JustMarkets Review 481

These guys were very good before but now they have many problems with deposits, I made a deposit since Thursday, today is Monday still they tell me same response from their copy and paste message of the department of finance is working on it but till now, nothing is credited and I have no hope for it. I NO LONGER RECOMMEND THIS BROKER!!! VERY DISAPPOINTED!!

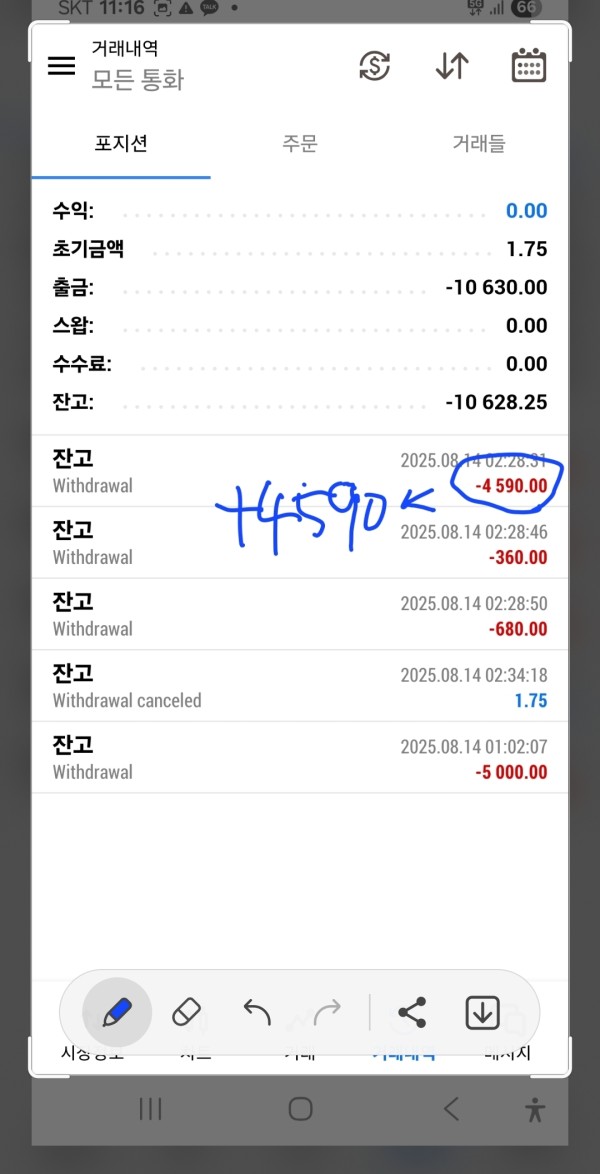

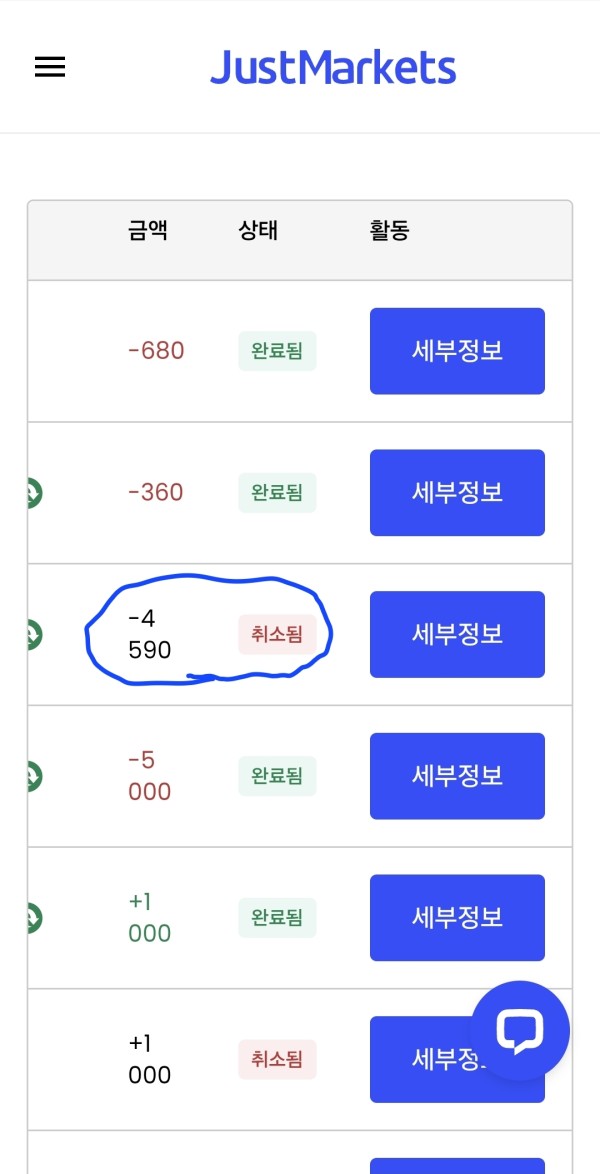

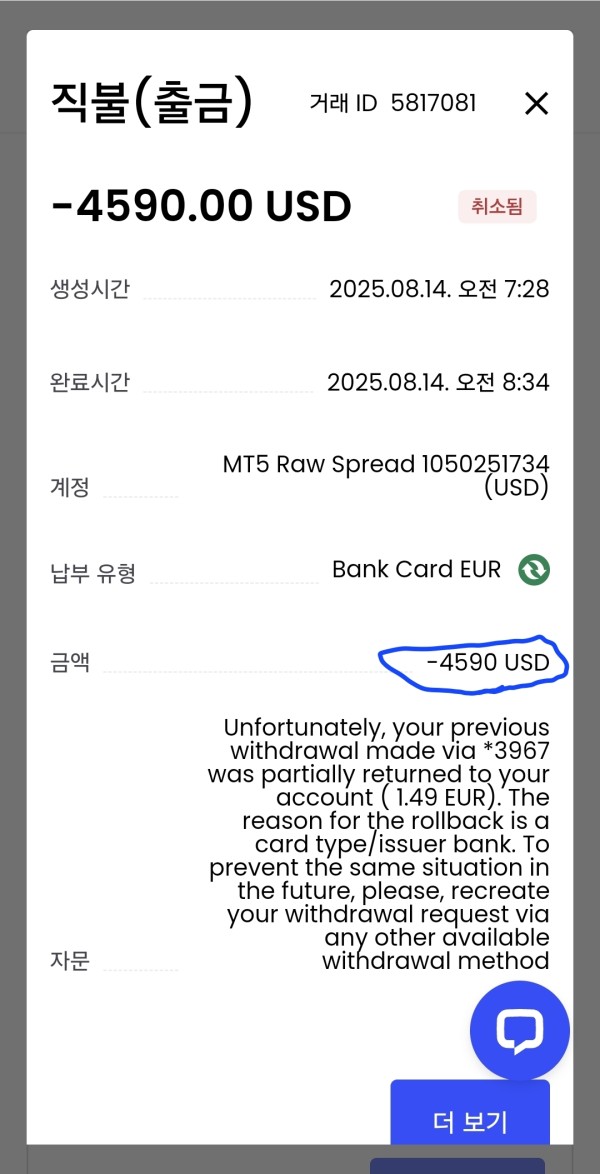

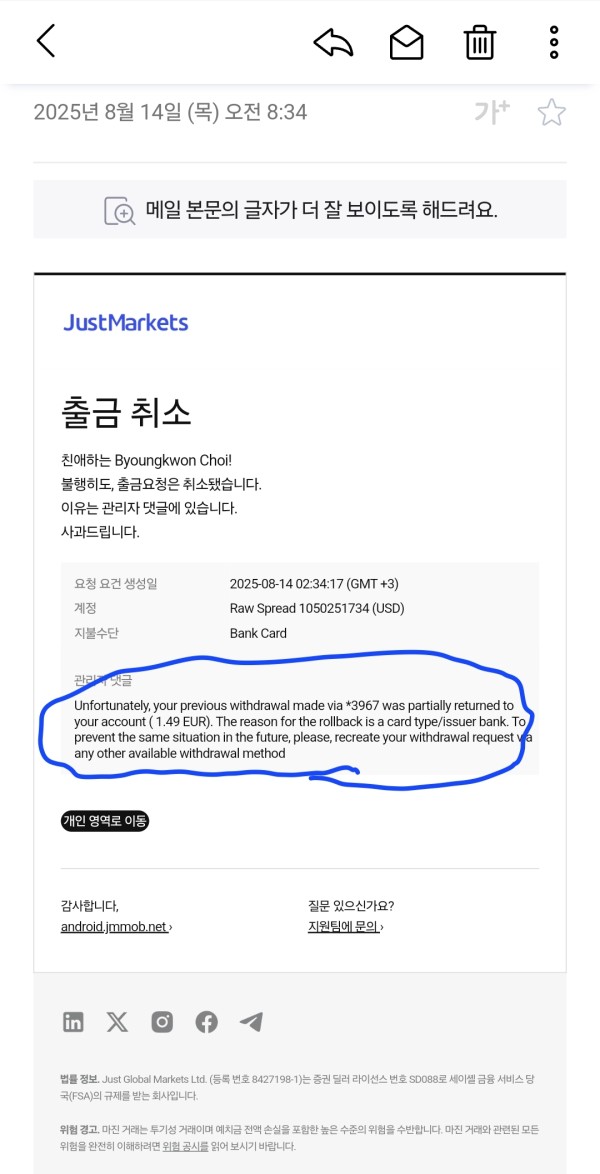

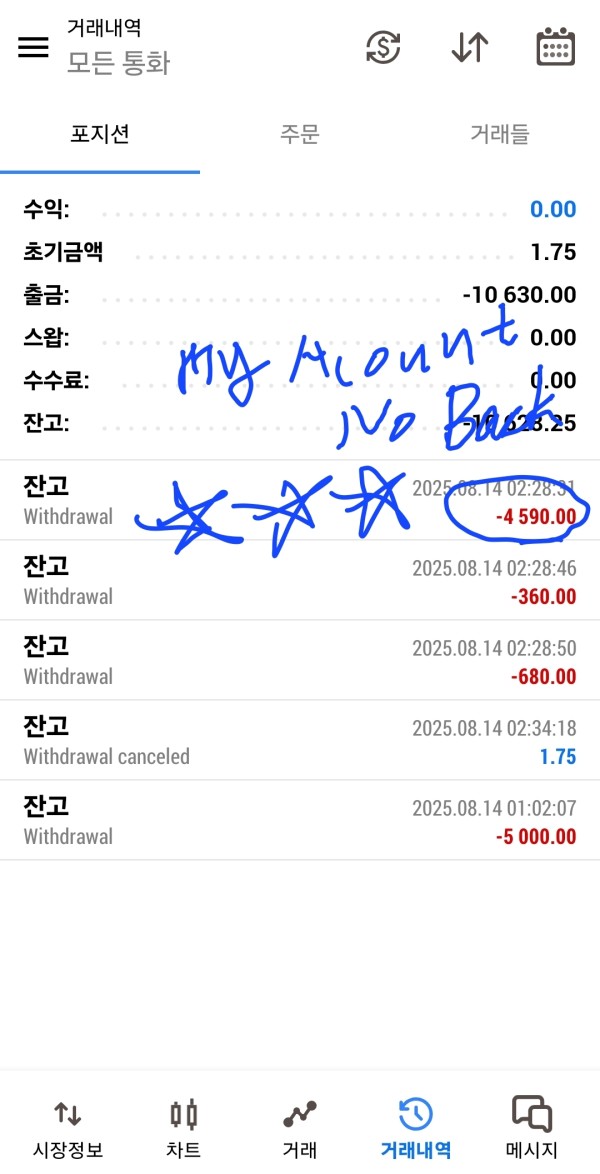

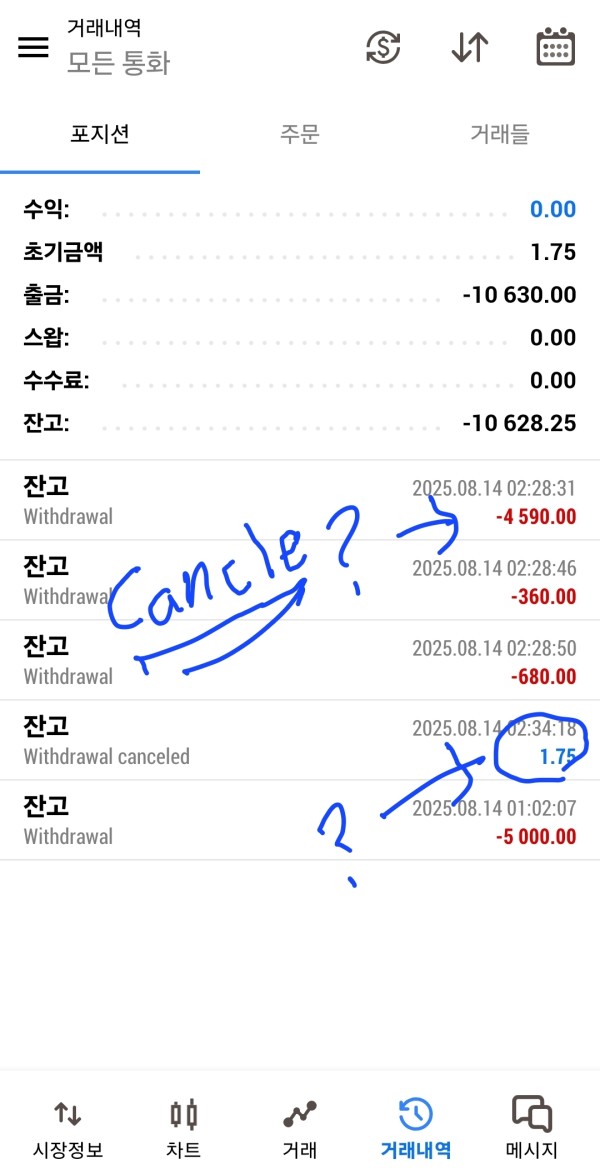

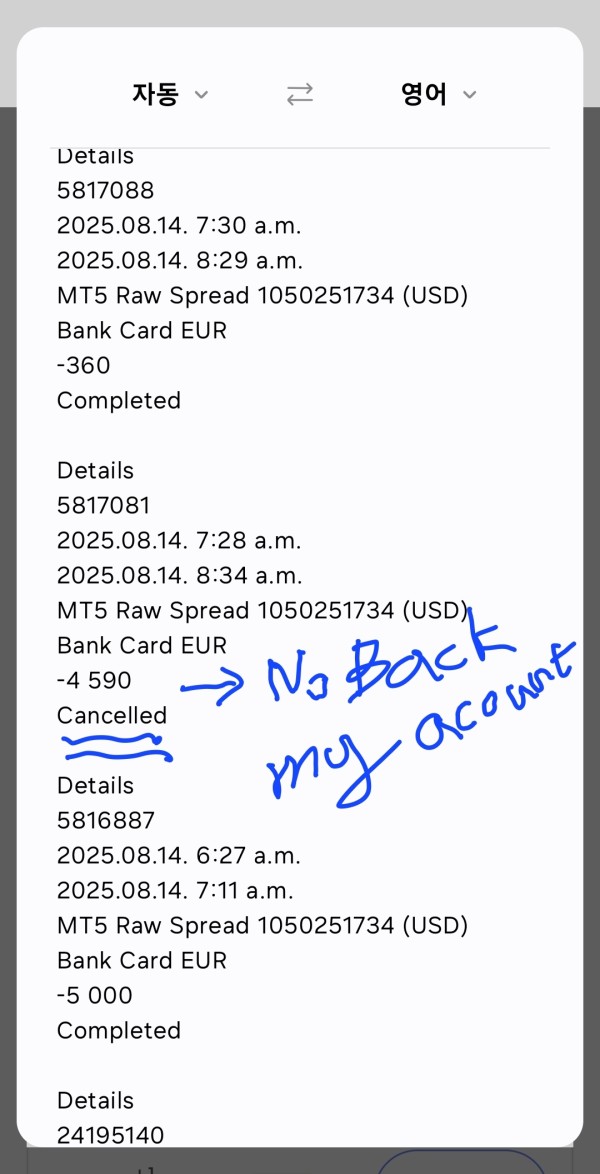

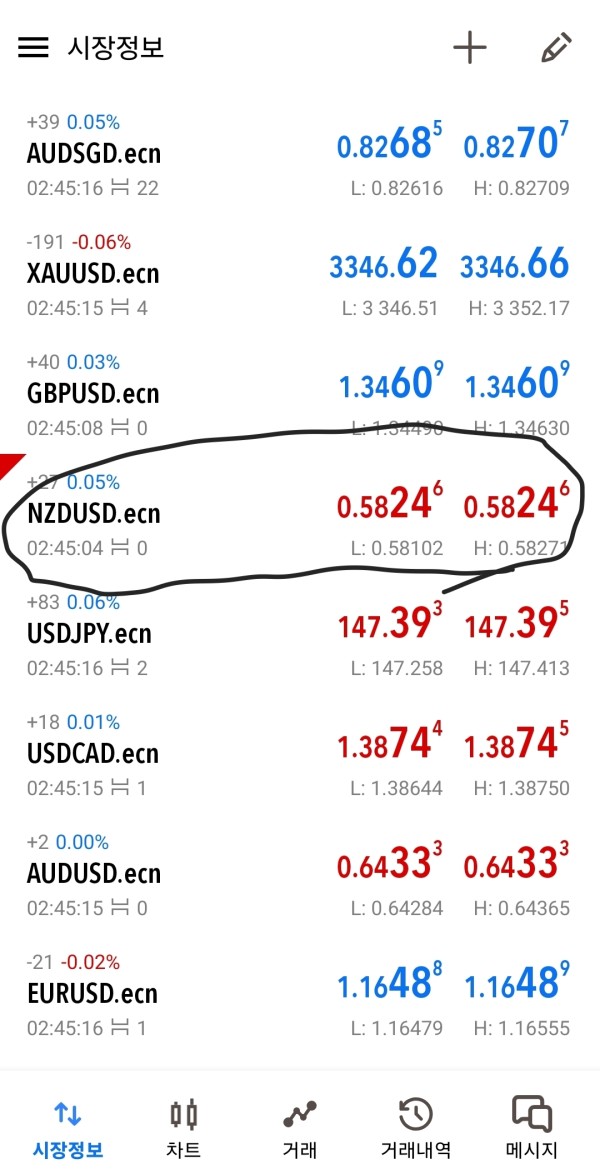

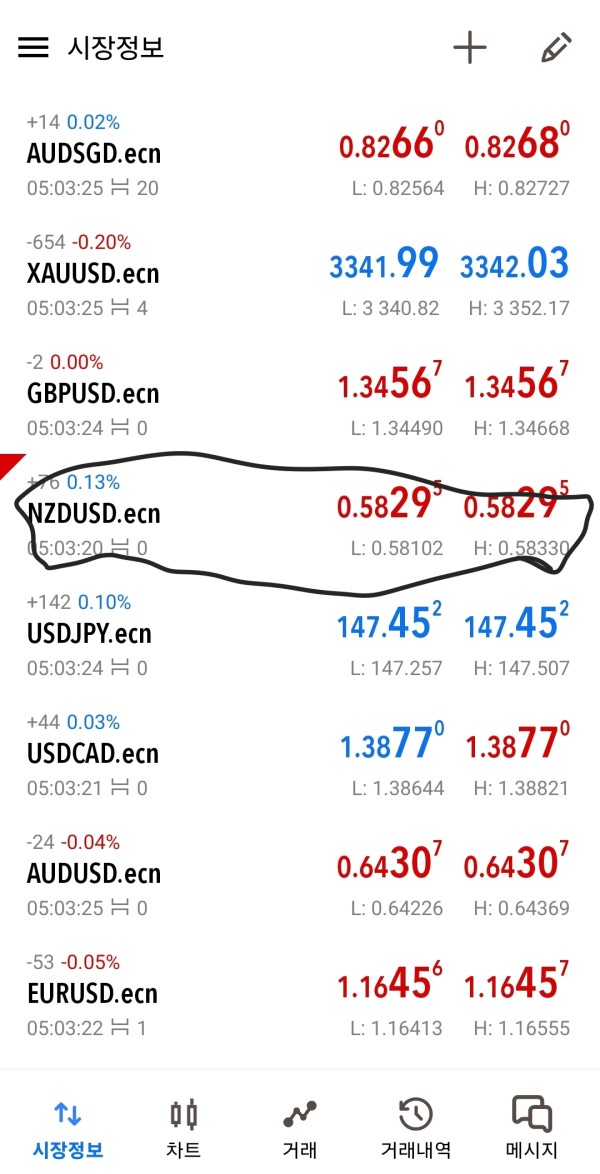

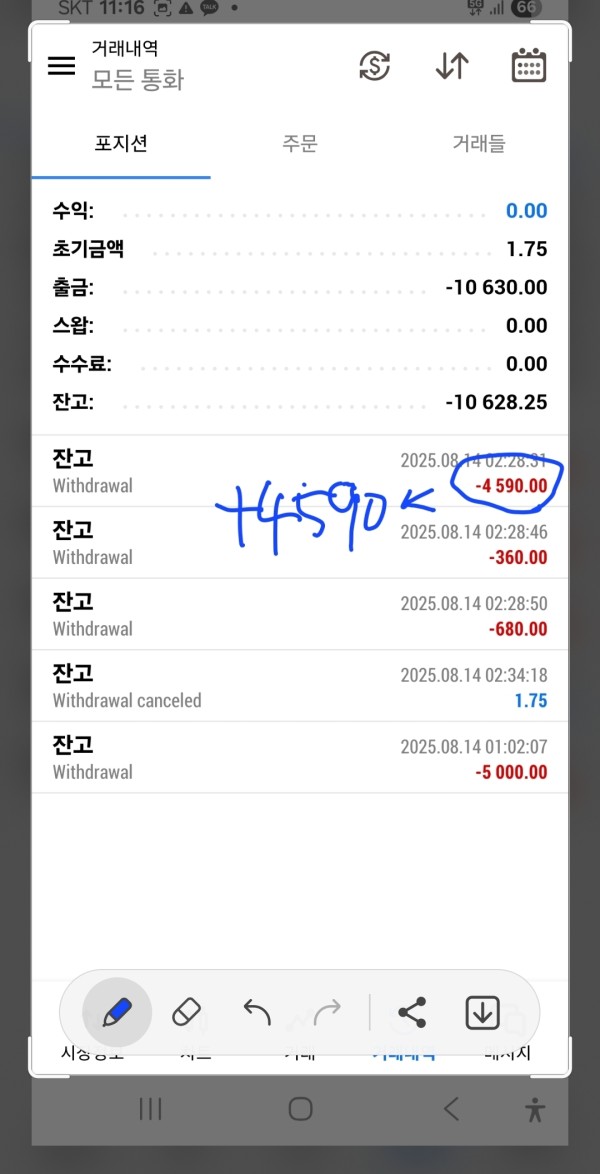

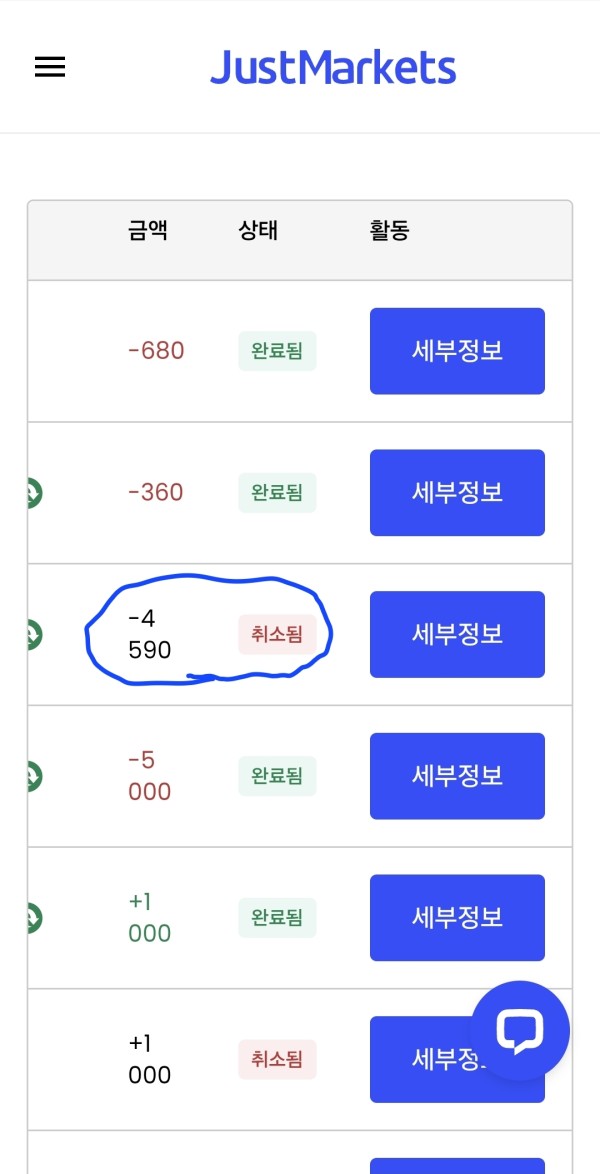

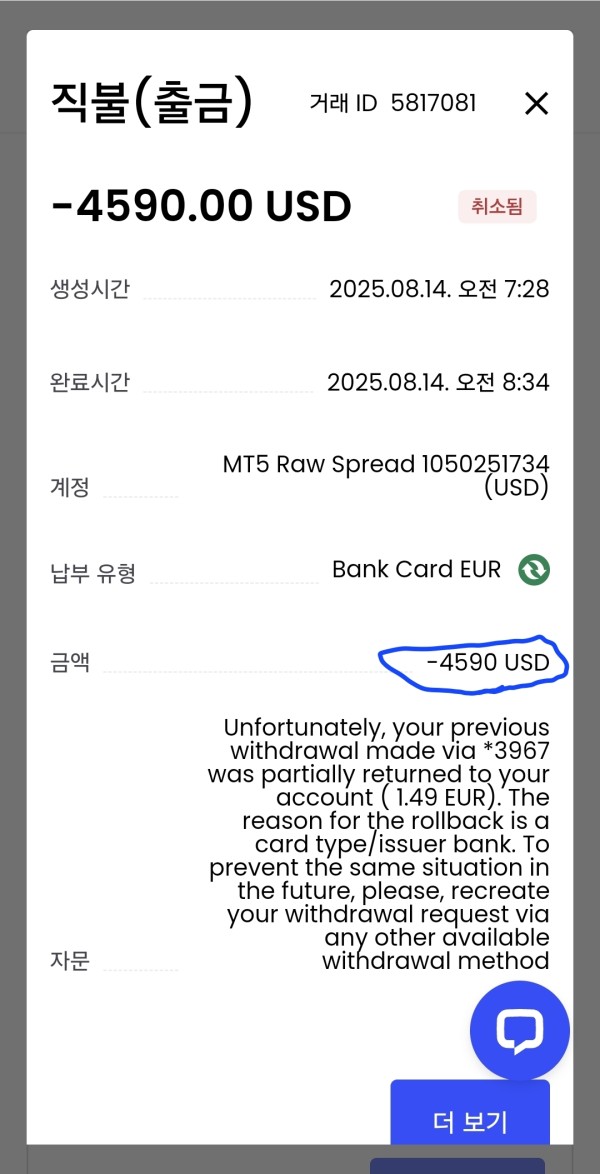

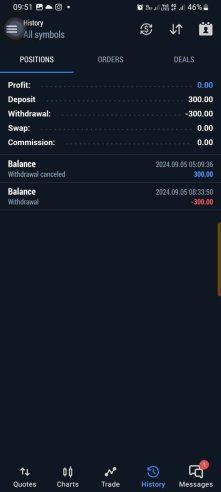

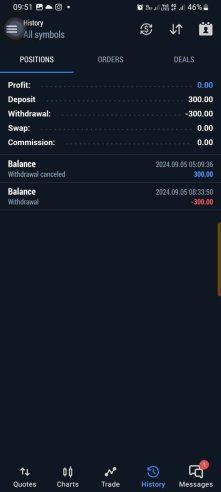

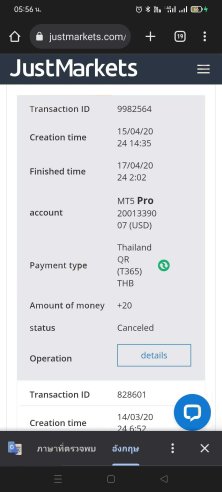

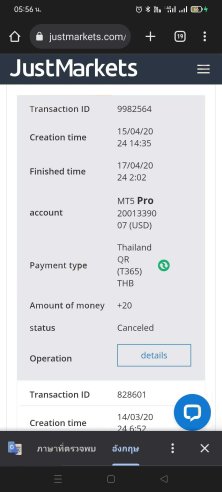

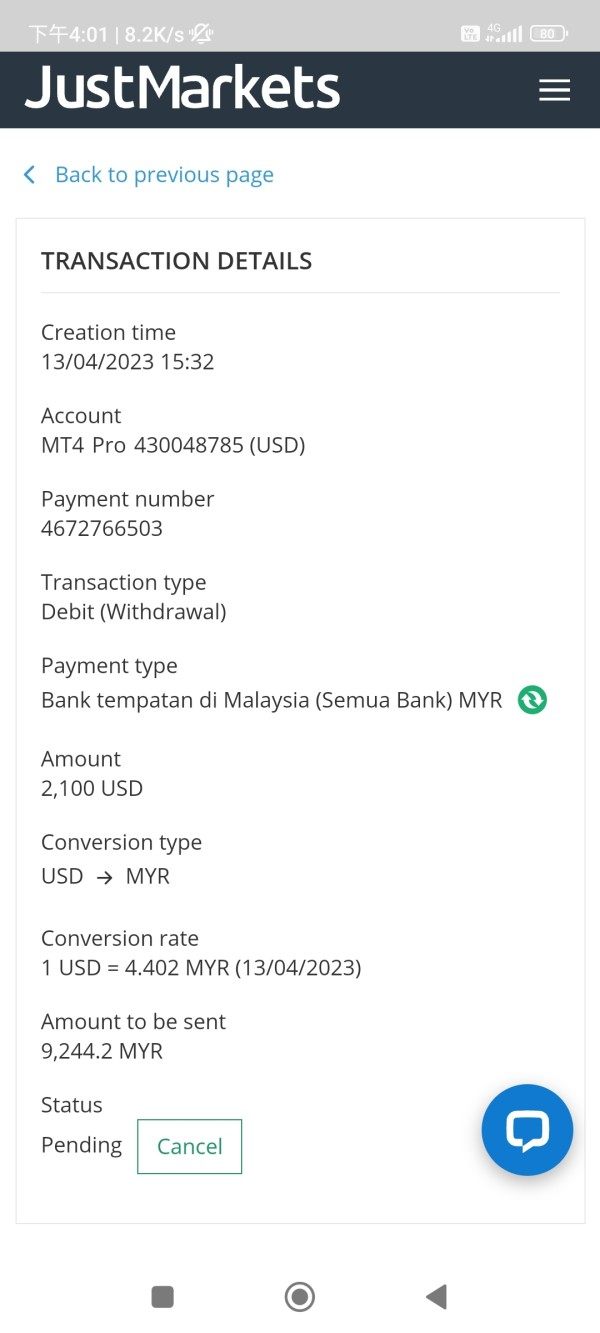

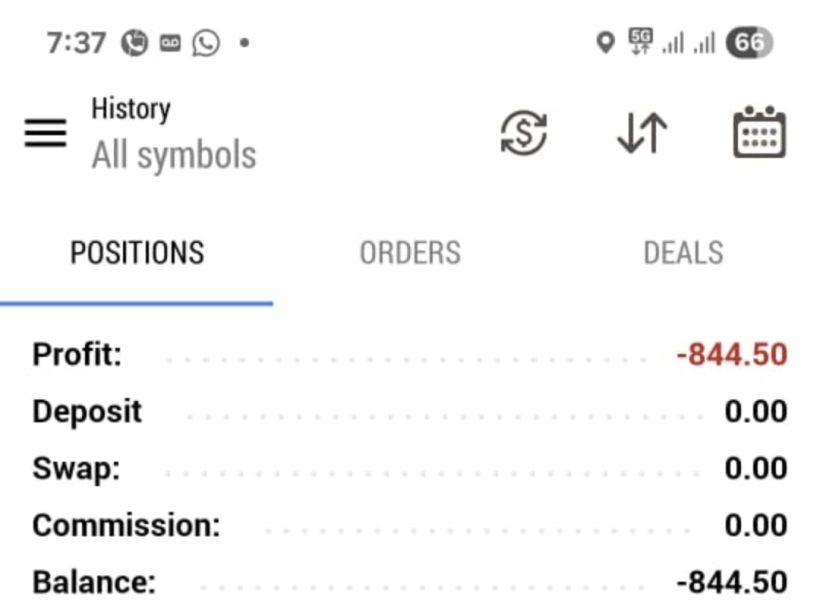

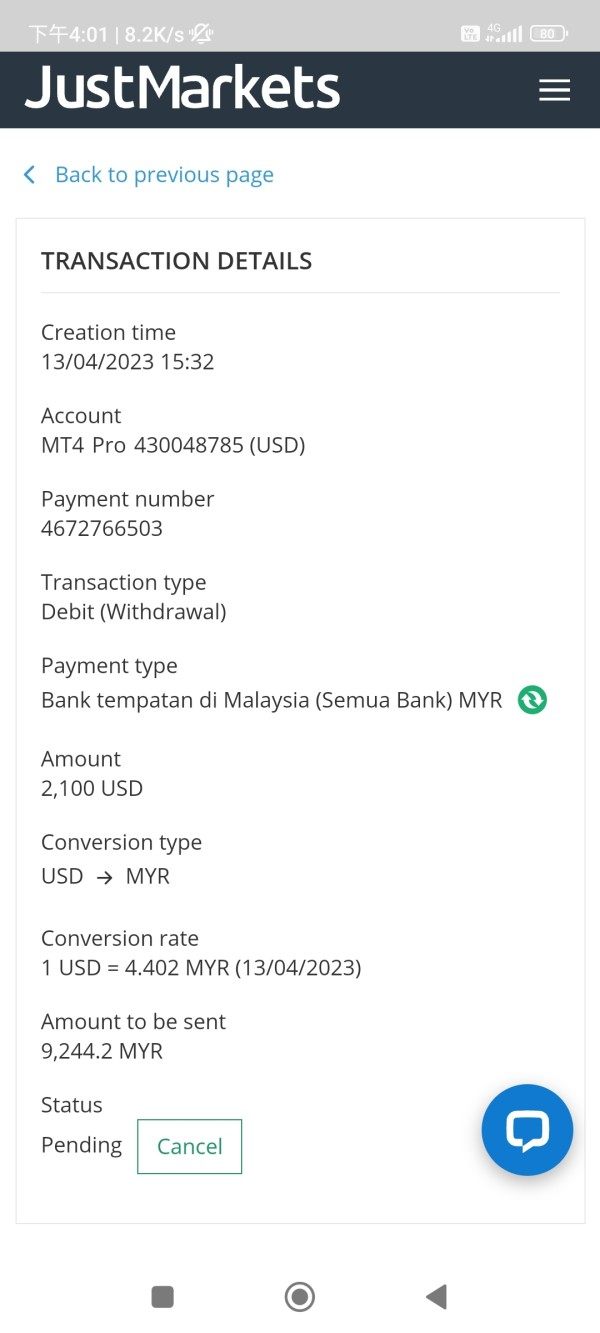

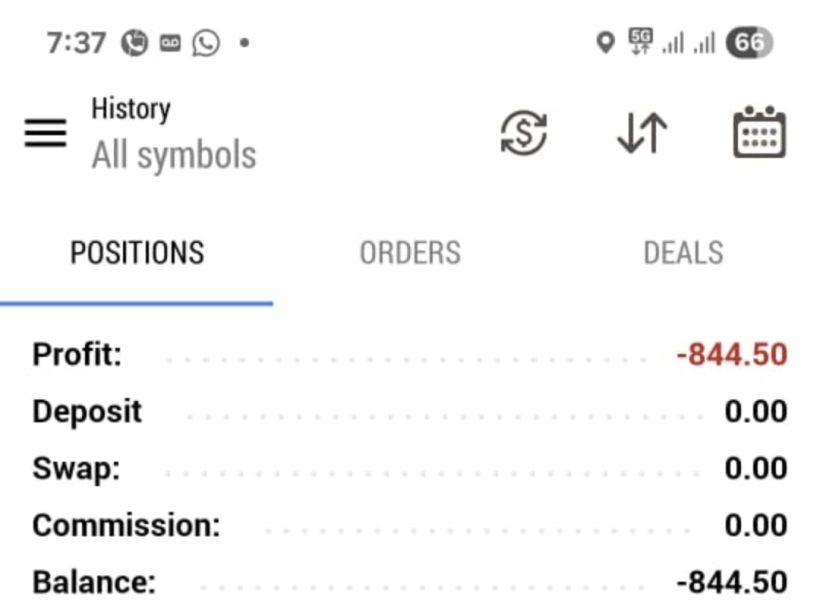

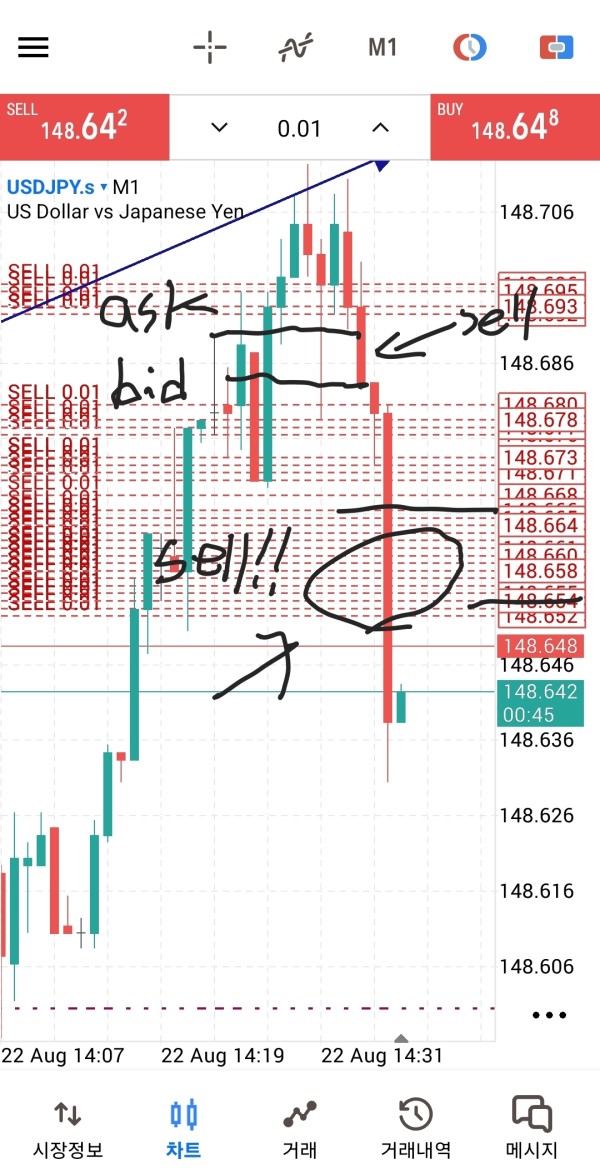

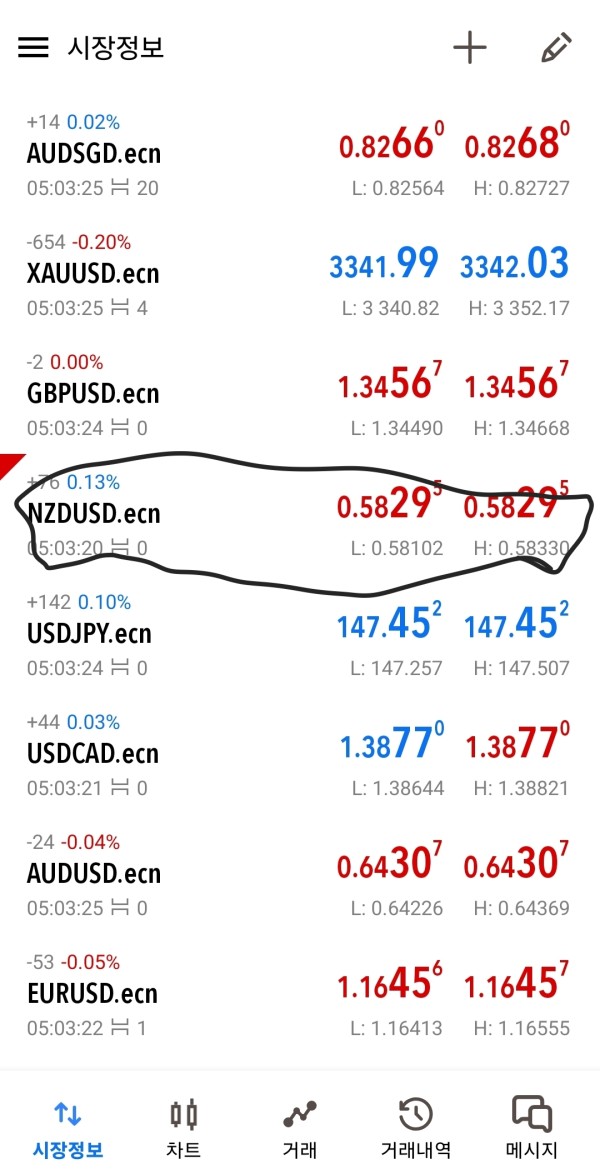

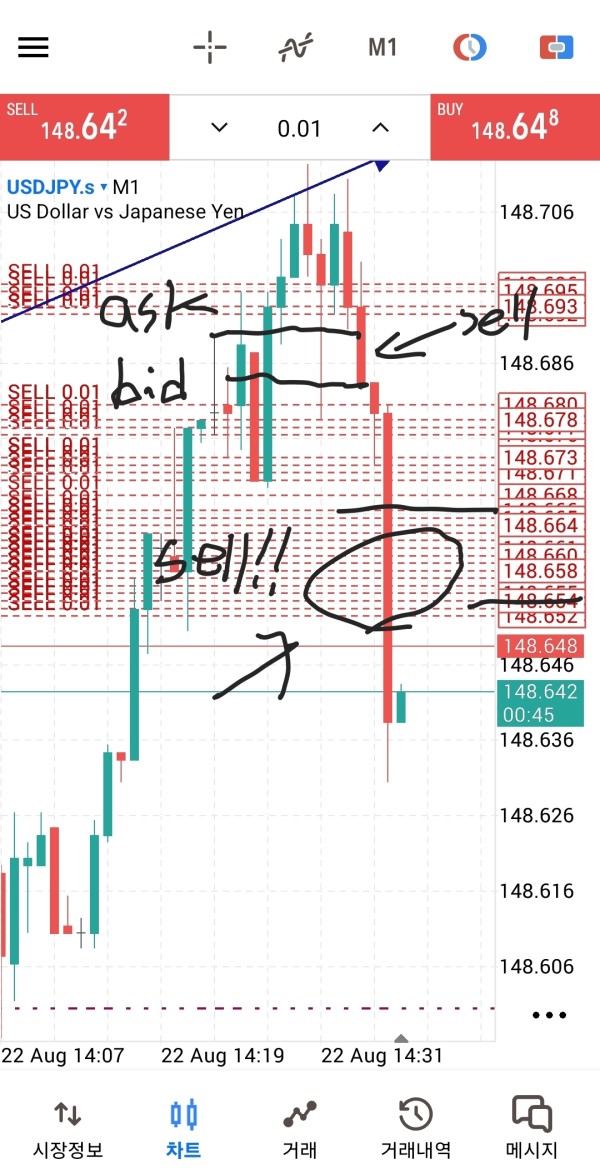

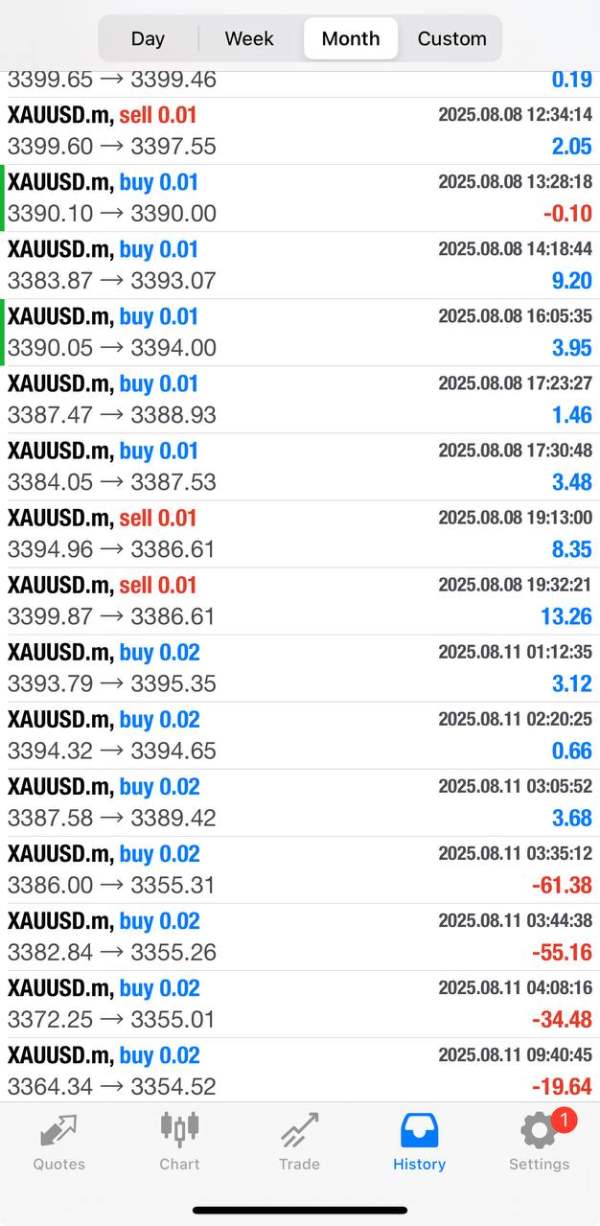

It's been almost half a month since the order book and quotes stopped matching. It's not slippage—there's a nearly fixed spread difference of over 3 times compared to the order book. So even if scalping profits appear, when selling, the spread is 3 times wider, leading to liquidation in full margin cases. Customer support is just a chatbot repeating the same responses with no visible intent to resolve the issue. Based on observation, the manipulation sequence is as follows: 1. Deposits are processed extremely fast. 2. When profits increase and withdrawals become frequent, withdrawal speeds slow down. They make system-related excuses, and errors start appearing. 3. Account withdrawals get automatically canceled, and they keep asking to retry, repeating this behavior. Then, the entire amount disappears from the account. If the amount isn't large, they claim everything is back to normal and redeposit the funds—hahaha. 4. They split withdrawals and delay them to induce trading. If you still don't lose, suddenly the spread widens drastically. Note: It's not slippage—they keep providing quotes that don't match the order book to force liquidation. If you open additional trades while using full margin, the spread becomes so wide that you can't even cut losses or take profits, leading to liquidation. 5. Even though the manipulation is blatantly obvious, they keep lying, saying they're reviewing or investigating.

I am extremely frustrated with JustMarkets because withdrawals simply do not go through properly. My own money, which I earned through trading, is repeatedly delayed or blocked, and customer support provides no clear answers. It feels like the platform doesn’t care about letting clients access their funds. This experience has completely destroyed my trust in JustMarkets and made me question whether it’s even a reliable broker.

My experience with JustMarkets has been extremely frustrating due to their inability to process withdrawals properly. The funds I worked hard to earn should have been easily accessible, yet every withdrawal request faced delays, vague responses, or no resolution at all. This left me feeling anxious and powerless, as if my money was trapped. The trust I once had in the platform has completely eroded. For me, the ability to withdraw funds smoothly is far more important than any trading features, and JustMarkets has utterly failed in this fundamental aspect.

Facing withdrawal problems with JustMarkets left me feeling extremely angry and helpless. These are my own invested and hard-earned funds, yet when I tried to withdraw, I ran into endless obstacles—delays, vague responses, and no clear solution. The whole experience made me feel trapped and even question whether the platform is truly reliable. For a broker, withdrawals should be the most basic and error-free process, but JustMarkets has completely failed in this regard, destroying my trust in them.

Those motherfuckers make money disappear blaming the system. Because withdrawals keep happening, they force executions that don't match the spread on the order book. Eventually, a margin call happens. Because the spread is so wide, you can't sell even if you're in profit. Feedback emails come often, but they just repeat the same thing. They say they'll look into it, but keep repeating the same words.

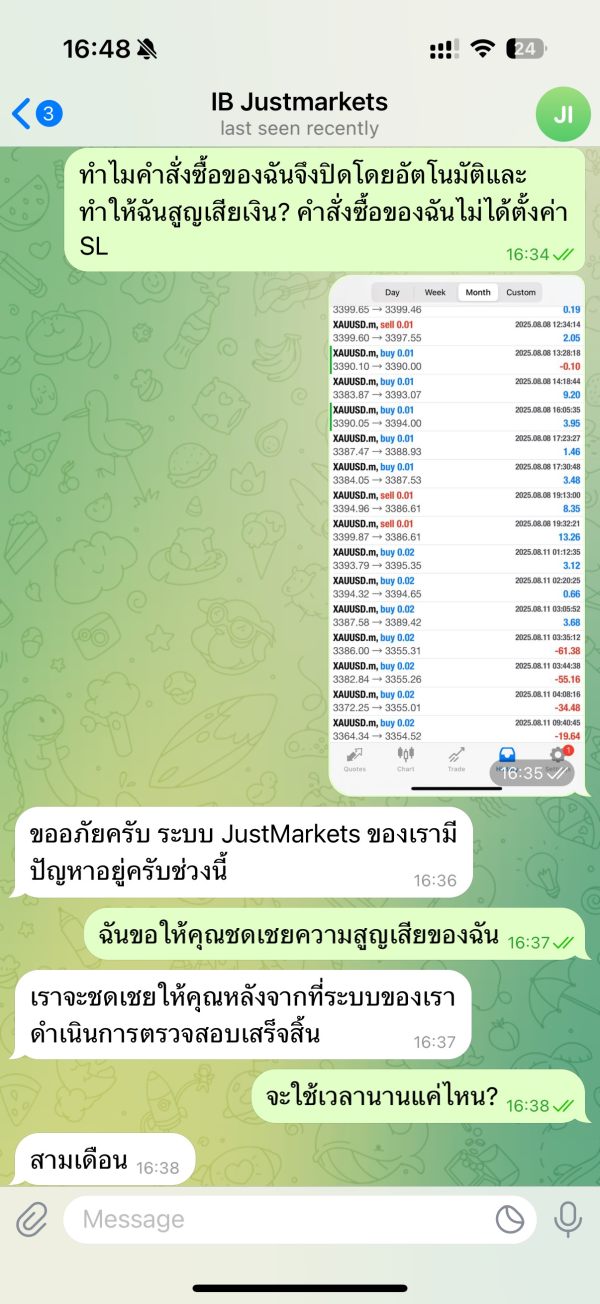

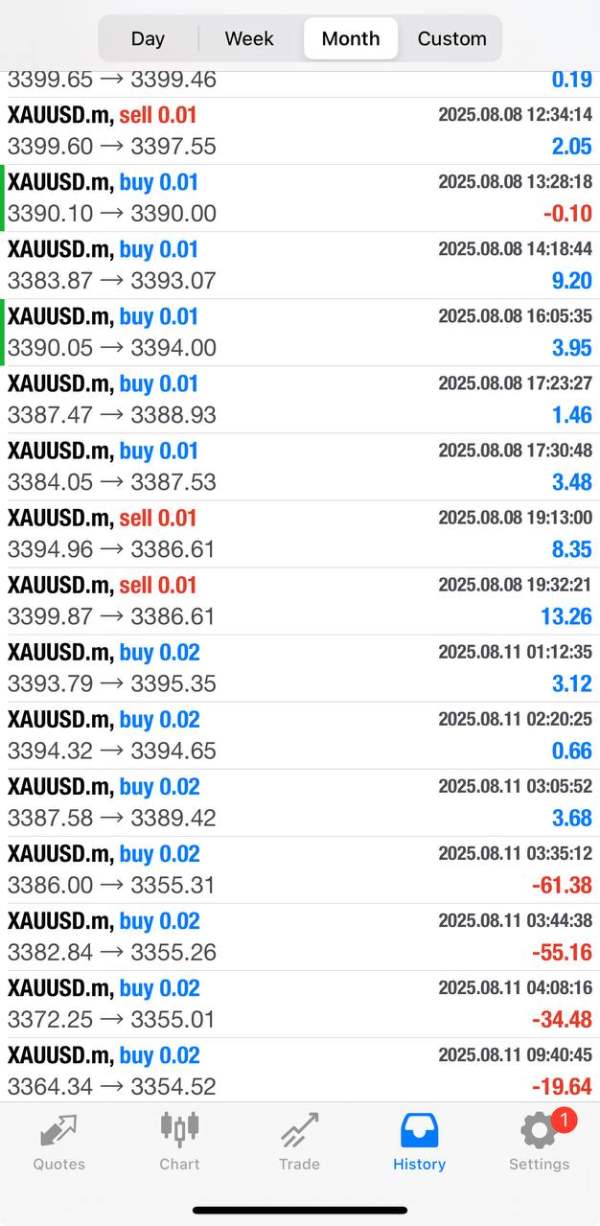

My initial trades went well, but the next few orders disappointed me because I found that JustMarkets automatically closed all my trading orders, causing me to lose money.

From my own trading experience, the slippage on JustMarkets has been far more severe than I expected. On multiple trades, I placed orders at a certain price, only to see the execution slip by a large margin—even when market conditions were relatively stable. This has turned potentially profitable trades into break-even or even losing ones, which is extremely frustrating. What troubles me the most is that this slippage isn’t just during major news events or high volatility; it sometimes occurs during normal trading hours without any clear reason. Over time, this has made me lose confidence in their execution quality and hesitate to trade during key market moments.