moomoo 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive moomoo review looks at one of the most talked-about commission-free trading platforms in today's market. Moomoo started in 2018 and quickly became a great choice for active traders who want low-cost trading and powerful analysis tools.

The platform offers zero-commission trading across many types of investments and advanced charts that compete with expensive trading platforms. New users can get promotional offers, including up to five free stocks when they sign up, which makes it appealing for both new and experienced traders.

Moomoo targets active traders and investors who want low-cost trading without giving up good platform features. The broker focuses on mobile apps first, with dedicated applications for Android and iOS devices, which appeals to traders who like managing their portfolios on their phones. User feedback shows the platform has become popular among cost-conscious investors who want comprehensive market analysis tools.

However, potential users should know about certain limits, including gaps in regulatory information and regional restrictions that may affect access for international traders.

Important Notice

This moomoo review uses publicly available information and user feedback collected from various sources as of 2025. Readers should know that regulatory rules and services may vary a lot across different regions where moomoo operates.

The review method used here includes analysis of platform features, user testimonials, cost structures, and market positioning. Because of limited regulatory disclosure in available materials, certain aspects of regulatory compliance and oversight may need independent verification by prospective users.

Rating Framework

Broker Overview

Moomoo appeared in the financial technology world in 2018 as a subsidiary of Futu Holdings Ltd, headquartered in Palo Alto, California. The company positioned itself strategically within the growing commission-free trading sector, taking advantage of the industry shift toward easier investment access and lower trading costs.

The platform's business model focuses on eliminating traditional commission structures while keeping revenue through other channels such as payment for order flow and premium service offerings. This approach has helped moomoo attract many users seeking cost-effective trading solutions without giving up platform quality.

Moomoo operates mainly through its mobile application system, supporting both Android and iOS platforms. The platform allows trading across multiple asset classes including stocks, exchange-traded funds (ETFs), mutual funds, options, and bonds. This diverse offering makes moomoo a comprehensive investment platform rather than a specialized trading tool.

The company's technology emphasizes real-time market data, advanced charting capabilities, and social trading features that set it apart from traditional discount brokers. This moomoo review finds that the platform's combination of professional-grade analytical tools with user-friendly interfaces has contributed significantly to its acceptance among active trading communities.

Regulatory Oversight: Available documentation does not provide comprehensive details regarding specific regulatory authorities overseeing moomoo's operations, which represents a significant information gap for potential users seeking regulatory clarity.

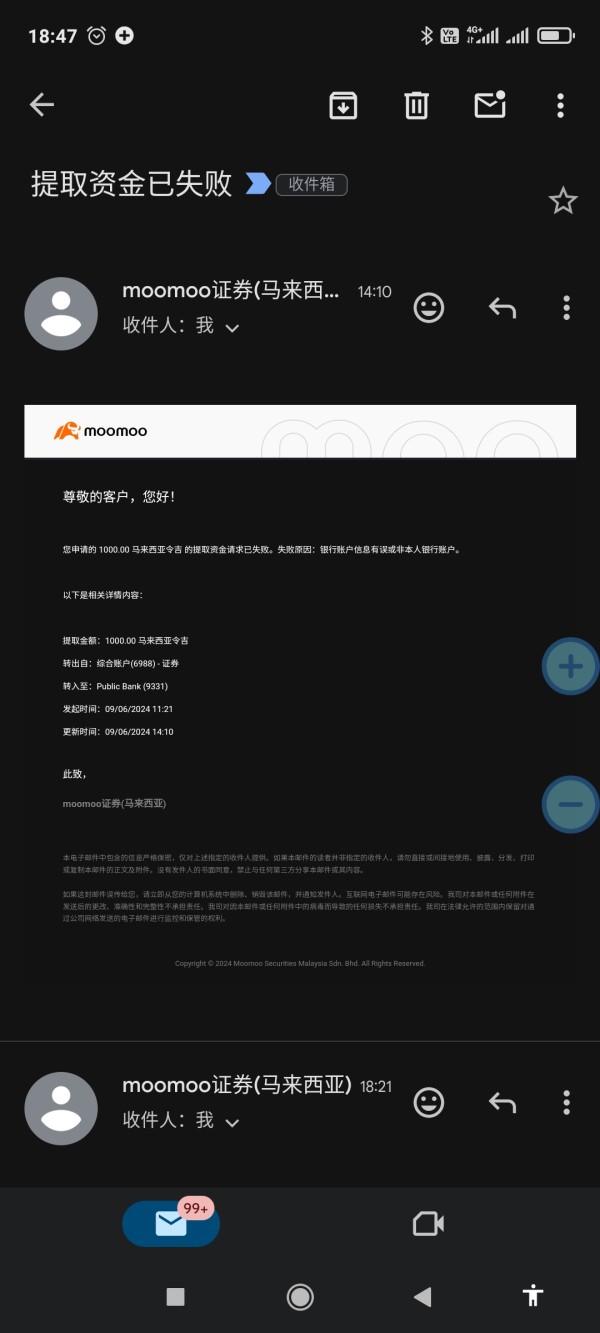

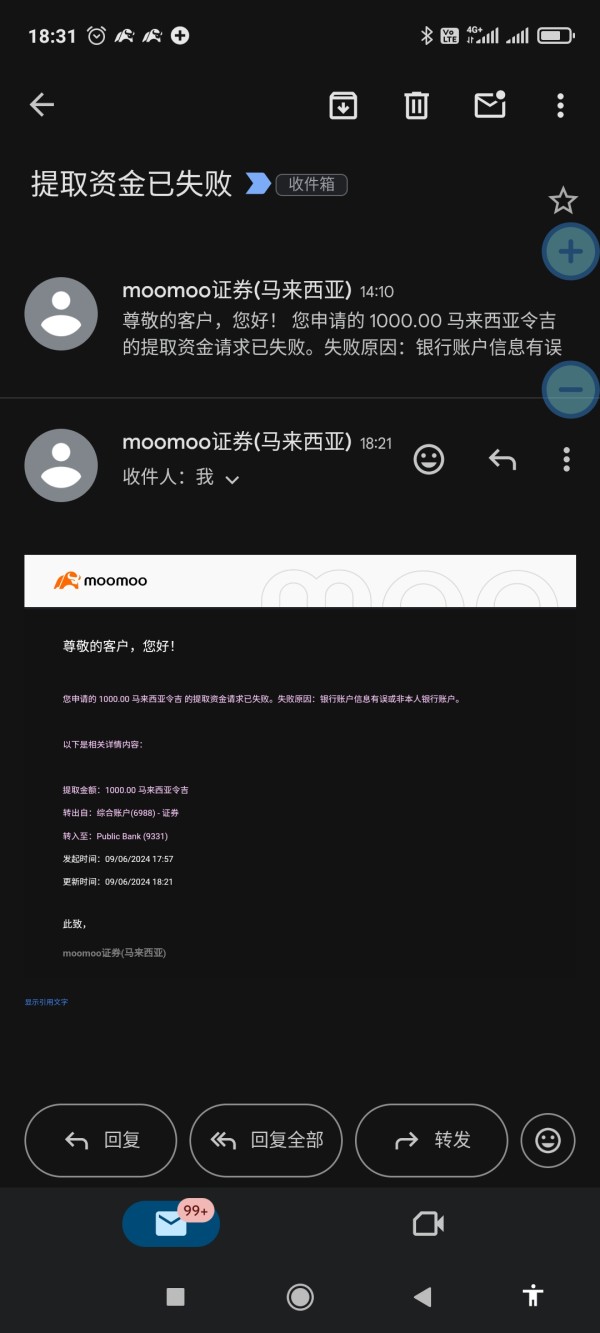

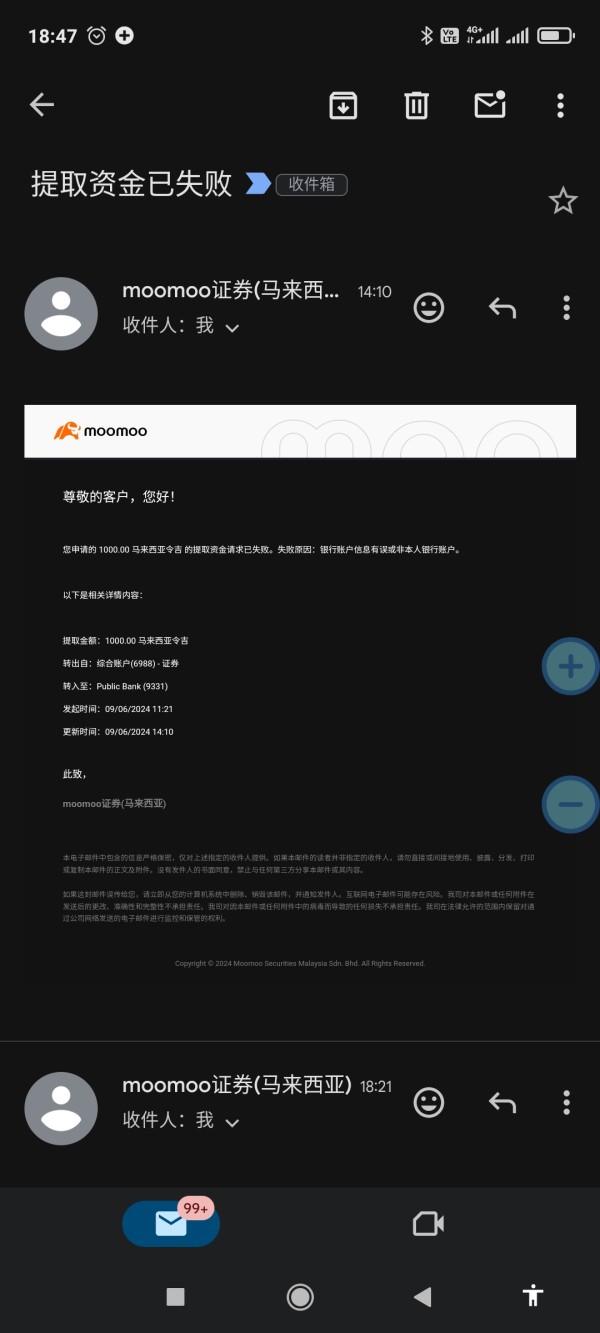

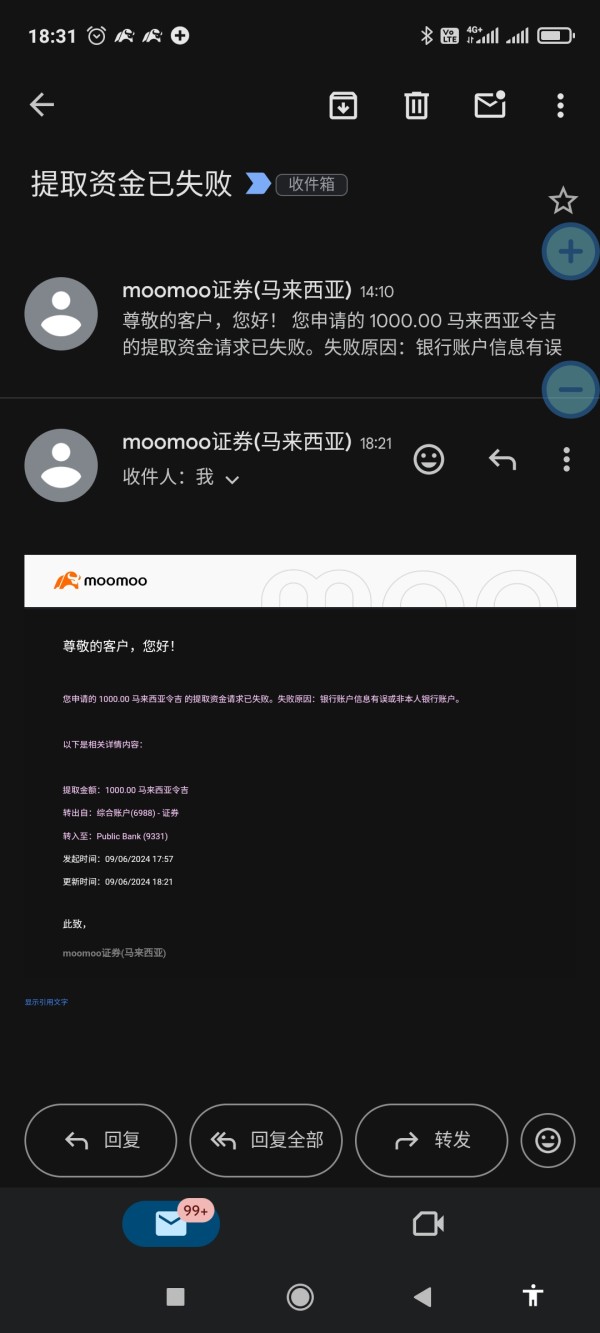

Deposit and Withdrawal Methods: Specific funding mechanisms and withdrawal procedures are not detailed in available materials, though the platform likely supports standard electronic transfer methods common to modern trading platforms.

Minimum Deposit Requirements: Current minimum deposit thresholds are not specified in accessible documentation, which suggests either flexible entry requirements or region-specific variations.

Promotional Offerings: New account registrations can qualify for promotional benefits including up to five complimentary stock allocations, providing immediate portfolio diversification for beginning traders.

Available Assets: The platform supports trading in stocks, ETFs, mutual funds, options contracts, and bonds, offering comprehensive market exposure across major asset classes.

Cost Structure: While commission-free trading represents the primary value proposition, users should expect potential charges including regulatory fees, exchange-imposed costs, and options contract fees that may apply to specific transaction types.

Leverage Options: Leverage ratios and margin trading capabilities are not specifically detailed in available information, which requires direct platform inquiry for precise specifications.

Platform Selection: Trading operations are conducted primarily through the moomoo mobile application, available for Android and iOS devices, with emphasis on mobile-optimized functionality.

This moomoo review notes that regional service restrictions may apply, though specific geographical limitations are not comprehensively documented in available materials.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

The evaluation of moomoo's account conditions reveals several areas where information transparency could be enhanced. Available documentation does not provide clear specifications regarding account tier structures, minimum deposit requirements, or different service levels that might be available to users with varying investment capital.

The account opening process appears streamlined based on user feedback, though specific verification requirements and timeline expectations are not detailed in accessible materials. This lack of transparency may create uncertainty for potential users attempting to plan their account establishment timeline.

Unlike many traditional brokers that offer specialized account types such as Islamic-compliant accounts or professional trader designations, available information does not indicate whether moomoo provides such specialized account options. This moomoo review finds that the platform's account structure appears designed for simplicity rather than customization.

The absence of clearly defined account tiers may actually benefit users seeking straightforward access without navigating complex qualification criteria, though it may also limit advanced features for sophisticated traders.

Moomoo demonstrates significant strength in its analytical tool offering, providing advanced charting capabilities that compete effectively with premium trading platforms. The platform integrates comprehensive technical analysis tools, real-time market data, and customizable interface options that meet serious traders' analytical requirements.

User feedback consistently highlights the platform's charting functionality as a primary strength, with many traders noting the availability of professional-grade indicators and drawing tools typically associated with more expensive trading software. The integration of fundamental analysis resources alongside technical tools provides a comprehensive analytical environment.

The platform's social trading features add an additional dimension to the analytical toolkit, allowing users to observe and learn from experienced traders' strategies. This community-driven approach to market analysis represents an innovative addition to traditional broker offerings.

However, educational resources and structured learning materials are not comprehensively detailed in available information, which potentially limits the platform's appeal to beginning traders seeking guided learning experiences.

Customer Service and Support Analysis (6/10)

Available information provides limited insight into moomoo's customer service infrastructure, including response time expectations, available communication channels, and service quality metrics. This information gap represents a significant concern for traders who prioritize reliable customer support access.

The absence of detailed customer service information makes it difficult to assess whether the platform provides adequate support for complex trading issues or technical difficulties that may arise during market hours. Active traders, in particular, require confidence in their broker's ability to provide timely assistance during critical trading situations.

Multi-language support capabilities are not specified in available documentation, which may impact international users' service experience. Similarly, customer service availability hours and geographic coverage are not clearly defined.

User feedback regarding customer service experiences is not comprehensively available, which limits the ability to assess real-world service quality and responsiveness based on actual user experiences.

Trading Experience Analysis (8/10)

The trading experience on moomoo receives positive evaluation based on available user feedback and platform feature analysis. Users consistently report high satisfaction with platform stability and execution reliability, particularly during standard market hours.

The mobile-first design philosophy appears well-executed, with users praising the intuitive interface design and smooth navigation experience. The platform's emphasis on visual data presentation and customizable dashboard options enhances the overall trading workflow for active users.

Order execution quality, while not specifically detailed in available performance metrics, appears satisfactory based on user feedback patterns. The absence of significant user complaints regarding execution issues suggests adequate performance standards, though specific execution statistics would strengthen this assessment.

The platform's integration of real-time market data with advanced charting tools creates a seamless analytical and execution environment that supports efficient trading workflows. This moomoo review finds that the combination of analytical depth and execution simplicity represents a significant platform strength.

Trust and Regulation Analysis (5/10)

The regulatory transparency aspect presents the most significant concern in this moomoo evaluation. Available documentation does not provide comprehensive information regarding specific regulatory authorities, license numbers, or compliance frameworks governing the platform's operations.

This regulatory information gap creates uncertainty for users seeking assurance regarding fund safety measures, dispute resolution procedures, and oversight accountability. Modern traders increasingly prioritize regulatory clarity when selecting trading platforms, making this transparency deficit a notable limitation.

Company transparency regarding operational procedures, fund segregation practices, and client protection measures is not comprehensively detailed in accessible materials. This lack of detailed disclosure may impact user confidence, particularly among risk-conscious investors.

The absence of publicly available information regarding industry awards, regulatory recognition, or third-party certifications further limits the ability to assess the platform's industry standing and reputation among regulatory authorities.

User Experience Analysis (8/10)

User experience represents a clear strength for moomoo, with consistent positive feedback regarding platform usability and interface design. The mobile application's intuitive navigation and responsive design contribute to high user satisfaction levels among active trading communities.

The platform's emphasis on visual data presentation and customizable interface options allows users to tailor their trading environment to personal preferences and trading styles. This flexibility enhances long-term user satisfaction and platform adoption rates.

Registration and account verification processes appear streamlined based on user feedback, though specific timeline expectations and documentation requirements are not detailed in available information. The promotional offering of free stocks upon registration creates a positive initial user experience.

Common user concerns are not comprehensively documented in available materials, which limits the ability to identify recurring issues or areas for platform improvement. However, the overall positive user sentiment suggests that major usability problems are not widespread among the user base.

Conclusion

This comprehensive moomoo review reveals a trading platform that excels in core functionality while presenting some transparency challenges. The platform's commission-free trading model, combined with sophisticated analytical tools and intuitive mobile interface design, creates compelling value for active traders seeking cost-effective market access.

Moomoo appears particularly well-suited for tech-savvy traders who prioritize mobile trading capabilities and advanced charting tools without the expense of traditional full-service brokers. The platform's strength in analytical resources and user interface design makes it attractive for intermediate to advanced traders seeking professional-grade tools at consumer-friendly pricing.

However, potential users should carefully consider the regulatory transparency limitations and information gaps regarding customer service infrastructure before committing significant trading capital. While the platform demonstrates strong technical capabilities and user satisfaction, the absence of comprehensive regulatory disclosure may concern risk-conscious investors seeking maximum transparency and oversight assurance.