OEXN 2025 Review: Everything You Need to Know

Executive Summary

OEXN (Open Exchange Network) is an emerging forex and CFD broker that was established in 2022. It shows its position as a relatively new player in the competitive online trading landscape. This oexn review reveals that the company operates under dual regulatory oversight from the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission of Mauritius (FSC), which provides a foundation of regulatory credibility for the platform.

The broker stands out by offering spreads starting from 0 pips. It also provides access to a diverse range of trading instruments including forex pairs, stocks, precious metals, indices, commodities, energy products, options, and ETFs. This comprehensive asset selection positions OEXN as a potentially suitable choice for traders seeking portfolio diversification across multiple market segments.

The platform appears to target traders of various experience levels, particularly those who prioritize access to multiple asset classes and competitive pricing structures. However, our analysis reveals several areas where transparency could be improved, particularly regarding account conditions, minimum deposit requirements, and detailed cost structures beyond the advertised zero spreads.

Important Disclaimer

OEXN operates across multiple regulatory jurisdictions. This may result in different legal protections and service offerings depending on the client's geographical location and the specific OEXN entity they are dealing with. Traders should verify which regulatory framework applies to their account based on their residency and the entity providing services.

This review is based on publicly available information and market analysis as of 2025. It does not include user ratings or comprehensive feedback analysis due to the limited availability of verified customer reviews for this relatively new broker. Potential clients should conduct their own due diligence before making any trading decisions.

Rating Framework

Broker Overview

OEXN emerged in the forex and CFD trading space in 2022. It positions itself as a modern trading platform headquartered in Cyprus. The company operates under the full name Open Exchange Network and has structured its business model around providing comprehensive trading services across multiple asset classes. As a relatively new entrant to the market, OEXN appears to be focusing on establishing its presence through competitive pricing and regulatory compliance.

The broker's business model centers on providing CFD and forex trading services with an emphasis on tight spreads and diverse asset accessibility. According to available information, OEXN aims to serve both retail and potentially institutional clients, though specific details about account segregation and service tiers remain limited in publicly available documentation.

The platform operates under regulatory supervision from two key financial authorities: the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission of Mauritius (FSC). This dual regulatory approach suggests the company's intention to serve clients across different geographical regions while maintaining compliance with international financial standards. The broker offers access to forex pairs, individual stocks, precious metals including gold and silver, major global indices, various commodities, energy products, options contracts, and exchange-traded funds (ETFs), creating a comprehensive trading ecosystem for its clients.

Regulatory Jurisdictions: OEXN operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission of Mauritius (FSC). This provides dual-jurisdiction compliance that enhances regulatory credibility.

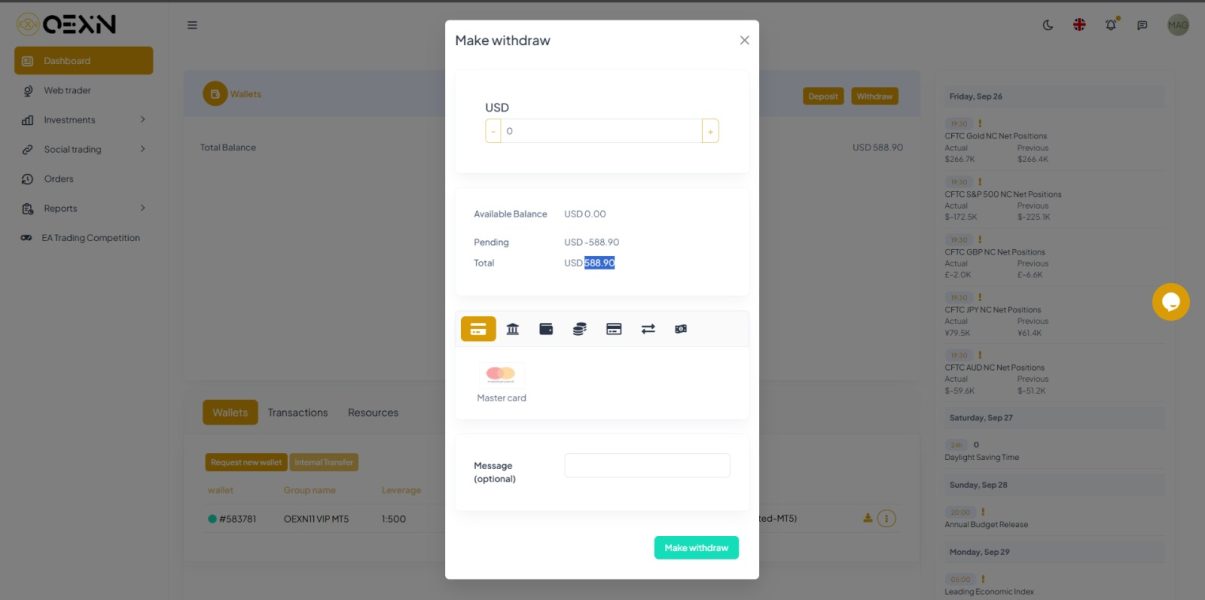

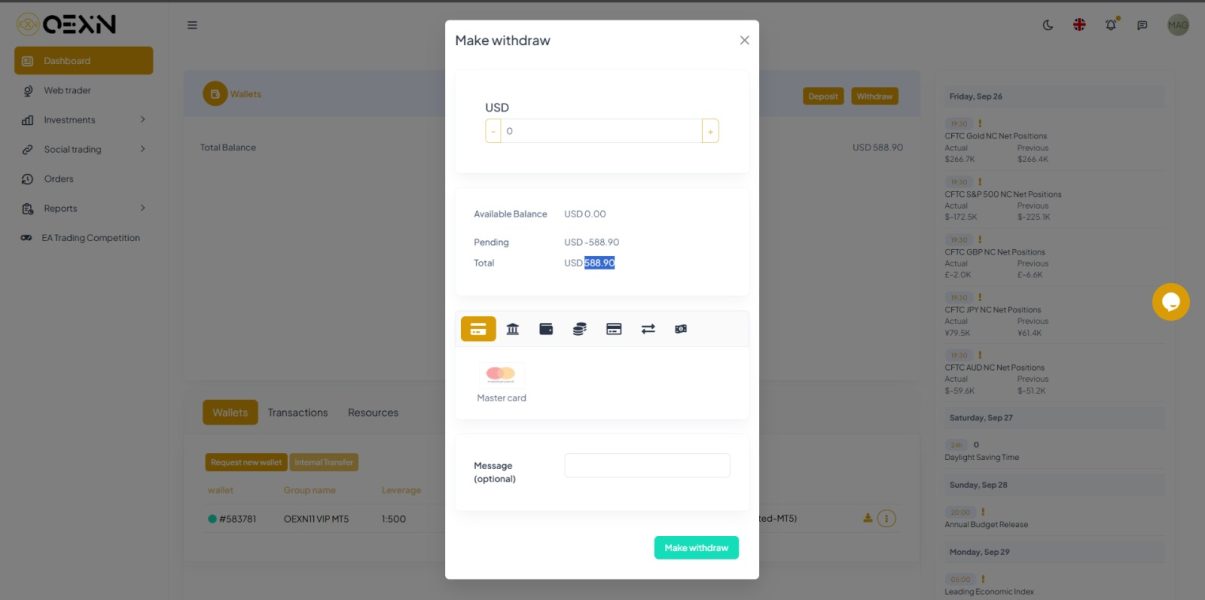

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available documentation. This represents a transparency gap that potential clients should inquire about directly.

Minimum Deposit Requirements: The minimum deposit requirements for different account types are not specified in available public information. This limits the ability to assess accessibility for various trader categories.

Bonus and Promotional Offers: Detailed information about welcome bonuses, promotional campaigns, or loyalty programs is not readily available in current documentation.

Tradeable Assets: The platform provides access to a comprehensive range of assets including forex currency pairs, individual stocks, precious metals, market indices, commodities, energy products, options, and ETFs. This offers substantial diversification opportunities.

Cost Structure: While OEXN advertises spreads starting from 0 pips, comprehensive information about commission structures, overnight financing costs, and other potential fees requires further clarification for complete cost transparency.

Leverage Ratios: Specific leverage ratios offered to different client categories and asset classes are not detailed in available public information.

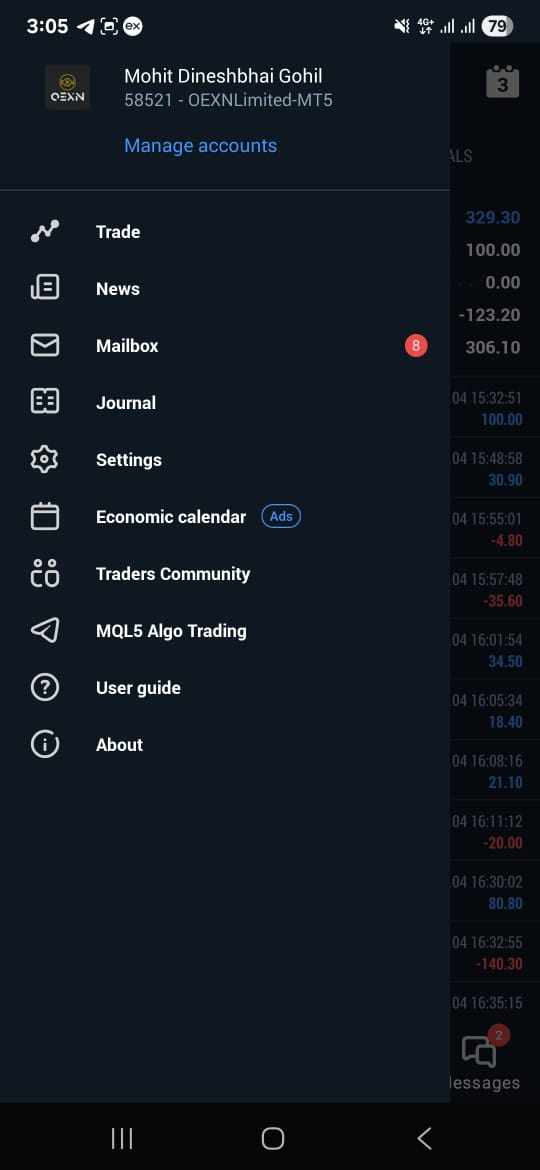

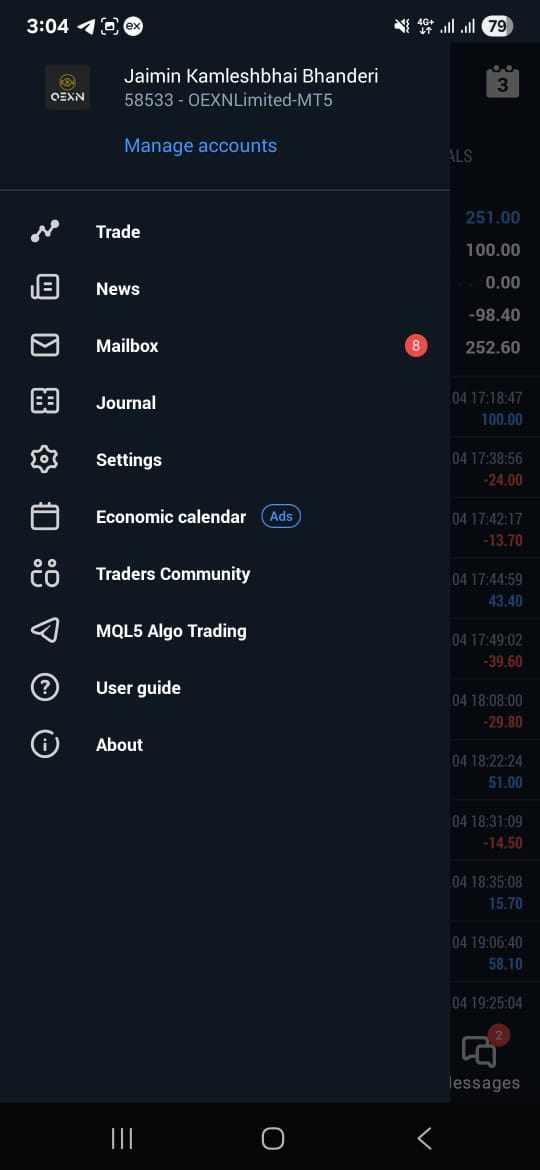

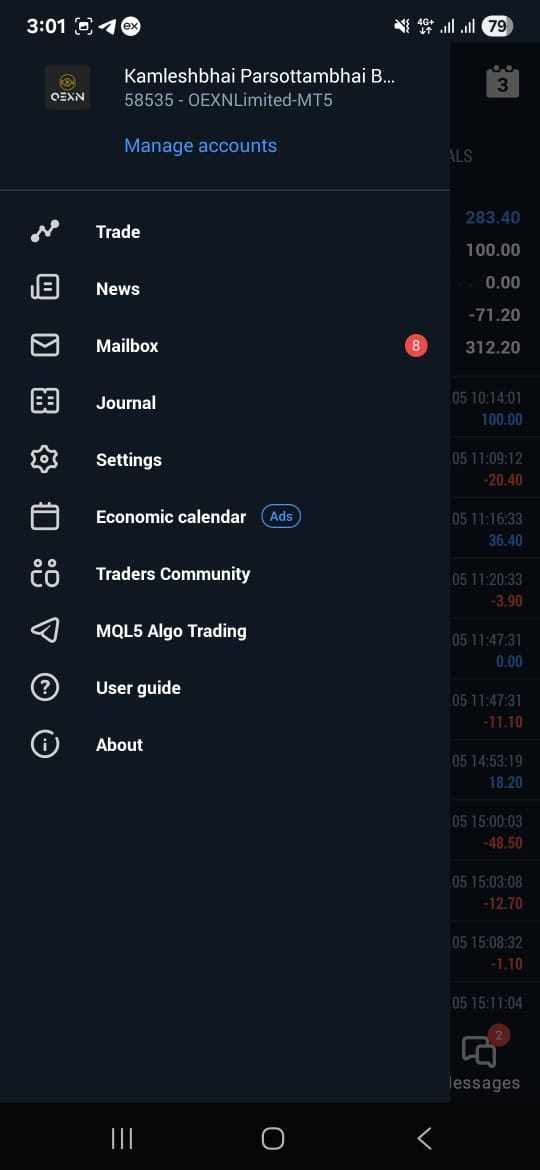

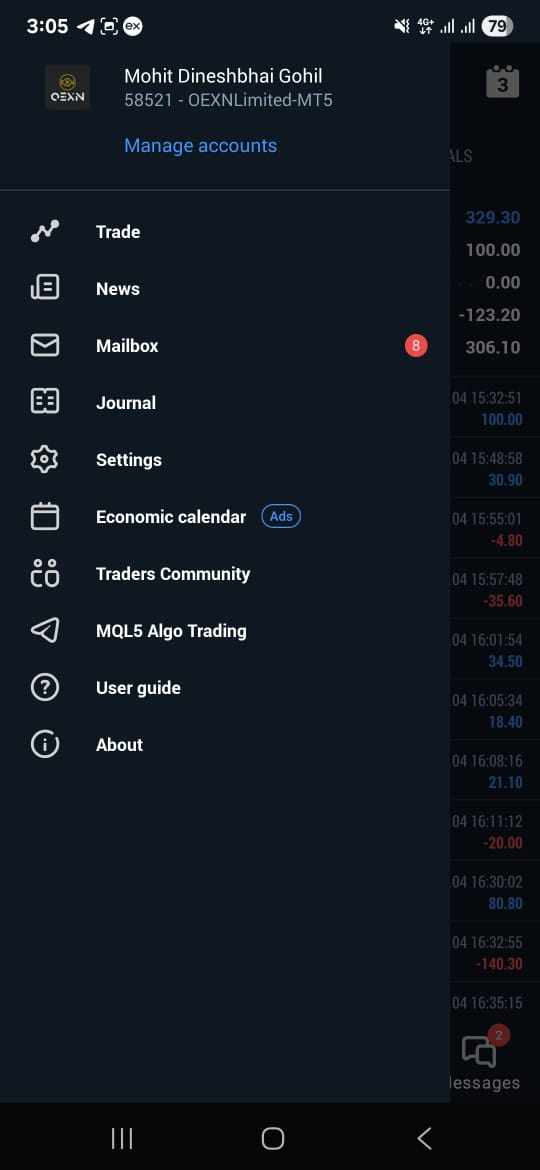

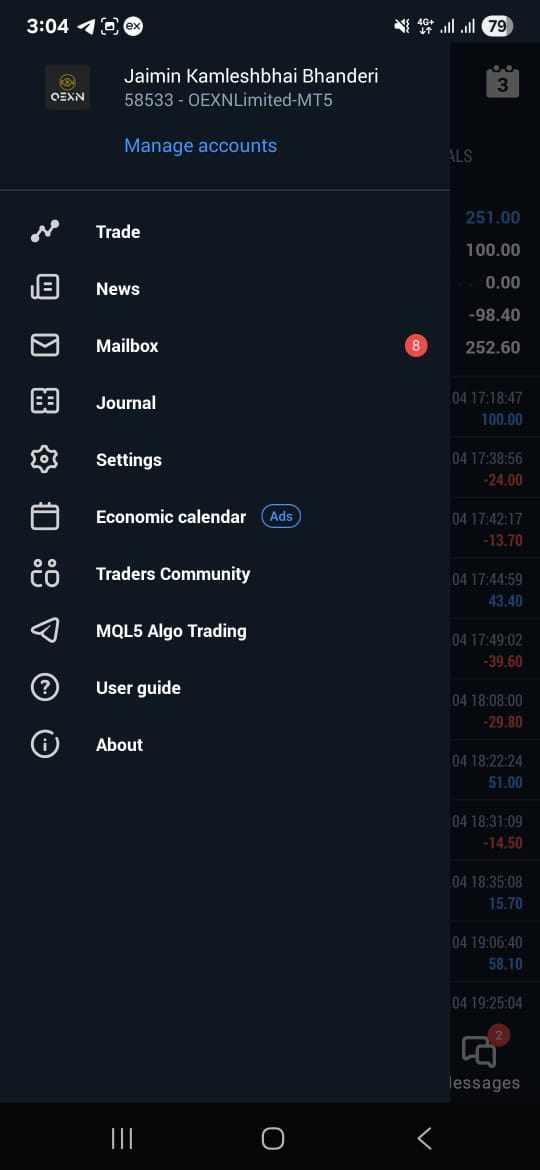

Platform Options: The specific trading platforms offered by OEXN, including whether they provide MetaTrader access or proprietary platform solutions, requires additional investigation.

Geographic Restrictions: Information about countries or regions where OEXN services are restricted is not comprehensively detailed in available sources.

Customer Service Languages: The range of languages supported by OEXN's customer service team is not specified in current documentation.

This oexn review highlights several areas where additional transparency would benefit potential clients in making informed decisions about the platform's suitability for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The account conditions offered by OEXN present a mixed picture that reflects both the opportunities and limitations of working with a newer broker in the market. While the platform advertises competitive spreads starting from 0 pips, the lack of detailed information about account types, minimum deposit requirements, and comprehensive fee structures significantly impacts the transparency that experienced traders typically expect.

The absence of clearly defined account tiers makes it difficult for potential clients to understand what services and conditions apply to their specific trading volume or deposit level. Most established brokers provide detailed breakdowns of standard, premium, and VIP account offerings, each with distinct advantages and requirements. This oexn review finds that OEXN's current public documentation does not adequately address these fundamental account structure questions.

The account opening process details are similarly unclear. No specific information is available about required documentation, verification timeframes, or any special account features such as Islamic accounts for traders requiring Sharia-compliant trading conditions. This lack of detailed account information represents a significant transparency gap that could deter traders who prefer to fully understand terms and conditions before committing to a platform.

For a broker established in 2022, this level of account condition transparency falls below industry standards, particularly when compared to more established competitors who provide comprehensive account comparison tools and detailed condition breakdowns.

OEXN demonstrates considerable strength in its tools and resources offering, particularly in the breadth of tradeable instruments available to clients. The platform provides access to forex pairs, stocks, precious metals, indices, commodities, energy products, options, and ETFs, creating a comprehensive trading environment that can accommodate diverse investment strategies and portfolio diversification needs.

This extensive asset selection represents one of OEXN's most compelling features. It allows traders to access multiple markets through a single platform rather than maintaining accounts with specialized brokers for different asset classes. The inclusion of both traditional forex pairs and more sophisticated instruments like options and ETFs suggests that the platform is designed to serve traders with varying levels of experience and strategic complexity.

However, while the range of tradeable instruments is impressive, specific information about research and analysis resources, educational materials, market commentary, economic calendar integration, and automated trading support remains limited in available documentation. Most competitive brokers in today's market provide comprehensive analytical tools, daily market insights, and educational resources to support trader development and decision-making.

The platform's approach to trading tools beyond basic asset access requires further investigation, as modern traders increasingly expect integrated charting packages, technical analysis tools, and market research capabilities as standard platform features.

Customer Service and Support Analysis (Score: Not Rated)

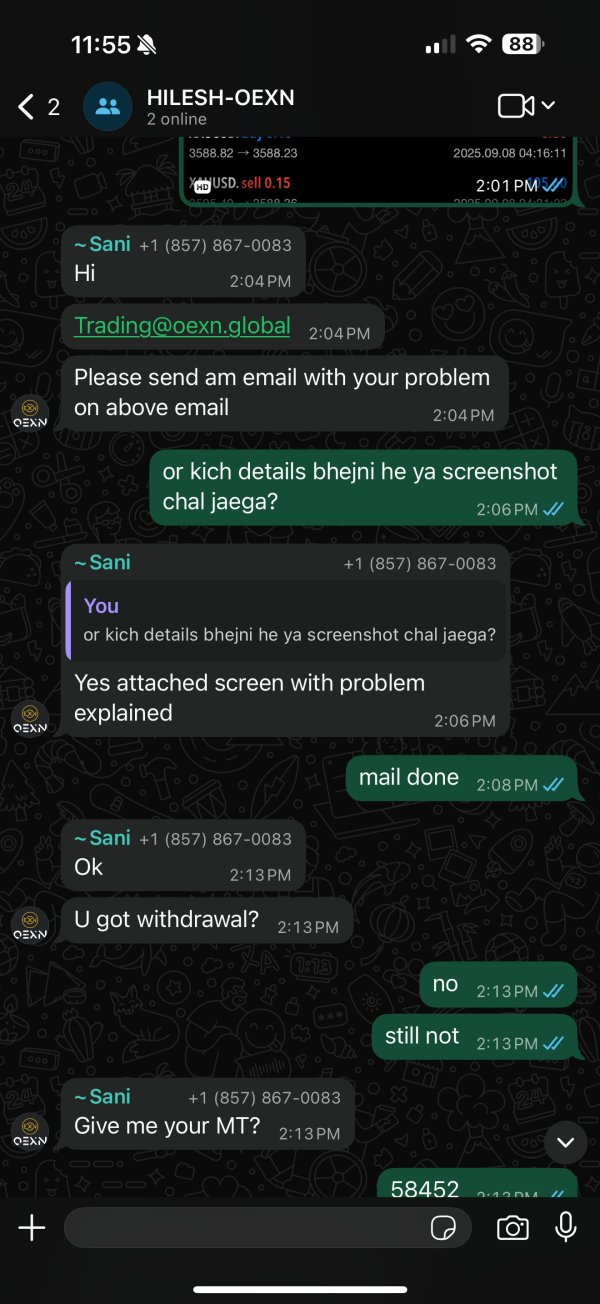

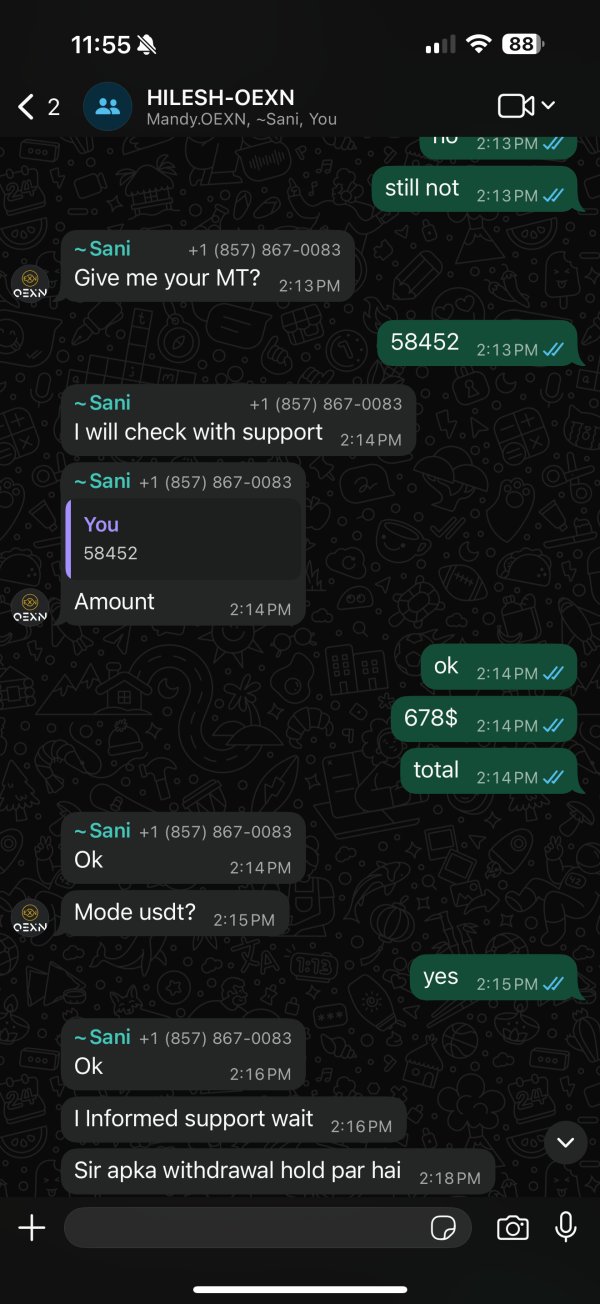

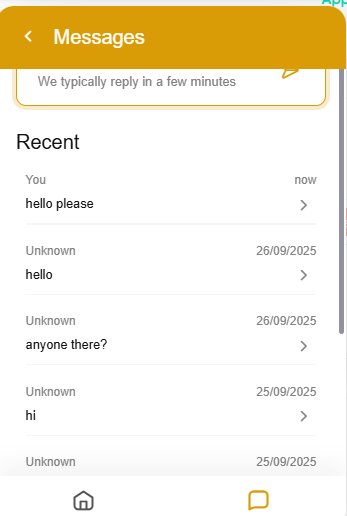

The evaluation of OEXN's customer service and support capabilities is significantly hampered by the limited availability of detailed information about service channels, response times, and support quality measures. This represents a critical information gap for potential clients who prioritize reliable customer support as a key factor in broker selection.

Available documentation does not specify the customer service channels offered by OEXN. These would include live chat availability, telephone support hours, email response protocols, or any premium support options for higher-tier account holders. The absence of this fundamental service information makes it impossible to assess whether the broker provides adequate support infrastructure for its client base.

Multi-language support capabilities, which are essential for international brokers serving diverse client populations, are not detailed in current public information. Similarly, customer service availability hours, weekend support options, and regional support teams remain unspecified.

Without access to verified customer feedback about actual service experiences, response quality, problem resolution effectiveness, or support team expertise, this oexn review cannot provide a meaningful assessment of the customer service dimension. This information gap represents a significant transparency issue that potential clients should address through direct inquiry before account opening.

Trading Experience Analysis (Score: Not Rated)

The trading experience evaluation for OEXN is constrained by the limited availability of detailed information about platform performance, execution quality, and user interface characteristics. These factors are fundamental to trader satisfaction and platform effectiveness, making their absence in available documentation a significant limitation for potential clients.

Platform stability and execution speed data, which are crucial for active traders and scalping strategies, are not documented in accessible sources. Order execution quality metrics, slippage statistics, and platform uptime records would typically be available for established brokers but remain unspecified for OEXN.

The user interface design, platform functionality, charting capabilities, and order management tools require direct platform evaluation. Detailed descriptions are not available in current public documentation. Mobile trading application features, cross-device synchronization, and platform customization options similarly lack detailed coverage.

Trading environment characteristics such as market depth visibility, news feed integration, one-click trading capabilities, and advanced order types need clarification through direct platform testing or detailed broker communication. The absence of comprehensive trading experience documentation represents a significant information gap for this relatively new broker.

Trust Factor Analysis (Score: 7/10)

OEXN's trust factor assessment benefits significantly from its regulatory status under both the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission of Mauritius (FSC). This dual regulatory oversight provides a solid foundation for client protection and operational standards compliance, which is particularly important for a broker established as recently as 2022.

The CySEC regulation is especially valuable as it provides European Union-level investor protection standards. This includes participation in the Investor Compensation Fund and adherence to MiFID II requirements. The additional FSC oversight from Mauritius suggests the broker's commitment to maintaining regulatory compliance across multiple jurisdictions, which can enhance client confidence.

However, the company's limited operational history means that its track record for handling market stress, client disputes, or regulatory challenges remains unestablished. The absence of detailed information about client fund segregation practices, insurance coverage beyond regulatory minimums, and third-party auditing arrangements represents areas where additional transparency would strengthen the trust factor assessment.

The broker's industry reputation is still developing given its recent establishment, and the limited availability of verified client feedback makes it difficult to assess real-world operational reliability and ethical business practices over extended periods.

User Experience Analysis (Score: Not Rated)

The user experience assessment for OEXN is significantly limited by the scarcity of verified user feedback and detailed interface documentation. As a broker established in 2022, the platform has had limited time to develop a substantial user base and corresponding feedback ecosystem that would typically inform user experience evaluations.

Overall user satisfaction metrics, interface design quality, registration and verification process efficiency, and fund operation convenience are not adequately documented in available sources. The absence of comprehensive user reviews makes it difficult to identify common user complaints, satisfaction patterns, or areas where the platform excels in user experience delivery.

Account opening and verification processes, which significantly impact initial user experience, lack detailed documentation regarding required steps, timeframes, and potential complications. Similarly, the ease of navigation, platform learning curve, and user interface intuitiveness require direct evaluation or comprehensive user feedback that is not currently available.

The platform's suitability for different trader types, user interface customization options, and overall user journey optimization remain areas requiring additional investigation through direct platform engagement or expanded user feedback collection.

Conclusion

This comprehensive oexn review reveals OEXN as an emerging forex and CFD broker that demonstrates both promising features and areas requiring enhanced transparency. While the platform's dual regulatory oversight from CySEC and FSC provides a solid regulatory foundation, and its diverse asset offering presents attractive opportunities for portfolio diversification, several transparency gaps limit the ability to provide a complete assessment.

OEXN appears most suitable for traders who prioritize access to multiple asset classes and competitive spreads. It particularly appeals to those willing to work with a newer broker that is still developing its market presence. The platform's regulatory compliance and comprehensive asset selection represent its strongest attributes.

The primary limitations center on transparency regarding account conditions, customer service capabilities, and detailed cost structures beyond basic spread information. Potential clients should conduct thorough direct inquiries about these areas before making trading decisions, particularly regarding minimum deposits, comprehensive fee structures, and customer support availability.