Regarding the legitimacy of TICKMILL forex brokers, it provides FCA, CYSEC, FSCA and WikiBit, (also has a graphic survey regarding security).

Is TICKMILL safe?

Pros

Cons

Is TICKMILL markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

TICKMILL UK LTD

Effective Date: Change Record

2016-07-29Email Address of Licensed Institution:

r.pone@tickmill.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.tickmill.com/uk/Expiration Time:

--Address of Licensed Institution:

First Floor The Bengal Wing 9A Devonshire Square London EC2M 4YN UNITED KINGDOMPhone Number of Licensed Institution:

+4407717003875Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 17

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Tickmill Europe Ltd

Effective Date:

2015-08-05Email Address of Licensed Institution:

compliance@tickmill.euSharing Status:

No SharingWebsite of Licensed Institution:

www.tickmill.com/euExpiration Time:

--Address of Licensed Institution:

Kedron 9, Mesa Geitonia 4004 LimassolPhone Number of Licensed Institution:

+357 25 247 650Licensed Institution Certified Documents:

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

TICKMILL SOUTH AFRICA (PTY) LTD

Effective Date: Change Record

2019-10-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

3RD FLOOR34 WHITELEY ROADMELROSE ARCH2196Phone Number of Licensed Institution:

0104489718Licensed Institution Certified Documents:

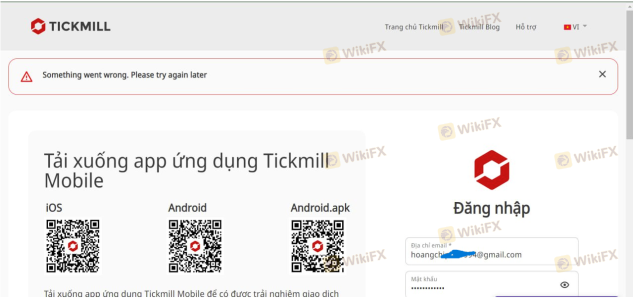

Is Tickmill A Scam?

Introduction

Tickmill is a global online broker that specializes in forex and CFD trading, positioning itself as a competitive player in the financial market since its inception in 2014. With its headquarters in Seychelles and regulatory licenses from several reputable financial authorities, Tickmill aims to provide traders with low-cost trading options and advanced trading platforms. However, as with any financial service provider, it is crucial for traders to assess the legitimacy and reliability of the broker before committing their funds. The forex market is rife with scams and unreliable brokers, making due diligence essential for protecting one's investments.

This article aims to provide a comprehensive evaluation of Tickmill, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experience, platform performance, and associated risks. Our investigation is based on a careful analysis of multiple credible sources, including regulatory filings, user reviews, and expert assessments.

Regulation and Legitimacy

The regulatory landscape is a pivotal factor in determining the trustworthiness of a forex broker. Tickmill is regulated by several reputable authorities, which adds a layer of credibility to its operations. The broker is authorized by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa, among others. These regulatory bodies enforce strict compliance with financial standards, ensuring that brokers operate transparently and protect client funds.

Regulatory Information Table

| Regulatory Body | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| FCA | 717270 | United Kingdom | Verified |

| CySEC | 278/15 | Cyprus | Verified |

| FSCA | 49464 | South Africa | Verified |

| FSA | SD008 | Seychelles | Verified |

The presence of these tier-1 and tier-2 regulators signifies that Tickmill adheres to high standards of operational integrity and customer protection. Moreover, the broker offers negative balance protection, ensuring that clients cannot lose more than their deposited funds. Historically, Tickmill has maintained a clean regulatory record with no significant compliance issues reported, further enhancing its reputation as a trustworthy broker.

Company Background Investigation

Tickmill was founded by brothers Ingmar and Illimar Mattus, both seasoned professionals in the forex trading industry. The company's rapid growth and establishment in multiple jurisdictions reflect its commitment to providing transparent and reliable trading services. Tickmill's ownership structure consists of various entities, including Tickmill UK Ltd, Tickmill Europe Ltd, and Tickmill Ltd in Seychelles, which allows it to cater to a diverse clientele.

The management team at Tickmill boasts extensive experience in financial services, contributing to the broker's strategic direction and operational efficiency. The company's transparency in its operations, including clear disclosures about fees and trading conditions, further supports its credibility. Tickmills website also provides comprehensive information about its services, indicating a commitment to keeping clients informed.

Trading Conditions Analysis

Tickmill offers a range of trading accounts, including Classic, Pro, and VIP accounts, each with distinct features and fee structures. The overall cost of trading is a critical aspect for traders, and Tickmill aims to keep its fees competitive compared to industry standards.

Core Trading Cost Comparison Table

| Fee Type | Tickmill | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | 0.5 pips |

| Commission Model | $2 per lot (Pro) | $4 per lot |

| Overnight Interest Range | Varies | Varies |

Tickmills Classic account has no commission but features higher spreads, starting from 1.6 pips. In contrast, the Pro and VIP accounts offer lower spreads beginning at 0.0 pips but charge a commission per trade. This tiered pricing structure allows traders to select an account type that best suits their trading style and volume.

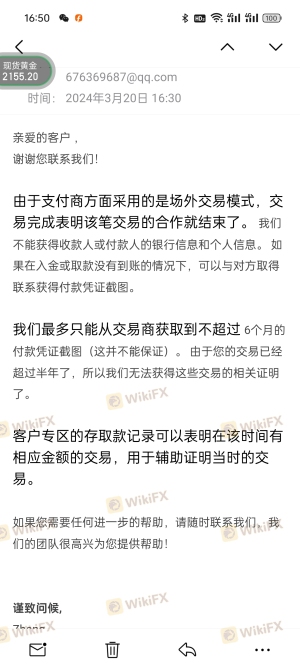

However, some users have reported concerns regarding the transparency of fees, particularly related to overnight interest rates and the conditions under which they apply. It is essential for traders to thoroughly review the fee structure and understand any potential costs associated with their trading activities.

Client Fund Safety

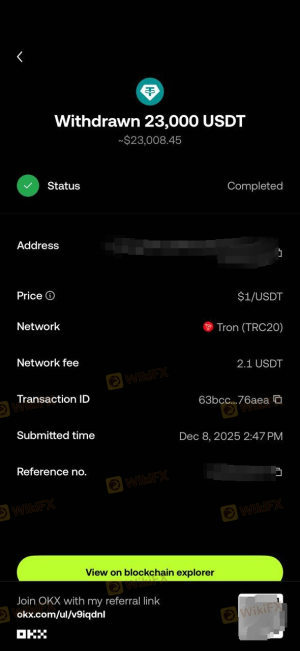

The safety of client funds is paramount in the forex trading environment. Tickmill implements several measures to protect client assets, including segregating client funds from its operational capital. This segregation ensures that client funds are not used for company expenses and are readily available for withdrawal.

Moreover, Tickmill participates in investor compensation schemes, such as the Financial Services Compensation Scheme (FSCS) in the UK, which protects clients' funds up to £85,000 in the event of broker insolvency. For European clients, the Investor Compensation Fund (ICF) provides coverage of up to €20,000.

Tickmill also employs advanced cybersecurity protocols, including SSL encryption, to safeguard clients' personal and financial information from unauthorized access. Despite these robust safety measures, it is crucial for traders to remain vigilant and conduct their own risk assessments, especially if they are trading with significant amounts.

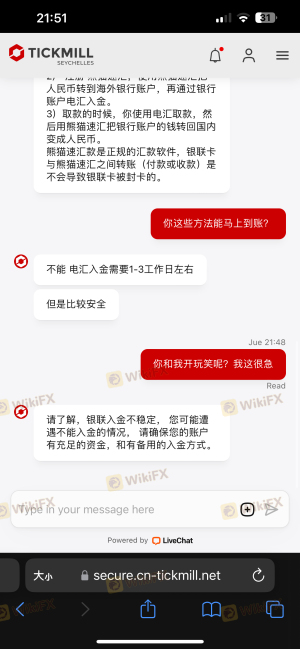

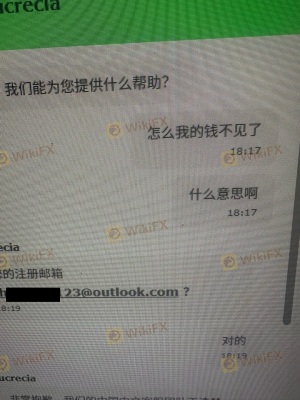

Customer Experience and Complaints

Customer feedback plays a vital role in understanding the overall user experience with a broker. Tickmill has received a mix of reviews from clients, with many praising its competitive trading conditions and efficient execution. However, some common complaints have emerged regarding customer support responsiveness and withdrawal processing times.

Common Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Addressed within 24 hours |

| Customer Support Availability | High | Limited to business hours |

| Platform Stability Issues | Medium | Ongoing improvements |

For example, some traders have reported delays in processing withdrawal requests, leading to frustration. While Tickmill has addressed these complaints, the resolution times can vary. Additionally, the customer support team operates only during business hours, which may not be ideal for traders in different time zones.

Platform and Trade Execution

Tickmill offers trading through the widely recognized MetaTrader 4 and MetaTrader 5 platforms, which are known for their reliability and user-friendly interfaces. The broker's execution model is designed to ensure fast order processing, with average execution times reported at around 0.2 seconds.

However, some users have noted instances of slippage during high volatility periods, which can impact trading outcomes. The absence of a proprietary trading platform may also deter some traders seeking unique features.

Risk Assessment

While Tickmill presents many advantages, it is essential to consider the inherent risks associated with trading through any broker.

Risk Assessment Summary Table

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by multiple authorities |

| Operational Risk | Medium | Occasional withdrawal delays reported |

| Market Risk | High | Forex and CFD trading involves high volatility |

| Cybersecurity Risk | Low | Strong encryption and fund segregation in place |

To mitigate risks, traders should employ sound risk management strategies, such as setting stop-loss orders and avoiding excessive leverage. Additionally, maintaining awareness of market conditions and regulatory changes can further enhance trading safety.

Conclusion and Recommendations

In conclusion, Tickmill is not a scam; it is a regulated broker with a solid reputation in the forex and CFD trading space. The presence of multiple regulatory licenses, coupled with its commitment to client fund safety and competitive trading conditions, positions Tickmill as a trustworthy option for traders.

However, potential clients should be aware of the limitations in customer support availability and the occasional withdrawal processing delays. For traders who prioritize low costs and are comfortable with the MetaTrader platforms, Tickmill offers a compelling choice.

For those seeking alternatives, brokers such as IG or Saxo Bank may provide a broader range of instruments and enhanced customer support. Ultimately, traders should assess their individual needs and preferences before selecting a broker.

Is TICKMILL a scam, or is it legit?

The latest exposure and evaluation content of TICKMILL brokers.

TICKMILL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TICKMILL latest industry rating score is 7.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.