Coinexx 2025 Review: Everything You Need to Know

Summary

Coinexx is a young forex broker that started in 2017. This coinexx review shows a broker with both good points and serious problems. The company works as a Market Maker (MM) broker based in Saint Vincent and the Grenadines, offering forex and CFD trading through MT4 and MT5 platforms.

The broker attracts traders with spreads as low as 0.0 pips and very low fees. Coinexx offers over 80 trading tools and needs only $7 to start trading, making it easy for new and skilled traders to join. The platform lets users deposit and withdraw money using cryptocurrency, which fits modern trading needs.

But user reviews tell two different stories. Some traders like the fast trades and low costs, while others worry about whether they can trust the broker. The company follows rules from Saint Vincent and the Grenadines, which is legal but offers less protection than major financial centers.

Our study shows that Coinexx offers good trading conditions but has trust problems that make traders need to be very careful before putting money in.

Important Notice

This review of Coinexx uses public information, user stories, and rule data from 2025. Since Coinexx works in Saint Vincent and the Grenadines, different countries may have different rules about using this broker. Traders should check if the broker is legal in their country before opening an account.

This coinexx review tries to give fair information to help people make smart choices. Trading forex and CFDs can lose you money, and past results don't promise future success. We suggest doing careful research and thinking about your risk level before using any broker.

Rating Framework

Broker Overview

Coinexx started trading forex and CFDs in 2017. The company works as a cryptocurrency-friendly broker in Saint Vincent and the Grenadines. It uses the Market Maker business model, which means it takes the other side of client trades.

This location choice lets the broker offer flexible trading rules while following less strict requirements than major financial centers. Coinexx focuses on technology and claims to offer "STP/ECN lightning-fast executions" with crypto-based systems. The company targets traders who want privacy and flexibility, especially those interested in cryptocurrency trading.

The broker's Caribbean location lets it serve customers worldwide while keeping operational flexibility. Coinexx supports both MetaTrader 4 and MetaTrader 5 platforms, giving traders familiar and strong trading environments. The broker covers forex pairs, cryptocurrency CFDs, indices, and other financial tools, with more than 80 trading options total.

The crypto-focused approach makes it different from regular forex brokers by offering deposit and withdrawal options in various cryptocurrencies plus normal payment methods. The Financial Services Authority (FSA) of Saint Vincent and the Grenadines watches over Coinexx operations. This gives legal regulatory status, but traders should know this jurisdiction offers different protection levels than top regulatory bodies like the FCA, CySEC, or ASIC.

This regulatory setup lets Coinexx offer competitive trading conditions while following financial regulations.

Regulatory Jurisdiction: Coinexx follows rules from the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. This offshore regulatory system provides basic oversight while letting the broker offer flexible trading conditions to international clients.

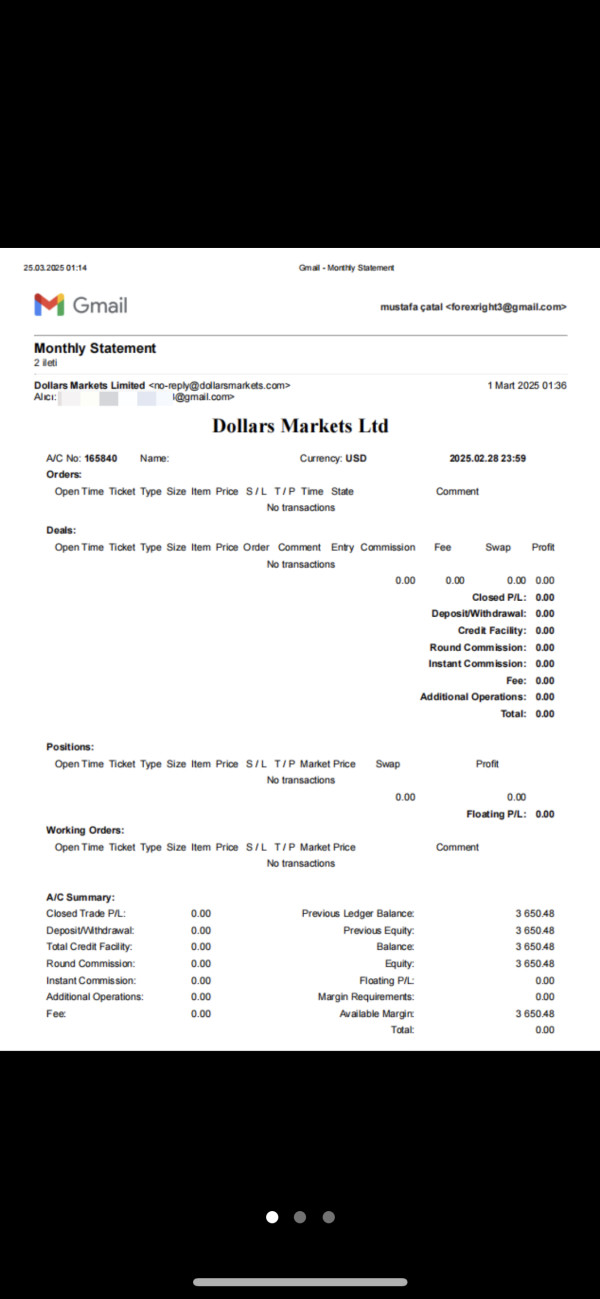

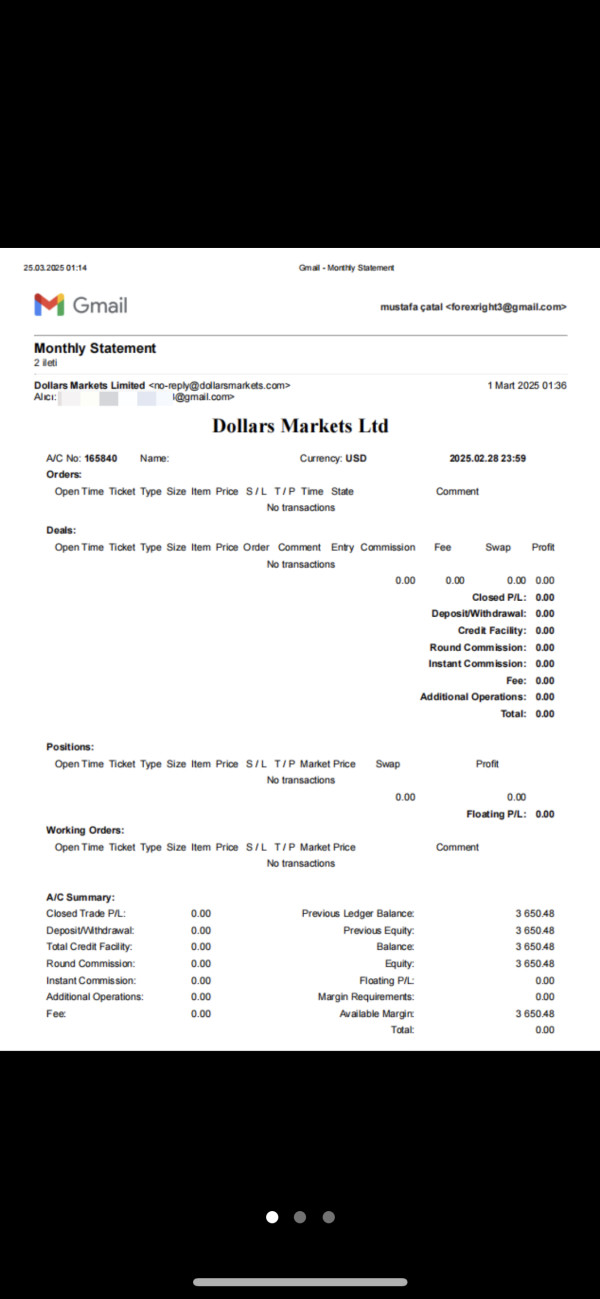

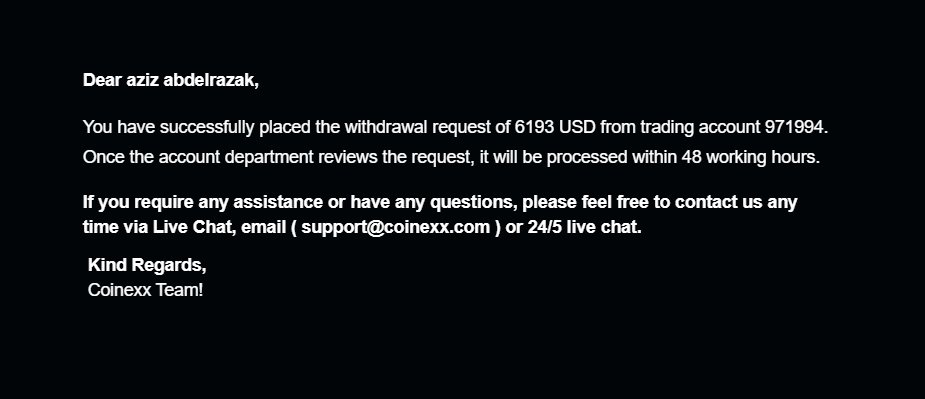

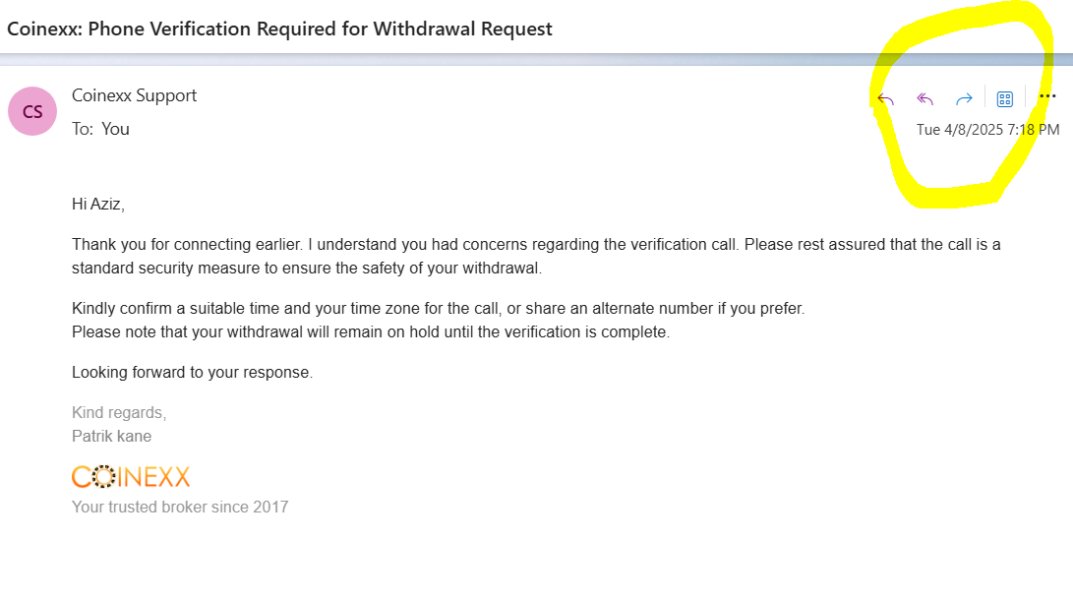

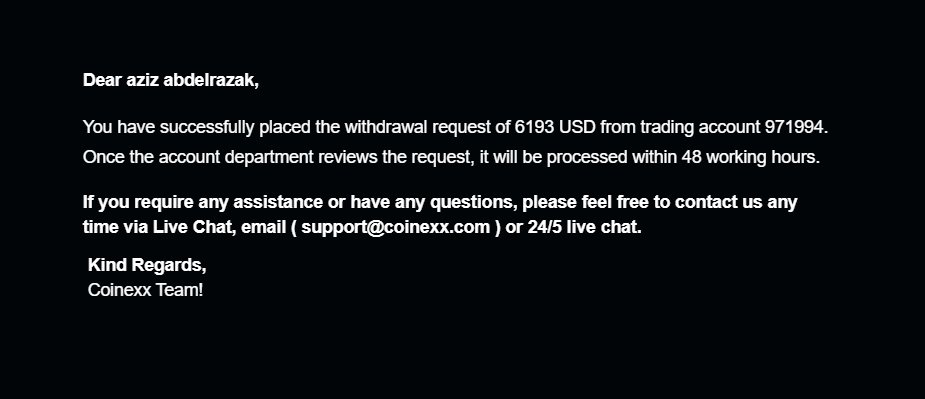

Deposit and Withdrawal Methods: The broker focuses on cryptocurrency transactions, supporting deposits and withdrawals in various digital currencies. Available sources didn't give specific information about traditional payment methods and processing times.

Minimum Deposit Requirements: Coinexx needs only $7 minimum deposit, making it one of the most accessible brokers for new traders with limited money.

Bonus and Promotional Offers: Available documents didn't mention specific information about bonus programs or promotional campaigns, suggesting either no such offers or limited public disclosure.

Tradeable Assets: The platform gives access to over 80 trading instruments covering forex currency pairs, cryptocurrency CFDs, stock indices, and other financial derivatives, offering reasonable variety.

Cost Structure: One of Coinexx's main advantages is its pricing model, featuring spreads as low as 0.0 pips and very low commission fees. This cost-effective structure especially helps high-frequency traders and scalping strategies.

Leverage Ratios: Available sources didn't detail specific leverage information, which is a significant information gap for potential traders checking risk management parameters.

Platform Options: Traders can access markets through both MetaTrader 4 and MetaTrader 5 platforms, providing complete charting tools, automated trading abilities, and familiar interfaces for experienced traders.

Geographic Restrictions: Reviewed sources didn't have detailed information about country-specific restrictions, though offshore brokers typically face limitations in certain areas.

Customer Support Languages: Available documentation didn't mention specific language support information, possibly showing limited multilingual customer service options.

This coinexx review shows a broker with competitive pricing and accessible entry requirements, though several important operational details remain unclear from public sources.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Coinexx shows excellent accessibility in its account conditions, mainly through its very low minimum deposit requirement of just $7. This entry level puts the broker among the most accessible options for new traders and those with limited starting money. User feedback says the account opening process is straightforward and can be completed fairly quickly, which makes the overall user experience better.

The broker's account structure seems designed to help traders at different experience levels, from beginners testing with minimal investment to bigger traders seeking competitive conditions. User stories suggest that the account verification process is generally efficient, though available sources didn't detail specific timeframes.

However, this coinexx review notes that detailed information about different account types, their specific features, and any benefits remains limited in public documentation. The lack of complete account tier information is a potential area for better transparency. Despite this limitation, the combination of low entry barriers and user-friendly processes earns Coinexx a strong rating in this category.

The competitive minimum deposit requirement especially stands out when compared to industry standards, where many brokers require $100 to $500 for initial deposits.

Coinexx offers a solid foundation of trading tools through its selection of over 80 trading instruments across multiple asset classes. The broker's instrument coverage includes major and minor forex pairs, cryptocurrency CFDs, stock indices, and various other financial derivatives, giving traders reasonable variety within a single platform.

Having both MetaTrader 4 and MetaTrader 5 platforms is a significant strength, as these industry-standard platforms provide complete charting abilities, technical analysis tools, and automated trading features. Users familiar with these platforms can immediately use their existing knowledge and strategies.

However, available sources didn't detail additional research resources, market analysis tools, or educational materials that might improve the trading experience. The absence of information about fundamental analysis resources, economic calendars, or trading education programs is a notable gap in the broker's tool offering. Many successful traders rely on complete market analysis and educational resources to make informed decisions.

User feedback suggests satisfaction with the basic trading tools provided, but the overall evaluation is limited by the apparent lack of advanced research abilities and educational support.

Customer Service and Support Analysis (6/10)

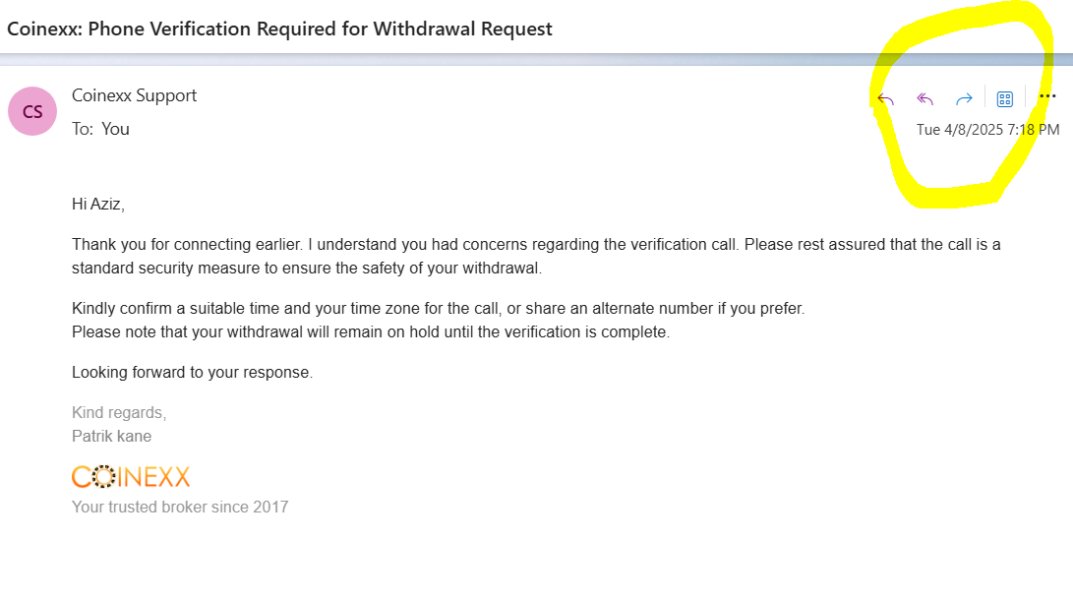

Customer service is a mixed aspect of the Coinexx offering, with user feedback showing inconsistent experiences across different support interactions. Some traders report satisfactory help when needed, while others express frustration with response times and service quality variations.

Available documentation doesn't specify the customer support channels offered by Coinexx, such as live chat, email support, or telephone assistance. This lack of transparency about support accessibility creates uncertainty for potential clients who value reliable customer service. The absence of clear information about support hours, response time commitments, or escalation procedures further adds to these concerns.

User reviews show that while some traders have received helpful assistance, others have encountered delays or unsatisfactory responses to their questions. This inconsistency in service quality suggests potential staffing or training issues within the support department. The variation in user experiences prevents a higher rating in this crucial category.

Additionally, the lack of detailed information about multilingual support abilities may limit accessibility for non-English speaking traders.

Trading Experience Analysis (7/10)

The trading experience with Coinexx receives generally positive feedback from users, particularly about execution speeds and order processing. Multiple user stories highlight fast execution as a notable strength, which is crucial for traders using time-sensitive strategies such as scalping or day trading.

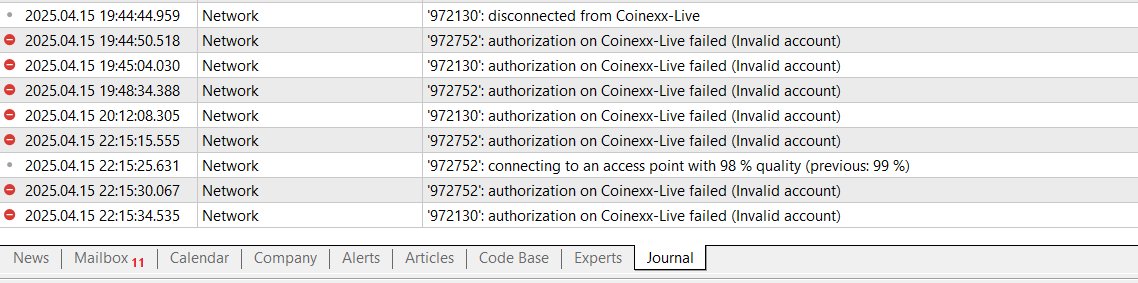

The broker's claimed "STP/ECN lightning-fast executions" appear to translate into practical benefits for active traders, with users reporting minimal delays in order processing. Having both MT4 and MT5 platforms ensures that traders can access familiar interfaces and use their preferred trading tools and expert advisors.

However, this coinexx review identifies several gaps in available information that impact the complete evaluation of trading experience. Available sources didn't provide specific data about slippage rates, requote frequency, and average execution times. These technical performance metrics are crucial for traders evaluating platform reliability.

The broker's spread structure, featuring rates as low as 0.0 pips, combined with low commission fees, creates favorable cost conditions for frequent trading.

Trust and Reliability Analysis (5/10)

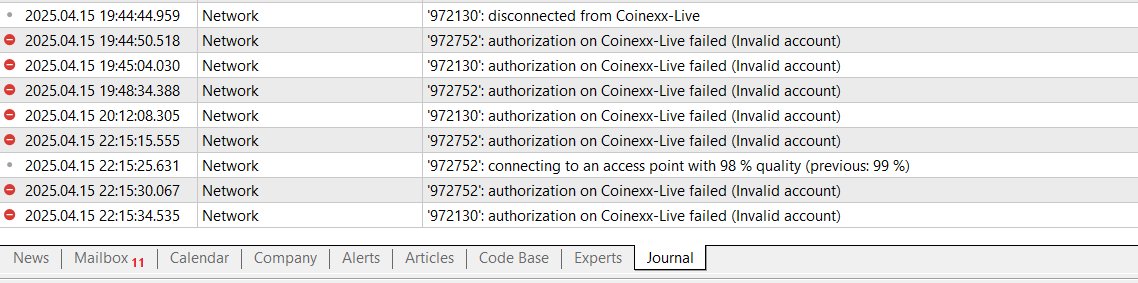

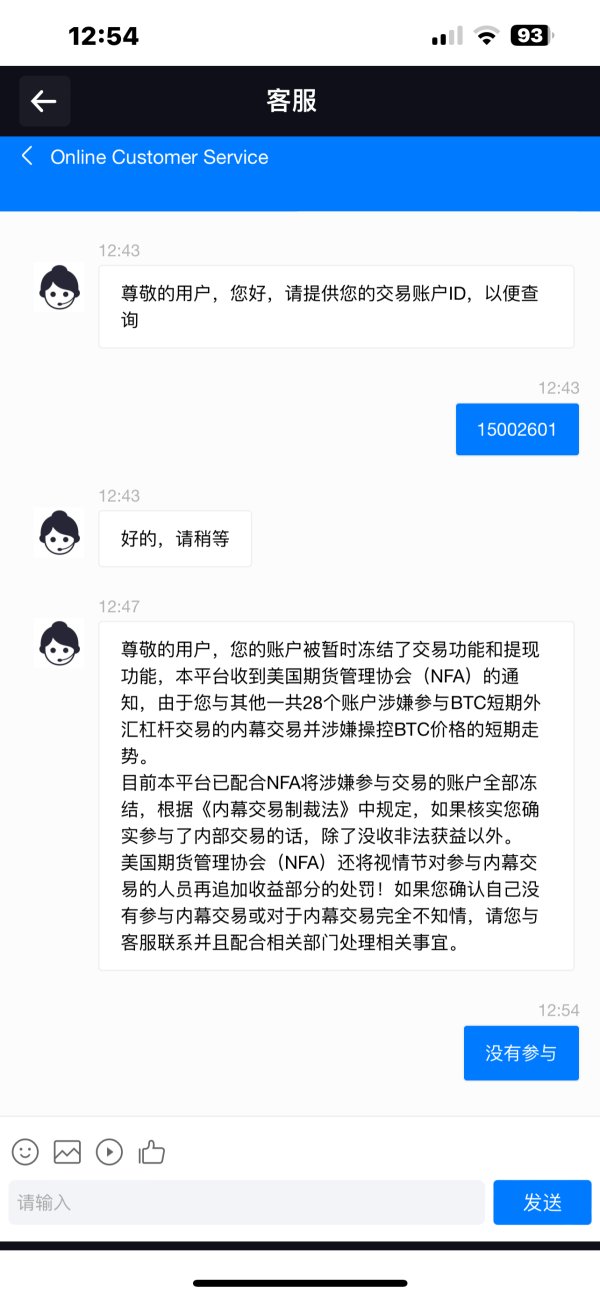

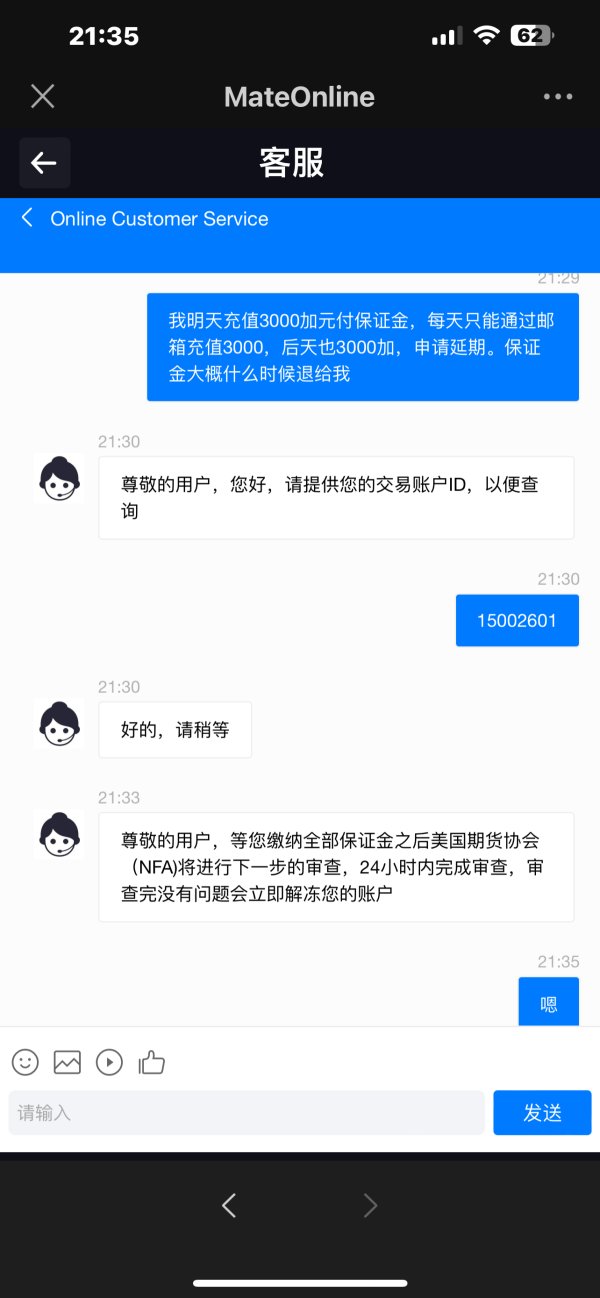

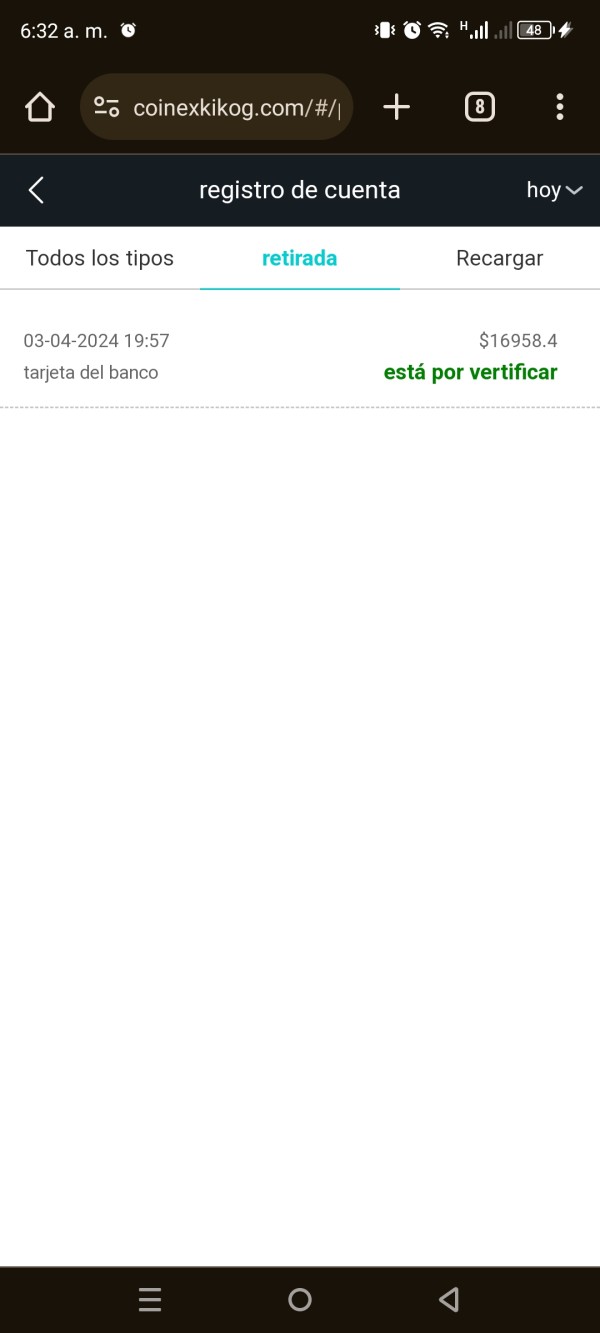

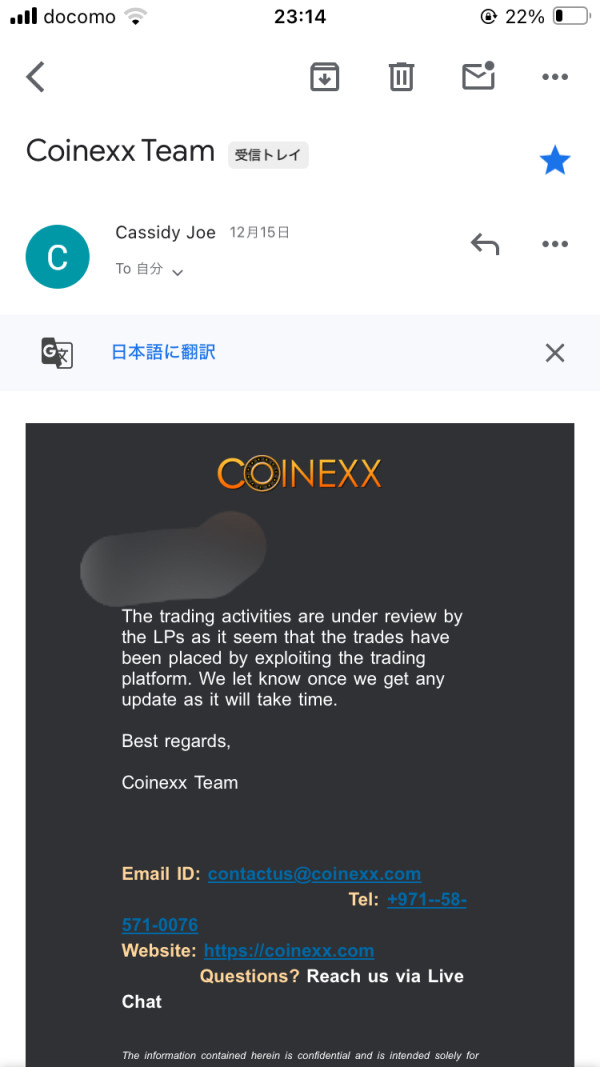

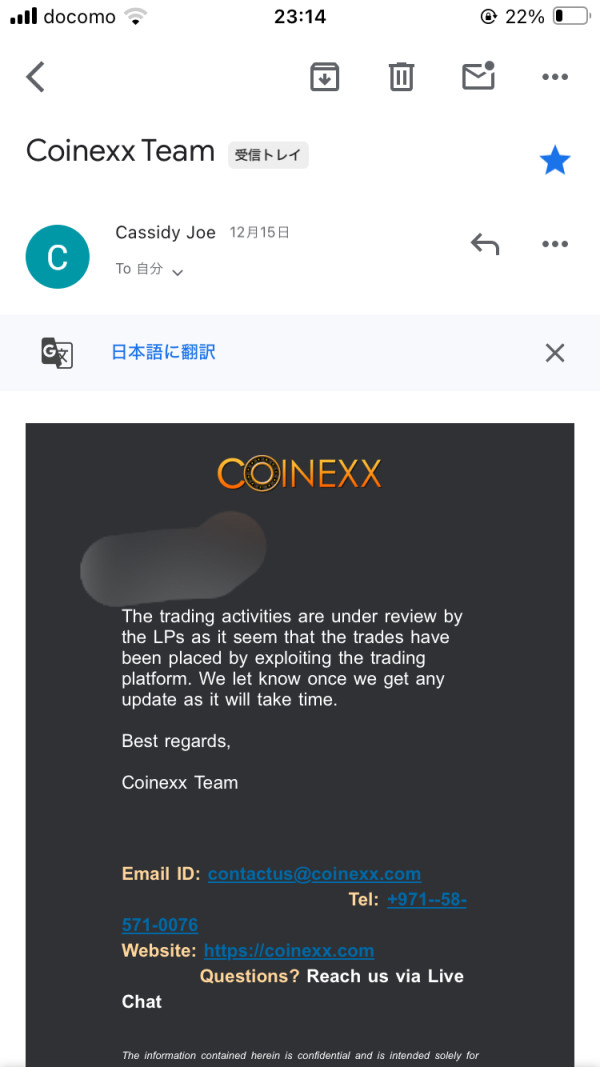

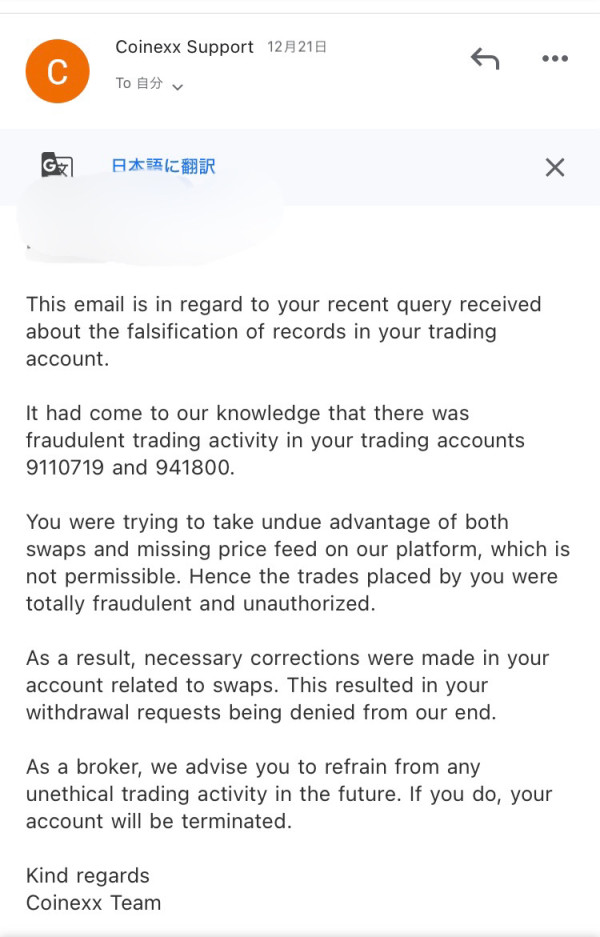

Trust and reliability represent the most challenging aspects of the Coinexx evaluation, with user feedback showing significant polarization in opinions about the broker's credibility. While some traders report satisfactory experiences, others have raised serious concerns about the company's practices and reliability.

The regulatory status under Saint Vincent and the Grenadines' Financial Services Authority provides basic legitimacy but offers limited protection compared to major regulatory jurisdictions. This offshore regulatory framework, while legal, may not provide the same level of investor protection and dispute resolution mechanisms available through tier-one regulators like the FCA or CySEC.

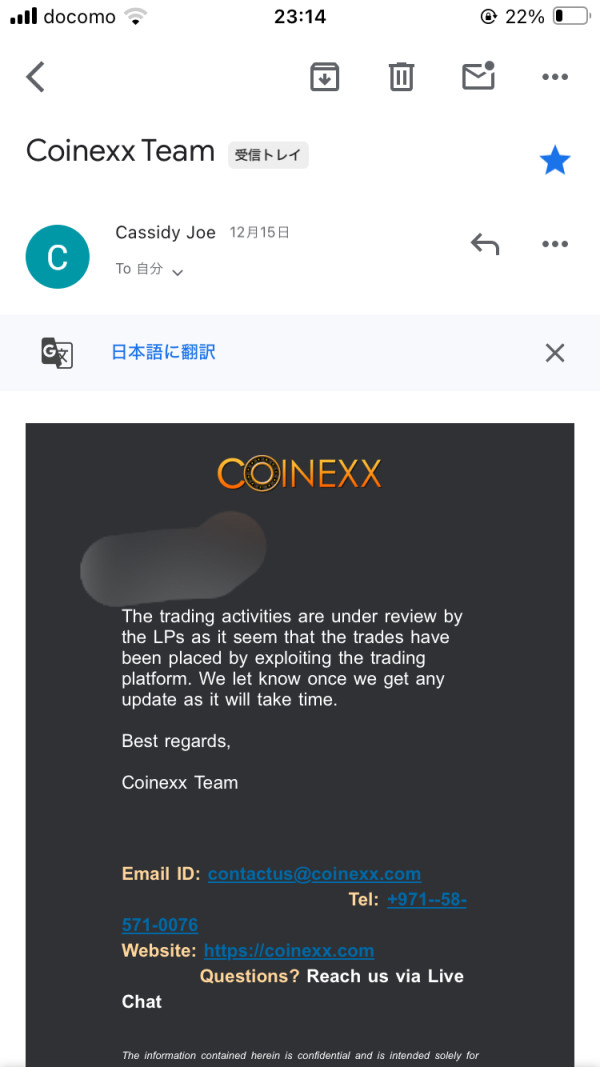

Particularly concerning are user reports describing negative experiences, with some reviewers making serious allegations about the broker's practices. According to available feedback, certain users have questioned the company's integrity, with one review specifically referring to Coinexx as problematic. These negative testimonials, while not universal, create significant concerns about operational reliability.

The absence of detailed information about fund segregation practices, insurance coverage, or other investor protection measures further impacts the trust evaluation.

User Experience Analysis (6/10)

Overall user experience with Coinexx presents a mixed picture, with satisfaction levels varying significantly among different traders. The broker appears to serve certain user segments effectively while falling short of expectations for others, resulting in polarized feedback across review platforms.

Positive aspects of the user experience include the accessible minimum deposit requirement, which allows new traders to begin with minimal financial commitment. The fast execution speeds reported by users contribute to a generally smooth trading environment for those focused on active trading strategies. The cryptocurrency integration also appeals to traders seeking modern, flexible payment options.

However, user feedback reveals several areas where experience falls short of expectations. Available sources didn't detail interface design and platform usability information, making it difficult to assess the overall user-friendliness of the trading environment. The lack of complete educational resources may particularly impact new traders who rely on broker-provided learning materials.

User testimonials suggest that while some traders find the platform suitable for their needs, others have encountered significant issues that impacted their overall satisfaction.

Conclusion

This comprehensive coinexx review reveals a broker operating in the complex middle ground of the forex industry, where competitive trading conditions coexist with significant trust and reliability concerns. Coinexx offers genuine advantages including exceptionally low minimum deposits, competitive spreads starting at 0.0 pips, and fast execution speeds that appeal to cost-conscious and active traders.

The broker's accessibility through its $7 minimum deposit and support for over 80 trading instruments makes it technically suitable for both newcomers and experienced traders seeking competitive conditions. However, the mixed user feedback, offshore regulatory status, and limited transparency in several operational areas create substantial concerns that potential users must carefully consider.

Traders considering Coinexx should weigh the attractive cost structure against the documented trust issues and regulatory limitations. The platform may serve specific trading needs effectively, but users should exercise heightened caution, start with minimal deposits, and maintain realistic expectations about support and protection levels compared to more established, heavily regulated alternatives.