MTrading 2025 Review: Everything You Need to Know

Executive Summary

MTrading is an online forex and CFD broker that has built a strong presence across Latin America, Africa, and Asia-Pacific regions since 2012. It offers exciting features for traders who want high leverage opportunities. This mtrading review looks at a broker that provides leverage up to 1:1000 and a $200 no-deposit bonus. The company is based in Belize and regulated by the International Financial Services Commission (IFSC). MTrading works as a platform that both new and experienced traders can use.

The broker's main appeal includes a very low minimum deposit of just $1 USD. This makes it perfect for traders who want easy market entry. However, potential clients should know about regulatory concerns, especially the broker's spot on Malaysia's investor alert list. This raises questions about how well it follows rules in certain areas. MTrading gets ratings of 4.2/5 and 4.3/5 across different review platforms, based on available user feedback. It has a user recommendation rate of 63%, which shows generally positive but mixed experiences. This mtrading review will give you detailed analysis to help traders decide if this broker fits their trading needs and risk comfort level.

Important Notice

Regional Entity Differences: MTrading works under different regulatory systems across various areas. The broker is regulated by the IFSC in Belize, but it appears on Malaysia's investor alert list. This shows potential regulatory compliance problems in that specific region. Traders should check the regulatory status in their own countries before opening accounts.

Review Methodology: This evaluation uses comprehensive analysis of user feedback, publicly available market information, regulatory documents, and official broker communications. All assessments reflect information available as of 2025. They may change as the broker updates its services and regulatory status.

Rating Framework

Broker Overview

MTrading started in the online trading world in 2012. It set up headquarters in Belize with a focus on providing easy forex and CFD trading services across emerging markets. The company has built its reputation by targeting regions where traditional banking and investment services may be limited. This includes Latin America, Africa, and Asia-Pacific territories. Reports from Revieweek and other industry sources show that MTrading has positioned itself as a broker that understands the unique needs of traders in developing markets. It offers services designed to work with different levels of trading experience and available capital.

The broker works mainly as a market maker. It provides access to many financial instruments including foreign exchange pairs, contracts for difference on stocks, commodities, indices, and cryptocurrency assets. MTrading's business model focuses on low-barrier entry combined with high leverage opportunities. This strategy has attracted traders who want to maximize their market exposure with limited starting capital. The company's regulatory framework centers around its IFSC license. However, this mtrading review notes that regulatory recognition varies significantly across different areas, with some regions expressing concerns about the broker's compliance status.

Regulatory Jurisdiction: MTrading operates under the oversight of the International Financial Services Commission (IFSC) of Belize. Traders should note the broker's inclusion on Malaysia's investor alert list, which may indicate regulatory concerns in certain regions.

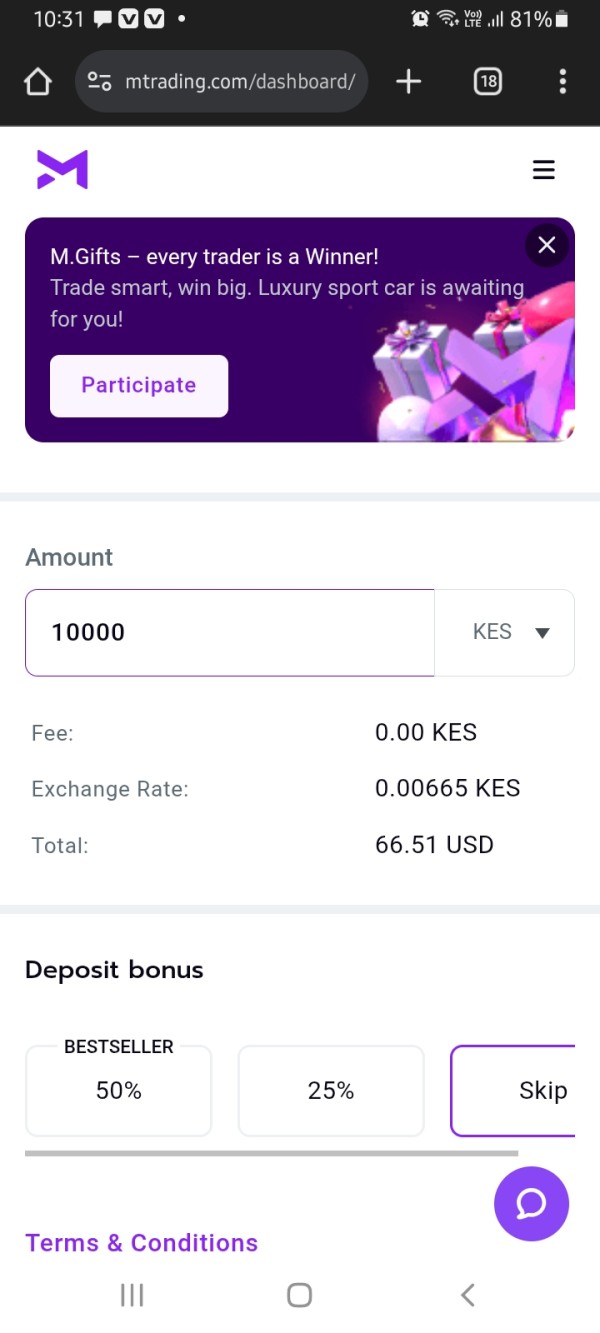

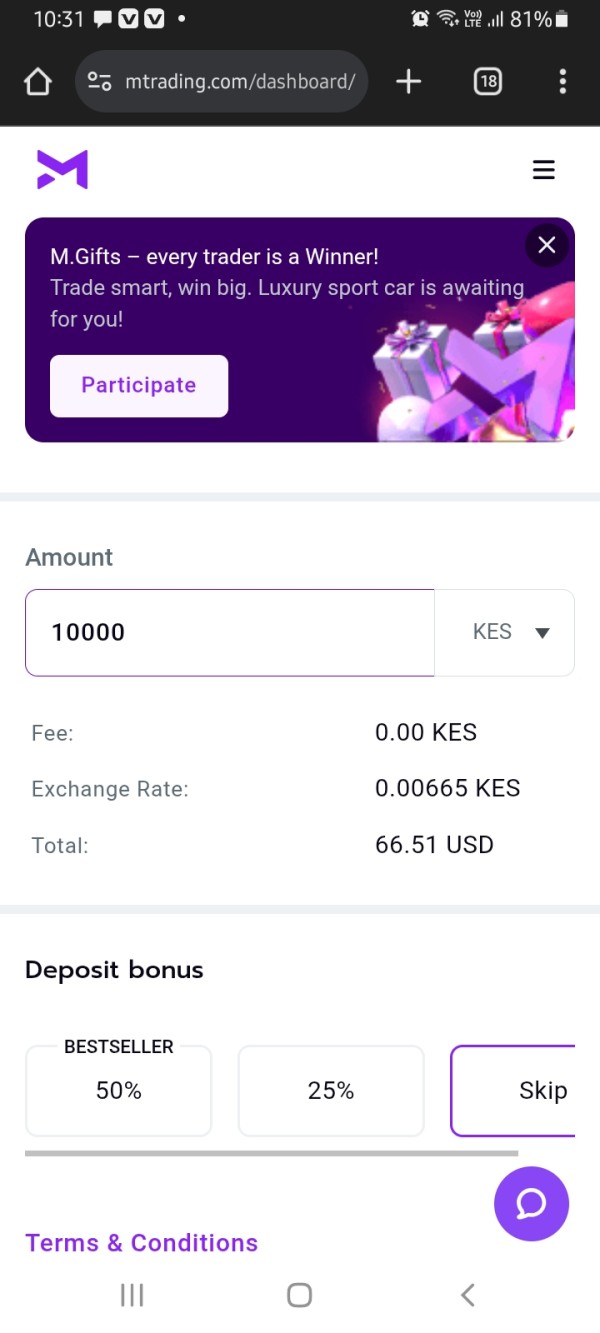

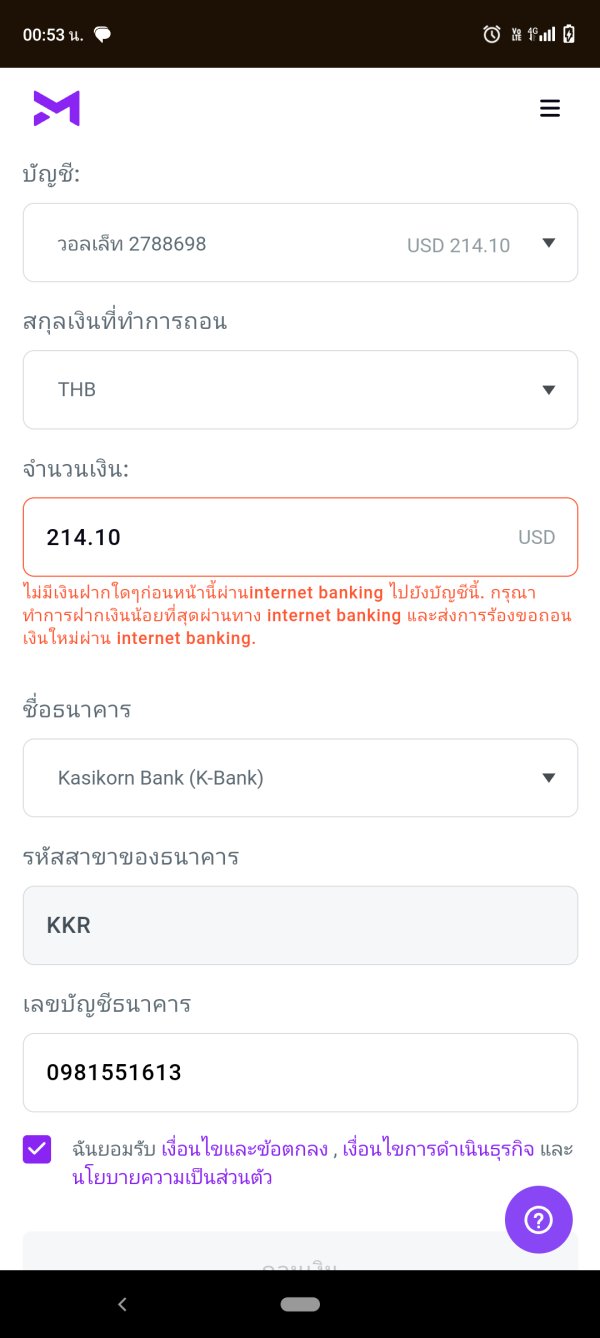

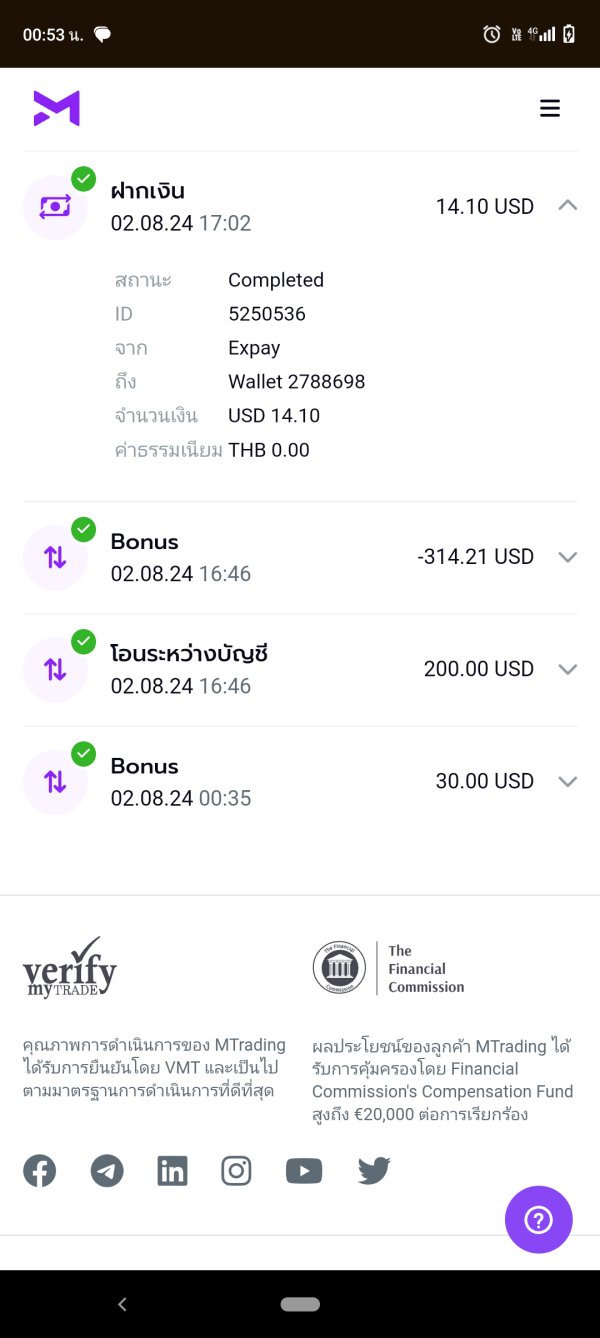

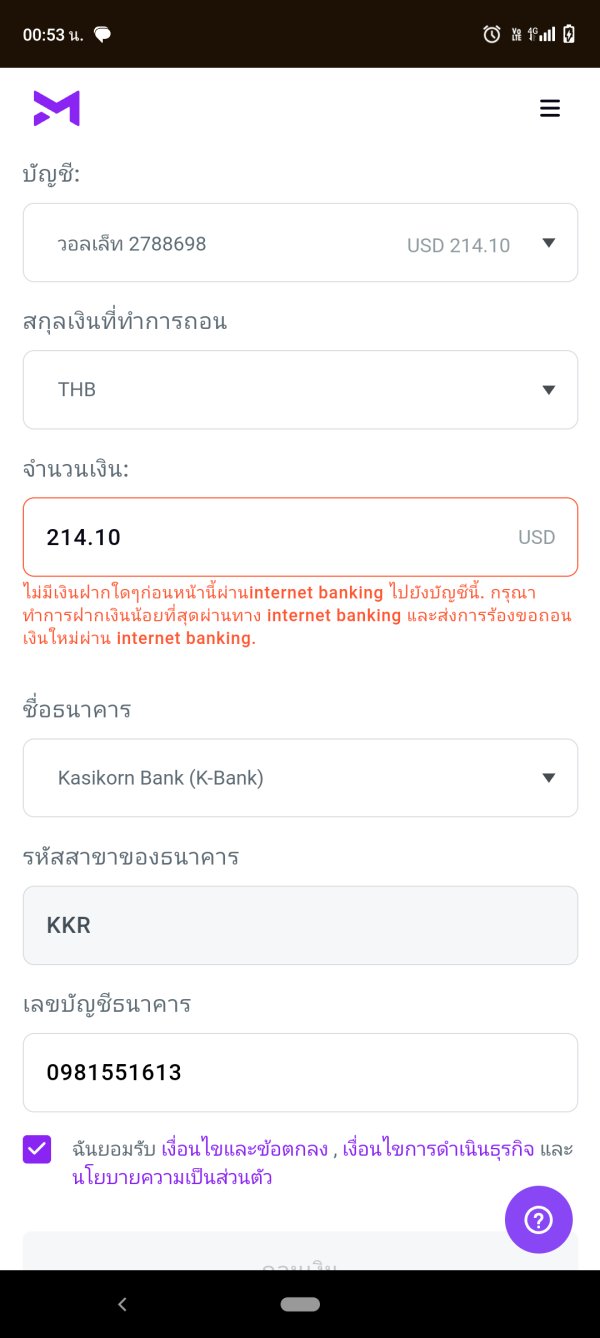

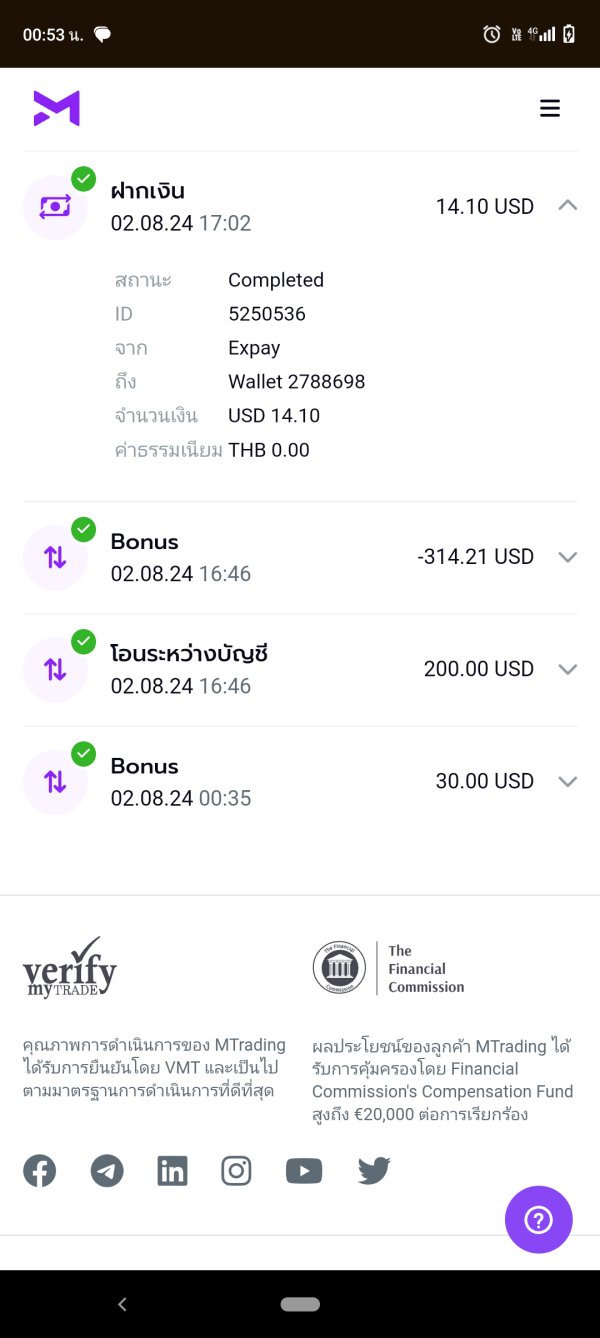

Deposit and Withdrawal Methods: Specific information about available payment methods was not detailed in available sources. The very low minimum deposit requirement suggests multiple accessible funding options.

Minimum Deposit Requirements: MTrading sets its minimum deposit at just $1 USD. This makes it one of the most accessible brokers in terms of initial capital requirements.

Bonus and Promotional Offers: The broker actively promotes a $200 no-deposit bonus. It is designed to attract new traders and provide risk-free trading opportunities for account holders.

Available Trading Assets: MTrading provides access to foreign exchange markets, CFDs on stocks, commodities trading, major indices, and cryptocurrency instruments. This offers a comprehensive trading environment.

Cost Structure: Specific spread and commission details were not extensively documented in available sources. MTrading claims to offer "ultra-tight spreads," though traders should verify current pricing through direct broker contact.

Leverage Options: Maximum leverage reaches 1:1000. This positions MTrading among brokers offering the highest leverage ratios in the industry.

Platform Selection: Specific trading platform information was not detailed in available documentation. This requires further investigation from potential clients.

Geographic Restrictions: Certain regions may face regulatory limitations. This is particularly true given the Malaysia investor alert status.

Customer Support Languages: Available documentation did not specify the range of languages supported by customer service teams.

This mtrading review identifies several areas where additional transparency would benefit potential clients. This is particularly true regarding platform specifications and detailed cost structures.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

MTrading's account conditions represent one of its strongest competitive advantages. This is particularly true for traders seeking low-barrier market entry. The broker's $1 USD minimum deposit requirement stands out as exceptionally accessible. It removes traditional barriers that prevent new traders from entering financial markets. This approach aligns with MTrading's apparent strategy of serving emerging markets where capital availability may be limited. The availability of 1:1000 leverage further enhances the appeal for traders looking to maximize their market exposure. However, such high leverage also significantly increases risk exposure.

Specific account type information was not detailed in available sources. The combination of minimal deposit requirements and high leverage suggests a flexible approach to accommodating different trader profiles. The $200 no-deposit bonus adds additional value for new account holders. It provides opportunities to experience the platform without initial financial commitment. However, traders should carefully review the terms and conditions associated with bonus offers. Such promotions typically include trading volume requirements and withdrawal restrictions.

The lack of detailed information about account tiers, features, and specific benefits represents a transparency gap. Potential clients should address this through direct broker communication. This mtrading review recommends that prospective traders request comprehensive account documentation before making commitments. This is particularly important regarding any restrictions or limitations that may apply to different account levels.

MTrading offers access to a diverse range of tradeable assets spanning multiple financial markets. These include forex, stocks, commodities, indices, and cryptocurrencies. This comprehensive asset selection provides traders with opportunities for portfolio diversification and exposure to various market sectors. The broker's focus on multiple asset classes suggests an understanding of modern trading strategies. These often require access to correlated and uncorrelated instruments for risk management and profit optimization.

However, available documentation lacks specific details about the trading tools, analytical resources, and educational materials provided to account holders. Modern traders typically expect access to advanced charting capabilities, technical analysis tools, economic calendars, and market research resources. The absence of detailed information about these critical trading support elements represents a significant gap in publicly available broker documentation.

The lack of specific information about automated trading support, expert advisor compatibility, and API access further limits the assessment of MTrading's technological capabilities. Professional traders increasingly require sophisticated tool integration and custom strategy implementation capabilities. These are areas where additional transparency would strengthen the broker's market position.

Customer Service and Support Analysis (6/10)

Customer service quality represents a critical factor in broker selection. This is particularly true for traders operating across different time zones and requiring multilingual support. Available user feedback regarding MTrading's customer service presents a mixed picture. Some clients report satisfactory experiences while others indicate areas for improvement. The 63% user recommendation rate suggests that while many clients find the service acceptable, there remains significant room for enhancement.

Specific information about customer support channels, response times, and availability hours was not detailed in accessible sources. This makes it difficult to assess the comprehensiveness of support services. Modern traders typically expect multiple contact methods including live chat, email, telephone support, and comprehensive FAQ resources. The availability of support in multiple languages becomes particularly important for a broker serving diverse geographic regions.

The absence of detailed customer service information in public documentation suggests that potential clients should directly test support responsiveness and quality before committing to significant trading activities. Given the broker's focus on emerging markets, robust customer support becomes even more critical. This is especially true for traders who may be new to online trading platforms.

Trading Experience Analysis (7/10)

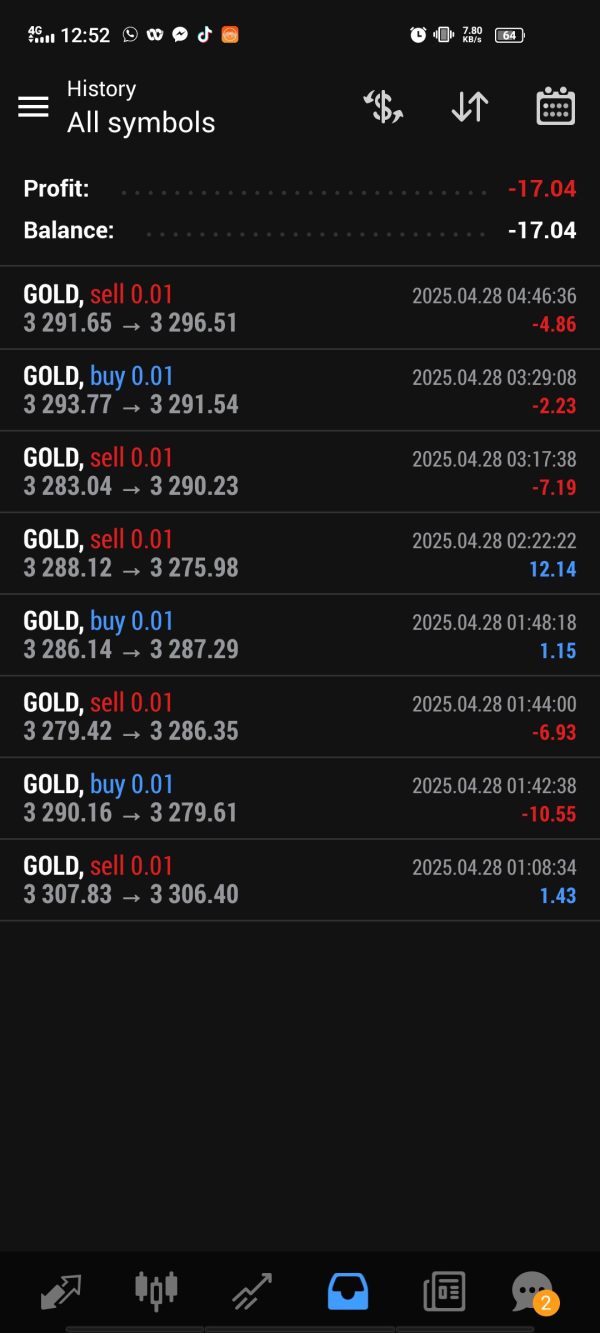

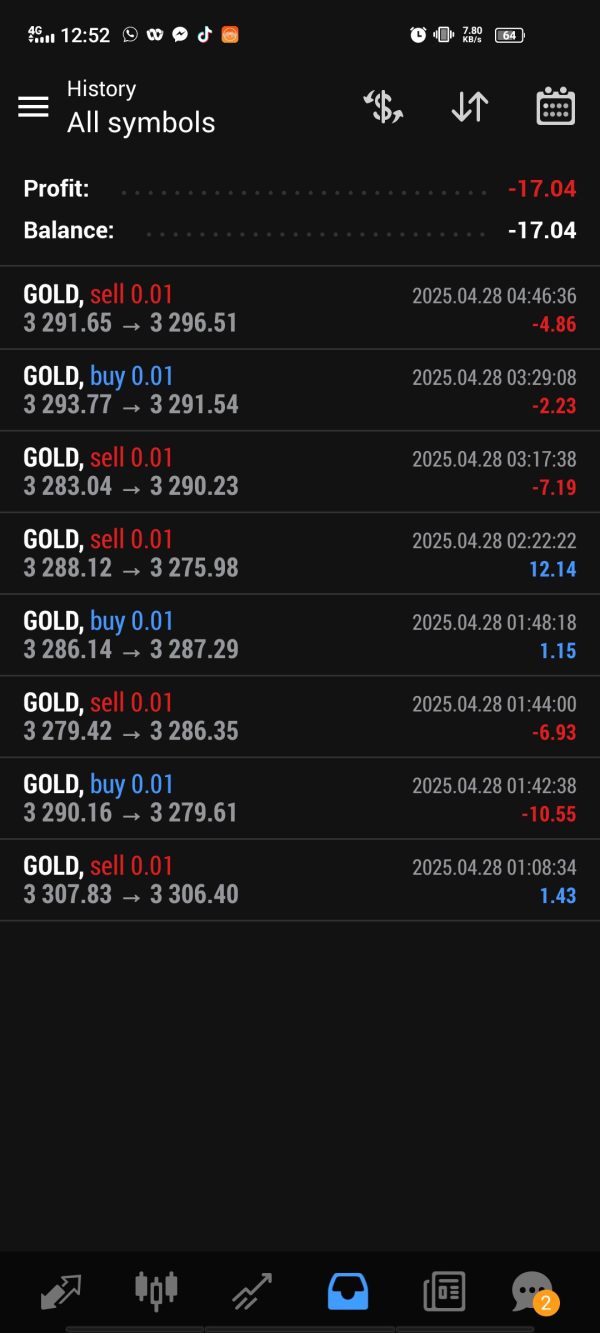

User ratings of 4.2/5 and 4.3/5 across different review platforms indicate generally positive trading experiences. However, the lack of specific platform information limits detailed assessment of trading conditions. The claimed "ultra-tight spreads" suggest competitive pricing. Specific spread data and execution statistics would provide more meaningful evaluation criteria. Order execution quality, slippage rates, and platform stability represent critical factors that require direct testing or more detailed user feedback for comprehensive assessment.

The absence of specific trading platform information represents a significant limitation in evaluating the overall trading experience. Modern traders expect robust, reliable platforms with advanced charting capabilities, multiple order types, and mobile accessibility. Without detailed platform specifications, potential clients cannot adequately assess whether MTrading's technology infrastructure meets their trading requirements.

Platform performance during high-volatility market conditions, news events, and peak trading hours represents another critical factor that requires additional documentation. This mtrading review recommends that potential clients request demo accounts or detailed platform demonstrations before making trading commitments. This is particularly important for strategies requiring precise execution timing or advanced order management capabilities.

Trust and Security Analysis (5/10)

MTrading's trust profile presents a mixed picture that requires careful consideration by potential clients. The broker maintains IFSC regulation from Belize, but its inclusion on Malaysia's investor alert list raises legitimate concerns about regulatory compliance and operational standards. This regulatory discrepancy suggests that MTrading may face challenges meeting different jurisdictional requirements. This could potentially impact service quality or client protection measures.

The IFSC regulatory framework provides some level of oversight. Traders should understand that offshore regulatory jurisdictions may offer different levels of client protection compared to major financial centers. Client fund segregation, deposit insurance, and dispute resolution mechanisms represent critical security factors. These require clarification through direct broker communication.

The lack of detailed information about security measures, fund protection protocols, and transparency regarding company ownership and financial stability further complicates trust assessment. Professional traders typically require comprehensive documentation about broker financial health, audit reports, and regulatory compliance history. This is needed before committing significant capital to trading accounts.

User Experience Analysis (6/10)

Overall user satisfaction metrics indicate moderate success. Ratings of 4.2/5 and 4.3/5 suggest that many clients find MTrading's services acceptable for their trading needs. However, the 63% recommendation rate indicates that approximately one-third of users would not recommend the broker to others. This suggests significant areas for improvement in service delivery or platform functionality.

The combination of low minimum deposits and high leverage appears to attract traders seeking accessible market entry. This is particularly true for those with limited initial capital. This positioning aligns well with emerging market traders who may face traditional banking limitations or capital constraints. However, the lack of detailed information about user interface design, platform usability, and mobile trading capabilities limits comprehensive user experience assessment.

Account opening and verification processes, fund deposit and withdrawal efficiency, and overall platform navigation represent critical user experience factors that require additional documentation. The absence of detailed user journey information suggests that potential clients should thoroughly test all platform functions through demo accounts. This should be done before committing to live trading activities.

Conclusion

This comprehensive mtrading review reveals a broker with both compelling advantages and notable limitations that potential clients must carefully consider. MTrading's exceptional accessibility through its $1 minimum deposit requirement and high leverage up to 1:1000 makes it particularly attractive for traders seeking low-barrier market entry. This is especially true in emerging markets where traditional investment options may be limited. The $200 no-deposit bonus further enhances its appeal for new traders looking to test the platform without initial financial commitment.

However, significant concerns regarding regulatory status, particularly the inclusion on Malaysia's investor alert list, combined with limited transparency about platform specifications, customer service details, and security measures, require careful consideration. User ratings indicate generally positive experiences, but the 63% recommendation rate suggests room for improvement in service delivery and client satisfaction.

MTrading appears most suitable for traders prioritizing accessibility and high leverage opportunities while accepting higher regulatory risk and limited transparency. Prospective clients should conduct thorough due diligence, including direct platform testing and comprehensive terms review, before making trading commitments.