Orient Securities 2025 Review: Everything You Need to Know

Executive Summary

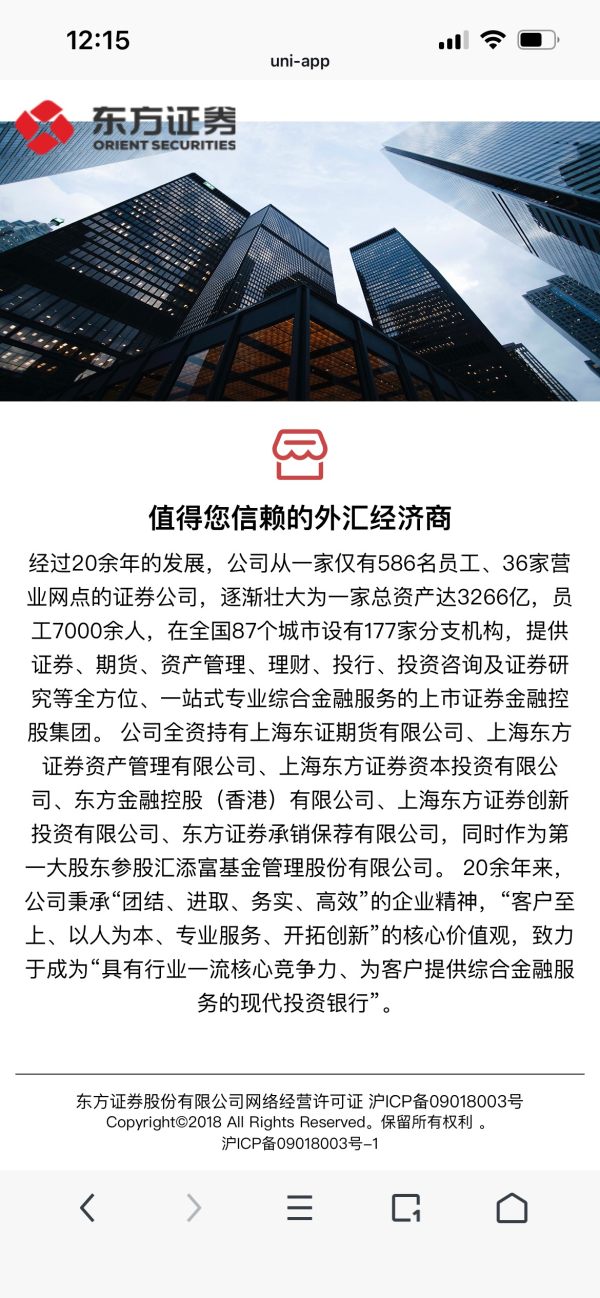

This comprehensive Orient Securities review evaluates a regulated brokerage firm that has established itself as a notable player in the financial services sector since 1998. The company operates under the supervision of the Hong Kong Securities and Futures Commission with license number AFP038. This regulatory foundation provides compliance that appeals to both retail and institutional clients seeking diversified investment opportunities.

The brokerage distinguishes itself through its multi-channel support system and diverse range of tradeable instruments. These include securities, investments, and forex products. According to available data, Orient Securities maintains an employee rating of 4.2 out of 5 based on 84 anonymous reviews, reflecting moderate user satisfaction levels.

However, user feedback reveals mixed experiences with the platform. Some clients praise the platform's trading capabilities while others highlight areas requiring improvement. These concerns particularly focus on customer service quality and platform usability.

Orient Securities primarily serves clients looking for comprehensive investment solutions. The firm offers services that span stock trading, asset management, and investment advisory. Its Shanghai headquarters positions it strategically within Asia's financial landscape, though its Hong Kong regulatory status extends its appeal to international traders seeking regulated exposure to Asian markets.

Important Notice

Orient Securities operates across different jurisdictions. Users should be aware that regulatory policies may vary significantly between regions. The company's operations in different territories may be subject to distinct regulatory frameworks, compliance requirements, and legal protections.

Prospective clients must carefully review the specific regulations applicable to their jurisdiction before engaging with Orient Securities' services. This Orient Securities review is based on publicly available information and user feedback collected from various sources. The evaluation aims to provide potential clients with comprehensive insights into the brokerage's offerings, performance, and regulatory standing.

Readers should conduct their own due diligence and consider their individual financial circumstances before making investment decisions.

Rating Framework

Broker Overview

Orient Securities emerged in the financial services landscape in 1998. The company established its headquarters in Shanghai and positioned itself as a comprehensive financial services provider. Over its operational history, Orient Securities has developed a business model centered on providing stock trading, asset management, and investment advisory services designed to meet varied investment requirements across different market segments.

The brokerage operates with a focus on delivering multi-channel support to its clients. However, specific platform details remain limited in available documentation. Orient Securities offers access to multiple asset classes, including securities, investments, and foreign exchange products. This positions the company as a one-stop solution for traders seeking diversified investment opportunities.

The company's regulatory compliance is anchored by its oversight under the Hong Kong Securities and Futures Commission. This provides an additional layer of credibility and regulatory protection for international clients seeking exposure to Asian financial markets.

Regulatory Jurisdiction

Orient Securities operates under the regulatory supervision of the Hong Kong Securities and Futures Commission. The company holds license number AFP038. This regulatory framework ensures compliance with international financial standards and provides client protection measures consistent with Hong Kong's financial regulatory environment.

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods is not detailed in available documentation. Prospective clients should contact Orient Securities directly to understand available funding options and associated processing procedures.

Minimum Deposit Requirements

The minimum deposit requirements for opening accounts with Orient Securities are not specified in accessible materials. This information would typically vary based on account type and client classification.

Current promotional offers and bonus programs are not mentioned in available documentation. Traders interested in promotional incentives should inquire directly with Orient Securities about any ongoing campaigns or new client offers.

Tradeable Assets

Orient Securities provides access to a diverse range of tradeable assets. These include securities, investment products, and foreign exchange instruments. This variety enables clients to construct diversified portfolios across multiple asset classes, though specific instruments and market coverage details require direct confirmation with the brokerage.

Cost Structure

Detailed information about spreads, commissions, and fee structures is not available in current documentation. Cost considerations are crucial for trading decisions, and prospective clients should request comprehensive fee schedules before account opening.

Leverage Ratios

Leverage offerings and maximum leverage ratios are not specified in available materials. This Orient Securities review cannot provide definitive information about leverage policies without additional documentation from the brokerage.

Orient Securities mentions multi-channel support capabilities. However, specific trading platform details are not elaborated in accessible information. Platform selection and features would require direct inquiry with the brokerage.

Regional Restrictions

Geographic limitations and regional restrictions are not detailed in available documentation. International clients should verify service availability in their jurisdiction before proceeding with account applications.

Customer Service Languages

Supported customer service languages are not specified in current materials. However, the brokerage's Asian focus suggests multilingual capabilities.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for Orient Securities faces limitations due to insufficient detailed information in available documentation. Specific account types, their respective features, and associated benefits are not comprehensively outlined in accessible materials. This lack of transparency makes it challenging for potential clients to understand the different account tiers and their corresponding advantages.

Minimum deposit requirements significantly impact accessibility for retail traders. However, these requirements are not specified in current documentation. Similarly, the account opening process lacks detailed explanation, including required documentation, verification procedures, and approval timelines.

Special account features are not mentioned in available materials. These would include Islamic accounts for clients requiring Shariah-compliant trading conditions. Without comprehensive account condition information, this Orient Securities review cannot provide a definitive evaluation of this crucial aspect.

Prospective clients must directly contact Orient Securities to understand account structures, requirements, and features before making informed decisions about account opening. The absence of detailed account information represents a significant transparency gap that may concern potential clients seeking comprehensive pre-registration information.

This limitation affects the overall evaluation of Orient Securities' account offerings and accessibility.

Orient Securities' tools and resources evaluation relies primarily on user feedback indicating diverse tradeable instruments. However, specific tool categories and functionalities are not detailed in available documentation. The brokerage appears to offer multiple asset classes, suggesting some level of trading tool diversity, but comprehensive tool specifications remain unclear.

Research and analysis resources are not specifically mentioned in accessible materials. These would include market analysis, economic calendars, news feeds, and technical analysis tools. Educational resources lack detailed description in available documentation, which are increasingly important for trader development.

The availability of webinars, tutorials, trading guides, or market education materials cannot be confirmed through current information sources. Automated trading support is not addressed in available documentation, including expert advisors, trading robots, or algorithmic trading capabilities.

This gap limits understanding of Orient Securities' technological offerings and advanced trading features. User feedback suggests satisfaction with available tools, though specific user experiences regarding tool quality, reliability, and effectiveness are not detailed in accessible reviews.

The lack of comprehensive tool documentation makes it difficult to assess Orient Securities' competitive position in terms of trading resources and analytical capabilities.

Customer Service and Support Analysis

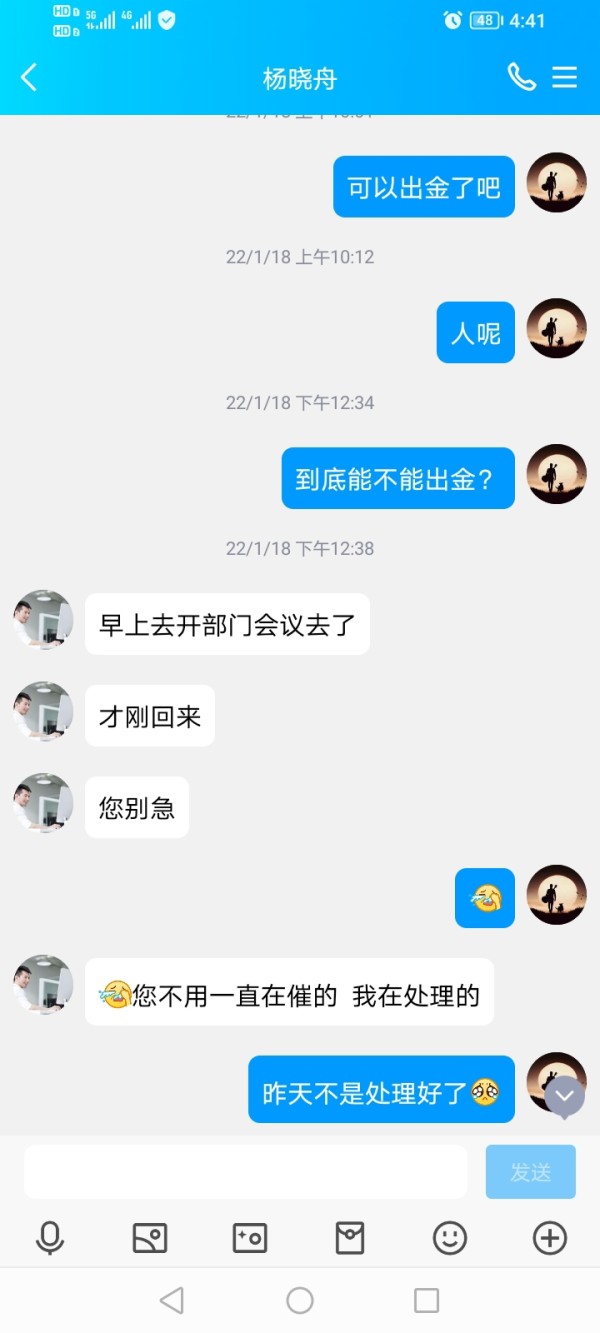

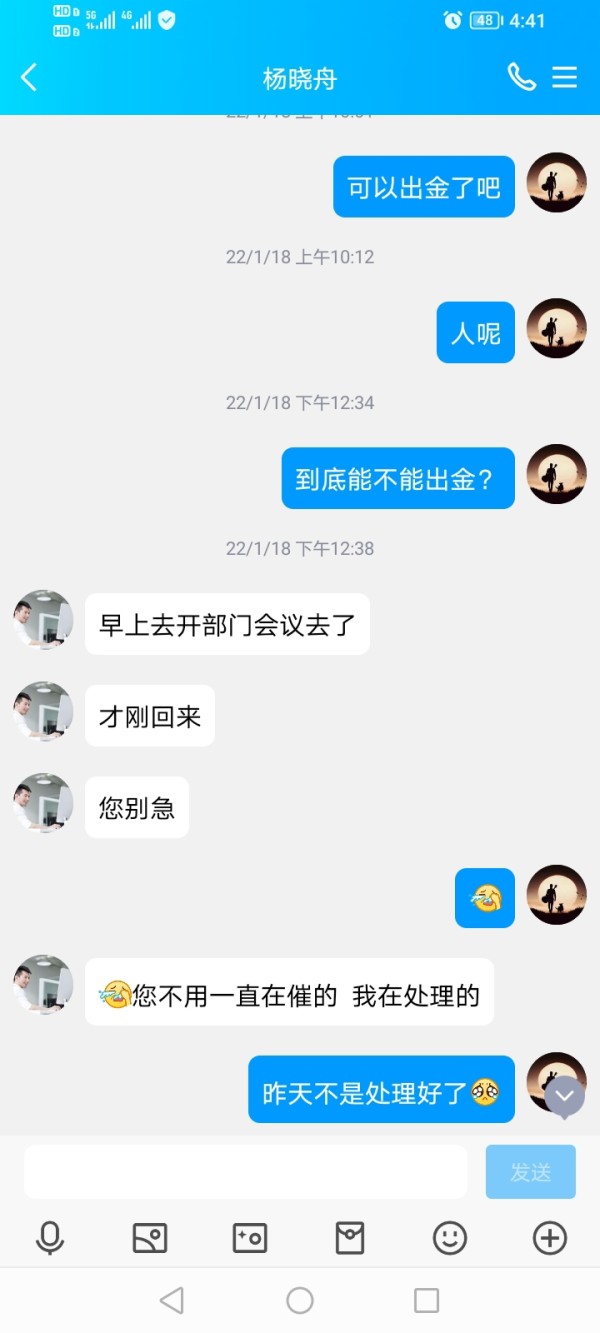

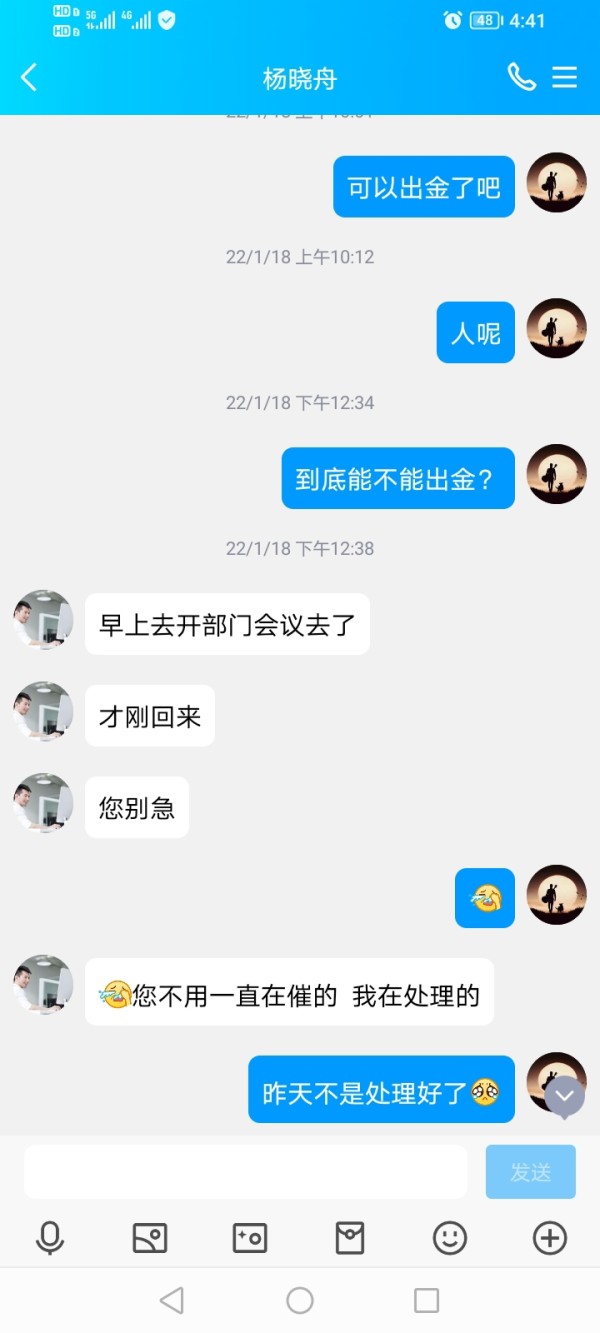

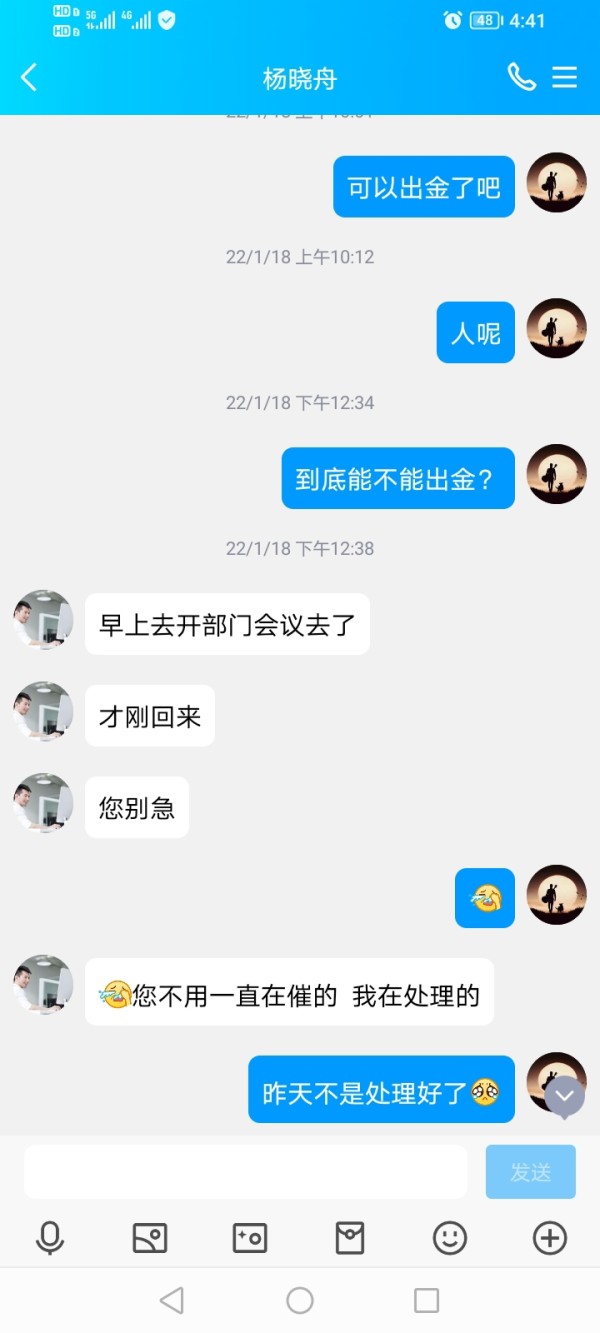

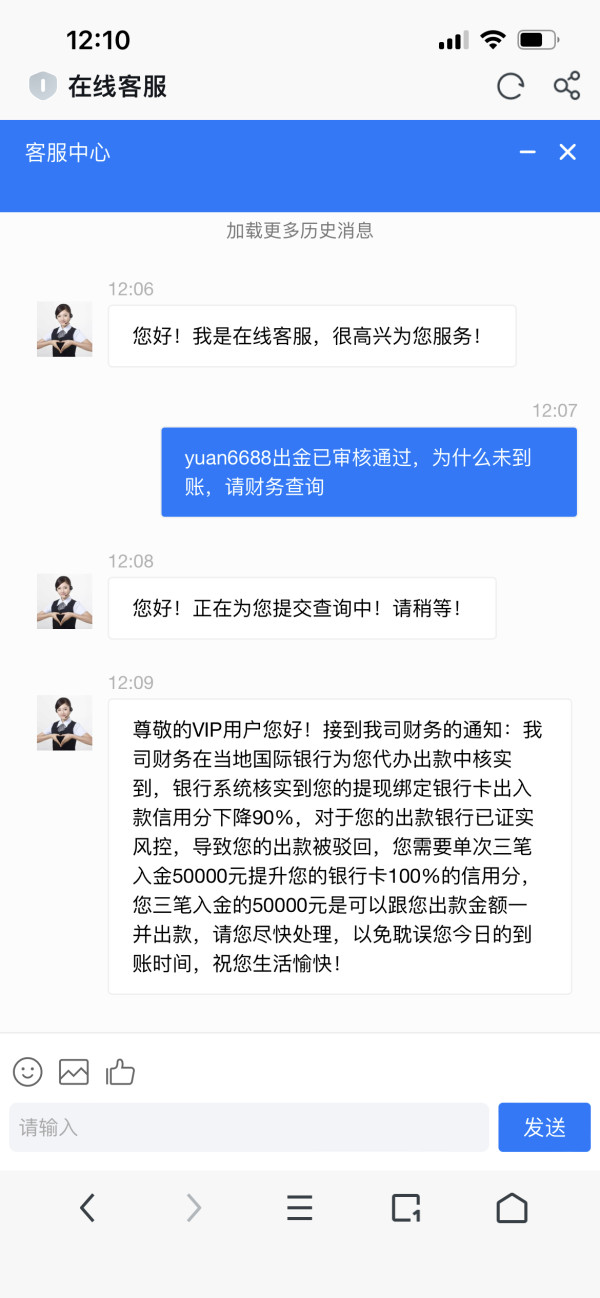

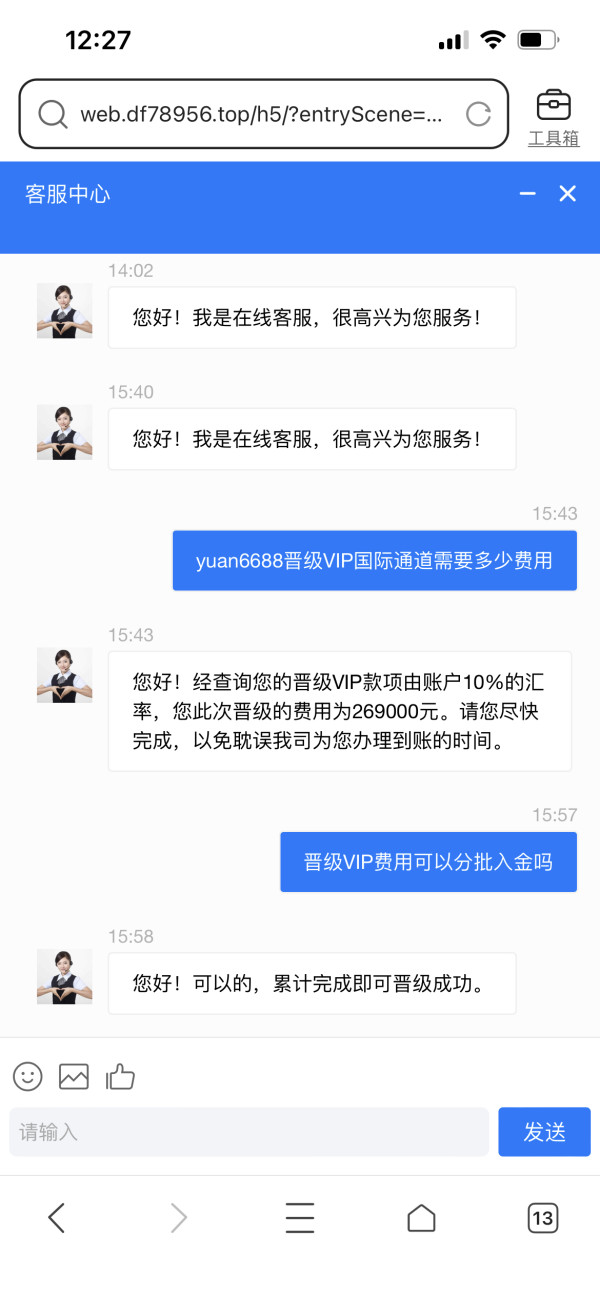

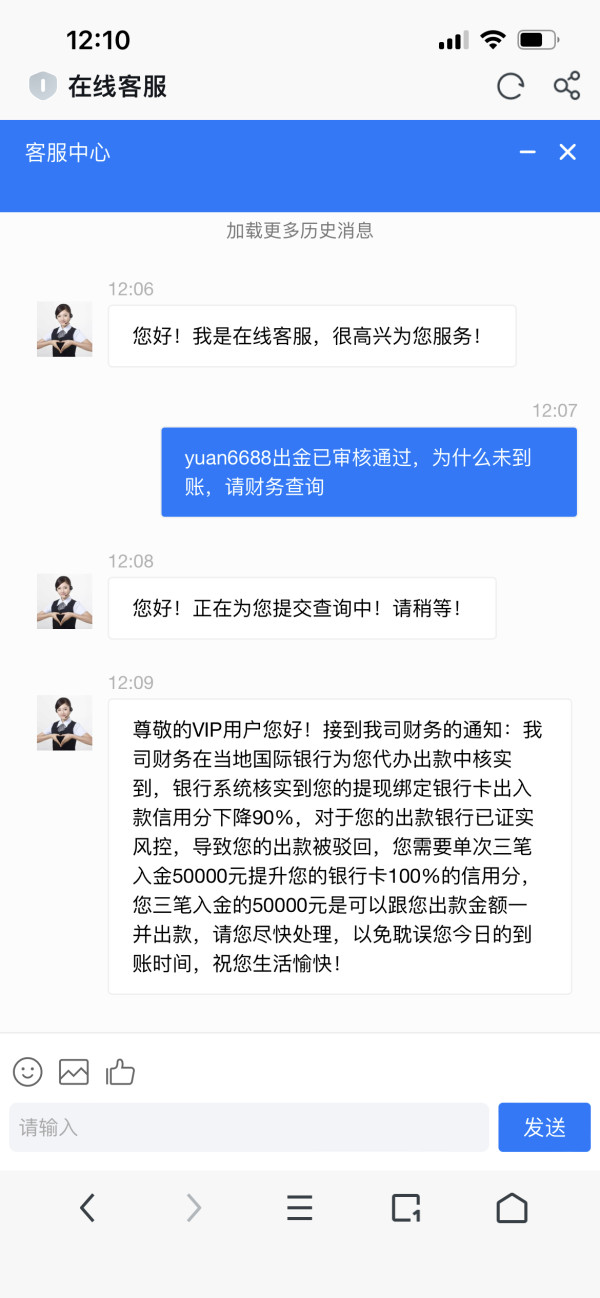

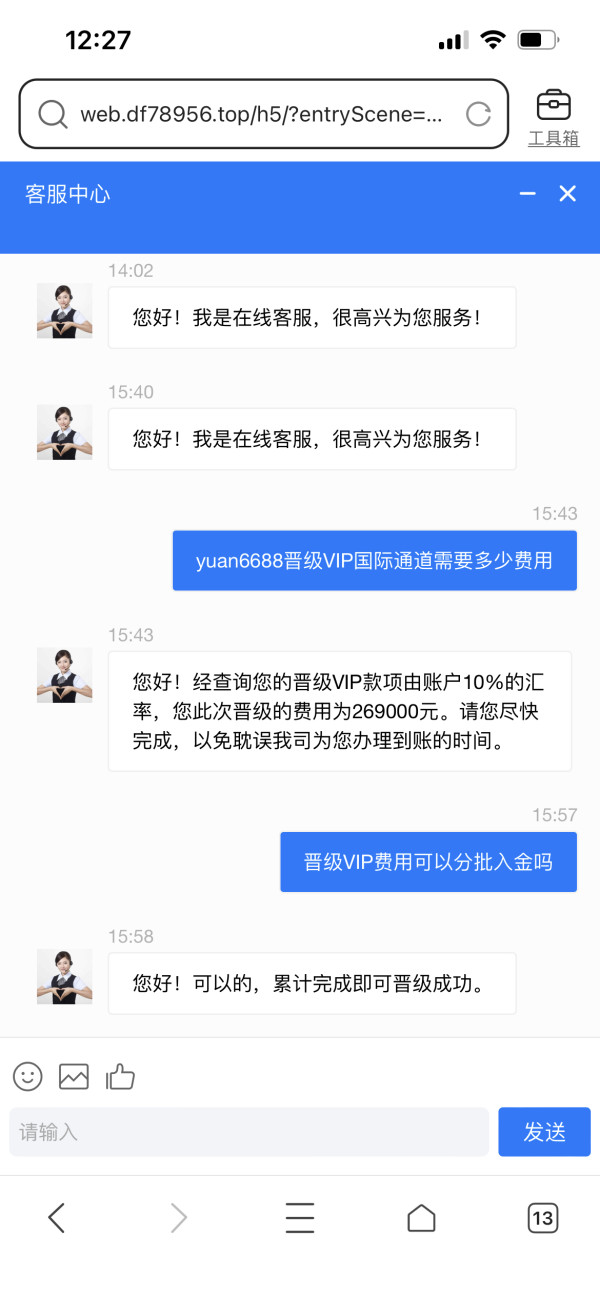

Customer service evaluation for Orient Securities reveals mixed feedback from users. Some reviews indicate that service quality requires improvement. The specific customer service channels available are not detailed in available documentation, including phone support, email assistance, live chat, or ticket systems.

Response time performance receives criticism in some user feedback. This is a critical factor in customer satisfaction, suggesting potential delays in support resolution. Service quality concerns mentioned in user reviews indicate inconsistent support experiences, though specific examples or detailed complaints are not elaborated in accessible materials.

Multi-language support capabilities are not specified in current documentation. This is despite Orient Securities' international regulatory status suggesting potential multilingual requirements. Customer service operating hours lack clear documentation in available materials, including weekend availability or 24/7 support.

The absence of detailed customer service information, combined with user feedback indicating improvement needs, suggests that Orient Securities may need to enhance both service quality and transparency regarding support capabilities. This represents an area requiring attention for improved client satisfaction and retention.

Trading Experience Analysis

The trading experience evaluation for Orient Securities shows generally positive user sentiment. Feedback indicates satisfaction with overall trading capabilities and minimal negative reports regarding platform performance. Users appear to experience acceptable trading conditions, though specific performance metrics are not detailed in available documentation.

Platform stability and execution speed receive positive implicit feedback through the absence of significant user complaints about technical issues. These are crucial factors for trading success. Order execution quality lacks specific documentation but appears satisfactory based on user experience reports, including slippage rates, requote frequency, and fill rates.

Platform functionality completeness is not comprehensively detailed in accessible materials. This includes charting capabilities, order types, risk management tools, and analytical features. Mobile trading experience lacks specific evaluation in available documentation regarding app performance, feature availability, and user interface quality, which is increasingly important for modern traders.

The trading environment appears adequate based on user satisfaction levels. This includes spread stability, liquidity provision, and market access, though specific performance data is not available. This Orient Securities review notes that while user experience appears positive, the lack of detailed technical specifications limits comprehensive evaluation of trading conditions.

Trustworthiness Analysis

Orient Securities demonstrates strong regulatory credentials through its supervision by the Hong Kong Securities and Futures Commission. This provides a solid foundation for trustworthiness evaluation. The regulatory framework ensures compliance with international financial standards and offers client protection measures consistent with Hong Kong's established financial regulatory environment.

Fund safety measures are not specifically detailed in available documentation. These would include client fund segregation, deposit insurance, and bankruptcy protection. However, the Hong Kong regulatory framework typically includes robust client protection mechanisms.

Company transparency receives some support through mentions of strong financial performance. However, detailed financial disclosures are not accessible in current materials. Industry reputation and peer recognition are not specifically addressed in available documentation, limiting assessment of Orient Securities' standing within the broader financial services community.

The handling of negative events, regulatory actions, or client disputes lacks documentation in accessible materials. The brokerage's established operational history since 1998 provides some confidence in its stability and longevity.

Combined with regulatory oversight, these factors contribute to a relatively strong trustworthiness profile. However, enhanced transparency in fund protection measures and company operations would strengthen client confidence further.

User Experience Analysis

User experience evaluation for Orient Securities shows moderate satisfaction levels. The company has an employee rating of 4.2 out of 5 based on 84 anonymous reviews. This rating suggests reasonable but not exceptional user satisfaction, indicating room for improvement in overall user experience delivery.

Interface design and platform usability feedback is not specifically detailed in available documentation. However, user reviews suggest mixed experiences with platform navigation and functionality. The absence of detailed user interface feedback limits assessment of platform intuitiveness and design quality.

Registration and verification processes lack detailed user feedback in accessible materials. This includes account opening convenience, documentation requirements, and approval efficiency. Fund operation experiences are not specifically addressed in available user reviews, including deposit and withdrawal convenience, processing speeds, and transaction reliability.

Common user complaints appear to focus on customer service quality, as mentioned in feedback. However, specific complaint categories and resolution effectiveness are not detailed. The user base appears to consist primarily of traders seeking diversified investment options, suggesting that Orient Securities attracts clients with varied investment objectives and experience levels.

Conclusion

Orient Securities presents a mixed profile in the competitive brokerage landscape. The company demonstrates strengths in regulatory compliance and trading experience while facing challenges in customer service quality and information transparency. The brokerage's supervision by the Hong Kong Securities and Futures Commission provides a solid regulatory foundation that appeals to clients seeking regulated trading environments.

The firm appears well-suited for retail and institutional clients seeking comprehensive investment options across multiple asset classes. This is particularly true for those interested in Asian market exposure. However, potential improvements in customer service responsiveness and enhanced transparency regarding account conditions, fees, and platform features would strengthen Orient Securities' competitive position.

While user satisfaction levels indicate reasonable service delivery, the areas of customer support and platform usability require attention to achieve higher client satisfaction ratings. This Orient Securities review suggests that while the brokerage offers a regulated trading environment with diverse investment opportunities, prospective clients should carefully evaluate their specific needs against available information. They should also consider direct communication with Orient Securities to address information gaps before making account opening decisions.