UITFX 2025 Review: Everything You Need to Know

Executive Summary

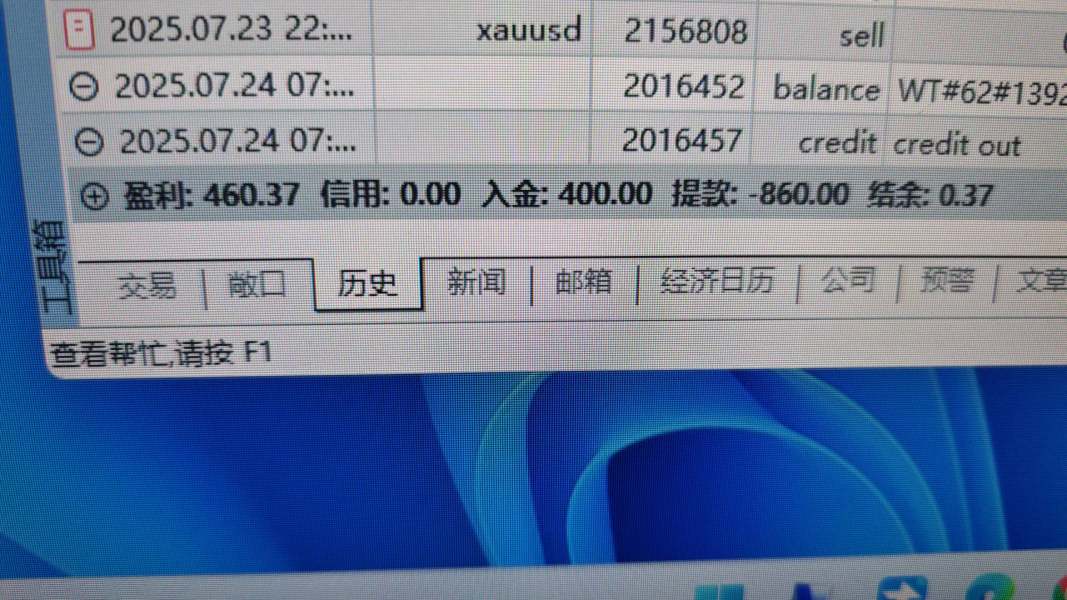

UITFX is an unregulated Hong Kong-registered forex broker. It has gained significant controversy regarding its legitimacy and credibility. According to multiple review platforms, this uitfx review reveals concerning patterns in user feedback and operational transparency. The broker offers high leverage up to 1:500. It claims to provide ECN MICRO accounts with spreads starting from 1.5 pips. However, the lack of regulatory oversight raises serious questions about trader protection and fund security.

The platform primarily targets experienced traders seeking high-leverage trading strategies. But the overall user rating of 1/5 stars across various review platforms suggests significant operational issues. UITFX operates through MT5 trading platform and offers multiple asset classes including forex, commodities, and cryptocurrencies. Despite these offerings, the absence of proper regulatory framework and negative user experiences make this broker a high-risk choice for potential traders.

Important Notice

UITFX operates as an offshore broker without proper regulatory oversight. This significantly increases the risk for traders. As an unregistered entity in major financial jurisdictions, users should exercise extreme caution when considering this platform. This review is based on publicly available information and user feedback from various sources. It aims to provide a comprehensive analysis of the broker's services and reputation. The information presented here reflects the current state of available data and should not be considered as investment advice.

Rating Framework

Broker Overview

UITFX was established in 2021 as a Hong Kong-registered online trading broker. It positioned itself in the competitive forex and CFD trading market. The company operates through computer software in network environments. It facilitates trades across multiple asset classes. Despite its relatively recent establishment, the broker has attracted attention primarily due to concerns about its operational legitimacy and regulatory status. The company claims to serve international clients but lacks the regulatory framework that would provide standard trader protections.

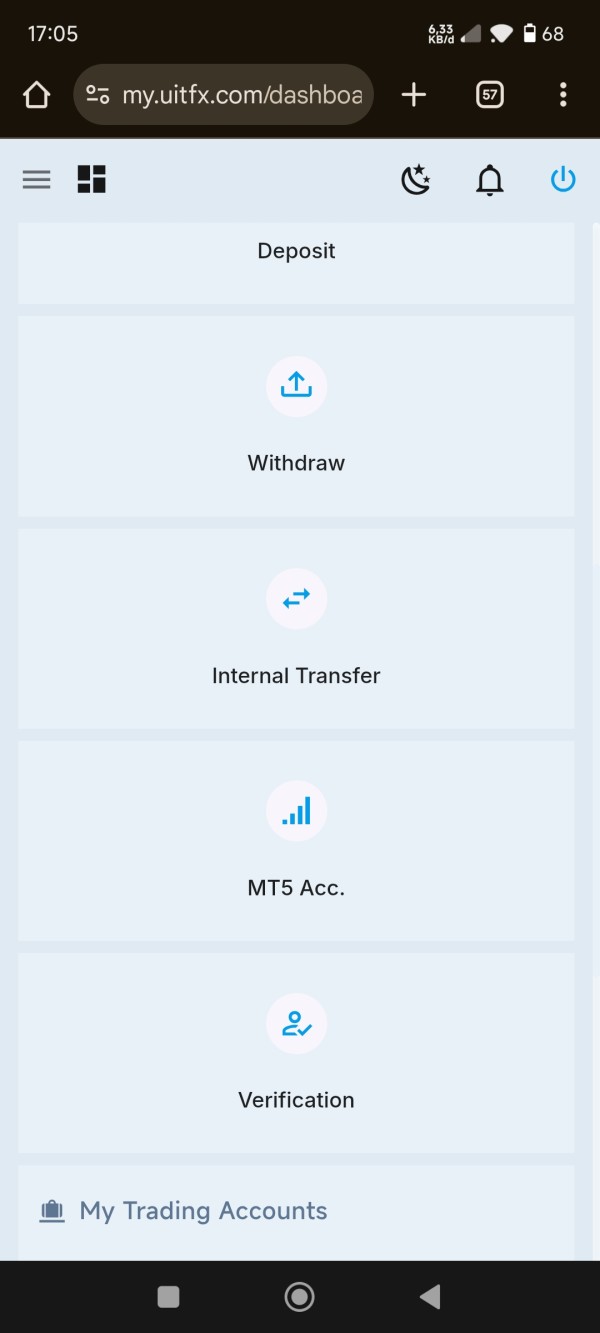

The broker's business model centers around providing access to global financial markets through the popular MetaTrader 5 platform. UITFX offers trading in forex pairs, precious metals, commodities, indices, stocks, and cryptocurrencies. It attempts to cater to diverse trading preferences. However, the absence of proper licensing from recognized financial authorities has raised significant red flags among industry observers and potential clients. The platform's operational transparency remains questionable. Limited information is available about its corporate structure and financial backing.

Regulatory Status: UITFX is registered in Hong Kong but operates without proper regulatory oversight from major financial authorities. This unregulated status poses significant risks for traders.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not clearly disclosed in available materials. This raises transparency concerns.

Minimum Deposit Requirements: The minimum deposit requirements are not specified in available documentation. This is unusual for established brokers.

Bonuses and Promotions: No specific bonus or promotional offers are mentioned in the available information.

Tradeable Assets: The platform offers forex pairs, metals, commodities, indices, stocks, and cryptocurrencies. It provides a relatively diverse trading portfolio.

Cost Structure: ECN MICRO accounts reportedly offer spreads up to 1.5 pips. Commission information remains undisclosed.

Leverage Ratios: Maximum leverage of up to 1:500 is available. This is relatively high compared to regulated brokers.

Platform Options: UITFX provides the MetaTrader 5 trading platform for client trading activities.

Regional Restrictions: Specific regional restrictions are not detailed in available materials.

Customer Support Languages: Information about supported languages for customer service is not specified.

This uitfx review highlights significant gaps in publicly available information. This is concerning for potential traders seeking transparency.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

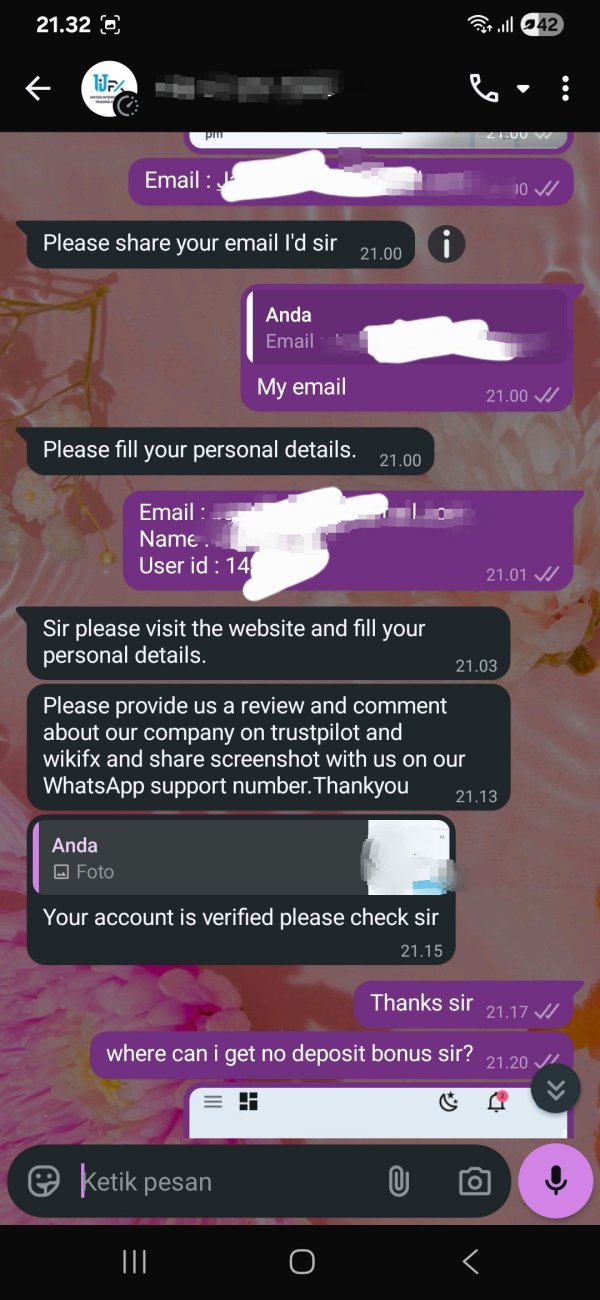

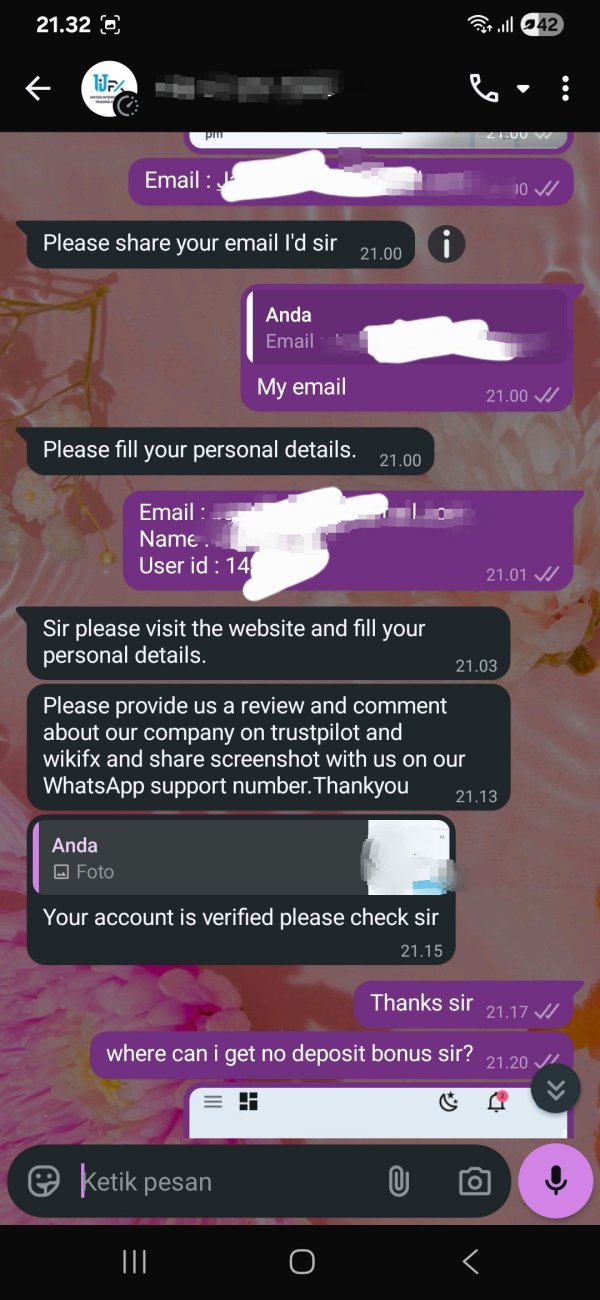

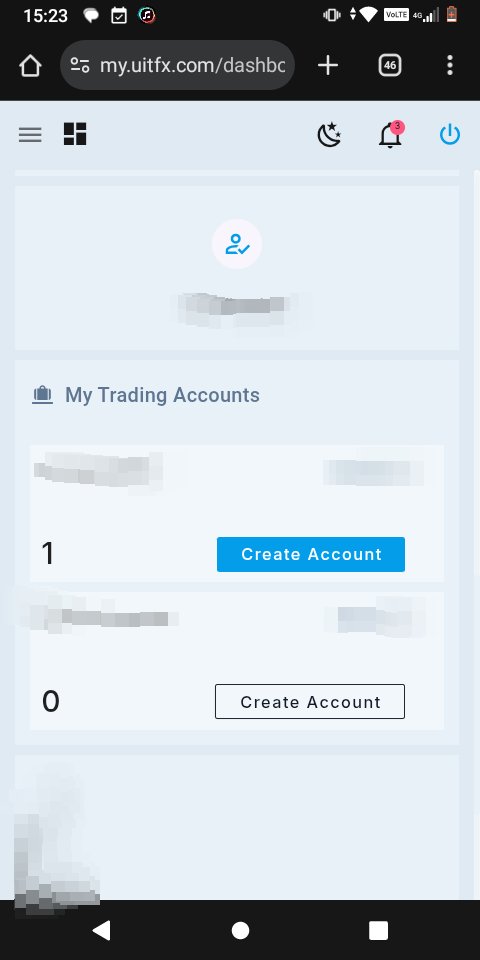

UITFX's account conditions present several concerning aspects that contribute to its below-average rating. The broker fails to provide clear information about specific account types, minimum deposit requirements, or detailed fee structures. This lack of transparency is particularly troubling for potential traders who need comprehensive information to make informed decisions. According to user feedback, the account opening process lacks the clarity and professionalism expected from legitimate brokers.

The absence of detailed account specifications makes it difficult for traders to understand what they're signing up for. Unlike regulated brokers that must disclose comprehensive terms and conditions, UITFX's opaque approach to account information raises significant red flags. Users have reported confusion about account features and limitations. This suggests that the broker's communication about account conditions is inadequate.

Furthermore, the lack of information about special account types, such as Islamic accounts or professional trader accounts, indicates limited service customization. This uitfx review reveals that the broker's account conditions fall significantly short of industry standards. This is particularly true when compared to properly regulated competitors who provide detailed and transparent account information.

UITFX offers a reasonable selection of trading tools and resources. It earns an average rating in this category. The broker provides access to multiple asset classes including forex, commodities, and cryptocurrencies. This gives traders diverse opportunities. The MetaTrader 5 platform serves as the primary trading interface. It offers standard charting tools and technical indicators that most traders expect.

However, the quality and depth of research and analysis resources remain unclear from available information. While the platform supports various trading instruments, there's limited evidence of comprehensive market analysis, economic calendars, or educational materials that would enhance the trading experience. User feedback suggests that while basic trading tools are available, the overall resource package lacks the sophistication found in established brokers.

The automated trading support through MT5 provides some value for algorithmic traders. Specific details about expert advisor functionality and restrictions are not well documented. The broker's tool offering appears functional but basic. It lacks the advanced features or proprietary tools that distinguish leading brokers in the market.

Customer Service and Support Analysis (3/10)

Customer service represents one of UITFX's weakest areas. It earns a poor rating based on user feedback and available information. Multiple user reviews indicate significant issues with response times and service quality. The lack of clearly defined customer support channels and operating hours adds to the overall poor customer service experience.

Users have reported difficulties in reaching support representatives and receiving satisfactory resolutions to their queries. The absence of comprehensive contact information, including phone numbers, email addresses, and live chat availability, suggests limited commitment to customer support. This is particularly concerning for traders who may need urgent assistance with their accounts or trading issues.

The multilingual support capabilities are not clearly specified. This could be problematic for international clients. Professional brokers typically provide 24/5 support with multiple communication channels, but UITFX appears to fall short of these industry standards. The poor customer service rating significantly impacts the overall user experience and raises questions about the broker's commitment to client satisfaction.

Trading Experience Analysis (5/10)

The trading experience with UITFX receives an average rating. This is primarily due to the MetaTrader 5 platform's inherent functionality. Users report that the platform's stability is acceptable, though not exceptional. The MT5 platform provides standard charting capabilities and technical analysis tools that most traders require for market analysis and order execution.

However, specific information about order execution quality, including slippage rates and requote frequency, is not readily available. This lack of transparency about execution performance makes it difficult for traders to assess the true quality of the trading environment. Some users have reported satisfactory experiences with trade execution. Others have expressed concerns about platform reliability during volatile market conditions.

The mobile trading experience and platform customization options are not well documented. This is increasingly important for modern traders. The absence of detailed performance metrics and execution statistics that reputable brokers typically provide further diminishes confidence in the trading environment. While the basic trading functionality appears adequate, the overall experience lacks the polish and reliability expected from established brokers.

Trust and Security Analysis (2/10)

Trust and security represent UITFX's most significant weakness. It earns a very poor rating due to fundamental regulatory and transparency issues. The broker's unregulated status poses substantial risks for trader funds and legal recourse. Without proper licensing from recognized financial authorities, traders have limited protection and legal remedies in case of disputes or operational failures.

The lack of information about fund security measures, segregated accounts, and investor compensation schemes is deeply concerning. Established brokers typically maintain client funds in segregated accounts and provide detailed information about fund protection measures. UITFX's failure to address these critical security aspects raises serious questions about fund safety.

Company transparency remains poor. Limited information is available about corporate structure, financial backing, and operational history. The absence of audited financial statements, regulatory filings, and third-party security certifications further undermines trust. User feedback consistently highlights concerns about the broker's legitimacy and fund security, making this a high-risk choice for potential traders.

User Experience Analysis (3/10)

Overall user experience with UITFX receives a poor rating. This is primarily driven by the consistently low user satisfaction scores of 1/5 across multiple review platforms. This rating reflects widespread dissatisfaction with various aspects of the broker's services, from account management to customer support and platform functionality.

The registration and verification process lacks the streamlined efficiency that users expect from modern brokers. User feedback suggests confusion and frustration with account setup procedures and documentation requirements. The absence of clear guidance and support during the onboarding process contributes to negative first impressions.

Common user complaints center around transparency issues, poor customer service, and concerns about the broker's legitimacy. The lack of user-friendly features, such as comprehensive FAQ sections, educational resources, and intuitive account management tools, further diminishes the overall experience. This uitfx review indicates that significant improvements would be needed to meet basic user experience standards expected in the modern trading industry.

Conclusion

This comprehensive uitfx review reveals a broker with significant shortcomings that outweigh its limited advantages. While UITFX offers high leverage up to 1:500 and access to diverse trading assets, the fundamental lack of regulatory oversight and poor user feedback make it a questionable choice for most traders. The broker may only be suitable for highly experienced traders who understand and accept the substantial risks associated with unregulated platforms.

The main advantages include competitive leverage ratios and access to multiple asset classes through the MT5 platform. However, these benefits are overshadowed by critical disadvantages including lack of regulatory protection, poor customer service quality, limited transparency, and consistently negative user reviews. The overall evaluation suggests that traders would be better served by choosing properly regulated alternatives that offer greater security and professional standards.