Regarding the legitimacy of Alvexo forex brokers, it provides CYSEC, FSA and WikiBit, (also has a graphic survey regarding security).

Is Alvexo safe?

Business

Risk Control

Is Alvexo markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 22

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

VPR Safe Financial Group Ltd

Effective Date:

2014-06-03Email Address of Licensed Institution:

compliance@alvexo.euSharing Status:

No SharingWebsite of Licensed Institution:

www.alvexo.eu, www.alvexo.fr, www.alvexo.de, www.alvexo.itExpiration Time:

--Address of Licensed Institution:

1, Agias Fylaxeos Street, KPMG Center, 5th Floor, CY-3025 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 056 147, +357 25 030 482Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

HSN Capital Group Ltd

Effective Date:

--Email Address of Licensed Institution:

info.hn@alvexo.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.alvexo.comExpiration Time:

--Address of Licensed Institution:

No. 5, HIS Building, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

(+248) 4671950Licensed Institution Certified Documents:

Is Alvexo Safe or a Scam?

Introduction

Alvexo is a forex and CFD broker that has been operating since 2014. Positioned as a multi-asset trading platform, it offers a wide range of financial instruments, including currency pairs, stocks, commodities, indices, and cryptocurrencies. With its headquarters in Limassol, Cyprus, Alvexo aims to provide a user-friendly trading experience while emphasizing education and customer service. However, in a market rife with scams and unreliable brokers, it is crucial for traders to carefully assess the legitimacy and safety of their chosen trading platforms. This article aims to investigate whether Alvexo is a safe choice for traders or if it raises red flags that warrant concern. Our evaluation is based on a thorough review of regulatory compliance, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

Alvexo operates under the regulation of two key authorities: the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) of Seychelles. Regulatory oversight is vital in the trading industry as it ensures that brokers adhere to strict guidelines aimed at protecting traders' interests. Below is a summary of Alvexo's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 236/14 | Cyprus | Verified |

| FSA | SD030 | Seychelles | Verified |

The CySEC regulation is particularly significant as it subjects Alvexo to the EU's Markets in Financial Instruments Directive (MiFID), which mandates stringent requirements for investor protection, including the segregation of client funds and compensation schemes. However, it is important to note that Alvexo's Seychelles license is considered less robust compared to European regulations, leading to concerns about its overall safety. Historically, Alvexo has faced some compliance issues, including a fine imposed by CySEC for not acting fairly towards clients. This raises questions about the brokers commitment to regulatory standards and customer protection.

Company Background Investigation

Alvexo was founded by a group of experienced market professionals and fintech innovators, with the intention of creating a comprehensive trading platform. The broker is owned by VPR Safe Financial Group Ltd, a Cyprus-based company, which adds a layer of credibility to its operations. The management team comprises individuals with extensive backgrounds in finance and technology, which positions Alvexo as a knowledgeable player in the forex market.

However, transparency regarding the company's operations and ownership structure is crucial for traders. Alvexo provides essential information about its services and regulatory compliance on its website, but it could improve in terms of disclosing the full identities and qualifications of its management team. This lack of transparency may cause potential clients to hesitate when considering whether Alvexo is safe.

Trading Conditions Analysis

Alvexo offers a tiered account system with varying trading conditions, which can impact the overall cost of trading. The broker's fee structure is primarily based on spreads, which can be relatively high compared to industry standards. Below is a comparison of Alvexo's core trading costs:

| Fee Type | Alvexo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.9 pips | 1.0 - 1.5 pips |

| Commission Model | No commissions | Varies |

| Overnight Interest Range | Varies | Varies |

Alvexo's spreads start at 2.9 pips for the classic account, which is significantly higher than the industry average. This could be a concern for traders, especially those who engage in high-frequency trading or scalping strategies. Moreover, the broker charges an inactivity fee of €10 after three months of inactivity, which can be seen as an additional cost that traders should be aware of. Understanding the fee structure is essential for evaluating if Alvexo is safe for your trading style.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Alvexo claims to take significant measures to ensure the security of client funds, including the segregation of accounts and negative balance protection. This means that clients' funds are kept separate from the broker's operational funds, reducing the risk of loss in the event of insolvency. Additionally, negative balance protection ensures that traders cannot lose more money than they have deposited.

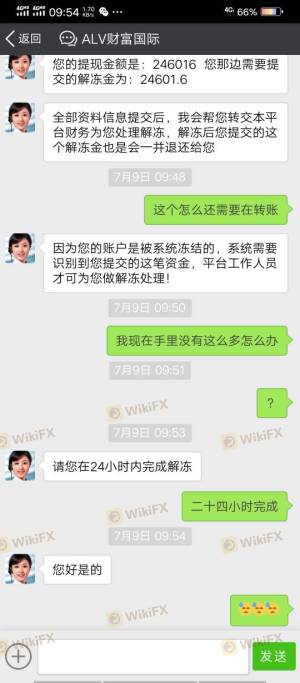

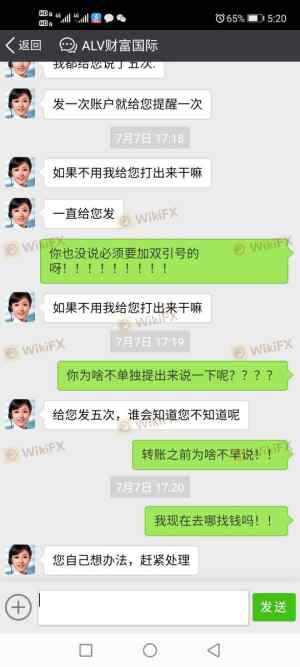

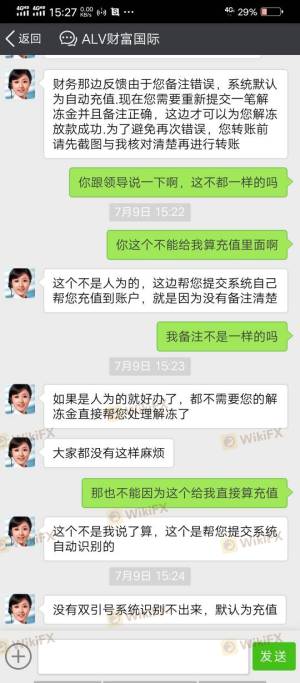

However, the broker's reliance on offshore regulation raises questions about the robustness of these safety measures. While Alvexo is part of the Investors Compensation Fund, which covers up to €20,000 per client in the event of bankruptcy, the effectiveness of this protection may be limited in the case of the Seychelles entity. A history of issues related to fund security, including complaints regarding withdrawal delays, has been reported by some users, further complicating the assessment of whether Alvexo is truly safe.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Alvexo has received mixed reviews from users, with some praising its educational resources and customer service, while others have raised concerns about high spreads and withdrawal issues.

Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| High spreads | Medium | Acknowledged |

| Withdrawal delays | High | Addressed |

| Customer service response | Medium | Mixed feedback |

For instance, one user reported significant delays in withdrawing funds, claiming it took over a week to process their request, which is concerning for those needing timely access to their capital. On the other hand, some traders have expressed satisfaction with the educational materials provided by Alvexo, indicating that the broker does offer valuable resources for improving trading skills.

Platform and Execution

Alvexo offers a proprietary web-based trading platform and supports MetaTrader 4 (MT4), a popular choice among traders for its advanced analytical tools. The platform is generally user-friendly, but some users have reported issues with execution speed and slippage during volatile market conditions.

The quality of order execution is critical for traders, especially for those employing strategies that require precise entry and exit points. Reports of slippage and re-quotes have raised concerns about whether Alvexo is safe in terms of execution quality.

Risk Assessment

Using Alvexo carries certain risks, which can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Operates under offshore regulation |

| Financial Risk | High | High spreads and potential withdrawal issues |

| Execution Risk | Medium | Reports of slippage during volatile markets |

To mitigate these risks, traders should ensure they are well-informed about Alvexo's trading conditions and consider starting with a demo account to familiarize themselves with the platform before committing real funds.

Conclusion and Recommendations

In conclusion, while Alvexo is regulated by CySEC and FSA, which adds a layer of legitimacy, several factors raise concerns about its overall safety. The high spreads, mixed customer feedback, and history of compliance issues suggest that traders should exercise caution.

For those considering Alvexo, it may be suitable for traders who prioritize educational resources and are willing to accept higher trading costs. However, for more cost-sensitive traders or those who require timely access to their funds, it may be prudent to explore alternative brokers with stronger regulatory oversight and better trading conditions.

Overall, the question of "Is Alvexo safe?" remains complex. While it is not outright a scam, potential clients should conduct thorough research and weigh the risks before engaging with this brokerage.

Is Alvexo a scam, or is it legit?

The latest exposure and evaluation content of Alvexo brokers.

Alvexo Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Alvexo latest industry rating score is 5.79, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.79 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.