Regarding the legitimacy of ORIENT SECURITIES forex brokers, it provides CFFEX, MAS and WikiBit, .

Is ORIENT SECURITIES safe?

Risk Control

Software Index

Is ORIENT SECURITIES markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

上海东证期货有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

22F, No. 318 South Zhongshan Road, Shanghai, China Postcode: 200010Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

MAS Market Making License (MM)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ORIENT FUTURES INTERNATIONAL (SINGAPORE) PTE. LTD.

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.orientfutures.com.sgExpiration Time:

--Address of Licensed Institution:

128 BEACH ROAD #08-03 GUOCO MIDTOWN 189773Phone Number of Licensed Institution:

+65 69557500Licensed Institution Certified Documents:

Is Orient Securities Safe or Scam?

Introduction

Orient Securities, a prominent player in the forex market, is a Chinese investment firm that provides a range of financial services, including securities brokerage, asset management, and investment advisory. Established in 1998 and headquartered in Shanghai, Orient Securities has positioned itself as a key player in the Asian financial landscape, particularly in the realm of foreign exchange trading. However, the rapid growth of online trading platforms has also led to an increase in fraudulent activities, making it essential for traders to carefully assess the credibility of their chosen brokers. This article aims to explore whether Orient Securities is a safe trading option or a potential scam. The analysis is based on a thorough review of regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy and safety. Orient Securities operates under the oversight of the China Financial Futures Exchange (CFFEX) and holds a futures license, which adds a layer of credibility to its operations. The significance of regulation cannot be overstated, as it ensures that brokers adhere to strict operational standards designed to protect investors. Below is a summary of the core regulatory information for Orient Securities:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | 0156 | China | Verified |

The regulatory quality of CFFEX is generally regarded as robust, providing a structured framework for brokers to operate within. However, it is worth noting that while the presence of regulation is reassuring, it does not guarantee complete safety. Historical compliance records indicate that Orient Securities has maintained its regulatory standing, but there have been complaints regarding withdrawal difficulties, raising concerns about its operational integrity.

Company Background Investigation

Orient Securities has a rich history, having been established in 1998. Over the years, it has expanded its service offerings and has become a significant player in the Chinese financial services sector. The company is publicly traded and has a diverse ownership structure, which includes state-owned enterprises and institutional investors. The management team comprises seasoned professionals with extensive experience in finance and investment, contributing to the company's operational effectiveness.

The transparency of Orient Securities is a critical aspect of its credibility. The firm has made efforts to disclose relevant information to its clients, including details about its services, fees, and regulatory compliance. However, the level of detail provided can vary, and some reports suggest that there may be gaps in information disclosure, particularly regarding specific account types and associated benefits.

Trading Conditions Analysis

When evaluating whether Orient Securities is safe, the trading conditions it offers play a pivotal role. The firm's fee structure is diverse, covering various investment types. However, some traders have reported concerns regarding high commission rates and unusual fees that may not be standard in the industry. Below is a comparison of key trading costs:

| Fee Type | Orient Securities | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Variable | 1-2 pips |

| Commission Model | Tiered | Flat or Tiered |

| Overnight Interest Range | 0.5% - 1.5% | 0.5% - 1% |

The overall trading conditions at Orient Securities suggest a competitive environment, but potential clients should be aware of the specific fee structures that may apply to their trading activities. The presence of tiered commissions indicates that costs could escalate based on trading volume or account type, which may not be favorable for all traders.

Customer Funds Security

The safety of customer funds is of utmost importance when assessing the credibility of a broker. Orient Securities has implemented several measures to ensure the security of client funds, including segregated accounts that separate client deposits from the company's operating funds. This practice is crucial in mitigating the risk of misappropriation. Additionally, the firm adheres to strict regulatory standards that mandate the use of tier-1 banks for holding client funds, further enhancing security.

Despite these measures, there have been historical concerns regarding fund withdrawal processes, with some clients reporting difficulties in accessing their funds. These issues raise questions about the effectiveness of the firm's operational protocols and highlight the importance of understanding a broker's policies regarding fund withdrawals and security measures.

Customer Experience and Complaints

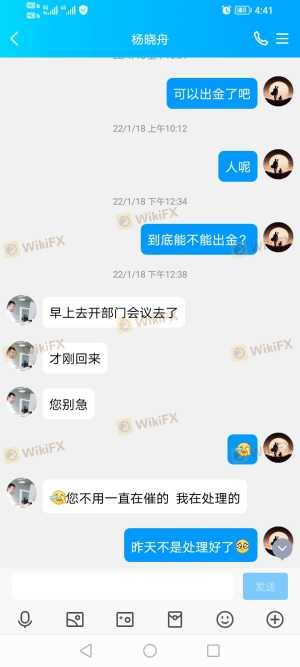

Customer feedback is a vital indicator of a broker's reliability. Reviews of Orient Securities reveal a mixed bag of experiences. While some clients praise the firm's trading platform and customer service, others have voiced concerns about withdrawal difficulties and communication issues. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Communication Delays | Medium | Average Response |

| Platform Stability | Low | Prompt Response |

Several typical cases highlight these complaints, with clients expressing frustration over their inability to withdraw funds despite meeting all necessary requirements. Such experiences can significantly impact a trader's perception of safety and reliability, suggesting the need for potential clients to approach Orient Securities with caution.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for a seamless trading experience. Orient Securities offers various platforms, but user feedback indicates that the execution quality may vary. Traders have reported instances of slippage and order rejections, which can adversely affect trading outcomes. The platform's stability is generally rated positively, but concerns about execution quality and potential manipulation have been raised.

Risk Assessment

Evaluating the risks associated with trading through Orient Securities is essential for informed decision-making. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Subject to regulatory scrutiny |

| Fund Withdrawal | High | Historical issues with fund access |

| Platform Reliability | Medium | Occasional reports of execution issues |

To mitigate these risks, traders are advised to thoroughly research the broker's policies, maintain clear communication with customer service, and consider starting with a demo account to familiarize themselves with the platform before committing significant capital.

Conclusion and Recommendations

In conclusion, while Orient Securities is a regulated entity with a long-standing presence in the market, there are several factors that warrant caution. The companys regulatory status is verified, and it has made strides in ensuring the security of client funds. However, the historical issues related to fund withdrawals and mixed customer feedback raise concerns about its overall reliability.

For traders considering whether to engage with Orient Securities, it is crucial to weigh the potential risks against the benefits. Those who prioritize regulatory oversight and fund safety may find some comfort in the firm's credentials, but it is advisable to proceed with caution, especially if withdrawal flexibility is a priority.

For those seeking alternatives, consider brokers with a strong regulatory framework and positive customer feedback, such as those regulated by top-tier authorities like the FCA or ASIC. Ultimately, the decision should align with individual trading goals, risk tolerance, and the need for a reliable trading partner.

In summary, is Orient Securities safe? The answer is nuanced; while it operates within a regulated framework, potential clients should be aware of the issues highlighted in this analysis and proceed with due diligence.

Is ORIENT SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of ORIENT SECURITIES brokers.

ORIENT SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ORIENT SECURITIES latest industry rating score is 7.91, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.91 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.