de riva 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive de riva review evaluates a Hong Kong-based derivatives broker. The company specializes in providing equity derivatives brokerage services to professional investors. De Riva Asia Limited operates under the supervision of the Securities and Futures Commission of Hong Kong. The company holds licenses for dealing in securities and dealing in futures contracts regulated activities. Since March 2020, the company has also become a trading participant of the stock options exchange. This expansion broadened its service offerings within the derivatives market.

The broker positions itself specifically for professional investors. It notably does not provide margin financing services, which distinguishes it from many traditional retail brokers. As an interdealer broker, de riva focuses on facilitating transactions between institutional clients rather than serving the retail trading community. This de riva review reveals a mixed picture. Regulatory compliance stands as a strength, but significant information gaps regarding trading conditions and user feedback raise questions about transparency and overall service quality.

Important Disclaimers

This de riva review is based on publicly available information and regulatory disclosures. As de riva operates under Hong Kong's Securities and Futures Commission regulation, trading conditions, legal protections, and operational procedures may differ significantly from brokers in other jurisdictions. The company's focus on professional investors means that retail traders may find limited relevant information or may not qualify for services.

Our evaluation methodology relies on official regulatory data, company disclosures, and available user feedback. However, the limited public information about trading conditions, fees, and user experiences creates inherent limitations in this assessment. Potential clients should conduct independent due diligence and verify current terms directly with the broker.

Rating Framework

Broker Overview

De riva operates as a specialized derivatives broker headquartered in Hong Kong. The company focuses exclusively on serving professional investors through its wholly-owned subsidiary, De Riva Asia Limited. The company's business model centers on equity derivatives brokerage services without providing margin financing. This approach positions it as a more conservative player in the derivatives market. This approach suggests a focus on institutional-grade services rather than leveraged retail trading products.

The broker's regulatory framework is anchored by its licensing under Hong Kong's Securities and Futures Ordinance. The company has authorization to conduct dealing in securities and dealing in futures contracts regulated activities. Since March 2020, de riva has expanded its market access by becoming a trading participant of the stock options exchange. This expansion indicates growth in its derivatives trading capabilities. The company operates as an interdealer broker, which means it primarily facilitates transactions between professional market participants rather than serving individual retail clients. This de riva review suggests that the broker's target market is quite specific and may not be suitable for typical retail forex or CFD traders.

Regulatory Jurisdiction: De riva operates under the regulatory oversight of the Securities and Futures Commission of Hong Kong. The company holds the necessary licenses for securities and futures dealing activities.

Deposit and Withdrawal Methods: Specific information about funding methods is not detailed in available public materials. This may reflect the broker's focus on institutional clients who typically use specialized banking arrangements.

Minimum Deposit Requirements: Minimum deposit information is not publicly disclosed. This is likely due to the customized nature of professional investor accounts.

Bonuses and Promotions: No promotional offers or bonus structures are mentioned in available documentation. This is consistent with institutional-focused business models.

Tradeable Assets: The broker specializes in securities and futures contracts. The company has particular emphasis on equity derivatives and stock options since becoming an exchange participant in 2020.

Cost Structure: Detailed fee schedules, spreads, and commission structures are not publicly available. This may indicate bespoke pricing arrangements for professional clients.

Leverage Ratios: Leverage information is not specified in public materials. However, the absence of margin financing services suggests a more conservative approach to leverage.

Platform Options: Specific trading platform details are not disclosed in available information. This may reflect the use of institutional-grade systems not typically marketed to retail clients.

Geographic Restrictions: Service availability appears focused on professional investors. However, specific geographic limitations are not detailed in public materials.

Customer Service Languages: Language support information is not specified in available documentation.

This de riva review highlights significant information gaps that potential clients would need to address through direct contact with the broker.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions evaluation for de riva reveals significant transparency challenges that impact the overall assessment. Unlike retail-focused brokers that typically provide comprehensive information about account types, minimum deposits, and trading conditions, de riva's institutional focus means that much of this information is not publicly available. This lack of transparency, while potentially normal for institutional brokers, creates difficulties for potential clients seeking to understand basic account requirements.

The absence of publicly available information about account opening procedures, minimum deposit requirements, and account tier structures suggests that these matters are handled on a case-by-case basis with professional investors. While this approach may offer customization benefits for qualified clients, it lacks the standardization and transparency that many traders expect. The broker's emphasis on serving professional investors without margin financing services indicates a conservative approach, but the specific terms and conditions remain unclear.

User feedback, where available, has indicated some dissatisfaction with account-related matters. However, specific details are limited. The lack of clear information about account types, such as whether Islamic accounts or other specialized arrangements are available, further complicates the assessment. This de riva review finds that the opacity surrounding account conditions significantly impacts the broker's accessibility and appeal to potential clients who require clear, upfront information about trading terms.

De riva's tools and resources offering receives a moderate rating based on its specialization in equity derivatives and stock options trading. The broker's status as a Hong Kong Futures Exchange participant and stock options exchange trading participant since March 2020 indicates access to institutional-grade trading infrastructure. However, the specific details about trading tools, analytical resources, and platform capabilities are not readily available in public documentation.

The company's focus on providing liquidity and price discovery services suggests sophisticated backend systems designed for professional market participants. However, the absence of detailed information about research resources, market analysis tools, or educational materials limits the assessment of the broker's comprehensive offering. Unlike retail brokers that typically showcase their platform features and analytical tools, de riva's institutional focus means these resources may be provided through specialized channels not publicly marketed.

User feedback regarding tools and resources is limited. This makes it difficult to assess the practical quality and effectiveness of the broker's technological offerings. The lack of information about automated trading support, API access, or third-party platform integration further complicates the evaluation. This de riva review suggests that while the broker likely provides professional-grade tools appropriate for its target market, the lack of transparency about these offerings limits its appeal to traders seeking detailed information before engagement.

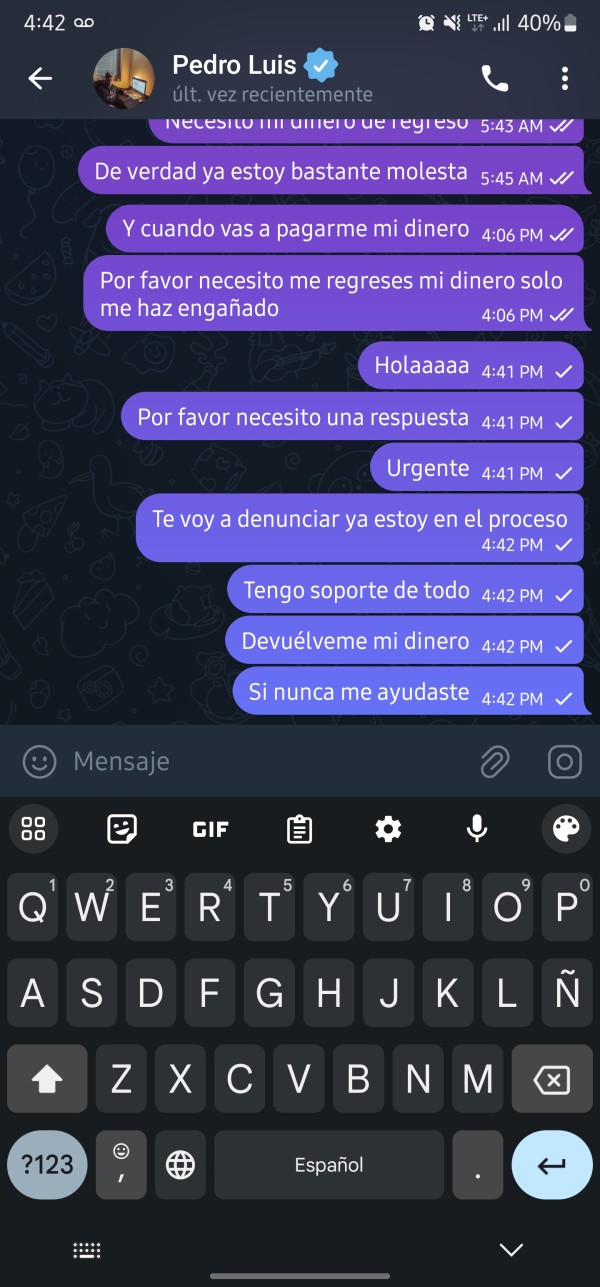

Customer Service and Support Analysis (4/10)

The customer service evaluation for de riva is constrained by limited available information about support channels, response times, and service quality metrics. Available user feedback indicates some negative experiences with customer support, though the specific nature and scope of these issues are not well-documented. The broker's institutional focus may mean that customer service operates differently from retail-oriented firms, potentially with dedicated relationship managers rather than general support channels.

The absence of publicly available information about customer service hours, available communication channels, or multilingual support capabilities raises questions about accessibility for potential clients. While institutional brokers often provide high-touch service to their qualified clients, the lack of transparency about service standards and availability creates uncertainty for prospective users.

Negative user feedback, where documented, suggests that some clients have experienced difficulties with support responsiveness or issue resolution. However, the limited sample size and lack of detailed case studies make it difficult to assess whether these represent systemic issues or isolated incidents. The broker's focus on professional investors may mean that service expectations and delivery methods differ significantly from retail trading environments, but the lack of clear information about service standards impacts the overall assessment.

Trading Experience Analysis (5/10)

The trading experience assessment for de riva is challenged by the lack of detailed information about platform performance, execution quality, and overall trading environment. As an interdealer broker focusing on professional investors, the trading experience likely differs significantly from retail trading platforms, but specific performance metrics and user experience data are not readily available.

User feedback suggests some concerns about trading experience quality. However, the specific nature of these issues is not well-documented. The broker's role as a Hong Kong Futures Exchange participant and stock options exchange trading participant indicates access to institutional-grade execution venues. This should theoretically provide quality execution for derivatives trading.

The absence of information about platform stability, execution speeds, order types, or mobile trading capabilities limits the ability to provide a comprehensive assessment. Unlike retail brokers that typically provide detailed platform demonstrations and performance statistics, de riva's institutional approach means this information may only be available to qualified prospects through direct engagement.

The lack of transparency about trading conditions, including typical execution quality and platform reliability, impacts the overall assessment. This de riva review finds that while the broker's institutional infrastructure may provide adequate trading experiences for professional clients, the lack of publicly available performance data and mixed user feedback suggests room for improvement in transparency and communication about trading quality.

Trust and Reliability Analysis (6/10)

De riva's trust and reliability assessment benefits significantly from its regulatory status under the Hong Kong Securities and Futures Commission. This provides a solid foundation for operational credibility. The SFC is recognized as a reputable financial regulator, and the broker's licensing for dealing in securities and dealing in futures contracts activities demonstrates compliance with established regulatory standards.

The company's status as a Hong Kong Futures Exchange participant and stock options exchange trading participant since March 2020 further reinforces its standing within the institutional trading community. These exchange relationships require meeting specific operational and financial standards. This supports the broker's credibility within its target market.

However, the assessment is limited by the lack of detailed information about client fund protection measures, segregation policies, and other safety protocols that are typically highlighted by retail-focused brokers. While institutional brokers may have different approaches to client protection, the absence of publicly available information about these safeguards creates some uncertainty.

User feedback includes some concerns about trust-related matters. However, the specific nature and validity of these concerns require further investigation. The broker's conservative approach of not providing margin financing services may actually enhance its reliability profile by reducing operational risk, but this potential advantage is not well-communicated to potential clients.

User Experience Analysis (4/10)

The user experience evaluation for de riva is significantly impacted by limited user feedback and the absence of detailed information about interface design, registration processes, and overall client journey. Available user feedback indicates some negative experiences, though the sample size and specific details are limited, making it difficult to assess whether these represent broader systemic issues.

The broker's institutional focus means that user experience expectations and delivery methods likely differ from retail trading environments. Professional investors may prioritize different aspects of service delivery, such as relationship management and customized solutions, over standardized user interfaces and self-service capabilities.

The lack of publicly available information about the registration and verification process, user interface design, and client onboarding procedures suggests that these matters are handled through direct client engagement rather than standardized online processes. While this approach may provide personalization benefits for qualified clients, it lacks the transparency and accessibility that many modern traders expect.

Common user complaints, where documented, appear to relate to communication and transparency issues rather than specific technical problems. The absence of detailed user satisfaction metrics or comprehensive feedback analysis limits the ability to provide definitive conclusions about overall user experience quality. This assessment suggests that de riva may need to improve its communication and transparency practices to better serve both current and prospective clients.

Conclusion

This de riva review reveals a broker with solid regulatory foundations but significant transparency challenges that impact its overall assessment. While de riva's licensing under the Hong Kong Securities and Futures Commission and its status as an exchange participant provide credibility within the institutional derivatives market, the lack of publicly available information about trading conditions, fees, and service standards creates barriers for potential clients seeking to evaluate the broker's offerings.

The broker appears most suitable for professional investors and institutional clients who can engage directly with the company to obtain detailed information about services and conditions. Retail traders or those seeking transparent, standardized trading conditions may find de riva's approach less accessible than traditional retail-focused brokers.

The main advantages include regulatory compliance and institutional-grade market access. The primary disadvantages center on limited transparency and mixed user feedback. Potential clients should conduct thorough due diligence and direct engagement with the broker to obtain the detailed information necessary for informed decision-making.