Is AKFX safe?

Pros

Cons

Is Akfx Safe or Scam?

Introduction

Akfx is a forex broker that positions itself as a player in the online trading market, offering a range of financial instruments including forex, commodities, and indices. Established in Malta, Akfx aims to attract both retail and institutional clients with its trading services. However, as the forex market continues to grow, so does the need for traders to exercise caution when selecting a broker. Unscrupulous entities can take advantage of inexperienced traders, making it essential to thoroughly assess a broker's legitimacy before committing funds. This article investigates the safety and reliability of Akfx, utilizing a combination of regulatory assessments, company background checks, trading conditions analysis, and customer feedback to arrive at a well-rounded conclusion.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Akfx claims to be regulated by the Malta Financial Services Authority (MFSA), which is known for its stringent standards. However, there are reports indicating that Akfx is marked as a "suspicious clone," raising concerns about its regulatory claims.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Malta Financial Services Authority (MFSA) | C 60473 | Malta | Suspicious Clone |

The MFSA is generally regarded as a reputable regulatory body, but the designation of Akfx as a "suspicious clone" suggests that there may be discrepancies in its licensing or operational practices. This classification highlights the importance of verifying the authenticity of a broker's regulatory claims, as a lack of valid regulation can expose traders to significant risks. Furthermore, the absence of a robust regulatory framework raises questions about Akfx's adherence to compliance standards and its historical record concerning regulatory issues.

Company Background Investigation

Akfx Financial Services Ltd. was founded in 2005 in Malta, and it has since aimed to establish itself in the competitive forex market. The ownership structure and management team play a crucial role in the company's operations. However, there is limited publicly available information about the key personnel and their qualifications. The lack of transparency regarding the management team can be a red flag for potential clients, as it raises questions about the broker's accountability and governance.

Moreover, the company's history is not without controversy. While it claims to offer a secure trading environment, the designation of Akfx as a "suspicious clone" suggests that it may not have the best track record. This lack of clarity regarding the company's operational history and ownership structure can deter potential traders who prioritize transparency and trustworthiness in their broker selection.

Trading Conditions Analysis

The trading conditions offered by Akfx are a crucial aspect of its appeal to traders. The broker provides various account types, each with different minimum deposit requirements and trading costs. However, the overall fee structure raises some concerns.

| Fee Type | Akfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.2 pips | From 1.0 pips |

| Commission Model | No commission | Varies by broker |

| Overnight Interest Range | Variable | Variable |

While Akfx does not charge commissions, the spreads can be higher than the industry average, particularly for standard accounts. Additionally, the variability in overnight interest rates may lead to unexpected costs for traders who hold positions overnight. This fee structure could be seen as a disadvantage for traders seeking low-cost trading options. Overall, while Akfx offers some competitive features, the potential for higher trading costs may deter cost-conscious traders.

Customer Funds Security

The safety of client funds is paramount in the forex trading environment. Akfx claims to implement several measures to protect client deposits, including segregated accounts and adherence to anti-money laundering (AML) regulations. Segregating client funds means that they are kept separate from the broker's operational funds, reducing the risk of loss in the event of bankruptcy.

However, the designation of Akfx as a "suspicious clone" raises concerns about the effectiveness of these safety measures. If the broker is indeed operating without valid regulation, the protections typically afforded by regulatory bodies may not be applicable. Additionally, there have been no documented incidents of fund security breaches; however, the lack of transparency surrounding the broker's financial practices can leave traders feeling vulnerable.

Customer Experience and Complaints

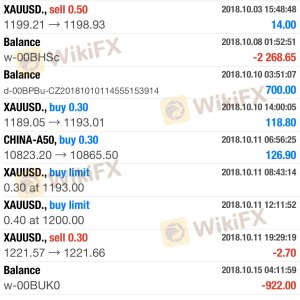

Customer feedback is an essential component in assessing the reliability of any broker. Reviews of Akfx reveal a mixed bag of experiences, with some traders praising the platform's features while others report issues with withdrawals and customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Support | Medium | Limited availability |

| Account Management | Medium | Varying quality |

Common complaints include difficulties in withdrawing funds and slow response times from customer support. These issues can significantly impact the trading experience, leading to frustration and a lack of trust in the broker. Traders have reported that Akfx's customer service is not as responsive as they would like, particularly when urgent issues arise. This lack of effective communication can exacerbate concerns regarding the broker's reliability.

Platform and Trade Execution

The trading platform offered by Akfx is primarily MetaTrader 4 (MT4), a widely used platform known for its user-friendly interface and comprehensive trading tools. However, the performance of the platform, including order execution quality and slippage rates, remains a critical factor for traders.

Traders have reported varying experiences with order execution, with some experiencing slippage during volatile market conditions. While slippage is common in forex trading, excessive slippage or frequent rejections of orders can indicate underlying issues with the broker's execution capabilities. If traders frequently encounter these problems, it may signal that Akfx is not providing the level of service expected from a reputable broker.

Risk Assessment

Using Akfx carries certain risks that potential traders should be aware of. The combination of regulatory concerns, customer complaints, and trading conditions can create a challenging environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation raises concerns. |

| Financial Risk | Medium | Variable spreads and fees can impact profitability. |

| Operational Risk | Medium | Customer support issues may hinder trading experience. |

To mitigate these risks, traders should conduct thorough research before engaging with Akfx. It may also be prudent to start with a demo account or a small deposit to evaluate the broker's performance before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that Akfx raises several red flags that warrant caution. While it offers a range of trading instruments and competitive features, its designation as a "suspicious clone" and concerns regarding regulatory compliance cast doubt on its legitimacy.

Traders should be particularly wary of the higher-than-average trading costs and reported issues with withdrawals and customer support. For those considering trading with Akfx, it may be advisable to seek alternative brokers that are well-regulated and have established reputations for reliability.

For traders seeking safer options, consider brokers regulated by tier-1 authorities, such as the FCA or ASIC, which offer enhanced protections and more transparent operations. Always prioritize due diligence and ensure that your chosen broker meets your trading needs and risk tolerance before committing funds.

Ultimately, the question "Is Akfx safe?" leans towards a cautious "no," and potential traders should proceed with extreme caution or explore more reputable alternatives.

Is AKFX a scam, or is it legit?

The latest exposure and evaluation content of AKFX brokers.

AKFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AKFX latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.