Regarding the legitimacy of FBS forex brokers, it provides ASIC, CYSEC and WikiBit, (also has a graphic survey regarding security).

Is FBS safe?

Pros

Cons

Is FBS markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Intelligent Financial Markets Pty Ltd

Effective Date: Change Record

2012-12-13Email Address of Licensed Institution:

dominic.l@fbsaustralia.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.fbsaustralia.comExpiration Time:

--Address of Licensed Institution:

INTELLIGENT FINANCIAL MARKETS PTY LTD SE 509 L 20 99 WALKER ST NORTH SYDNEY NSW 2060Phone Number of Licensed Institution:

1300735125Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Tradestone Ltd

Effective Date: Change Record

2017-08-07Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www.fbs.euExpiration Time:

--Address of Licensed Institution:

89 George A, Mairoza complex, block A, 1st Floor, Potamos Germasogeias, LimassolPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FBS A Scam?

Introduction

FBS is a well-known forex and CFD broker that has been operating since 2009, primarily targeting retail traders across more than 150 countries. With its headquarters in Belize and additional regulatory oversight in Cyprus, Australia, and South Africa, FBS has positioned itself as a global player in the competitive forex market. However, as the number of brokers continues to grow, so does the need for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with opportunities, but it can also be a breeding ground for scams and unregulated entities.

In this article, we will investigate whether FBS can be considered a safe and legitimate broker or if it raises red flags that warrant caution. Our evaluation will be based on multiple sources, including regulatory information, customer feedback, company history, trading conditions, and risk assessments. By employing a comprehensive framework for analysis, we aim to provide a balanced view of FBS's credibility and reliability.

Regulation and Legitimacy

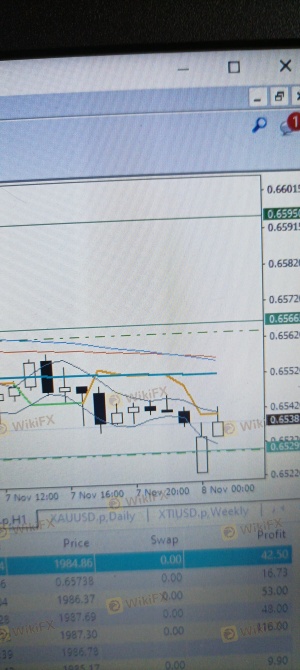

One of the most critical factors in assessing the safety of a forex broker is its regulatory status. FBS operates under several regulatory bodies, which adds a layer of security for its clients. The following table summarizes the core regulatory information for FBS:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 331/17 | Cyprus | Verified |

| International Financial Services Commission (IFSC) | IFSC/60/230/TS/18 | Belize | Verified |

| Australian Securities and Investments Commission (ASIC) | 426359 | Australia | Verified |

| Financial Sector Conduct Authority (FSCA) | 51024 | South Africa | Verified |

FBS's regulatory framework is robust, with oversight from reputable organizations such as CySEC and ASIC. These regulators impose strict rules to ensure that brokers operate in a fair and transparent manner. For instance, CySEC requires brokers to maintain segregated accounts for client funds, which protects traders in case of insolvency. Additionally, clients are covered by the Investor Compensation Fund (ICF) in the EU, which provides compensation of up to €20,000 in case of broker failure.

However, it is essential to note that while FBS is regulated by these authorities, it is not considered a tier-1 broker. This classification generally applies to brokers regulated by agencies like the FCA (UK) or SEC (USA), which enforce even stricter compliance measures. Nonetheless, FBS has maintained a clean regulatory record, with no significant compliance issues reported.

Company Background Investigation

FBS was founded in 2009, initially operating out of Belize. Over the years, it has expanded its services globally, claiming to serve over 27 million clients. The company has also established multiple subsidiaries to cater to different markets, including FBS Markets Inc. in Belize, Tradestone Ltd. in Cyprus, and Intelligent Financial Markets Pty Ltd. in Australia. This diversified structure allows FBS to operate within various regulatory frameworks and cater to a wide range of traders.

The management team at FBS consists of experienced professionals with backgrounds in finance and technology. Their expertise contributes to the company's operational efficiency and customer service quality. Transparency is a crucial aspect of FBS's operations, as it regularly publishes information about its services, trading conditions, and educational resources on its website. This commitment to transparency is essential for building trust among clients and fostering a positive trading environment.

Trading Conditions Analysis

FBS offers a variety of trading accounts, including Cent, Standard, and ECN accounts, each designed to cater to different trading strategies and risk appetites. The overall fee structure is competitive, but it is essential to scrutinize any unusual or problematic fee policies. The following table provides a comparison of core trading costs:

| Fee Type | FBS | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | From 0.7 pips | 1.0 pips |

| Commission Model | Zero for Standard | Varies |

| Overnight Interest Range | Varies by account | Varies |

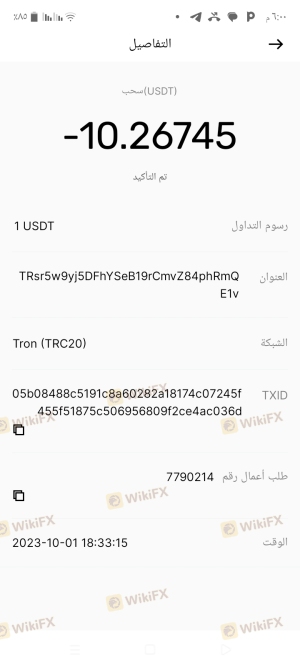

FBS's spreads are generally competitive, particularly for its Standard and ECN accounts. However, traders should be aware of potential commissions that may apply to certain account types, particularly the ECN accounts, which charge a commission of $6 per lot. Additionally, FBS does not charge deposit or withdrawal fees for most methods, making it an attractive option for cost-conscious traders.

Despite these favorable conditions, some traders have reported experiencing unexpected fees or unfavorable trading conditions during volatile market periods. This highlights the importance of reading the fine print and understanding the terms and conditions associated with each account type.

Client Fund Security

The safety of client funds is paramount in the forex trading environment. FBS employs several measures to ensure the security of its clients' deposits. The broker maintains segregated accounts, which means that client funds are held separately from the company's operational funds. This practice minimizes the risk of loss in the event of financial difficulties faced by the broker.

FBS also provides negative balance protection, ensuring that clients cannot lose more money than they have deposited. This is particularly crucial for traders utilizing high leverage, as it mitigates the risk of incurring debts to the broker. Furthermore, FBS participates in the Investor Compensation Fund (ICF) for European clients, offering additional protection for their investments.

However, it is essential to remain vigilant and conduct thorough research, as no broker is entirely free from risk. While FBS has not faced significant fund security issues, traders should be aware of the inherent risks associated with forex trading, including market volatility and potential broker insolvency.

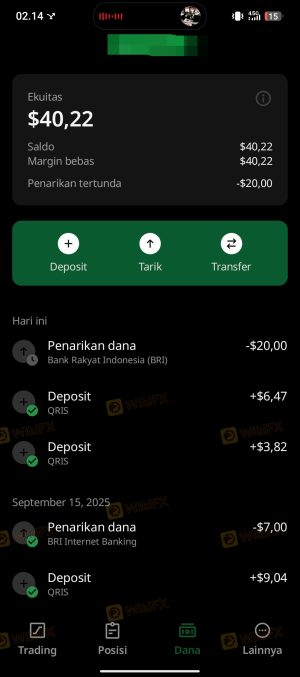

Customer Experience and Complaints

Customer feedback is another critical aspect of evaluating a broker's reliability. FBS has garnered a mix of reviews from users, with many praising its customer support and trading conditions. However, some common complaint patterns have emerged, particularly concerning withdrawal times and the responsiveness of customer service.

The following table summarizes the main types of complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Account Verification Issues | High | Quick resolution |

| Platform Stability Issues | Moderate | Ongoing improvements |

One notable case involved a trader who reported delays in withdrawing funds, leading to frustration and concern over the broker's reliability. In contrast, many users have highlighted the effectiveness of FBS's customer support, often receiving prompt assistance through live chat and email.

Overall, while FBS has received its share of complaints, the company's commitment to addressing issues and improving customer service is evident. This proactive approach can enhance the overall trading experience for clients.

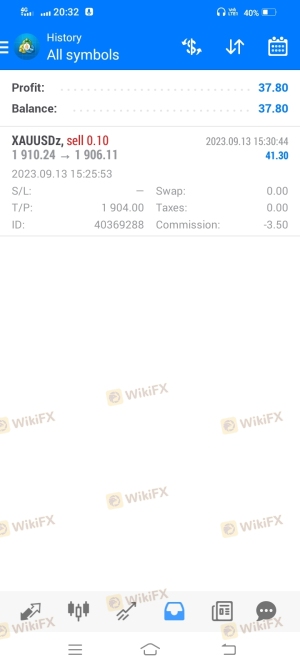

Platform and Execution

FBS offers a range of trading platforms, including the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as its proprietary FBS Trader app. The performance of these platforms has generally been well-received, with users reporting fast execution speeds and a user-friendly interface.

In terms of order execution quality, FBS claims that 95% of trades are executed within 0.4 seconds, a commendable figure in the industry. However, some traders have reported instances of slippage and order rejections during high volatility, which can be concerning for those relying on precise execution.

There have been no significant indications of platform manipulation, but traders should remain cautious and monitor their trading experiences closely. Ensuring that you have a reliable internet connection and using the appropriate trading settings can help mitigate potential issues.

Risk Assessment

When considering trading with FBS, it is essential to evaluate the associated risks. The following risk scorecard summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Not tier-1 regulated |

| Fund Security Risk | Low | Segregated accounts and protections |

| Execution Risk | Medium | Potential slippage during volatility |

| Customer Service Risk | Low | Generally responsive |

To mitigate these risks, traders should conduct thorough research, utilize risk management strategies, and maintain open communication with the broker. Understanding the market conditions and being aware of the broker's policies can also help reduce potential pitfalls.

Conclusion and Recommendations

In conclusion, FBS is a well-established broker with a solid regulatory framework and a significant global presence. While it is not without its challenges, particularly concerning customer complaints and execution issues, the overall evidence suggests that FBS is not a scam. The broker's commitment to providing a secure trading environment, coupled with its competitive trading conditions, makes it a viable option for many traders.

However, potential clients should remain cautious and consider their trading goals and risk tolerance. For beginners, FBS offers a low minimum deposit and extensive educational resources, making it an attractive choice. More experienced traders may appreciate the higher leverage options but should be mindful of the associated risks.

For those seeking alternative options, brokers like IG Group, OANDA, or Pepperstone may provide similar services with varying features and regulatory oversight. Always conduct thorough research and consider your individual trading needs before committing to any broker.

Is FBS a scam, or is it legit?

The latest exposure and evaluation content of FBS brokers.

FBS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FBS latest industry rating score is 7.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.