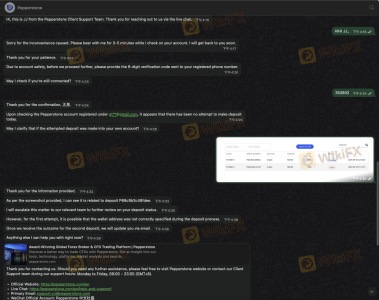

Customer Experience and Complaints

Customer feedback is a critical aspect of evaluating any broker. Overall, Pepperstone has received positive reviews from clients, particularly regarding its trading conditions, platform performance, and customer support. However, like any broker, it has also faced its share of complaints.

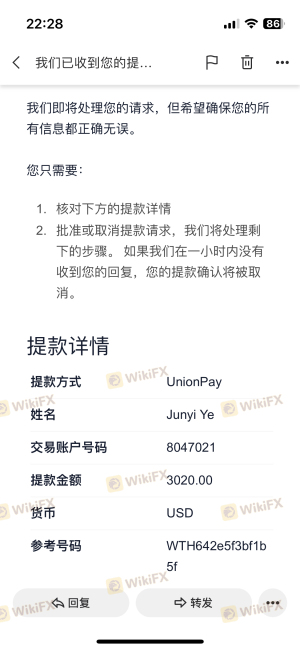

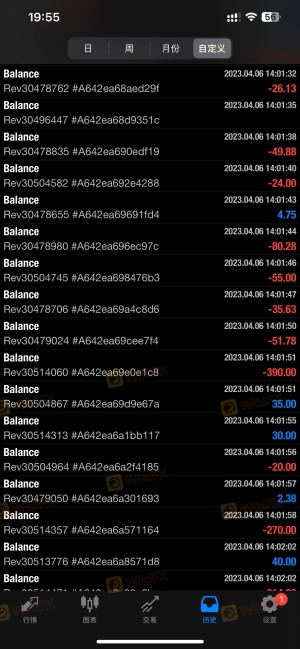

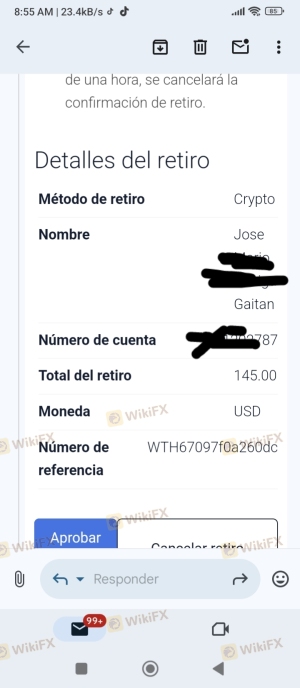

Common complaints about Pepperstone include issues related to withdrawal delays and customer service responsiveness. Below is a summary of the main complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Addressed within 24 hours |

| Customer Service Responsiveness | Medium | Generally prompt, but can vary |

| Slippage Issues | Low | Minimal impact reported |

For instance, some traders have reported delays in processing withdrawals, particularly when using bank transfers. However, Pepperstone has generally been responsive to these concerns, often resolving issues within a reasonable timeframe.

In one notable case, a trader expressed frustration over a prolonged withdrawal process, but the company was able to address the issue and facilitate the withdrawal after confirming the necessary documentation was in order. This illustrates the importance of maintaining open communication with customer support to resolve any potential issues.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. Pepperstone offers several popular platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView. These platforms are known for their reliability, advanced features, and user-friendly interfaces, catering to traders of all experience levels.

In terms of order execution quality, Pepperstone has a strong reputation for fast and reliable fills. The broker uses a no-dealing desk (NDD) model, which allows for direct access to liquidity providers. This model minimizes slippage and ensures that trades are executed at the best available prices.

Traders have reported an average fill rate of 99.5%, which is indicative of the brokers commitment to providing a seamless trading experience. However, it is essential for traders to remain vigilant and monitor their trades, as unexpected market conditions can still lead to slippage or re-quotes.

Risk Assessment

Using Pepperstone as a trading platform comes with its own set of risks, as is the case with any forex broker. Below is a summary of the key risk areas associated with trading with Pepperstone:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Market Risk | High | Sudden price movements can lead to significant losses. |

| Counterparty Risk | Low | Strong regulatory oversight and fund segregation mitigate this risk. |

| Withdrawal Risk | Medium | Some clients have reported delays, but generally manageable. |

| Execution Risk | Low | High fill rates and fast execution minimize this risk. |

To mitigate these risks, traders are advised to implement sound risk management practices, such as setting stop-loss orders, diversifying their trading strategies, and maintaining adequate account balances to absorb potential losses.

Conclusion and Recommendations

In conclusion, Pepperstone is not a scam but a reputable and well-regulated broker that offers a wide range of trading options and competitive conditions. Its strong regulatory framework, commitment to client fund safety, and positive customer feedback underscore its reliability as a trading platform. However, potential clients should remain aware of the inherent risks associated with trading and the possibility of withdrawal delays.

For traders looking for a trustworthy broker, Pepperstone is a solid choice, especially for those interested in forex and CFD trading. However, it may not be the best fit for those seeking direct stock investments or extensive educational resources.

If you are considering alternatives, brokers such as IG, eToro, and Forex.com offer similar services with varying features that may better suit your trading style and preferences. Always conduct thorough research and consider your trading needs before making a decision.

Is Pepperstone a scam, or is it legit?

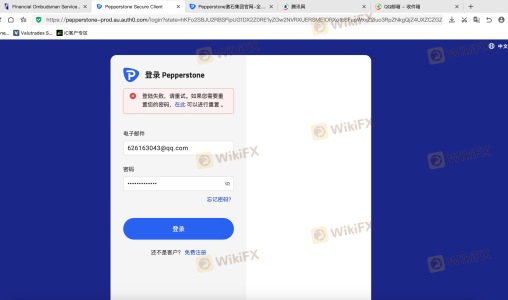

The latest exposure and evaluation content of Pepperstone brokers.

Pepperstone Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Pepperstone latest industry rating score is 7.77, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.77 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.