Regarding the legitimacy of FOREX.com forex brokers, it provides ASIC, FSA, NFA, CYSEC, CIRO, MAS and WikiBit, (also has a graphic survey regarding security).

Is FOREX.com safe?

Pros

Cons

Is FOREX.com markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

STONEX FINANCIAL PTY LTD

Effective Date: Change Record

2010-05-31Email Address of Licensed Institution:

John.Blundell@StoneX.comSharing Status:

No SharingWebsite of Licensed Institution:

www.cityindex.com.auExpiration Time:

--Address of Licensed Institution:

'01' SE 42 264-278 GEORGE ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0280305011Licensed Institution Certified Documents:

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

StoneX証券株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都中央区日本橋室町4-4-10 東短室町ビル3階Phone Number of Licensed Institution:

03-5205-6161Licensed Institution Certified Documents:

NFA Forex Trading License (EP)

National Futures Association

National Futures Association

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

GAIN CAPITAL GROUP LLC

Effective Date:

2004-07-29Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

30 Independence Blv, 3rd Floor Warren, NJ 07059 United StatesPhone Number of Licensed Institution:

908-731-0750Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 18

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

StoneX Europe Ltd

Effective Date:

2021-05-24Email Address of Licensed Institution:

complianceeu@stonex.comSharing Status:

No SharingWebsite of Licensed Institution:

www.forex.com/ie, https://www.forex.com/de-de/, https://www.forex.com/pl-pl/Expiration Time:

--Address of Licensed Institution:

Nikokreontos 2, 5th Floor, 1066 Nicosia, CyprusPhone Number of Licensed Institution:

+357 22090062Licensed Institution Certified Documents:

CIRO Derivatives Trading License (EP)

Canadian Investment Regulatory Organization

Canadian Investment Regulatory Organization

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

GAIN Capital - FOREX.com Canada Ltd.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www.forex.comExpiration Time:

--Address of Licensed Institution:

30 Independence Blvd., Suite 300 Warren, NJ 07059Phone Number of Licensed Institution:

908-731-0700Licensed Institution Certified Documents:

MAS Market Making License (MM)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

STONEX FINANCIAL PTE. LTD.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

Website of Licensed Institution:

http://www.stonex.comExpiration Time:

--Address of Licensed Institution:

1 RAFFLES PLACE #18-61 ONE RAFFLES PLACE TOWER 2 048616Phone Number of Licensed Institution:

+65 63091000Licensed Institution Certified Documents:

Is FOREX.COM A Scam?

Introduction

FOREX.COM, a well-known name in the forex trading industry, has established itself as a prominent broker catering to both novice and experienced traders. Founded in 1999, it is part of the Stonex Group, which is publicly traded and boasts a significant global presence. As forex trading continues to gain traction among retail investors, the importance of thoroughly evaluating brokers cannot be overstated. Traders must ensure that the broker they choose is reputable, secure, and compliant with regulatory standards to protect their investments and personal information.

This article aims to provide an objective assessment of FOREX.COM, exploring its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risks. The evaluation is based on a comprehensive review of the broker's operations, regulatory compliance, and user feedback from various trusted sources.

Regulation and Legitimacy

The regulatory framework within which a broker operates is crucial for establishing its legitimacy and trustworthiness. FOREX.COM is regulated by several top-tier authorities globally, including the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and the Australian Securities and Investments Commission (ASIC). This multi-regulatory oversight indicates a commitment to maintaining high standards of financial conduct and transparency.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 113942 | UK | Verified |

| CFTC | N/A | US | Verified |

| ASIC | 345646 | Australia | Verified |

| NFA | 0339826 | US | Verified |

| IIROC | 20-0143 | Canada | Verified |

| CIMA | 25033 | Cayman Islands | Verified |

| FSA | N/A | Japan | Verified |

The presence of these regulatory licenses is significant as it offers a layer of protection to traders, ensuring that client funds are kept in segregated accounts and that the broker adheres to strict operational guidelines. Furthermore, the FCA provides an investor compensation scheme, which protects clients in the event of broker insolvency, adding an additional level of security.

Company Background Investigation

FOREX.COM has a rich history that dates back to its founding in 1999. Initially launched as a forex trading platform, it has evolved significantly over the years, driven by technological advancements and the growing demand for online trading. The broker is owned by Gain Capital Holdings, Inc., which is publicly traded on the New York Stock Exchange. This ownership structure contributes to its financial stability and transparency.

The management team at FOREX.COM comprises experienced professionals with extensive backgrounds in finance and trading. Their expertise ensures that the broker remains competitive and responsive to market changes. The company's commitment to transparency is evident in its comprehensive disclosure of fees, trading conditions, and regulatory compliance, which are readily accessible on its website.

Moreover, the broker provides a wealth of educational resources and market analysis tools, empowering traders to make informed decisions. This level of transparency and commitment to client education positions FOREX.COM as a reputable player in the forex market.

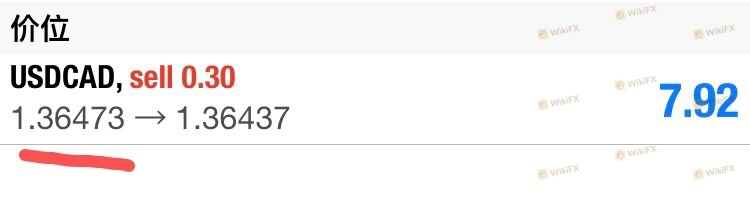

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is essential. FOREX.COM offers a variety of account types, including standard and commission-based accounts, each with its own fee structure. The broker's spreads are competitive, particularly for major currency pairs, although they can be higher compared to some competitors.

| Fee Type | FOREX.COM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 0.8 pips |

| Commission Model | $7 per 100k | $5 per 100k |

| Overnight Interest Range | Varies | Varies |

The spread for major currency pairs like EUR/USD typically averages around 1.3 pips for standard accounts, which is slightly above the industry average. For traders choosing the commission-based account, the spread can be as low as 0.0 pips, but this comes with a commission of $7 per 100,000 traded. Additionally, traders should be aware of the inactivity fee of $15 per month after 12 months of inactivity, which may be a concern for those who do not trade frequently.

Overall, while FOREX.COM's trading conditions are competitive, the slightly higher spreads and additional fees may deter some traders, particularly those who prioritize cost-effectiveness.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading industry. FOREX.COM employs several measures to ensure the protection of client funds. As part of its regulatory obligations, the broker keeps client funds in segregated accounts, separate from its operating capital. This segregation helps protect clients in the event of financial difficulties faced by the broker.

Additionally, FOREX.COM offers negative balance protection, ensuring that clients cannot lose more than their account balance. This feature is particularly important for traders using high leverage, as it mitigates the risk of incurring significant losses beyond the initial investment.

Despite these safety measures, it is essential for traders to remain vigilant and informed about any historical issues related to fund security. While there have been no significant controversies surrounding FOREX.COM in recent years, traders should always conduct their due diligence and stay updated on the broker's operational practices.

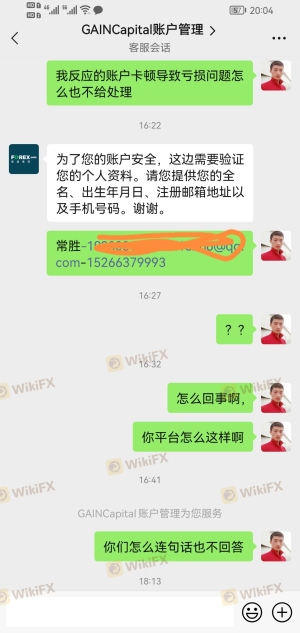

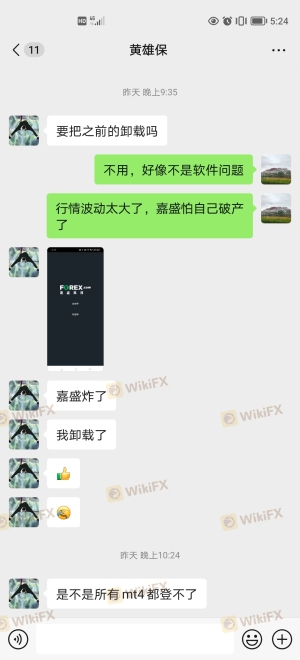

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Overall, FOREX.COM has received a mix of positive and negative reviews from users. Many traders praise the broker for its user-friendly platforms, fast execution speeds, and extensive educational resources. However, common complaints include high spreads, slow customer support response times, and withdrawal issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Mixed responses |

| High Spreads | Low | Acknowledged |

| Customer Support Issues | High | Slow response |

For instance, some users have reported delays in processing withdrawal requests, stating that it took longer than the promised timeframe. Others have expressed dissatisfaction with the quality of customer support, particularly during peak trading hours. While FOREX.COM has acknowledged these concerns and is working to improve its support services, it is crucial for potential clients to consider these factors when choosing a broker.

Platform and Trade Execution

The performance of a trading platform and the quality of order execution are critical for traders. FOREX.COM offers several platforms, including its proprietary web trader, MetaTrader 4, and MetaTrader 5. Users generally find the platforms to be stable and intuitive, with a range of advanced charting tools and technical indicators.

In terms of order execution, FOREX.COM boasts impressive statistics, with a reported 99.12% of trades executed in less than one second. This rapid execution speed is a significant advantage for traders, especially those engaging in high-frequency trading. However, some users have reported experiencing slippage during volatile market conditions, which is a common issue across the industry.

Overall, while the platforms are well-regarded, traders should remain aware of the potential for slippage and ensure they are comfortable with the execution conditions provided by FOREX.COM.

Risk Assessment

Trading with any broker involves inherent risks, and it is essential for traders to assess these risks before proceeding. Using FOREX.COM presents several risks, primarily related to market volatility, fees, and the broker's operational practices.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Market Volatility | High | Potential for significant losses |

| Fee Structure | Medium | Higher spreads and inactivity fees |

| Customer Support | Medium | Slow response times can impact trading |

To mitigate these risks, traders should employ sound risk management strategies, such as setting stop-loss orders and limiting leverage usage. Additionally, staying informed about market conditions and the broker's operational practices can help traders navigate potential challenges effectively.

Conclusion and Recommendations

In conclusion, FOREX.COM is a reputable broker with a strong regulatory framework and a long-standing presence in the forex market. While it is not a scam, potential clients should be aware of certain aspects that may warrant caution, such as higher spreads and occasional customer support challenges.

For traders seeking a reliable platform with robust educational resources and a wide range of trading instruments, FOREX.COM is a solid choice. However, those who prioritize low-cost trading or require 24/7 customer support may want to consider alternative options such as OANDA or IG, which offer competitive pricing and more responsive support services.

Ultimately, conducting thorough research and assessing personal trading needs will help traders make informed decisions when selecting a forex broker.

Is FOREX.com a scam, or is it legit?

The latest exposure and evaluation content of FOREX.com brokers.

FOREX.com Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOREX.com latest industry rating score is 8.27, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.27 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.